presentation

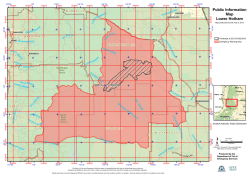

Mexico’s Energy Reform: Midstream & downstream 2015 Louisiana Gulf Coast Oil Exposition (LAGCOE) Industry Briefing: “Oil and Gas Mexico Seminar” The Cajundome & Convention Center Lafayette, LA Francisco Xavier Salazar Diez de Sollano Chair Description of the reform Private investment opportunities before the reform (natural gas) Upstream Gas Well Keys: Pipelines LNG/CNG Closed to private investment Open to private investment Imports Transport Distribution Service Stations Final users Gas Processing Transport Oil Well Storage Refining Midstream Downstream Private investment opportunities after the reform (natural gas) Upstream Gas Well Keys: Pipelines LNG/CNG Closed to private investment Open to private investment Imports Transport Distribution Service Stations Final users Gas Processing Transport Oil Well Storage Refining Midstream Downstream Natural gas: Authorities Upstream Gas Well Pipelines LNG/CNG CRE Sener CNH ASEA Transport Distribution Service Stations Final Users Refining Midstream Keys: Imports Gas Processing Transport Oil Well Storage Downstream Private investment opportunities before the reform (LPG) Upstream Gas Well Keys: Pipelines Other Closed to private investment Open to private investment Imports Transport Distribution Service Stations Retail (Other) Gas Processing Transport Oil Well Storage Refining Midstream Final Users Downstream Private investment opportunities before the reform (liquids) Upstream Gas Well Keys: Pipelines Other Closed to private investment Open to private investment Imports Transport Distribution Service Stations Retail (Other) Gas Processing Transport Oil Well Storage Refining Midstream Final Users Downstream Private investment opportunities after the reform (LPG & liquids) Upstream Gas Well Keys: Pipelines Other Closed to private investment Open to private investment Imports Transport Distribution Service Stations Retail (Other) Gas Processing Transport Oil Well Storage Refining Midstream Final Users Downstream LPG & liquids: Authorities Upstream Gas Well Keys: Transport Distribution Service Stations Retail (Other) Refining Midstream Pipelines LNG/CNG CRE Sener CNH ASEA Imports Gas Processing Transport Oil Well Storage Final Users Downstream Basic characteristics of the regulatory framework General Natural gas Others • Transitory assymetric regulation imposed on Pemex as a dominant player in all markets: - Vertical unbundling - Price controls - Mandatory open access - Market caps • Regulation for other players according to market characteristics • Pemex pipelines transfered to CENAGAS, who will also act as independent operator of the “integrated” system • Stricter regulation: - Mandatory open seasons (limits to proprietary pipelines) - Use it or loose it principle - Electronic bulletin boards - Regulated tariffs • Lighter regulation. Flexibility on: - Vertical integration - Proprietary infrastructure - Open seasons - Tariffs • More flexibility on infrastructure linked to upstream and storage • Less on LPG, pipelines and airport infrastructure Principles for regulation of prices and rates • • • • • • • Competitive sectors are not regulated ex-ante (hands off policy). Anticompetitive behavior sanctioned by COFECE (Competition Authority). Incumbent prices are regulated based on opportunity cost (netback to relevant markets). Rates for networks and essential facilities regulated based on incentive schemes Competition for the market is preferred over rate setting (when public bids are an alternative, CRE reviews and approves the terms of reference). Rates are reviewed every 5 years but initial CAPEX and ROE are maintained. Additional investments and OPEX are evaluated during the corresponding rate case. Regulated ROE is set based on CAPM methodology updated every year (country & market risk series). Debt level approved according to the project. Assets base as well as O&M are subject to benchmarking. Opportunities Private investment in natural gas infrastructure to 2019 LNG Terminals (existing) Previously operating pipelines New operating pipelines (2013/2014/2015) Pipelines under construction (2015/2016) Pending pipelines Sásabe San Isidro Puerto Libertad Samalayuca El Encino Colombia Guaymas Topolobampo Camargo El Oro La Laguna Escobedo 2019 Los Ramones Mazatlán 8920, 45% Durango Altamira Tuxpan 11071 , 55% Guadalajara Huexca Lázaro Cárdenas Other (Private) CENAGAS Tula Zempoala Cd. Pemex Acapulco Salina Cruz Tapachula Private investment in natural gas infrastructure to 2019 LNG Terminals (existing) Previously operating pipelines New operating pipelines (2013/2014/2015) Pipelines under construction (2015/2016) Pending pipelines Sásabe San Isidro Puerto Libertad Samalayuca El Encino Topolobampo 2761, 24% Colombia Guaymas Camargo El Oro La Laguna Escobedo 2014 Los Ramones Mazatlán Durango Altamira Tuxpan Guadalajara 8920, 76% Huexca Lázaro Cárdenas Other (Private) Tula CENAGAS Zempoala Cd. Pemex Acapulco Salina Cruz Tapachula More investment is needed in infrastructure for liquids 6 Refineries 77 Storage facilities Rosarito Mexicali Cd. Juárez 10 Maritime operation facilities (5 port terminals) ~ 9000 km of Pipelines Magdalena Hermosillo Guaymas Nuevo Laredo Culiacán Current situation: ~ 50% imports Reynosa/Matamoros Durango Topolobampo La Paz Mazatlán Sta. Catarina Zacatecas Madero Qro. Pach. León > 90 uptime in pipelines < 6 days of autonomy in maritime terminals S.L.P. Aguas. Manzanillo Progreso Tuxpan Lerma Azcap.* Morelia Pajaritos Toluca Cuern. Lázaro C. Cuautla Acapulco T. Blanca Tehua. Salina C. Tuxtla Gutiérrez Tapachula Current infrastructure in storage for oil products Days of storage by fuel type 30 25 20 Large amounts of money need to be invested in pipelines and storage tanks to satisfy demand growth (~3.5%) and increasing strategic stocks (15-30 days)… 15 10 5 0 2007 2008 2009 Gasoline 2010 Diesel 2011 2012 Infrastructure related to Round 1 (E&P) Unconventional Existing Pemex infrastructure More infrastructure needed Perdido Area Unconventional & mature 13 8 9 10 7 4 3 2 1 5 6 11 Deep Water (South) 12 14 Chicontepec Heavy crude Shallow waters VERACRUZ Thanks! [email protected] www.cre.gob.mx

© Copyright 2026