Global Markets Overview

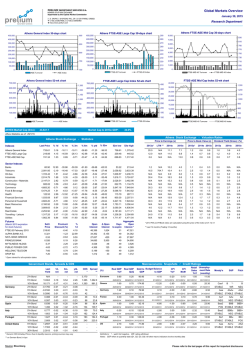

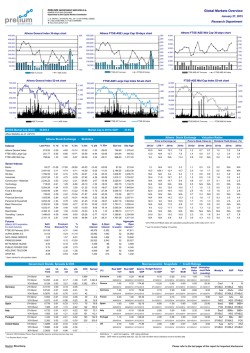

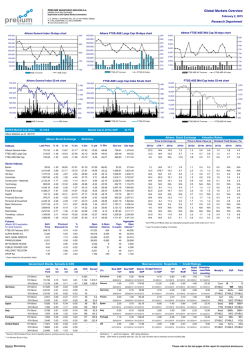

Global Markets Overview January 29, 2015 Research Department Athens General Index 30-days chart 450,000 900 400,000 Athens FTSE-ASE Mid Cap 30-days chart Athens FTSE-ASE Large Cap 30-days chart 450,000 290 8,000 400,000 280 7,000 350,000 270 300,000 300,000 260 250,000 250,000 250 200,000 200,000 240 150,000 150,000 230 100,000 350,000 850 800 750 100,000 50,000 0 710 50,000 210 1,000 690 0 200 0 FTSE-MID 40 Turnover 400,000 1,050 300,000 950 700,000 450 600,000 400 500,000 350 40,000 1,300 35,000 1,200 30,000 400,000 300 300,000 250 15,000 900 10,000 800 700 200,000 200 100,000 750 100,000 150 5,000 0 650 0 100 0 FTSE-20 Turnover ASE Index 41,819.8 1,000 20,000 850 ATHEX Market Cap (€mn): 1,100 25,000 200,000 ASE Turnover FTSE-MID 40 Index FTSE-ASE Mid Cap Index 52-wk chart FTSE-ASE Large Cap Index 52-wk chart 1,150 670 FTSE-20 Index 1,350 500,000 750 730 Athens General Index 52-wk chart 1,250 770 4,000 2,000 FTSE-20 Turnover 600,000 790 5,000 220 ASE Index 700,000 810 6,000 3,000 700 ASE Turnover 830 Market Cap to 2013e GDP: 0* 600 FTSE-20 Index FTSE-MID 40 Turnover FTSE-MID 40 Index 23.0% Athex Statistics as of: 28/1/15 Athens Stock Exchange - Valuation Ratios Athens Stock Exchange - Statistics Price to Earnings (x) Price to Book Value (x) Dividend Yield (Gross) (%) Last Price % 1d % 1m % 3m % 6m % ytd % 52w 52w low 52w high 2013a* LTM ** 2014e 2015e 2013a* 2013a 2014e 2015e Athens General Index 711.13 -9.24 -13.26 -23.79 -40.54 -13.93 -36.86 708.61 1,379.42 20.0 N/A 10.7 6.9 1.2 0.6 0.6 1.0 3.7 4.1 FTSE-ASE Large Cap 210.15 -12.10 -21.03 -31.24 -45.30 -20.66 -43.22 209.48 445.52 12.0 N/A 10.6 6.6 1.4 0.6 0.6 1.2 4.2 4.3 FTSE-ASE Mid Cap 733.76 -5.98 0.66 -13.57 -34.12 -5.08 -32.71 696.63 1,317.40 0.6 N/A N/A 13.1 0.8 0.5 0.7 0.8 0.7 0.8 Indexes 2014e 2015e Sector Indexes 53.94 -26.67 -44.63 -58.04 -66.09 -43.92 -68.07 53.22 213.44 1.2 N/A 9.1 3.6 1.1 0.3 0.3 0.0 N/A N/A Telecoms 2,138.75 -12.70 -16.09 -16.90 -27.04 -14.62 -22.84 2,127.74 3,633.39 16.5 720.4 10.7 9.3 2.5 1.6 1.4 0.0 N/A N/A Oil-Gas 1,697.77 -7.79 -1.35 -4.95 -32.73 -6.45 -37.42 1,608.57 3,236.15 N/A N/A 8.8 5.9 1.3 0.8 0.7 3.3 6.3 9.1 Industrials 1,981.58 -3.46 4.26 -9.99 -39.36 1.41 -35.91 1,816.11 3,724.87 30.4 69.7 18.3 8.6 1.5 0.8 0.9 1.6 3.3 4.2 Construction - Materials Banks 2,086.66 -6.11 -2.63 -6.49 -34.36 -4.50 -19.21 2,028.51 3,482.98 N/A N/A 14.9 9.0 0.8 0.6 0.6 0.1 0.9 2.5 Technology 659.36 -5.37 -4.02 -14.05 -31.78 -9.19 -22.92 622.75 1,134.79 N/A N/A N/A N/A 0.5 N/A N/A 0.5 N/A N/A Commerce 4,967.05 -2.03 6.46 6.70 -21.04 9.10 -17.96 3,847.16 7,649.84 30.3 9.4 12.7 10.5 1.7 1.4 1.3 0.0 2.5 2.3 Food & Beverage 5,392.75 0.13 -7.76 -14.84 -18.25 -7.94 -26.81 5,066.70 7,697.32 62.5 23.8 16.6 15.3 2.5 1.6 1.5 1.6 2.7 2.9 119.75 -6.79 -9.04 -24.63 -37.13 -17.04 -49.25 115.79 287.11 N/A N/A N/A N/A 0.7 0.3 N/A 0.0 N/A N/A Health Financial Services 948.02 -7.07 0.59 -21.44 -49.27 -5.35 -41.03 900.30 2,207.51 N/A N/A 12.8 11.4 1.2 1.6 1.5 0.3 5.6 5.2 Personal & Household 4,967.05 -2.03 6.46 6.70 -21.04 9.10 -17.96 3,847.16 7,649.84 30.3 9.4 12.7 10.5 1.7 1.4 1.3 0.0 2.5 2.3 Basic Resources 2,154.62 -7.34 12.78 -6.74 -25.21 11.74 -15.19 1,753.11 3,356.44 N/A N/A 9.8 6.4 0.7 0.6 0.5 0.0 N/A N/A Retail 3,809.65 -5.54 -0.85 -2.76 -14.68 0.20 22.75 3,090.34 4,836.94 4.6 12.2 11.7 10.4 1.3 1.3 1.2 0.0 2.3 2.9 Real Estate 2,274.58 -2.61 -3.86 -13.86 -23.51 -0.32 -4.07 2,181.63 3,111.71 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A Travelling - Leisure 1,252.46 -10.34 -18.26 -23.12 -41.64 -18.31 -24.65 1,252.46 2,304.69 24.0 16.9 10.9 8.9 2.3 1.6 1.5 5.4 7.9 9.3 Utilities 1,780.58 -10.06 -14.78 -17.46 -56.19 -15.15 -47.08 1,711.47 4,471.04 N/A N/A 5.7 4.7 0.5 0.2 0.2 0.8 5.4 6.0 Futures (March 2015 expiration for stock futures) FTSE-20 February 2015 ALPHA BANK A.E. NATL BANK GREECE PIRAEUS BANK Aggregate Days Open to expire Interest * Settl. Price Premium/ Discount (%) % 1d Open Interest ∆ Open Interest 209.25 -0.43 -11.80 44,575 633 0.261 -3.69 -29.65 39,517 1,472 50 39,517 0.85 2.16 -23.84 28,657 2,148 50 28,707 30,740 22 * 2013 P/E and P/Book ratios are calculated using the price of the index at 31.12.13 ** Last 12 months (Trailing 12 months) 45,142 0.495 -0.60 -28.57 30,735 4,453 50 MYTILINEOS HLDGS 5.25 0.00 -7.41 3,574 -33 50 3,574 PUBLIC POWER COR 4.44 -0.22 -12.94 4,244 79 50 4,244 HELLENIC TELECOM 7.86 1.16 -10.68 5,349 -914 50 5,359 OPAP SA 6.90 0.58 -11.54 1,269 18 50 1,269 Real GDP YoY Real GDP QoQ * Open interest for all expiration dates Government Bonds, Spreads & CDS Last Yield Greece Germany France Spain Italy Portugal United States 1d, net 6m, net Source: Bloomberg CDS * Spread ** 2Yr Bond N/A - - - 2,893 - 5Yr Bond 13.291 -0.13 9.23 1.95 1,680 1,331.8 10Yr Bond 10.367 0.03 4.51 0.62 1,320 1,002.9 2Yr Bond -0.1740 -0.01 -0.20 -0.08 - - 5Yr Bond -0.0270 -0.01 -0.33 -0.04 18 - 10Yr Bond 0.3380 -0.02 -0.78 -0.20 42 - 5Yr Bond 0.089 -0.01 -0.43 -0.09 48 11.6 10Yr Bond 0.572 0.00 -0.93 -0.25 91 23.4 5Yr Bond 0.878 0.03 -0.16 0.00 85 90.5 10Yr Bond 1.478 0.04 -0.99 -0.13 134 114.0 5Yr Bond 0.830 0.03 -0.33 -0.12 107 85.7 10Yr Bond 1.633 0.04 -1.01 -0.26 159 129.5 5Yr Bond 1.604 -0.01 -0.46 0.15 174 163.1 10Yr Bond 2.584 0.00 -1.00 -0.10 240 224.6 5Yr Bond 1.2552 0.02 -0.43 -0.40 - - 10Yr Bond 1.7308 0.01 -0.73 -0.44 - - 30Yr Bond 2.2954 0.00 -0.93 -0.46 - - * Generic CDS Intraday Prices. Due to liquidity reasons, pricing sources may vary ** vs German Bund, in bps Macroeconomic Snapshots / Credit Ratings ytd, net (%) Eurozone 0.80 30/9/2014 Greece 1.60 30/9/2014 Germany 1.20 30/9/2014 France 0.40 30/9/2014 Spain 1.60 30/9/2014 Italy -0.50 30/9/2014 Portugal 1.10 30/9/2014 US 2.70 30/9/2014 0.20 Debt to Budget Balance to GDP GDP 90.90 -4.10 30/9/2014 31/12/2013 31/3/2014 174.90 -12.20 30/9/2014 31/12/2013 0.70 31/12/2013 76.90 0.10 30/9/2014 31/12/2013 0.10 31/12/2013 93.40 -4.10 30/9/2014 31/12/2013 1.00 31/12/2013 92.10 -6.80 30/9/2014 31/12/2013 0.49 31/12/2013 132.60 -2.80 30/9/2014 31/12/2013 -0.10 31/12/2013 128.00 -4.90 30/9/2014 31/12/2013 0.30 31/12/2013 71.80 -2.80 30/9/2014 31/12/2013 5.00 30/9/2014 CPI YoY CPI MoM -0.20 -0.10 Retail UnemploySales ment Rate (monthly) YoY 1.50 11.50 31/12/2014 31/12/2014 30/11/2014 30/11/2014 -2.60 S&P 0.50 25.30 Caa1 *- B 31/10/2014 STABLE WR NEG Aaa AAAu AAA -0.80 6.50 31/12/2014 31/12/2014 30/11/2014 31/12/2014 0.10 0.00 