Momentum Picks

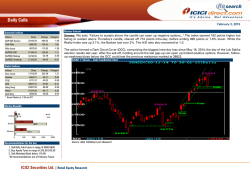

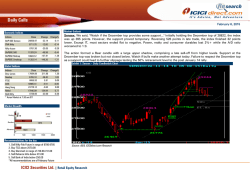

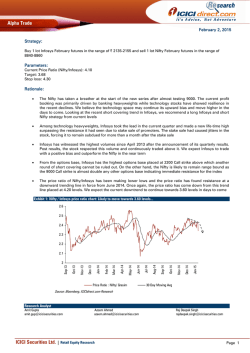

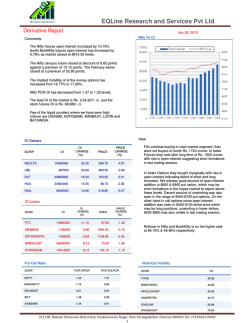

Momentum Picks February 6, 2015 Market Outlook Domestic Indices Indices Close Change Change% 28850.97 -32.14 -0.11 8711.70 -12.00 -0.14 8751.30 -25.05 -0.29 S&PBSE 500 11203.24 S&PBSE Midcap 10603.57 -48.99 -137.81 -0.44 -1.28 S&PBSE Smallcap 11283.14 -149.26 -1.31 Indices Close 17884.88 Dow Jones Nasdaq 4765.10 6865.93 FTSE DAX 10905.41 24770.12 Hang Seng Nikkei 17646.09 8726.00 SGX Nifty * Asian Market at 7:30 am.IST Change 211.86 48.40 5.91 -5.91 -0.63 134.94 -23.00 Change% 1.20 1.03 0.09 -0.05 0.00 0.77 -0.26 S&P BSE Sensex CNX Nifty Nifty future Snapshot Global Indices Day’s action Equity benchmarks ended a highly volatile session of trade on a weak note and extended the losing streak to a fifth consecutive session on Thursday dragged down by a late sell-off across key heavyweights. The Sensex lost 427 points from the day’s high (29277) to end at 28850, down 32 points or 0.11%. The Nifty lost more than 130 points from the high (8838) to close at 8711, down 12 point or 0.14%. Broader markets underperformed the benchmarks as the BSE midcap and small cap indices ended down 1.3% each. The overall market breadth was negative • The Nifty opened on a flat note and traded with a positive bias in the first half. The index gained momentum towards mid-session and climbed to a high of 8838. However, a strong bout of selling pressure near identical highs of Monday and Tuesday (8840) swept the markets off their feet as the index plummeted over 130 points from the session’s high to end at 8711. Heavy selling pressure was seen across the banking, metals, power and realty indices, which lost over 2% each. The IT index outperformed by gaining over 2% • The price action formed a small bodied bear candle with a large upper shadow, which resembles an Inverted Hammer highlighting the late sell-off. The index reacted sharply lower precisely from this week’s high of 8840. The current corrective bias will remain intact as long as the index fails to post a strong close above 8840 • • CNX Nifty Technical Picture Nifty Trend Intraday Down Trend Reversal Short Term Rangebound 8780 Support 8670-8640 8600 Resistance 8745-8780 8900 20 Days EMA 8657 200 days EMA 7862 Structurally speaking • Institutional Activity Cash Segment (| Cr) 5-Feb-15 FII -27.4 DII 325.6 4-Feb-15 -83.8 -72.4 3-Feb-15 -264.4 -137.3 2-Feb-15 -630.0 -224.1 30-Jan-15 -771.6 -37.6 • Oscillators ICICI Securities Ltd. | Retail Equity Research The Nifty remained in a corrective mode for a fifth consecutive session and retraced 50% of the gains witnessed in the preceding 10 session rise from 8380 to 8996. We expect the index to continue its breather and ease off towards 8600 in the coming sessions The index has entered a corrective mode after testing the key overhead trend line (marked in maroon) connecting all major swing highs since May 2014. Over the past seven months, the index has tended to enter a corrective phase to form a higher bottom after testing this rising trend line. The overall medium-term price structure remains bullish. We expect the index to witness a higher base formation in the vicinity of 8600 before continuing the larger uptrend. Stock specific action will continue while the index takes a breather ahead of the Union Budget From a short-term perspective, the recent breakout area and December 2014 high of 8626 is expected to act as immediate support for the index. The placement of 38.2% Fibonacci retracement of the January 2015 up move (8065 to 8925) around the 8600 region makes this a key support area for the index The current rally from December 2014 low of 7961 to 8985 (1024 points) is the largest in magnitude over the last one year. Since February 2014 each major directional up move has measured average 900 points. The current up leg getting larger than all preceding up moves signals an extending market, which holds further upside potential. The minimum 138.2% Fibonacci extension of the October-December 2014 up move projected from the December 2014 low of 7961 opens upsides towards 9200 in coming months Among oscillators, the 14 period RSI continues to work its way out of the recent