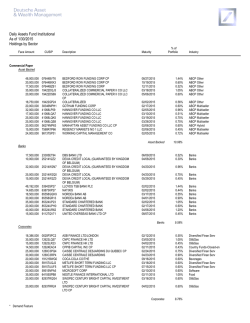

Cash Management Portfolio As of 1/23/2015 Holdings by Sector

Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP % of Portfolio Description Maturity Industry ASB FINANCE LTD/LONDON APPLE INC APPLE INC APPLE INC ARMY & AIR FORCE EXCHANGE SERVICE/THE CP BMW US CAPITAL LLC BEDFORD ROW FUNDING CORP 0.2325% 7/2/2015 CNPC FINANCE HK LTD CNPC FINANCE HK LTD CNPC FINANCE HK LTD CPPIB CAPITAL INC CP CPPIB CAPITAL INC CP CPPIB CAPITAL INC CP CAISSE CENTRALE DESJARDINS DU QUEBEC CP CATHOLIC HEALTH INITIATIVES CP CHEVRON CORPORATION CITY OF CHICAGO IL CP COCA-COLA CO/THE COCA-COLA CO/THE COCA-COLA CO/THE COCA-COLA CO/THE COCA-COLA CO/THE COCA-COLA CO/THE COCA-COLA CO/THE COCA-COLA CO/THE WALT DISNEY COMPANY WALT DISNEY COMPANY EXXON MOBIL CORPORATION GENERAL ELECTRIC CAPITAL CORP GENERAL ELECTRIC CAPITAL CORP KIMBERLY-CLARK CORP CP KIMBERLY-CLARK CORP CP MERCK & CO INC/NJ MERCK & CO INC/NJ MERCK & CO INC/NJ MERCK & CO INC/NJ METLIFE SHORT TERM FUNDING LLC METLIFE SHORT TERM FUNDING LLC CP MICROSOFT CORP MICROSOFT CORP MICROSOFT CORP NESTLE FINANCE INTERNATIONAL LTD NEW YORK LIFE CAP CORP NEW YORK LIFE CAP CORP PSP CAPITAL INC CP PEPSICO INC/NC PEPSICO INC/NC PHILIP MORRIS INTERNATIONAL INC PROCTER & GAMBLE CO PROCTER & GAMBLE CO PROCTER & GAMBLE CO ROCHE HOLDINGS INC. SIEMENS CAPITAL CO LLC SIEMENS CAPITAL CO LLC SINOPEC CENTURY BRIGHT CAPITAL INVESTMENT LTD SINOPEC CENTURY BRIGHT CAPITAL INVESTMENT LTD 07/21/2015 02/06/2015 02/10/2015 06/17/2015 03/26/2015 02/09/2015 07/02/2015 03/05/2015 03/17/2015 04/02/2015 02/11/2015 02/17/2015 02/27/2015 02/12/2015 05/05/2015 03/11/2015 04/07/2015 02/18/2015 02/19/2015 03/06/2015 03/20/2015 03/25/2015 09/10/2015 09/16/2015 11/05/2015 02/18/2015 02/26/2015 03/23/2015 02/09/2015 02/11/2015 02/04/2015 02/17/2015 02/05/2015 02/09/2015 02/10/2015 02/17/2015 03/18/2015 07/15/2015 02/10/2015 02/25/2015 03/18/2015 02/11/2015 02/10/2015 02/11/2015 04/17/2015 02/24/2015 03/18/2015 02/09/2015 02/02/2015 03/11/2015 04/14/2015 02/02/2015 03/12/2015 03/26/2015 02/10/2015 0.09% 0.10% 0.10% 0.08% 0.42% 0.20% 0.23% 0.16% 0.24% 0.19% 0.11% 0.05% 0.05% 0.28% 0.06% 0.43% 0.06% 0.26% 0.21% 0.01% 0.04% 0.23% 0.03% 0.43% 0.05% 0.78% 0.75% 0.83% 0.65% 0.10% 0.06% 0.02% 0.13% 0.81% 0.55% 0.31% 0.12% 0.41% 0.89% 1.41% 0.60% 0.76% 0.04% 0.11% 0.07% 0.10% 0.34% 0.25% 0.54% 0.26% 0.52% 0.26% 0.30% 0.13% 0.78% Diversified Finan Serv Other Other Other Retail Auto Manufacturers Diversified Finan Serv Oil&Gas Oil&Gas Oil&Gas Country Funds-Closed-en Country Funds-Closed-en Country Funds-Closed-en Diversified Finan Serv Commercial Services Oil&Gas Municipal Beverages Beverages Beverages Beverages Beverages Beverages Beverages Beverages Media Media Oil&Gas Diversified Finan Serv Diversified Finan Serv Household Products/Ware Household Products/Ware Pharmaceuticals Pharmaceuticals Pharmaceuticals Pharmaceuticals Diversified Finan Serv Diversified Finan Serv Software Software Software Food Insurance Insurance Diversified Finan Serv Beverages Beverages Agriculture Cosmetics/Personal Care Cosmetics/Personal Care