WEEKLY MARKET UPDATE

Weekly Market Update | 2 February 2015

WEEKLY MARKET UPDATE

2 February 2015

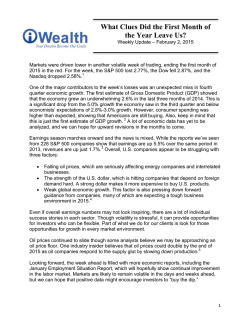

Still bullish on Europe despite geopolitical risks

Data out of Europe looks to be improving

Citi Economic Surprise Index

A general election in Greece showed the anti-austerity party Syriza won,

with 36% of the vote. The left-wing party has promised to ditch austerity

and renegotiate the country's €240bn bailout with the European Union and

International Monetary Fund.

While Syriza negotiations could run into months, with Greece surviving on

a possible combination of emergency liquidity issuance, arrears on debt

and bill issuance for the government, Citi analysts believe that Greece is

unlikely to spread contagion to other markets and the risk of Grexit is low.

Amidst the political noise, we still view the broad case for European asset

markets as positive with equities and higher-yield bonds being strong

beneficiaries as investors migrate to higher yields and riskier assets. The

recent €1.1 trillion stimulus from the ECB and addition consumption boost

from lower oil prices is likely to provide a tailwind to Europe through 2015.

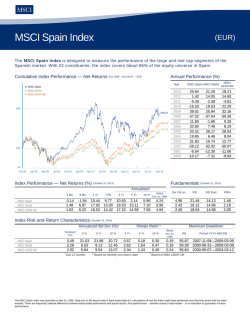

CESIUSD Index

CESIEUR Index

CESICNY Index

60

30

0

-30

-60

Nov-14

Dec-14

Jan-15

Source: Bloomberg as of 30 January 2015

HY slowly recovering

Accumulated 3-month Bond Index Returns

World Govt Bonds Index

HY Index

Global EMD Index

1%

0%

-1%

-2%

Performance

-4%

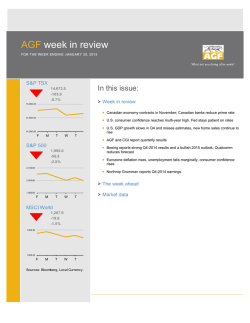

The MSCI World index retreated 1.9% to 410.33 for the week. US markets

were also lower, as the Dow Jones Industrial Average dropped 2.9% and

the S&P 500 Index fell 2.8%.

Despite falling 0.46% for the week, the Stoxx Europe 600 still posted its

best January since 1989, climbing 7.2%. Japanese equities also rose with

the Nikkei225 and Topix gaining 0.9% and 0.8% respectively.

-5%

-6%

Nov-14

Dec-14

Equities — QE is generally good for equities. We are overweight in QE

markets although the ECB’s recent actions are priced in. We also prefer US

domestic earners vs. external earners.

Credit — QE episodes are usually supportive for credit spread tightening.

We prefer High Yield bonds over Investment Grade in both Europe and US.

Citi expects € spreads to tighten 20-25%.

Rates — A lower EUR and ECB QE mix likely lowers real yields, raises

breakevens, and sees Bunds underperform USTs and periphery Europe.

Commodities — Demand-supply and USD strength are dominating

commodities. With the outlook for a stronger dollar, upside appears limited

unless there is significant reduction in supply or demand recovery.

Jan-15

Source: Bloomberg as of 30 January 2015

EM equities worst performing

Accumulated 3-month Equity Index Returns

The MSCI Emerging Markets Index fell 3% to 961.61. Within the region,

Emerging Europe and Latin America took a beating, dropping 7% and 6.1%

respectively. The MSCI Asia ex Japan fared better in comparison, losing

1.6%. The Shanghai Composite Index was the biggest underperformer,

sliding 4.2% for the week.

