Economic Update The Long Expansion February 2015

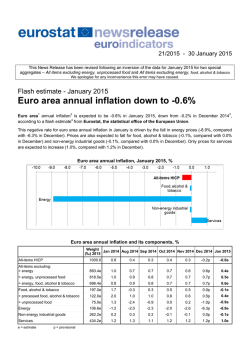

ECONOMIC UPDATE: The Long Expansion Richard B. Hoey Chief Economist, BNY Mellon The global economy remains in a long economic expansion. Due to low inflation and the slow pace of expansion, monetary policy has been able to retain more of an early cycle stance than a late cycle stance. For now, many central banks are motivated to maintain an easy monetary policy, given the fall in both actual inflation and expected inflation. We expect global GDP growth to run somewhat faster in 2015 and 2016 than it has in the last three years for several reasons, including the avoidance of special drags, much lower oil prices, and past and current monetary ease. Several special factors which held back growth in 2014 are unlikely to be repeated. These include the weather-impacted decline in U.S. GDP in the first quarter of 2014 and the Japanese recession in the middle two quarters of 2014 due to the rise in the value-added tax. A second round of fiscal tightening in Japan, originally planned for 2015, has now been postponed. We expect low energy prices to help support global growth. The benefits of the sharp decline in oil prices for global growth should exceed the drag from those sectors and countries negatively impacted. We also expect that current and past monetary ease will contribute to global growth. In recent weeks there have been monetary policy easing moves from the ECB, the Swiss National Bank, the Bank of Canada, the National Bank of Denmark, Norway’s Norges Bank, the Central Bank of the Republic of Turkey, the Central Reserve Bank of Peru, the Reserve Bank of India, and the Central Bank of Egypt, among others. In addition, with February 2, 2015 downward pressure on inflation, countries expected to tighten monetary policy in 2015 should have greater flexibility to limit or delay their monetary tightening, if they wish. Recent currency trends should support global growth. There should be a boost to export competitiveness in such economically weak regions as Europe and Japan, due to sharp declines in their currencies. Because these currency declines have coincided with a sharp drop in oil prices, the currency declines are more likely to have cyclicallyappropriate anti-deflationary effects than to generate excess inflation. One reason that other countries have tolerated the currency depreciation strategies of the ECB and the Bank of Japan is that in both cases inflation is running well below the central bank’s target. Therefore, these policies can be viewed as appropriately anti-deflationary in an inflation-targeting context. The recovery in global growth has been more sluggish in this cycle than in past recoveries. Despite the aggressive use of credit to finance the leveraged purchase of existing assets, the appetite to use credit to finance increased current spending has been restrained until now in many countries. In addition, there has been a downward shift to lower trend growth in China. China engineered a domestic credit boom a half-decade ago to limit the spillover to the Chinese economy of the global financial crisis and global recession. However, the hangover from that credit boom is now contributing to a slowdown in the growth rate of China. This is occurring just as there is a demographic inflection point to slower growth in the Chinese labor force. We believe that the outlook for the Chinese economy is a downward shift to slower trend growth rather than a hard landing. An additional trend which has restrained the pace of global growth (but not its longevity) is that the global trade multiplier has dropped. In past cycles, global trade tended to grow more rapidly than global GDP (i.e., the global trade multiplier was above 1.0). As emerging markets are now becoming more dependent on domestic demand growth than in the past, the global trade multiplier has shifted down, with global trade and the global economy both growing at about the same pace. There has recently been a very sharp drop in commodity prices. Both the old normal and the new normal in the commodities market is an alternation of cyclical booms and busts. In general, copper mines and oil wells tend to be long-lived assets and remain in production long after the boomtime demand has ebbed. The current commodity bust was created by three basic factors: (1) past overbuilding of capacity due to cheap capital and enthusiasm for an expected commodity supercycle of emerging market demand led by the Chinese goods producing sector, (2) a subsequent slowing in emerging market demand growth, especially in the Chinese goods producing sector and (3) a favorable supply shock due to technological innovation, notably in U.S. shale oil production. When commodity prices decline sharply, it is important to distinguish the causes. The source of commodity price weakness has important implications for the outlook for future global growth. If commodity prices plunge because the global economy goes into recession, the decline in commodity prices is merely a symptom of bad economic news. We do not believe that is what is now occurring. It is true that there is some demand weakness for commodities. We believe that is more attributable to a downward shift in the trend growth of the goods producing sector in China than to broad global economic weakness. In addition, some of the demand weakness is technological not cyclical. For example, demand deceleration due to technological innovation (such as cars with better mileage) should not be regarded as a cyclical signal of a weak global economy. We believe that the main story today is not cyclical weakness in the demand for commodities. Rather it is that there has been an expansion of cheap supply due to overestimates of commodities demand from China combined with