Union Bank of India

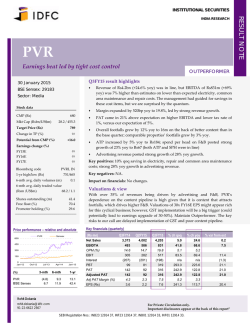

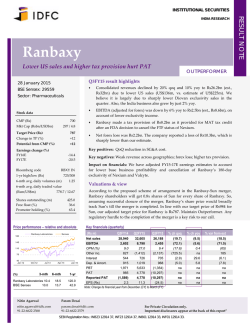

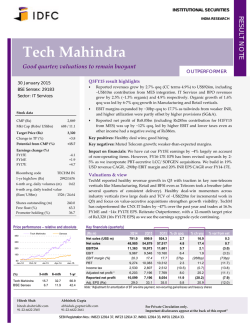

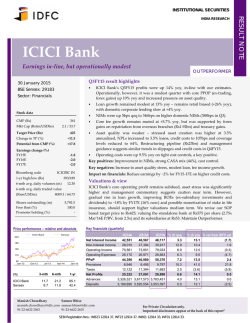

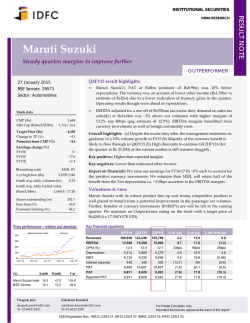

INSTITUTIONAL SECURITIES Union Bank of India Asset quality remains volatile, earnings weak OUTPERFORMER 27 January 2015 Q3FY15 result highlights BSE Sensex: 29571 Union’s Q3 profits were down 13% yoy and well below our estimates. Key weakness was on asset quality – NPLs were up 10% qoq, slippages remained high (2.9% annualized) and so did fresh restructurings. Credit costs were up to 142bps and coverage levels remain low (44%). Operationally too, it was a modest quarter with PPOP (ex-trading gains) up +2% yoy. NIMs were largely stable at 250bps as lower cost of funds, offset the decline in loan yields. We expect NIMs to remain stable near term. Loan growth, in-line with management’s stance to conserve capital - was slow at +9% yoy and driven by retail (+27% yoy) and MSME loans (+25% yoy). Corporate loans declined 2% yoy. Core-fee income growth was relatively healthy at 12% yoy led by retail fees Sector: Financials Stock data CMP (Rs) 238 151.4 / 2.5 Mkt Cap (Rsbn/USDbn) Target Price (Rs) 265 Ù Change in TP (%) Potential from CMP (%) Earnings change (%) FY15E FY16E FY17E Bloomberg code +11.3 Key positives: Healthy core fee income growth, stable loan loss coverage. -7.6 -8.9 -7.9 UNBK IN 1-yr high/low (Rs) 260/101 6-mth avg. daily volumes (m) 4.90 6-mth avg. daily traded value (Rsm/USDm) 1053 / 17.14 Shares outstanding (m) Free float (%) Promoter holding (%) 635.8 39.5 60.5 Price performance – relative and absolute Union Bank of India Key negatives: Continued higher stress asset creation, high effective tax rate (51%). Impact on financials: We cut our earnings estimates by 7-9% for FY15-17E on lower loan growth, rigid credit costs and slower improvement in NIMs. Valuations & view Union’s asset quality stress remains higher than our estimates with gross stressed assets now at 10% of loans. However, excluding SEBs its gross stressed assets are relatively lower than peers at 8% of loans and we continue to expect gradual improvements in asset quality as economic activity improves. While the stock has outperformed Bankex in the last 1 month, Union’s relatively higher leverage to the falling interest rate cycle and cheap valuations (0.7x FY16E P/BV) should be key downside supports. Maintain Outperformer with Rs265 target (0.8x FY16E P/BV). Key financials (quarterly) 3Q14A 2Q15A 3Q15A % ch qoq Net Interest Income 19,635 20,844 21,212 1.8 8.0 Non-Interest Income 6,799 8,113 8,772 8.1 29.0 (3.0) 26,434 28,958 29,985 3.5 13.4 (3.2) (7.0) Sensex 180 145 110 Operating Income % ch yoy % var from IDFC est (3.3) 75 Operating Expenses 13,818 15,618 15,331 (1.8) 11.0 40 Jan-12 PPoP 12,616 13,339 14,653 9.9 16.1 1.1 6,104 7,854 8,519 8.5 39.6 31.7 Oct-12 Jul-13 Apr-14 Jan-15 Provisions 3-mth 6-mth 1-yr Union Bank of India 4.5 Sensex 10.1 23.6 13.2 115.3 (%) 39.9 Taxes 3,034 1,772 3,110 75.5 2.5 24.2 Net Profits 3,478 3,713 3,024 -18.6 (13.1) (45.2) Advances 2,277,450 2,444,110 2,480,990 1.5 8.9 (1.0) Deposits 2,851,251 3,001,648 3,129,121 4.2 9.7 1.7 Manish Chowdhary Sameer Bhise [email protected] [email protected] 91-22-6622 2563 91-22-6622 2635 For Private Circulation only. Important disclosures appear at the back of this report” SEBI Registration Nos.: INB23 12914 37, INF23 12914 37, INB01 12914 33, INF01 12914 33. RESULT NOTE INDIA RESEARCH Union Bank of India – Q3FY15 result Exhibit 1: Quarterly results Union Bank of India Interest Income Interest Expense Net Interest Income 3Q15A 