Asset Allocation

-3%

MSCI World

MSCI EM

MSCI Asia

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

-12%

Nov-14

Dec-14

Jan-15

Source: Bloomberg as of 30 January 2015

Week Ahead Key Data and Event

Date

Country

Data & Event

2-Feb

EC

Markit Eurozone Manufacturing PMI

Jan F

51.0

51.0

2-Feb

US

Personal Income

Period Survey

Dec

0.2%

0.4%

Prior

Citi Fct

0.2%

2-Feb

US

Personal Spending

Dec

-0.2%

0.6%

-0.3%

2-Feb

US

ISM Manufacturing

Jan

54.5

55.5

56.0

4-Feb

EC

Markit Eurozone Services PMI

Jan F

52.3

52.3

52.3

4-Feb

EC

Markit Eurozone Composite PMI

Jan F

52.2

52.2

52.2

4-Feb

EC

Retail Sales MoM

Dec

0.0%

0.6%

0.3%

4-Feb

EC

Retail Sales YoY

Dec

2.0%

1.5%

2.4%

6-Feb

US

Change in Nonfarm Payrolls

Jan

235K

252K

275K

6-Feb

JN

Leading Index CI

Dec P

105.4

103.9

105.3

6-Feb

JN

Coincident Index

Dec P

110.5

109.2

110.5

6-Feb

IN

GDP YoY

4Q

--

5.3%

5.6%

51.0

Source: Bloomberg as of 30 January 2015

Page 1

Weekly Market Update | 2 February 2015

Drivers and Risk By Market

United States

Driver: The National Federation of Independent Business surveys still show an

appetite to grow capital investment in 2015 despite the hits coming from the energy

industry. Against this backdrop, expenditures on software and hardware may

continue to climb.

Risk: Recent earnings reports and guidance cuts by several major technology and

industrial companies not to mention the pressures in the oil patch have left investors

wondering about growth prospects, earnings and the economic future. These factors

may erode confidence.

Implication: Low oil prices may present some opportunity within the retailing and

consumer durable sectors. In addition, we continue to see opportunities in Financials

(Banks and REITs) as well as IT (Software & Hardware).

End-2015 Target: 2200

2200

2100

2000

1900

1800

1700

1600

Source: Bloomberg as of 30 January 2015

Europe

Driver: ECB QE is key ingredient in Citi’s bull case for European equities. We retain

our end-2015 Stoxx target of 400 as we see some scope for “double up” - positive

earnings growth & re-rating in Europe.

Risk: Deflation remains a risk but we think that much is already priced in. Political

risks in the Eurozone are rising more broadly as far-left opposition party Syriza won

the elections in Greece and difficult negotiations lie ahead to agree on a follow-up

bailout with Greece’s troika creditors. An agreement may eventually be found due to

the strong mutual incentives of both parties to avoid the worst-case scenarios of

Greek government default or Grexit, but the negotiations may likely be lengthy and

could fail.

End-2015 Target: 400

390

370

350

330

310

290

DJ Stoxx TMI

270

Source: Bloomberg as of 30 January 2015

Implication: To benefit from the QE, our strategy includes (1) Search for yield –

Dividend stocks (Insurance, Telecoms, Banks, Autos), (2) European high yield

bonds, (3) Cyclicals/Financials over Defensives and (4) Stocks with a strong

balance sheet and high sales exposure to the US.

Japan

S&P 500

1500

Driver: Japan’s economy has already escaped from the technical recession and has

returned to a positive growth track in Q4 last year. Japan’s Q4 real GDP likely grew

at 0.9% QoQ and BoJ’s real exports index rose a solid 3.3% MoM in December

2014. By item, information/communication-related goods and capital goods drove

the recent pickup. By destination, real exports to the US and Asia—even those to

China—grew at a solid pace. A rebound in the global tech cycle and solid growth in

US capex—are main drivers for the renewed pickup in exports.

Risk: While falling JGB yields are positive for Japanese equities boosting valuations,

rising risk premium due to uncertainty about the impact of the plunge in crude prices

or concerns on geopolitics may offset the benefit of falling yields.

End-2015 Target: 1650

1600

1500

1400

1300

1200

1100

Japan Topix

1000

Source: Bloomberg as of 30 January 2015

Implication: We prefer autos and tires exporters, brokerage and insurance.

Asia

Driver: China may enjoy benefits of low commodity price, together with reform

dividend in 2015 and beyond. The friendly oil price this year could save the cost of

imports equivalent to 0.9% of GDP. It may not notably lift the official GDP growth,

but could trim the downside risks to the economy and improve the underlying

growth momentum.

Risk: The Chinese economy is unlikely to stabilize unless the property sector

recovers in the near term or new growth drivers emerge in the longer term.

Combined policy easing and structural reforms are necessary to avoid the shortterm pain of transition.

Implication: Our end-2015 MXCN/ CSI300 index targets stand at 78/ 3,700 and in

terms of sectors, we prefer health care, I.T., Consumer discretionary,

Transportation, Insurance and Real Estate.

