Emerging Markets Debt Indicator - Amazon Web Services

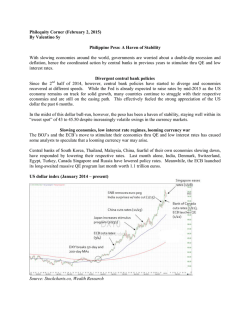

INDICATOR Investec Emerging Markets Debt Month ending 31 October 2014 Market Background Emerging market debt bounced back in October following the previous month’s weakness. The minutes from the September Federal Reserve (Fed) meeting spooked markets, resulting in the 10-year Treasury yield rallying through 2%. Treasuries have since steadily sold off on the back of continued strength in domestic economic data, while the Fed announced the end of its quantitative easing (QE) programme with the final US$15 billion taper. The impact on global liquidity conditions was partially offset by the Bank of Japan’s decision to step up its QE programme. Chinese data showed signs of stabilisation despite annualised GDP slipping to levels not seen since 2009. Third-quarter GDP fell to 7.3% versus 7.5% the previous quarter, but China’s leaders suggested it was in line with the ‘new normal’ as the country’s growth model transforms to one driven by consumer spending. Elsewhere in Asia, South Korea’s central bank cut rates by 25 basis points after revising down their forecasts for both economic growth and inflation. In Latin America, Brazilian markets were rattled by incumbent President Dilma Rousseff’s narrow re-election victory towards the end of the month. Although a surprise rate hike helped support the currency towards the end of the month. In Chile, the central bank cut rates for the fourth straight month after concerns over weaker growth. However, persistently high inflation means this is likely to be the end of its year-long easing cycle. Russia was once again a notable laggard over the month as geopolitical risks remain. A weaker ruble and ban on western food imports has kept inflation stubbornly higher prompting the Russian central bank to raise interest rates 150 basis points to 9.5%. Local currency bonds rallied 1.56% in October, as measured by the JP Morgan GBI-EM Global Diversified Index. Bonds returned 1.62%, while currencies were marginally down 0.06%. The Chilean peso was the best performing currency in the index as the central bank signalled an end to its easing cycle as inflation ticks higher. The Turkish lira and South African rand were also relatively stronger. By contrast, the principal laggard was the Russian ruble, despite the central bank’s attempts to defend the currency. The Colombian peso and Polish zloty were also weak.Turkey was the top performing bond market with the central bank modestly more dovish on the inflation outlook given lower commodity prices. Indonesian and South African bonds were also relatively strong. Russia was the weakest bond market as capital outflows continued. Nigerian bonds also came under pressure with falling oil prices a notable headwind. Hard currency bonds, as measured by the JP Morgan EMBI Global Diversified Index, fell by 1.71%. The index yield ended somewhat lower at 5.22% while spreads over US Treasuries fell slightly to 296 basis points. The best performing hard currency bond market was Turkey, followed by the Dominican Republic and Ukraine. By contrast, the worst performers were Venezuela, Iraq and Senegal. Corporate bonds, as measured by the JP Morgan CEMBI Broad Diversified Index, rose 0.91% with spreads rising slightly to 308 basis points. Investment grade bonds (1.02%) outperformed high yield bonds (0.68%). The top performing sector was TMT with infrastructure and utilities also outperforming. By contrast, metals & mining and oil & gas both lagged the overall index. Regionally, Latin America performed well, while Africa was the principal laggard. Outlook The picture for global growth remains mixed. In developed markets, we continue to witness a growing disparity between a relatively strong recovery in the US on the one hand and weakness in Europe and Japan on the other. Meanwhile, Chinese data flow remains on a moderating trajectory, although growth should stay between 7 and 7.5% for this year. As a result, the growth fortunes of individual emerging markets will depend on the extent and nature of their exposure to these large economies. Emerging market inflation continues to moderate on the back of depressed food and energy prices and this dynamic is likely to remain over the coming months. This should help to mitigate the impact of pass-through from the stronger US dollar, although we are cognisant of the threat of deflation in some markets (such as Hungary) and accelerating inflation in others such as Russia. Portfolio flows into emerging market debt have been modestly stronger in recent