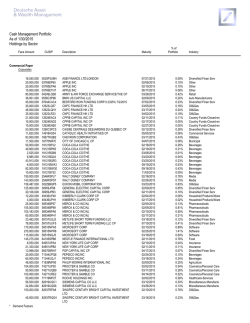

Daily Assets Fund Institutional As of 1/23/2015 Holdings by Sector

Daily Assets Fund Institutional As of 1/30/2015 Holdings by Sector Face Amount CUSIP % of Portfolio Description Maturity Industry BEDFORD ROW FUNDING CORP CP BEDFORD ROW FUNDING CORP CP BEDFORD ROW FUNDING CORP COLLATERALIZED COMMERCIAL PAPER II CO LLC COLLATERALIZED COMMERCIAL PAPER II CO LLC CP COLLATERALIZED GOTHAM FUNDING CORP HANNOVER FUNDING CO LLC HANNOVER FUNDING CO LLC HANNOVER FUNDING CO LLC HANNOVER FUNDING CO LLC MANHATTAN ASSET FUNDING CO LLC CP REGENCY MARKETS NO 1 LLC WORKING CAPITAL MANAGEMENT CO 08/27/2015 10/19/2015 12/11/2015 03/18/2015 05/06/2015 1.44% 0.60% 0.52% 1.05% 0.60% ABCP Other ABCP Other ABCP Other ABCP Other ABCP Other 02/02/2015 02/17/2015 02/05/2015 03/10/2015 03/19/2015 03/26/2015 02/06/2015 02/06/2015 02/05/2015 0.56% 0.60% 0.96% 0.51% 0.75% 0.75% 0.60% 0.45% 0.72% ABCP Other ABCP Multiseller ABCP Multiseller ABCP Multiseller ABCP Multiseller ABCP Multiseller ABCP Hybrid ABCP Multiseller ABCP Multiseller Commercial Paper Asset Backed 48,000,000 20,000,000 17,500,000 35,000,000 20,000,000 07644BVT6 07644BXK3 07644BZB1 19422DQJ3 19422DS69 18,750,000 20,000,000 32,000,000 17,000,000 25,000,000 25,000,000 20,000,000 15,000,000 24,000,000 19422GP24 38346MPH1 41068LP59 41068LQA7 41068LQK5 41068LQS8 56274MP63 7588R1P66 98137SP51 Asset Backed 10.08% Banks 17,500,000 23305ET94 10,000,000 25214V2Z2 32,000,000 25214W2N7 25,000,000 25214W2Q0 15,000,000 25214W2Z0 48,192,000 14,655,000 18,500,000 30,000,000 35,000,000 20,000,000 40,000,000 15,000,000 53943SP27 63873KP27 65558GQH9 65558GR13 85324UP23 85324UPH0 85324UR62 91127QV71 DBS BANK LTD DEXIA CREDIT LOCAL (GUARANTEED BY KINGDOM OF BELGIUM) DEXIA CREDIT LOCAL (GUARANTEED BY KINGDOM OF BELGIUM) DEXIA CREDIT LOCAL DEXIA CREDIT LOCAL (GUARANTEED BY KINGDOM OF BELGIUM) LLOYDS TSB BANK PLC NATIXIS NORDEA BANK AB NORDEA BANK AB STANDARD CHARTERED BANK STANDARD CHARTERED BANK STANDARD CHARTERED BANK UNITED OVERSEAS BANK LTD CP 06/09/2015 04/08/2015 0.52% 0.30% Banks Banks 04/20/2015 0.96% Banks 04/20/2015 05/29/2015 0.75% 0.45% Banks Banks 02/02/2015 02/02/2015 03/17/2015 04/01/2015 02/02/2015 02/17/2015 04/06/2015 08/07/2015 1.44% 0.44% 0.55% 0.90% 1.05% 0.60% 1.20% 0.45% Banks Banks Banks Banks Banks Banks Banks Banks Banks 9.59% Corporates 18,386,000 35,000,000 15,000,000 14,500,000 25,000,000 30,000,000 20,000,000 20,000,000 20,000,000 20,000,000 35,000,000 20,000,000 0020P3PC2 12623LQ57 12623LR23 12624EAC4 1280C3PQ4 1280C3RP4 19121BWG0 59157UQJ2 59157UUF5 59515NPA5 64105SPB8 82937RQG4 20,000,000 82937RR24 ASB FINANCE LTD/LONDON CNPC FINANCE HK LTD CNPC FINANCE HK LTD CPPIB CAPITAL INC CP CAISSE CENTRALE DESJARDINS