Cosmetics/Personal Care Healthcare-Services Miscellaneous Manufactu Miscellaneous Manufactu Oil&Gas 03/16/2015 0.23% Oil&Gas Commercial Paper Corporates 16,550,000 20,000,000 20,000,000 15,000,000 80,000,000 38,001,000 45,000,000 30,000,000 46,000,000 35,500,000 21,000,000 10,000,000 10,000,000 53,000,000 11,620,000 83,000,000 11,500,000 50,000,000 40,800,000 2,525,000 6,985,000 43,913,000 6,500,000 82,000,000 10,000,000 150,000,000 143,000,000 159,487,000 125,000,000 20,108,000 12,200,000 4,000,000 25,000,000 155,000,000 105,183,000 60,000,000 23,462,000 78,000,000 170,000,000 270,000,000 115,000,000 145,275,000 8,550,000 21,330,000 13,998,000 20,000,000 65,000,000 48,000,000 104,000,000 50,000,000 100,000,000 50,000,000 56,500,000 24,854,000 150,000,000 0020P3UM4 03785EP65 03785EPA6 03785ETH7 04249LQS8 0556C3P96 07644CAC4 12623LQ57 12623LQH1 12623LR23 12624EAC4 12624EAD2 12624EAE0 1280C3PC5 14918HS54 16677KQB2 16770NR70 19121BPJ2 19121BPK9 19121BQ69 19121BQL6 19121BQR3 19121BWA3 19121BWG0 19121BY52 2546R3PJ7 2546R3PS7 30229BQP5 36959JP98 36959JPB3 49436UP40 49436UPH1 58934BP57 58934BP99 58934BPA6 58934BPH1 59157UQJ2 59157UUF5 59515NPA5 59515NPR8 59515NQJ5 64105SPB8 64951XPA4 64951XPB2 69370BRH7 71344UPQ6 71344UQJ1 71838MP95 74271UP20 74271UQB9 74271URE2 77119MP27 82619UQC1 82619UQS6 82937RPA8 45,000,000 82937RQG4 * Demand Feature Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP Description Maturity SINOPEC CENTURY BRIGHT CAPITAL INVESTMENT LTD CP 04/02/2015 % of Portfolio Industry Commercial Paper Corporates 50,000,000 82937RR24 Corporates 0.26% Oil&Gas 17.53% Asset Backed 35,000,000 40,000,000 50,000,000 33,000,000 133,000,000 110,000,000 71,500,000 116,800,000 07644BR12 07644BRN4 07644BT93 07644BUP5 16115XQ65 19422DQJ3 19422DS44 19422DS69 108,000,000 57,900,000 30,746,000 25,000,000 98,819,000 100,000,000 33,500,000 51,000,000 100,000,000 41,000,000 1,900,000 50,000,000 106,000,000 50,000,000 1,538,000 100,000,000 50,000,000 69,000,000 75,000,000 55,830,000 19422GP24 38346MPH1 41068LP59 41068LQK5 48802TQJ7 48802TQN8 48802TQT5 48802WXL7 48802XNW2 56274MQ39 67983USS3 67984X2E5 67984XCC8 67985A2H7 7588R1P66 88603H2F4 88603H2G2 92512MP29 92646LQ29 98137SPD4 BEDFORD ROW FUNDING CORP CP BEDFORD ROW FUNDING CORP CP BEDFORD ROW FUNDING CORP CP BEDFORD ROW FUNDING CORP CP CHARTA CORP COLLATERALIZED COMMERCIAL PAPER II CO LLC COLLATERALIZED COMMERCIAL PAPER II CO LLC COLLATERALIZED COMMERCIAL PAPER II CO LLC CP COLLATERALIZED GOTHAM FUNDING CORP HANNOVER FUNDING CO LLC HANNOVER FUNDING CO LLC KELLS FUNDING LLC KELLS FUNDING LLC KELLS FUNDING LLC KELLS FUNDING LLC KELLS FUNDING LLC MANHATTAN ASSET FUNDING CO LLC CP OLD LINE FUNDING LLC OLD LINE FUNDING LLC OLD LINE FUNDING LLC OLD LINE FUNDING LLC REGENCY MARKETS NO 1 LLC THUNDER BAY FUNDING LLC THUNDER BAY FUNDING LLC VERSAILLES COMERCIAL PAPER LLC VICTORY RECEIVABLES CORP WORKING CAPITAL MANAGEMENT CO 04/01/2015 04/22/2015 06/09/2015 07/23/2015 03/06/2015 03/18/2015 05/04/2015 05/06/2015 0.18% 0.21% 0.26% 0.17% 0.69% 0.57% 0.37% 0.61% ABCP Other ABCP Other ABCP Other ABCP Other ABCP Multiseller