weeks. We also believe the composition of flows has come more from institutional clients which tends to be more longer term investment, as opposed to retail and cross-over investors who were the big sellers of emerging markets last year. We still feel global investors, particularly US institutional investors, remain structurally under-allocated to emerging markets which will provide a tailwind for flows over the medium term. Overall, we believe global growth patterns, positioning within the economic cycle and the external financing requirements of individual emerging market economies will remain the key determinants of individual market performance. This communication is only for professional investors and professional financial advisors. It is not to be distributed to the public or within a country where such distribution would be contrary to applicable law or regulations. Topic of the month: Growing up — emerging market central bank credibility underpins local bond markets Introduction Taking a step back from short-term events, longer-term economic and market trends are becoming increasingly apparent in emerging market (EM) local currency debt markets, which have important implications for how we can think about structuring our portfolio going forwards. Currency weakness in emerging markets has, historically, been linked to rising bond yields in these markets. However, we believe this relationship is not as strong as it once was. The Asian financial crisis prompted many EMs to take key steps to reform macroeconomic policy, including enhancing central bank credibility in an effort to make their economies more resilient to external shocks. The evolution of central bank policy and deepening of domestic bond markets means that, even in a rising dollar environment, many EM central banks are now relatively free to pursue monetary policy suitable for their domestic economies. As such, it is possible to have positive gains in local currency bond markets even in a period of modest currency weakness. Historical context Historically, monetary policy in emerging markets was hostage to external shocks and policy shifts in developed markets, particularly in the US. Moreover, the dynamics of the US dollar and the euro have also played their part in influencing policy decisions. Regardless of domestic inflation and growth trajectories, a stronger US dollar put pressure on the domestic currency, feeding fears of imported inflation, hurting the bond market and driving further outflows and currency weakness. In the end, central banks had to hike interest rates, despite often weaker domestic conditions. If the local currency had been pegged, then these pegs often broke under the pressure and there was widespread financial distress, and in some cases, default. This was particularly manifest during the 1997-98 Asian financial crisis. Although the reasons for the crisis were profuse, dollar strength versus EM currencies and the prevalence of ‘original sin’ – the proportion of outstanding sovereign debt denominated in foreign currencies (typically US dollar) – exacerbated the crisis. More expensive external debt repayments reinforced further currency weakness and outflows. As a result of the crisis, currencies (such as the pegged Thai baht), collapsed and interest rates were dramatically hiked in a number of countries, including Indonesia. Chart 1 outlines the Bank of Indonesia’s monetary policy tightening imposed during the crisis with interest rates soaring to extreme levels. The severe sell-off in regional currencies and assets led to economic depression and political instability in a number of countries. Chart 1 Indonesia interest rates versus the US dollar index during the 1997-98 Asian financial crisis 80 130 70 120 60 110 50 100 40 90 30 80 20 70 10 60 Jan 90 Jan 91 Jan 92 Jan 93 Jan 94 Jan 95 Jan 96 Jan 97 Jan 98 Jan 99 Jan 00 Jan 01 Jan 02 Jan 03 US dollar index Bank of Indonesia: benchmark interest rate Source: Bloomberg The chaotic events that unfolded during the Asian financial crisis can be contrasted with what Harvard economist Ricardo Hausmann has referred to as the “mythical” status of Australia back in the 1990s.1 Despite having a small, open economy with commodity-intensive exports, Australia was able to set domestic monetary policy relatively free from external constraints. At the time, this was unthinkable for EMs. Reserve Bank of Australia Conference,1999. Transcript: http://www.rba.gov.au/publications/confs/1999/hausmann-disc.html 1 What has changed? However, in the years since the Asian financial crisis, emerging markets have taken significant