DU QUEBEC CP CAISSE CENTRALE DESJARDINS COCA-COLA CO/THE METLIFE SHORT TERM FUNDING LLC METLIFE SHORT TERM FUNDING LLC CP MICROSOFT CORP NESTLE FINANCE INTERNATIONAL LTD SINOPEC CENTURY BRIGHT CAPITAL INVESTMENT LTD SINOPEC CENTURY BRIGHT CAPITAL INVESTMENT LTD CP 02/12/2015 03/05/2015 04/02/2015 02/11/2015 02/24/2015 04/23/2015 09/16/2015 03/18/2015 07/15/2015 02/10/2015 02/11/2015 03/16/2015 0.55% 1.05% 0.45% 0.43% 0.75% 0.90% 0.60% 0.60% 0.60% 0.60% 1.05% 0.60% Diversified Finan Serv Oil&Gas Oil&Gas Country Funds-Closed-en Diversified Finan Serv Diversified Finan Serv Beverages Diversified Finan Serv Diversified Finan Serv Software Food Oil&Gas 04/02/2015 0.60% Oil&Gas Corporates * Demand Feature 8.76% Daily Assets Fund Institutional As of 1/30/2015 Holdings by Sector Face Amount CUSIP % of Portfolio Description Maturity ERSTE ABWICKLUNGSANSTALT ERSTE ABWICKLUNGSANSTALT 02/19/2015 07/28/2015 Industry Commercial Paper Sovereign 25,000,000 29604DPK0 20,000,000 29604DUU2 0.75% 0.60% Sovereign 1.35% Commercial Paper 29.78% Multi-National Multi-National Euro Time Deposits Banks 100,000,000 49,000,000 100,000,000 100,000,000 100,000,000 95,000,000 SKANDINAVISKA ENSKILDA BANKEN AB BANK OF SCOTLAND PLC SWEDBANK AB KBC BANK NV DNB BANK ASA CITIBANK NA 02/02/2015 02/02/2015 02/02/2015 02/02/2015 02/02/2015 02/02/2015 2.99% 1.46% 2.99% 2.99% 2.99% 2.84% Banks Banks Banks Banks Banks Banks Banks 16.26% Corporates 85,247,595 CREDIT AGRICOLE CORPORATE & INVESTMENT BANK 02/02/2015 2.55% Corporates 2.55% Euro Time Deposits 18.81% Diversified Finan Serv Yankee CDs Banks 25,000,000 25,000,000 25,000,000 40,000,000 24,000,000 38,000,000 05962P3B3 06417HA63 06417HTQ9 06538JAU0 13606Y5F9 23328AGU2 20,000,000 23328AHX5 106,078,000 86563RAF5 25,000,000 89113EAU0 25,000,000 89113ECA2 BANCO DEL ESTADO DE CHILE BANK OF NOVA SCOTIA BANK OF NOVA SCOTIA BANK OF TOKYO-MITSUBISHI UFJ LTD CANADIAN IMPERIAL BANK OF COMMERCE/CANADA DZ BANK AG DEUTSCHE ZENTRALGENOSSENSCHAFTSBANK DZ BANK AG DEUTSCHE ZENTRALGENOSSENSCHAFTSBANK SUMITOMO MITSUI BANKING CORP TORONTO-DOMINION BANK TORONTO-DOMINION BANK 05/04/2015 08/03/2015 03/03/2015 02/17/2015 02/09/2015 02/19/2015 0.75% 0.75% 0.75% 1.20% 0.72% 1.14% Banks Banks Banks Banks Banks Banks 04/29/2015 0.60% Banks 02/06/2015 08/07/2015 08/11/2015 3.17% 0.75% 0.75% Banks Banks Banks Banks 10.56% Yankee CDs 10.56% Floating Rate Commercial Paper Banks 28,000,000 1,750,000 10,000,000 14,000,000 30,000,000 * Demand Feature 05253DAK0 05253MDD3 0556X4BX3 0556X4CD6 0556X4CF1 AUST & NZ BKG GP/HONG KG AUST & NZ BANKING GROUP BNZ INTERNATIONAL FNDNG BNZ INTERNATIONAL FNDNG BNZ INTERNATIONAL FNDNG 04/30/2015 02/25/2015 02/02/2015 06/10/2015 10/14/2015 0.84% 0.05% 0.30% 0.42% 0.90% Banks