ABCP Other ABCP Other ABCP Other 02/02/2015 02/17/2015 02/05/2015 03/19/2015 04/21/2015 06/05/2015 05/04/2015 05/07/2015 04/22/2015 03/03/2015 05/26/2015 05/29/2015 03/09/2015 06/02/2015 02/06/2015 06/10/2015 06/15/2015 02/02/2015 03/02/2015 02/13/2015 0.56% 0.30% 0.16% 0.13% 0.52% 0.52% 0.17% 0.27% 0.52% 0.21% 0.01% 0.26% 0.55% 0.26% 0.01% 0.52% 0.26% 0.36% 0.39% 0.29% ABCP Other ABCP Multiseller ABCP Multiseller ABCP Multiseller ABCP Other ABCP Other ABCP Other ABCP Other ABCP Other ABCP Hybrid ABCP Multiseller ABCP Multiseller ABCP Multiseller ABCP Multiseller ABCP Multiseller ABCP Hybrid ABCP Hybrid ABCP Multiseller ABCP Multiseller ABCP Multiseller Asset Backed 9.37% Banks 11,101,000 23305ES53 54,800,000 23305EU76 35,000,000 25214V2Z2 68,500,000 25214W2Z0 26,770,000 25215C3J8 50,927,000 25215E2R7 100,000,000 25215E2U0 1,000,000 50,000,000 33,000,000 30,000,000 90,000,000 100,000,000 25,500,000 * Demand Feature 48246USM9 55607LRH9 62939MP92 62944HT27 63975VU99 65558GP98 65558GR13 DBS BANK LTD DBS BANK LTD DEXIA CREDIT LOCAL (GUARANTEED BY KINGDOM OF BELGIUM) DEXIA CREDIT LOCAL (GUARANTEED BY KINGDOM OF BELGIUM) DEXIA CREDIT LOCAL (GUARANTEED BY KINGDOM OF BELGIUM) DEXIA CREDIT LOCAL DEXIA CREDIT LOCAL (GUARANTEED BY KINGDOM OF BELGIUM) KREDITANSTALT FUER WIEDERAUFBAU MACQUARIE BANK LTD CP NRW.BANK BANK NEDERLANDSE GEMEENTEN CP NEDER WATERSCHAPSBANK NV NORDEA BANK AB NORDEA BANK AB 05/05/2015 07/07/2015 04/08/2015 0.06% 0.29% 0.18% Banks Banks Banks 05/29/2015 0.36% Banks 05/05/2015 0.14% Banks 05/29/2015 08/06/2015 0.27% 0.52% Banks Banks 05/21/2015 04/17/2015 02/09/2015 06/02/2015 07/09/2015 02/09/2015 04/01/2015 0.01% 0.26% 0.17% 0.16% 0.47% 0.52% 0.13% Banks Banks Banks Banks Banks Banks Banks Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP % of Portfolio Description Maturity NORDEA BANK AB STANDARD CHARTERED BANK STANDARD CHARTERED BANK STANDARD CHARTERED BANK STANDARD CHARTERED BANK TORONTO-DOMINION HOLDINGS USA INC UNITED OVERSEAS BANK LTD CP WESTPAC BANKING CORP 05/04/2015 02/02/2015 03/03/2015 04/06/2015 06/08/2015 06/05/2015 08/07/2015 05/27/2015 Industry Commercial Paper Banks 16,487,000 179,500,000 145,000,000 132,500,000 112,000,000 56,500,000 60,000,000 17,000,000 65558GS46 85324UP23 85324UQ30 85324UR62 85324UT86 89116FT59 91127QV71 9612C1ST5 0.09% 0.94% 0.76% 0.69% 0.58% 0.30% 0.31% 0.09% Banks Banks Banks Banks Banks Banks Banks Banks Banks 7.29% Sovereign 3,011,000 5,000,000 106,500,000 38,175,000 100,000,000 100,000,000 12800BPH9 29604DP38 29604DPK0 29604DR85 29604DU65 29604DUX6 CAISSE DES DEPOTS ET CONSIGNATIONS ERSTE ABWICKLUNGSANSTALT ERSTE ABWICKLUNGSANSTALT ERSTE ABWICKLUNGSANSTALT ERSTE ABWICKLUNGSANSTALT ERSTE ABWICKLUNGSANSTALT 02/17/2015 02/03/2015 02/19/2015 04/08/2015 07/06/2015 07/31/2015 0.02% 0.03% 0.56% 0.20% 0.52% 0.52% Sovereign 1.84% Commercial Paper 36.03% Sovereign Multi-National Multi-National Multi-National Multi-National Multi-National Euro Time Deposits Banks 750,000,000 350,000,000 800,000,000 73,975,000 500,000,000 114,000,000 341,252,690 SKANDINAVISKA ENSKILDA BANKEN AB SWEDBANK AB KBC BANK