here - Thomson Reuters

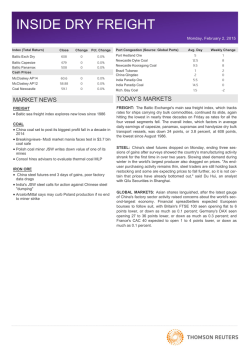

INSIDE METALS Tuesday, February 3, 2015 CHART OF THE DAY Click on the chart for full-size image Click here for LME charts GENERAL NEWS As India opens up coal sector, global miners cool on investing Interview-Nunavut premier plays down tax break talk as commodities slide Goldman Sachs' CNR to ship coal via public Colombia port -Source Interview-Zimbabwe says tax on raw platinum exports to stay for now S.Africa's Sibanye agrees with unions to cut fewer jobs at Cooke mine Australia's BC iron to exit Brazilian JV as ore price sinks -Partner TODAY’S MARKETS BASE METALS: London copper climbed on technical buying that traders expected to sputter out, after wobbly factory data in China and Europe fuelled deflation concerns that are further clouding the outlook for demand. "Copper has had a pretty good run in light of the China PMI numbers - I thought we would see some weakness throughout the week. The market maybe got itself a little bit too short and has to cover," said analyst Daniel Hynes of ANZ in Sydney. PRECIOUS METALS: Gold advanced for a second session in three as a wobbly outlook for the global economy burnished bullion's safe-haven appeal, with holdings at the top gold fund at their highest in four months. Weak data from the United States to China and Europe dragged Asian equities into the red, boosting outlook for gold which has climbed 8 percent so far in 2015 after a two-year slide. FOREX: The Australian dollar skidded more than one U.S. cent to a six -year low and plunged more than two percent against the yen after the Reserve Bank of Australia slashed interest rates to a record low. The Aussie's drop against the yen gave the U.S. currency a cross-trading lift against the dollar, which shed about 0.5 percent to 117.03 yen . MARKET NEWS ALUMINIUM: Aluminium industry body stops stocks data reports in blow to transparency NICKEL/STEEL: UK steelmakers call for EU action as imports flood in Cliffs natural iron ore sales volumes rise, shares jump INSIDE METALS February 3, 2015 GENERAL NEWS As India opens up coal sector, global miners cool on investing Anglo American was also unlikely to be interested since it is focusing on divesting South African coal assets, said a source familiar with the miner's plans. India's plans to attract badly needed foreign investment and technology to its coal sector are getting a cool response from some miners and trading houses, even though the country is one of the few bright spots for global coal demand. Rio Tinto Chief Executive Sam Walsh said the firm had not looked at Indian coal investments yet but was open to opportunities, while Peabody Energy said it would "evaluate investments to serve India's rising coal needs as appropriate". Seeking to curb a growing reliance on imports, Prime Minister Narendra Modi passed an order in December to allow private firms to mine and sell coal for the first time in more than 42 years. India wants to more than double coal output to 1.5 billion tonnes by 2020, but its mining is deeply inefficient. Coal India, the world's largest coal miner, produces 1,100 tonnes of coal per employee a year, compared with 36,700 tonnes for Peabody Energy and 12,700 tonnes for China's Shenhua Energy. But even with India on track to overtake the United States as the second-largest coal consumer after China this decade, executives at Japanese trading houses and some of the biggest global miners said they were currently not looking to invest. Despite the lack of foreign interest in mining coal, both local and overseas investors flocked to a 10 percent stake sale of staterun Coal India that raised about $3.6 billion. However, this interest may also indicate how government firms will continue to have an edge in navigating India's maze of clearances. Red tape, problems with land and environmental approvals, and the quality of its coal have been cited as issues deterring investment, while on top of this Asian coal prices are languishing near 6-year lows. Interview-Nunavut premier plays down tax break talk as commodities slide Despite huge coal reserves, India's failure to modernise mining means it has become the world's third-biggest importer, shipping in coal from countries such as Australia and Indonesia. The premier of Canada's vast mineral-rich Arctic territory of Nunavut on Monday played down the idea of tax breaks to combat a slide in commodity prices, saying investors instead wanted more infrastructure. Asked about progress attracting investors for auctions that may start later this year, Coal Secretary Anil Swarup told Reuters talks were going on with several global firms on upgrading mining technology, although nothing had been finalised. Peter Taptuna said in an interview that the slump had hurt the economy and that he was keeping an eye on the handful of major