Page 1 COMMENTARY P E R F O R M A N C E

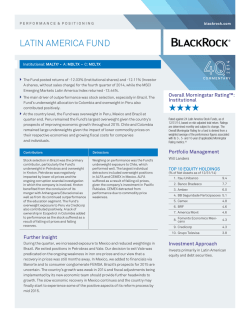

PERFORMANCE & POSITIONING blackrock.com 4Q Institutional: PNIGX • A: CIGAX • C: BIGCX • R: BGBRX1 The Fund posted returns of 1.62% (Institutional shares) and 1.45% (Investor A 2014 US GOVERNMENT BOND FUND C O M M E N TA R Y shares, without sales charge) for the fourth quarter of 2014, while the Barclays U.S. Govt./Mortgage Index returned 1.83%. The Fund's underweight allocation to mortgage-backed securities (MBS) relative to U.S. Treasuries and underweight duration positioning (lower sensitivity to interest rate movements) relative to the benchmark index detracted from performance. The largest positive contributors were the Fund's underweight in short-maturity U.S. rates versus longer-maturity U.S. Treasuries, an overweight in higher-coupon (4.5% and 5%) 30-year MBS and an underweight in 15-year MBS. The Fund ended the fourth quarter underweight in duration versus the benchmark and underweight in agency MBS relative to U.S. Treasuries. The Fund’s duration underweight was expressed in short-maturity U.S. rates. Our positive outlook for the U.S. economy was manifested through long exposure to the U.S. dollar versus the euro, Japanese yen and Australian dollar. Contributors Detractors The Fund's U.S. yield curve flattening bias contributed significantly to performance, as did its U.S.-dollar long exposure versus other major currencies. Additionally, an overweight in 30-year MBS and underweight in 15-year MBS added to performance as the curve flattened. The Fund's underweight in duration detracted from performance as rates rallied lower during the quarter. The Fund's underweight allocation to MBS relative to U.S. Treasuries also detracted. Further Insight The Fund finished the fourth quarter of 2014 underweight in U.S. duration, with a yield curve flattening bias, along with a slight underweight in MBS relative to U.S. Treasuries. Due to the global divergence in monetary policies, we maintained long U.S. dollar exposure. The Fund’s allocations within agency MBS favored 4.5% coupons broadly, with underweights in 3.5% and 4% coupons as 30-year primary mortgage rates touched year-to-date lows late in December, potentially increasing pre-payment risk early in 2015. The Fund remained overweight in securitized assets including commercial mortgage-backed securities and asset-backed securities, and Canadian covered bonds. Overall Morningstar Rating™: Institutional ★★★★ Rated against 307 Intermediate Government Funds, as of 12/31/14, based on risk-adjusted total return. Ratings are determined monthly and subject to change. The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating metrics.†† Portfolio Management Bob Miller, Matthew Kraeger Investment Approach Invests primarily in the highest rated government and agency bonds and maintains an average portfolio duration within ±20% of the Barclays Intermediate Government Index. The fund normally invests at least 80% of its assets in bonds issued or guaranteed by the U.S. government and its agencies. Securities purchased by the fund generally are rated in the highest rating category (AAA or Aaa) at the time of purchase by at least one major rating agency or are determined by the fund management team to be of similar quality. % AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/14 4Q14 YTD (not annualized) (not annualized) Institutional Investor A (Without Sales Charge)3 Investor A (With Sales Charge) 3 Lipper Intermediate U.S. Government Funds Avg.4 Morningstar Intermediate Government Funds Avg. Barclays U.S. Govt./Mortgage5 1 Year 3 Year 5 Years 10 Years Since Inception2 1.62 5.64 5.64 2.00 3.77 4.10 5.18 1.45 5.34 5.34 1.70 3.43 3.71 4.79 -2.61 1.13 1.13 0.33 2.59 3.29 4.60 1.21 3.81 3.81 1.02 2.90 3.61 — 1.32 4.73 4.73 1.47 3.33 3.94 — 1.83 5.41 5.41 1.81 3.69 4.50 — Data represents past performance and is no guarantee of future results. Investment returns and principal values may fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. All returns assume reinvestment of dividends and capital gains. Current performance may be lower or higher than that shown. Refer to blackrock.com for most recent month-end performance. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. Share classes have different fees and other features. Returns with sales charge reflect deduction of current maximum initial sales charge of 4% for Investor A shares. Institutional shares have no front- or back-end load. Minimum initial investment for Institutional shares is $2 million. Institutional shares also are available to clients of registered investment advisors with $250,000 invested in the fund, and offered to participants in various wrap fee programs and other sponsored arrangements at various minimums. Expenses for Institutional shares: Total 0.84%; Net, Including Investment Related Expenses (dividend expense, interest expense, acquired fund fees and expenses and certain other fund expenses) 0.64%; Net, Excluding Investment Related Expenses 0.62%. For Investor A shares: Total 1.07%; Net, Including Investment Related Expenses 0.92%; Net, Excluding Investment Related Expenses 0.90%. Institutional and Investor A shares have contractual waivers with an end date of 2/1/15 terminable upon 90 days' notice. For certain share classes, BlackRock may voluntarily agree to waive certain fees and expenses in which the adviser may discontinue at any time without notice. Expenses stated as of the fund’s most recent prospectus. Important Risks: The fund is actively managed and its characteristics will vary. Holdings shown should not be deemed as a recommendation to buy or sell securities. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Principal of mortgage- or asset-backed securities normally may be prepaid at any time, reducing the yield and market value of those securities. Obligations of U.S. gov't agencies are supported by varying degrees of credit but generally are not backed by the full faith and credit of the U.S. gov't. The fund may use derivatives to hedge its investments or to seek to enhance returns. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility. The opinions expressed are those of the fund’s portfolio management team as of December 31, 2014, and may change as subsequent conditions vary. Information and opinions are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Past performance is no guarantee of future results. There is no guarantee that any forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Investment involves risk. Reliance upon information in this material is at the sole discretion of the reader. 1 Institutional shares are not available to all investors. Please see prospectus for details. 2 Fund inception: 4/20/92. 3 Performance for Investor A shares prior to their introduction (5/11/92) is based on the performance of Institutional shares adjusted to reflect the class-specific fees applicable to Investor A at time of such share class launch. This information may be considered when assessing the fund’s performance, but does not represent actual performance of these share classes. 4 Lipper category is as of 12/31/14 and may not accurately represent the current composition of the portfolio. 5 The Barclays U.S. Government/Mortgage Index is comprised of the Barclays U.S. Treasury Index, which includes public obligations of the U.S. Treasury; the Barclays U.S. Agency Index, which includes native currency agency debentures from issuers such as Fannie Mae (FNMA), Freddie Mac (FHLMC) and Federal Home Loan Bank; and the Barclays U.S. MBS Index, which includes U.S. agency mortgage-backed pass-through securities (both fixed-rate and hybrid ARM) issued by Ginnie Mae (GNMA), FNMA and FHLMC. †† For each fund with a 3-year history, a Morningstar Rating™ is calculated based on risk-adjusted returns that account for variations in a fund’s monthly performance (including sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The fund was rated against the following numbers of U.S.-domiciled Intermediate Government funds over the following time periods:307 in the last 3 years, 273 in the last 5 years and 224 in the last 10 years. With respect to these Intermediate Government funds, the fund received a Morningstar Rating of 4, 4 and 3 stars for the 3-, 5- and 10-year periods, respectively.Other classes may have different performance characteristics. You should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling 800-882-0052 or from your financial professional. The prospectus should be read carefully before investing. FOR MORE INFORMATION OR TO RECEIVE UPDATES, VISIT: blackrock.com ©2015 BlackRock, Inc. All Rights Reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners. Prepared by BlackRock Investments, LLC, member FINRA. Not FDIC Insured • May Lose Value • No Bank Guarantee 01/15 — US Government Bond Fund USR-5121

© Copyright 2026