NV FORTIS BANK SA/NV DNB BANK ASA STANDARD CHARTERED BANK NORDEA BANK FINLAND PLC 02/02/2015 02/02/2015 02/02/2015 02/02/2015 02/02/2015 02/02/2015 02/02/2015 3.92% 1.83% 4.18% 0.39% 2.61% 0.60% 1.78% Banks Banks Banks Banks Banks Banks Banks Banks 15.29% Corporates 94,000,000 141,847,596 500,000,000 CREDIT AGRICOLE CORPORATE & INVESTMENT BANK CREDIT AGRICOLE CORPORATE & INVESTMENT BANK CREDIT AGRICOLE CORPORATE & INVESTMENT BANK 02/02/2015 02/02/2015 02/02/2015 0.49% 0.74% 2.61% Corporates 3.84% Euro Time Deposits 19.14% Diversified Finan Serv Diversified Finan Serv Diversified Finan Serv Floating Rate Commercial Paper Banks 40,000,000 50,000,000 20,000,000 43,300,000 210,000,000 50,000,000 * Demand Feature 05253DAK0 0556X4BX3 0556X4CD6 05962PZ77 06366CSY5 13606Y5J1 AUST & NZ BKG GP/HONG KG BNZ INTERNATIONAL FNDNG BNZ INTERNATIONAL FNDNG BANCO ESTADO NOTE SR UNSEC FRN BANK OF MONTREAL 0.2665% 10/9/2015 CANADIAN IMP BK COMM NY SR UNSEC 04/30/2015 02/02/2015 06/10/2015 03/05/2015 10/09/2015 05/08/2015 0.21% 0.26% 0.10% 0.23% 1.10% 0.26% Banks Banks Banks Banks Banks Banks Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP Description Maturity DBS BANK LTD NATIONAL AUSTRALI BANK NEDERLANDSE WATERSCHAPS ROYAL BANK OF CANADA FRNCP ROYAL BANK OF CANADA SR UNSEC ROYAL BANK OF CANADA SR UNSEC WELLS FARGO BANK NA SR UNSEC WELL FARGO BANK SR UNSEC WESTPAC BANKING CORP NY SR UNSEC WESTPAC BANKING CORP 02/20/2015 10/08/2015 07/09/2015 02/12/2015 09/03/2015 12/10/2015 09/09/2015 12/10/2015 02/20/2015 10/13/2015 % of Portfolio Industry Floating Rate Commercial Paper Banks 35,000,000 180,000,000 5,000,000 100,000,000 136,500,000 50,000,000 75,000,000 110,000,000 14,500,000 138,000,000 23305GAD0 63254GAR6 63975WBL1 78009NQM1 78009NRW8 78009NSW7 94988EA24 94988ECP1 96121TVG0 9612C4PC9 0.18% 0.94% 0.03% 0.52% 0.71% 0.26% 0.39% 0.57% 0.08% 0.72% Banks Banks Banks Banks Banks Banks Banks Banks Banks Banks Banks 6.56% Corporates 100,000,000 120,700,000 50,000,000 20,500,000 65,000,000 26,000,000 100,000,000 83,000,000 0020P5EP0 05252TBF6 07644CAB6 36962G7E8 48803AGV1 48803AGX7 67984RAG4 PPRNBW1Y2 ASB FINANCE LTD LONDON AUST & NZ BANKING GROUP FRNCP BEDFORD ROW FUNDING CORP GENERAL ELECTRIC CAPITAL CORP KELLS FUNDING LLC KELLS FUNDING LLC OLD LINE FUNDING LLC OLD LINE FUNDING LLC FRNCP 06/16/2015 08/18/2015 06/26/2015 01/14/2016 02/05/2015 02/13/2015 10/23/2015 02/02/2015 0.52% 0.63% 0.26% 0.11% 0.34% 0.14% 0.52% 0.43% Corporates 2.95% Floating Rate Commercial Paper 9.52% Diversified Finan Serv Other Diversified Finan Serv Diversified Finan Serv Diversified Finan Serv Diversified Finan Serv Diversified Finan Serv Diversified Finan Serv Yankee CDs Banks 90,000,000 150,000,000 61,100,000 80,000,000 160,000,000 20,000,000 40,008,000 140,000,000 63,500,000 200,000,000 9,004,000 05962P3A5 06366CJS8 06366CTV0 06417HA63 06417HTQ9 06538JGK6 13606Y5F9 21684BRR7 21684BSF2 22536TFK4 23328AGR9 25,000,000 23328AGU2 150,000,000 200,000,000 35,000,000 49,000,000 40,000,000 50,000,000 50,000,000 91,400,000 75,000,000 60682ATL0 65558E4X3 65558E6C7 69033PR51 69033PS35 86562Y4Q4 