3Q14A % YoY 2Q15A 80,438 75,503 6.5 79,434 % QoQ Comments 1.3 (59,225) (55,868) 6.0 (58,589) 1.1 21,212 19,635 8.0 20,844 1.8 Loan yields down 16bp qoq to 893bps NIMs largely stable qoq as lower cost of funds (down 12bp qoq) offset lower loan yields Fee-Based Income 6,252 6,099 2.5 7,363 -15.1 Core-fee income (ex-recoveries) up a relatively healthy 12% yoy Other Non-Interest Income 2,520 700 260.0 750 236.0 Strong trading gains from the bond portfolio in Q3 Non Interest Income Operating Income Operating Expenses 8,772 6,799 29.0 8,113 29,985 26,434 13.4 28,958 8.1 3.5 (15,331) (13,818) 11.0 (15,618) -1.8 Employee costs were up 17% yoy and led to higher CIR despite stringent cost control on other operating expenses (up 2% yoy) Pre-Provision Profit 14,653 12,616 16.1 13,339 9.9 Core-PPOP (ex-trading gains) up a modest 2% yoy Charges for Bad Debts (8,779) (5,664) 55.0 (7,064) 24.3 Credit costs up 25bp qoq to 142bps due to continued high slippages (2.9% of loans, annualized) Other Operating Items Pre-Tax Profit Tax 260 (440) NM (790) NM 6,134 6,512 (3,110) (3,034) -5.8 5,485 11.8 2.5 (1,772) 75.5 High effective tax rate in Q3 - management says - should normalise in Q4 Net Profit 3,024 3,478 -13.1 3,713 -18.6 Continued weakness in asset quality and high credit costs impact earnings, despite higher bond gains EPS Customer Loans 4.8 5.5 -13.8 5.8 -18.6 2,480,990 2,277,450 8.9 2,444,110 1.5 Loan growth remains tepid with management's stated stance of conserving capital. However, retail and MSME loans grew at healthy 27% and 29% yoy, respectively Customer Deposits 3,129,121 2,851,251 9.7 3,001,648 4.2 AIEA 3,394,467 3,143,025 8.0 3,299,883 2.9 AIBL 3,065,641 2,838,556 8.0 3,058,846 0.2 Total Assets 3,717,797 3,438,339 8.1 3,604,886 3.1 Avg Assets 3,661,341 3,415,114 7.2 3,585,017 2.1 125,960 87,762 43.5 114,616 9.9 Non-Performing Loans (NPL) CASA ratio flat qoq at 28.7% Sharp rise in NPLs due to higher slippages, incremental restructuring in Q3 at Rs12.1bn (2% of loans, annualized) Loan Loss Reserves (LLR) (54,776) (37,283) 46.9 (50,125) 9.3 Shareholders’ Funds 183,539 166,630 10.1 180,515 1.7 289 264 9.2 284 1.7 Tier 1 ratio (including 9M profits) at 7.6% improving, but remains low Book Value Per Share 2 |IDFC SECURITIES 27 January 2014 Union Bank of India – Q3FY15 result Key Ratios (%) Key Ratios (%) 3Q15A ROAA (annualized) 3Q14A∆ YoY (Bps) 0.3 0.4 -8 2Q15A ∆ QoQ (Bps) 0.4 -8 Comments Profitability remains under pressure due to elevated credit costs ROAE (annualized) 6.6 8.3 -176 8.2 -164 Net Interest Margin (bps) 250 250 0 253 -3 Expect NIMs to remain modest near to medium term as interest rates decline Fee Inc/Operating Income 20.9 23.1 -222 25.4 -458 Fee income growth has been relatively modest, though slightly better than other PSU peers Other Non-Interest Inc/Op Inc 29.3 25.7 354 28.0 124 Op. Cost/ Operating Income 51.1 52.3 -114 53.9 -281 Loan-to-Deposit Ratio (LDR) 79.3 79.9 -59 81.4 -214 5.1 3.9 122 4.7 39 Core-CIR (ex-trading gains) up 60bp qoq to 55.8% NPL/Loan Ratio Asset quality remains under pressure with gross stressed assets at 10.1% LLR/NPL Ratio 43.5 42.5 100 43.7 -25 Reported coverage levels at 57.3%. Expect credit costs to remain high near-term Source: Company, IDFC Securities Research Other highlights Union’s incremental asset impairment continued at relatively high levels in Q3 as well – slippages stood at Rs17.4bn (2.9% of loans, annualized) and incremental restructurings at Rs12.1bn (2% of loans, annualized). Management stated that slippages in Q3 included three large corporate accounts worth ~Rs5bn from sugar and construction sectors. Slippages ~Rs2.2bn emanated from the