Small Cap Perspectives (PDF)

SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS RUSSELL INDEXES DECEMBER 2014 Russell Indexes by Russell Investments Market recap commentary – Q4 2014 After trailing large caps for much of 2014, small cap stocks sprinted ahead during the fourth quarter. The Russell 2000® Index posted its strongest quarter since the third quarter of 2013, recovering from negative territory and making all of its gains for the year and more during the period. Investors overcame geopolitical concerns and questions about the strength of global growth to focus on continued solid earnings growth, signs of a strengthening U.S. economy and the potential economic benefits of a sharp decline in oil prices. The smallest stocks led in the quarter In a reversal from the first three quarters of 2014, the smallest stocks reassumed leadership during the fourth quarter. The Russell Microcap® Index surged 11.2% during the period, followed by the Russell 2000 at 9.7%. The largest stocks were the weakest performers, though they still posted solid returns for the period. The Russell Top 200® Index of mega cap stocks returned 4.4%, followed by the Russell 1000 at 4.9%. In that environment, the Russell 2000 rose 9.7% during the fourth quarter, after a pullback of more than 11% during September and early October. The index saw positive returns during every month of the quarter for the first time since the fourth quarter of 2013. Large cap stocks also saw solid gains during the quarter, with a total return of 4.9% for the Russell 1000® Index. For the full year, large caps led with a total return of 13.2% vs. 4.9% for small caps. In terms of style, growth continued to lead value in small cap during the fourth quarter after having reassumed leadership during the third quarter. The Russell 2000® Growth Index gained 10.1% compared with 9.4% for the Russell 2000® Value Index. In large cap, growth and value showed little differentiation during the period, with both the Russell 1000® Growth and Value Indexes gaining approximately 5%. For the full year, growth led value in small cap and performed essentially in line with value in large cap. The strong gains during the fourth quarter boosted the valuation of the Russell 2000 back above its longer-term average, after having fallen back significantly during the third quarter. At the end of 2014, the price-to-earnings ratio — based on 1-year forecasted analyst estimates — stood at 18.8 vs. 16.9 at the end of the third quarter, well above the 10-year average of approximately 16.3, but below 19.6 at the end of 2013. The Russell 2000® Index has much greater exposure to companies deriving their revenue from the U.S. than large-cap indexes like the Russell 1000® Index, which contain more multinational companies. For this reason, the Index can be a strong indicator for the relative health of the U.S. economy,” said David Koenig, CFA, FRM, Index Investment Strategist with Russell Investments. “And with accelerating U.S. economic growth, solid corporate earnings and valuations that had dropped nearer to historical averages, it is not surprising that investors appeared to be coming back to this asset class.” Among the Russell Stability Indexes™, defensive-oriented stocks continued to outpace dynamic-oriented stocks during the quarter in both small cap and large cap. With growth and defensive leading their style counterparts during the quarter, this highlights how Stability captures a different dimension of style from traditional growth and value, providing an additional lens for investors to help understand constantly shifting market trends. For all of 2014, defensiveoriented stocks outperformed dynamic-oriented stocks in both small cap and large cap. Volatility continued to move higher Volatility was consistently higher during the fourth quarter than during the third quarter. The Russell 2000 saw 28 moves of at least 1% during the fourth quarter, with 4 moves of at least 2% and one gain of more than 3%. That compares with 16 moves of at least 1% during the third quarter, with 1 of