U UK Pr roper rty Fu und Serie es H

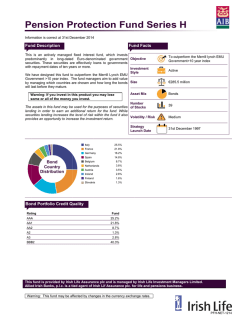

UK U Prroperrty Fu und Serie es H Inforrmation is corrrect at 31st De ecember 2014 4 Fun nd Descrip ption Fun nd Facts The fund is inve ested in UK commercial properties accross the Ob bjective ce, retail and in ndustrial secto ors. offic o over 50 Inv The fund gives invvestors accesss to a diversiffied portfolio of vestment ong term Sty UK commercial investment prroperties that are let on lo yle ses and are a actively mana aged to generrate a blend of rental leas inco ome and capita al growth. Invvestment in th he fund will be e in Euro and the propertie es will be valued in Sterlin ng. Investors are fully Sizze ected againstt falls in the value of Sterrling. The cosst of this prote prote ection is charg ged to the fund. Asset Mix s fund is suittable for inve estors who want w a higher growth This pote ential over the e long-term th han deposit accounts a can offer but Nu umber with a lower risk p profile than equities. of Stocks Warning: W If yo ou invest in this t product you y may lose e some s or all off the money you y invest. A delay perio od is likely to apply to swittches, withdrawals w o or transfers out o of this fun nd at some po oint during d your in nvestment. Retail 73.0% Office es 23.0% enerate a blen nd of rental inccome To ge and capital c growth Activ ve €12 million m Property 16 Vo olatility / Risk High Strrategy Launch Date 26th November 20 007 4.0% Indus strial Sec ctor Distrib bution Top p Five Hold dings Prop perty Coun ntry 145--155 King Stree et, Hammersmith h, Lond don W6 UK 25/2 27 Petty Cury, C Cambridge UK 42/4 46 Market Streett, Manchester UK Chalfont Square Re etail Park, Read ding UK Mill Lane, Alton UK This s fund is prov vided by Irish h Life Assuran nce plc and is managed by b Irish Life In nvestment Ma anagers Limited. Allie ed Irish Bank ks, p.l.c. is a tied agent of Irish I Lif Assu urance plc. fo or life and pen nsions business. Wa arning: This fu und may be afffected by cha anges in the cu urrency excha ange rates. PKH--NET-1214 UK Pro operty y Fund d Seriies H Callendar Year Returns 2010 16.31% % Fun nd* Perrformance as at 31/12 2/2014 1 Month M 3 Month M YTD 1 Year Y 3 Year Y p.a. 5 Year Y p.a. Sin nce launch p.a.*** 2011 2.15% 2012 -3.63% 2013 7.71% 2014 13.77% Perfo ormance ch hart Fund d* 0.48% 2.31% 13.77% 13.77% 5.69% 7.00% 7.23% % Retu urn 16 14 12 10 8 6 4 2 0 Since launch p.a.** 5 Year p.a. 3 Year p.a. 1 Year YTD 3 Month 1 Month Fund* Time Fund F returns are e quoted before e taxes and after a standard annual manageme ent charge of 1.63%. The fund d management charge and pro oduct charges c will varyy depending on the terms and conditions c of yo our contract ** Launch L Date (fo or the series use ed in the above performance illu ustration) = 24/0 07/2009 Source: S Irish Life e Investment Managers * Wa arning: Past P Performance is not a relia able guide to future f perforrmance. Wa arning: The value of your investment may m go down as well as up p. Allied Irish Banks,, p.l.c. is a tied d agent of Irish h Life Assuran nce, plc, for life e and pension ns business. Allied Irish Banks,, p.l.c. is regulated by the ce entral bank of Ireland. ent Managers is regulated by b the central bank of Ireland. Irish Life Investme entral bank of Ireland. Irish Life Assurancce plc is regulated by the ce PKH--NET-1214

© Copyright 2026