restructured book. Additionally, management indicated that upgrades of accounts (from NPLs to standard category) worth ~Rs4.5bn that were expected in Q3 did not take place and management expects the same to come through in Q4. Restructuring pipeline for Q4FY15E stands at ~Rs12-13bn. With regards to bunching up of restructuring proposals towards end of Q4 given that regulatory forbearance on loan restructuring is coming to an end in Mar15, management indicated that banks are likely to make a representation to RBI to extend the same. Union’s gross stressed assets inched up 30bp qoq to 10.1% of loans. However, adjusted for restructured SEB exposures, gross stressed assets are relatively lower than peers at 7.9% of loans. Credit costs were at elevated levels at 142bps (+25bp qoq) given elevated asset stress. Loan loss coverage (incl. technical write-offs) was marginally lower qoq at 57.3% (vs 58% in Q2). Exhibit 2: GNPLs (%), Std. restructured loans (%) GNPLs (%) Slippages (%), fresh restructurings (%)* Slippages (% annualized) Standard restructured loans (%) Fresh restructurings (% annualized) 4.5% 6.0% 4.5% 3.0% 3.0% 1.5% 1.5% 0.0% 0.0% 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Source: Company, IDFC Securities Research *% of average loans Union’s risk weighted assets (RWA) growth has slowed to 2% yoy, in-line with management’s stance of conserving capital. The bank’s CET 1 ratio is currently ~7.6% (including 9M profits). According to the 3 |IDFC SECURITIES 27 January 2014 Union Bank of India – Q3FY15 result management, Union has headroom to raise ~Rs40bn of additional Tier 1 (AT1) and ~Rs14bn of equity capital. However, management reiterated its stance of waiting for for better market opportunity for raising equity capital. Given its relatively low capital adequacy, Union’s management reiterated its conservative stance on growth. Management has guided to a slower 10-12% loan growth for FY15E. We believe this is a medium term positive, until capital adequacy is shored up. In Q1, loan growth was led by retail (+27% yoy) and agriculture loans (+29% yoy). Corporate loans declined 2% yoy. Retail+SME+Agri loans now form 50% of Union’s domestic advances. Exhibit 3: Loan growth (% yoy) Loan mix (%) Loan grow th (% yoy) 30.0% Retail, 12.2% 24.0% Agriculture, 12.0% 18.0% Corporate, 54.6% 12.0% 6.0% MSME, 21.3% 0.0% 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Source: Company, IDFC Securities Research NIMs declined 3bp qoq to 250bps led by lower yields on advances (down 16bp qoq) that offset the benefits of lower cost of funds (down 12bp qoq). We expect some improvement in NIMs in FY16 led by favorable funding costs as well as lower asset stress. CASA ratio stood at 28.7%, flat qoq. Union’s savings bank accounts grew 11% yoy while growth in current account deposits was relatively muted at 4.2% yoy. Management stated it continues to focus on savings account accretion. Exhibit 4: NIMs (quarterly) (bps) (%) NIMs 350 280 210 140 70 0 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Source: Company, IDFC Securities Research 4 |IDFC SECURITIES 27 January 2014 Union Bank of India – Q3FY15 result Core fee income (ex-recoveries and trading gains) growth was relatively healthy at 12% yoy – with processing fees up a robust 26% yoy. Management expects momentum in fee income growth to sustain. Operating expenses grew 11% yoy in Q3 with operating expenses up only 2% yoy. Employee costs increased 17% yoy. Union provided Rs710m towards wage revisions that are under negotiations currently and total provisions till date on this account stand at ~Rs4.2bn (corresponding to 10-12% growth in wages). Exhibit 5: Fee income (ex-trading) growth (% yoy) Cost-income ratio (%), CIR (ex-trading) (%) Fee income grow th (% yoy) Cost-income ratio (%) 50% CIR (ex-trading) (%) 60.0% 40% 52.5% 30% 45.0% 20% 37.5% 10% 30.0% 0% 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 Source: Company, IDFC Securities Research Union’s effective tax rate was sharply higher at 51% in Q3 as management provided for excess tax writebacks booked in earlier quarters. For 9mFY15, effective tax rate stands at 38%. Management indicated that FY15E effective tax rate should normalize to 30%. Exhibit 6: Earnings revision summary Net Profit EPS DPS Old New % change Old New % change Old New FY15E 21,456 19,819 (7.6) 34.0 31.4 (7.6) 4.5 4.0 FY16E 25,537 23,266 (8.9) 40.5 36.9 (8.9) 6.0 4.5 FY17E Source: IDFC Securities Research 31,219 28,755 (7.9) 49.5 45.6 (7.9) 7.5 5.0 5 |IDFC SECURITIES 27 January 2014 Union Bank of India – Q3FY15 result Income statement Valuation Metrics Year to 31 Mar (Rs m) Net Interest Income FY16E FY17E 75,428 FY13 78,793 85,213 99,711 118,664 Net Profit 23,266 28,755 9.2 4.5 8.1 17.0 19.0 EPS (Rs) 37.6 27.6 31.4 36.9 45.6 20,750 23,335 26,254 29,405 32,933 EPS growth (%) 13.1 (26.5) 13.8 17.4 23.6 4,770 4,857 6,557 5,901 5,311 PE (x) 6.3 8.6 7.6 6.5 5.2 25,520 28,192 32,812 35,306 38,245 P/BV (x) 0.9 0.9 0.8 0.7 0.6 100,949 106,985 118,024 135,018 156,909 P/Adj BV (x) 1.2 1.3 1.3 1.0 0.9 10.3 14.4 16.2 P/PPOP (x) 2.5 2.7 2.6 2.3 1.9 (45,122) (54,828) (62,295) yoy growth (%) Fee Income Trading Profits Non Interest income Net Operating Revenue yoy growth (%) 9.2 Operating Expenses FY14 FY15E 6.0 Year to 31 Mar FY13 FY14 FY15E FY16E FY17E 21,579 16,958 19,819 (71,969) (83,157) RoA (%) 0.8 0.5 0.5 0.6 0.6 13.2 21.5 13.6 15.5 15.5 RoE (%) 15.0 10.4 11.2 11.9 13.2 55,827 52,158 55,729 63,049 73,752 3.6 1.8 1.7 1.9 2.1 6.3 (6.6) 6.8 13.1 17.0 Provisions for Bad Debts (20,165) (26,678) (28,166) yoy growth (%) PPoP yoy growth (%) (28,811) (31,674) Other Provisions (5,020) (4,814) 750 (1,000) (1,000) Profit Before Tax 30,643 20,666 28,313 33,238 41,078 Tax (9,064) (3,708) (8,494) (9,971) (12,324) Minorities/Exceptionals Profit After Tax - - - - - 21,579 16,958 19,819 23,266 28,755 yoy growth (%) 20.7 (21.4) 16.9 17.4 23.6 Balance sheet As on 31 Mar (Rs m) Customer Loans FY13 FY14 FY15E FY16E FY17E 17.0 10.1 9.0 14.0 17.0 Investments 808,304 937,232 1,050,231 1,191,463 1,348,908 Cash & bank balances 162,104 230,729 182,801 209,317 240,528 24,790 26,085 27,389 28,758 30,196 42,388 52,720 57,991 63,791 70,170 Fixed Assets Other Assets 3,118,608 3,537,809 3,816,395 4,341,029 5,021,611 Networth Deposits 171,852 183,644 200,513 220,461 Year to 31 Mar (Rs m) FY13 Net Interest Margin 266 FY14 FY15E FY16E FY17E 239 233 246 255 Non Interest Income / Operating Income 25.3 26.4 27.8 26.1 24.4 Cost/Income 44.7 51.2 52.8 53.3 53.0 Operating Expense/Avg assets 1.6 1.6 1.7 1.8 1.8 Credit Costs / Avg Loans 1.0 1.2 1.2 1.1 1.0 Effective Tax Rate 29.6 17.9 30.0 30.0 30.0 Loan Deposit Ratio 78.9 77.0 77.5 76.9 77.0 2,637,616 2,976,756 3,223,631 3,703,237 4,326,376 9.2 7.6 7.4 7.1 6.9 - Savings % 21.8 21.9 22.6 22.2 21.7 - Term % 1-year forward P/BV (x) -1SD Avg. Union Bank India +1SD 2.0 1.5 245,528 - Current % 69.0 70.5 70.0 70.7 71.4 Borrowings 170,073 207,766 217,922 238,285 265,907 Other Liabilities 139,068 169,643 174,328 179,046 183,799 Key Financials ratios Year to 31 Mar Operating Ratios 2,081,022 2,291,044 2,497,982 2,847,700 3,331,809 yoy growth (%) Total assets Dividend Yield (%) 1.0 0.5 0.0 Jan06 Jan07 Jan08 Jan09 Jan10 Jan11 Jan12 Jan13 Jan14 Jan15 Shareholding pattern FY13 FY14 FY15E FY16E FY17E RoA 0.8 0.5 0.5 0.6 0.6 RoE 15.0 