those a decline of greater than 2%. Volatility rose toward longer-term averages over the course of 2014 compared with the exceptionally low volatility of 2013. However, volatility remained well below its longer-term averages, as measured (continued) SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS 01 Russell Indexes by Russell Investments Market recap commentary (continued) by trailing 1-year standard deviation. U.S. economy continued to strengthen; oil prices saw dramatic decline The fourth quarter brought additional signs of a strengthening U.S. economy. Gross domestic product (GDP) increased at an annual rate of 5.0% in the third quarter, following 4.6% in the second quarter, according to the Bureau of Economic Analysis. That was the strongest two consecutive quarters of growth since the second half of 2003. Unemployment continued its steady decline, falling to 5.6% in December, down from a high of 10.0% reached in October 2009. Job growth in 2014 was the strongest in 15 years, with 2.95 million jobs added. However, the labor participation rate declined further, underemployment is still elevated and wage growth remained stagnant. As a result, inflation has remained tame throughout the gradual economic recovery. The core personal consumption expenditures index, the Fed’s preferred inflation measure, stood at an annual rate of 1.4% as of November, below the Fed’s 2.0% target. Contrary to expectations, bond yields moved lower in 2014, with the 10-year note yield at approximately 2.2% at year-end compared with 3.0% at the end of 2013. the Federal Open Market Committee (FOMC) noted the expanding economic activity, improving labor market, solid household spending and advancing business investment. The committee revised its language about holding shortterm interest rates near zero for a “considerable time,” stating instead that it could be “patient” in beginning to normalize interest rates but that the timing of any changes in monetary policy would be highly data dependent. Bottom line After exceptionally strong performance in 2013, the Russell 2000 posted moderate gains for 2014 despite trading in negative territory for much of the year. As 2015 began, small cap stocks were supported by strengthening U.S. economic growth, falling unemployment and continued low inflation. However, with valuations for the Russell 2000 still above longer-term averages and prospects for the Fed to begin raising interest rates in 2015, investors could face another year of modest returns punctuated by periods of heightened volatility. “We believe the U.S. will continue to set the tone for global equities as we enter 2015. And, while U.S. large cap stocks likely may continue to modestly outperform U.S. small cap stocks next year, we expect the Russell 1000® Index to grow in the mid single digits,” said Doug Gordon, Senior Portfolio Manager for Tactical Asset Allocation Strategies, Russell Investments.1 “Our expectation is that the U.S. Fed will likely start to tighten interest rates near the end of the second quarter, while central banks outside the U.S. such as the European Central Bank and Bank of Japan may continue to move in the opposite direction. As the year progresses, we’ll keep a close eye on economic data such as employment, wage inflation and fourth quarter earnings for clues on U.S. monetary policy direction as we expect a data driven Fed will be tracking those numbers closely.” Crude oil prices continued to decline sharply and the U.S. dollar strengthened further during the fourth quarter. By year-end, oil prices had fallen more than 50% from above $100 in July 2014, reaching levels last seen during the 2008–2009 financial crisis. The rapid decline in oil prices led to a meaningful drop in gasoline prices, providing a potential boost to consumer spending. The oil price decline was attributed largely to a supply glut as a result of the shale oil boom, further fueled by the strengthening dollar. However, the rapid decline also raised concerns about the strength of global growth amid continued economic weakness in Europe and slower growth in China. With U.S. economic growth strengthening, the Federal Reserve ended its quantitative easing program during the fourth quarter and appeared to remain on track to begin raising interest rates in mid-2015. At its December meeting, Russell Investments, “2015 Annual Global Outlook,” December 2014. 