Parallel Advisors Q4 2014 Newsletter

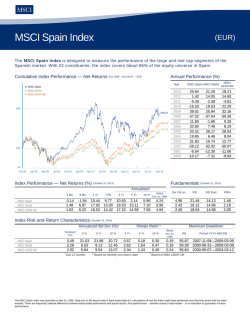

January 2015 Parallel Advisors’ Quarterly Newsletter 2014 proved to be a fascinating year in the global capital markets. Key portfolio components enjoyed a nice year (U.S. Large Cap Equities, Municipal Bonds, U.S. Real Estate) while headwinds of slowing global growth and a supply glut in oil challenged other parts of a diversified portfolio (U.S. Small Cap, Developed International, Emerging Markets, High Yield Debt, and Energy Infrastructure). This is of course endemic to the design of diversification, which produces the best results over time, albeit not every time. As we look forward to 2015, we continue to see opportunity in the United States. Decent GDP growth, declining unemployment (without wage growth as of yet), and falling energy costs continue to foster an environment with little to no inflation. While the S&P 500 has been the “nicest house on the block”, we remain ever mindful that with our current higher valuations, markets are always subject to sharp reversals and rotation to lagging asset classes. The current wave of currency devaluations by central banks and governments around the globe is a significant trend that we are watching closely. Risk Management continues to be our highest calling as we balance the various return opportunities with the amount of risk taking required. As always, we welcome the opportunity to discuss this in depth with you. 2014 marked the best year for U.S. job growth since 1999. Employers added 252,000 new jobs in December, ahead of the 235,000 consensus estimate. The unemployment rate dropped from 5.8% in November to 5.6% in December. The October and November reports were revised higher by a total of 50,000 jobs and the labor participation rate came in at 62.7%. Job growth averaged 246,000 in 2014 and there were only two months with growth below the 200,000 level. The private sector added about 240,000 jobs and this was consistent with the December ADP report. By all accounts, the U.S. job market continues to gather steam, but wages have not and this should allow the Fed to remain on the sidelines for longer. Average hourly earnings actually declined 0.2% last month and they have only risen 1.7% year-over-year. While there has been an acceleration in job growth and a faster decline in the unemployment rate, there are also few signs of wage pressure. Key questions for 2015 will be whether job growth leads to an increase in wages and if the collapse in oil prices leads to mass layoffs in the energy sector. The pace of growth in the manufacturing sector slowed in December as the ISM Manufacturing Index fell from 58.7 in November to 55.5. The manufacturing sector still remains quite healthy, but the strong U.S. dollar could be hurting exports and weak global growth could be impacting demand for U.S. products. New orders and production slowed last month, but the employment component moved higher. Falling energy prices have not yet had a substantial impact on manufacturing, however that should change over the next few months as demand from energy driven markets declines. There should be some positive offset as production costs should also decline. 400,000 U.S. Job Growth 350,000 300,000 250,000 200,000 150,000 100,000 50,000 0 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Source: Bureau of Labor Statistics Factory orders dropped more than expected in November with weakness primarily focused on industrial machinery, military aircraft and demand for primary metals. Factory orders fell 0.7% while a component that serves as a proxy for business investment spending declined 0.5%. This weak report follows a weaker than expected November durable goods report that showed a decline of 0.7%. We believe that these reports represent a temporary hiccup and consumer/business demand should improve with an added boost from lower energy prices. Parallel Advisors, LLC January 2015 Parallel Advisors’ Quarterly Newsletter The ISM Non-Manufacturing Index fell to 56.2 in December from November’s 59.3 reading. The December reading came in below economists expectations and the weakness was led by a drop-off in the business activity, new orders and employment sub-components. The price index fell in December, reflecting falling oil and input prices. Although the headline numbers declined, the U.S. service sector continues to show significant strength. CoreLogic thinks strong U.S. economic fundamentals should lead to greater housing demand in 2015. They predict that housing sales will rise 9% this year and housing starts will jump 14%. The improvement is positive, but these levels remain below averages from the past 50+ years. 