successful technological innovation, notably in shale oil. Technological innovation in the oil and gas sector is a positive supply shock. We expect that weak energy prices will aid real income growth and global economic expansion. It is notable that in prior periods when there was a sharp decline in oil prices without a U.S. recession, such as 1986 and 1998, the resulting combination of low inflation and improved real income growth contributed to solid economic growth and a rise in stock prices to very elevated levels, eventually building towards stock market peaks in August 1987 and March 2000. We expect low energy prices to persist long enough to provide substantial support for a long global expansion. In the long run, the relatively high full cycle cost of newly developed energy supplies implies that oil prices should eventually return to higher levels. However, we expect that sharply depressed crude oil prices are likely to persist for a number of quarters. Few existing productive assets will be shut in quickly, as the marginal cash costs of continuing to produce are relatively low. The depletion rates of shale oil are relatively fast, so that a plunge in new capital spending should eventually rebalance oil supply/demand over the next several years. However, rig productivity continues to improve and capital spending dollars should stretch further as rising excess capacity in the oil service sector should lower costs substantially. The adjustment in supply growth should eventually occur, but only slowly. Overall, we expect that low energy prices will make a favorable contribution to a long global expansion for the next several years. Central bank policy rates today are already at or somewhat below the “so-called” zero bound in many developed countries. As a result, additional monetary easing in response to below target __________________________________________________________________________________ ECONOMIC UPDATE — February 2, 2015 2 inflation can be somewhat complex for some central banks to engineer and complex for analysts to evaluate. Quantitative easing has proved to be powerful monetary medicine, but there is a risk that dangerous side effects will emerge in the future. Long-term sovereign bond yields have traditionally been regarded as the anchor of valuation estimates for other assets. To the degree that central bank manipulation of long-term sovereign bond yields by quantitative easing creates a “crooked ruler effect,” there is a potential risk of asset bubbles. Reduction of the normal sovereign bond supply available to the private sector has been engineered by each of the G4 central banks, either in the recent past (Federal Reserve, Bank of England) or currently (Bank of Japan, ECB). This may prove to be a monetary oversteering, giving rise to the risk of asset bubbles, followed by an eventual financial hangover in some future year. Expectations of inflation have been falling. We believe that the markets are totally rational to lower estimates of inflation over the next year or two. However, we suspect that the sharp plunge in very long-term inflation expectations as measured by bond market breakevens may prove to be a mistake in the end. Given the intensity of anti-deflationary policies which have been adopted by the central banks, higher inflation should return--just not soon. We are quite skeptical about the concept that central banks will prove unable to accelerate inflation in the long run. We believe that the ability of central banks to drive inflation higher has been limited by bank deleveraging (especially in Europe) and round after round of financial regulatory tightening. We believe that this has recently disrupted the transmission of excess financial liquidity into credit-financed current spending, but that pattern may not prove permanent. We believe that restrictive financial regulation has created a gap between gross monetary policy (which is aggressively stimulative) and net monetary policy (moderately stimulative). While the central banks have jammed down the monetary accelerator, the financial regulators have jammed down the regulatory brake, resulting in a grinding of gears in the financial system. Over the coming years, however, we expect less incremental regulatory tightening beyond what has already been decided. If so, excess liquidity is likely to be eventually mobilized to finance increased spending in the real economy and generate a faster pace of nominal GDP growth and inflation. Most developed countries have inflation targets near 2% over the medium term. This is due in part to Janet Yellen’s success at the July 1996 FOMC meeting in persuading Alan Greenspan of the benefits of an inflation target near 2% rather than zero. In many developed countries, core inflation is currently running about 1% lower than a 2% pace, certainly a less challenging problem than if core inflation was running near minus 1%, roughly 1% below a zero target. Our view is that the risks of a major deflation are low, but with inflation below target in many developed countries, global monetary policy is likely to remain quite easy over the next several years. There are different kinds of deflation and lowflation, with very different consequences. One of the worst kinds of deflation is a collateral deflation which reflects a sharp decline in collateral for bank loans, threatening to create a financial crisis. That’s what occurred in the Great Depression. Former Fed Chairman Ben Bernanke was very aggressive in combatting the collateral deflation risk in 2008 and 2009. Now that core banks have delevered their balance sheets, asset prices have recovered and tight financial regulation has suppressed risktaking by financial intermediaries, we believe that the risk of collateral deflation today is low in the context of easy monetary