companies that are operating in Nunavut, which is rich in gold, diamonds, iron ore, lead, zinc and uranium. "It is not just about mining on their own but also to provide technology to Coal India and Indian companies," he said. Up to now only state firms have been allowed to mine coal, but the sector is being opened up to help meet surging demand for coal for power. These include Agnico Eagle Mines Ltd, which runs the territory's only gold mine. Luxembourg-based steel maker ArcelorMittal SA owns half of Baffinland, a Canadian mining company that plans to exploit the huge Mary River iron ore deposit on Baffin Island. Indian conglomerates such as the Adani Group and GVK are expected to bid for coal blocks, but foreign firms will be harder to attract after previously facing obstacles to investing. An almost complete lack of infrastructure means operating costs are exorbitant in Nunavut, an 810,000 square mile (2.1 million square km) expanse of rock and ice slightly larger than Turkey. For example, global miner Rio Tint has had to wait more than a decade to secure approvals to start mining iron ore in India. Japanese trading firms have recently been increasing investments in coal, but executives at two firms said they did not intend to invest in India. "In Nunavut it's not necessarily the tax breaks ... that are going to attract investment. It's infrastructure, especially transportation infrastructure," Taptuna said in Ottawa. "We have no plan to consider joining coal mine projects in India even (as) it opens up, as there are other countries which we are focusing on and where it is easier to manage projects," said an official at a trading firm, declining to be identified. "It's very difficult to do much of anything without proper marine facilities." Taptuna said his priority was to construct port facilities in important centers such as the capital Iqaluit, where tricky tides and an absence of docks mean it can take cargo ships up to 10 days to unload their cargoes. Another senior executive at a rival firm said the quality of coal in India was not very high and the firm preferred to sell coal to the country rather than join in projects. Taptuna said a port in Iqaluit would cost between C$90 million ($71 million) and $140 million to build - money his government does not have. Among global miners, a spokesman for BHP Billiton, the world's biggest coking coal producer, declined to comment on India specifically but pointed to recent management statements that the miner planned no new coal investments. 2 INSIDE METALS February 3, 2015 GENERAL NEWS (Continued) Options include private-public partnerships or increasing the debt cap, he said, but he declined to give more details. Nunavut currently as a debt cap of C$400 million and any increase would have to be approved by the federal government. European thermal coal futures were trading at around $58.80 a tonne around the middle of last week. Interview-Zimbabwe says tax on raw platinum exports to stay for now With the general commodity slump, the value of mining exploration in Nunavut dropped to C$148 million in 2014 from C$258 million in 2013. Zimbabwe will keep a 15 percent export tax on unrefined platinum for now because mines have failed to provide a roadmap on how they plan to set up a local refinery, Finance Minister Patrick Chinamasa said on Monday. Goldman Sachs' CNR to ship coal via public colombia port Source President Robert Mugabe's government first proposed the levy in 2013 in an effort to push mines to process the metal locally. Goldman Sachs' mining affiliate CNR has reached a deal with a public port in Colombia to load its coal shipments which have been suspended for a year after its own docks fell afoul of environmental regulations, a port source told Reuters on Monday. In November, Chinamasa announced in a budget speech that he had postponed its introduction until January 2017 to give the firms time to build the smelting and refining plants. CNR, or Colombian Natural Resources, will export via the Carbosan terminal at the government-operated Santa Marta port. But the government's finance bill, which was published on Jan. 9, proposes its introduction from Jan. 1, 2015. "There has been an agreement established between the two sides. I don't know when it is due to begin," said the source, who asked not to be named because he was not authorized to speak officially about the matter. Chinamasa told Reuters in an interview that he had made his budget speech on the assumption that producers in Zimbabwe, which holds the world's second largest platinum deposits, had a firm plan on setting up a refinery. One Colombia-based coal industry source said he had heard shipments could begin as soon as this week or next. A CNR official told Reuters she could not immediately comment. "There was some mistake on my part there in the budget