STABLE STABLE STABLE 0.70 9.90 Aa1 31/12/2014 31/12/2014 30/11/2014 30/9/2014 NEG NEG STABLE 0.50 23.90 Baa2 BBB 31/12/2014 31/12/2014 30/11/2014 30/11/2014 -1.00 0.00 0.10 B Fitch 31/12/2014 31/12/2014 31/10/2014 0.20 -0.50 Moody's -0.60 -2.32 13.40 Baa2 30/11/2014 STABLE 0.20 13.90 31/12/2014 31/12/2014 30/11/2014 30/11/2014 0.80 0.00 3.20 5.60 31/12/2014 31/12/2014 31/12/2014 -0.37 31/12/2014 AA BBB+ POS STABLE STABLE 31/12/2014 31/12/2014 30/11/2014 -0.36 0.00 AAu Ba1 BBBu BBB+ NEG STABLE BBu BB+ STABLE STABLE POS Aaa AA+u AAA STABLE STABLE STABLE Definitions: *- : watch list negative, WR: rating withdrawn Notes: GDP refers to quarterly data (Q1, Q2, Q3, Q4). All other macro indicators involve monthly data Please refer to the last pages of this report for important disclosures Global Markets Overview January 29, 2015 Research Department DAX Index 30-days chart 12,000,000 11,000 10,800 10,000,000 S&P 500 Index 30-days chart Dow Jones Index 30-days chart 16,000,000 10,400 6,000,000 12,000,000 10,200 10,000,000 10,000 8,000,000 9,800 4,000,000 DAX Turnover 2,000,000 16,600 10,000,000 9,000 0 16,400 0 Dow Jones Turnover 10,500 10,000 7,000,000 6,000,000 9,500 5,000,000 9,000 4,000,000 8,500 3,000,000 8,000 2,000,000 1,000,000 7,500 0 7,000 FTSE MIB INDEX 1,980 1,960 1,940 S&P 500 Turnover S&P 500 Index S&P 500 Index 52-week chart 18,000 140,000,000 17,500 120,000,000 16,000,000 17,000 2,100 2,050 2,000 1,950 1,900 1,850 1,800 1,750 1,700 1,650 1,600 1,550 1,500 100,000,000 16,500 12,000,000 80,000,000 16,000 8,000,000 15,500 4,000,000 60,000,000 15,000 40,000,000 14,500 20,000,000 14,000 0 Dow Jones Turnover 0 S&P 500 Turnover Dow Jones Index S&P 500 Index WORLD INDEXES - Valuation Ratios WORLD INDEXES - Statistics PSI All-Share Index GR 30,000,000 Dow Jones Index 20,000,000 DAX Index IBEX 35 INDEX 2,000 2,060 Dow Jones Index 52-week chart 8,000,000 FTSE 100 INDEX 2,020 40,000,000 9,200 11,000 CAC 40 INDEX 2,040 50,000,000 20,000,000 DAX Index 52-week chart DAX INDEX 60,000,000 16,800 9,000,000 Athex Composite Share Pr 17,400 4,000,000 10,000,000 Europe 70,000,000 17,000 DAX Index DAX Turnover 80,000,000 17,600 6,000,000 9,400 0 2,080 17,800 17,200 9,600 2,000,000 2,100 90,000,000 14,000,000 10,600 8,000,000 100,000,000 18,000 Price to Earnings (x) Price to Book (x) Dividend Yield (%) % 6m % ytd % 52w 52w Low 52w High 2013a* LTM ** 2014e 2015e 2013a* 2014e 2015e 2013a 2014e 2015e 28/1/2015 -40.54 -13.93 -36.86 708.61 1,379.42 20.0 N/A 10.7 6.9 1.2 0.6 0.6 1.0 3.7 4.1 10.95 9.23 14.72 8,354.97 10,810.57 18.2 18.5 13.8 12.6 1.8 1.7 1.6 2.8 2.9 3.2 28/1/2015 5.62 7.92 10.92 3,789.11 4,679.26 25.6 18.2 14.9 13.2 1.5 1.4 1.3 3.1 3.4 3.7 28/1/2015 0.27 3.96 4.30 6,072.68 6,904.86 16.7 19.6 15.3 13.6 2.0 1.7 1.7 3.6 4.0 4.2 Country Last Price % 1d Last Upd Greece 711.13 -9.24 Germany 10,710.97 0.78 28/1/2015 France 4,610.94 -0.29 UK 6,825.94 0.21 Spain 10,456.90 -1.34 28/1/2015 -4.08 1.73 5.67 9,370.50 11,249.40 16.5 21.8 14.9 12.7 1.4 1.4 1.3 4.4 3.7 4.1 Portugal 2,295.59 -1.43 28/1/2015 -17.70 7.85 -17.85 2,053.74 3,170.54 N/A N/A 13.1 8.9 1.3 1.0 0.9 3.1 3.7 4.6 Italy 20,478.44 -0.81 28/1/2015 -2.88 7.71 5.90 17,555.77 22,590.18 180.9 N/A 14.5 11.9 1.0 1.0 1.0 2.9 3.7 4.3 Ireland 5,508.09 -0.60 28/1/2015 15.96 5.43 16.61 4,275.26 5,639.89 52.4 36.7 17.9 15.6 1.9 2.0 1.8 1.6 2.0 1.9 Sweden 1,562.54 1.90 28/1/2015 11.78 6.69 19.27 1,246.56 1,562.54 17.0 17.1 16.0 14.9 2.3 2.3 2.2 3.9 4.0 4.3 Luxembourg 1,593.60 1.55 28/1/2015 1.99 4.82 10.89 1,353.57 1,608.63 56.0 20.3 18.4 14.6 1.1 1.1 1.1 4.8 2.8 3.1 AUSTRIAN TRADED ATX INDX Austria 2,194.14 -1.33 28/1/2015 -6.44 1.58 -15.60 1,980.53 2,692.64 24.7 N/A 12.8 10.5 1.0 0.9 0.8 2.8 3.6 4.2 OMX COPENHAGEN 20 INDEX Denmark 815.19 0.85 28/1/2015 9.70 9.50 30.61 618.14 822.04 19.7 22.7 17.6 15.5 2.5 2.8 2.6 1.8 2.1 2.6 Switzerland 8,311.55 -1.09 28/1/2015 -2.59 -7.48 2.16 7,852.83 9,292.44 18.4 19.4 16.2 14.9 2.6 2.4 2.3 3.0 3.5 3.9 IRISH OVERALL INDEX OMX STOCKHOLM 30 INDEX LUXEMBOURG LuxX INDEX SWISS MARKET INDEX Emerging Europe BIST 100 INDEX SOFIX INDEX WSE WIG INDEX BUCHAREST BET INDEX Turkey 90,341.63 -0.89 28/1/2015 7.27 5.39 45.50 60,753.53 91,805.74 9.9 11.0 11.1 9.7 1.3 1.5 1.3 2.7 2.7 3.0 Bulgaria 501.65 0.40 28/1/2015 -8.06 -3.92 -8.94 486.61 625.40 7.0 7.6 N/A N/A 0.7 N/A N/A 5.3 N/A N/A Poland 51,706.19 0.25 28/1/2015 0.84 0.56 3.15 48,765.47 55,687.59 17.5 16.7 13.3 11.4 1.3 1.2 1.2 3.7 3.7 4.0 Romania 7,007.52 0.81 28/1/2015 1.66 -1.07 8.70 6,110.93 7,309.05 11.9 9.6 8.7 8.1 1.0 0.9 0.8 2.8 4.2 4.9 -4.63 0.29 44,904.83 62,304.88 29.8 15.7 10.6 9.0 1.1 1.1 1.0 4.0 4.4 5.1 18.11 12.75 1,182.89 1,706.29 6.7 8.8 5.3 4.6 0.8 0.5 0.4 3.9 5.5 6.4 BRIC BRAZIL IBOVESPA INDEX MICEX INDEX S&P BSE SENSEX INDEX Brazil 47,694.54 -1.85 Russia 1,649.59 0.11 28/1/2015 -16.50 9:42:07 πµ 20.42 India 29,464.83 -0.32 9:27:08 πµ 13.36 7.15 42.71 19,963.12 29,786.32 16.7 20.5 18.7 16.0 2.6 2.9 2.6 1.5 1.4 1.5 China 3,262.31 -1.31 9:26:35 πµ 49.43 0.85 59.14 1,974.38 3,406.79 10.3 15.6 12.5 11.0 1.4 1.7 1.5 3.0 2.4 2.7 DOW JONES INDUS. AVG US 17,191.37 -1.13 28/1/2015 1.65 -3.54 9.23 15,340.69 18,103.45 15.7 15.4 15.8 14.3 2.9 2.8 2.6 2.1 2.4 2.6 NASDAQ COMPOSITE INDEX US 4,637.99 -0.93 12:16:00 πµ 4.40 -2.07 14.48 3,946.03 4,814.95 27 34 19.7 16.9 3.3 3.3 3.0 1.2 1.2 1.2 S&P 500 INDEX US 2,002.16 -1.35 28/1/2015 1.64 -2.76 12.85 1,737.92 2,093.55 17.2 17.6 16.7 14.8 2.6 2.5 2.3 1.9 2.1 2.3 1.7 SHANGHAI SE COMPOSITE US Asia, Pacific NIKKEI 225 HANG SENG INDEX Japan 17,606.22 -1.06 8:28:01 πµ 12.73 0.89 14.45 13,885.11 18,030.83 22.2 21.1 19.0 16.8 1.7 1.7 1.6 1.3 1.5 Hong Kong 24,584.82 -1.11 9:27:06 πµ -0.23 4.15 11.03 21,137.61 25,362.98 10.9 10.4 11.4 10.3 1.4 1.3 1.2 3.3 3.5 3.8 Singapore 3,423.20 0.12 9:27:08 πµ 2.00 1.73 12.31 2,953.01 3,428.49 13.6 13.9 14.0 12.7 1.4 1.3 1.2 3.3 3.3 3.6 Australia 5,569.49 0.30 7:54:50 πµ -0.34 2.93 6.51 5,052.20 5,679.50 19.8 19.2 16.0 14.7 2.0 1.9 1.8 4.3 4.6 4.9 Straits Times Index STI S&P/ASX 200 INDEX Volatility & Risk Indexes * 2013 P/E and P/Book ratios are calculated using the price of the index at 31.12.13 VDAX VIX VXN DAX 19.39 -4.86 28/1/2015 36.84 -0.46 9.55 10.80 24.09 S&P 500 20.44 18.70 28/1/2015 53.92 6.46 17.81 10.28 31.06 Nasdaq 100 21.39 11.29 28/1/2015 50.63 8.91 14.45 9.66 31.17 MARKIT ITRX EUROPE 12/19 (Generic) Europe 56.54 - 9:42:00 πµ -8.28 -10.12 -30.69 51.78 86.56 MARKIT ITRX EUR XOVER 12/19 (Generic) Europe 311.52 - 9:42:00 πµ 25.52 -9.96 1.01 218.43 429.90 % 6m % ytd % 52w 52w Low 52w High COMMODITIES