30-Year mortgage rates should remain in the 4.2-4.3% level in 2015 and the housing sector will likely benefit from muted inflation and low energy prices. S&P 500 earnings are projected to grow 1.1% in Q4, down from the 8.4% estimate at the start of the quarter. Earnings have been revised lower across all ten sectors led by energy and materials. Revenues are projected to increase 1.1%, but this is also down from the beginning of Q4. While energy, materials and utilities are expected to see a decline in earnings, other sectors such as telecom, healthcare and industrials should see solid growth. 30% S&P 500 Earnings Growth 25% 20% 15% 10% 5% 0% -5% -10% -15% Source: FactSet Q4'14 2014 2015 Guidance continues to have a negative tone, but assuming no surprises, we should end the year with solid 4.9% earnings growth. The analyst community expects S&P 500 earnings growth of 7.8% in 2015. Over the past few months there have been some stunning developments across the globe including the return of the U.S. greenback, falling bond yields and collapsing oil prices. Oil has fallen over 50% since it peaked this summer and markets continue to digest the impact. U.S. economic growth eclipsed the vaunted 5% level in Q3 and the dollar has rallied higher versus all other major currencies. The U.S. dollar index has hit its highest level since the financial crisis and there appears to be room for further gains considering where the U.S. economy stands versus the rest of the globe. The euro sits at around €1.18 versus the dollar and it takes ¥118.5 yen to purchase a dollar. As of January 9th, the national average for a gallon of regular gas was $2.168, down from $3.307 a year ago. Cheap gas should provide stimulus for the economy while also keeping a lid on inflation. The 10-Year Treasury ended 2014 at 2.17% and this is higher than comparable debt from Italy, Spain, France, and Ireland. We believe that the dollar will likely continue its march higher in 2015 and Treasury yields will remain subdued and range-bound due to the global relative value trade firmly in place. On December 29th the Greek parliament failed to elect a president, forcing an early snap election to be called for January 25th. That day, the Greek stock market fell nearly 5% and 10-year bond yields hit their highest levels in 2014. Alexis Tsipras, a far left leaning populist candidate, is leading in the polls and that has created a tense situation since he wants to reverse austerity measures and dump all conditions tied to the recent Greek bailouts. These events have created a new political crisis in the country and have renewed questions over whether Greece will exit the euro. A game of chicken is being played by Mr. Tsipras and Angela Merkel with a storyline that could spook markets. While this is a significant development, we ultimately believe that the ECB has the tools in place to quell any contagion. The ECB is scheduled to meet on January 22nd and the pressure is on for the governing body to announce a major monetary stimulus program to boost growth and fight deflation. Rumors have suggested that the size of the sovereign bond buying program could be based on the paid in capital contributions from each eurozone central bank. The overall size of the program is expected to be at least €500 billion and the ECB needs to make sure that the amount is sufficient to shore up confidence and provide the necessary stimulus to the struggling region. Eurozone inflation dropped 0.2% in December, but it actually rose 0.8% excluding volatile food and energy. High quality stocks finally outperformed low quality in 2014 after a difficult start to the year. This was consistent across all market caps, but low quality still leads over the prior three, five and ten year periods. R3000 High vs. Low Quality Returns 30.0% 25.3% 25.0% 20.0% 18.5% 17.5% 14.3% 13.9% 15.0% 10.9% 9.6% 10.0% 6.9% 6.2% 5.0% 4.0% 0.0% Q4 2014 Source: Atlanta Capital Parallel Advisors, LLC 3 Year High Low 5 Year 10 Year January 2015 Parallel Advisors’ Quarterly Newsletter Market Review U.S. equity markets outperformed their non-U.S. counterparts in December continuing the persistent trend in 2014 that resulted in the S&P 500 gaining 13.69% for the year while the MSCI EAFE was actually down 4.48%. After a difficult start to December, U.S. stocks went into full Santa mode during the second half of the month and the Russell 2000 