Global Markets Overview

Global Markets Overview

February 2, 2015

Research Department

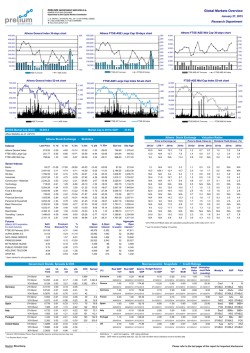

Athens General Index 30-days chart

450,000

900

400,000

Athens FTSE-ASE Mid Cap 30-days chart

Athens FTSE-ASE Large Cap 30-days chart

450,000

290

8,000

400,000

280

7,000

350,000

270

300,000

300,000

260

250,000

250,000

250

200,000

200,000

240

150,000

150,000

230

100,000

350,000

850

800

750

100,000

50,000

0

710

50,000

210

1,000

690

0

200

0

FTSE-MID 40 Turnover

400,000

1,050

300,000

950

700,000

450

600,000

400

500,000

350

40,000

1,300

35,000

1,200

30,000

400,000

300

300,000

250

15,000

900

10,000

800

700

200,000

200

100,000

750

100,000

150

5,000

0

650

0

100

0

FTSE-20 Turnover

ASE Index

43,152.0

1,000

20,000

850

ATHEX Market Cap (€mn):

1,100

25,000

200,000

ASE Turnover

FTSE-MID 40 Index

FTSE-ASE Mid Cap Index 52-wk chart

FTSE-ASE Large Cap Index 52-wk chart

1,150

670

FTSE-20 Index

1,350

500,000

750

730

Athens General Index 52-wk chart

1,250

770

4,000

2,000

FTSE-20 Turnover

600,000

790

5,000

220

ASE Index

700,000

810

6,000

3,000

700

ASE Turnover

830

Market Cap to 2013e GDP:

0*

600

FTSE-20 Index

FTSE-MID 40 Turnover

FTSE-MID 40 Index

23.7%

Athex Statistics as of: 30/1/15

Athens Stock Exchange - Valuation Ratios

Athens Stock Exchange - Statistics

Price to Earnings (x)

Price to Book Value (x)

Dividend Yield (Gross) (%)

Last Price

% 1d

% 1m

% 3m

% 6m

% ytd

% 52w

52w low

52w high

2013a*

LTM **

2014e

2015e

2013a*

2013a

2014e

2015e

Athens General Index

721.93

-1.59

-13.67

-21.17

-37.92

-12.62

-38.66

708.61

1,379.42

20.0

N/A

10.9

7.0

1.2

0.6

0.6

1.0

3.6

4.0

FTSE-ASE Large Cap

215.63

-1.48

-19.53

-27.95

-42.10

-18.59

-44.03

209.48

445.52

12.0

N/A

10.8

6.7

1.4

0.7

0.6

1.2

4.1

4.1

FTSE-ASE Mid Cap

730.08

-1.52

-9.29

-11.66

-33.72

-5.56

-34.87

696.63

1,317.40

0.6

N/A

N/A

12.8

0.8

0.5

0.7

0.8

0.7

0.9

Indexes

2014e 2015e

Sector Indexes

59.93

-1.59

-38.82

-51.61

-61.30

-37.69

-66.60

53.22

213.44

1.2

N/A

10.1

3.9

1.1

0.4

0.3

0.0

N/A

N/A

Telecoms

2,014.88

-3.68

-21.71

-18.76

-27.81

-19.56

-32.22

1,995.61

3,633.39

16.5

678.7

10.0

8.7

2.5

1.5

1.3

0.0

N/A

N/A

Oil-Gas

1,727.23

0.22

-4.97

-2.52

-28.60

-4.83

-39.12

1,608.57

3,236.15

N/A

N/A

9.0

6.0

1.3

0.8

0.7

3.3

6.2

8.9

Industrials

1,967.96

-2.32

-1.65

-4.46

-37.70

0.71

-38.49

1,816.11

3,724.87

30.4

69.3

18.1

8.5

1.5

0.8

0.9

1.6

3.4

4.3

Construction - Materials

2,122.34

-1.17

-3.20

-1.14

-30.11

-2.86

-22.70

2,028.51

3,482.98

N/A

N/A

15.1

9.2

0.8

0.6

0.6

0.1

0.9

2.5

Banks

Technology

665.80

-2.49

-10.32

-6.88

-30.66

-8.30

-23.59

622.75

1,134.79

N/A

N/A

N/A

N/A

0.5

N/A

N/A

0.5

N/A

N/A

Commerce

4,436.16

-5.28

-2.28

-7.07

-30.15

-2.56

-29.98

3,847.16

7,649.84

30.3

8.4

11.3

9.4

1.7

1.3

1.2

0.0

2.8

2.6

Food & Beverage

5,386.27

-1.61

-5.50

-15.57

-16.25

-8.05

-26.54

5,066.70

7,553.58

62.5

23.8

16.7

15.4

2.5

1.6

1.5

1.6

2.7

2.9

122.13

-0.65

-16.31

-23.15

-37.17

-15.39

-48.78

115.79

287.11

N/A

N/A

N/A

N/A

0.7

0.3

N/A

0.0

N/A

N/A

5.0

Health

Financial Services

976.27

-5.50

-4.20

-14.79

-45.81

-2.53

-42.88

900.30

2,207.51

N/A

N/A

13.2

11.7

1.2

1.7

1.6

0.3

5.4

Personal & Household

4,436.16

-5.28

-2.28

-7.07

-30.15

-2.56

-29.98

3,847.16

7,649.84

30.3

8.4

11.3

9.4

1.7

1.3

1.2

0.0

2.8

2.6

Basic Resources

2,071.59

-4.13

5.31

-6.57

-26.36

7.44

-23.07

1,753.11

3,356.44

N/A

N/A

9.4

6.2

0.7

0.6

0.5

0.0

N/A

N/A

Retail

3,809.65

-5.54

-0.19

1.31

-14.22

0.20

20.80

3,121.12

4,836.94

4.6

N/A

N/A

N/A

1.3

N/A

N/A

0.0

N/A

N/A

Real Estate

2,237.83

-0.71

-1.36

-11.46

-23.58

-1.93

-8.13

2,181.63

3,111.71

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Travelling - Leisure

1,345.06

2.11

-16.04

-18.28

-33.56

-12.27

-19.63

1,238.26

2,304.69

24.0

18.1

11.6

9.5

2.3

1.7

1.6

5.4

7.5

8.8

Utilities

1,926.99

1.29

-10.24

-13.95

-51.50

-8.17

-45.98

1,711.47

4,471.04

N/A

N/A

6.0

5.1

0.5

0.3

0.3

0.8

5.1

5.6

Settl.

Price

Premium/

Discount (%)

%

1d

Open

Interest

∆ Open

Interest

Days

to expire

Aggregate

Open

Interest *

208.75

-3.19

-4.24

47,233

834

18

48,500

Futures

(March 2015 expiration

for stock futures)

FTSE-20 February 2015

ALPHA BANK A.E.

0.324

0.00

0.93

40,916

6,554

46

40,916

0.91

-1.73

-2.68

23,964

-3,873

46

24,014

0.521

0.58

-0.95

28,803

-5,882

46

28,808

MYTILINEOS HLDGS

5.07

0.80

-5.59

3,532

6

46

3,532

PUBLIC POWER COR

4.64

-3.33

-0.22

4,390

21

46

4,390

HELLENIC TELECOM

7.37

0.68

-3.79

5,201

2

46

5,211

OPAP SA

7.36

-1.87

2.22

1,162

-150

46

1,162

Real GDP

YoY

Real GDP

QoQ

NATL BANK GREECE

PIRAEUS BANK

* 2013 P/E and P/Book ratios are calculated using the price of the index at 31.12.13

** Last 12 months (Trailing 12 months)

* Open interest for all expiration dates

Government Bonds, Spreads & CDS

Last

Yield

Greece

Germany

France

Spain

Italy

Portugal

United States

1d,

net

6m,

net

Source: Bloomberg

CDS

*

Spread

**

2Yr Bond

N/A

-

-

-

3,082

-

5Yr Bond

15.156

0.15

10.81

3.81

1,732

1,519.7

10Yr Bond

11.216

0.04

5.11

1.47

1,398

1,090.4

2Yr Bond

-0.1820

0.00

-0.20

-0.08

-

-

5Yr Bond

-0.0410

0.01

-0.33

-0.06

18

-

10Yr Bond

0.3120

0.01

-0.82

-0.23

42

-

5Yr Bond

0.051

0.00

-0.47

-0.13

46

9.2

10Yr Bond

0.542

0.01

-0.97

-0.28

86

23.0

5Yr Bond

0.826

-0.01

-0.34

-0.05

86

86.7

10Yr Bond

1.395

-0.03

-1.17

-0.22

136

108.3

5Yr Bond

0.788

0.01

-0.50

-0.16

108

82.9

10Yr Bond

1.554

-0.04

-1.20

-0.34

166

124.2

5Yr Bond

1.655

0.00

-0.59

0.20

177

169.6

10Yr Bond

2.640

0.03

-0.93

-0.05

260

232.8

5Yr Bond

1.1821

0.03

-0.48

-0.47

-

-

10Yr Bond

1.6684

0.03

-0.82

-0.50

-

-

30Yr Bond

2.2490

0.03

-1.03

-0.50

-

-

* Generic CDS Intraday Prices. Due to liquidity reasons, pricing sources may vary