Energy Currencies Price % 1d % 6m % ytd EUR / US Dollar 1.1301 -0.47 -15.73 -6.60 -17.27 1.1098 - EUR/Japanese Yen 132.93 -0.61 -2.95 -8.33 -4.72 130.15 149.80 44.08 107.73 EUR / British Pound 0.7460 -0.30 -5.78 -3.95 -9.53 0.7405 0.8403 -55.01 45.19 115.71 EUR / Swiss Franc 1.0274 -0.11 -15.51 -14.57 -15.90 0.7813 1.2262 -48.12 2.77 6.49 EUR / Canadian Dollar 1.4142 0.04 -7.17 1.3754 1.5587 EUR / Australian Dollar 1.4336 0.68 0.33 -3.26 -8.01 1.3798 1.5676 EUR / Turkish Lira 2.7051 0.03 -4.51 -4.39 -11.80 2.6045 3.1354 3m Exchange Last Price % 1d - 45.96 -0.65 9:41:00 πµ -56.71 -17.58 -57.62 - NYM 44.42 -0.07 9:41:50 πµ -56.01 -16.61 -54.38 Brent Crude Futr-Generic 1st month ($/bbl) ICE 48.52 0.10 9:32:03 πµ -54.96 -15.37 Natural Gas Futr-Generic 1st month ($/bbl) NYM 2.88 1.44 9:40:23 πµ -24.29 -0.21 Dated BFO Crude Oil Spot Px ($/bbl) WTI Crude Futr-Generic 1st month ($/bbl) Last Upd Precious Metals Exchange Last Price % 1d Last Upd % 6m % ytd % 52w 52w Low 52w High GOLD SPOT $/OZ - 1,281.76 -0.21 9:42:08 πµ -1.33 8.18 1.15 1131.24 1392.22 SILVER SPOT $/OZ - 17.85 -0.83 9:42:08 πµ -13.23 13.68 -9.65 14.29 22.18 PLATINUM SPOT $/OZ - 1,253.05 -0.10 9:42:08 πµ -15.33 3.73 -11.31 1177.15 1521.38 PALLADIUM SPOT $/OZ - 795.55 0.00 Base Metals ** Last 12 months (Trailing 12 months) 9:41:58 πµ -9.50 -0.28 11.31 696.80 912.00 Money Market Rates 1w -2.85 1.3994 6m 9m 12m -0.0140 0.0050 0.0550 0.1380 0.2080 0.2770 US 0.1371 0.1680 0.2526 0.3554 0.5508 0.6224 Japan 0.0457 0.0729 0.1007 0.1436 0.3543 0.2704 Europe 1m 0.62 % 52w 52wLow 52wHigh Exchange Last Price % 1d Last Upd % 6m % ytd % 52w 52w Low 52w High LME ALUMINUM 3MO ($) / MT LME 1,850.00 -0.27 28/1/2015 -8.19 -0.13 5.44 1671.25 2119.50 LME COPPER LME 5,484.00 1.16 28/1/2015 -22.98 -12.95 -23.19 5339.50 7220.00 LME 1,888.50 1.02 28/1/2015 -17.93 1.64 -12.33 1743.00 2307.00 Latest Rate Last Update Next Update LME 15,050.00 1.76 28/1/2015 -19.95 -0.66 6.44 13650.00 21625.00 Europe ECB 0.05 22/1/2015 5/3/2015 Exchange Last Price % 1d Last Upd % 6m % ytd % 52w 52w Low 52w High UK BoE 0.50 8/1/2015 5/2/2015 CBT 372.00 -0.33 9:31:57 πµ 2.90 -6.30 -12.98 318.25 519.50 US Fed 0.25 28/1/2015 18/3/2015 Japan BoJ 0.10 22/1/2014 * LME LEAD LME NICKEL 3MO ($) / MT 3MO ($) / MT 3MO ($) / MT Agriculture Corn Futr-Generic 1st month ($/bu.) Wheat Futr - Generic 1st month ($/bu.) CBT 502.75 -0.49 9:31:09 πµ -3.32 -14.75 -8.84 466.25 735.00 Soybean Futr - Generic 1st month ($/bu.) CBT 970.00 -0.03 9:31:35 πµ -20.91 -4.83 -23.58 904.00 1536.75 Sugar Futr - Generic 1st month ($/lb.) NYB 15.16 0.00 28/1/2015 -10.51 4.41 0.93 13.32 18.47 Coffee Futr - Generic 1st month ($/lb.) NYB 167.70 -0.30 28/1/2015 -7.40 0.66 46.27 113.70 225.50 Live Cattle Futr - Generic 1st month ($/lb.) CME 153.95 0.74 28/1/2015 -3.21 -7.09 8.00 135.40 171.98 Lean Hogs Futr - Generic 1st month ($/lb.) CME 71.53 3.02 28/1/2015 -42.17 -11.92 -16.12 68.53 133.90 Source: Bloomberg Interest Rates * As of 4/4/2013, the BOJ has shifted its monetary policy focus to a targeted monetary base via Japanese government bond (JGB) purchases. Please refer to the last pages of this report for important disclosures Global Markets Overview January 29, 2015 Research Department Bonds, Spreads, CDS 10 Yr Bond Yields 5 Yr Bond Yields Greece, Germany, Ireland, Portugal, Spain Germany, Ireland, Portugal, Spain, Greece 13 11 12 10 11 9 10 8 9 7 8 7 6 6 5 5 4 4 3 3 2 2 1 1 0 0 30/1/2014 23/4/2014 Greece 15/7/2014 Germany Ireland 6/10/2014 Portugal -1 29/1/2014 28/12/2014 Spain Italy Greek Spreads, 10 Yr Bonds (5 Yr n/a) 35835 -3 1,250 22/4/2014 Germany 14/7/2014 Ireland 5/10/2014 Portugal Spain 27/12/2014 Italy Greece Greek CDS, 5 Yr & 10 Yr Bonds (CMAN pricing) 66257 1,600 1,200 1,550 1,150 1,500 1,450 1,100 1,400 1,050 1,350 1,000 1,300 950 1,250 900 1,200 850 1,150 800 1,100 750 1,050 700 1,000 650 950 600 900 550 26/11/2014 6/12/2014 16/12/2014 26/12/2014 Greek 10Yr Spread 5/1/2015 15/1/2015 25/1/2015 850 12/1/2015 Greek 5Yr Spread 15/1/2015 18/1/2015 21/1/2015 Greek 5Yr CDS Spreads and CDS, 10 Yr Bonds - Ireland, Portugal, Italy, Spain (CBIL pricing for CDS) 300 24/1/2015 27/1/2015 Greek 10Yr CDS Spreads and CDS, 5 Yr Bonds Ireland, Portugal, Italy, Spain (CBIL pricing for CDS) 220 280 200 260 180 240 220 160 200 140 180 523 160 120 140 100 725.1 702.1 120 80 100 60 80 60 40 40 20 390.16 20 0 18/12/2014 28/12/2014 Irish Spread Portugese CDS Italian Spread Source: Bloomberg 7/1/2015 Irish CDS Spanish Spread Italian CDS 17/1/2015 Portugese Spread Spanish CDS 27/1/2015 0 18/12/2014 28/12/2014 Irish Spread (6Yr) Portugese CDS Italian Spread 7/1/2015 Irish CDS Spanish Spread Italian CDS 17/1/2015 27/1/2015 Portugese Spread Spanish CDS Please refer to the last pages of this report for important disclosures Global Markets Overview January 29, 2015 Research Department Currencies Euro / US Dollar 1.1301 -0.47% 1.40 1.38 1.36 1.34 1.32 1.30 1.28 1.26 1.24 1.22 1.20 1.18 1.16 1.14 1.12 1.10 29/1/2014 28/2/2014 29/3/2014 29/4/2014 29/5/2014 Euro / Japanese Yen 132.93 29/6/2014 29/7/2014 29/8/2014 29/9/2014 29/10/2014 29/11/2014 29/12/2014 Euro / British Pound -0.61% 0.7460 29/1/2015 -0.30% 0.85 150 ###### -3.00 145 0.84 0.83 0.82 0.81 0.80 140 0.79 0.78 0.77 135 0.76 0.75 130 29/1/2014 29/3/2014 29/5/2014 29/7/2014 29/9/2014 29/11/2014 29/1/2015 0.74 29/1/2014 29/3/2014 29/5/2014 29/7/2014 29/9/2014 29/11/2014 29/1/2015 Commodities, (Precious) Metals Dated BFO Crude Oil Spot Px ($/bbl) 45.96 Gold, Spot ($/OZ) -0.65% 120 1,281.76 -0.21% 1,450 110 1,400 100 1,350 90 1,300 80 - 1,250 70 1,200 60 1,150 50 40 29/1/2014 29/3/2014 29/5/2014 29/7/2014 29/9/2014 Aluminum (3MO Future) ($/MT) 1,850.00 29/11/2014 29/1/2015 1,100 29/1/2014 29/5/2014 7,400 2,100 29/7/2014 29/9/2014 Copper (3MO Future) ($/MT) -0.27% 2,150 29/3/2014 29/11/2014 5,484.00 29/1/2015 1.16% 702.1 7,200 2,050 7,000 2,000 6,800 1,950 6,600 1,900 6,400 1,850 6,200 363.8 1,800 6,000 1,750 5,800 1,700 1,650 29/1/2014 Source: Bloomberg 390.2 5,600 22/4/2014 14/7/2014 5/10/2014 27/12/2014 5,400 29/1/2014 22/4/2014 14/7/2014 5/10/2014 27/12/2014 Please refer to the last pages of this report for important disclosures Global Markets Overview January 29, 2015 Research Department Macroeconomic Calendar Regions included: EC, Greece, Germany, France, Portugal, Italy, Spain, Ireland, United Kingdom, US, China, Japan Date Time 01/28/2015 03:45 01/28/2015 04:00 01/28/2015 09:00 01/28/2015 09:00 01/28/2015 09:00 01/28/2015 09:45 01/28/2015 13:00 01/28/2015 13:00 01/28/2015 13:00 01/28/2015 