overbought readings and is poised at a neutral territory with a reading of 57. The shedding of overstretched conditions by short-term momentum indicators is a healthy sign and will create room for further upsides, going forward Nifty futures are set to open on a subdued note amid mixed global cues. After the late sell-off on Thursday and further weak opening in today's session, some initial pullbacks are not ruled out. Utilise pullbacks towards 87808790 on Nifty February futures to create shorts for target of 8735 with a protective stop loss of 8810 Intraday strategy Intraday Spot levels The Nifty spot has resistance at 8745, 8780 while support is at 8670, 8640 Exhibit 1: CNX NSE Nifty – Daily Candlestick Chart CNX Nifty Spot Open High Low Close 8733.10 8838.45 8683.65 8711.70 The Nifty formed a small bodied bear candle with a large upper shadow which resembles an Inverted Hammer highlighting the selling pressure at this weeks opening high of 8840 level. We expect the index to ease off towards 8600 levels in the coming sessions 1024 points 8626 903 points 8065 7961 7723 The 14 period RSI continues to work off its overstretched conditions and is poised at neutral territory with a reading of 57 Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 2 CNX Bank Nifty Futures Outlook CNX Bank Nifty Futures Indices CNX Bank Nifty Close Change change% 19,147.1 -137.6 -0.7 Day’s action • CNX Bank Nifty Spot Performance Performance in % Index Bank Nifty Current 19,051.9 1M 3.4 3M 9.8 6M 26.9 12M 86.7 Day’s action CNX Bank Nifty Future Technical Picture Bank Nifty Trend Intraday Down Trend Reversal Short Term Rangebound 19370 Support 19060-18900 18700 Resistance 19370-19575 20000 20 Days EMA 19559 200 days EMA 16334 CNX Bank Nifty vs. Nifty 8600 8300 8000 7700 7400 7100 6800 6500 Structurally speaking 6-Aug 25-Aug 11-Sep 29-Sep 21-Oct 11-Nov 27-Nov 15-Dec 1-Jan 19-Jan 5-Feb 20200 19000 17800 16600 15400 14200 13000 Bank Nifty (RHS) Bank Nifty future traded with high volatility and continues to drag lower. The index extended its recent decline for a seventh consecutive session weighed down by profit booking across banking heavyweights. Nifty February Future settled at 19147, down by 137 points or 0.7% for the day NSE (LHS) Oscillators Intraday Future levels ICICI Securities Ltd. | Retail Equity Research The Bank Nifty futures opened on flat note and took support at its previous session’s low (19220) and traded with a positive bias in the first half. The index gained strong momentum in the second half and made a high of 19574 in the afternoon trade. However, strong selling pressure at higher levels in the last hour of trade saw the index giving up all its gains and closing down 0.7% for the day • The price action formed a bear candle with a long upper shadow signalling a strong selling pressure at higher levels. It carries a lower low indicating continuance of the corrective trend. The current profit booking trend is expected to continue as long as the index fails to form a higher high and higher low on the daily chart • The Bank Nifty continued to cool off for a seventh consecutive session and has retraced the previous up move (18306 to 20934) by more then 61.8% on Thursday. The sharp decline in the last seven sessions has led the short-term stochastic into the extreme oversold territory. Hence, the index can see sideways price action in the coming session, thus forming base for further upsides in short-term • Since August 2013, each major directional up move on the Bank Nifty has measured average 3500 points. The index replicated this price wise trait and almost achieved our target area of 21000 from the December 2014 low of 17600. Sustainability above 21000 will be the key thing to watch in the shortterm as it would signal an extending market. In extending markets, the next logical price objective based on minimum 123.6% Fibonacci extension of the preceding 3500 point rally would open up further upsides towards 21900 over the medium-term • On Wednesday, the index closed below the short-term trend line support in place since October 2014 as can be seen on the adjacent chart. A sustained breach of the support line will signal an extended profit booking and the index can test levels of 18700 being the confluence of the 61.8% retracement