daily market buzz - Bank One ~ Mauritius

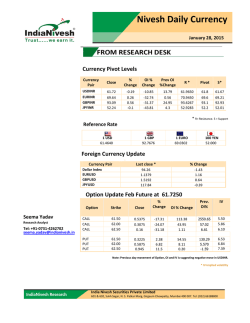

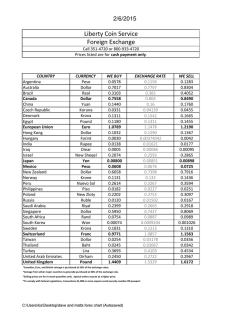

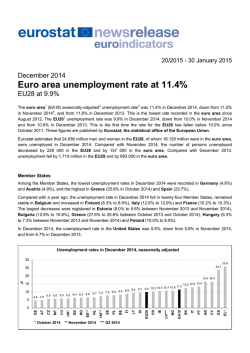

BANK ONE Market Buzz Currency Market Currency EUR-USD GBP-USD USD-JPY USD-ZAR USD-MUR EUR-MUR GBP-MUR Treasury Bills/ Govt Bonds Actual 1.1469 1.5336 117.35 11.3050 32.950 37.786 50.498 Previous 1.1356 1.5207 117.31 11.4670 33.000 37.472 50.184 2.932 2.894 ZAR-MUR 6-Feb-15 Equities Market Tbills/Govt Bonds 91-Day 182-Day 273-Day 364-Day 3-Year 5-Year 10-Year Actual 3.04% 3.00% 2.64% 2.73% 3.11% 4.68% 6.09% Previous 2.21% 2.88% 3.24% 2.85% 3.11% 4.01% 6.24% 15-Year 6.97% 7.60% Market Highlights- International & Local Market News • The single currency rose on views that the Swiss National Bank was buying euros to weaken the franc , this helped the currency to recover from its recent losses arising from ECB comments that they will not accept Greek bonds as collateral. • The dollar tumbled further after data showed that US trade deficit widened sharply to its highest level since 2012. Market will be awaiting US non-farm payrolls data for further cues. • The pound sterling rose against the dollar, largely supported by an unexpected rise in housing data, whilst the Bank of England kept interest rates unchanged at 0.5 percent. • The rand was supported by weaker dollar which triggered a higher demand for emerging market assets. • US stocks climbed as energy shares bounced with oil prices. Local Securities • The Bank of Mauritius will auction MUR 500 million for the 182-Day Treasury bills today. Indices DOW JONES FTSE NIKKEI SEM Today 17,884.88 6,865.93 17,644.17 1,998.48 Previous 17,673.02 6,860.02 17,525.85 2,003.16 % Change 1.20 0.09 0.68 (0.23) Today Economic Calendar: Country 11.00 GE 13.30 UK 17.30 US 17.30 US 17.30 US Indicators Industrial Output Trade Balance Non-Farm Payrolls Private Payrolls Unemployment Rate Poll 0.40% -9.10 b 12 K 225 K 5.60% Prior -0.10% -8.84 b 17 K 240 K 5.60% Economic Definition: (US) Unemployment Rate The US Unemployment Rate reflects the percentage of people considered unemployed in the United States. Unemployment is the single most popularly used figure to give a snapshot of US labor market conditions. Because the Federal Reserve is under strict pressure to keep unemployment under control, high unemployment puts downward pressure on interest rates, as the Fed will look to bolster the economy to remedy the employment situation. More generally, unemployment is indicative of the economy's production, private consumption, workers' earnings, and consumer sentiment. We will be pleased to assist you, should you require any further information: [email protected] 202-9322 [email protected] 202-9359 [email protected] 202-9321 [email protected] 202-9270 DISCLAIMER: This report has been issued by members of the Treasury Department of Bank One Limited. This document has been prepared in good faith on the basis of information available at the date of publication without any independent verification. This communication is provided for information and discussion purposes only. Unless otherwise indicated, it does not constitute an offer or recommendation to purchase or sell any financial instruments or other products. Bank One does not guarantee or warrant the accuracy, reliability, completeness of the information in this publication.

© Copyright 2026