steps in addressing their policy limitations to provide greater resilience in times of stress. It is no longer the case that EM currency weakness is necessarily associated with rising domestic interest rates. Those EMs, such as Chile and South Korea, that adequately reformed can increasingly set policy rates relatively unconstrained by external factors. (This has not been the case for all emerging markets. For example, Brazil, Russia, South Africa and Turkey have been forced to raise interest rates in the past few months in a more traditional manner to prop up the value of their currencies and stem outflows). Firstly, there has been rapid growth in foreign exchange reserves, which has allowed many emerging markets to smooth currency volatility and ensure plentiful supply of foreign exchange in times of stress. There has also been a significant reduction in ‘original sin’, which has reduced dependency on US monetary policy and the risks arising from significant dollar appreciation.2 Both of these well-documented developments have been underpinned by a fundamental shift towards greater credibility in EM central bank policy through greater central bank independence and explicit mandates to curb inflation. The credibility of central banks is crucial because it anchors inflation expectations, turning a self-fulfilling problem into a self-fulfilling positive cycle. Thus domestic economic agents’ price-setting behaviour becomes less affected by exchange rate fluctuations. So in periods of moderate currency weakness, domestic economic agents do not expect a sustained rise in inflation, and so this self-fulfilling behaviour helps to keep a lid on inflation. In the current environment, this supports disinflation from lower commodity prices despite the strengthening dollar. If economic agents believe the central bank has the means and the willingness to fight inflation as and when it arises, then they will view interest rate cuts and modest currency weakness as a natural outcome of disinflation. Domestic and foreign investors will therefore look to buy bonds (possibly on a currency-hedged basis) if they believe inflation is falling, which is the case today across many EMs today. Indeed, we have seen great strides in central bank credibility in a number of countries over the last 15 years since the 1990s crises 3. This has resulted in more credible monetary policy. For instance, over the periods 2007-8, and again in 2011-2013, a number of central banks had to cope with high inflation at the same time as a deterioration in growth prospects. Confronted with this spectre of ‘stagflation’, central bankers with sufficient independence and long-sightedness had the room to hike interest rates to combat inflation before it spiralled. More recently, central bankers in India and Indonesia focused on their inflation mandates and raised interest rates to moderate price growth despite the lacklustre pace of economic expansion. Where central bank credibility was already established in the early 2000s, it has allowed dovish monetary policy in a number of markets recently despite dollar strength. Chart 2 below shows the relationship between the key benchmark interest rates for Israel, South Korea, Mexico and Poland versus the US dollar. As the chart shows, since the first quarter of 2011 these central banks have been implementing monetary policy easing while the US dollar has been strengthening. Even during the latest sharp correction in the US dollar we have seen rate cuts in Poland, Korea and Israel as their central banks try to reignite economic growth. Chart 2: Benchmark interest rates in selected EMs (LHS) versus the US dollar index (RHS) 6 90 88 5 86 84 4 82 3 80 78 2 76 74 1 72 70 Jan 11 Israel Poland Jan 12 Korea Mexico Jan 13 Jan 14 US dollar index Source: Bloomberg 2 Although it should be noted that emerging market corporates have issued considerable amounts of hard currency debt. See IMF working paper WP/06/228. ‘Measures of central bank autonomy: empirical evidence for OECD, Developing, and emerging market economies’ by Arnone, Laurens and Segalotto. 