** vs German Bund, in bps

Macroeconomic Snapshots / Credit Ratings

ytd,

net

(%)

Eurozone

0.80

30/9/2014

Greece

1.60

30/9/2014

Germany

1.20

30/9/2014

France

0.40

30/9/2014

Spain

2.00

31/12/2014

Italy

-0.50

30/9/2014

Portugal

1.10

30/9/2014

US

2.50

31/12/2014

0.20

Debt to Budget Balance

to GDP

GDP

CPI

YoY

90.90

-4.10

-0.60

30/9/2014 31/12/2013

31/3/2014

31/1/2015

174.90

-12.20

30/9/2014 31/12/2013

0.70

31/12/2013

0.10

-2.60

Caa1

*-

B

STABLE

WR

NEG

Aaa

AAAu

AAA

-0.30

31/1/2015

-4.10

92.10

-6.80

31/12/2014 31/12/2013

0.70

31/12/2013

132.60

-2.80

30/9/2014 31/12/2013

-0.10

31/12/2013

128.00

-4.90

30/9/2014 31/12/2013

0.30

31/12/2013

71.80

-2.80

31/12/2014 31/12/2013

2.60

31/12/2014

0.10

-0.50

4.00

6.50

31/1/2015 31/12/2014

-1.00

31/1/2015

STABLE STABLE STABLE

1.50

9.90

Aa1

31/12/2014 31/12/2014 31/12/2014

30/9/2014

NEG

NEG STABLE

5.40

23.70

Baa2

BBB

31/1/2015 31/12/2014 31/12/2014

31/12/2014

-1.40

0.00

0.10

B

Fitch

25.30

0.10

31/12/2013

11.40

31/12/2014

S&P

31/10/2014

31/12/2013

93.40

1.50

31/1/2015 30/11/2014

Moody's

-1.60

76.90

1.00

-1.60

Retail UnemploySales ment Rate

(monthly)

YoY

31/12/2014 31/12/2014 30/11/2014

30/9/2014 31/12/2013

30/9/2014 31/12/2013

CPI

MoM

-0.60

-2.32

12.90

Baa2

31/12/2014

STABLE

1.20

13.40

31/12/2014 31/12/2014 31/12/2014

31/12/2014

0.80

0.00

3.20

5.60

31/12/2014 31/12/2014 31/12/2014

-0.37

31/12/2014

AA

BBB+

POS STABLE STABLE

31/12/2014 31/12/2014 30/11/2014

-0.36

0.00

AAu

Ba1

BBBu

BBB+

NEG STABLE

BBu

BB+

STABLE STABLE

POS

Aaa

AA+u

AAA

STABLE STABLE STABLE

Definitions: *- : watch list negative, WR: rating withdrawn

Notes: GDP refers to quarterly data (Q1, Q2, Q3, Q4). All other macro indicators involve monthly data

Please refer to the last pages of this report for important disclosures

Global Markets Overview

February 2, 2015

Research Department

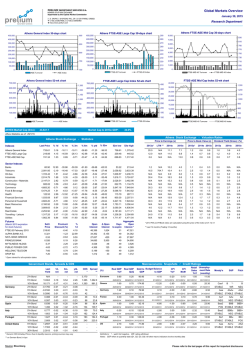

DAX Index 30-days chart

12,000,000

11,000

10,800

10,000,000

S&P 500 Index 30-days chart

Dow Jones Index 30-days chart

16,000,000

10,400

6,000,000

12,000,000

10,200

10,000,000

10,000

8,000,000

9,800

4,000,000

DAX Turnover

2,000,000

16,600

10,000,000

9,000

0

16,400

0

Dow Jones Turnover

10,500

10,000

7,000,000

6,000,000

9,500

5,000,000

9,000

4,000,000

8,500

3,000,000

8,000

2,000,000

1,000,000

7,500

0

7,000

FTSE MIB INDEX

1,980

1,960

1,940

S&P 500 Turnover

S&P 500 Index

S&P 500 Index 52-week chart

18,000

140,000,000

17,500

120,000,000

16,000,000

17,000

2,100

2,050

2,000

1,950

1,900

1,850

1,800

1,750

1,700

1,650

1,600

1,550

1,500

100,000,000

16,500

12,000,000

80,000,000

16,000

8,000,000

15,500

4,000,000

60,000,000

15,000

40,000,000

14,500

20,000,000

14,000

0

Dow Jones Turnover

0

S&P 500 Turnover

Dow Jones Index

S&P 500 Index

WORLD INDEXES - Valuation Ratios

WORLD INDEXES - Statistics

PSI All-Share Index GR

30,000,000

Dow Jones Index

20,000,000

DAX Index

IBEX 35 INDEX

2,000

2,060

Dow Jones Index 52-week chart

8,000,000

FTSE 100 INDEX

2,020

40,000,000

9,200

11,000

CAC 40 INDEX

2,040

50,000,000

20,000,000

DAX Index 52-week chart

DAX INDEX

60,000,000

16,800

9,000,000

Athex Composite Share Pr

17,400

4,000,000

10,000,000

Europe

70,000,000

17,000

DAX Index

DAX Turnover

80,000,000

17,600

6,000,000

9,400

0

2,080

17,800

17,200

9,600

2,000,000

2,100

90,000,000

14,000,000

10,600

8,000,000

100,000,000

18,000

Price to Earnings (x)

Price to Book (x)

Dividend Yield (%)