of the December-January up move from 17600 to 20934 and the bullish gap area of January 15, 2015 (18690-19125) Among oscillators, the short-term stochastic, as a result of sharp decline in the previous seven session is in oversold territory and placed near previous lows. Hence, a sideways consolidation is likely in the coming sessions For the upcoming session, Bank Nifty February futures has supports at 19060, 18900 while resistances are at 19370, 19575 Page 3 Exhibit 2: CNX Bank Nifty Generic Future – Daily Candlestick Chart The Bank Nifty formed a bear candle with a long upper shadow signalling selling pressure at higher levels. The index has closed below the short term trend line support in place since October 2014. Sustenance below the support line will signal an extended profit booking and the index can test levels of 18700 in the coming sessions 20934 19284 18930 CNX Bank Nifty Future Open High Low Close 19343.30 19574.90 19061.60 19147.05 Gap @ 1869019115 17600 Gap @ 1599016190 15180 The 14 period RSI has eased off from the overbought territory and is placed near previous support area. While short-term stochastic has also approached oversold territory after the recent correction Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 4 Trend Scanner Sectoral Indices Performance Sector Close Points Chg % Change Positive Trends Candlestick Patterns Auto 19593.92 -133.69 -0.68 Scrip Name Close % Change 10-day SMA Delivery (%) Banks 21813.19 -102.06 -0.47 Infosys Ltd 2193.80 2.38 2157.44 68.21 Bullish Engulfing BSE Small Cap 11283.14 -149.26 -1.31 Kajaria Ceramics Ltd 750.40 4.49 724.90 68.35 Scrip Name Close Scrip Name Capital Goods 16845.71 -143.24 -0.84 Shree Cement Ltd 11001.85 2.93 10914.12 61.10 Shree Cement 10980.0 Jindal Saw Consumer Durables 10447.66 -240.4 -2.25 Gateway Distriparks Ltd 393.30 3.51 386.19 70.10 Jubilant FoodWorks FMCG Bullish Candlestick Formations 8221.46 48.09 0.59 Healthcare 15486.19 -146.02 -0.93 Bullish Continuation pattern IT 11521.21 236.19 2.09 BPCL Metals 10239.18 -198.79 -1.90 Mid Cap 10603.57 -137.81 -1.28 Oil & Gas 10198.12 -118.51 -1.15 Power 2130.99 -61.35 -2.80 PSU 8037.49 -122.83 -1.51 Real Estate 1757.69 -49.50 -2.74 Negative Trends HCL Technologies Scrip Name Close % Change 10-day SMA Delivery (%) Bank of India 249.45 -2.96 276.44 23.21 Reliance Infrastructure Ltd 469.80 -5.62 489.89 25.48 Jindal Steel & Power Ltd 146.30 -4.88 154.92 41.56 Overbought Stocks 11.6 8.6 6.1 5.9 5.5 5.5 2.9 2.8 0.9 0.5 0.2 TCS Close 79.0 1440.0 Bearish Continuation pattern 746.2 1970.8 JP Associates 26.0 Jindal Steel & Power 145.5 743.5 Bank of India 247.8 2553.0 Reliance Infra 466.5 1075.2 ONGC Evening Star 355.9 Note: For Candlestick pattern description please refer towards end of the report. Oversold Stocks Stocks rising for 5 days & stochastic overbought Stocks falling for 5 days & stochastic oversold Scrip Name LTP Stochastic Scrip Name Dabur India 266.25 85.25 417.4 88.09 United Phosphorus Bearish Engulfing Piercing Line Godrej CP Sectoral Indices - Monthly Performance (%) Real Estate IT Capital Goods Consumer Durables FMCG Healthcare Oil & Gas Auto Power Mid Cap Banks BSE Small Cap PSU Metals Glenmark Bearish Candlestick Formations LTP Stochastic Bata India 1366 12.82 Hindustan Unilever 908.5 17.08 Thomas Cook 191.5 19.5 Stocks hitting 52 week high Scrip Name HCL Tech Lupin LTP 1965.85 1588.7 Ramco system 526.9 Tata Chemical 465.35 Wipro 637.5 -0.3 -3.2 -6.2 -12 -2 8 18 ICICI Securities Ltd. | Retail Equity Research Page 5 Global Asset Classes Market Activity Report Global Currencies Nifty Heat Map Swiss Franc 0.923 0.921 -0.26 Bajaj Auto 2,245.3 L&T Global Treasury Yields Closing Yield (%) Previous Yield (%) India 10 year 7.70 7.70 US 10 Year 1.82 1.82 EURO 10 Year 0.36 0.37 GBP 10 Year 1.54 1.53 JPY 10 Year 0.38 0.36 Dr Reddy Power Grid Cipla Hindalco Commodities US Dollar Close Prev. Close %Chg Gold/ounce 1265.65 1264.82 0.01 Copper /ton 5743.5 5732.75 -0.15 57.23 56.57 1.24 Brent Crude/barrel Sesa Goa 0.6% 0.0% 1,682.4 -0.4% 3,072.1 -0.8% 143.7 -1.8% 662.4 -2.3% 148.1 -2.9% 207.8 -4.1% Lupin Tata Motors Maruti GAIL Tata Steel BHEL JSPL 0.6% 1,578.3 -0.1% 589.2 -0.4% 3,522.7 -1.0% 423.9 -1.8% 379.3 -2.6% 276.9 -2.9% 146.3 -4.9% ITC Ranbaxy Ambuja Cement Ultratech NTPC M&M PNB Reliance