1 SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS 02 Russell Indexes by Russell Investments Market performance Size ›› Equity market returns were strong across capitalization tiers during the fourth quarter, with the smallest stocks the strongest performers (See Exhibit 1). ›› Microcap stocks were the leaders (+11.2%) during the fourth quarter, followed by small caps (+9.7%). The weakest, though still strong, performers were mega cap stocks (+4.4%) and large cap stocks (+4.9%). ›› For the trailing 12-month period, the largest stocks remained the leaders, with performance ranked according to size. Mega cap stocks led (+13.3%) for the period, with small caps (+4.9%) and micro caps (+3.7%) the weakest performers for the period Exhibit 1 / Market Cap Performance Total Return (%) (as of 12/31/2014) 2014 4th qtr ›› Defensive-oriented companies continued to lead dynamic-oriented companies in both small cap and large cap during the quarter, as investors appeared to focus on higher-quality companies that continued to show stable growth prospects and lower stock-price volatility. ›› For the 12-month period, growth led in small cap but showed little differentiation with value in large cap. Defensive-oriented companies led dynamic-oriented companies in both capitalization tiers. 2nd qtr 1st qtr 12 Mos 5.2 0.0 4.9 2.0 12.6 Russell Top 200© Index 4.4 1.7 5.2 1.4 13.3 Russell 1000 Index 4.9 0.7 5.1 2.0 13.2 Russell Midcap© Index 5.9 -1.7 5.0 3.5 13.2 Russell 2000© Index 9.7 -7.4 2.0 1.1 4.9 Russell Microcap Index 11.2 -8.2 -1.4 3.0 3.7 2014 4th qtr 3rd qtr © © Exhibit 2 / Style Performance Total Return (%) (as of 12/31/2014) Style ›› In terms of style, growth continued to lead in small cap during the fourth quarter, while growth and value posted relatively comparable returns in large cap (See Exhibit 2). 3rd qtr Russell 3000© Index 2nd qtr 1st qtr 12 Mos Russell 1000 Growth Index 4.8 1.5 5.1 1.1 13.1 Russell 2000® Growth Index 10.1 -6.1 1.7 0.5 5.6 Russell 1000® Value Index 5.0 -0.2 5.1 3.0 13.5 Russell 2000 Value Index 9.4 -8.6 2.4 1.8 4.2 Russell 1000® Defensive Index 5.4 1.1 4.7 2.0 13.8 Russell 2000® Defensive Index 11.5 -5.8 1.3 0.0 6.4 Russell 1000® Dynamic Index 4.4 0.2 5.5 2.1 12.6 Russell 2000 Dynamic Index 7.9 -8.9 2.7 2.2 3.3 ® ® ® Russell Investments considers style along three dimensions: size, valuation and stability. The size dimension includes large cap and small cap as defined by market capitalization. Valuation includes growth and value measures. Stability provides a risk dimension to style by assessing a variety of factors related to quality and volatility exposures. Stability includes dynamic (companies with greater economic sensitivity and more variable earnings profiles) and defensive (companies with less economic sensitivity and more stable earnings profiles). For more information on Russell’s style definitions, please refer to the Complete methodology document: Russell U.S. Indexes available at Russell.com/Indexes. SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS 03 Russell Indexes by Russell Investments Small Cap performance analysis Exhibit 3 / Russell 2000 Index Price Performance ›› The Russell 2000 returned to positive gains during the fourth quarter. That followed a decline during the third-quarter, which was its first negative quarter following a streak of eight consecutive quarters of positive total returns. ›› For the year, the Russell 2000 gained 4.9%, compared with its exceptionally strong return of 38.8% in 2013 (See Exhibit 3). ›› On a rolling 12-month basis, the strong performance of small cap stocks during the quarter narrowed the performance gap with large cap stocks, which had reached more than 15 percentage points earlier in the year. By the end of 