led the way with a return of 2.85%. After trailing large cap stocks all year, small caps gained a little under 10% in Q4, which more than doubled the return of the S&P. But, 2014 was all about U.S. large cap equities as they easily outperformed all other major markets. Non-U.S. equities ended a forgettable year with losses in December and in Q4. After holding up relatively well for most of the year, emerging market equities were down 4.56% in December and about the same amount in Q4 with Eastern Europe and Latin America hit especially hard. Most pundits believe that the U.S. will lead again in 2015, but with the central bank in Europe likely to unleash quantitative easing sometime soon, the tide could turn quickly. U.S. fixed income markets capped off a remarkable year that saw the 10-year Treasury yield drop all the way down to 2.17% after starting the year at 3.03% (it is now down below 2%). The Barclays Aggregate was up 1.79% in Q4 and returned 5.97% in 2014. Municipals also posted a very strong quarter and 2014 on the back of the decrease in rates and limited supply. High yield and bank loans experienced some spread widening last quarter, but both managed small gains for the year. The strong U.S. dollar was a major headwind for fixed income outside of the U.S. with local currency EMD faring the worst. Investors fled MLPs in Q4 as the sell-off in oil accelerated—they were down 12.29%, but managed to hold onto a YTD gain of 4.80%. Commodities capped off a miserable year that saw the asset class lose just over 17% with the energy sub-sector down 39%. REITs bucked the trend in the real assets space with a gain of 12.27% in Q4 capping off a stellar year in which they were up 27.23%. Hedge funds once again disappointed investors with low single-digit returns as they continue to wait for a long overdue correction in the markets. Market Performance December 31, 2014 Fixed Income Indices MTD QTD YTD 1 Year 3 Year 5 Year 10 Year BarCap Municipal 0.50% 1.37% 9.05% 9.05% 4.30% 5.16% 4.74% BarCap US Aggregate Bond 0.09% 1.79% 5.97% 5.97% 2.66% 4.45% 4.71% Barclays US High Yield -1.45% -1.00% 2.45% 2.45% 8.43% 9.03% 7.74% Barclays Global Aggregate -0.69% -1.04% 0.59% 0.59% 0.73% 2.65% 3.60% JPM GBI-EM Global Diversified -5.93% -5.71% -5.72% -5.72% 0.07% 2.63% 6.65% DJ Industrial Average 0.12% 5.20% 10.04% 10.04% 16.29% 14.22% 7.91% S&P 500 -0.25% 4.93% 13.69% 13.69% 20.41% 15.45% 7.67% NASDAQ Composite -1.16% 5.40% 13.40% 13.40% 22.05% 15.85% 8.09% Russell 1000 -0.23% 4.88% 13.24% 13.24% 20.62% 15.64% 7.96% Russell 1000 Growth -1.04% 4.78% 13.05% 13.05% 20.26% 15.81% 8.49% Russell 1000 Value 0.61% 4.98% 13.45% 13.45% 20.89% 15.42% 7.30% Russell Mid Cap 0.21% 5.94% 13.22% 13.22% 21.40% 17.19% 9.56% Russell 2000 2.85% 9.73% 4.89% 4.89% 19.21% 15.55% 7.77% Russell 2000 Growth 2.97% 10.06% 5.60% 5.60% 20.14% 16.80% 8.54% Russell 2000 Value 2.73% 9.40% 4.22% 4.22% 18.29% 14.26% 6.89% HFRI Equity Hedge 0.04% 0.39% 2.26% 2.26% 7.87% 4.90% 4.71% MSCI World -1.57% 1.12% 5.50% 5.50% 16.13% 10.81% 6.61% MSCI ACWI Ex USA -3.57% -3.81% -3.44% -3.44% 9.49% 4.89% 5.59% MSCI EAFE -3.44% -3.53% -4.48% -4.48% 11.56% 5.81% 4.91% MSCI EAFE Small Cap -0.53% -2.23% -4.63% -4.63% 14.20% 8.98% 6.40% MSCI Emerging Markets -4.56% -4.44% -1.82% -1.82% 4.41% 2.11% 8.78% MSCI Frontier Markets -4.02% -12.44% 7.21% 7.21% 13.95% 8.45% 5.58% Equity Indices Real Assets FTSE NAREIT Composite 0.96% 12.27% 27.23% 27.23% 15.95% 16.37% 7.29% Alerian MLP -5.62% -12.29% 4.80% 4.80% 11.90% 16.74% 13.81% DJ UBS Commodity -7.63% -12.10% -17.01% -17.01% -9.43% -5.53% -1.86% Source: Morningstar, Barclays, MSCI, FTSE, Dow Jones, Factset Research, HFR 1-year, 3-year, 5-year, and 10-year data are annualized Should you have any questions or comments, please contact us at 1.866.627.6984 or e-mail us at [email protected] Parallel Advisors, LLC January 2015 Parallel Advisors’ Quarterly Newsletter Note: The views expressed are those of Parallel Advisors, LLC as of the date of this newsletter. Opinions expressed in this newsletter are subject to change and are not guarantees of future performance. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Parallel Advisors, LLC), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Parallel Advisors, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Parallel Advisors, LLC is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Parallel Advisors, LLC’s current written disclosure statement discussing our advisory services and fees is available upon request. Parallel Advisors, LLC

© Copyright 2026