policy. Notably, much of the energy-related risk has been taken on by unlevered final investors outside the banking system. Much of the current concern among developed country central banks about low inflation and falling inflation expectations is linked to concern about “monetary traction,” the ability of central banks to arrange real yields (nominal yields minus actual or expected inflation) low enough to stimulate economic expansion. With short-term nominal interest rates down near the so-called zero bound, we believe that most major developed countries will __________________________________________________________________________________ ECONOMIC UPDATE — February 2, 2015 3 be able to grow somewhat faster than their relatively modest potential real GDP growth rates over the next several years. While European and Japanese inflation may fall short of the inflation targets of the ECB and the Bank of Japan for several years, our view is that deflation risk will fade. The long global expansion we expect should gradually calm fears of deflation. BNY Mellon Investment Management is one of the world’s leading investment management organizations and one of the top U.S. wealth managers, encompassing BNY Mellon’s affiliated investment management firms, wealth management organization and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally. The statements and opinions expressed in this document are those of the authors as of the date of the article, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY Mellon, BNY Mellon Investment Management EMEA Limited or any of their respective affiliates. The information contained in this document has been provided as a general market commentary only, and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY Mellon Investment Management EMEA Limited and its affiliates are not responsible for any subsequent investment advice given based on the information supplied. This document is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. To the extent that these materials contain statements about future performance, such statements are forward looking and are subject to a number of risks and uncertainties. Information and opinions presented in this material have been obtained or derived from sources which BNY Mellon believed to be reliable, but BNY Mellon makes no representation to its accuracy and completeness. BNY Mellon accepts no liability for loss arising from use of this material. If nothing is indicated to the contrary, all figures are unaudited. Past performance is not a guide to future performance. The value of investments and the income from them is not guaranteed and can fall as well as rise due to stock market and currency movements. When you sell your investment you may get back less than you originally invested. While the information in this document is not intended to be investment advice, it may be deemed a financial promotion in non-U.S. jurisdictions. Accordingly, where this document is used or distributed in any non-U.S. jurisdiction, the information provided is for use by professional and wholesale investors only and not for onward distribution to, or to be relied upon by, retail investors. This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This document may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this document comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this document in their jurisdiction. The investment products and services mentioned here are not insured by the FDIC (or any other state or federal agency), are not deposits of or guaranteed by any bank, and may lose value. This document should not be published in hard copy, electronic form, via the web or in any other medium accessible to the public, unless authorized by BNY Mellon Investment Management EMEA Limited. In Australia, this document is issued by BNY Mellon Investment Management Australia Ltd (ABN 56 102 482 815, AFS License No. 227865). Authorized and regulated by the Australian Securities & Investments Commission. • In Brazil, this document is issued by BNY Mellon Serviços Financeiros DTVM S.A., Av. Presidente Wilson, 231, 11th floor, Rio de Janeiro, RJ, Brazil, CEP 20030-905. BNY Mellon Serviços Financeiros DTVM S.A. is a Financial Institution, duly authorized by the Brazilian Central Bank to provide securities distribution and by the Brazilian Securities and Exchange Commission (CVM) to provide securities portfolio managing services under Declaratory Act No. 4.620, issued on December 19, 1997. • Securities in Canada are offered through BNY Mellon Asset Management Canada Ltd., registered as a Portfolio Manager and Exempt Market Dealer in all provinces and territories of Canada, and as an Investment Fund Manager and Commodity Trading Manager in Ontario. • In Dubai, United Arab Emirates, this document is issued by the Dubai branch of The Bank of New York Mellon, which is regulated by the Dubai Financial Services Authority. • In Hong Kong, this document is issued by BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • In Japan, this document is issued by BNY Mellon Asset Management Japan Limited. BNY Mellon Asset Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Securities Investment Advisers Association. • In Singapore, this document is issued by BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • This document is issued in the UK and in mainland Europe, by BNY Mellon Investment Management EMEA Limited, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorized and regulated by the Financial Conduct Authority. • This document is issued in the United States by BNY Mellon Investment Management. © 2015 The Bank of New York Mellon Corporation. bnymellon.com __________________________________________________________________________________ ECONOMIC UPDATE — February 2, 2015 4

© Copyright 2026