statement. I had been made to understand by the chamber of mines that platinum producers had provided a roadmap towards establishment of a platinum refinery," he said. Colombia is the world's fourth-biggest coal exporter and exports most of its coal to Europe for power generation. "So when there was a non-existent roadmap, because they had been given this warning two years back and there was nothing to show for it, I then decided to keep the provisions which we had put in the finance bill to remain as is," said Chinamasa. CNR continued to produce coal last year without exporting it. In 2013, the company produced around 3.5 million tonnes of coal, about 4 percent of national Colombian output of around 82 million tonnes that year. Miners Aquarius and Impala said on Friday they were seeking clarity from the government over the tax, which, if enforced, would slash their margins. The company had been expected to export its coal using the port of Colombia's second-biggest coal miner, U.S.-based Drummond, according to comments from government sources last October. The status of that deal could not immediately be clarified. With platinum prices already depressed, the tax would eat into the profits of companies with platinum assets in the country, which include Anglo American as well as Aquarius Platinum and Impala. CNR, with two Colombian coal mines, stopped exports on Dec. 31, 2013, as it could not comply with a new requirement to load ships by conveyor belt rather than crane, to prevent coal dust pollution and contamination of the ocean. Chinamasa said the chamber of mines, which represents the mining companies was holding discussions with the ministry of mines. The company said then it was considering building a conveyor belt but the plan does not appear to have advanced and looks increasingly unfeasible given its high cost, the price of coal which is near nine-year lows, and the small volumes produced by CNR. Taxes are finalised on the 7th of each month for the prior month in Zimbabwe, so the industry should have clarity by Feb. 7. CNR's coal reaches its Rio Cordoba port near Santa Marta via the Fenoco railway it operates jointly with two larger producers, Drummond and Glencore Xstrata unit Prodeco. Mining companies have previously said Zimbabwe's infrastructure and energy supply was not adequate to run a big refinery and note excess refining capacity next door in South Africa. Asked whether the government would change its position, Chinamasa said: "There are many ways to change this provision. But for now it is effective." Coal would likely have to be transferred a fairly short distance from Rio Cordoba to the Sociedad Portuaria de Santa Marta port via truck. 3 INSIDE METALS February 3, 2015 GENERAL NEWS (Continued) S. Africa's Sibanye agrees with unions to cut fewer jobs at Cooke mine the downturn in ore prices, Cleveland Mining Co Ltd, its partner, said on Monday. South African-focused bullion producer Sibanye Gold said on Monday it had reached an agreement with unions to cut fewer jobs than had been at risk at its struggling Cooke 4 operation. With iron ore prices about half the level of a year ago, BC Iron and other miners have managed to stay profitable mainly through a weaker Australian dollar, cheap freight rates and lower costs associated with a drop in oil prices. The agreement includes cutting 392 out of the 2,403 jobs at the mine west of Johannesburg and a pledge by the unions there not to embark on any strike over wages in 2015 as Sibanye tries to turn the mine's fortunes around, it said in a statement. "In light of market conditions, BC Iron has indicated its intention to withdraw from the fifty-fifty alliance between the companies over the Bahia and Minas Novas iron ore exploration projects in Brazil," Cleveland said in a statement. Sibanye said that up to 1,776 jobs could have been on the line and that no forced lay-offs had been carried out. BC Iron was not immediately available for comment. To combat falling ore prices, BC Iron cut dozens of jobs in December at its Nullagine mine in Australia, operated as a joint venture with Fortescue Metals Group. "The required reduction in the employee complement was primarily achieved through voluntary separation packages and voluntary early retirement," the company said. BC Iron sold 1.2 million tonnes of ore at an average price of $60 a tonne over the last quarter. It is targeting all-in costs of between A$54 ($42) and A$61 ($48) per tonne for the 2014/2015 fiscal year. The no-strike clause only applies to the miners at Cooke 4, who comprise about 6 percent of Sibanye's roughly 35,000 employees. Iron ore lost more than 10 percent of its value in January, stretching a 47 percent drop in all of 2014. Wage agreements in the gold sector expire in June of this year and negotiations will take place against the backdrop of a rise in union