3 Similarly, chart 3 highlights the notable fall in EM bond yields even as the dollar has strengthened. Of note, while there was an inevitable rise in EM yields during the ‘taper tantrum’ the gap between the two has widened once more in recent months. Despite the prospect of US interest rate hikes in the coming months and a significantly stronger US dollar, bond yields in these emerging markets have fallen over the past few months – with bond yields falling in tandem with easing in South Korea and Poland. Chart 3: Selected EM 10-year yields versus the US dollar over past five years 120 100 80 60 40 20 Nov 2009 US dollar index Nov 2010 Korea Nov 2011 Indonesia Poland Nov 2012 Nov 2013 Nov 2014 Mexico Source: Bloomberg Conclusion The result of these developments is a changing environment for emerging market debt, where many (although not all) emerging markets can tolerate periods of modest currency weakness accompanied by disinflation and positive returns in local bond markets. Specific market returns will be dependent on the quality of institutions, credibility of monetary policy, inflation outlook and the ownership structure of the domestic debt market. Our scorecard process considers all these factors and this allows us to distinguish those countries which can achieve the positive feedback loop described above. In the team, each regional specialist is required to consistently score the quality of not only short-term monetary and fiscal policymaking decisions, but the longer-term socioeconomic and governance factors which can underpin the kind of changes in central bank credibility we have discussed. These scores are consistent across countries and time horizons, allowing us to take advantage of such trends in our portfolio decisions. EMD country and sector analysis For detailed analysis please click here. Important information This document is not for general public distribution. If you are a private investor and receive it as part of a general circulation, please contact us at +44 207 597 1900. The information discusses general market activity or industry trends and should not be construed as investment advice. The economic and market forecasts presented herein reflect our judgment as at the date shown and are subject to change without notice. These forecasts will be affected by changes in interest rates, general market conditions and other political, social and economic developments. There can be no assurance that these forecasts will be achieved. Investors are not certain to make profits; losses may be made. Past performance should not be seen as a guide to the future. The information contained in this document is believed to be reliable but may be inaccurate or incomplete. Any opinions stated are honestly held but are not guaranteed and should not be relied upon. This communication is provided for general information only. It is not an invitation to make an investment nor does it constitute an offer for sale and is not a buy, sell or hold recommendation for any particular investment. In the US, this communication should only be read by institutional investors, professional financial advisors and, at their exclusive discretion, their eligible clients. It must not be distributed to US Persons apart from the aforementioned recipients. In Australia, this document is provided for general information only to wholesale clients (as defined in the Corporations Act 2001). All data sourced from Bloomberg and Investec Asset Management. Outside the US, telephone calls may be recorded for training and quality assurance purposes. Issued by Investec Asset Management. FOR MORE INFORMATION, PLEASE CONTACT: AUSTRALIA NAMIBIA UNITED KINGDOM Level 23, The Chifley Tower 2 Chifley Square Sydney, NSW 2000 Telephone: +61 2 9293 6257 Facsimile: +61 2 9293 2429 100 Robert Mugabe Avenue Office 1, Ground Floor Heritage Square Building Windhoek Telephone: +264 (61) 389 500 Facsimile: +264 (61) 249 689 Woolgate Exchange 25 Basinghall Street London, EC2V 5HA Telephone: +44 (0)20 7597 1900 Facsimile: +44 (0)20 7597 1919 SOUTH AFRICA 666 5th Avenue, 37th Floor New York, NY10103 US Toll Free: +1 800 434 5623 Telephone: +1 917 206 5179 Facsimile: +1 917 206 5155 BOTSWANA Plot 64511, Unit 5 Fairgrounds, Gaborone Telephone: +267 318 0112 Facsimile: +267 318 0114 CHANNEL ISLANDS PO Box 250, St Peter Port Guernsey, GY1 3QH Telephone: +44 (0)1481 710 404 Facsimile:+44 (0)1481 712 065 EUROPE (EX UK) Woolgate Exchange 25 Basinghall Street London, EC2V 5HA Telephone: +44 (0)20 7597 1999 Facsimile: +44 (0)20 7597 1919 HONG KONG 19849 – 11/14 Suites 2602-06, Tower 2 The Gateway, Harbour City Tsim Sha Tsui, Kowloon Hong Kong Telephone: +852 2861 6888 Facsimile: +852 2861 6861 www.investecassetmanagement.com 36 Hans Strijdom Avenue Foreshore, Cape Town 8001 Telephone: +27 (0)21 416 2000 Facsimile: +27 (0)21 416 2001 SINGAPORE One Fullerton #02-01 1 Fullerton Road Singapore, 049213 Telephone: +65 6832 5052 TAIWAN Unit C, 49F, Taipei 101 Tower No.7, Section 5, Xin Yi Road Taipei 110, Taiwan Telephone: +886 2 8101 0800 Facsimile: +886 2 8101 0900 UNITED STATES

© Copyright 2026