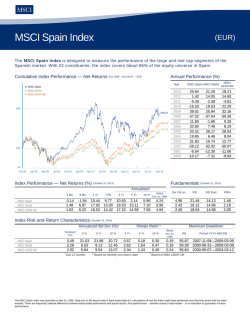

Fact sheet Performance Investment Profile Risk Profile Basic

Fact sheet January 29th 2015 Registred as Portfolio Manager with The Danish Financial Authorities (Finanstilsynet) Basic Information Performance Since launch May 15th 2014 Recent month Recent week Year to date MMGA A/S 17,67% 7,12 % -1,75% 7,12 % MSCI World 16,09 % 4,76 % 0,28 % 4,76 % OMX C20 CAP 10,74 % 7,19 % 2,26 % 7,19 % Historical Performance ( May 15th 2014 - Jan. 29th 2015) Rate 600 Dividend status CVR no. ISIN Exchange Launched Reporting currency Investment Advisor Net Asset Value Management Company Value last quarter Investment Universe Entering and exiting Return protection Accumulative 35820175 DK0060559821 Nonlisted 15-05-2014 DKK Momentum Markets 588. 36 Citco Denmark 30,8 mio. Global Equities Quarterly High Watermark 575 550 Monthly Report 525 Changes in the Portfolio’s Investment Strategy will be described in the monthly report, which will be e-mailed to investors within the first week of each month. 500 475 Maj 2014 Jun 2014 Jul 2014 Aug 2014 Sep 2014 Okt 2014 Nov 2014 Dec 2014 Jan 2015 MMGA A/S MSCI World i DKK OMX C20 CAP Rate 29.01.2015 Rate 29.01.2015 Rate 29.01.2015 580,45 588,36 553,70 Investment Profile The company maintains a Global Equity exposure by direct investments, primarily in the Mayor Global Stock Exchanges. Our aim is to harvest Global Growth through investments in listed companies with top line and bottom line growth. We focus on companies that are trading beneath their estimated long-term value and companies with increased or unappreciated earnings stream. Markets and facts are constantly changing, and we will try to act accordingly. Our mandate is active, thus we will not try to copy the Mayor Indices. Our approach will be theme oriented, and focused on the 23 sectors that we have identified as attractive. The strategy will focus primarily on investing in the “best of breed” companies. The Portfolio will not contain all sectors simultaneously, but will occasionally make rotations according to the strategy. The company will follow the strategy of Momentum Markets 2 Model Portfolios Rhino and Dragon Global. Costs Administation costs 1% p.a. max. Performance fee Step Model based on returns over 3% p.a. Entrance cost 0.5% Advisor Portfolio Manager Chief Strategist Domenick Beskos Risk Profile Low Risk typically, low returns 1 High Risk 2 3 4 5 6 MMGA A/S 7 typically, high returns Contact Frederiksborggade 15, 2nd, DK-1360 Copenhagen K Denmark Tel: +45 3368 1540 [email protected] Disclaimer: The fact sheet has been prepared by Momentum Markets Global Equity A/S. The fact sheet should not be regarded as an offer to subscribe for securities. Subscription shall take place on the basis of tender documents (Private Placement Memorandum). Drawing should also be based on your risk profile, time horizon and other assets. Past performance is not a reliable indicator of future results.

© Copyright 2026