End-2015 Target: 630

620

600

580

560

540

520

500

MSCI Asia ex JP

480

Source: Bloomberg as of 30 January 2015

Page 2

Weekly Market Update | 2 February 2015

Currency Forecast

Currency 30-Jan-15

Weekly Market Performance

Forecasts

Last price

Mar-15

Jun-15

Sep-15

Dec-15

Mar-16

1.14

1.12

1.10

1.08

1.05

G10-US Dollar

Euro

Japanese yen

(04/07/2014~04/11/2014)

EURUSD

USDJPY

1.13

117.5

118

124

129

132

GBPUSD

1.51

1.52

1.50

1.47

1.44

1.41

Swiss Franc

USDCHF

0.92

0.85

0.90

0.95

0.99

1.03

Australian Dollar

AUDUSD

0.78

0.80

0.76

0.73

0.72

0.71

New Zealand

NZDUSD

0.73

0.75

0.71

0.68

0.67

USDCAD

1.27

1.20

1.22

1.25

1.26

5.8%

Oil

Japan TPX Index

0.8%

134

British Pound

Canadian Dollar

(26 – 30 January 2015)

0.7%

Korea KOSPI

0.7%

Citi Global Emerging Mkt Sovereigns

0.4%

Citi World Broad Inv Grade

0.3%

Citi High Yield

0.66

-0.8%

Gold

1.27

-0.9%

Europe Stoxx Europe 600

-1.2%

Taiwan TAIEX

EM Asia

-1.2%

UK FTSE 100

-1.4%

HK Hang Seng

Chinese Renminbi

USDCNY

6.25

6.23

6.26

6.29

6.27

6.23

Hong Kong

USDHKD

7.75

7.76

7.77

7.79

7.78

7.78

-1.6%

MSCI AsiaXJapan

Indonesian Rupiah

USDIDR

12672

12,830

12,999

13,170

13,167

13,127

-1.9%

MSCI AC World

Indian Rupee

USDINR

62

62.8

63.3

63.9

64.1

64.2

Korean Won

USDKRW

1093.68

1,107

1,122

1,137

1,140

1,140

Malaysian Ringgit

USDMYR

3.63

3.65

3.66

3.67

3.66

3.64

Philippine Peso

USDPHP

44.11

45.3

45.6

45.9

46.0

46.0

Singapore Dollar

USDSGD

1.35

1.35

1.36

1.37

1.37

1.37

Thai Baht

USDTHB

32.76

33.3

33.4

33.6

33.5

33.4

Taiwan Dollar

USDTWD

31.53

32.0

32.1

32.2

32.2

32.1

Russian Ruble

USDRUB

69.47

64.0

63.6

63.2

63.9

64.7

South African Rand

USDZAR

11.65

11.69

11.88

12.07

12.13

12.17

Brazilian Real

USDBRL

2.68

2.78

2.83

2.89

2.92

2.94

Mexican Peso

USDMXN

14.98

14.7

14.5

14.2

14.1

14.1

US S&P 500

-2.8%

China Shanghai Composite

-4.2%

China HSCEI

-4.4%

-6.1%

MSCI Latin America

-7.0%

MSCI Emerging Europe

-10%

0%

10%

Source: Bloomberg as of 30 January 2015

EM Europe

EM Latam

Market Performance (Year-To-Date)

(As of 30 January 2015)

8.3%

Source: Citi Research and Bloomberg as of 30 January 2015

HK Hang Seng

3.8%

UK FTSE 100

2.8%

Short Rates and 10-Year Yield Forecasts

Forecasts

Last price

30-Jan-15

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

Short Rates (End of Period)

US

0.25

0.25

0.25

0.25

0.50

0.50

Japan

0.1

0.1

0.1

0.1

0.1

0.1

0.1

Euro Area

0.05

0.05

0.05

0.05

0.05

0.05

0.05

1.64

1.95

2.20

2.35

2.55

2.65

2.65

Japan

0.29

0.25

0.35

0.40

0.45

0.50

0.50

Euro Area

0.30

0.55

0.55

0.65

0.65

0.75

0.75

MSCI AsiaXJapan

1.9%

Citi World Broad Inv Grade

1.8%

Korea KOSPI

1.2%

Citi Global Emerging Mkt Sovereigns

0.6%

Taiwan TAIEX

0.5%

Japan TPX Index

Citi High Yield

China Shanghai Composite

-0.8%

10-Year Yield (Period Average)

US

2.5%

0.4%

0.75

-1.6%

MSCI AC World

-2.1%

MSCI Emerging Europe

-2.2%

China HSCEI

US S&P 500

-3.1%

MSCI Latin America

-6.3%

Oil

-9.4%

-20%

Gold

Europe Stoxx Europe 600

7.2%

0%

20%

Source: Citi Research and Bloomberg as of 30 January 2015

Source: Bloomberg as of 30 January 2015

Page 3

Weekly Market Update | 2 February 2015

World Market At Glance

Historical Returns (%)