militancy as the once dominant National Union of Mineworkers (NUM) faces a struggle for members with the hardline Association of Mineworkers and Construction Union (AMCU). Benchmark 62 percent grade iron ore for immediate delivery to China stood at $61.70 a tonne. For its part, Cleveland said it intended to divest the Brazilian iron ore holdings into a separate company so it can focus on gold mining. Cooke 4 produces about 70,000 ounces of gold a year, about 4.5 percent of Sibanye's total. Australia's BC iron to exit Brazilian JV as ore price sinks Partner The world's biggest iron ore suppliers, led by Vale, Rio Tinto and BHP Billiton, have been increasing output by tens of millions of tonnes to win market share from smaller producers such as BC Iron and miners in China. Australia's BC Iron Ltd is withdrawing from a joint venture in Brazil aimed at expanding its mining operations overseas due to This, coupled with slowing demand in China for imported ore, is driving down the price, according to analysts. 4 INSIDE METALS February 3, 2015 MARKET NEWS market a magnet for overseas steel companies with excess capacity on their hands," it said in a statement. Aluminium industry body stops stocks data reports in blow to transparency Steel exports from China, by far the world's largest steel producer and consumer, surged 50.5 percent in 2014 from a year earlier to 93.78 million tonnes, Chinese customs data shows. The International Aluminium Institute (IAI) has stopped reporting global inventory stocks, in another blow to transparency for a metal whose price, critics say, has been skewed by big banks and trading houses. UK Steel said imports took up about 60 percent of the British market last year, versus 56 percent in 2013. It also estimates British steel demand recovered by some 12 percent last year, but local steelmakers struggled to benefit. In a statement, the IAI said the aluminium stocks numbers it receives from global smelters had become incomplete to the point where it would be misleading to carry on reporting them. Tata Steel for example, Europe's second-largest steelmaker, entered talks last year to sell some of its largest steelmaking operations in Britain to Geneva-based Klesch Group. Last year, a U.S. Senate investigation concluded that Wall Street banks had manipulated commodity prices and gained unfair trading advantages at the expense of consumers. The problem was especially acute in aluminium. The EEF has some 5,000 member firms in British engineering, manufacturing, technology and the wider industrial sector. Owners of London Metal Exchange warehouses, typically big banks and trade houses, have in the past held back supplies in a bid to boost rental revenues. The strategy also inflated aluminium prices by causing premiums, paid to secure metal deliveries inside or outside the LME system, to soar. Cliffs natural iron ore sales volumes rise, shares jump Miner Cliffs Natural Resources Inc reported a 26 percent jump in quarterly iron-ore sales volumes and lower production costs in the United States as it continued to cut jobs and related expenses. Premiums are still inflated today despite unprecedented regulatory scrutiny and reforms to LME warehouse rules. As such, further lack of clarity on global aluminium stockpiles is a blow to an aluminium market that still has pricing problems. Cliffs Natural Resources shares rose as much as 11 percent to $7.70 in after-market trading. "(We) understand that many analysts ... have used the IAI inventory reports as part of their information-gathering process, however, we do not consider the data ... is now adequately reflecting a true picture of global producer stocks," said the IAI. U.S. iron ore pellet sales volume increased to 7.8 million tons for the fourth quarter ended Dec. 31, while cash production costs for iron ore fell 5 percent to $59.06 per ton. Iron ore miners are struggling to survive weak prices as low demand for the steel-making ingredient in both domestic and international markets continues to weigh on their results. Problems began in the second half of last year when 35 smelters, or up to a third of smelters currently reporting stocks figures to the IAI, either stopped reporting or had difficulties reporting on a monthly basis. Cliffs Natural moved to stop production at its loss-making Bloom Lake iron ore mine in Quebec in November, helping it cut its fourth-quarter capital spending by more than half. UK steelmakers call for EU action as imports flood in Last week, the company scrapped its quarterly dividend and sought creditor protection for its Canadian arm, which will shield it from the majority of the closure-related costs. British steelmakers on Monday added their voice to calls for the European Commission to take action over what they say is the dumping of cheap steel in EU markets, adding that a recovery in