86562Y4Z4 89112UNH0 89113ECA2 BANCO DEL ESTADO DE CHILE BANK OF MONTREAL BANK OF MONTREAL BANK OF NOVA SCOTIA BANK OF NOVA SCOTIA BANK OF TOKYO-MITSUBISHI UFJ LTD CANADIAN IMPERIAL BANK OF COMMERCE/CANADA RABOBANK NEDERLAND NV RABOBANK NEDERLAND NV CREDIT INDUSTRIEL ET COMMERCIAL DZ BANK AG DEUTSCHE ZENTRALGENOSSENSCHAFTSBANK DZ BANK AG DEUTSCHE ZENTRALGENOSSENSCHAFTSBANK MITSUBISHI UFJ TRUST AND BANKING CORP NORDEA BANK FINLAND PLC NORDEA BANK FINLAND PLC OVERSEA-CHINESE BANKING CORP LTD OVERSEA-CHINESE BANKING CORP LTD SUMITOMO MITSUI BANKING CORP SUMITOMO MITSUI BANKING CORP TORONTO-DOMINION BANK TORONTO-DOMINION BANK 04/03/2015 05/13/2015 07/15/2015 08/03/2015 03/03/2015 02/04/2015 02/09/2015 03/13/2015 07/03/2015 02/03/2015 02/13/2015 0.47% 0.78% 0.32% 0.42% 0.84% 0.10% 0.21% 0.73% 0.33% 1.04% 0.05% Banks Banks Banks Banks Banks Banks Banks Banks Banks Banks Banks 02/19/2015 0.13% Banks 04/09/2015 04/02/2015 05/21/2015 08/03/2015 03/09/2015 03/18/2015 02/17/2015 07/13/2015 08/11/2015 0.78% 1.04% 0.18% 0.26% 0.21% 0.26% 0.26% 0.48% 0.39% Banks Banks Banks Banks Banks Banks Banks Banks Banks Banks * Demand Feature 9.29% Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP Description % of Portfolio Maturity Industry Yankee CDs Banks Yankee CDs 9.29% Floating Rate Notes Banks 58,000,000 111,000,000 85,000,000 176,750,000 180,000,000 59,500,000 05962P3K3 06417F5V8 06417FYQ7 13606YZB5 2027A0HH5 21684BLM4 70,000,000 136,500,000 164,250,000 125,000,000 125,000,000 110,000,000 21684BPD0 21684BPG3 48125LLP5 94988E4L9 96121TWA2 96121TWU8 BANK ESTADO CHILE SR UNSEC BANK OF NOVA SCOTIA HOUS SR UNSEC BANK NOVA SC YCD FRN CANADIAN IMP BK COMM NY SR UNSEC COMMONWEALTH BANK AUST UNSEC 144A COOPERATIEVE CENTRALE RAIFFEISENBOERENLEENBANK BA/NY SR UNSEC RABOBANK NEDERLAND NY SR UNSEC RABOBANK NEDERLAND NY SR UNSEC FRN JP MORGAN CHASE BANK NA 0.352747% 6/22/2015 WELLS FARGO BANK NA 0.2503% 6/16/2015 WESTPAC BANKING COPR NY SR UNSEC WESTPAC BANKING CORP NY SR UNSEC 05/14/2015 12/31/2015 02/24/2016 08/18/2015 07/10/2015 04/10/2015 0.30% 0.58% 0.44% 0.92% 0.94% 0.31% Banks Banks Banks Banks Banks Banks 06/01/2015 07/06/2015 02/22/2016 06/16/2015 05/04/2015 05/11/2015 0.37% 0.71% 0.86% 0.65% 0.65% 0.57% Banks Banks Banks Banks Banks Banks Banks 7.32% Corporates 168,000,000 86959JGT9 SVENSKA HANDELSBANKEN 10/02/2015 Corporates 0.88% Other 0.88% US Governments 65,610,000 912828WV8 UNITED STATES OF AMERICA 07/31/2016 US Governments 0.34% US Governments 0.34% Sovereign 5,000,000 45905UNX8 INTL BK RECON & DEVELOP 0.19% 6/17/2015 06/17/2015 0.03% Sovereign 0.03% Floating Rate Notes 8.56% Multi-National Repurchase Agreements Corporates 152,500,000 358,000,000 134,000,000 140,000,000 50,000,000 JP MORGAN SECURITIES LLC (CORP REPO) JP MORGAN SECURITIES LLC (NON TRAD REPO) WELLS FARGO SECURITIES LLC (TRI-PARTY) WELLS FARGO SECURITIES LLC (TRI-PARTY) BNP PARIBAS (TRI-PARTY) 02/13/2015 06/06/2044 02/02/2015 02/02/2015 02/02/2015 Corporates 0.80% 1.87% 0.70% 0.73% 0.26% Diversified Finan Serv Diversified Finan Serv Diversified Finan Serv Diversified Finan Serv Other 4.36% US