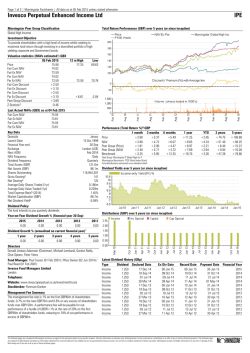

Page 1 COMMENTARY P E R F O R M A N C E

PERFORMANCE & POSITIONING blackrock.com 4Q Institutional: MALTX1 • A: MDLTX • C: MCLTX The Fund posted returns of -12.03% (Institutional shares) and -12.11% (Investor 2014 LATIN AMERICA FUND C O M M E N TA R Y A shares, without sales charge) for the fourth quarter of 2014, while the MSCI Emerging Markets Latin America Index returned -13.44%. The main driver of outperformance was stock selection, especially in Brazil. The Fund’s underweight allocation to Colombia and overweight in Peru also contributed positively. At the country level, the Fund was overweight in Peru, Mexico and Brazil at Overall Morningstar Rating™: Institutional ★★★★ quarter end. Peru remained the Fund’s largest overweight given the country’s prospects of improving economic growth throughout 2015. Chile and Colombia remained large underweights given the impact of lower commodity prices on their respective economies and growing fiscal costs for companies and individuals. Rated against 24 Latin America Stock Funds, as of 12/31/14, based on risk-adjusted total return. Ratings are determined monthly and subject to change. The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating metrics.†† Contributors Detractors Portfolio Management Stock selection in Brazil was the primary contributor, particularly the Fund’s underweight in Petrobras and overweight in Kroton. Petrobras was negatively impacted by lower oil prices and the ongoing corruption scandal investigation in which the company is involved. Kroton benefited from the conclusion of its merger with Anhanguera Educacional as well as from its continued outperformance of the education segment. The Fund’s overweight exposure to Peru via Credicorp also contributed positively. A lack of ownership in Ecopetrol in Colombia added to performance as the stock suffered as a result of falling oil prices and falling reserves. Weighing on performance was the Fund’s underweight exposure to Chile, which performed well. The largest individual detractors included overweight positions in ALFA and CEMEX in Mexico. ALFA suffered as a result of falling oil prices, given the company’s investment in Pacific Rubiales. CEMEX detracted from performance due to commodity price weakness. Will Landers TOP 10 EQUITY HOLDINGS (% of Net Assets as of 12/31/14) 1. Itau Unibanco 9.4 2. Banco Bradesco 7.7 3. Ambev 6.0 4. BB Seguridade Participacoes 5.1 5. Cemex 4.8 6. BRF 4.6 7. America Movil 4.6 Economico Mexi8. Fomento cano 4.3 9. Credicorp 4.3 10. Grupo Televisa 3.8 Further Insight During the quarter, we increased exposure to Mexico and reduced weightings in Brazil. We exited positions in Petrobras and Vale. Our decision to exit Vale was predicated on the ongoing weakness in iron ore prices and our view that a recovery in prices was still months away. In Mexico, we added to financials via Banorte and to consumer conglomerate FEMSA. Brazil’s prospects for 2015 are uncertain. The country’s growth was weak in 2014 and fiscal adjustments being implemented by its new economic team should provide further headwinds to growth. The slow economic recovery in Mexico continues and the country may finally start to experience some of the positive aspects of its reform process by mid 2015. Investment Approach Invests primarily in Latin American equity and debt securities. % AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/14 4Q14 YTD (not annualized) (not annualized) 1 Year 3 Year 5 Years 10 Years Since Inception2 Institutional1 -12.03 -9.33 -9.33 -5.18 -5.00 9.96 7.29 Investor A (Without Sales Charge) -12.11 -9.60 -9.60 -5.42 -5.25 9.67 9.08 Investor A (With Sales Charge) -16.72 -14.35 -14.35 -7.11 -6.27 9.08 8.83 Lipper Latin American Funds Avg.3 -12.87 -13.61 -13.61 -6.23 -4.32 8.62 — Morningstar Latin America Stock Funds Avg. -12.88 -12.90 -12.90 -5.63 -4.68 8.39 — MSCI Emerging Markets Latin America4 -13.44 -12.30 -12.30 -6.19 -5.26 9.34 — Data represents past performance and is no guarantee of future results. Investment returns and principal values may fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. All returns assume reinvestment of dividends and capital gains. Refer to www.blackrock.com for current month-end performance. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. Share classes have different fees and other features. Returns with sales charge reflect deduction of current maximum initial sales charge of 5.25% for Investor A shares. Institutional shares have no front- or back-end load. Minimum initial investment for Institutional shares is $2 million. Institutional shares also are available to clients of registered investment advisors with $250,000 invested in the fund, and offered to participants in various wrap fee programs and other sponsored arrangements at various minimums. Expenses for Institutional shares: Total 1.27%. For Investor A shares: Total 1.53%. Expenses stated as of the fund’s most recent prospectus. Important Risks: The fund is actively managed and its characteristics will vary. Holdings shown should not be deemed as a recommendation to buy or sell securities. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. International investing involves special risks including, but not limited to, currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets. Non-diversification of investments means that more assets are potentially invested in fewer securities than if investments were diversified, so risk is increased because each investment has a greater effect on performance. Short-selling entails special risks. If the fund makes short sales in securities that increase in value, the fund will lose value. Any loss on short positions may or may not be offset by investing shortsale proceeds in other investments. The fund may use derivatives to hedge its investments or to seek to enhance returns. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility. Investments in emerging markets may be considered speculative and are more likely to experience hyperinflation and currency devaluations, which adversely affect returns. In addition, many emerging securities markets have lower trading volumes and less liquidity. The opinions expressed are those of the fund’s portfolio management team as of December 31, 2014, and may change as subsequent conditions vary. Information and opinions are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Past performance is no guarantee of future results. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Investment involves risk. Reliance upon information in this material is at the sole discretion of the reader. 1 Institutional shares are not available to all investors. Please see prospectus for details. 2 Fund inception: 9/27/91. 3 Lipper category is as of 12/31/14 and may not accurately represent the current composition of the portfolio. 4 Morgan Stanley Capital International (MSCI) Emerging Markets (EM) — Latin America Index is a market-capitalization-weighted index composed of a sample of companies representative of the market structure of the selected Latin American countries. †† For each fund with a 3-year history, a Morningstar Rating™ is calculated based on riskadjusted returns that account for variations in a fund’s monthly performance (including sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The fund was rated against the following numbers of U.S.-domiciled Latin America Stock funds over the following time periods:24 in the last 3 years and 16 in the last 5 years. With respect to these Latin America Stock funds, the fund received a Morningstar Rating of 3 and 4 stars for the 3- and 5-year periods, respectively.Other classes may have different performance characteristics. You should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling 800-882-0052 or from your financial professional. The prospectus should be read carefully before investing. FOR MORE INFORMATION OR TO RECEIVE UPDATES, VISIT: blackrock.com ©2015 BlackRock, Inc. All Rights Reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners. Prepared by BlackRock Investments, LLC, member FINRA. Not FDIC Insured • May Lose Value • No Bank Guarantee 01/15 — Latin America Fund USR-5121

© Copyright 2026

![Curriculum Vitae [pdf.] - Romance Languages and Literatures](http://s2.esdocs.com/store/data/001452293_1-ea49058edf5b9feefb152701b63bf3b3-250x500.png)