13:00 01/28/2015 14:00 01/28/2015 21:00 01/28/2015 21:00 01/29/2015 01:50 01/29/2015 01:50 01/29/2015 01:50 01/29/2015 01:50 01/29/2015 01:50 01/29/2015 01:50 01/29/2015 01:50 01/29/2015 01:50 01/29/2015 09:00 01/29/2015 09:00 01/29/2015 10:00 01/29/2015 10:00 01/29/2015 10:00 01/29/2015 10:00 01/29/2015 10:55 01/29/2015 10:55 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:00 01/29/2015 11:30 01/29/2015 11:30 01/29/2015 11:30 01/29/2015 11:30 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 13:00 01/29/2015 15:00 01/29/2015 15:00 01/29/2015 15:00 01/29/2015 15:00 01/29/2015 15:30 01/29/2015 15:30 01/29/2015 16:45 01/29/2015 17:00 01/29/2015 17:00 01/29/2015 17:00 01/29/2015 01/29/2015 01/30/2015 01:30 01/30/2015 01:30 01/30/2015 01:30 01/30/2015 01:30 01/30/2015 01:30 01/30/2015 01:30 01/30/2015 01:30 01/30/2015 01:30 01/30/2015 01:30 01/30/2015 01:50 01/30/2015 01:50 01/30/2015 02:05 01/30/2015 04:00 01/30/2015 07:00 01/30/2015 07:00 01/30/2015 08:00 01/30/2015 09:00 01/30/2015 09:00 01/30/2015 09:45 01/30/2015 09:45 01/30/2015 09:45 01/30/2015 09:45 01/30/2015 10:00 01/30/2015 10:00 Source: Bloomberg Event CH CH GE GE GE FR IR IR IR IR US US US JN JN JN JN JN JN JN JN UK UK GE GE SP SP GE GE EC EC GE GE GE GE GE GE IT IT PO PO GE GE IT IT IT EC EC EC EC EC UK GE GE GE GE US US US US US US GE GE JN JN JN JN JN JN JN JN JN JN JN UK JN JN JN JN GE GE FR FR FR FR SP SP 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) 13) 14) 15) 16) 17) 18) 19) 20) 21) 22) 23) 24) 25) 26) 27) 28) 29) 30) 31) 32) 33) 34) 35) 36) 37) 38) 39) 40) 41) 42) 43) 44) 45) 46) 47) 48) 49) 50) 51) 52) 53) 54) 55) 56) 57) 58) 59) 60) 61) 62) 63) 64) 65) 66) 67) 68) 69) 70) 71) 72) 73) 74) 75) 76) 77) 78) 79) 80) 81) 82) 83) 84) 85) 86) 87) 88) Westpac-MNI Consumer Sentiment Bloomberg Jan. China Economic Survey (Table) Import Price Index MoM Import Price Index YoY GfK Consumer Confidence Consumer Confidence Property Prices MoM Property Prices YoY Retail Sales Volume MoM Retail Sales Volume YoY MBA Mortgage Applications FOMC Rate Decision (Upper Bound) FOMC Rate Decision (Lower Bound) Japan Buying Foreign Bonds Japan Buying Foreign Stocks Foreign Buying Japan Bonds Foreign Buying Japan Stocks Retail Trade YoY Retail Sales MoM Large Retailers' Sales Loans & Discounts Corp YoY Nationwide House PX MoM Nationwide House Px NSA YoY CPI Saxony YoY CPI Saxony MoM Retail Sales YoY Retail Sales SA YoY Unemployment Change (000's) Unemployment Rate M3 Money Supply YoY M3 3-month average CPI Brandenburg MoM CPI Brandenburg YoY CPI Hesse MoM CPI Hesse YoY CPI Bavaria MoM CPI Bavaria YoY Hourly Wages MoM Hourly Wages YoY Consumer Confidence Index Economic Climate Indicator CPI North Rhine Westphalia MoM CPI North Rhine Westphalia YoY Consumer Confidence Index Business Confidence Economic Sentiment Business Climate Indicator Industrial Confidence Consumer Confidence Economic Confidence Services Confidence CBI Reported Sales CPI MoM CPI YoY CPI EU Harmonized MoM CPI EU Harmonized YoY Initial Jobless Claims Continuing Claims Bloomberg Consumer Comfort Pending Home Sales MoM Pending Home Sales NSA YoY ISM Releases Seasonal Adjustments CPI Baden Wuerttemberg MoM CPI Baden Wuerttemberg YoY Jobless Rate Job-To-Applicant Ratio Overall Household Spending YoY Natl CPI YoY Natl CPI Ex Fresh Food YoY Natl CPI Ex Food, Energy YoY Tokyo CPI YoY Tokyo CPI Ex-Fresh Food YoY Tokyo CPI Ex Food, Energy YoY Industrial Production MoM Industrial Production YoY GfK Consumer Confidence Vehicle Production YoY Housing Starts YoY Annualized Housing Starts Construction Orders YoY Retail Sales MoM Retail Sales YoY Consumer Spending MoM Consumer Spending YoY PPI MoM PPI YoY GDP QoQ GDP YoY Survey Actual Prior Revised Jan -- 112.1 112.5 -- Dec Dec Feb Jan Dec Dec Dec Dec Jan 23 Jan 28 Jan 28 Jan 23 Jan 23 Jan 23 Jan 23 Dec Dec Dec Dec Jan Jan Jan Jan Dec Dec Jan Jan Dec Dec Jan Jan Jan Jan Jan Jan Dec Dec Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan F Jan Jan Jan Jan P Jan P Jan P Jan P Jan 24 Jan 17 Jan 25 Dec Dec -1.50% -3.40% 9.1 91 -----0.25% -----0.90% 0.30% 0.50% -0.30% 6.60% ---2.50% -10K 6.50% 3.50% 3.10% ------------100 98 -0.12 -4.5 -8.5 101.6 6 32 -0.80% -0.10% -1.00% -0.20% 300K 2405K -0.50% 10.80% -1.70% -3.70% 9.3 90 0.40% 16.30% 0.50% 5.10% -3.20% 0.25% 0.00% ¥45.6B ¥382.1B ¥237.5B ¥466.9B 0.20% -0.30% 0.10% 3.06% 0.30% 6.80% --------------------------------------- -0.80% -2.10% 9 90 0.50% 16.20% 0.20% 4.70% 14.20% 0.25% 0.00% -¥397.2B ¥657.4B -¥233.7B -¥577.4B 0.40% -0.30% 1.20% 2.88% 0.20% 7.20% 0.50% 0.20% 0.50% 1.90% -27K 6.50% 3.10% 2.70% 0.00% 0.30% -0.10% 0.00% 0.00% 0.30% 0.10% 1.10% -22.3 0.3 -0.10% 0.10% 99.7 97.5 87.6 0.04 -5.2 -8.5 100.7 5.6 61 0.00% 0.20% 0.10% 0.10% 307K 2443K 44.7 0.80% 1.70% ------0.50% 4.90% 16.10% ---¥395.1B --¥234.0B -¥577.1B 0.50% -0.20% 1.10% ----------------0.10% 0.20% ------------------------- Jan Jan Dec Dec Dec Dec Dec Dec Jan Jan Jan Dec P Dec P Jan Dec Dec Dec Dec Dec Dec Dec Dec Dec Dec 4Q P 4Q P --3.50% 1.12 -2.30% 2.30% 2.60% 2.10% 2.20% 2.20% 1.80% 1.20% 0.30% -2 --14.80% 0.900M -0.30% 3.60% 0.50% -0.50% --0.50% 1.90% --------------------------- -0.10% 0.10% 3.50% 1.12 -2.50% 2.40% 2.70% 2.10% 2.10% 2.30% 1.80% -0.50% -3.70% -4 -12.20% -14.30% 0.888M 16.90% 1.00% -0.80% 0.40% -1.10% -0.10% -2.00% 0.50% 1.60% ------------------0.50% -0.80% ------- Please refer to the last pages of this report for important disclosures Global Markets Overview January 29, 2015 Research Department Economic Events Calendar 01/29/2015 10:30 01/29/2015 11:10 01/29/2015 11:30 01/29/2015 13:00 01/29/2015 16:00 01/29/2015 16:00 01/29/2015 18:00 01/29/2015 18:30 01/29/2015 01/30 01/30/2015 11:00 01/30/2015 11:00 01/30/2015 12:00 01/30/2015 13:00 01/30/2015 13:00 01/30/2015 14:45 01/30/2015 18:30 02/03/2015 11:00 02/04/2015 13:00 02/04/2015 18:00 02/04/2015 18:00 02/04/2015 19:45 02/05/2015 11:00 02/05/2015 13:00 02/05/2015 18:00 02/06/2015 12:00 02/06/2015 19:45 02/06/2015 02/08/2015 02/10 02/09/2015 03:30 02/09/2015 13:00 02/10/2015 11:00 02/10/2015 11:00 02/10/2015 15:20 02/10/2015 17:00 02/11/2015 15:00 02/11/2015 18:00 02/12/2015 02/13/2015 15:30 02/13/2015 02/16/2015 16:00 02/17/2015 10:00 02/18/2015 05:00 02/20/2015 15:30 02/25/2015 14:45 PO EC PO PO IT EC PO EC EC EC EC PO PO PO PO GE PO PO EC PO US EC PO PO IT US EC GR JN PO PO PO US PO US PO EC US PO EC EC JN US EC Regions included: EC, Greece, Germany, France, Portugal, Italy, Spain, Ireland, United Kingdom, US, China, Japan 1) Portuguese Government