10.4 11.2 11.9 13.2 Tier I Capital adequacy 8.2 7.6 7.6 7.4 7.1 Gross NPL 3.0 4.2 5.1 4.2 3.6 Net NPL 1.6 2.3 2.9 2.1 1.7 Loan Loss Coverage 46.9 44.2 43.7 49.4 54.4 CASA ratio 31.0 29.5 30.0 29.3 28.6 Assets / Equity 18.1 19.3 19.0 19.7 20.5 Dividend Payout 22.6 15.5 12.7 12.2 11.0 Public & Others 8.5% Foreign 11.5% Institutions 14.6% Promoters 60.5% Nonpromoter corporate holding 5.0% As of September 2014 6 |IDFC SECURITIES 27 January 2014 Union Bank of India – Q3FY15 result Disclaimer This document has been prepared by IDFC Securities Ltd (IDFC SEC). IDFC SEC is a full-service, integrated investment banking, and institutional broking group. There are no material disciplinary actions taken against IDFC SEC. Details of associates of IDFC SEC are attached as annexure. This document does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, the opinions and information in this report are subject to change without notice and IDFC SEC, its subsidiaries and associated companies, their directors and employees (“IDFC SEC and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent IDFC SEC and affiliates from doing so. Thus, the opinions expressed herein should be considered those of IDFC SEC as of the date on this document only. We do not make any representation either express or implied that information contained herein is accurate or complete and it should not be relied upon as such. The information contained in this document has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The investment discussed or views expressed in the document may not be suitable for all investors. Investors should make their own investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved) and investment decisions based upon their own financial objectives and financial resources. Investors assume the entire risk of any use made of the information contained in the document. Investments in general involve some degree of risk, including the risk of capital loss. Past performance is not necessarily a guide to future performance and an investor may not get back the amount originally invested. Foreign currency-denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value or the price of, or income derived from, the investment. In addition, investors in securities, the values of which are influenced by foreign currencies, effectively assume currency risk. Affiliates of IDFC SEC may have issued other reports that are inconsistent with and reach different conclusions from, the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject IDFC SEC and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to a certain category of investors. Persons in whose possession this document may come are required to inform themselves of, and to observe, such applicable restrictions. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. IDFC SEC and affiliates, their directors, officers, and employees may from time to time have positions in, purchase or sell, or be materially interested in any of the securities mentioned or related securities. IDFC SEC and affiliates may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall IDFC SEC, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind including but not limited to any direct or consequential loss or damage, however arising, from the use of this document. Any comments or statements made herein are those of the analyst and do not necessarily reflect those of IDFC SEC and affiliates. This document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. IDFC SEC will not treat recipients as customers by virtue of their receiving this report. IDFC Capital (USA) Inc. has reviewed the report and, to