2014, that gap had narrowed to approximately 8 percentage points (See Exhibit 4). ›› Since the market trough on March 9, 2009, the Russell 2000 has advanced about two and a half times, with a cumulative total return of approximately 251% (See Exhibit 5). As of the end of the year, the Russell 2000 had risen approximately 41% since its previous peak on July 13, 2007. Exhibit 4 / 12-Month Rolling Returns (January 2013 – December 2014) 2014 Total Return +4.9% 2013 Total Return +38.8% 3000 2800 2600 2400 2200 2000 1800 03/28/2013 06/28/2013 09/30/2013 12/31/2013 03/31/2014 06/30/2014 09/30/2014 12/31/2014 Exhibit 5 / Russell 2000 Index Price Performance Total Return (%) — 10 Years (as of 12/31/2014) (January 2007 – December 2014) % 80 3500 60 3000 40 2500 20 2000 0 1500 -20 Total Return Since 03/09/2009 Low +251.0% 1000 -40 -60 Dec-04 Total Return Since 07/13/2007 Peak +40.8% 500 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 RUSSELL 2000 INDEX Dec-13 Dec-14 12/29/2006 12/31/2007 12/31/2008 12/31/2009 12/31/2010 12/30/2011 12/31/2012 12/31/2013 12/31/2014 RUSSELL 1000 INDEX Exhibit 6 / Performance Total Return (%) (as of 12/31/2014) Annualized returns (%) Calendar year return (%) 4th Qtr 1 yr 3 yr 5 yr 10 yr 2010 2011 2012 2013 2014 Russell 2000 Index 9.73 4.89 19.21 15.55 7.77 26.85 -4.18 16.35 38.82 4.89 Russell 1000 Index 4.88 13.24 20.62 15.64 7.96 16.10 1.50 16.42 33.11 13.24 SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS 04 Russell Indexes by Russell Investments Relative returns analysis Exhibit 7 / Performance — Growth of $1,000 ›› Over the past decade, both small cap and large cap stocks have posted strong cumulative total returns. From December 2004–December 2014, both the Russell 2000 and the Russell 1000 have more than doubled in value (See Exhibit 7). ›› Among the traditional nine style boxes, the Russell 2000 Growth Index was the top performer for the fourth quarter, while the Russell 1000 Growth Index was the bottom performer. For 2014, the Russell Midcap Value Index was the top performer (See Exhibit 8). ›› For all of 2014, active small cap managers underperformed the Russell 2000, on average, delivering an average total return of 4.1% vs. 4.9% for the index. However, the median manager return of 5.2% was slightly ahead of the index (See Exhibit 9). Exhibit 8 / Russell Index Style Performance 3Q 2014 Growth Large (1000) 5.0 4.9 4.8 Mid 6.1 5.9 5.8 2000 1500 1000 500 0 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 RUSSELL 2000 INDEX Dec-12 Dec-13 Dec-14 RUSSELL 1000 INDEX Total Return (%) (as of 12/31/2014) 4Q 2014 Core $ 2500 Exhibit 9 / Small Cap Manager Universe Returns Total Return (%) (as of 12/31/2014) Value Total Return (%) — 10 Years (as of 12/31/2014) Russell 2000 Index 120 Value Core Growth Large (1000) -0.2 0.7 1.5 Mid -2.7 -1.7 -0.7 Manager average 100 80 60 40 20 0 Small (2000) 9.4 9.7 10.1 Small (2000) -8.6 -7.3 -6.1 -20 -40 -60 2014 -80 2013 Value Core Growth Large (1000) 32.5 33.1 33.5 11.9 Mid 33.5 34.8 35.7 5.6 Small (2000) 34.5 38.8 43.3 Value Core Growth Large (1000) 13.5 13.2 13.1 Mid 14.8 13.2 Small (2000) 4.2 4.9 Russell 2000 Index Manager average High 25th percentile Median 75th percentile Low # of Observations SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS 2009 27.2 33.9 100.2 43.5 34.1 26.5 0.8 2010 26.9 27.2 109.1 31.2 27.7 24.1 3.4 2011 -4.2 -1.8 19.0 1.6 -1.9 -5.4 -24.5 2012 16.3 16.4 41.0 19.6 16.4 13.3 -4.8 2013 38.8 41.2 66.3 45.5 41.1 36.4 8.6 2014 4.9 4.1 19.0 7.8 5.2 1.7 -20.2 730 703 675 637 614 556 Source: eVestment. Small Cap Manager universe data obtained on 01/15/2015. The eVestment Small Cap manager universe includes data from between 556 and 730 managers. 