Infra 368.9 0.4% 736.3 -0.1% 247.6 -0.5% 3,064.1 -1.1% 140.2 -1.9% 1,179.7 -2.6% 171.4 -3.2% 469.8 -5.6% 865.4 Grasim Ind 3,887.5 RIL Bharti Airtel IDFC ICICI Bank ONGC JP Asso. 0.2% -0.2% 923.7 -0.5% 364.7 -1.2% 166.7 -2.2% 335.6 -2.6% 356.7 -3.2% 26.5 -7.0% HDFC Bank 1,076.5 Sun Pharma 959.6 16,000.00 0.1% 8,000.00 Kotak Bank 1,287.9 SBI NMDC DLF 0.8% 0.00 -0.3% 290.8 -0.8% 138.3 -1.3% 169.4 -2.3% Cairn India 247.0 Bank of Baroda 177.6 Tata power 24,000.00 -2.7% NSE Derivatives Turnover (| crore) 700000 600000 500000 400000 300000 200000 100000 0 -4.0% NSE Derivative 29-Jan 30-Jan 2-Feb 3-Feb 4-Feb 5-Feb 83.3 -7.5% Advances / Declines NSE BSE 4% 62% ICICI Securities Ltd. | Retail Equity Research 3,702 Indusind Bank 0.9% 4,216 810.9 4,738 Asian Paints 19,618 0.37 1,504.6 1.0% 5-Feb 0.780 ACC 909.1 208,617 0.783 2,847.3 HUL 20,224 Australian ($) Hero Moto 1.1% BSE Cash 4-Feb 0.12 369.9 NSE Cash 32,000.00 172,476 0.01 117.530 Coal India 1.3% 21,682 1.533 117.380 1.1% 565.9 3-Feb 1.533 Japanese Yen 1,246.5 1.5% Axis Bank 211,082 British Pound HDFC Ltd 2,552.4 4,201 -0.08 2.4% TCS 21,335 1.148 3.8% 2,193.8 2-Feb 1.147 Euro 4.0% Infosys 156,780 0.04 1,972.7 4,050 93.569 HCL Tech 24,551 93.604 750.0 30-Jan Dollar Index BPCL 196,875 0.02 3,745 % Chg 61.754 25,432 Prev.close 61.739 29-Jan Close Rupee (|) 580,848 Spot Exchange Cash Turnover (| crore) 34% 72% 2% 26% Page 6 Stock recommendations for the day Exhibit 3: TCS (TCS) Daily Candlestick Chart Price trading in upward rising channel signalling continuation of positive trend in the short term TCS (TCS) February Future CMP 2568.25 Comment : Price trading in upward rising channel and MACD in uptrend forming higher high in daily charts Action : Buy above 2570.00 Targets : 2600/2615/Higher Stop-loss : 2552.00 MACD in uptrend forming higher high and taking support at its signal line in the daily chart Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 7 Exhibit 4: Glenmark (GLEPHA) Daily Candlestick Chart Trend line breakout and price close above 21 day EMA indicating further upsides in coming sessions Glenmark (GLEPHA) February Future CMP 743.65 Comment : Short term trendline breakout and price above 21 day EMA and RSI in up trend forming higher high in daily chart Action : Buy in the range of 740.00-741.00 Targets : 752/758/Higher Stop-loss : 734.00 RSI in up trend forming higher high in daily chart supports the bullish bias in price Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 8 Exhibit 5: Reliance Infrastructure (BSES) Daily Candlestick Chart Price facing resistance at 50 day EMA and rising support line breached signalling continuation of profit booking in the coming sessions Reliance Infra (BSES) February Future CMP 473.20 Comment : Price facing resistance at 50 day EMA and rising support line breached and RSI generated bearish crossover in the daily chart Action : Sell below 473.00 Targets : 466/462/Lower Stop-loss : 477.00 Bearish crossover of the RSI below its nine period’s average in the daily chart Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 9 Exhibit 6: Bank of India (BANIND) Weekly Candlestick Chart Short term trend line joining major lows is breached signalling continuation of profit booking in the coming sessions Bank of India (BANIND) February Future CMP 250.50 Comment : Short term trendline joining major lows is breached and MACD giving sell signal in the weekly chart Action : Sell below 250.00 Targets : 245/243/Lower Stop-loss : 252.50 MACD in sell mode moving below signal line indicating further downsides in the coming sessions Source: Bloomberg, ICICIdirect.com Research ICICI Securities Ltd. | Retail Equity Research Page 10 Previous Day’s Performance Scrip Product Strategy Recommended Price Targets SL Gain/Loss %* Lupin Tata Chemical LIC Housing Finance Future Future Future Buy Buy Sell In range of 1586-1588 In range of 471-472 below 457 1610/1622/+ 479/483/+ 449.5/445.5/- 1575.00 467.50 461.20 2.10 1.50 -0.90 Comment Target 2 almost achieved Target 1 achieved Stoploss triggered * Return Opportunity Stock profits: Avg 0.90% per trade (Cum. Profits over last 201 days:279.25%) Strike Rate for the day: 2/3 (Cum strike rate over 201 days: 266/443 Note: The follow-up and performance review table of the strategies indicates the profit opportunity