% 6m

% ytd

% 52w

52w Low

52w High

2013a*

LTM **

2014e

2015e

2013a*

2014e

2015e

2013a

2014e

2015e

-1.59

30/1/2015 -37.92

-12.62

-38.66

708.61

1,379.42

20.0

N/A

10.9

7.0

1.2

0.6

0.6

1.0

3.6

4.0

10,694.32

-0.41

30/1/2015

16.12

9.06

14.91

8,354.97

10,810.57

18.2

17.6

13.8

12.6

1.8

1.7

1.6

2.8

3.0

3.2

France

4,604.25

-0.59

30/1/2015

9.55

7.76

10.53

3,789.11

4,679.26

25.6

18.2

14.9

13.2

1.5

1.4

1.3

3.1

3.4

3.7

UK

6,749.40

-0.90

30/1/2015

1.05

2.79

3.67

6,072.68

6,904.86

16.7

19.5

15.1

13.4

2.0

1.7

1.7

3.6

4.0

4.3

Country

Last Price

% 1d

Greece

721.93

Germany

Last Upd

Spain

10,403.30

-0.99

30/1/2015

-1.05

1.20

4.87

9,370.50

11,249.40

16.5

21.6

14.8

12.7

1.4

1.4

1.3

4.4

3.7

4.1

Portugal

2,274.01

-1.31

30/1/2015 -10.99

6.84

-17.75

2,053.74

3,170.54

N/A

N/A

13.0

8.8

1.3

1.0

0.9

3.1

3.7

4.6

Italy

20,503.38

-0.44

30/1/2015

0.69

7.84

5.59

17,555.77

22,590.18

180.9

N/A

14.6

12.0

1.0

1.0

1.0

2.9

3.7

4.3

Ireland

5,471.52

-0.49

30/1/2015

18.56

4.73

17.61

4,275.26

5,639.89

52.4

36.5

17.8

15.5

1.9

2.0

1.8

1.6

2.0

1.9

Sweden

1,573.62

0.21

30/1/2015

15.59

7.45

20.63

1,246.56

1,582.10

17.0

16.9

16.1

15.0

2.3

2.3

2.2

3.9

3.9

4.2

Luxembourg

1,584.36

1.15

30/1/2015

3.48

4.21

10.67

1,353.57

1,608.63

56.0

20.2

18.3

14.5

1.1

1.1

1.1

4.8

2.8

3.1

AUSTRIAN TRADED ATX INDX

Austria

2,191.11

0.18

30/1/2015

-3.93

1.44

-14.40

1,980.53

2,692.17

24.7

N/A

12.9

10.5

1.0

0.9

0.8

2.8

3.6

4.2

OMX COPENHAGEN 20 INDEX

Denmark

810.94

-0.54

30/1/2015

12.07

8.93

25.30

636.54

824.93

19.7

22.4

17.6

15.4

2.5

2.8

2.6

1.8

2.2

2.6

Switzerland

8,385.13

-0.60

30/1/2015

-0.30

-6.66

2.37

7,852.83

9,292.44

18.4

19.5

16.3

15.0

2.6

2.4

2.3

3.0

3.5

3.8

IRISH OVERALL INDEX

OMX STOCKHOLM 30 INDEX

LUXEMBOURG LuxX INDEX

SWISS MARKET INDEX

Emerging Europe

BIST 100 INDEX

SOFIX INDEX

WSE WIG INDEX

BUCHAREST BET INDEX

Turkey

88,945.82

0.44

30/1/2015

8.35

3.76

43.79

60,848.52

91,805.74

9.9

11.7

11.0

9.5

1.3

1.4

1.3

2.7

2.7

3.1

Bulgaria

500.49

0.42

30/1/2015

-8.03

-4.14

-8.47

486.61

625.40

7.0

7.6

N/A

N/A

0.7

N/A

N/A

5.3

N/A

N/A

Poland

52,102.39

0.12

30/1/2015

3.40

1.33

2.50

48,765.47

55,687.59

17.5

16.9

13.5

11.5

1.3

1.3

1.2

3.7

3.7

4.0

Romania

7,033.17

0.32

30/1/2015

1.34

-0.70

10.26

6,110.93

7,309.05

11.9

9.7

8.9

8.2

1.0

0.9

0.8

2.8

4.1

4.8

-6.20

-1.54

44,904.83

62,304.88

29.8

15.1

10.5

8.9

1.1

1.1

1.0

4.0

4.5

5.2

18.85

14.12

1,182.89

1,706.29

6.7

8.2

5.3

4.6

0.8

0.5

0.4

3.9

5.5

6.5

BRIC

BRAZIL IBOVESPA INDEX

MICEX INDEX

S&P BSE SENSEX INDEX

Brazil

46,907.68

-1.79

Russia

1,659.89

0.74

30/1/2015 -16.09

9:17:18 πµ

20.73

India

29,000.29

-0.63

9:02:20 πµ

13.81

5.46

41.37

19,963.12

29,844.16

16.7

20.3

18.5

15.8

2.6

2.9

2.6

1.5

1.4

1.6

China

3,128.30

-2.56

9:01:36 πµ

43.15

-3.29

53.87

1,974.38

3,406.79

10.3

15.0

11.9

10.5

1.4

1.6

1.4

3.0

2.5

2.8

DOW JONES INDUS. AVG

US

17,164.95

-1.45

30/1/2015

4.07

-3.69

9.34

15,340.69

18,103.45

15.7

15.5

15.9

14.3

2.9

2.8

2.6

2.1

2.4

2.6

NASDAQ COMPOSITE INDEX

US

4,635.24

-1.03

31/1/2015

6.49

-2.13

12.95

3,946.03

4,814.95

27

33

19.7

16.9

3.3

3.3

3.0

1.2

1.2

1.2

S&P 500 INDEX

US

1,994.99

-1.30

30/1/2015

3.63

-3.10

11.92

1,737.92

2,093.55

17.2

17.6

16.7

14.8

2.6

2.5

2.3

1.9

2.1

2.3

1.7

SHANGHAI SE COMPOSITE

US

Asia, Pacific

NIKKEI 225

HANG SENG INDEX

Japan

17,558.04

-0.66

8:28:01 πµ

13.11

0.61

17.72

13,885.11

18,030.83

22.2

20.3

18.9

16.7

1.7

1.7

1.6

1.3

1.5

Hong Kong

24,415.96

-0.37

9:02:18 πµ

-0.47

3.44

10.80

21,137.61

25,362.98

10.9

10.3

11.4

10.2

1.4

1.3

1.2

3.3

3.5

3.8

Singapore

3,410.73

0.58

9:02:18 πµ

1.98

1.35

12.67

2,953.01

3,432.62

13.6

13.8

13.9

12.6

1.4

1.3

1.2

3.3

3.4

3.6

Australia

5,625.34

0.66

8:06:29 πµ

1.24

3.96

8.39

5,052.20

5,679.50

19.8

19.4

16.0

14.8

2.0

1.9

1.8

4.3

4.6

4.9

Straits Times Index STI

S&P/ASX 200 INDEX

Volatility & Risk Indexes

* 2013 P/E and P/Book ratios are calculated using the price of the index at 31.12.13

VDAX

VIX

VXN

DAX

21.21

6.91

30/1/2015

20.99

8.88

19.83

10.80

24.09

S&P 500

20.97

11.78

30/1/2015

23.14

9.22

13.91

10.28

31.06

30/1/2015

Nasdaq 100

21.59

10.83

25.09

9.93

13.81

9.66

31.17

MARKIT ITRX EUROPE 12/19 (Generic)

Europe

59.94

-

7:11:46 πµ -10.57

-4.72

-28.52

51.78

86.56

MARKIT ITRX EUR XOVER 12/19 (Generic)

Europe

323.92

-

7:11:46 πµ

18.45

-6.37

0.14

218.43

429.90

% 6m

% ytd

% 52w

52w Low

52w High

9:16:00 πµ -50.99

-8.98

-52.66

-

-

COMMODITIES

Energy

Dated BFO Crude Oil Spot Px ($/bbl)

Exchange

Last Price

% 1d

-

50.75

-0.04

Last Upd

** Last 12 months (Trailing 12 months)

Currencies

Price

% 1d

% 6m

% ytd

EUR / US Dollar

1.1299

0.10

-15.79

-6.62

-16.41

1.1098

1.3994

EUR/Japanese Yen

132.94

0.31

-3.32

-8.32

-2.79

130.15

149.80

-5.78

-3.38

-9.46

0.7405

0.8403

-13.73 -12.70

-13.87

0.7813

1.2262

-3.96

1.3754

1.5587

% 52w 52wLow 52wHigh

WTI Crude Futr-Generic 1st month ($/bbl)

NYM

47.21

-2.14

9:17:17 πµ -51.77

-11.38

-51.57

43.58

107.73

EUR / British Pound

0.7503

-0.15

Brent Crude Futr-Generic 1st month ($/bbl)

ICE

51.90

-2.06

9:07:19 πµ -50.50

-9.47

-51.22

45.19

115.71

EUR / Swiss Franc

1.0498

1.15

Natural Gas Futr-Generic 1st month ($/bbl)

NYM

2.66

-1.23

9:16:51 πµ -30.02

-8.00

-46.23

2.64

6.49

EUR / Canadian Dollar

1.4402

0.28

EUR / Australian Dollar

1.4514

-0.18

0.91

-2.06

-5.75

1.3798

1.5538

EUR / Turkish Lira

2.7552

-0.12

-3.76

-2.62

-10.36

2.6045

3.1300

3m

Precious Metals

Exchange

Last Price

% 1d

Last Upd

% 6m

% ytd

% 52w

52w Low

52w High

GOLD SPOT $/OZ

-

1,279.16

-0.36

9:17:18 πµ

-1.10

7.96

2.78

1131.24

1392.22

SILVER SPOT $/OZ

-

17.12

-0.81

9:17:03 πµ -15.80

9.00

-10.75

14.29

22.18

PLATINUM SPOT $/OZ

-

1,233.25

-0.63

9:17:13 πµ -15.77

2.09

-10.59

1177.15

1521.38

PALLADIUM SPOT $/OZ

-

773.70

0.16

9:16:34 πµ -10.50

-3.01

9.90

696.80

912.00

Base Metals

Money Market Rates

1w

-1.65

6m

9m

12m

-0.0240

0.0010

0.0540 0.1320

0.2020

0.2700

US

0.1351

0.1713

0.2531 0.3574

0.5508

0.6209

Japan

0.0436

0.0729

0.1043 0.1421

0.3543

0.2661

Europe

1m

2.48

Exchange

Last Price

% 1d

Last Upd

% 6m

% ytd

% 52w

52w Low

52w High

LME ALUMINUM 3MO ($) / MT

LME

1,864.00

2.47

30/1/2015

-7.81

0.62

7.81

1671.25

2119.50

LME COPPER

LME

5,495.00

1.85

30/1/2015 -22.88

-12.78

-22.55

5339.50

7220.00

LME

1,859.50

-0.03

30/1/2015 -17.72

0.08

-12.04

1743.00

2307.00

Latest Rate

Last Update

Next Update

LME

15,165.00

1.78

30/1/2015 -20.02

0.10

9.81

13723.00

21625.00

Europe

ECB

0.05

22/1/2015

5/3/2015

Exchange

Last Price

% 1d

Last Upd

% 6m

% ytd

% 52w

52w Low

52w High

UK

BoE

0.50

8/1/2015

5/2/2015

CBT

368.50

-0.41

9:06:51 πµ

4.54

-7.18

-15.09

318.25

519.50

US

Fed

0.25

28/1/2015

18/3/2015

Japan

BoJ

0.10

22/1/2014

*

LME LEAD

LME NICKEL

3MO ($) / MT

3MO ($) / MT

3MO ($) / MT

Agriculture

Corn Futr-Generic 1st month ($/bu.)