Governments 184,000,000 100,000,000 100,000,000 * Demand Feature BNP PARIBAS (TRI-PARTY) HSBC SECURITIES INC MERRILL LYNCH PIERCE FENNER & SMITH INC 02/02/2015 02/02/2015 02/02/2015 0.96% 0.52% 0.52% US Governments US Governments US Governments Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP % of Portfolio Description Maturity GOLDMAN SACHS & CO (TRI-PARTY) 02/02/2015 Industry Repurchase Agreements US Governments 25,000,000 0.13% US Governments US Governments 2.14% Banks 200,000,000 BNP PARIBAS SECURITIES CORP (CORPORATE REPO) 01/01/2049 1.04% Banks 1.04% Repurchase Agreements 7.54% 05/13/2015 02/04/2015 02/11/2015 01/29/2016 02/02/2015 03/04/2015 04/06/2015 04/16/2015 04/21/2015 05/20/2015 06/01/2015 12/07/2015 02/17/2015 04/16/2015 05/18/2015 05/21/2015 08/03/2015 0.07% 0.10% 0.07% 0.54% 0.13% 0.26% 0.19% 0.19% 0.13% 0.10% 0.14% 0.17% 0.16% 0.07% 0.26% 0.10% 0.10% Banks Discount Notes US Governments 12,500,000 20,000,000 12,500,000 104,000,000 25,000,000 50,000,000 36,667,000 35,800,000 25,000,000 20,000,000 26,500,000 32,223,000 30,000,000 12,500,000 50,000,000 20,000,000 20,000,000 313312FN5 313384BL2 313384BT5 313384SK6 313396BJ1 313396CQ4 313396DZ3 313396EK5 313396EQ2 313396FV0 313396GH0 313396QE6 313588BZ7 313588EK7 313588FT7 313588FW0 313588JY2 FED FARM CRD DISCOUNT NT 0% 05/13/2015 FED HOME LN DISCOUNT NT 0% 02/04/2015 FEDERAL HOME LOAN BANKS FED HOME LN DISCOUNT NT 0% 01/29/2016 FREDDIE MAC DISCOUNT NT 0% 02/02/2015 FREDDIE MAC DISCOUNT NT 0% 03/04/2015 FREDDIE MAC DISCOUNT NT 0% 04/06/2015 FREDDIE MAC DISCOUNT NT 0% 04/16/2015 FREDDIE MAC DISCOUNT NT 0% 04/21/2015 FREDDIE MAC DISCOUNT NT 0% 05/20/2015 FREDDIE MAC DISCOUNT NT 0% 06/01/2015 FREDDIE MAC DISCOUNT NT 0% 12/07/2015 FANNIE DISCOUNT NOTE 0% 02/17/2015 FANNIE DISCOUNT NOTE 0% 04/16/2015 FANNIE DISCOUNT NOTE 0% 05/18/2015 FANNIE DISCOUNT NOTE 0% 05/21/2015 FANNIE DISCOUNT NOTE 0% 08/03/2015 US Governments 2.78% Discount Notes 2.78% US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments US Governments Variable Rate Demand Notes General 16,500,000 452001ZK9 25,000,000 59447PXU0 40,000,000 70,075,000 76252PEQ8 IL EDL ADJ-FIELD MUSE MI FIN AUTH-A-TXBL NUVEEN SELECT QLTY MUN FD INC CITY OF DETROIT FINANCIAL RECOVERY INCOME TAX REVENUE 02/04/2015 * 02/04/2015 * 02/04/2015 * 02/04/2015 * General 15,520,000 9,750,000 12,500,000 50,460,000 49130PJ62 646108EH9 64986U4H7 64986UQ83 KY HSG-VAR-TXB-O 2006-O NJ ST HSG & MTG FIN AGY SR 2008C NY ST HSG FIN AGY-B NY HSG FIN AGY-B-TXBL 02/04/2015 * 02/04/2015 * 02/04/2015 * 09/04/2014 * 0.09% 0.13% 0.21% 0.37% 0.79% 0.08% 0.05% 0.07% 0.26% 0.46% * Demand Feature General General General General Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP % of Portfolio Description Maturity MICHIGAN FINANCE AUTHORITY MICHIGAN FINANCE AUTHORITY 08/10/2011 * 02/04/2015 * Industry Variable Rate Demand Notes Education 25,000,000 59447PCH2 21,000,000 59447PCJ8 0.13% 0.11% Education Education Education 0.24% Medical 11,075,000 478271KA6 25,000,000 914293AA3 TN JOHNSON CITY HLTH & EDU FACS BRD MTN ST HLTH SR 2013B UNIV HOSPS HLTH SYS INC 02/04/2015 * 