Last price

52-Week

52-Week

30-Jan-15

High

Low

1 week

1 month

1 year

Year-to-date

Year-to-date

(USD)

US / Global

MSCI World

410.33

434.24

382.57

-1.89%

-2.19%

4.17%

-1.63%

-1.63%

Dow Jones Industrial Average

17164.95

18103.45

15340.69

-2.87%

-4.55%

8.31%

-3.69%

-3.69%

S&P 500

NASDAQ

1994.99

4635.24

2093.55

4814.95

1737.92

3946.03

-2.77%

-2.58%

-4.10%

-2.98%

11.19%

12.42%

-3.10%

-2.13%

-3.10%

-2.13%

MSCI Europe

435.07

506.61

409.57

-0.91%

-0.37%

-6.69%

-0.19%

-0.19%

Stoxx Europe 600

367.05

372.78

302.48

-0.90%

7.63%

13.53%

7.16%

-0.04%

FTSE100

6749.40

6904.86

6072.68

-1.22%

3.09%

3.23%

2.79%

-0.91%

CAC40

4604.25

4679.26

3789.11

-0.79%

8.45%

10.15%

7.76%

0.53%

DAX

10694.32

10810.57

8354.97

0.42%

9.06%

14.09%

9.06%

1.27%

NIKKEI225

17674.39

18030.83

13885.11

0.93%

1.28%

17.77%

1.28%

3.04%

Topix

1415.07

1454.22

1121.50

0.84%

0.54%

15.60%

0.54%

2.28%

MSCI Emerging Market

961.61

1104.31

906.25

-2.95%

0.74%

2.70%

0.55%

0.55%

MSCI Latin America

2555.44

3720.81

2455.16

-6.11%

-6.10%

-11.50%

-6.31%

-6.31%

MSCI Emerging Europe

117.56

198.14

106.52

-6.97%

-6.18%

-36.21%

-2.13%

-2.13%

MSCI EM Middle East & Africa

271.12

341.09

248.54

-3.45%

-1.15%

-9.28%

0.13%

0.13%

46907.68

62304.88

44904.83

-3.83%

-6.20%

-0.71%

-6.20%

-7.47%

737.35

1421.07

578.21

-10.19%

-6.75%

-44.18%

-6.75%

-6.75%

Europe

Japan

Emerging Markets

Brazil Bovespa

Russia RTS

Asia

MSCI Asia ex-Japan

577.69

608.06

508.53

-1.61%

2.94%

10.44%

2.48%

2.48%

Australia S&P/ASX 200

5588.32

5679.50

5052.20

1.57%

3.17%

7.72%

3.28%

-1.81%

China HSCEI (H-shares)

11720.10

12400.40

9159.76

-4.40%

-1.05%

19.37%

-2.21%

-2.19%

China Shanghai Composite

3210.36

3406.79

1974.38

-4.22%

1.41%

57.91%

-0.75%

-1.47%

Hong Kong Hang Seng

24507.05

25362.98

21137.61

-1.38%

4.28%

11.22%

3.82%

3.84%

India Sensex30

29182.95

29844.16

19963.12

-0.33%

6.49%

42.37%

6.12%

8.08%

Indonesia JCI

5289.40

5325.04

4320.78

-0.65%

1.19%

19.70%

1.19%

-1.46%

Malaysia KLCI

1781.26

1896.23

1671.82

-1.21%

0.82%

-1.26%

1.14%

-2.67%

Korea KOSPI

1949.26

2093.08

1876.27

0.68%

1.76%

0.42%

1.76%

1.01%

Philippines PSE

7689.91

7736.97

5886.01

1.87%

6.35%

27.29%

6.35%

7.65%

Singapore STI

3391.20

3432.62

2953.01

-0.60%

0.75%

12.02%

0.77%

-1.43%

Taiwan TAIEX

9361.91

9593.68

8230.46

-1.15%

1.01%

10.63%

0.59%

0.19%

Thailand SET

1581.25

1610.78

1266.78

-1.07%

5.58%

25.09%

5.58%

6.04%

48.24

107.73

43.58

5.81%

-10.86%

-50.89%

-9.44%

-9.44%

1283.77

1392.22

1131.24

-0.80%

6.93%

3.20%

8.35%

8.35%

Commodity

Oil

Gold spot

Source: Citi Research and Bloomberg as of 30 January 2015

Page 4

Weekly Market Update | 2 February 2015

Disclaimer

“Citi analysts” refers to investment professionals within Citi Research (“CR”), Citi Global Markets Inc. (“CGMI”) and voting members of the Citi Global

Investment Committee.