Banks Banks Banks Banks Daily Assets Fund Institutional As of 1/30/2015 Holdings by Sector Face Amount CUSIP Description Maturity BNZ INTERNATIONAL FNDNG BANCO ESTADO NOTE SR UNSEC FRN CANADIAN IMP BK COMM NY SR UNSEC RABOBANK NEDERLAND NY SR UNSEC DBS BANK LTD ROYAL BANK OF CANADA SR UNSEC WELLS FARGO BANK NA SR UNSEC WELL FARGO BANK SR UNSEC WESTPAC BANKING CORP WESTPAC BANKING CORP 01/28/2016 03/05/2015 05/08/2015 10/01/2015 02/20/2015 12/10/2015 09/09/2015 12/10/2015 02/19/2015 10/13/2015 % of Portfolio Industry Floating Rate Commercial Paper Banks 18,500,000 10,000,000 20,000,000 22,500,000 15,000,000 15,000,000 34,000,000 20,000,000 20,000,000 20,000,000 0556X4CJ3 05962PZ77 13606Y5J1 21684BKM5 23305GAD0 78009NSW7 94988EA24 94988ECP1 9612C4KZ3 9612C4PC9 0.55% 0.30% 0.60% 0.67% 0.45% 0.45% 1.02% 0.60% 0.60% 0.60% Banks Banks Banks Banks Banks Banks Banks Banks Banks Banks Banks 8.33% Corporates 30,000,000 05252TBF6 20,000,000 PPECLN5G4 AUST & NZ BANKING GROUP FRNCP STARBIRD FUNDING CORP FRNCP 08/18/2015 05/04/2015 0.90% 0.60% Corporates 1.49% Floating Rate Commercial Paper 9.83% Other Diversified Finan Serv Repurchase Agreements Corporates 33,750,000 114,500,000 127,500,000 JP MORGAN SECURITIES LLC (CORP REPO) JP MORGAN SECURITIES LLC (NON TRAD REPO) BNP PARIBAS (TRI-PARTY) 02/13/2015 06/06/2044 02/02/2015 1.01% 3.42% 3.81% Corporates Diversified Finan Serv Diversified Finan Serv Other 8.24% Banks 30,000,000 BNP PARIBAS SECURITIES CORP (CORPORATE REPO) 01/01/2049 0.90% Banks 0.90% Repurchase Agreements 9.14% 05/14/2015 02/24/2016 08/07/2015 08/18/2015 07/06/2015 02/22/2016 03/23/2015 06/16/2015 05/04/2015 05/11/2015 1.20% 1.35% 0.75% 1.20% 0.60% 0.90% 0.45% 0.90% 0.45% 0.90% Banks Floating Rate Notes Banks 40,000,000 45,000,000 25,000,000 40,000,000 20,000,000 30,000,000 15,000,000 30,000,000 15,000,000 30,000,000 05962P3K3 06417FYQ7 06417HEY8 13606YZB5 21684BPG3 48125LLP5 78009NQW9 94988E4L9 96121TWA2 96121TWU8 BANK ESTADO CHILE SR UNSEC BANK NOVA SC YCD FRN BANK OF NOVA SCOTIA CANADIAN IMP BK COMM NY SR UNSEC RABOBANK NEDERLAND NY SR UNSEC FRN JP MORGAN CHASE BANK NA 0.352747% 6/22/2015 ROYAL BANK OF CANADA NY SR UNSEC FRN WELLS FARGO BANK NA 0.2503% 6/16/2015 WESTPAC BANKING COPR NY SR UNSEC WESTPAC BANKING CORP NY SR UNSEC Banks * Demand Feature 8.67% Banks Banks Banks Banks Banks Banks Banks Banks Banks Banks Daily Assets Fund Institutional As of 1/30/2015 Holdings by Sector Face Amount CUSIP Description % of Portfolio Maturity Industry Floating Rate Notes Banks Floating Rate Notes 8.67% Variable Rate Demand Notes General 13,450,000 60534Q6S5 20,000,000 37,375,000 76252PES4 MS DEV BANK SR 2008B NUVEEN INVT QLTY MUN FD INC CDH-DELNOR HEALTH SYSTEM, CENTRAL DUPAGE HOSPITAL ASSOCIATION 