that was available in the strategies. Individual profits may vary, depending upon the entry and exit price and stop losses. ICICI Securities Ltd. | Retail Equity Research Page 11 Nifty Options OI Distribution Derivative Comments • Nifty Call Put Concentration (FEB) 60 50 33.0 2.6 30.6 19.0 32.9 18.1 27.7 24.1 Call 1.6 0 11.4 27.2 10 29.8 20 10.4 27.0 50.8 30 8.4 OI in Lacs 40 Put • OI addition: We saw long build-up in Jubilant Foods, BPCL, Bata India and IndusInd Bank while short build-up was seen in Uco 18.5 21.7 21.2 21.3 23.5 24.3 25.2 26.4 28.6 31.6 25.4 26.2 25.7 26.1 26.0 25.6 Bank and Idea Cellular 920 900 880 860 840 820 800 780 14-Jan 15-Jan 16-Jan 19-Jan 20-Jan 21-Jan 22-Jan 23-Jan 27-Jan 28-Jan 29-Jan 30-Jan 2-Feb 3-Feb 4-Feb 5-Feb OI In million Nifty OI vs. Future Price 35 30 25 20 15 10 5 0 Nifty Futures OI Nifty Fut Price (RHS) • OI shedding: We saw short covering in Coal India, ACC, NHPC and HCL Tech whereas long closure was seen in UPL, Voltas, DLF and Wockhardt Ltd OI Gainers Symbol Call (%) 8700 OI chg % -4.49 IV (%) 18.28 OI chg % -0.29 IV (%) 18.32 8800 12.24 17.95 12.80 17.57 8900 15.15 17.66 7.33 16.49 9000 10.96 17.34 -0.49 15.77 9100 -2.09 17.42 7.22 15.26 OI % Chg Price % Chg Symbol OI 2517750 13.55 1,440 6.2 WOCKPHARMA AUROPHARM 8575750 10.01 1,155 -5.2 COALINDIA TATAPOWER 29884000 7.90 84 -7.7 SRTRANSFIN 2691000 UCOBANK Put (%) OI Losers JUBLFOOD DIVISLAB Nifty Active Strikes Strike Post a flat start, the index witnessed decent buying, which helped it to gain 120 points. However, the news of the Greece market opening 8% lower and Greece bank index down 20%, acted as a turning point. Due to some panic here as well, the Nifty gave up all its gains and ended 15 points lower. Nifty future premium declined and settled at 40 points. India VIX increased 2.81% and settled at 20.65 • FIIs sold | 27 crore while DIIs bought | 325 crore in the cash segment. FIIs sold | 576 crore in index futures and bought | 731 crore in index options. In stock futures, they bought | 275 crore • The highest Put base is at the 8500 strike with 29 lakh shares while the highest Call base is at the 9000 strike with 51 lakh shares. The 8800 and 8900 Calls saw addition of 2.44 and 0.90 lakh shares, respectively. The 8700 and 8600 Put strikes saw addition of 1.75 and 1.55 lakh shares, respectively Stock Analysis ICICI Securities Ltd. | Retail Equity Research 673875 5.98 1,631 -1.0 UPL 21672000 5.66 69 -6.0 GLENMARK % Chg Price % Chg 3391500 -22.89 1,240 -4.1 24145000 -13.62 369 0.7 796000 -12.24 1,158 0.6 4388000 -9.62 419 -2.6 -9.58 744 1.3 Page 12 Support and Resistance SCRIP SENSEX NIFTY ACC CLOSE S1 S2 S3 R1 R2 R3 TREND 28850.97 28774.7 28643.55 28566.35 29036.95 29168.1 29245.35 Neutral 8711.7 8689.45 8650.75 8628.65 8766.85 8805.55 8827.65 Neutral +ve 1504.55 1505.85 1495.1 1484.35 1527.35 1535.75 1544.15 ADANI ENTER. 622.85 610.65 602.80 594.90 627.20 635.50 643.75 ADANI POWER 47.45 46.15 45.55 44.90 47.80 48.65 49.45 -ve 1750.60 1734.05 1722.80 1711.55 1758.55 1770.80 1783.05 -ve 107.25 106.20 104.45 103.40 109.70 111.40 112.50 86.60 84.50 83.75 82.95 87.25 88.65 90.00 -ve 1294.65 1278.15 1270.25 1262.35 1299.85 1310.70 1321.60 -ve APOLLO TYRES 226.85 223.95 221.10 218.20 227.75 229.65 231.55 -ve ARVIND 287.55 279.35 274.90 270.40 289.70 294.90 300.05 -ve ADITYA BIRLA ALLAHABAD BANK ANDHRA BANK APOLLO HOSPITALS ASHOK LEYLAND -ve Neutral 62.45 61.25 60.60 60.00 62.75 63.50 64.30 810.85 812.95 808.35 803.75 822.15 828.80 835.45 AUROBINDO PHARMA 1150.85 1128.00 1114.75 1101.55 1156.85 1171.30 1185.75 -ve BAJAJ AUTO 2245.30 2241.05 2233.55 2220.70 2256.05 2263.50 2276.40 Neutral BOB 177.55 173.30 171.80 170.35 178.55 181.20 183.80 BOI 249.45 244.40 242.35 240.30 251.00 254.35 257.65 BATA INDIA 1360.70 1351.90 1340.85 1327.95 1374.05 1385.15 1398.00 Neutral BHARAT FORGE Neutral ASIAN PAINTS -ve +ve -ve -ve 1088.05 1082.00 1074.25 1065.50 1097.45 1105.20 1113.95 BPCL 750.00 749.30 736.85 724.40 774.20 779.65 785.05 BHARTI AIRTEL 364.70 359.20 356.10 353.05 365.10 368.10 371.05 -ve BIOCON 420.30 413.30 411.55 409.80 421.20 425.20 429.15 -ve -ve +ve CAIRNS INDIA 247.00 245.05 240.95 236.85 247.25 248.35 249.50 CANARA BANK 429.55 418.55 408.75 398.95 433.40 440.85 448.30 -ve CENTURY TEXT. 525.00 522.55 518.15 509.75 531.35 535.75 