Wheat Futr - Generic 1st month ($/bu.)

CBT

502.00

-0.15

9:07:13 πµ

-6.04

-14.88

-9.67

466.25

735.00

Soybean Futr - Generic 1st month ($/bu.)

CBT

959.00

-0.21

9:06:06 πµ -21.07

-5.91

-25.24

904.00

1536.75

Sugar Futr - Generic 1st month ($/lb.)

NYB

14.79

-0.40

30/1/2015 -11.06

1.86

-1.33

13.32

18.47

Coffee Futr - Generic 1st month ($/lb.)

NYB

161.90

1.19

30/1/2015 -11.29

-2.82

34.92

125.00

225.50

Live Cattle Futr - Generic 1st month ($/lb.)

CME

154.85

0.86

30/1/2015

Lean Hogs Futr - Generic 1st month ($/lb.)

CME

67.48

-1.57

Source: Bloomberg

-3.13

-6.55

8.93

135.40

171.98

30/1/2015 -43.37

-16.90

-21.88

67.35

133.90

Interest Rates

* As of 4/4/2013, the BOJ has shifted its monetary policy focus to a targeted monetary

base via Japanese government bond (JGB) purchases.

Please refer to the last pages of this report for important disclosures

Global Markets Overview

February 2, 2015

Research Department

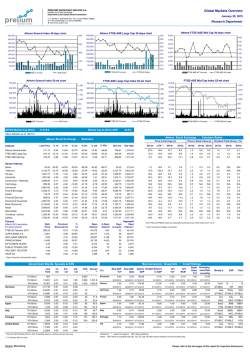

Bonds, Spreads, CDS

10 Yr Bond Yields

5 Yr Bond Yields

Greece, Germany, Ireland, Portugal, Spain

Germany, Ireland, Portugal, Spain, Greece

16

12

15

11

14

10

13

12

9

11

8

10

9

7

8

6

7

5

6

5

4

4

3

3

2

2

1

1

0

0

3/2/14

28/4/14

21/7/14

Greece

Germany

Ireland

13/10/14

Portugal

-1

3/2/14

5/1/15

Spain

28/4/14

Italy

Greek Spreads, 10 Yr Bonds (5 Yr n/a)

Germany

35835

-3

1,650

13/10/14

Portugal

Spain

5/1/15

Italy

Greece

Greek CDS, 5 Yr & 10 Yr Bonds (CMAN pricing)

66257

1,850

1,550

1,750

1,450

1,650

1,350

21/7/14

Ireland

1,550

1,250

1,450

1,150

1,350

1,050

1,250

950

1,150

850

750

1,050

650

950

550

28/11/14

850

8/12/14

18/12/14

28/12/14

Greek 10Yr Spread

7/1/15

17/1/15

27/1/15

14/1/15

Greek 5Yr Spread

20/1/15

23/1/15

Greek 5Yr CDS

Spreads and CDS, 10 Yr Bonds

-

Ireland, Portugal, Italy, Spain (CBIL pricing for CDS)

300

17/1/15

26/1/15

29/1/15

Greek 10Yr CDS

Spreads and CDS, 5 Yr Bonds

Ireland, Portugal, Italy, Spain (CBIL pricing for CDS)

220

280

200

260

180

240

220

160

200

140

180

523

160

120

140

100

725.1

702.1

120

80

100

60

80

60

40

40

20

390.16

20

0

22/12/14

Irish Spread

Portugese CDS

Italian Spread

Source: Bloomberg

0

22/12/14

Irish CDS

Spanish Spread

Italian CDS

Portugese Spread

Spanish CDS

Irish Spread (6Yr)

Portugese CDS

Italian Spread

Irish CDS

Spanish Spread

Italian CDS

Portugese Spread

Spanish CDS

Please refer to the last pages of this report for important disclosures

Global Markets Overview

February 2, 2015

Research Department

Currencies

Euro / US Dollar

1.1299

0.10%

1.40

1.38

1.36

1.34

1.32

1.30

1.28

1.26

1.24

1.22

1.20

1.18

1.16

1.14

1.12

1.10

3/2/14

3/4/14

3/6/14

Euro / Japanese Yen

132.94

3/8/14

3/10/14

3/12/14

Euro / British Pound

0.31%

0.7503

-0.15%

0.85

150

######

-3.00

145

0.84

0.83

0.82

0.81

0.80

140

0.79

0.78

0.77

135

0.76

0.75

130

3/2/14

3/4/14

3/6/14

3/8/14

3/10/14

0.74

3/2/14

3/12/14

3/4/14

3/6/14

3/8/14

3/10/14

3/12/14

Commodities, (Precious) Metals

Dated BFO Crude Oil Spot Px ($/bbl)

50.75

Gold, Spot ($/OZ)

-0.04%

120

1,279.16

-0.36%

1,450

110

1,400

100

1,350

90

1,300

80

-

1,250

70

1,200

60

1,150

50

40

3/2/14

3/4/14

3/6/14

3/8/14

3/10/14

Aluminum (3MO Future) ($/MT)

1,864.00

1,100

3/2/14

3/12/14

3/6/14

3/8/14

Copper (3MO Future) ($/MT)

2.47%

2,150

3/4/14

7,400

2,100

7,200

2,050

7,000

2,000

6,800

1,950

6,600

3/10/14

3/12/14

5,495.00

1.85%

702.1

6,400

1,900

6,200

1,850

6,000

363.8

1,800

390.2

5,800

1,750

5,600

1,700

1,650

3/2/14

Source: Bloomberg

5,400

28/4/14

21/7/14

13/10/14

5/1/15

5,200

3/2/14

28/4/14

21/7/14

13/10/14

5/1/15

Please refer to the last pages of this report for important disclosures

Global Markets Overview

February 2, 2015

Research Department

Macroeconomic Calendar

Regions included: EC, Greece, Germany, France, Portugal, Italy, Spain, Ireland, United Kingdom, US, China, Japan

Date Time

02/01/2015 03:00

02/01/2015 03:00

02/02/2015 03:35

02/02/2015 03:45

02/02/2015 07:00

02/02/2015 08:00

02/02/2015 10:00

02/02/2015 10:15

02/02/2015 10:45

02/02/2015 10:50

02/02/2015 10:55

02/02/2015 11:00

02/02/2015 11:00

02/02/2015 11:30

02/02/2015 15:30

02/02/2015 15:30

02/02/2015 15:30

02/02/2015 15:30

02/02/2015 15:30

02/02/2015 15:30

02/02/2015 16:45

02/02/2015 17:00

02/02/2015 17:00

02/02/2015 17:00

02/02/2015 19:00

02/02/2015 19:00

02/01/2015 02/08

02/03/2015 01:50

02/03/2015 01:50

02/03/2015 11:00

02/03/2015 11:30

02/03/2015 12:00

02/03/2015 12:00

02/03/2015 12:00

02/03/2015 12:00

02/03/2015 12:00

02/03/2015 12:00

02/03/2015 16:45

02/03/2015 17:00

02/03/2015 17:00

02/03/2015

02/03/2015

02/04/2015 02:01

02/04/2015 03:30

02/04/2015 03:30

02/04/2015 03:35

02/04/2015 03:35

02/04/2015 03:45

02/04/2015 03:45

02/04/2015 08:00

02/04/2015 08:00

02/04/2015 10:15

02/04/2015 10:15

02/04/2015 10:45

02/04/2015 10:45

02/04/2015 10:50

02/04/2015 10:50

02/04/2015 10:55

02/04/2015 10:55

02/04/2015 11:00

02/04/2015 11:00

02/04/2015 11:30

02/04/2015 11:30

02/04/2015 11:30

02/04/2015 11:30

02/04/2015 12:00

02/04/2015 12:00

02/04/2015 13:00

02/04/2015 13:00

02/04/2015 13:00

02/04/2015 13:00

02/04/2015 14:00

02/04/2015 15:15

02/04/2015 16:45

02/04/2015 16:45

02/04/2015 17:00

02/05/2015 01:50

02/05/2015 01:50

02/05/2015 01:50

02/05/2015 01:50

02/05/2015 03:00

02/05/2015 09:00

02/05/2015 09:00

02/05/2015 09:45

02/05/2015 10:30

02/05/2015 11:00

02/05/2015 11:00

02/05/2015 11:10

Source: Bloomberg

Event

CH

CH

JN

CH

JN

IR

SP

SP

IT

FR

GE

GR

EC

UK

US

US

US

US

US

US

US

US

US

US

IT

IT

IR

JN

JN

IT

UK

EC

EC

IT

IT

IT

IT

US

US

US

US

US

UK

JN

JN

JN

JN

CH

CH

IR

IR

SP

SP

IT

IT

FR

FR

GE

GE

EC

EC

UK

UK

UK

UK

EC

EC

PO

IR

IR

IR

US

US

US

US

US

JN

JN

JN

JN

JN

GE

GE

FR

GE

UK

EC

GE

1)