the extent that it includes present or past information, it is believed to be reliable, although its correctness cannot be assured. The analyst certifies that all of the views expressed in this research report accurately reflect his/her personal views about any and all of the subject issuer(s) or securities. The analyst certifies that no part of her compensation was, is, or will be directly or indirectly related to the specific recommendation(s) and/or views expressed in this report. Additional Disclosures of interest: Unless specifically mentioned in Point No. 9 below: 1. The Research Analyst(s), IDFC Sec, Associate of Analyst or his relative does not have any financial interest in the company(ies) covered in this report. 2. The Research Analyst, IDFC SEC or its associates or relatives of the Research Analyst affiliates collectively do not hold more than 1% of the securities of the company (ies) covered in this report as of the end of the month immediately preceding the distribution of the research report. 3. The Research Analyst, his associate, his relative and IDFC SEC do not have any other material conflict of interest at the time of publication of this research report. 4. The Research Analyst, IDFC SEC and its associates have not received compensation for investment banking or merchant banking or brokerage services or for any other products or services from the company(ies) covered in this report, in the past twelve months. 5. The Research Analyst, IDFC SEC or its associates have not managed or co-managed in the previous twelve months, a private or public offering of securities for the company (ies) covered in this report. 6. IDFC SEC or its associates have not received compensation or other benefits from the company(ies) covered in this report or from any third party, in connection with the research report. 7. The Research Analyst has not served as an Officer, Director or employee of the company (ies) covered in the Research report. 8. The Research Analyst and IDFC SEC has not been engaged in market making activity for the company(ies) covered in the Research report. 9. Details IDFC SEC , Research Analyst and its associates pertaining to the companies covered in the Research report: Sr. No. 1. 2. 3. 4. 5. Particulars Yes / No. Whether compensation has been received from the company(ies) covered in the Research report in the past 12 months for investment banking transaction by IDFC SEC Whether Research Analyst, IDFC SEC or its associates or relatives of the Research Analyst affiliates collectively hold more than 1% of the company(ies) covered in the Research report No. No Whether compensation has been received by IDFC SEC or its associates from the company(ies) covered in the Research report No IDFC SEC or its affiliates have managed or co-managed in the previous twelve months a private or public offering of securities for the company(ies) covered in the Research report Research Analyst, his associate, IDFC SEC or its associates have received compensation for investment banking or merchant banking or brokerage services or for any other products or services from the the company(ies) covered in the Research report, in the last twelve months No No Explanation of Ratings: 1. Outperformer 2. Neutral 3. Underperformer : : : More than 5% to Index Within 0-5% (upside or downside) to Index Less than 5% to Index Copyright in this document vests exclusively with IDFC Securities Ltd. 7 |IDFC SECURITIES 27 January 2014 Union Bank of India – Q3FY15 result Annexure Associates of IDFC Securities Limited Sr. No. Name of Company Category Non Banking Finance Company, SEBI registered Merchant Banker, SEBI