Page 01 - Arab Times

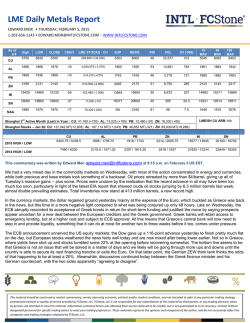

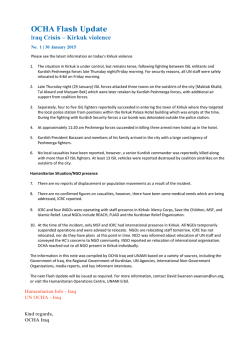

KFH names 80 winners of iPhone 6 Plus in 11 draws Kuwait Finance House (KFH) has named 11 winners of iPhone 6 plus in the eleventh and last draw of new promotional campaign themed “Win iPhone 6 Plus daily for 80 days”. Thus, the total number of winners in the 11 draws has reached 80 people. The winners are: Diaa Albader, Yousef Alshayea, Haya Alshumari, Munira ALkooh, Aisha Alsaedi, Amthal Alsayer, Waleed Alyasin, Adel Aljalibi, Abdullah Alajmi, Mohammad Aladwani and Abdulrahman Alsaeed. The campaign launched for banking cards A flyer of KFH campaign. Market Movements AUSTRALIA JAPAN PHILIPPINES - All Ordinaries Nikkei All Shares Change +10.40 +68.17 +38.12 clients to encourage them use KFH credit and prepaid banking cards and ATM cards while making purchases. It enhanced the added value of the cards, serves the market movement where it facilitates purchases, and boosts sales. It also includes daily prizes when using KFH credit and prepaid banking cards in making purchases in Kuwait and overseas. Moreover, the campaign allowed KFH banking cards holders one chance to enter a draw to win daily prizes (iPhone 6 Plus) for every KD 10 purchase made in Kuwait and overseas using the banking cards, while only purchases made by ATM cards overseas can be valid for the draw. Chances of winning increase when the value of purchases increases. It’s worth noting launching such campaigns is part of KFH’s efforts to reward its clients and grant them additional value; thus cementing the clients’ satisfaction through using the banking cards, in addition to enhancing the bank’s presence and market share in this pivotal banking sector. The campaign also encourages the usage of banking cards as a method of payment. 30-01-2015 Closing pts 5,551.60 17,674.30 4,465.28 INDIA S. KOREA HONG KONG GERMANY FRANCE EUROPE - Sensex KRX 100 Hang Seng DAX CAC 40 Euro Stoxx 50 Change -498.82 -19.24 -88.80 -43.55 -27.18 -20.39 Business Closing pts 29,182.95 4,022.31 24,507.05 10,694.32 4,604.25 3,351.44 KSE monthly report Bayan Investment Co Price index edges 0.56 pct higher in January K uwait Stock Exchange (KSE) ended January in the green zone. The Price Index closed at 6,572.26 points, up by 0.56% compared to the closings of the month before, the Weighted Index increased by 0.67% after closing at 441.84 points, whereas the KSX-15 Index closed at 1,072.70 points increasing by 1.20%. Furthermore, last month’s average turnover decreased by 10.23%, compared to the preceding month, reaching K.D 26.40 million, whereas trading volume average was 286.85 million shares, recording increase of 14.58%. The stock market indicators were able to increase, supported by the purchasing power that included many stocks of large-cap and small-cap, especially of declined prices during the previous months, among traders’ optimism for the listed companies annual results, after the positive data disclosed by some companies and banks during the current month. On the contrary, the stock market was affected by the profit collection operations, as such were able to lighten the market gains and limit its increases in some sessions, however did not succeed in pushing it to close in the red zone on a monthly level. Also, the stock market witnessed during the first few sessions of the month some random selling operations on many of the listed stocks, as a result to the worry state of many traders due to the oil prices drop crisis, which caused the three indices to decline rapidly, before it were able to compensate its losses thereafter, affected by the relative stability of the oil prices, in addition to the companies’ results which disclosed positive financial data for the year end 2014, to positively affect the traders’ morale, and caused a purchasing trend to appear on many stocks, especially on stocks of previous declines, First contraction since 2006 Gaza war pushes Palestinian economy into recession: IMF WASHINGTON, Jan 30, (AFP): The war between Israel and Gaza drove the Palestinian economy of Gaza and the West Bank into its first contraction since 2006, the International Monetary Fund said Thursday. While the West Bank managed a 4.5 percent expansion last year, Gaza’s economic activity declined by about 15 percent, the IMF said, linking it to Israel’s harsh bombing and shelling of the Gaza enclave and slow progress on rebuilding. Overall, the contraction amounted to about one percent of gross domestic product. “Economic activity contracted in 2014, following the war in Gaza in the summer and mounting political tensions in the West Bank and East Jerusalem,” the IMF said. After a mission to assess the state of the economy, IMF said a strong recovery this year was also in doubt due to Israel’s continued refusal to hand over some $127 million worth of clearance revenues due to the Palestinian Authority on goods imported into the West Bank and Gaza. “These represent about twothirds of net revenues and are essential to the PA’s budget and to the Palestinian economy,” it said. “Reduced wage payments and other public spending cuts necessitated by the suspension of clearance revenues in the presence of financing constraints will likely cause a sharp reduction in private consumption and investment.” Moreover, it added, reconstruc- tion in Gaza is moving slowly, partly due to a lack of real reconciliation among factions in Palestinian politics, and partly due to donors not following through on their pledges to support rebuilding. “Real