Holds Weekly Cabinet Meeting 2) ECB's Praet Speaks in Luxembourg 3) Portugal Releases Consumer, Business Confidence Report 4) Portugal Releases Monthly Employment, Unemployment Estimates 5) Italian Parliament, Regional Delegates Vote on New President 6) EU Foreign Ministers Hold Meeting on Ukraine in Brussels 7) Former Novo Banco Board Member Honorio Speaks in Parliament 8) ECB's Coeure Speaks in Milan 9) EU Justice, Interior Ministers Hold Meeting in Latvia 10) NATO's Stoltenberg Holds Press Conference in Brussels 11) EU's Katainen Speaks on EU Investment Program in Frankfurt 12) Portuguese Prime Minister Speaks at Debate in Parliament 13) Portugal Releases December Retail Sales, Employment Report 14) Portugal Reports Industrial Production Index 15) Portuguese Vice Premier Portas Speaks at Awards Event 16) Bundesbank's Nagel Speaks in Munich 17) Fitch Ratings Holds Lisbon Credit Conference 18) Portugal Reports Fourth-Quarter Unemployment Rate 19) EU's Hill Speaks at Long-Term Financing Conference in Brussels 20) Former Novo Banco Board Member Rato Speaks in Parliament 21) Fed's Mester Speaks on Economy and Banking in Columbus 22) EU Publishes Economic Forecasts 23) Portugal Releases Industrial Sales, Employment Report 24) Espirito Santo Board Member dos Santos Speaks in Parliament 25) Bank of Italy Report on Balance-Sheet Aggregates 26) Fed's Lockhart Speaks on U.S. Economy in Naples, Florida 27) U.S.'s Biden Meets With EU Officials in Brussels 28) Merkel to Make Two-Day Trip to U.S. and Canada 29) BOJ Board Member Morimoto Speaks in Chiba 30) Portugal Reports International Trade Figures for December 31) ECB's Costa, Praet Speak on Financial Stability in Lisbon 32) Novo Banco CEO Stock da Cunha Speaks in Parliament 33) Fed's Lacker to Speak on Economy in Raleigh, North Carolina 34) Construction Entrepreneur Guilherme Speaks in Parliament 35) Fed's Fisher Speaks to Economists in New York 36) Former Tranquilidade CEO Brito e Cunha Speaks in Parliament 37) EU Leaders Hold Summit in Brussels 38) Revisions of Producer Price Index 39) Bank of Portugal Releases Data on Banks 40) Euro-Area Finance Ministers Meet in Brussels 41) EU Finance Ministers Hold Meeting in Brussels 42) Bank of Japan Policy Statement/Kuroda Press Conference 43) Revisions of Consumer Price Index 44) EU Publishes Its Winter Economic Forecasts CH IT GE US US CH JN JN IT IT IT IR US US UK UK UK US US CH CH CH JN US US CH GR UK JN JN FR JN UK UK UK GE US US JN US US IT GR GE Regions included: EC, Greece, Germany, France, Portugal, Italy, Spain, Ireland, United Kingdom, US, China, Japan 1) China to Sell CNY20 Bln 10-Year Bonds (1429) 2) Italy Sells Bills 3) Germany Sells EUR939 Mln 2.5% 2046 Bonds; Yld 1.07% 4) U.S. Sells USD15 Bln 2-Year FRN; High Discount Margin 0.084% 5) U.S. Sells USD26 Bln 2-Year Notes; High Yld 0.540% 6) China Development Bank to Sell CNY4Bln 1-Year Bonds(1502) 7) Japan Sells JPY5.73 Tln 3-Month Bills; Yield -0.0027%(509) 8) Japan Sells JPY2.699 Tln 2-Year Bonds; Yld 0.006% (349) 9) Italy to Sell Up to EUR3 Bln 1.05% 2019 Bonds 10) Italy to Sell Up to EUR3.5 Bln 2.5% 2024 Bonds 11) Italy to Sell Up to EUR1.75 Bln Floating 2020 Bonds 12) Ireland to Sell EUR500 Mln 183-Day Bills 13) U.S. to Sell USD35 Bln 5-Year Notes 14) U.S. to Sell USD29 Bln 7-Year Notes 15) U.K. to Sell GBP500 Mln 28-Day Bills 16) U.K. to Sell GBP1.5 Bln 182-Day Bills 17) U.K. to Sell GBP1 Bln 92-Day Bills 18) U.S. to Sell 3-Month Bills 19) U.S. to Sell 6-Month Bills 20) China Development Bank to Sell CNY6 Bln 5-Year Bonds (1503) 21) China Development Bank to Sell CNY5 Bln 7-Year Bonds (1504) 22) China Development Bank to Sell CNY7 Bln 10-Year Bonds (1505) 23) Japan to Sell 10-Year Bonds 24) U.S. to Sell 52-Week Bills 25) U.S. to Sell 4-Week Bills 26) China to Sell CNY20 Bln 5-Year Bonds (1503) 27) Greece to Sell 26-Week Bills 28) U.K. to Sell 2024 I/L Bonds 29) Japan to Sell 3-Month Bill 30) Japan to Sell 30-Year Bonds 31) France to Sell Bonds 32) Japan to Sell 6-Month Bill 33) U.K. to Sell 1-Month Bills 34) U.K. to Sell 3-Month Bills 35) U.K. to Sell 6-Month Bills 36) Germany to Sell EUR2 Bln Bubills (DE0001119386) 37) U.S. to Sell 3-Month Bills 38) U.S. to Sell 6-Month Bills 39) Japan Auction for Enhanced-Liquidity 40) U.S. to Sell 4-Week Bills 41) U.S. to Sell 3-Year Notes 42) Italy to Sell Bills 43) Greece to Sell 13-Week Bills 44) Germany to Sell EUR5 Bln Bonds (DE0001137495) Government Auctions / Buyouts Calendar 01/28/2015 05:00 01/28/2015 12:00 01/28/2015 12:30 01/28/2015 18:30 01/28/2015 20:00 01/29/2015 05:00 01/29/2015 05:35 01/29/2015 05:45 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 12:00 01/29/2015 12:30 01/29/2015 18:30 01/29/2015 20:00 01/30/2015 13:00 01/30/2015 13:00 01/30/2015 13:00 02/02/2015 18:30 02/02/2015 18:30 02/03/2015 04:30 02/03/2015 05:00 02/03/2015 05:00 02/03/2015 05:45 02/03/2015 18:30 02/03/2015 18:30 02/04/2015 05:00 02/04/2015 12:00 02/04/2015 12:30 02/05/2015 05:35 02/05/2015 05:45 02/05/2015 11:50 02/06/2015 05:35 02/06/2015 13:00 02/06/2015 13:00 02/06/2015 13:00 02/09/2015 12:30 02/09/2015 18:30 02/09/2015 18:30 02/10/2015 10:00 02/10/2015 18:30 02/10/2015 20:00 02/11/2015 12:00 02/11/2015 12:00 02/11/2015 12:30 Source: Bloomberg Please refer to the last pages of this report for important disclosures Global Markets Overview January 29, 2015 Research Department Earnings Releases Calendar Global - Top Events Primary Exchange SIX Swiss Ex Stockholm Korea SE Stockholm Stockholm New York New York Stockholm New York New York New York New York New York New York NASDAQ GS NASDAQ GS New York NASDAQ GS New York New York New York EN Amsterdam New York BM&FBOVESPA Tokyo Tokyo Helsinki SIX Swiss Ex Xetra London Stockholm MICEX Main London New York New York New York New York New York New York New York New York New York New York New York New York NASDAQ GS Xetra New York NASDAQ GS New York New York New York NASDAQ GS New York NASDAQ GS New York Helsinki Toronto Stockholm New York New York New York New York New York NASDAQ GS New York New York Toronto NASDAQ GS NASDAQ GS New York MICEX Main Stockholm New York Company Name Roche Holding AG Nordea Bank AB (C) SK Hynix Inc Electrolux AB Hennes & Mauritz AB Anthem Inc International Paper Co SKF AB AmerisourceBergen Corp ADT Corp/The Hess Corp Boeing Co/The Rayonier Advanced Materials Inc Fiat Chrysler Automobiles NV Qorvo Inc QUALCOMM Inc Las Vegas Sands Corp Facebook Inc Core Laboratories NV Alliant Techsystems Inc DHT Holdings Inc Unibail-Rodamco SE Albemarle Corp (C) Petroleo Brasileiro SA (C) Nomura Holdings Inc (C) Toshiba Corp Nokia OYJ Givaudan SA Infineon Technologies AG Diageo PLC Sandvik AB (C) Gazprom OAO Royal Dutch Shell PLC Abbott Laboratories Baxter International Inc Colgate-Palmolive Co Dow Chemical Co/The Harley-Davidson Inc Helmerich & Payne Inc Hershey Co/The Kate Spade & Co Occidental Petroleum Corp ConocoPhillips PulteGroup Inc Thermo Fisher Scientific Inc Celgene Corp Deutsche Bank AG Royal Caribbean Cruises Ltd Alexion Pharmaceuticals Inc Valero Energy Corp Blackstone Group LP/The Enterprise Products Partners LP JetBlue Airways Corp Time Warner Cable Inc Viacom Inc Alibaba Group Holding Ltd Kone OYJ Potash Corp of Saskatchewan Inc Atlas Copco AB EMC Corp/MA Ford Motor Co Coach Inc Ally Financial Inc Phillips 66 Biogen Idec Inc Manitowoc Co Inc/The Deckers Outdoor Corp Canadian Oil Sands Ltd Amazon.com Inc Google Inc Visa Inc (P) MMC Norilsk Nickel OJSC Svenska Cellulosa AB SCA Chevron Corp Bloomberg Ticker ROG VX NDA SS 000660 KS ELUXB SS HMB SS ANTM US IP US SKFB SS ABC US ADT US HES US BA US RYAM US FCAU US QRVO US QCOM US LVS US FB US CLB US ATK US DHT US UL NA ALB US PETR4 BZ 8604 JP 6502 JP NOK1V FH GIVN VX IFX GR DGE LN SAND SS GAZP RM RDSA LN ABT US BAX US CL US DOW US HOG US HP US HSY US KATE US OXY US COP US PHM US TMO US CELG US DBK GR RCL US ALXN US VLO US BX US EPD US JBLU US TWC US VIAB US BABA US KNEBV FH POT CN ATCOA SS EMC US F US COH US ALLY US PSX US BIIB US MTW US DECK US COS CN AMZN US GOOGL US V US GMKN RM SCAB SS CVX US Date 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 28/1/2015 29/1/2015 28/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 29/1/2015 30/1/2015 30/1/2015 C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C E C C Time Period 8:00 8:00 8:07 9:00 9:00 13:00 14:00 14:00 14:00 14:00 14:30 14:30 15:00 15:05 23:00 23:01 23:01 23:01 23:08 23:30 23:36 Aft-mkt 0:12 Y 2014 Y 2014 Y 2014 Y 2014 Y 2014 Q4 2014 Q4 2014 Y 2014 Q1 2015 Q1 2015 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q3 2015 Q1 2015 Q4 2014 Q4 2014 Q4 2014 Q3 2015 Q4 2014 Y 2014 Q4 2014 Q3 2014 Q3 2015 Q3 2015 Y 2014 Y 2014 Q1 2015 S1 2015 Y 2014 Q3 2014 Y 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q1 2015 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Y 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q1 2015 Q3 2015 Y 2014 Q4 2014 Y 2014 Q4 2014 Q4 2014 Q2 2015 Q4 2014 Q4 2014 Q4 2014 Q4 2014 Q3 2015 Q4 2014 Q4 2014 Q4 2014 Q1 2015 Y 2014 Y 2014 Q4 2014 8:00 8:00 8:00 8:00 8:30 9:00 9:00 9:00 9:01 Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt Bef-mkt 12:45 13:00 13:00 14:00 14:00 14:00 15:00 15:00 Aft-mkt Aft-mkt Aft-mkt Aft-mkt Aft-mkt Aft-mkt Aft-mkt 9:00 Bef-mkt EPS (local currency) Estimate Surprise Guidance 14.706 -2.86% 0.841 1.78% 5374.82 8.84% 6.059 28.34% 12.038 0.27% 1.744 -0.80% 0.484 9.50% 11.099 -1.70% 0.971 17.40% 0.491 3.87% 0.199 -9.55% 2.103 9.84% 0.607 0.49% 0.328 6.71% 1.181 1.34 1.254 6.86% 1.24 0.92 0.785 17.20% 0.54 0.485 11.34% 1.54 1.539 0.06% 1.545 3.0238 2.842 6.40% 0.31 0.068 355.88% 10.919 10.856 0.58% 10.782 0.99 1.02 -2.94% 0.237 0.365 -35.07% 19.23 15.118 27.20% 9.6976 8.502 14.06% 0.294 0.27 8.89% 61.18 68.478 -10.66% 0.115 0.099 16.16% 0.537 0.621 -13.53% 4.797 4.782 0.31% 4.464 3.575 3.601 -0.72% 0.686 0.69 1.311 1.315 0.743 0.695 0.334 1.551 1.064 0.238 0.678 0.584 0.402 1.94 1.007 1.01 3.928 2.982 31.72% 0.418 0.375 1.287 1.328 0.918 0.366 0.239 2.092 1.285 4.651 1.548 0.464 10.192 0.683 0.224 0.66 0.393 1.407 3.775 0.318 4.515 4.46 0.213 0.19 7.185 2.487 Actual 14.286 0.856 5850 7.776 12.07 1.73 0.53 10.91 1.14 0.51 0.18 2.31 0.61 0.35 10.633 1.643 Currency CHF SEK KRW SEK SEK USD USD SEK USD USD USD USD USD USD USD USD USD USD USD USD USD EUR USD BRL JPY JPY EUR CHF EUR GBp SEK RUB GBp USD USD USD USD USD USD USD USD USD USD USD USD USD EUR USD USD USD USD USD USD USD USD USD EUR CAD SEK USD USD USD USD USD USD USD USD CAD USD USD USD RUB SEK USD (*) Reported Value, (^) GAAP Value, (T) Tentative, (C) Confirmed Date, (E) Estimated Date Source: Bloomberg Please refer to the last pages of this report for important disclosures Global Markets Overview January 29, 2015 Research Department GREEK MARKET - Corporate Actions General Meetings Company GM Date Time Livanis Publishing Organizatio 29/1/15 11.00 Compucon Computer Applications 30/1/15 12.00 Balkan Real Estate SA 3/2/15 15.00 Kleemann Hellas SA 4/2/15 14.00 MLS Multimedia SA 11/2/15 15.00 Alco Hellas SA 13/2/15 12.00 AGM: Annual General Meeting, EGM: Extra-ordinary General Meeting, Rep: Repetitive Meeting Type EGM EGM EGM EGM EGM EGM Comments Dividends Company Interim Div 2014 X-Div Date Remaining Div 2014 X-Div Date Total Div 2014 (gross* ) X-Div Date Capital X-Div Return 2014 Date Notes 0.15 € To be proposed at the 26/6/14 GM 0.20 € To be proposed at the 17/6/14 GM 0.03 € Approved by the 3/6/14 GM 1.50 € Approved by the 29/5/14 GM Approved by the 29/12/14GM 0.125 € 0.2017€ (gross) interim div. + 0.0283€ (net) distribution of tax free reserves (0.23€ total, 0.21€ net) 21/01/15 0.17 20/1/15 0.025 € Nexans Hellas SA Hellenic Exchanges - Athens St Elve SA Alpha Trust Mutual Fund Manage Folli Follie SA OPAP SA 0.2300 € 12/01/15 GEKE SA Thrace Plastics Co SA * The abovementioned dividend amounts are subject to a 25% withholding tax (Law 3943/2011) (1) 0.65€ from retained earnings & reserves + 0.15€ interim dividend 2014. Net amount equals to 0.5461€+0.1250€=0.672€ Rights Issue / Bonus Issue - (Reverse) Splits Company Compucon Computer Applications Ilyda SA Alco Hellas SA Kekrops SA Compucon Computer Applications Lamda Development SA JUMBO SA Kathimerini Publishing SA Kathimerini Publishing SA Terms 9 new / 4 old at 1.82€ 1 new / 100 old at 0.90€ Rev. Split: 1 new / 5 old 3 new / 1 old at 0.40€ Rev. Split: 1 new / 11 old 0.79469... new / 1 old at 4.25€ Bonus shares: 1 new / 22 old 8 new / 1 old at 0.33€ Rev. Split: 2 new / 10 old New Rights Exercise Trading shares Period Period trading day 13/10/14 15/10/14 16/10 - 30/10/2014 16/10 - 24/10/2014 18/11/14 Cease of trading: 1/9/2014 5/9/14 11/8 - 19/8/2014 5/8/14 11/8 - 25/8/2014 29/8/14 2/7/14 4/7/14 8/7/14 27/6 - 11/7/2014 23/6/14 25/6/14 27/6 - 7/7/2014 22/7/2014 5/3/14 7/3/14 - 11/3/2014 6/3/14 10/3 - 24/3/2014 4/3/14 10/3 - 18/3/2014 28/3/14 4/3/14 10/3/14 ExDate Record Date Comments & Notes Approved by the 6/5 GM Adjusted start share price 0.751€ Adjusted start share price 0.418€ Approved by the 12/2 GM Adjusted price €4.46 after the split, €0.788 after the