02/04/2015 * 02/04/2015 * 02/04/2015 * 0.40% 0.60% 1.12% General 16,620,000 646108KN9 11,000,000 64986UKW6 25,000,000 64986UQ83 NJ ST HSG & MTGE FIN AGY SR 2013-6 NY ST TAXABLE HSG FIN AGY CLINTON PARK PHASE II SR 2011B NY HSG FIN AGY-B-TXBL General General General 2.12% 02/04/2015 * 06/06/2012 * 0.50% 0.33% 09/04/2014 * 0.75% 1.57% Higher Education 12,000,000 64990EAA5 29,920,000 91412GEX9 NY ST DORM AUTH PIT SR 2011-30020-I UNIV CA-Z1-TXB 02/04/2015 * 02/04/2015 * 0.36% 0.89% Higher Education Higher Education Higher Education 1.25% Development 4,835,000 59333ECM3 MIAMI-DADE IDA-TXBL 02/04/2015 * 0.14% Development Development 0.14% Education 4,430,000 57583RR64 MASSACHUSETTS ST DEV FIN AGY- MILTON ACADEMY SER B 02/04/2015 * 0.13% Education 0.13% Variable Rate Demand Notes 5.22% Education Medium Term Notes Banks 12,000,000 20,000,000 14,470,000 27,865,000 8,500,000 10,000,000 35,000,000 19,000,000 00182EAQ2 00182FAM8 064149C47 20271RAA8 2027A0EM7 2027A1EM5 21685WBL0 63254AAC2 ANZ NEW ZEALAND INTL/LDN 1.85% 10/15/2015 ANZ NEW ZEALAND INTL/LDN 1.85% 10/15/2015 BANK OF NOVA SCOTIA 2.05% 10/7/2015 COM BK AUSTR NY SR UNSEC CMW BK AUST SR NT 144A COMMONWEALTH BANK AU SR UNSEC RABOBANK NEDERLAND CO GTD NATIONAL AUSTR BK SR UNSEC 10/15/2015 10/15/2015 10/07/2015 03/16/2015 03/19/2015 03/19/2015 10/13/2015 08/07/2015 0.36% 0.60% 0.43% 0.83% 0.25% 0.30% 1.05% 0.57% Banks * Demand Feature 4.39% Banks Banks Banks Banks Banks Banks Banks Banks Daily Assets Fund Institutional As of 1/30/2015 Holdings by Sector Face Amount CUSIP % of Portfolio Description Maturity GENERAL ELEC CAP CORP 4.875% 3/4/2015 03/04/2015 Industry Medium Term Notes Corporates 13,655,000 36962GP65 0.41% Corporates 0.41% Medium Term Notes 4.80% Diversified Finan Serv Agencies US Governments 12,000,000 3130A2XM3 7,500,000 3130A2ZT6 14,000,000 3130A2ZV1 FEDERAL HOME LOAN BANK 0.25% 10/2/2015 FEDERAL HOME LOAN BANK 0.2% 9/17/2015 FEDERAL HOME LOAN BANK 0.263% 10/9/2015 10/02/2015 09/17/2015 10/09/2015 0.36% 0.22% 0.42% US Governments 1.00% Agencies 1.00% US Governments US Governments US Governments Euro CDs Banks 25,000,000 DZ BANK AG DEUTSCHE ZENTRALGENOSSENSCHAFTSBANK 05/07/2015 0.75% Banks 0.75% Euro CDs 0.75% Banks Tax Exempt Commercial Paper 24,000,000 92415WAE5 VERMONT ECONOMIC DEVELOPMENT AUTHORITY TAXABLE CPX 05/07/2015 0.72% 0.72% Tax Exempt Commercial Paper 0.72% CMOs Corporates 10,000,000 76115BAB3 RESI 2013-1 A2B 03/07/2015 0.30% Corporates 0.30% CMOs 0.30% Other U S Treasury Notes US Governments 10,000,000 912828SK7 US TREASURY N/B 0.375% 3/15/2015 03/15/2015 US Governments * Demand Feature 0.30% 0.30% US Governments Daily Assets Fund Institutional As of 1/30/2015 Holdings by Sector Face Amount CUSIP Description Maturity % of