registered Debenture Trustee 1. IDFC Ltd. 2. IDFC Capital (USA) INC. Subsidiary 3. IDFC Capital (Singapore) Pte. Ltd. Subsidiary Fund Manager 4. IDFC Securities Singapore Pte. Ltd. Subsidiary Dealing in Securities 5. IDFC Fund of Funds Limited Subsidiary Sponsor Investments 8 |IDFC SECURITIES Parent Nature of business Broker Dealer registered with FINRA 27 January 2014 Union Bank of India – Q3FY15 result www.idfc.com Analyst Sector/Industry/Coverage E-mail Anish Damania Shirish Rane Co-CEO - IDFC Securities, Head - Institutional Equities; Strategy Head of Research; Construction, Power [email protected] [email protected] Tel.+91-22-6622 2600 Prakash Joshi Oil & Gas, Metals, Mining [email protected] 91-22-662 22564 Nitin Agarwal Pharmaceuticals, Real Estate, Agri-inputs [email protected] 91-22-662 22568 91-22-6622 2522 91-22-662 22575 Hitesh Shah IT Services & Telecom [email protected] 91-22-662 22565 Manish Chowdhary Financials [email protected] 91-22-662 22563 Bhoomika Nair Engineering, Cement, Power Equipment, Logistics [email protected] 91-22-662 22561 Ashish Shah Construction, Power [email protected] 91-22-662 22560 Deepak Jain Vijayaraghavan G Automobiles, Auto ancillaries Midcaps [email protected] [email protected] 91-22-662 22562 91-22-662 22690 Rohit Dokania Media & Entertainment [email protected] 91-22-662 22567 Abhishek Gupta Telecom, IT services [email protected] 91-22-662 22661 Mohit Kumar, CFA Construction, Power [email protected] 91-22-662 22573 Param Desai Pharmaceuticals, Real Estate, Agri-inputs [email protected] 91-22-662 22579 Sameer Narang Strategy, Economy [email protected] 91-22-662 22566 Probal Sen Oil & Gas [email protected] 91-22-662 22569 Saumil Mehta Metals, Mining [email protected] 91-22-662 22578 Harit Kapoor FMCG, Retail, Alcoholic Beverages [email protected] 91-22-662 22649 Sameer Bhise Financials [email protected] 91-22-662 22635 Abhishek Ghosh Engineering, Cement, Power Equipment, Logistics [email protected] 91-22-662 22658 Saksham Kaushal Automobiles, Auto ancillaries [email protected] 91-22-662 22529 Dharmendra Sahu Database Analyst [email protected] 91-22-662 22580 Equity Sales/Dealing Designation E-mail Tel.+91-22-6622 2500 Ashish Kalra Managing Director, Sales [email protected] 91-22-6622 2525 Rajesh Makharia Director, Sales [email protected] 91-22-6622 2528 Palak Shah SVP, Sales [email protected] 91-22-6622 2696 Varun Saboo VP, Sales [email protected] 91-22-6622 2558 Arati Mishra VP, Sales [email protected] 91-22-6622 2597 Hemal Ghia VP, Sales [email protected] 91-22-6622 2533 Tanvi Dixit AVP, Sales [email protected] 91-22-6622 2595 Nirav Bhatt AVP, Sales [email protected] 91-22-6622 2681 Chandan Asrani Manager, Sales [email protected] 91-22-6622 2540 Sneha Baxi Manager, Sales [email protected] 91-22-6622 2537 Suryakant Bhatt Director & Head - Sales trading [email protected] 91-22-6622 2693 Mukesh Chaturvedi Director, Sales trading [email protected] 91-22-6622 2512 Viren Sompura SVP, Sales trading [email protected] 91-22-6622 2527 Rajashekhar Hiremath SVP, Sales trading [email protected] 91-22-6622 2516 Alok Shyamsukha VP, Sales trading [email protected] 91-22-6622 2523 Suketu Parekh VP, Sales trading [email protected] 91-22-6622 2674 IDFC Securities Naman Chambers, C-32, 7th floor, G- Block, Bandra-Kurla Complex, Bandra (East), Mumbai 400 051 INDIA IDFC Capital (USA) Inc, Regus Business Centre 600 Third Avenue, 2nd Floor, New York,10016 Tel: +91 22 6622 2600 Tel: +1 646 571 2303 Our research is also available on Bloomberg and Thomson Reuters For any assistance in access, please contact [email protected] 9 |IDFC SECURITIES 27 January 2014

© Copyright 2026