2)

3)

4)

5)

6)

7)

8)

9)

10)

11)

12)

13)

14)

15)

16)

17)

18)

19)

20)

21)

22)

23)

24)

25)

26)

27)

28)

29)

30)

31)

32)

33)

34)

35)

36)

37)

38)

39)

40)

41)

42)

43)

44)

45)

46)

47)

48)

49)

50)

51)

52)

53)

54)

55)

56)

57)

58)

59)

60)

61)

62)

63)

64)

65)

66)

67)

68)

69)

70)

71)

72)

73)

74)

75)

76)

77)

78)

79)

80)

81)

82)

83)

84)

85)

86)

87)

88)

Manufacturing PMI

Non-manufacturing PMI

Markit/JMMA Japan Manufacturing PMI

HSBC China Manufacturing PMI

Vehicle Sales YoY

Investec Manufacturing PMI Ireland

Unemployment MoM Net ('000s)

Markit Spain Manufacturing PMI

Markit/ADACI Italy Manufacturing PMI

Markit France Manufacturing PMI

Markit/BME Germany Manufacturing PMI

Markit Greece Manufacturing PMI

Markit Eurozone Manufacturing PMI

Markit UK PMI Manufacturing SA

Personal Income

Personal Spending

PCE Deflator MoM

PCE Deflator YoY

PCE Core MoM

PCE Core YoY

Markit US Manufacturing PMI

Construction Spending MoM

ISM Manufacturing

ISM Prices Paid

New Car Registrations YoY

Budget Balance

Consumer Confidence Index

Monetary Base YoY

Monetary Base End of period

Istat Releases the New Inflation Baskets

Markit/CIPS UK Construction PMI

PPI MoM

PPI YoY

CPI NIC incl. tobacco MoM

CPI NIC incl. tobacco YoY

CPI EU Harmonized MoM

CPI EU Harmonized YoY

ISM New York

Factory Orders

IBD/TIPP Economic Optimism

Wards Domestic Vehicle Sales

Wards Total Vehicle Sales

BRC Shop Price Index YoY

Labor Cash Earnings YoY

Real Cash Earnings YoY

Markit Japan Services PMI

Markit/JMMA Japan Composite PMI

HSBC China Composite PMI

HSBC China Services PMI

Investec Services PMI Ireland

Investec Composite PMI Ireland

Markit Spain Services PMI

Markit Spain Composite PMI

Markit/ADACI Italy Services PMI

Markit/ADACI Italy Composite PMI

Markit France Services PMI

Markit France Composite PMI

Markit Germany Services PMI

Markit/BME Germany Composite PMI

Markit Eurozone Services PMI

Markit Eurozone Composite PMI

Official Reserves Changes

Markit/CIPS UK Services PMI

Markit/CIPS UK Composite PMI

Lloyds Business Barometer

Retail Sales MoM

Retail Sales YoY

Unemployment Rate

Live Register Level SA (000's)

Live Register Monthly Change

Unemployment Rate

MBA Mortgage Applications

ADP Employment Change

Markit US Composite PMI

Markit US Services PMI

ISM Non-Manf. Composite

Japan Buying Foreign Bonds

Japan Buying Foreign Stocks

Foreign Buying Japan Bonds

Foreign Buying Japan Stocks

Bloomberg Feb. Japan Economic Survey

Factory Orders MoM

Factory Orders WDA YoY

Survey of Industrial Investment

Markit Germany Construction PMI

New Car Registrations YoY

ECB Publishes Economic Bulletin

Markit Germany Retail PMI

Survey

Actual

Prior

Revised

Jan

Jan

Jan F

Jan F

Jan

Jan

Jan

Jan

Jan

Jan F

Jan F

Jan

Jan F

Jan

Dec

Dec

Dec

Dec

Dec

Dec

Jan F

Dec

Jan

Jan

Jan

Jan

Jan

Jan

Jan

50.2

--49.8

--88

54.1

48.8

49.5

51

-51

52.7

0.20%

-0.20%

-0.30%

0.80%

0.00%

1.30%

53.7

0.70%

54.5

39.8

------

49.8

53.7

52.2

49.7

-18.90%

55.1

------------------------

50.1

54.1

52.1

49.8

-8.80%

56.9

-64.4

53.8

48.4

49.5

51

49.4

51

52.5

0.40%

0.60%

-0.20%

1.20%

0.00%

1.40%

53.7

-0.30%

55.5

38.5

2.35%

5.1B

90.5

38.20%

¥275.9T

----------------------55.1

-------

Jan

Dec

Dec

Jan P

Jan P

Jan P

Jan P

Jan

Dec

Feb

Jan

Jan

Jan

Dec

Dec

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan F

Jan F

Jan F

Jan F

Jan F

Jan F

Jan

Jan

Jan

Jan

Dec

Dec

4Q

Jan

Jan

Jan

Jan 30

Jan

Jan F

Jan F

Jan

Jan 30

Jan 30

Jan 30

Jan 30

57

-0.70%

-2.50%

-0.20%

-0.30%

-2.40%

-0.40%

--2.20%

51.4

13.50M

16.60M

-1.60%

1.60%

-------54.4

54.6

50

50.1

49.5

49.5

52.7

52.6

52.3

52.2

-56.3

55.5

-0.00%

2.00%

-----225K

-54.1

56.5

-----

---------------------------------------------------

57.6

-0.30%

-1.60%

0.00%

0.00%

0.00%

-0.10%

70.8

-0.70%

51.5

13.46M

16.80M

-1.70%

-1.50%

-4.30%

51.7

51.9

51.4

53.4

62.6

61

54.3

54.3

49.4

49.4

49.5

49.5

52.7

52.6

52.3

52.2

-$1664M

55.8

55.2

45

0.60%

1.50%

13.10%

363.9

-3.3K

10.60%

-3.20%

241K

54.2

54

56.2

¥45.6B

¥382.1B

¥237.5B

¥466.9B

-------------0.10%

-2.70%

------------------------------56.5

-----

Dec

Dec

1.50%

0.70%

---

-2.40%

-0.40%

---

Jan

Jan

---

---

50.5

8.70%

---

--

--

51.7

--

Jan

Please refer to the last pages of this report for important disclosures

Global Markets Overview

February 2, 2015

Research Department

Economic Events Calendar

02/02/2015 10:00

02/02/2015 15:00

02/02/2015 18:30

02/02/2015

02/02/2015

02/03/2015 11:00

02/03/2015 11:00

02/04/2015 13:00

02/04/2015 18:00

02/04/2015 18:00

02/04/2015 19:45

02/05/2015 03:30

02/05/2015 11:00

02/05/2015 13:00

02/05/2015 13:30

02/05/2015 18:00

02/05/2015

02/06/2015 12:00

02/06/2015 16:00

02/06/2015 19:45

02/06/2015

02/08/2015 02/10

02/09/2015 03:30

02/09/2015 13:00

02/10/2015 11:00

02/10/2015 11:00

02/10/2015 15:20

02/10/2015 17:00

02/11/2015 15:00

02/11/2015 18:00

02/12/2015

02/13/2015 15:30

02/13/2015 20:30

02/13/2015

02/16/2015 16:00

02/17/2015 10:00

02/18/2015 05:00

02/20/2015 15:30

02/25/2015 19:00

02/25/2015

02/26/2015 20:00

02/27/2015

03/06/2015 12:00

03/08/2015 03/10

HU

PO

EC

US

GR

PO

IT

PO

EC

PO

US

JN

EC

PO

GE

PO

EC

IT

GE

US

EC

GR

JN

PO

PO

PO

US

PO

US

PO

EC

US

US

PO

EC

EC

JN

US

FR

PO

GE

EC

IT

US

Regions included: EC, Greece, Germany, France, Portugal, Italy, Spain, Ireland, United Kingdom, US, China, Japan