0.06% Medical 02/04/2015 * 0.13% Medical Medical 0.19% Power 24,630,000 19247TAA7 COHASSET-VAR-REF-A-MI 02/04/2015 * 0.13% Power Power 0.13% Higher Education 16,199,000 644614P37 NH HLTH & EDU FACS AUTH NH HIGHER EDU LN CORP SR 2011A 02/04/2015 * 0.08% Higher Education Higher Education 0.08% Multifamily Housing 11,750,000 64986MK95 NY STATE HFA VAR - TAXABLE - 88 LEONARD SER A 02/04/2015 * 0.06% Multifamily Housing 0.06% 02/04/2015 * 0.06% Multifamily Housing Student Loan 11,500,000 60416MAD5 MN ST OFFICE OF HIGHER ED SUPPL STUDENT LN SR 2008A Student Loan Student Loan 0.06% Water 8,000,000 64972FY83 NYC MUN WTR FIN AUTH WTR & SWR TXBLE TR T30001 02/04/2015 * 0.04% Water Water 0.04% Single Family Housing 3,765,000 49130PXQ2 KY KENTUCKY HSG CORP HSG REV VAR-AMT-SER F 02/04/2015 * 0.02% Single Family Housing 0.02% Variable Rate Demand Notes 2.08% Single Family Housing Agencies US Governments 55,000,000 3130A2W93 10,000,000 3130A2WV4 * Demand Feature FEDERAL HOME LOAN BANK 0.19% 9/1/2015 FEDERAL HOME LOAN BANK 0.125% 9/2/2015 09/01/2015 09/02/2015 0.29% 0.05% US Governments US Governments Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP % of Portfolio Description Maturity FEDERAL HOME LOAN BANK 0.19% 9/3/2015 FEDERAL HOME LOAN BANK 0.25% 10/2/2015 FEDERAL HOME LOAN BANK 0.2% 9/17/2015 FEDERAL HOME LOAN BANK 0.263% 10/9/2015 FEDERAL HOME LOAN BANK 0.21% 10/13/2015 FEDERAL FARM CREDIT BANK 0.1345% 3/3/2016 09/03/2015 10/02/2015 09/17/2015 10/09/2015 10/13/2015 03/03/2016 Industry Agencies US Governments 27,500,000 64,600,000 64,125,000 79,825,000 40,000,000 35,000,000 3130A2XG6 3130A2XM3 3130A2ZT6 3130A2ZV1 3130A32V5 3133EDG55 0.14% 0.34% 0.33% 0.42% 0.21% 0.18% US Governments 1.96% Agencies 1.96% US Governments US Governments US Governments US Governments US Governments US Governments Medium Term Notes Banks 20,000,000 1,000,000 57,200,000 8,923,000 143,635,000 63254AAA6 63254AAC2 6325C0BN0 78008SPH3 89114QAJ7 NATIONAL AUSTRALIA BK SR NT NATIONAL AUSTR BK SR UNSEC NATIONAL AUSTRALIA BANK 2.75% 9/28/2015 ROYAL BK CANADA TORONTO DOM BANK SR UNSEC FRN 03/09/2015 08/07/2015 09/28/2015 10/30/2015 05/01/2015 0.10% 0.01% 0.30% 0.05% 0.75% Banks Banks Banks Banks Banks Banks 1.20% Corporates 22,813,000 594918AG9 3,030,000 6832348H4 34,000,000 931142BB8 MICROSOFT CORP 1.625% 9/25/2015 ONTARIO (PROVINCE OF) 2.95% 2/5/2015 WAL-MART STORES INC 5.319% 6/1/2015 09/25/2015 02/05/2015 06/01/2015 0.12% 0.02% 0.18% Corporates Software Regional(state/provnc) Retail 0.31% US Governments 31,200,000 3130A1UD8 9,500,000 3133ECLP7 FEDERAL HOME LOAN BANK 0.14% 8/5/2015 FEDERAL FARM CREDIT BANK 0.3% 8/17/2015 08/05/2015 08/17/2015 0.16% 0.05% US Governments 0.21% Medium Term Notes 1.73% US Governments US Governments Euro CDs Banks 100,000,000 DZ BANK AG DEUTSCHE ZENTRALGENOSSENSCHAFTSBANK 05/07/2015 0.52% Banks 0.52% Euro CDs 0.52% Tax Exempt Commercial Paper 75,000,000 92415WAE5 VERMONT ECONOMIC DEVELOPMENT AUTHORITY TAXABLE CPX 05/07/2015 0.39% 0.39% * Demand Feature Banks Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP Description Maturity % of Portfolio Industry