544.15 Neutral CESC 672.25 655.65 648.85 642.10 676.05 686.25 696.45 59.70 59.45 58.95 58.55 60.45 60.95 61.40 CIPLA 662.40 654.25 648.55 642.85 663.90 668.75 673.55 -ve COAL INDIA 369.90 370.15 367.95 365.80 374.50 377.55 380.65 +ve +ve CHAMBAL FERT. COLGATE PALM. -ve Neutral 1857.70 1851.30 1832.55 1813.80 1888.80 1900.60 1912.45 CROMPTON GREAVES 161.75 157.80 154.35 150.90 163.15 165.85 168.55 -ve DABUR INDIA 267.90 266.35 264.80 262.80 269.45 271.00 273.00 Neutral 77.85 75.40 74.65 73.95 78.25 79.70 81.15 DISH TV ICICI Securities Ltd. | Retail Equity Research -ve Page 13 SCRIP DIVI'S LAB. DLF DR.REDDY'S LAB. CLOSE S1 S2 S3 R1 R2 R3 TREND 1622.00 1609.65 1594.20 1578.70 1622.15 1628.40 1634.65 -ve 169.40 166.95 163.45 159.95 170.00 171.55 173.10 -ve 3072.05 3057.15 3046.40 3035.60 3074.05 3082.50 3090.95 -ve EXIDE IND. 191.65 189.30 187.55 185.75 192.25 193.70 195.15 -ve FEDERAL BANK 137.05 133.45 132.40 131.40 136.90 138.60 140.30 -ve +ve FUTURE RETAIL 139.95 140.25 137.70 135.15 145.35 147.80 150.25 GAIL 423.90 419.30 415.30 411.25 425.00 427.85 430.70 -ve 5598.20 5476.85 5454.10 5431.35 5593.30 5651.55 5709.80 -ve 742.10 742.55 737.85 733.15 752.00 760.15 768.25 18.10 16.95 16.60 16.25 18.20 18.85 19.50 1078.45 1071.20 1055.30 1039.45 1102.95 1119.00 1135.05 GLAXO SMITH.C.H. GLENMARK PHARMA. GMR INFRA. GODREJ CONSUMER GODREJ IND. GRASIM HAVELL'S INDIA +ve -ve +ve 305.35 300.70 295.50 290.30 306.10 308.80 311.50 -ve 3887.50 3849.90 3834.35 3818.80 3887.55 3906.40 3925.25 -ve 249.00 244.85 242.00 239.15 249.70 252.10 254.55 HCL TECH 1972.65 1959.75 1936.25 1912.80 2006.70 2012.80 2018.90 +ve -ve HDFC BANK 1076.50 1078.20 1072.60 1066.95 1089.40 1095.95 1102.50 +ve HDFC 1246.45 1247.65 1226.70 1205.75 1289.60 1297.30 1305.05 +ve HERO MOTO 2847.30 2843.00 2831.30 2819.60 2866.40 2894.90 2923.40 +ve HEXAWARE TECH. 233.20 228.80 226.80 224.80 234.30 237.05 239.80 -ve HINDALCO 148.05 145.25 143.30 141.35 148.80 150.60 152.40 -ve HIND. UNILEVER 909.05 909.55 904.90 900.25 918.85 925.35 931.85 +ve HPCL 605.30 607.85 599.80 591.75 623.95 630.40 636.85 +ve HINDUSTAN ZINC 173.90 170.55 169.60 168.60 173.80 175.40 177.00 -ve HDIL 105.70 102.95 100.35 97.80 106.20 107.80 109.45 -ve ICICI BANK 335.60 330.45 328.70 326.95 336.75 339.90 343.00 -ve 65.75 64.15 63.75 63.30 66.20 67.20 68.25 -ve IDBI IDEA CELLULAR 154.25 152.95 151.95 150.95 154.40 155.10 155.85 -ve NSE INFRA DEV FINANC 166.70 164.00 162.60 161.25 167.25 168.90 170.55 -ve NSE IND.FIN.CORP.OF INDUSIND BANK INDIA CEMENTS 37.75 37.00 36.55 36.10 38.00 38.50 39.00 865.40 866.00 857.90 849.80 882.15 887.45 892.70 +ve -ve -ve 96.25 91.40 89.95 88.50 97.55 100.65 103.75 INDRAPRASTHA GAS 461.95 455.80 451.90 447.95 464.55 468.90 473.30 -ve IOC 334.65 332.25 328.20 325.60 340.25 344.25 346.90 Neutral IOB 50.25 47.90 47.50 47.05 51.15 52.80 54.40 ICICI Securities Ltd. | Retail Equity Research -ve Page 14 SCRIP IB REAL ESTATE CLOSE S1 S2 S3 R1 R2 R3 TREND 76.95 74.60 73.35 72.10 77.70 79.25 80.80 2193.80 2190.55 2172.55 2154.55 2226.55 2235.10 2243.65 IRB INFRA. 254.50 244.95 240.90 236.85 256.15 261.75 267.35 -ve ITC 368.90 368.55 366.45 364.35 372.75 374.05 375.35 +ve INFOSYS -ve +ve JAIPRAKASH ASS. 26.50 25.20 24.60 23.95 26.75 27.50 28.25 -ve J.P.POWER VENT. 11.55 11.20 11.05 10.90 11.65 11.85 12.10 -ve JAIN IRRIGATION 69.55 67.05 65.80 64.50 70.00 71.50 72.95 -ve JINDAL ST&POW 146.30 142.40 140.10 137.75 147.35 149.80 152.25 -ve JSW ENERGY 104.65 101.60 99.60 97.55 105.45 107.35 109.25 -ve NSE JSW STEEL 976.50 965.15 959.65 954.10 979.55 986.75 993.90 -ve JUBILANT FOOD 1431.95 1417.30 1387.15 1357.00 1477.65 1492.40 1507.20 KARNATAKA BANK 133.60 131.00 129.90 128.80 134.15 135.70 137.25 KOTAK MAH.BANK 1287.90 1281.45 1273.30 1262.45 1297.75 1305.90 1316.75 L&T 1682.40 1669.00 1656.55 1644.10 1684.95 1692.95 1700.90 459.95 459.30 454.30 449.30 469.30 474.90 480.50 LIC HOUSING +ve -ve Neutral -ve +ve NSE LUPIN 1578.30 1567.70 1554.95 1541.55 1593.10 1605.80 1619.25 Neutral M&M 1179.70 1164.90 1159.70 1154.55 1184.90 1194.90 1204.90 -ve MARUTI SUZUKI 3522.70 3488.15 3467.25 3446.40 3532.65 3554.90 3577.15 -ve MCLEOD RUSSEL 211.55 209.45 208.00 206.60 212.10 213.45 214.80 -ve M&M FIN.SERV. 256.00 251.85 248.55 245.25 257.05 259.70 262.30 -ve 39729.10 39496.75 39209.25 38921.75 