05 Russell Indexes by Russell Investments Risk analysis Exhibit 10 / Implied Volatility ›› While realized volatility, as measured by the daily returns of the Russell 2000, has moved a bit higher in 2014, it remains moderate relative to levels reached in 2011 and during the financial crisis in 2008–2009 (See Exhibit 11). ›› As illustrated by rolling one-year standard deviation, volatility continued to move moderately higher during the fourth quarter after reaching exceptionally low levels in 2013. At about 15.0%, however, as of the end of the quarter, it remained below its 10-year average of approximately 17.5% (See Exhibit 12). Exhibit 11 / Russell 2000 Index Daily Returns RVX Index Value CBOE Russell 2000 Volatility Index (RVX) (December 2004 – December 2014) ›› Expected volatility among small cap stocks moved meaningfully higher over the course of 2014, rising to about 22.7 at year-end vs. 17.5 at the end of 2013, as measured by the CBOE Russell 2000 Volatility Index (RVX). Volatility has moved back near longer-term averages after falling to exceptionally low levels in 2013 (See Exhibit 10). 100 90 80 70 60 50 40 30 20 10 0 Dec-04 Dec-05 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Source: CBOE. CBOE®, Chicago Board Options Exchange®, CBOE Volatility Index®, and VIX® are registered trademarks of Chicago Board Options Exchange, Incorporated (CBOE). RVX is a service mark of CBOE. The Russell 2000 Index is a registered trademark of The Frank Russell Company, used under license. This data is believed to be correct but CBOE does not guarantee the accuracy of the data and will not be held liable for consequences of its use. Exhibit 12 / 12-Month Rolling Standard Deviation (%) Total Return (%) — 20 Years (as of 12/31/2014) 10 Years (as of 12/31/2014) % % 15 40 10 Russell 2000 Index 10 Yr Avg 17.5% 30 5 0 20 -5 10 -10 -15 Dec-94 Dec-06 Dec-96 Dec-98 Dec-00 Dec-02 Dec-04 Dec-06 Dec-08 Dec-10 Dec-12 Dec-14 0 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 RUSSELL 2000 INDEX Dec-12 Dec-13 Dec-14 RUSSELL 1000 INDEX Exhibit 13 / Risk Characteristics Annualized (as of 12/31/2014) Standard Deviation (%) Sharpe Ratio 1 yr 3 yr 5 yr 10 yr 1 yr 3 yr 5 yr 10 yr Russell 2000 Index 14.86 13.12 17.83 19.67 0.39 1.41 0.9 0.41 Russell 1000 Index 8.11 9.12 13.15 14.91 1.58 2.11 1.17 0.49 SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS 06 Russell Indexes by Russell Investments Small cap asset flows Exhibit 14 / Quarterly Small Cap Total Assets ($ billions) 10 Years (As of 12/31/2014) ›› A return to positive flows and strong performance for small cap U.S. equities during the fourth quarter pushed total assets in small cap mutual funds and ETFs to a record high at year-end. Total assets reached $580.4 billion at the end of 2014, edging above the previous record of $579.2 billion at the end of the second quarter 2014 (See Exhibit 14). ›› Small cap flows were positive in two of three months during the quarter, with strong flows in November and December offsetting the negative flows that occurred in October amid significant market volatility (See Exhibit 15). $ 600 500 400 ›› Measured on a quarterly basis, small cap mutual funds and ETFs saw moderate but positive flows of approximately $1 billion during the quarter. That followed two consecutive quarters of outflows that totaled more than $16 billion (See Exhibit 16). ›› Net flows specifically into U.S. small cap ETFs were positive during each month of the quarter, with total net inflows of more than $4 billion for all of 2014, according to Blackrock’s Dec. 31 ETF Landscape. Exhibit 15 / Monthly Small Cap Asset Flows ($ billions) 300 200 100 0 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-12 Dec-13 Dec-14 Exhibit 16 / Quarterly Small Cap Asset Flows ($ billions) Estimated Net Flows (January 2013 – December 2014) Estimated Net Flows — 10 Years (As of 12/31/2014) 8000 $ 6000 15 4000 10 2000 0 5 -2000 0 -4000 Dec-14 Oct-14 Nov-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 Apr-14 Feb-14 Mar-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 Apr-13 May-13 -10 Mar-13 -8000 Jan-13 -5 Feb-13 -6000 Source: Morningstar Direct. Total assets and estimated net flows are for all U.S.