Ranbaxy - Business Standard

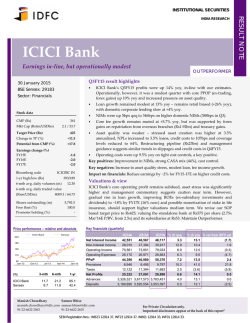

INSTITUTIONAL SECURITIES Ranbaxy Lower US sales and higher tax provision hurt PAT OUTPERFORMER 28 January 2015 Q3FY15 result highlights BSE Sensex: 29559 Consolidated revenues declined by 20% qoq and 10% yoy to Rs26.2bn (est., Rs32bn) due to lower US sales (US$136m, vs. estimate of US$225m). We believe it is largely due to sharply lower Diovan exclusivity sales in the quarter. Also, the India business also grew by just 2% yoy. EBITDA (adjusted for forex) was down by 6% yoy to Rs2.5bn (est., Rs8.6bn), on account of lower exclusivity income. Ranbaxy made a tax provision of Rs8.2bn as it provided for MAT tax credit after an FDA decision to cancel the FTF status of Nexium. Net forex loss was Rs2.2bn. The company reported a loss of Rs10.3bn, which is sharply lower than our estimate. Sector: Pharmaceuticals Stock data CMP (Rs) 700 297 / 4.8 Mkt Cap (Rsbn/USDbn) Target Price (Rs) 787 Change in TP (%) +12 Potential from CMP (%) +12 Key positives: QoQ reduction in SG&A cost. Earnings change (%) FY16E FY17E -14.4 -20.5 Bloomberg code RBXY IN 1-yr high/low (Rs) 725/308 6-mth avg. daily volumes (m) 1.25 6-mth avg. daily traded value (Rsm/US$m) 778.7 / 12.67 Shares outstanding (m) Free float (%) Promoter holding (%) 425.0 36.6 63.4 Price performance – relative and absolute Ranbaxy Laboratories Key negatives: Weak revenue across geographies; forex loss; higher tax provision. Impact on financials: We have adjusted FY15-17E earnings estimates to account for lower base business profitability and cancellation of Ranbaxy’s 180-day exclusivity of Nexium and Valcyte. Valuations & view According to the proposed scheme of arrangement in the Ranbaxy-Sun merger, Ranbaxy shareholders will get 0.8x shares of Sun for every share of Ranbaxy. So, assuming successful closure of the merger, Ranbaxy’s share price would broadly track Sun’s till the merger is completed. In line with our target price of Rs984 for Sun, our adjusted target price for Ranbaxy is Rs787. Maintain Outperformer. Any regulatory hurdle to the completion of the merger is a key risk to our call. Key financials (quarterly) (Rs m) Sensex Q3FY14 Q2FY15 Q3FY15 % ch qoq % ch yoy % var from est 28,940 32,605 26,188 (19.7) (9.5) (18.5) 2,602 8,790 2,455 (72.1) (5.6) (71.5) 9.0 827 27.0 (1,412) 9.4 (2,137) (17.6) (725.5) 0.4 na (65) 185 180 Net sales 145 EBITDA 110 OPM (%) Other inc. 75 40 Jan-12 Oct-12 (%) Jul-13 3-mth Apr-14 6-mth Jan-15 1-yr Interest 544 726 705 (2.9) 29.6 (6.1) Dep. & Amort. 915 1,019 968 (5.0) 5.8 (7.8) PBT 1,971 5,633 (1,354) na na na PAT 985 4,778 (10,297) na na na (1,589) 4,778 (10,297) na na na EPS (Rs) 2.3 11.3 (24.5) Note: Change its financial year from December (CY) to March (FY) na na na Reported PAT Ranbaxy Laboratories 10.4 BSE Sensex 10.0 18.5 13.7 120.0 42.9 Nitin Agarwal Param Desai [email protected] 91-22-6622 2568 [email protected] 91-22-6622 2579 For Private Circulation only. Important disclosures appear at the back of this report” SEBI Registration Nos.: INB23 12914 37, INF23 12914 37, INB01 12914 33, INF01 12914 33. RESULT NOTE INDIA RESEARCH Ranbaxy Labs – Q3FY15 result Consolidated quarterly results (detailed) (Rs m) Net sales Q4CY13 Q5CY13 Q1FY15 Q2FY15 28,940 24,668 24,263 32,605 Q3FY15 FY14 FY15E 26,188 132,685 109,460 Comments Lower revenues on account of lower Diovan sales Expenses Cost of sales 10,459 9,249 8,704 10,071 10,469 48,283 39,490 SG&A expenses 15,879 13,911 13,300 13,745 13,264 73,825 53,789 Total expenses 26,338 23,161 22,003 23,815 23,733 122,107 93,279 EBITDA 2,602 1,508 2,259 8,790 2,455 10,578 16,182 OPM (%) 9.0 6.1 9.3 27.0 9.4 8.0 14.8 Other income 827 1,334 21 (1,412) (2,137) (5,134) (3,363) Interest 544 689 753 726 705 2,735 2,900 Depreciation 915 953 1,074 1,019 968 4,762 4,061 1,971 1,200 453 5,633 (1,354) (2,053) 5,858 981 1,099 (56) 851 8,882 3,314 9,977 PBT Current tax Up 400bp yoy Below estimates Our estimate, 27% Includes forex loss of Rs2.2bn In line Tax provision of Rs8.2bn as it provided for MAT tax credit Tax rate (%) Minority interest PAT Extraordinary expenses Reported PAT 49.8 5 91.6 (66) (12.3) (9) 15.1 4 (655.9) 61 (161.4) 120 170.3 100 985 167 518 4,778 (10,297) (5,488) (4,219) 2,574 903 2,377 - - 5,364 2,377 (1,589) (737) (1,859) 4,778 (10,297) (10,853) (6,596) Below estimates % chg yoy Sales EBITDA Other income Depreciation 6.7 (0.2) (7.9) 16.4 (9.5) 6.6 221.4 (20.9) (13.9) 353.6 (5.6) (45.0) (17.5) 53.0 (138.8) 21.5 (100.4) (57.5) (358.4) 7,054.3 (34.5) 13.7 19.6 40.8 (23.6) 5.8 48.7 (14.7) PBT (173.9) (28.2) (112.3) (275.0) (168.7) (114.5) (385.3) PAT (132.1) (86.8) (112.8) (224.2) na (150.2) (23.1) (67.7) (158.5) (64.5) (205.2) na (219.7) (39.2) 421.0 421.0 421.0 421.0 421.0 421.0 421.0 EPS 2.3 Source: Company, IDFC Securities Research Note: * 15 months 0.4 1.2 11.3 na (13.0) (10.0) Reported PAT EPS Equity Other key highlights US business revenues of US$136m (down 39% qoq and 7% yoy) were sharply below our estimate of US$2224m. Diovan sales were sharply lower than our estimates. We believe that the company booked over US$20m of sales from Diovan compared with our estimate of US$110m. Sales would have also been hit by stoppage of formulation supplies from Ipca (Ranbaxy was Ipca’s major marketing partner in the US). o Ranbaxy secured approval to launch gDiovan (~US$2bn sales) on 26 June 2014 and launched the product in the first week of July with a 180-day exclusivity. We believe aggressive channel filling in the first month of exclusivity and lesser price erosion had resulted in sharply higher sales for Q2FY15. We had estimated ~US$110m Diovan sales during Q3FY15, in line with the management guidance that there was limited channel inventory of gDiovan as of 30 Sept 2014, which implied continued strong sales even in the Dec’14 quarter; Ranbaxy’s FTF exclusivity ended in Jan 2015. However, it seems that Ranbaxy had probably 2 | IDFC SECURITIES 28 January 2015 Ranbaxy Labs – Q3FY15 result accounted for significant channel inventory during Q2FY15 and/ or faced sharper price discounts, which led to the significant miss on Diovan estimates. o In Q4CY12, Ranbaxy launched Absorica, its branded CIP-Isotretenoin product, which has begun to steadily scale up. The company indicated that the drug has been received well by doctors, but there has been a marginal qoq decline in market share to 19.2% Rx (~20% in Q2FY15). The management had indicated that generic Isotret is ~US$400m market with the premium pricing associated with Absorica further expanding the market. At the current run rate, Absorica should become at least a US$100m product for Ranbaxy. o The FDA recently cancelled Ranbaxy’s FTF status on Nexium and has given approval to Teva for generic launch. We had assumed profit of ~Rs20bn for Ranbaxy during the exclusivity period. The FDA had earlier also cancelled Ranbaxy’s Valcyte exclusivity. India revenues grew by a mere 2% yoy to Rs5.9bn, vs. our estimate of Rs6.4bn, on account of sharply lower consumer business (declined ~30% yoy). The prescription business grew by 11%, vs. our estimate of 10% growth. Non-US export sales were hit by a sharp currency depreciation against the INR across markets. Among the key EU markets, Russia declined by 39% yoy in INR terms and Romania declined by 7% yoy. Overall, the East EU block declined by 22% yoy in INR terms, with the recent crisis in Ukraine also impacting growth. Sales in APAC (+7% yoy) and Latam (-18% yoy) were hit by weaker currency, but the company continued to book relatively strong gains in constant-currency terms. Africa sales also declined by 9%, broadly in line with our estimates. Overall, EBITDA margins (adjusted for forex) came in at 9.4% (down 1760bp qoq), vs. our estimate of 26.8% on account of lower Diovan sales. EBITDA margins were aided by 2% qoq decline in SG&A cost, which indicates that some of Ranbaxy’s efforts towards controlling costs have begun to yield results. Cumulative forex loss for the quarter stood at Rs2.2bn, vs. a loss of Rs1.6bn in Q2FY15. The forex loss comprised of: a) Rs153m loss on foreign currency derivatives, and b) Rs2.1bn translation loss (including interest rate swaps). Outstanding forex derivatives as of end-Q3FY15 were ~US$275m (sharply down qoq) with maturities of ~US$33m/ month. The company indicated that the pace of expiration will decrease. Total net debt increased qoq to US$762m vs. US$739m as of Sept-2014. During the quarter, the company made a one-time tax provision of Rs8.2bn as it provided for MAT tax credit after a recent FDA decision to cancel the FTF status of Nexium. Presumably, the company would have planned to set-off these MAT tax credits against Nexium FTF profits. The company stays eligible for utilizing this MAT credit against future profits as permitted by accounting rules. We believe this MAT credit may enable Sun Pharma to lower its consolidated tax liability after the consummation of the merger. Impending merger with Sun: The company is awaiting two approvals – US FTC and Punjab & Haryana high court approval (next hearing is on 2 February 2015). The management remains confident of successfully closing the merger with Sun Pharma. 3 | IDFC SECURITIES 28 January 2015 Ranbaxy Labs – Q3FY15 result Income statement Key ratios Year to 31 Dec (Rs m) FY15E FY16E FY17E 124,437 132,685 109,460 127,719 EBITDA margin (%) 15.4 8.0 14.8 11.8 14.2 4.6 11.5 EBIT margin (%) 12.9 4.4 11.1 8.2 10.8 105,218 122,107 PAT margin (%) 8.8 (4.1) 93,279 100,946 109,554 19,218 10,578 16,182 13,551 18,165 % change 53.0 (16.3) 34.0 RoCE (%) 14.1 5.2 13.1 11.2 16.3 1,828 700 800 800 Gearing (x) 0.1 1.4 1.8 1.4 1.1 (1,796) (2,735) (2,900) (2,800) (2,700) 3,202 4,762 4,061 4,200 4,400 (2,053) 5,858 7,351 11,865 2,939 3,314 9,977 1,470 2,373 Current tax 11,209 Minorities (5,368) (282) (1,860) (4,119) (120) (5,364) 5,881 (100) (100) (2,377) - 9,492 (100) - Net profit after non-recurring items 9,067 (10,853) (6,596) % change n/a (219.7) n/a 5,781 9,392 n/a 62.5 Balance sheet 26.0 (13.0) (10.0) 13.7 22.3 PE (x) 27.0 n/a n/a 51.0 31.4 Price/ Book (x) 7.1 8.7 11.3 9.7 7.6 EV/ Net sales (x) 2.4 2.6 3.1 3.0 2.6 EV/ EBITDA (x) 15.5 32.5 21.1 25.1 18.5 2.4 3.4 4.1 4.1 3.9 22.3 38,729 30,914 22,928 27,320 35,322 Total shareholders' equity 41,733 33,889 26,003 30,494 38,597 Total current liabilities 41,045 37,678 49,685 51,477 55,593 Total debt 49,013 63,950 53,950 48,950 43,950 (357) (633) (633) (633) (633) 32,729 4,260 4,260 4,260 4,260 Other non-current liabilities Total liabilities 122,431 105,256 107,263 104,054 103,171 Total equity & liabilities 164,163 139,144 133,266 134,549 141,767 Net fixed assets 52,156 53,839 54,278 54,578 54,678 112,008 85,306 78,988 79,971 87,090 70,963 47,628 29,303 28,494 31,497 Working capital US - base business India West EU RoW 250 200 150 100 50 0 Q3FY15 Reserves & surplus 2,117 Q2FY15 2,117 Q1FY15 2,117 Q5CY13 2,117 Deferred tax liabilities FY17E Q4CY13 2,115 164,163 139,144 133,266 134,549 141,767 Shareholding pattern Cash flow statement CY12 FY14 FY15E FY16E FY17E 11,865 Pre-tax profit 14,148 (2,053) 5,858 7,351 Depreciation 3,202 4,762 4,061 4,200 4,400 Chg in Working capital (1,555) (7,241) 10,213 (2,410) (4,592) Total tax paid (2,939) (3,314) (9,977) (1,470) (2,373) 101 (33,833) (2,377) - - 7,777 7,671 9,300 (6,445) (4,500) (4,500) (4,500) 8,172 (48,125) 3,277 3,171 4,800 Operating cash Inflow 12,957 (41,680) Capital expenditure (4,786) 192 4,106 Capital raised/(repaid) Net chg in cash 13.7 Adj. EPS (Rs) Q3CY13 