39805.75 39960.25 40114.75 -ve MRF NSE NHPC NMDC 20.05 19.90 19.70 19.55 20.25 20.40 20.60 138.25 136.95 136.10 135.25 138.50 139.30 140.10 Neutral -ve NSE NTPC 140.15 138.45 137.90 137.40 140.45 141.45 142.50 -ve ONGC 356.65 350.95 347.35 343.75 358.20 361.80 365.40 -ve OBC 248.35 240.40 238.25 236.10 250.15 255.00 259.90 -ve PETRONET LNG 184.15 182.45 180.65 178.90 186.00 187.75 189.55 Neutral POWER FINANCE 279.50 275.60 272.35 269.05 280.55 283.05 285.50 -ve POWER GRID 143.65 141.95 141.10 140.25 144.05 145.10 146.15 -ve POWER TRADING 93.85 92.15 91.40 90.65 94.05 95.00 96.00 PNB 171.40 169.35 166.45 164.90 175.15 178.00 179.60 RANBAXY 736.25 730.25 725.60 720.95 736.50 739.65 742.80 -ve 72.25 69.40 68.95 68.55 73.05 74.90 76.70 -ve 463.75 453.05 448.80 444.55 467.25 474.35 481.45 -ve RCOM REL. CAPITAL ICICI Securities Ltd. | Retail Equity Research -ve Neutral Page 15 SCRIP CLOSE S1 S2 S3 R1 R2 R3 TREND RELIANCE INFRA. 469.80 457.15 453.45 449.75 474.20 482.75 491.25 -ve RELIANCE 923.70 914.25 909.75 905.30 925.40 930.95 936.55 -ve 60.65 59.05 58.60 58.15 61.20 62.25 63.30 -ve 321.50 314.95 312.40 309.85 323.50 327.80 332.05 74.00 73.55 73.00 72.70 74.70 75.25 75.55 RELIANCE POWER REC SAIL SESA GOA 207.80 204.35 201.90 199.40 208.90 211.15 213.45 SHRIRAM TRANS. 1157.15 1159.70 1147.80 1135.85 1183.55 1194.50 1205.45 SIEMENS -ve Neutral -ve +ve 1094.00 1081.35 1072.55 1063.75 1094.05 1100.40 1106.75 SBI 290.80 289.55 287.40 284.65 293.85 296.00 298.75 Neutral SUN PHARMA 959.55 955.45 951.75 945.55 962.90 966.65 972.80 Neutral SUN TV 404.70 395.25 393.25 391.20 407.05 412.95 418.85 -ve SYNDICATE BANK 113.85 111.20 110.15 109.05 114.45 116.05 117.65 -ve TATA CHEMICALS 462.45 455.10 450.00 444.90 464.00 468.45 472.90 -ve TATA MOTOR DVR 356.40 357.15 354.35 351.50 362.85 364.90 366.95 +ve TATA MOTORS 589.20 579.85 575.20 570.60 590.30 595.50 600.75 -ve 83.30 80.05 78.90 77.75 84.45 86.65 88.80 -ve TATA POWER TATA GLOBAL BEV. -ve 154.75 152.25 150.85 149.50 155.40 156.95 158.55 TCS 2552.40 2553.40 2535.20 2517.05 2589.75 2608.30 2626.90 +ve -ve TECH MAHINDRA +ve 2867.75 2869.50 2855.50 2841.50 2897.45 2918.70 2939.90 TATA STEEL 379.25 373.95 370.85 367.80 381.30 385.00 388.70 -ve TITAN IND. 417.80 410.15 405.90 401.65 419.40 424.05 428.70 -ve -ve UCO BANK ULTRATECH CEMENT UBI 68.40 66.70 66.20 65.65 69.05 70.20 71.40 3064.10 3033.45 3018.85 3004.30 3067.90 3085.10 3102.35 -ve 193.35 189.30 187.40 185.50 194.60 197.25 199.95 -ve UNITED BREW. 953.45 917.15 909.70 902.25 956.00 975.45 994.90 -ve UNITED PHOSPH. 417.95 413.05 407.45 401.85 419.25 422.35 425.40 -ve UNITECH VOLTAS 17.50 16.15 15.75 15.35 17.65 18.40 19.20 -ve 262.85 256.85 251.40 245.95 264.90 268.95 273.00 -ve WIPRO 638.25 636.15 630.60 625.05 647.25 651.10 654.95 +ve NSE YES BANK 807.85 808.75 800.50 792.25 825.25 832.80 840.40 +ve ZEE 360.65 357.30 353.80 350.30 361.60 363.75 365.90 -ve ICICI Securities Ltd. | Retail Equity Research Page 16 NOTES: • • • • • • • Please execute the recommendation within the levels provided in the report Once the recommendation is executed, it is advisable to keep strict stop loss as provided in the report Avoid entering into the recommendation in the first 5 min of trade If the recommendation opens near the target levels due to gap up/gap down opening, then the recommendation is considered not initiated The recommendations are valid only for the day and should be squared off by the end of the day. Only stocks in derivatives segment have been considered for daily trading. Medium to long-term prospects of a stock does not have any bearing on the daily view. Trading Portfolio allocation • It is recommended to spread out the trading corpus in a proportionate manner between the various technical research products. • Please avoid allocating the entire trading corpus to a single stock or a single product segment. • Within each product segment it is advisable to allocate equal amount to each recommendation. • For example: The ‘Momentum Picks’ product carries 3 to 4 intraday recommendations. It is advisable to allocate equal amount to each recommendation ICICI Securities Ltd. | Retail Equity Research Page 17 Recommended Product wise Trading Portfolio allocation Products Allocations Product wise Max allocation allocation in 1 stock Return