the UK steel sector almost ground to a halt last year. Cliffs is the third major U.S. company in the past six months to seek creditor protection for their Canadian operations. U.S. Steel opted to do the same in September, while discount retailer Target Corp said last month it was abandoning its Canadian expansion. European steel body Eurofer has said EU steelmakers were losing market share to cheap imports from countries such as China, while a German steel association has said it expects slow growth in its sector this year due to imports. Cliffs took an impairment charge of $1.2 billion, partly related to the exit from Canada, leading to a fourth-quarter loss of $1.26 billion, compared with a profit of $30.5 million a year earlier. According to UK Steel, rising imports were the primary reason that steel output rose just 0.2 percent in Britain last year versus a 24 percent rise in 2013. UK steel is a division of the EEF, Britain's largest manufacturing trade association. Revenue fell nearly 15 percent to $1.28 billion, but edged past average analysts estimate of $1.21 billion, according to Thomson Reuters I/B/E/S. "Although steel demand in the UK recovered last year, the main beneficiaries have been foreign producers," UK Steel said. Up to Monday's close, the miner's shares have lost nearly twothirds of their value over the last 12 months. "The progressive rise in the value of sterling, the improved demand ... the sharp slowdown in Chinese growth ... (made) our 5 INSIDE METALS February 3, 2015 ANALYTIC CHARTS (Click on the charts for full-size image) Daily LME Aluminium 3-months Daily LME Copper 3-months Daily LME Nickel 3-months Daily LME Zinc 3-months Daily LME Lead 3-months Daily LME Tin 3-months Daily LME Alloy 3-months Daily LME Nasaac 3-months 6 INSIDE METALS February 3, 2015 MARKET REVIEW METALS-Copper climbs, but demand concerns seen snuffing out gains PRECIOUS-Gold rises on strong fund interest, economic growth woes London copper climbed on technical buying that traders expected to sputter out, after wobbly factory data in China and Europe fuelled deflation concerns that are further clouding the outlook for demand. Gold advanced for a second session in three as a wobbly outlook for the global economy burnished bullion's safe-haven appeal, with holdings at the top gold fund at their highest in four months. "Copper has had a pretty good run in light of the China PMI numbers - I thought we would see some weakness throughout the week. The market maybe got itself a little bit too short and has to cover," said analyst Daniel Hynes of ANZ in Sydney. Weak data from the United States to China and Europe dragged Asian equities into the red, boosting outlook for gold which has climbed 8 percent so far in 2015 after a two-year slide. "I think the sentiment on gold has changed from a very bearish tone last year which was due to expectations of higher U.S. interest rates," said Yuichi Ikemizu, branch manager at Standard Bank in Tokyo. "I wouldn't say we're out of the woods in terms of further potential weakness," he added. European and Chinese factories slashed prices in January as production flatlined, heightening global deflation risks that point to another wave of central bank stimulus in the coming year. "We have seen some good demand from Asia around $1,250 and the market is quite long at the moment." Spot gold was up 0.4 percent at $1,279.20 an ounce by 0651 GMT, after trading nearly flat in Asian morning hours. Three-month copper on the London Metal Exchange had climbed 1.1 percent to $5,562 a tonne by 0704 GMT, after closing the previous session little changed. Prices shed almost 13 percent in January, having plumbed 5-1/2-year lows of $5,339.50 a tonne last week. U.S. gold for April delivery gained 0.2 percent to $1,279.70 an ounce. Rising inflows into gold funds underlined how some investors are bullish on bullion. The most-traded April copper contract on the Shanghai Futures Exchange climbed 2.3 percent to 40,760 yuan ($6,442) a tonne. Holdings at SPDR Gold Trust , the world's largest gold-backed exchange-traded fund, stood at 24.65 million ounces on Monday, the highest since October. "Consumer interest is very low ahead of Chinese New Year," a physical trader in Singapore said, adding that he saw shortcovering and fresh long positions from those betting the bottom for copper had been reached. Traders also have little incentive to ship metal to China now, because of the high cost to store it over the coming lunar new year, he added. But Ikemizu said the market overall remained "pretty much split between bullish and bearish", warning there could be a sharp liquidation of long positions when the U.S. nonfarm payrolls data this week turns out strong. "We believe copper and base metals prices in general will remain under pressure for the rest of 1Q2015 as sentiment and