1)

Matolcsy Host a Meeting for European Central Bankers

2)

Portuguese Economy Minister Lima Holds Press Conference

3)

ECB Governing Council Member Nowotny Speaks on Monetary Policy

4)

U.S. President Obama to Release Fiscal 2016 Budget

5)

Yanis Meets With U.K. and France Fiance Ministers

6)

Fitch Ratings Holds Lisbon Credit Conference

7)

Istat Releases the New Inflation Baskets

8)

Portugal Reports Fourth-Quarter Unemployment Rate

9)

EU's Hill Speaks at Long-Term Financing Conference in Brussels

10)

Former Novo Banco Board Member Rato Speaks in Parliament

11)

Fed's Mester Speaks on Economy and Banking in Columbus

12)

BOJ's Iwata Gives a Speech and Hold a Press Conference

13)

EU Publishes Economic Forecasts

14)

Portugal Releases Industrial Sales, Employment Report

15)

Peter Praet Gives a Speech

16)

Espirito Santo Board Member dos Santos Speaks in Parliament

17)

NATO Defense Ministers Hold Meeting in Brussels

18)

Bank of Italy Report on Balance-Sheet Aggregates

19)

Country Leaders and Reps Show for Munich Security Conference

20)

Fed's Lockhart Speaks on U.S. Economy in Naples, Florida

21)

U.S.'s Biden Meets With EU Officials in Brussels

22)

Merkel to Make Two-Day Trip to U.S. and Canada

23)

BOJ Board Member Morimoto Speaks in Chiba

24)

Portugal Reports International Trade Figures for December

25)

ECB's Costa, Praet Speak on Financial Stability in Lisbon

26)

Novo Banco CEO Stock da Cunha Speaks in Parliament

27)

Fed's Lacker to Speak on Economy in Raleigh, North Carolina

28)

Construction Entrepreneur Guilherme Speaks in Parliament

29)

Fed's Fisher Speaks to Economists in New York

30)

Former Tranquilidade CEO Brito e Cunha Speaks in Parliament

31)

EU Leaders Hold Summit in Brussels

32)

Revisions of Producer Price Index

33)

Fed's Fisher Speaks at Luncheon in San Antonio

34)

Bank of Portugal Releases Data on Banks

35)

Euro-Area Finance Ministers Meet in Brussels

36)

EU Finance Ministers Hold Meeting in Brussels

37)

Bank of Japan Policy Statement/Kuroda Press Conference

38)

Revisions of Consumer Price Index

39)

Total Jobseekers

40)

Portugal Releases Year-to-Date Budget Report

41)

Fed's Lockhart Speaks on U.S. Outlook At Banking Conference

42)

EU-Brazil Summit in Brussels

43)

Bank of Italy Report on Balance-Sheet Aggregates

44)

NABE 2015 Policy Conference

UK

UK

UK

FR

FR

FR

US

US

CH

CH

CH

JN

US

US

CH

GR

UK

JN

JN

SP

SP

SP

FR

FR

JN

UK

UK

UK

GE

US

US

JN

US

US

IT

GR

UK

GE

US

JN

IT

IR

US

JN

Regions included: EC, Greece, Germany, France, Portugal, Italy, Spain, Ireland, United Kingdom, US, China, Japan

1)

U.K. Sells GBP500 Mln 28-Day Bills; Yield 0.303%

2)

U.K. Sells GBP1.5 Bln 182-Day Bills; Yield 0.4277%

3)

U.K. Sells GBP1 Bln 92-Day Bills; Yield 0.3423%

4)

France to Sell Up to EUR3.5 Bln 91-Day Bills

5)

France to Sell Up to EUR1.6 Bln 154-Day Bills

6)

France to Sell Up to EUR1.5 Bln 336-Day Bills

7)

U.S. to Sell USD26 Bln 3-Month Bills

8)

U.S. to Sell USD26 Bln 6-Month Bills

9)

China Development Bank to Sell CNY6 Bln 5-Year Bonds (1503)

10)

China Development Bank to Sell CNY5 Bln 7-Year Bonds (1504)

11)

China Development Bank to Sell CNY7 Bln 10-Year Bonds (1505)

12)

Japan to Sell 10-Year Bonds

13)

U.S. to Sell USD25 Bln 52-Week Bills

14)

U.S. to Sell 4-Week Bills

15)

China to Sell CNY20 Bln 5-Year Bonds (1503)

16)

Greece to Sell EUR625 Mln 182-Day Bills

17)

U.K. to Sell 2024 I/L Bonds

18)

Japan to Sell 3-Month Bill

19)

Japan to Sell 30-Year Bonds

20)

Spain to Sell 0.55% I/L 2019 Bonds

21)

Spain to Sell 6% 2029 Bonds

22)

Spain to Sell 5.15% 2044 Bonds

23)

France to Sell 0.5% 2025 Bonds

24)

France to Sell 6% 2025 Bonds

25)

Japan to Sell 6-Month Bill

26)

U.K. to Sell GBP500 Mln 28-Day Bills

27)

U.K. to Sell GBP1 Bln 91-Day Bills

28)

U.K. to Sell GBP1.5 Bln 182-Day Bills

29)

Germany to Sell EUR2 Bln 182-Day Bills (DE0001119386)

30)

U.S. to Sell 3-Month Bills

31)

U.S. to Sell 6-Month Bills

32)

Japan Auction for Enhanced-Liquidity

33)

U.S. to Sell 4-Week Bills

34)

U.S. to Sell 3-Year Notes

35)

Italy to Sell Bills

36)

Greece to Sell 13-Week Bills

37)

U.K. to Sell 3.5% 2045 Bonds

38)

Germany to Sell EUR5 Bln Bonds (DE0001137495)

39)

U.S. to Sell 10-Year Notes

40)

Japan to Sell 3-Month Bill

41)

Italy to Sell Bonds

42)

Ireland to Sell Bonds

43)

U.S. to Sell 30-Year Bonds

44)