Tax Exempt Commercial Paper Tax Exempt Commercial Paper 0.39% U S Treasury Notes US Governments 75,000,000 912828MH0 US TREASURY N/B 01/31/2015 0.39% US Governments 0.39% U S Treasury Notes 0.39% US Governments CP Mode Bonds General Obligation 15,000,000 CHICADXXX * Demand Feature CHICAGO TAXABLE CP SR 2002D 03/17/2015 0.08% General Obligation 0.08% CP Mode Bonds 0.08% General Obligation Cash Management Portfolio As of 1/30/2015 Holdings by Sector Face Amount CUSIP Description Maturity % of Portfolio Industry CP Mode Bonds General Obligation 19,152,107,286 Total Portfolio Face Value (Excluding Uninvested Cash) Portfolio holdings are subject to change. Percentage (%) of market value refers to all securities in the portolio, excluding uninvested cash balances. Because different calculation methods are used, the portofolio holdings information above may be different from the portolio holdings information for the same period contained in the fund's annual and semiannual shareholder reports or first and third quarter reports filed with the Securities and Exchange Commission on Form N-Q. Additionally, this data may differ from any holdings information found on firms' marketing materials. OBTAIN A PROSPECTUS To obtain a summary prospectus, if available, or prospectus, for Institutional money market fund distributed by DWS Investments Distributors, Inc., call Institutional Investor Services at (800) 730-1313 Monday through Friday, 8:00am to 6:00 pm ET. We advise you to carefully consider the product's objectives, risks, charges and expense before investing. The summary prospectus and prospectus contain this and other important information about the investment product, including management fees and expense. Please read the prospectus carefully before you invest or send money. DeAWM is Deutsche Bank's Asset and Wealth Management division and, within the US, represents the retail asset and wealth management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, Deutsche Investment Management Americas Inc. and DeAWM Trust Company. DeAWM Investments Distributors, Inc. 222 South Riverside Plaza Chicago, IL 60606-5808 www.deutschefunds.com Tel (800) 621-1148 TDD (800) 972-3006 NOT FDIC INSURED MAY LOSE VALUE An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, this share price isn't guaranteed and you could lose money by investing in the fund. The share price of money maket funds can fall below the $1.00 share price. You should not rely on or expect the Advisor to enter into support agreements or take other actions to maintain the fund's $1.00 share price. The credit quality of the fund's holdings can change rapidly in certain markets, and the default of a single holding could have an adverse impact on the fund's share price. The fund's share price can also be negatively affected during periods of high redemption pressures and/or illiquid markets. The actions of a few large investors in one class of shares of the fund may have a significant adverse effect on the share prices of all classes of the fund. R-018238-4 (03/14) * Demand Feature

© Copyright 2026