Portfolio Industry U S Treasury Notes US Governments U S Treasury Notes 0.30% CP Mode Bonds General Obligation 4,315,000 CHICADXXX CHICAGO TAXABLE CP SR 2002D 03/17/2015 0.13% General Obligation 0.13% CP Mode Bonds 0.13% General Obligation 3,344,743,595 Total Portfolio Face Value (Excluding Uninvested Cash) Portfolio holdings are subject to change. Percentage (%) of market value refers to all securities in the portolio, excluding uninvested cash balances. Because different calculation methods are used, the portofolio holdings information above may be different from the portolio holdings information for the same period contained in the fund's annual and semiannual shareholder reports or first and third quarter reports filed with the Securities and Exchange Commission on Form N-Q. Additionally, this data may differ from any holdings information found on firms' marketing materials. OBTAIN A PROSPECTUS To obtain a summary prospectus, if available, or prospectus, for Institutional money market fund distributed by DWS Investments Distributors, Inc., call Institutional Investor Services at (800) 730-1313 Monday through Friday, 8:00am to 6:00 pm ET. We advise you to carefully consider the product's objectives, risks, charges and expense before investing. The summary prospectus and prospectus contain this and other important information about the investment product, including management fees and expense. Please read the prospectus carefully before you invest or send money. DeAWM is Deutsche Bank's Asset and Wealth Management division and, within the US, represents the retail asset and wealth management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DeAWM Trust Company. DeAWM Investments Distributors, Inc. 222 South Riverside Plaza Chicago, IL 60606-5808 www.deutschefunds.com Tel (800) 621-1148 TDD (800) 972-3006 NOT FDIC INSURED MAY LOSE VALUE An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, this share price isn't guaranteed and you could lose money by investing in the fund. The share price of money maket funds can fall below the $1.00 share price. You should not rely on or expect the Advisor to enter into support agreements or take other actions to maintain the fund's $1.00 share price. The credit quality of the fund's holdings can change rapidly in certain markets, and the default of a single holding could have an adverse impact on the fund's share price. The fund's share price can also be negatively affected during periods of high redemption pressures and/or illiquid markets. The actions of a few large investors in one class of shares of the fund may have a significant adverse effect on the share prices of all classes of the fund. R-018238-4 (03/14) * Demand Feature

© Copyright 2026