Japan to Sell 5-Year Bonds

Government Auctions / Buyouts Calendar

01/30/2015 13:00

01/30/2015 13:00

01/30/2015 13:00

02/02/2015 15:50

02/02/2015 15:50

02/02/2015 15:50

02/02/2015 18:30

02/02/2015 18:30

02/03/2015 04:30

02/03/2015 05:00

02/03/2015 05:00

02/03/2015 05:45

02/03/2015 18:30

02/03/2015 18:30

02/04/2015 05:00

02/04/2015 12:00

02/04/2015 12:30

02/05/2015 05:35

02/05/2015 05:45

02/05/2015 11:30

02/05/2015 11:30

02/05/2015 11:30

02/05/2015 11:50

02/05/2015 11:50

02/06/2015 05:35

02/06/2015 13:00

02/06/2015 13:00

02/06/2015 13:00

02/09/2015 12:30

02/09/2015 18:30

02/09/2015 18:30

02/10/2015 10:00

02/10/2015 18:30

02/10/2015 20:00

02/11/2015 12:00

02/11/2015 12:00

02/11/2015 12:30

02/11/2015 12:30

02/11/2015 20:00

02/12/2015 05:35

02/12/2015 12:00

02/12/2015 12:30

02/12/2015 20:00

02/13/2015 05:45

Source: Bloomberg

Please refer to the last pages of this report for important disclosures

Global Markets Overview

February 2, 2015

Research Department

Earnings Releases Calendar

Global - Top Events

Primary Exchange

New York

Korea SE

London

Stockholm

Natl India

Copenhagen

Soc.Bol SIBE

NASDAQ GS

New York

New York

New York

New York

New York

New York

New York

NASDAQ GS

New York

New York

New York

New York

Natl India

Soc.Bol SIBE

SIX Swiss Ex

Dublin

New York

New York

New York

New York

NASDAQ GS

Tokyo

SIX Swiss Ex

London

London

New York

Soc.Bol SIBE

New York

New York

New York

New York

New York

New York

NASDAQ GS

New York

EN Paris

NASDAQ GS

New York

Copenhagen

Hong Kong

New York

Toronto

Tokyo

Tokyo

Tokyo

Oslo

SIX Swiss Ex

London

New York

New York

NASDAQ GS

New York

New York

New York

New York

London

NASDAQ GS

New York

New York

New York

EN Paris

NASDAQ GS

New York

New York

New York

NASDAQ GS

Company Name

Eastman Chemical Co

(C) Hyundai Glovis Co Ltd

BT Group PLC

Svenska Cellulosa AB SCA

(P) ICICI Bank Ltd

Novo Nordisk A/S

Banco Popular Espanol SA

Mattel Inc

Eli Lilly & Co

CONSOL Energy Inc

Ingersoll-Rand PLC

Altria Group Inc

Simon Property Group Inc

Tyson Foods Inc

AbbVie Inc

PACCAR Inc

MasterCard Inc

Chevron Corp

Franklin Resources Inc

Berry Plastics Group Inc

(C) ICICI Bank Ltd

CaixaBank SA

Julius Baer Group Ltd

Ryanair Holdings PLC

Sysco Corp

Exxon Mobil Corp

Anadarko Petroleum Corp

Cliffs Natural Resources Inc

Advent Software Inc

(C) Sharp Corp/Japan

ams AG

BG Group PLC

BP PLC

Archer-Daniels-Midland Co

Banco Santander SA

Eaton Corp PLC

Emerson Electric Co

LyondellBasell Industries NV

HCA Holdings Inc

United Parcel Service Inc

Chipotle Mexican Grill Inc

Gilead Sciences Inc

Walt Disney Co/The

LVMH Moet Hennessy Louis Vuitton SA

Wynn Resorts Ltd

Forest City Enterprises Inc

Danske Bank A/S

Lenovo Group Ltd

National Oilwell Varco Inc

PrairieSky Royalty Ltd

(C) Sony Corp

(C) Mazda Motor Corp

(C) Toyota Motor Corp

Marine Harvest ASA

Syngenta AG

Sky PLC

Boston Scientific Corp

Merck & Co Inc

Cognizant Technology Solutions Corp

Spectra Energy Corp

General Motors Co

Marathon Petroleum Corp

Whirlpool Corp

GlaxoSmithKline PLC

Twenty-First Century Fox Inc

Under Armour Inc

Weatherford International PLC

Noble Corp plc

Vinci SA

Keurig Green Mountain Inc

Prudential Financial Inc

Yum! Brands Inc

Brookdale Senior Living Inc

NXP Semiconductors NV

Bloomberg

Ticker

EMN US

086280 KS

BT/A LN

SCAB SS

ICICIBC IN

NOVOB DC

POP SM

MAT US

LLY US

CNX US

IR US

MO US

SPG US

TSN US

ABBV US

PCAR US

MA US

CVX US

BEN US

BERY US

ICICIBC IN

CABK SM

BAER VX

RYA ID

SYY US

XOM US

APC US

CLF US

ADVS US

6753 JP

AMS SW

BG/ LN

BP/ LN

ADM US

SAN SM

ETN US

EMR US

LYB US

HCA US

UPS US

CMG US

GILD US

DIS US

MC FP

WYNN US

FCE/A US

DANSKE DC

992 HK

NOV US

PSK CN

6758 JP

7261 JP

7203 JP

MHG NO

SYNN VX

SKY LN

BSX US

MRK US

CTSH US

SE US

GM US

MPC US

WHR US

GSK LN

FOXA US

UA US

WFT US

NE US

DG FP

GMCR US

PRU US

YUM US

BKD US

NXPI US

Date

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

30/1/15

2/2/15

2/2/15

2/2/15

2/2/15

2/2/15

2/2/15

2/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

3/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

4/2/15

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

E

C

C

C

E

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

C

Time

Period

0:08

7:09

9:00

9:00

10:36

Bef-mkt

Bef-mkt

13:00

13:25

13:45

14:00

14:00

14:00

14:30

14:47

15:00

15:00

15:30

15:30

15:30

Q4 2014

Y 2014

Q3 2015

Y 2014

Q3 2015

Y 2014

Y 2014

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q1 2015

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q1 2015

Q1 2015

Q3 2015

Y 2014

Y 2014

Q3 2015

Q2 2015

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q3 2015

Y 2014

Y 2014

Y 2014

Q4 2014

Y 2014

Q4 2014

Q1 2015

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q1 2015

Y 2014

Q4 2014

Q4 2014

Y 2014

Q3 2015

Q4 2014

Q4 2014

Q3 2015

Q3 2015

Q3 2015

Y 2014

Y 2014

S1 2015

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Q4 2014

Y 2014

Q2 2015

Q4 2014

Q4 2014

Q4 2014

Y 2014

Q1 2015

Q4 2014

Q4 2014

Q4 2014

Q4 2014

8:00

9:00

Bef-mkt

15:00

Aft-mkt

Aft-mkt

Aft-mkt

6:30

8:15

9:00

9:00

Bef-mkt

Bef-mkt

Bef-mkt

Bef-mkt

Bef-mkt

Bef-mkt

14:45

23:00

23:05

23:15

Aft-mkt

Aft-mkt

8:00

8:00

8:00

8:00

8:00

9:00

Bef-mkt

Bef-mkt

Bef-mkt

Bef-mkt

Bef-mkt

Bef-mkt

13:00

14:00

23:00

23:15

Aft-mkt

Aft-mkt

Aft-mkt

Aft-mkt

Aft-mkt

Aft-mkt

Aft-mkt

Aft-mkt

Actual

1.64

14300

0.081

10.891

4.99

10.207

0.156

0.52

0.75

0.25

0.79

0.66

2.47

0.77

0.89

1.11

0.72

1.85

0.91

0.27

0.114

2.683

0.035

EPS (local currency)

Estimate

Surprise Guidance

1.528

7.33%

15023.3

-4.82%

0.078

3.85%

10.631

2.45%

4.969

0.42%

10.071

1.35%

0.138

13.04%

0.913

-43.04%

0.733

2.32%

0.198

26.26%

0.686

15.16%

0.65

0.664

-0.60%

2.465

0.20%

0.727

5.91%

0.856

3.97%

1.095

1.37%

0.674

6.82%

1.643

12.60%

0.934

-2.57%

0.245

10.20%

0.125

2.69

0.02

0.408

1.339

0.859

0.117

0.357

7.327

1.416

1.082

0.627

0.955

0.486

1.2

0.725

2.166

1.29

1.25

3.788

2.212

1.068

6.814

1.418

12.103

0.021

1.598

0.3

37.957

65.176

165.728

4.095

18.692

0.292

0.214

0.857

0.639

0.334

0.83

1.377

3.186

0.936

0.415

0.389

0.315

0.482

3.526

0.891

2.382

0.662

-0.645

1.324

-8.80%

-0.26%

75%

1.2

1.25

0.21

0.63

1.084

0.385

0.855

1.31

Currency

USD

KRW

GBp

SEK

INR

DKK

EUR

USD

USD

USD

USD

USD

USD

USD

USD

USD

USD

USD

USD

USD

INR

EUR

CHF

EUR

USD

USD

USD

USD

USD

JPY

CHF

GBp

GBp

USD

EUR

USD

USD

USD

USD

USD

USD

USD

USD

EUR

USD

USD

DKK

HKD

USD

CAD

JPY

JPY

JPY

NOK

CHF

GBp

USD

USD

USD

USD

USD

USD

USD

GBp

USD

USD

USD

USD

EUR

USD

USD

USD

USD

USD

(*) Reported Value, (^) GAAP Value, (T) Tentative, (C) Confirmed Date, (E) Estimated Date

Source: Bloomberg

Please refer to the last pages of this report for important disclosures

Global Markets Overview

February 2, 2015

Research Department

GREEK MARKET - Corporate Actions

General Meetings

Company

GM Date

Time

Balkan Real Estate SA

3/2/15

15.00

Kleemann Hellas SA

4/2/15

14.00

MLS Multimedia SA

11/2/15

15.00

Alco Hellas SA

13/2/15

12.00

Bank of Greece

26/2/15

12.00

AGM: Annual General Meeting, EGM: Extra-ordinary General Meeting, Rep: Repetitive Meeting

Type

EGM

EGM

EGM

EGM

AGM

Comments

Dividends

Company

Interim Div

2014

X-Div

Date

Remaining Div

2014

X-Div

Date

Total Div

2014 (gross* )

X-Div

Date

Capital

X-Div

Return

Date

Notes

0.15 €

To be proposed at the 26/6/14 GM

0.20 €

To be proposed at the 17/6/14 GM

0.03 €

Approved by the 3/6/14 GM

1.50 €

Approved by the 29/5/14 GM

Approved by the 29/12/14GM

0.125 €

0.09 €

2/2/15

0.2017€ (gross) interim div. + 0.0283€ (net) distribution of tax free reserves (0.23€ total, 0.21€ net)