-domiciled open-end mutual funds (excluding money market funds and funds-of-funds) and Exchange Traded Products (ETPs) categorized as small cap, small cap growth or small cap value by Morningstar. SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS -15 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 07 Russell Indexes by Russell Investments Russell 2000 Index sector weights ›› The largest year-over-year change in the sector composition of the Russell 2000 occurred in the Energy sector. A decline of approximately 50% in the price of crude oil during the second half of 2014 caused the weighting of the Energy sector to decline more than 2.1 percentage points from year-end 2013 (See Exhibit 17). ›› Other meaningful year-over-year changes included increases of approximately 1.5 percentage points in the weightings of the Financial Services and Health Care sectors. ›› The Financial Services sector remained the largest sector in the Russell 2000, making up more than 25% of the index as of the end of 2014 (See Exhibit 18). Approximately a third of that weighting was in Real Estate Investment Trusts (REITs), providing a significant source of index yield. ›› The Technology sector remained the second largest sector, with a weighting of 14.9% as of the end of 2014, followed closely by the Health Care sector at 14.8% and Consumer Discretionary at 14.4%. ›› Consumer Staples — a sector dominated by large multi-nationals — remained the smallest sector within small cap at less than 3%, a decline of nearly half a percentage point compared with a year ago. Exhibit 17 / Historical Sector Weightings (%) 10 Years (as of 12/31/2014) % Financial Services 100 90 Technology 80 Health Care 70 Consumer Discretionary Producer Durables Materials & Processing 60 50 40 30 Utilities 20 Energy 10 Consumer Staples 0 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Exhibit 18 / Current Sector Weightings (%) (as of 12/31/2014) Energy Consumer Staples Utilities 3.2% 3.0% Financial Services 4.6% 25.4% Materials & Processing 6.5% Producer Durables 13.4% Technology 14.9% Consumer Discretionary 14.4% SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS Health Care 14.8% 08 Russell Indexes by Russell Investments Russell 2000 Index sector attribution analysis Exhibit 19 / Sector Contribution to Return (%) ›› The Russell 2000’s strong advance during the fourth quarter was broad-based, with eight of nine economic sectors contributing to returns. The only detractor was the Energy sector, which was pushed down by the sharp decline in the price of oil (See Exhibit 19). Fourth Quarter 2014 (as of 12/31/2014) % ›› The biotechnology industry was the strongest contributor to returns during the fourth quarter, adding nearly a percentage point to performance. That was followed by banks and computer services software. Overall, 117 out of 146 industries were positive contributors (See Exhibit 20). 3.0 2.5 2.0 1.5 1.0 0.5 0.0 ›› As during the third quarter, the biggest detractors were again oil industry companies as the price of crude oil dropped more than 50% from July through year-end to below $50 a barrel (See Exhibit 21). -0.5 -1.0 -1.5 -2.0 Financial Technology Services ›› The Financial Services sector was the strongest contributor to returns during the quarter due its strong advance and large weighting within the index. The Health Care sector had a stronger return but because of its smaller weighting it was a moderately smaller contributor to returns (See Exhibit 22). Health Consumer Producer Materials Utilities Care Discretionary Durables & Processing Energy Consumer Staples Exhibit 21 / Bottom Industry Contributors (%) Exhibit 20 / Top Industry Contributors (%) Fourth Quarter 2014 Fourth Quarter 2014 % % 0.0 1.0 -0.2 0.8 -0.4 0.6 -0.6 0.4 -0.8 0.2 -1.0 0.0 Biotechnology Banks: Diversified Computer Services Software & Systems Medical & Dental Instruments & Supplies Semiconductors & Components -1.2 Oil: Crude Producers Oil Well Equipment & Services Energy Equipment Metals & Minerals: Diversified Alternative Energy Exhibit 22 / Sector Review Fourth Quarter 2014 (as of 12/31/2014) Financial Services Technology Health Care Consumer Discretionary Russell 2000 Index Weight (%) 25.4 14.9 14.8 14.4 Total Return (%) 11.17 12.45 17.43 Contribution to Return (%) 2.89 1.74 2.41 SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS Producer Durables Materials & Processing Utilities Energy Consumer Staples 13.4 6.5 4.5 3.2 3.0 14.17 8.96 6.27 15.20 -34.75 14.09 1.96 1.22 0.42 0.68 -1.99 0.39 09 Russell Indexes by Russell Investments Russell 2000 Index fundamental characteristics Exhibit 23 / Price-to-earnings Ratio (P/E) I/B/E/S 1-year forecasted — 10 Years (as of 12/31/2014) ›› Following a significant decline in valuation levels during the third quarter, valuations moved higher again for the Russell 2000 during the fourth quarter. The index’s price-to-earnings ratio based on 1-year forecasted earnings per share was approximately 18.8 at year-end, down from 19.6 at the end of 2013. Solid earnings growth has supported valuations above its 10-year average of about 16.3 (See Exhibit 23). 30 25 10 Yr Avg 16.3 20 15 ›› Profitability, as measured by return on assets (ROA), continued to move upward during the fourth quarter, rising above its 10-year average of about 6.1% from 5.1% at the end of 2013 (See Exhibit 24). 10 ›› Forecasted earnings growth edged slightly downward to about 13.5% compared with 13.7% at the end of the third quarter. That compares with 13.3% at the end of 2013 and a longer-term average of about 13.8% (See Exhibit 25 5 0 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Exhibit 25 / Earnings growth Exhibit 24 / Return on Assets (ROA) I/B/E/S 5-year forecasted EPS — 10 Years (as of 12/31/2014) Trailing 5 Years (%) — 10 Years (as of 12/31/2014) % 10 20 10 Yr Avg 6.1 8 15 6 10 4 5 2 0 Dec-04 10 Yr Avg 13.8 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 0 Dec-04 Dec-14 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Exhibit 26 / Fundamental Characteristics Market Snapshot (as of 12/31/2014) Valuation Growth Quality P/E - I/B/E/S 1 Yr Forecasted Price/Book Price/Cash Flow Sales Per Share Growth – 5 Yr Long Term Forecasted Growth – I/B/E/S Median EPS Variability – 5 Yr ROA 5 Yr Avg Debt/Equity Dividend Yield Russell 2000 Index 18.81 2.31 18 6.16 13.47 51.36 6.18 0.91 1.29 Russell 1000 Index 17.16 2.78 12.86 8.82 11.27 28.18 11.9 1.23 1.9 SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS 10 Russell Indexes by Russell Investments Russell Investments is a trade name and registered trademark of Frank Russell Company, a Washington USA corporation, which operates through subsidiaries worldwide and is part of London Stock Exchange Group. Russell Investments is the owner of the trademarks, service marks and copyrights related to its respective indexes. Indexes are unmanaged and cannot be invested in directly. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. The inception date of the Russell 2000 Index and the Russell 3000 Index is January 31, 1984. Unless otherwise noted, the source for the data in this report is Russell Investments. Nothing contained in this material is intended to constitute legal, tax, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional. Copyright © Russell Investments 2015. All rights reserved. First used January 2014. Revised January 2015. CORP-10169-12-2017 SMALL CAP PERSPECTIVES RUSSELL 2000® INDEX QUARTERLY ANALYSIS For more information about Russell Indexes visit www.russell.com/indexes or contact Russell Indexes directly. Contact us Email: [email protected] Americas: +1-877-503-6437 APAC: +65-6880-5003 EMEA: +44-0-20-7024-6600 www.russell.com/indexes Russell Indexes by Russell Investments About Russell Indexes The Russell Indexes measure the performance of the global equity market based on all investable equity securities. The Indexes cover 98% of the investable global market. All securities in the Russell Indexes are classified according to size, region, country, and sector; as a result the index can be segmented into thousands of distinct benchmarks. The Indexes are constructed to provide a comprehensive and unbiased barometer for the globe and are completely reconstituted annually to accurately reflect the changes in the market over time.

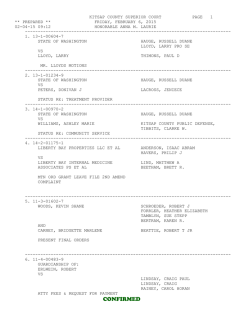

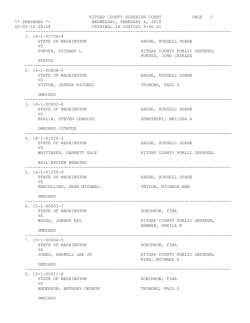

© Copyright 2026