increase Mergers Company (1) Elval - Hellenic Aluminium Ind Absorbed Company (2) ETEM SA Exchange Terms (1/1) 1/1 Exchange Terms (1/2) 1/6 Absorbed Company Cease Trading Day 02/12/14 New Shares Start Trading Day 5/12/14 Comments Financial Calendar Company FY 2014 Results Fourlis Holdings SA 24/2/15 Hellenic Telecommunications Or 26/2/15 Bmkt: Before market opens, Amkt: After market closes, ND: Non distribution (of dividend) Bold Colors indicate a new addition (stays bold for a couple of days) or a current action / event Time of Releases Amkt Bmkt Please refer to the last pages of this report for important disclosures IMPORTANT DISCLOSURES DISCLAIMER - This report has been compiled and issued by “Prelium Investment Services SA”. “Prelium Investment Services SA” is liable neither for the proper and complete transmission of this report nor for any delay in its receipt. Any unauthorized use, disclosure, copying, reproduction or distribution of the specific research material contained in this report, in whole or in part, is strictly prohibited, without the prior written permission of the issuer (“Prelium Investment Services SA”). All opinions and estimates expressed in this report reflect the personal views and judgments of the author and are given in good faith. In addition, those opinions and estimates apply as of the date of issuance of this report but are subject to change without any prior notice. Although the information herein was obtained from sources which are deemed reliable, “Prelium Investment Services SA” does not guarantee their accuracy or completeness. The recipient of this report accepts that “Prelium Investment Services SA” shall not be liable for any errors or omissions of the present report or in the reproduction, copying or transmission of the information contained in the present report and such errors and omissions can not establish any claim ΙΝΤΕΡto indemnity or action against any officer 26/3/2012 related or employee of “Prelium Investment Services SA” for any losses arising from such errors or omissions. - This report is prepared exclusively for the clients of “Prelium Investment Services SA”. Neither the information contained in this report nor any opinion expressed constitutes an offer, an advice, or an invitation to make an offer, to buy, or sell or subscribe for any financial instrument mentioned herein. Investors should not in any case rely exclusively upon information contained in this report in order to form any investment decision, but they should at their own and acting on an independent basis, analyze, evaluate and assess the appropriateness and the value of any particular investment, using the statements and recommendations of this report only as one of the factors which could effect their investment decisions. Investors should be aware of the fact that income from securities or financial instruments, if any, may fluctuate and that each security’s or financial instrument’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested or may lose their entire originally invested capital. “Prelium Investment Services SA” shall not be liable for any investment decision which is taken in compliance with that information. - Foreign currency rates of exchange may adversely affect the value, price or income of financial instruments mentioned herein. In addition, investors in financial instruments, such as ADRs, whose value are influenced by the currency of the underlying financial instrument, effectively assume currency risk. - Unless otherwise agreed in writing with Prelium Securities and Investment Services SA, this research is intended solely for internal use by the recipient. IMPORTANT REGULATORY DISCLOSURES ON SUBJECT COMPANY AND INTERNAL PROCEDURES - The information and opinions contained in this report were compiled by Prelium Investment Services SA, which is a member of the Athens Stock Exchange and is regulated by the Hellenic Capital Market Commission. The compensations of the research analysts principally responsible for the preparation of this research report may depend on various factors, such as quality of work, stock picking, client feedback and overall firm profitability and those compensations should not in any case originate from persons who have substantial interests in the result of the present research report. Prelium Investment Services SA has not entered with the subject company (-ies) into any contract, whose object shall be the preparation of this report. - This report has been published in accordance with the conflict of interests’ management policy and the relevant guidelines which have been enacted and applied by the Company. Any research analyst responsible for the content of this research report is compelled to notify the circumstances which can affect the objectivity of the present analysis, especially in the case that he has a significant financial profit from the financial instruments mentioned herein or in the case that he has substantial conflict of interests with the issuer mentioned herein. According to the policies of Prelium Investment Services SA, the Research Department is bound by confidentiality, with the exception of data allowed to be published in accordance with the provisions of the capital market legislation in force. The communication between the Research Department and the other departments of Prelium Investment Services SA is restricted by Chinese Walls set between the different departments, so that Investment Services SA can comply with the provisions and regulations regarding confidential information and market abuse. In this context and before the transmission of the present analysis, the issuers, the directors and the employees of Prelium Investment Services SA, and any other person with the exception of the research analysts who are responsible for the preparation of this report, -3 are not entitled to have access and examine the present analysis in order to verify the accuracy of the actual facts referred to this report or for any other reason, apart from the ascertainment of the compliance of Prelium Investment Services SA with its legal obligations, provided that the report contains ratings or target price. ANALYSTS CERTIFICATION Each research analyst primarily responsible for the content of this report, in whole or in part, certifies that with respect to each company/ issuer that the analyst covered in this report: a) all of the views referred herein reflect his or her personal views about those financial instruments or issuers; b) no part of his/her compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed by that research analyst in the research report, c) he/she has not received financial incentives and earnings by any person who has substantial interests in the publication of the present research report, and d) he/she has not promised to the issuer mentioned in the present analysis any favorable coverage. The name of the research analyst primarily responsible for the content of this research report is stated on the first page of this report. DISCLOSURE CHECKLIST FOR COMPANIES MENTIONED AND OTHER PRICE DATA INFORMATION None of the below mentioned are valid for the listed companies mentioned in this report 1. Prelium Investment Services has acted as manager/co-manager/adviser in the underwriting or placement of financial instruments of the company mentioned in this report within the past 12 months. 