0.17

21/01/15

20/1/15

0.025 €

Nexans Hellas SA

Hellenic Exchanges - Athens St

Elve SA

Alpha Trust Mutual Fund Manage

Folli Follie SA

Loulis Mills SA

OPAP SA

0.2300 €

12/01/15

GEKE SA

Thrace Plastics Co SA

* The abovementioned dividend amounts are subject to a 25% withholding tax (Law 3943/2011)

(1) 0.65€ from retained earnings & reserves + 0.15€ interim dividend 2014. Net amount equals to 0.5461€+0.1250€=0.672€

Rights Issue / Bonus Issue - (Reverse) Splits

Company

Compucon Computer Applications

Ilyda SA

Alco Hellas SA

Kekrops SA

Compucon Computer Applications

Lamda Development SA

JUMBO SA

Kathimerini Publishing SA

Kathimerini Publishing SA

Terms

9 new / 4 old at 1.82€

1 new / 100 old at 0.90€

Rev. Split: 1 new / 5 old

3 new / 1 old at 0.40€

Rev. Split: 1 new / 11 old

0.79469... new / 1 old at 4.25€

Bonus shares: 1 new / 22 old

8 new / 1 old at 0.33€

Rev. Split: 2 new / 10 old

New

Rights

Exercise

Trading

shares

Period

Period trading day

13/10/14

15/10/14

16/10 - 30/10/2014 16/10 - 24/10/2014

18/11/14

5/9/14

Cease of trading: 1/9/2014

11/8 - 25/8/2014

11/8 - 19/8/2014

5/8/14

29/8/14

2/7/14

4/7/14

8/7/14

27/6 - 11/7/2014

23/6/14

25/6/14

27/6 - 7/7/2014 22/7/2014

- 11/3/2014

5/3/14

7/3/14

6/3/14

10/3 - 24/3/2014

4/3/14

10/3 - 18/3/2014

28/3/14

4/3/14

10/3/14

ExDate

Record

Date

Comments

& Notes

Approved by the 6/5 GM

Adjusted start share price 0.751€

Adjusted start share price 0.418€

Approved by the 12/2 GM

Adjusted price €4.46 after the split,

€0.788 after the increase

Mergers

Company

(1)

Elval - Hellenic Aluminium Ind

Absorbed Company

(2)

ETEM SA

Exchange

Terms (1/1)

1/1

Exchange

Terms (1/2)

1/6

Absorbed Company

Cease Trading Day

02/12/14

New Shares

Start Trading Day

5/12/14

Comments

Financial Calendar

Company

FY 2014 Results

Fourlis Holdings SA

24/2/15

Hellenic Telecommunications Or

26/2/15

Mytilineos Holdings SA

18/3/15

Bmkt: Before market opens, Amkt: After market closes, ND: Non distribution (of dividend)

Bold Colors indicate a new addition (stays bold for a couple of days) or a current action / event

Time

of Releases

Amkt

Bmkt

Amkt

Please refer to the last pages of this report for important disclosures

Global Markets Overview

February 2, 2015

Research Department

Bonds, Spreads, CDS

10 Yr Bond Yields

5 Yr Bond Yields

Greece, Germany, Ireland, Portugal, Spain

Germany, Ireland, Portugal, Spain, Greece

16

12

15

11

14

10

13

12

9

11

8

10

9

7

8

6

7

5

6

5

4

4

3

3

2

2

1

1

0

0

3/2/14

28/4/14

21/7/14

Greece

Germany

Ireland

13/10/14

Portugal

-1

3/2/14

5/1/15

Spain

28/4/14

Italy

Greek Spreads, 10 Yr Bonds (5 Yr n/a)

Germany

35835

-3

1,650

13/10/14

Portugal

Spain

5/1/15

Italy

Greece

Greek CDS, 5 Yr & 10 Yr Bonds (CMAN pricing)

66257

1,850

1,550

1,750

1,450

1,650

1,350

21/7/14

Ireland

1,550

1,250

1,450

1,150

1,350

1,050

1,250

950

1,150

850

750

1,050

650

950

550

28/11/14

850

8/12/14

18/12/14

28/12/14

Greek 10Yr Spread

7/1/15

17/1/15

27/1/15

14/1/15

Greek 5Yr Spread

20/1/15

23/1/15

Greek 5Yr CDS

Spreads and CDS, 10 Yr Bonds

-

Ireland, Portugal, Italy, Spain (CBIL pricing for CDS)

300

17/1/15

26/1/15

29/1/15

Greek 10Yr CDS

Spreads and CDS, 5 Yr Bonds

Ireland, Portugal, Italy, Spain (CBIL pricing for CDS)

220

280

200

260

180

240

220

160

200

140

180

523

160

120

140

100

725.1

702.1

120

80

100

60

80

60

40

40

20

390.16

20

0

22/12/14

Irish Spread

Portugese CDS

Italian Spread

Source: Bloomberg

0

22/12/14

Irish CDS

Spanish Spread

Italian CDS

Portugese Spread

Spanish CDS

Irish Spread (6Yr)

Portugese CDS

Italian Spread

Irish CDS

Spanish Spread

Italian CDS

Portugese Spread

Spanish CDS

Please refer to the last pages of this report for important disclosures

OTHER IMPORTANT DISCLOSURES

- The present research report has been published for the first time today/ or on the…./…./……

- The above research material is provided to investors exclusively for information purposes and is not to be used or considered as an offer, advice or invitation to sell or buy or

subscribe for any financial instrument mentioned in the present report. Prelium Investment Services SA shall not treat recipients as its customers by virtue of receipt of this

report. Investors should not in any case rely exclusively upon information contained in this report in order to form any investment decision, but they should at their own and on

an independent basis analyze, evaluate and assess the appropriateness and the value of any particular investment, using the statements and recommendations of this report

only as one of the factors which could effect their investment decisions The investments or services contained or referred to in this report may not be suitable for all investors

and it is recommended that the investors, apart from the independent evaluation of particular investment and strategies, should consult an independent investment advisor if

they are in doubt about such investments or investment services. Securities or the other financial instruments referred to in the research report are subject to investment risks,

including the possible loss of the principal capital invested.

- The clients of Prelium Investment Services SA may already have or may have in the future a position or engage in transactions in any of the financial instruments mentioned

herein or any related investment.

- Although the information or opinions herein was obtained or compiled form sources that are deemed reliable, the accuracy, completeness or correctness of those information

or opinions can not be guaranteed. In producing the research reports, members of Prelium Investment Services SA Research Department may have received assistance from

the subject company (-ies), referred to in this report. Any such assistance may include access to sites of the issuers, visits to certain operations of the subject company (-ies),

meetings with management, employees or other parties associated with the subject company (-ies), and handing by them of historical data regarding the subject company (-ies)

(financial statements and other financial data), as well as of all publicly available information regarding strategy and financial targets. Prelium Investment Services SA research

personnel are prohibited from accepting payment or reimbursement of travel expenses from site visits to subject companies. It should be presumed that the author of this report,

in most cases, has had discussions with the subject company (-ies) to ensure factual accuracy prior to publication. All opinions and estimates in this report reflect the personal

views and judgments of the author and are given in good faith. In addition, those opinions and estimates apply as of the date of the issuance of this report but are subject to

changes without any prior notice. Prices and availability of financial instruments are also subject to changes without prior notice. It should be assumed that any prices quoted in

this report are the closing prices of the last session of the Athens Stock Exchange, unless otherwise indicated. Although Prelium Investment Services SA does not set a

predetermined frequency for publications, it is in the intention of Prelium Investment Services SA to provide research coverage of the subject company (-ies), including in

response to any news affecting these issuers, unless there is lack of news and capacity. Prelium Investment Services SA does not accept any liability whatsoever for any direct

or consequential loss arising from any use of this document or its contents or in respect of any errors or omissions thereto.

PRELIUM SECURITIES & INVESTMENT SERVICES S.A.

Member of the Athens Stock Exchange, Member of the Athens Derivatives Exchange

Head Office: S. Davaki 1 & Kifisias Ave., 115 26 Athens, Greece, Tel. +30 210 36 77 000, Fax +30 210 69 26 403

e-mail [email protected], www.prelium.com

INSTITUTIONAL SALES

RESEARCH DEPARTMENT

Babis Angeletopoulos, [email protected]

Emi Moundrou, [email protected]

FOREIGN MARKETS

ASSET MANAGEMENT

Ioanna Karamani, [email protected]

Konstantinos Asimakopoulos, [email protected]

DERIVATIVES

Andreas Nikolopoulos, [email protected]

© Copyright 2026