Paid-up capital Misc FY14 FY15E FY16E FY17E 21.5 (25.8) (15.7) Q2CY13 FY14 FY15E FY16E Dividend (incl. tax) CY12 Reported EPS (Rs) Q1CY13 CY12 Debt raised/(repaid) Year to 31 Dec Revenue trend across key markets As on 31 Dec (Rs m) Chg in investments Valuations EV/ CE (x) Note* :15 Months Free cash flow (a+b) 27.2 (45.0) 14,148 Ext ord. Items & others 7.4 20.5 6.8 Pre-tax profit Non-recurring items 5.0 30.7 (14.5) (14.1) 2,732 Depreciation Profit after tax (3.9) RoE (%) Q4CY12 Net interest Year to 31 Dec (Rs m) FY14 FY15E FY16E FY17E 114,497 Other income Total assets CY12 (17.5) 20.5 EBITDA Total current assets Year to 31 Dec 6.6 % growth Operating expenses FY14* Q3CY12 Net sales CY12 - - - 14,937 (10,000) 68 (5,000) (5,000) 5 2 - - - (1,389) (1,389) (1,389) (1,389) (1,389) 4,283 3,999 - (0) - 15,368 (30,508) (8,112) (3,218) (1,590) 4 | IDFC SECURITIES Public & Others 10.0% Foreign 15.0% Institutions 8.4% Promoters 63.4% Nonpromoter corporate holding 3.3% As of September 2014 28 January 2015 Ranbaxy Labs – Q3FY15 result Disclaimer This document has been prepared by IDFC Securities Ltd (IDFC SEC). IDFC SEC is a full-service, integrated investment banking, and institutional broking group. There are no material disciplinary actions taken against IDFC SEC. Details of associates of IDFC SEC are attached as annexure. This document does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, the opinions and information in this report are subject to change without notice and IDFC SEC, its subsidiaries and associated companies, their directors and employees (“IDFC SEC and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent IDFC SEC and affiliates from doing so. Thus, the opinions expressed herein should be considered those of IDFC SEC as of the date on this document only. We do not make any representation either express or implied that information contained herein is accurate or complete and it should not be relied upon as such. The information contained in this document has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The investment discussed or views expressed in the document may not be suitable for all investors. Investors should make their own investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved) and investment decisions based upon their own financial objectives and financial resources. Investors assume the entire risk of any use made of the information contained in the document. Investments in general involve some degree of risk, including the risk of capital loss. Past performance is not necessarily a guide to future performance and an investor may not get back the amount originally invested. Foreign currency-denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value or the price of, or income derived from, the investment. In addition, investors in securities, the values of which are influenced by foreign currencies, effectively assume currency risk. Affiliates of IDFC SEC may have issued other reports that are inconsistent with and reach different conclusions from, the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject IDFC SEC and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to a certain category of investors. Persons in whose possession this document may come are required to inform themselves of, and to observe, such applicable restrictions. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. IDFC SEC and affiliates, their directors, officers, and employees may from time to time have positions in, purchase or sell, or be materially interested in any of the securities mentioned or related securities. IDFC SEC and affiliates may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall IDFC SEC, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind including but not limited to any direct or consequential loss or damage, however arising, from the use of this document. Any comments or statements made herein are those of the analyst and do not necessarily reflect those of IDFC SEC and affiliates. This document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. IDFC SEC will not treat recipients as customers by virtue of their receiving this report. IDFC Capital (USA) Inc. has reviewed the report and, to the extent that it includes present or past information, it is believed to be reliable, although its correctness cannot be assured. The analyst certifies that all of the views expressed in this research report accurately reflect his/her personal views about any and all of the subject issuer(s) or securities. The analyst certifies that no part of her compensation was, is, or will be directly or indirectly related to the specific recommendation(s) and/or views expressed in this report. Additional Disclosures of interest: Unless specifically mentioned in Point No. 9 below: 1. The Research Analyst(s), IDFC Sec, Associate of Analyst or his relative does not have any financial interest in the company(ies) covered in this report. 2. The Research Analyst, IDFC SEC or its associates or relatives of the Research Analyst affiliates collectively do not hold more than 1% of the securities of the company (ies) covered in this report as of the end of the month immediately preceding the distribution of the research report. 3. The Research Analyst, his associate, his relative and IDFC SEC do not have any other material conflict of interest at the time of publication of this research report. 4. The Research Analyst, IDFC SEC and its associates have not received compensation for investment banking or merchant banking or brokerage services or for any other products or services from the company(ies) covered in this report, in the past twelve months. 5. The Research Analyst, IDFC SEC or its associates have not managed or co-managed in the previous twelve months, a private or public offering of securities for the company (ies) covered in this report. 6. IDFC SEC or its associates have not received compensation or other benefits from the company(ies) covered in this report or from any third party, in connection with the research report. 7. The Research Analyst has not served as an Officer, Director or employee of the company (ies) covered in the Research report. 8. The Research Analyst and IDFC SEC has not been engaged in market making activity for the company(ies) covered in the Research report. 9. Details IDFC SEC , Research Analyst and its associates pertaining to the companies covered in the Research report: Sr. No. 1. 2. 3. 4. 5. Particulars Yes / No. Whether compensation has been received from the company(ies) covered in the Research report in the past 12 months for investment banking transaction by IDFC SEC Whether Research Analyst, IDFC SEC or its associates or relatives of the Research Analyst affiliates collectively hold more than 1% of the company(ies) covered in the Research report No. No Whether compensation has been received by IDFC SEC or its associates from the company(ies) covered in the Research report No IDFC SEC or its affiliates have managed or co-managed in the previous twelve months a private or public offering of securities for the company(ies) covered in the Research report Research Analyst, his associate, IDFC SEC or its associates have received compensation for investment banking or merchant banking or brokerage services or for any other products or services from the the company(ies) covered in the Research report, in the last twelve months No No Explanation of Ratings: 1. Outperformer 2. Neutral 3. Underperformer : : : More than 5% to Index Within 0-5% (upside or downside) to Index Less than 5% to Index Copyright in this document vests exclusively with IDFC Securities Ltd. 5 | IDFC SECURITIES 28 