Objective Number of Calls Frontline Stocks Mid-cap stocks Duration Daily Calls 8% 2-3% 3-4 Stocks 0.50-1% 2-3% Intraday Short term Delivery 6% 3-5% 7-10 p.m 4-5% 7-10% Opportunity based Weekly Calls 8% 3-5% 1-2 Stocks 5-7% 7-10% 1 Week Weekly Technical 8% 3-5% 1-2 Stocks 5-7% 7-10% 1 Week Monthly Call 15% 5% 2-3 Stocks 7-10% 10-15% 1 Month Monthly Technical 15% 2-4% 5-8 Stocks 7-10% 10-15% 1 Month Techno Funda 15% 5-10% 1-2 Stocks 10% and above 15% and above 6 Months Technical Breakout 15% 5-10% 1-2 Stocks 10% and above 15% and above 3-6 Months Cash in Hand 10% - - - - - 100% ICICI Securities Ltd. | Retail Equity Research Page 18 Candlesticks Glossary: Candlestick patterns describe the market sentiment for the specified period. Some of the formations suggest reversal of sentiment (trend) and, therefore, are important for a chart reader. By themselves, the patterns do not carry any price target but only an indication of change in market behaviour. More importance needs to be given to the placement of the pattern within larger trend Bullish Engulfing Line: A potential bottom reversal pattern. This pattern typically appears at the culmination of a decline or downtrend. The market falls, and a black candle forms (ideally a small black candle). Next, a white real body wraps around the prior session’s black body. Low of the pattern becomes short term support for prices Piercing Line: Potential bottom reversal pattern. A black body forms in the downtrend. The market continues moving south on the next session’s open but that session culminates in a white real body that closes (e.g. pierces) than half way or more into the prior black body. Lowest low between two candles is referred to as technical support for prices Hammer: A candlestick line which, during a downtrend, has a very long lower shadow and small real body (black or white) at the top end of the session’s range. There should be no, or a very small, upper shadow. Pattern suggests buying support during declines and needs confirmation in terms of sustainability of prices above head of the Hammer in following session Bearish Engulfing Line: Potential top reversal signal. This two candlestick pattern emerges during a rally. A black candle real body wraps around a white real body (classically a small white candle) Highest high between two candles becomes resistance level for prices for future reference Dark Cloud cover: A dark cloud cover forms a top reversal pattern. The first session should be a strong, white real body. The second session’s price opens over the prior session’s high (or above the prior session’s close). By the end of the second session, it closes near the low of the session and should fall well into the prior session’s white body. Pattern suggests that market has a poor chance of rising immediately Shooting Star: A single candlestick line during a rally in which there is a small real body (white or black) at the bottom end of the session's range and a very long upper shadow. The candle line should also have little or no lower shadow. Pattern suggest the trouble for prices overhead ICICI Securities Ltd. | Retail Equity Research Page 19 Pankaj Pandey Head – Research [email protected] ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No 7, MIDC Andheri (East) Mumbai – 400 093 [email protected] ICICI Securities Ltd. | Retail Equity Research Page 20 Disclaimer ANALYST CERTIFICATION We /I, Dharmesh Shah, Dipesh Dagha, Nitin Kunte, Pabitro Mukherjee Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Terms & conditions and other disclosures: ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities is a whollyowned subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com. ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months. ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction. ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past twelve months. ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. It is confirmed that Dharmesh Shah, Dipesh Dagha, Nitin Kunte, Pabitro Mukherjee Research Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ICICI Securities or its subsidiaries collectively or Research Analysts do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this report. ICICI Securities Ltd. | Retail Equity Research Page 21

© Copyright 2026