anxiety, especially in Asia, remain bearish," JP Morgan said in a research note. A Reuters poll of analysts forecast U.S. employment data on Friday will show about 230,000 jobs were created in January, slowing slightly from 252,000 in December but still robust. On Monday, there were signals that the U.S. economy could be on a slightly softer footing than many had thought. "This sentiment will likely persist through the Chinese New Year in February until there is greater clarity on the Chinese economic growth target for this year after the meeting of the National People's Congress in March," the bank said. U.S. consumer spending recorded its biggest decline since late 2009 in December, while factory activity cooled in January. Those numbers followed data last week that showed a slowdown in U.S. economic expansion to 2.6 percent in the fourth quarter from 5 percent in July-September. Across other metals, ShFE aluminium jumped to its highest in more than a month, tracking end of month gains in LME aluminium, recovering from record lows reached in mid-January. Elsewhere, the economic scenario remained bleak. European and Chinese factories slashed prices in January as production flatlined, heightening global deflation risks that point to another wave of central bank stimulus in the coming year. Aluminum Corp of China Ltd (Chalco), the country's biggest producer of primary aluminium, expects to swing to a loss in 2014 due to sluggish market prices and provisions, it said last week. 7 INSIDE METALS February 3, 2015 MARKET REVIEW (Continued) Moreover, she said, Australian rate futures also rallied, showing the market is "now fully priced for a back-to-back rate cut, for another one in March," which is also keeping downward pressure on the Aussie as investors position for the possibility of even lower rates ahead. FOREX-Australian dollar skids to 6-year low after RBA cuts rates The Australian dollar skidded more than one U.S. cent to a sixyear low and plunged more than two percent against the yen after the Reserve Bank of Australia slashed interest rates to a record low. The Canadian dollar continued to get a lift against its U.S. counterpart as recently slumping crude oil prices staged a rebound. The loonie was up 0.5 percent at C$1.2622 per USD, well off a near six-year low of C$1.2800 plumbed last Friday. The Aussie's drop against the yen gave the U.S. currency a cross-trading lift against the dollar, which shed about 0.5 percent to 117.03 yen . Investors took profits on bearish positions as oil prices continued to rise strongly, fuelling talk that a seven-month rout has ended. Australia's central bank cut its cash rate a quarter point to 2.25 percent at its policy meeting, to spur a sluggish economy and keep downward pressure on its currency. A Reuters poll of 29 analysts had found 20 expected no change this week. The dollar remained in familiar ranges against the yen and the euro. It has spent much of the past two weeks oscillating between 117.00 and 119.00 yen and shows little sign of re-testing December's eight-year peak of 121.86. The Aussie dropped as far as $0.7650, from around $0.7790 before the central bank's announcement. It was last down 1.8 percent at $0.7663. The euro edged down about 0.1 percent to $1.1328, after finding a floor at an 11-year trough of $1.1098. It has held to a $1.1262-$1.1384 range over the past few sessions. Against the yen, the Aussie was down 2.2 percent at 89.72 yen, dropping below support at 90 yen for the first time since February 2014 to as low as 89.70. Against the yen, the common currency slipped about 0.5 percent to 132.68, also getting a cross-trading downdraft as the yen rallied against the Aussie, and moving back towards a 17month trough of 130.16 touched last week. "The surprise rate cut relative to consensus has seen the Aussie tumble across the board," said Sue Trinh, senior currency strategist at RBC Capital Markets in Hong Kong. (Inside Metals is compiled by Atiqul Habib in Bangalore) For more information: Learn more about our products and services for commodities professionals, click here Contact your local Thomson Reuters office, click here For questions and comments on Inside Metals click here Your subscription: To find out more and register for our free commodities newsletters, click here © 2015 Thomson Reuters. All rights reserved. This content is the intellectual property of Thomson Reuters and its affiliates. Any copying, distribution or redistribution of this content is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in content, or for any actions taken in reliance thereon. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world. Privacy statement: To find out more about how we may collect, use and share your personal information please read our privacy statement here To unsubscribe to this newsletter click here 8

© Copyright 2026