January 2015 Ranbaxy Labs – Q3FY15 result Annexure Associates of IDFC Securities Limited Sr. No. Name of Company Category Non Banking Finance Company, SEBI registered Merchant Banker, SEBI registered Debenture Trustee 1. IDFC Ltd. 2. IDFC Capital (USA) INC. Subsidiary 3. IDFC Capital (Singapore) Pte. Ltd. Subsidiary Fund Manager 4. IDFC Securities Singapore Pte. Ltd. Subsidiary Dealing in Securities 5. IDFC Fund of Funds Limited Subsidiary Sponsor Investments 6 | IDFC SECURITIES Parent Nature of business Broker Dealer registered with FINRA 28 January 2015 Ranbaxy Labs – Q3FY15 result www.idfc.com Analyst Sector/Industry/Coverage E-mail Tel.+91-22-6622 2600 Anish Damania Shirish Rane Co-CEO - IDFC Securities, Head - Institutional Equities; Strategy Head of Research; Construction, Power [email protected] [email protected] Prakash Joshi Oil & Gas, Metals, Mining [email protected] 91-22-662 22564 Nitin Agarwal Pharmaceuticals, Real Estate, Agri-inputs [email protected] 91-22-662 22568 91-22-6622 2522 91-22-662 22575 Hitesh Shah IT Services & Telecom [email protected] 91-22-662 22565 Manish Chowdhary Financials [email protected] 91-22-662 22563 Bhoomika Nair Engineering, Cement, Power Equipment, Logistics [email protected] 91-22-662 22561 Ashish Shah Construction, Power [email protected] 91-22-662 22560 Deepak Jain Vijayaraghavan G Automobiles, Auto ancillaries Midcaps [email protected] [email protected] 91-22-662 22562 91-22-662 22690 Rohit Dokania Media & Entertainment [email protected] 91-22-662 22567 Abhishek Gupta Telecom, IT services [email protected] 91-22-662 22661 Mohit Kumar, CFA Construction, Power [email protected] 91-22-662 22573 Param Desai Pharmaceuticals, Real Estate, Agri-inputs [email protected] 91-22-662 22579 Sameer Narang Strategy, Economy [email protected] 91-22-662 22566 Probal Sen Oil & Gas [email protected] 91-22-662 22569 Saumil Mehta Metals, Mining [email protected] 91-22-662 22578 Harit Kapoor FMCG, Retail, Alcoholic Beverages [email protected] 91-22-662 22649 Sameer Bhise Financials [email protected] 91-22-662 22635 Abhishek Ghosh Engineering, Cement, Power Equipment, Logistics [email protected] 91-22-662 22658 Saksham Kaushal Automobiles, Auto ancillaries [email protected] 91-22-662 22529 Dharmendra Sahu Database Analyst [email protected] 91-22-662 22580 Equity Sales/Dealing Designation E-mail Ashish Kalra Managing Director, Sales [email protected] Tel.+91-22-6622 2500 91-22-6622 2525 Rajesh Makharia Director, Sales [email protected] 91-22-6622 2528 Palak Shah SVP, Sales [email protected] 91-22-6622 2696 Varun Saboo VP, Sales [email protected] 91-22-6622 2558 Arati Mishra VP, Sales [email protected] 91-22-6622 2597 Hemal Ghia VP, Sales [email protected] 91-22-6622 2533 Tanvi Dixit AVP, Sales [email protected] 91-22-6622 2595 Nirav Bhatt AVP, Sales [email protected] 91-22-6622 2681 Chandan Asrani Manager, Sales [email protected] 91-22-6622 2540 Sneha Baxi Manager, Sales [email protected] 91-22-6622 2537 Suryakant Bhatt Director & Head - Sales trading [email protected] 91-22-6622 2693 Mukesh Chaturvedi Director, Sales trading [email protected] 91-22-6622 2512 Viren Sompura SVP, Sales trading [email protected] 91-22-6622 2527 Rajashekhar Hiremath SVP, Sales trading [email protected] 91-22-6622 2516 Alok Shyamsukha VP, Sales trading [email protected] 91-22-6622 2523 Suketu Parekh VP, Sales trading [email protected] 91-22-6622 2674 IDFC Securities Naman Chambers, C-32, 7th floor, G- Block, Bandra-Kurla Complex, Bandra (East), Mumbai 400 051 INDIA IDFC Capital (USA) Inc, Regus Business Centre 600 Third Avenue, 2nd Floor, New York,10016 Tel: +91 22 6622 2600 Tel: +1 646 571 2303 Our research is also available on Bloomberg and Thomson Reuters 7 | IDFC SECURITIES For any assistance in access, please contact [email protected] 28 January 2015

© Copyright 2026