P ensi on P Protec ction n Fun nd Se eries s H

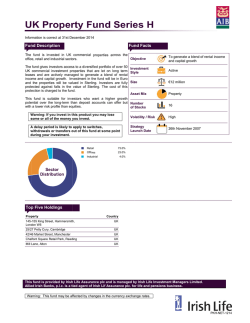

Pension Protec P ction n Fun nd Se eries sH Inforrmation is corrrect at 31st De ecember 2014 4 Fun nd Descrip ption Fun nd Facts This s is an active ely managed fixed interesst fund, which h invests bjective pred dominantly in n long-dated d Euro-denominated govvernment Ob secu urities. These securities arre effectively loans to gove ernments with repayment da ates of ten yea ars or more. Inv vestment Sty yle ed this fund to o outperform the t Merrill Lyn nch EMU We have designe vernment >10 year index. The T fund mana agers aim to add a value Gov by managing m whicch countries are a chosen an nd how long th he bonds Sizze will last l before the ey mature. Asset Mix Warning: W If yo ou invest in this t product you y may lose e some s or all off the money you y invest. Nu umber e used for the purposes of securities s The assets in thiss fund may be of Stocks ding in order to earn an ad dditional returrn for the fun nd. While lend secu urities lending g increases the e level of riskk within the fun nd it also Vo olatility / Risk prov vides an opporrtunity to incre ease the invesstment return. Strrategy Launch Date Bo ond Country Distrib bution Italy 25.5% France 21.8% German ny 16.2% Spain 14.8% Belgium m 8.7% Netherlands 3.8% Austria 3.5% Ireland 2.8% Finland d 1.6% Slovakiia 1.3% utperform the Merrill lynch EMU E To ou Gove ernment>10 ye ear index Activ ve €285 5.5 million Bond ds 39 Medium 31st December 19 997 Bond Portfolio Credit Quality Ratting Fu und AAA A 25.2% AA1 1 21.8% AA2 2 8.7% A2 1.3% A3 BBB B2 2.8% 40.3% This s fund is prov vided by Irish h Life Assuran nce plc and is managed by b Irish Life In nvestment Ma anagers Limited. Allie ed Irish Bank ks, p.l.c. is a tied agent of Irish I Lif Assu urance plc. fo or life and pen nsions business. Wa arning: This fu und may be afffected by cha anges in the cu urrency excha ange rates. PFH--NET-1214 Pe ensio on Pro otectio on Fund Se eries H Callendar Year Returns 2010 2.77% % 1.58% % Fun nd* Ben nchmark** Perrformance as at 31/12 2/2014 1 Month M 3 Month M YTD 1 Year Y 3 Year Y p.a. 5 Year Y p.a. Sin nce launch p.a.**** Fund* 2.51% 6.55% 26.61% 26.61% 14.24% 9.87% 9.94% Benchmark k** 2.71% 7.01% 28.92% 28.92% 15.53% 10.30% 10.29% 2011 4.47% 4.23% 2012 17.19% 17.80% 2013 0.53% 1.58% 2014 26.61% 2 2 28.92% Perfo ormance ch hart % Retu urn 30 25 20 15 10 5 0 Since launch p.a.*** 5 Year p.a. 3 Year p.a. 1 Year YTD 3 Month 1 Month Fund* Time * Fund F returns are e quoted before e taxes and after a standard annual manageme ent charge of 1.00%. The fund d management charge and pro oduct charges c will varyy depending on the terms and conditions c of yo our contract ** Benchmark: B The e standard against which the pe erformance of th he fund is meassured. It typicallyy includes mark ket indices or we eighted combina ations of these as approp priate. *** Launch L Date (fo or the series use ed in the above performance illu ustration) = 24/0 07/2009 Source: S Irish Life e Investment Managers Wa arning: Past P Performance is not a relia able guide to future f perforrmance. Wa arning: The value of your investment may m go down as well as up p. Allied Irish Banks,, p.l.c. is a tied d agent of Irish h Life Assuran nce, plc, for life e and pension ns business. Allied Irish Banks,, p.l.c. is regulated by the ce entral bank of Ireland. ent Managers is regulated by b the central bank of Ireland. Irish Life Investme entral bank of Ireland. Irish Life Assurancce plc is regulated by the ce PFH--NET-1214

© Copyright 2026