Citibank N.A. and its affiliates / subsidiaries provide no independent research or analysis in the substance or preparation of this document.

The information in this document has been obtained from reports issued by CGMI. Such information is based on sources CGMI believes to be reliable.

CGMI, however, does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute CGMI's judgment as of the

date of the report and are subject to change without notice. This document is for general information purposes only and is not intended as a

recommendation or an offer or solicitation for the purchase or sale of any security or currency. No part of this document may be reproduced in any

manner without the written consent of Citibank N.A. Information in this document has been prepared without taking account of the objectives, financial

situation, or needs of any particular investor. Any person considering an investment should consider the appropriateness of the investment having regard

to their objectives, financial situation, or needs, and should seek independent advice on the suitability or otherwise of a particular investment.

Investments are not deposits, are not obligations of, or guaranteed or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or

by any local government or insurance agency, and are subject to investment risk, including the possible loss of the principal amount invested. Investors

investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past

performance is not indicative of future performance, prices can go up or down. Some investment products (including mutual funds) are not available to US

persons and may not be available in all jurisdictions. Investors should be aware that it is his/her responsibility to seek legal and/or tax advice regarding

the legal and tax consequences of his/her investment transactions. If an investor changes residence, citizenship, nationality, or place of work, it is his/her

responsibility to understand how his/her investment transactions are affected by such change and comply with all applicable laws and regulations as and

when such becomes applicable. Citibank does not provide legal and/or tax advice and is not responsible for advising an investor on the laws pertaining

to his/her transaction.

Country Specific Disclosures

Australia

:

This document is distributed in Australia by Citigroup Pty Limited ABN 88 004 325 080, AFSL 238098. For a

full explanation of the risks of investing in any investment, please ensure that you fully read and understand the

relevant Product Disclosure Statement prior to investing.

Hong Kong

:

This document is distributed in Hong Kong by Citibank (Hong Kong) Limited ("CHKL"). Prices and

availability of financial instruments can be subject to change without notice. Certain high-volatility investments

can be subject to sudden and large falls in value that could equal the amount invested.

India

:

This document is distributed in India by Citibank N.A. Investment are subject to market risk including that of

loss of principal amounts invested. Products so distributed are not obligations of, or guaranteed by, Citibank and

are not bank deposits. Past performance does not guarantee future performance. Investment products cannot be

offered to US and Canada Persons. Investors are advised to read and understand the Offer Documents carefully

before investing.

Indonesia

:

This report is made available in Indonesia through Citibank N.A., Indonesia Branch. Citibank N. A., Indonesia is a bank

that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Korea

:

This document is distributed in South Korea by Citibank Korea Inc. Investors should be aware that

investment products are not guaranteed by the Korea Deposit Insurance Corporation and are subject to

investment risk including the possible loss of the principal amount invested. Investment products are not

available to US persons.

Malaysia

:

This document is distributed in Malaysia by Citibank Berhad.

People's Republic of China

:

This document is distributed by Citibank (China) Co., Ltd in the People's Republic of China (excluding the

Special Administrative Regions of Hong Kong and Macau, and Taiwan).

Philippines

:

This document is made available in Philippines by Citicorp Financial Services and Insurance Brokerage Phils.

Inc, Citibank N.A. Philippines. Investors should be aware that Investment products are not insured by the

Philippine Deposit Insurance Corporation or Federal Deposit Insurance Corporation or any other government

entity.

Singapore

:

This report is distributed in Singapore by Citibank Singapore Limited (“CSL”). Investment products are not

insured under the provisions of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011 of

Singapore and are not eligible for deposit insurance coverage under the Deposit Insurance Scheme.

Thailand

:

This document contains general information and insights distributed in Thailand by Citigroup and is made

available in English language only. Citi does not dictate or solicit investment in any specific securities and similar

products. Investment contains certain risk, please study prospectus before investing. Not an obligation of, or

guaranteed by, Citibank. Not bank deposits. Subject to investment risks, including possible loss of the principal

amount invested. Subject to price fluctuation. Past performance does not guarantee future performance. Not

offered to US persons.

United Kingdom

:

This document is distributed in U.K. by Citibank International Limited. Registered office: Citibank International

Limited, Citibank Centre, 25, Canada Square, Canary Wharf, London E14 5LB. Authorised by the Prudential

Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Page 5

© Copyright 2026