2. Prelium Investment Services had a contractual relationship or has received compensation for investment banking from the company mentioned in this report within the past 12 months. 3. Prelium Investment Services acts as a market maker for the company mentioned in this report. 4. Prelium Investment Services owns five percent or more of the total share capital of the company mentioned in this report at the date of issuance of this report. 5. The company mentioned in this report owns five percent or more of the total share capital of Prelium Investment Services at the date of issuance of this report. 6. Prelium Investment Services SA has other financial interests related to the company mentioned in this report at the date of issuance of the latter. 7. The following research analysts who participate in the preparation of this report have the following financial interests related to the company covered by this report……………………………………………………………………………………………………………………………………………………………………………………………………… …………………………………………………………………………………………………………………………………………………………………………………… PRELIUM INVESTMENT SERVICES S.A. RATING DISTRIBUTION As of 29-Jan-2015 % distribution breakdown Outperform Neutral Underperform Under Review / Not Rated Restricted 0% 0% 0% 100% 0% OTHER IMPORTANT DISCLOSURES - The present research report has been published for the first time today/ or on the…./…./…… - The above research material is provided to investors exclusively for information purposes and is not to be used or considered as an offer, advice or invitation to sell or buy or subscribe for any financial instrument mentioned in the present report. Prelium Investment Services SA shall not treat recipients as its customers by virtue of receipt of this report. Investors should not in any case rely exclusively upon information contained in this report in order to form any investment decision, but they should at their own and on an independent basis analyze, evaluate and assess the appropriateness and the value of any particular investment, using the statements and recommendations of this report only as one of the factors which could effect their investment decisions The investments or services contained or referred to in this report may not be suitable for all investors and it is recommended that the investors, apart from the independent evaluation of particular investment and strategies, should consult an independent investment advisor if they are in doubt about such investments or investment services. Securities or the other financial instruments referred to in the research report are subject to investment risks, including the possible loss of the principal capital invested. - The clients of Prelium Investment Services SA may already have or may have in the future a position or engage in transactions in any of the financial instruments mentioned herein or any related investment. - Although the information or opinions herein was obtained or compiled form sources that are deemed reliable, the accuracy, completeness or correctness of those information or opinions can not be guaranteed. In producing the research reports, members of Prelium Investment Services SA Research Department may have received assistance from the subject company (-ies), referred to in this report. Any such assistance may include access to sites of the issuers, visits to certain operations of the subject company (-ies), meetings with management, employees or other parties associated with the subject company (-ies), and handing by them of historical data regarding the subject company (-ies) (financial statements and other financial data), as well as of all publicly available information regarding strategy and financial targets. Prelium Investment Services SA research personnel are prohibited from accepting payment or reimbursement of travel expenses from site visits to subject companies. It should be presumed that the author of this report, in most cases, has had discussions with the subject company (-ies) to ensure factual accuracy prior to publication. All opinions and estimates in this report reflect the personal views and judgments of the author and are given in good faith. In addition, those opinions and estimates apply as of the date of the issuance of this report but are subject to changes without any prior notice. Prices and availability of financial instruments are also subject to changes without prior notice. It should be assumed that any prices quoted in this report are the closing prices of the last session of the Athens Stock Exchange, unless otherwise indicated. Although Prelium Investment Services SA does not set a predetermined frequency for publications, it is in the intention of Prelium Investment Services SA to provide research coverage of the subject company (-ies), including in response to any news affecting these issuers, unless there is lack of news and capacity. Prelium Investment Services SA does not accept any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents or in respect of any errors or omissions thereto. PRELIUM SECURITIES & INVESTMENT SERVICES S.A. Member of the Athens Stock Exchange, Member of the Athens Derivatives Exchange Head Office: S. Davaki 1 & Kifisias Ave., 115 26 Athens, Greece, Tel. +30 210 36 77 000, Fax +30 210 69 26 403 e-mail [email protected], www.prelium.com INSTITUTIONAL SALES RESEARCH DEPARTMENT Babis Angeletopoulos, [email protected] Emi Moundrou, [email protected] FOREIGN MARKETS ASSET MANAGEMENT Ioanna Karamani, [email protected] Konstantinos Asimakopoulos, [email protected] DERIVATIVES Andreas Nikolopoulos, [email protected]

© Copyright 2026