GDP in 2015 is therefore set to rise only modestly, with a pickup in Gaza from a low base and a drop of nearly two percent in the West Bank, although the sharp fall in oil prices provides some relief to energy consumers.” The turmoil has left unemployment very high in both areas, 19 percent in the West Bank and 41 percent in Gaza. Israel’s withholding the revenues will force the government to cut back spending and investment, keeping the medium-term growth picture only modest, the IMF said. The IMF praised the Palestinian Authority for keeping its fiscal deficit under control, but said that even assuming that Israel releases the funds, a large fiscal shortfall is expected. “In this volatile environment, safeguarding financial stability will remain a priority ..... Strong efforts by the PA can only go so far to contain the crisis for a few months. The situation could become untenable, with a growing risk of social unrest and strikes that could lead to political instability.” “These serious risks could be mitigated if Israel quickly resumed transfers of clearance revenue and donors front-loaded their aid.” headed by the large-cap and bluechip stocks, which received a large portion of the traded cash liquidity in the market. On the other hand, the stock mar- ket is witnessing a general state of watch and cautious in trading, due to the investors’ wait for the listed companies’ disclosure of its 2014 financial results, which is expected to be announced during the coming weeks. Sectors’ Indices Six of KSE’s sectors ended last month in the green zone, while the other six recorded declines. Last month’s highest gainer was the Industrial sector, achieving 3.58% growth rate as its index closed at 1,108.71 points. Whereas, in the second place, the Telecommunications sector’s index closed at 583.80 points recording 2.34% increase. The Banks sector came in third as its index achieved 1.50% growth, ending the month at 1,020.20 points. On the other hand, the Basic Materials sector headed the losers list as its index declined by 4.03% to end the month’s activity at 1,085.76 points. The Health Care sector was second on the losers’ list, which index declined by 1.92%, closing at 922.22 points, followed by the Iraq adopts revised 2015 budget constrained by falling oil prices Crude price assumed at $56 pb BAGHDAD, Jan 30, (RTRS): Iraq’s parliament approved a budget on Thursday worth 119 trillion Iraqi dinars (US$105 billion), made possible by improved ties between Baghdad and the autonomous Kurdish region but constrained by plunging global oil prices. Islamic State, which swept across northern Iraq last summer, prompting US-led air strikes. The budget, revised to trim the expected price of oil to $56 a barrel, down from the $70 originally assumed, foresees a 25 trillion dinar deficit. The adjusted oil forecast may have satisfied some MPs who saw previous estimates as unrealistic, but others remain critical. Passage represents a victory for Prime Minister Haider al-Abadi, who “I don’t know if they are deceiving themselves or the Iraqi people by saying fears lower oil revenues could hurt Iraq’s military campaign against the price of oil is $56,” MP Kadhim al-Saidi told reporters before voting began. Brent crude has been trading just below $50 this week, down from $115 in June. The budget seals a financial arrangement between Baghdad and the Kurdish region that will see the Kurds export 300,000 barrels per day of oil from Kirkuk and 250,000 bpd from their own fields in return for a 17 percent share of the budget. Opponents decried the size of Kurdistan’s share as unfair. “There is no legal formulation or constitutional cover for this agreement. It appears the political blocs ... robbed the Iraqi people,” said Saidi. For Abadi, the budget is a sign of growing goodwill between Baghdad and the Kurdish region as they both fight Islamic State. Surged Kurdish peshmerga forces rolled back the radical jihdaists after they surged across the Syrian border last summer, threatening the regional capital Arbil. But Islamic State, holding large swaths of Iraq’s north and west, remains a threat to the country’s A file photo shows Qatar Airways taking delivery of its first Airbus A380 at Hamad International Airport in Doha. Qatar Airways security and unity. Defence alone is said on Jan 30, 2015 that it had purchased almost 10 percent of IAG, parent of British Airways and Spanish carrier Iberia, expected to take up 20 percent of the second European entry by a Gulf carrier. (AFP) 2015 budget expenditure. In addition, the state must ensure the payment of its civil servants, with more than 5 million state employees. It is withholding 15 percent of highShares in IAG, which have risen by France and Lufthansa,” he said. LONDON, Jan 30, (RTRS): Qatar Airways has bought a 9.99 percent 44 percent in the last three months, IAG Chief Executive Willie Walsh level government salaries, which are stake in International Consolidated were trading up 0.3 percent at 565.5 said in a statement: “We will talk to meant to be paid back when the Airlines Group (IAG) worth around pence. They earlier reached 590 pence, them about what opportunities exist to country is more financially stable. Nechirvan Barzani, prime minister 1.15 billion pounds ($1.7 billion), the highest level since the group was work more closely together and further building closer ties with the owner of formed four years ago. IAG’s ambitions”. of the Kurdish region, praised the its partners British Airways and Iberia IAG, a leading transatlantic carrier, 2015 budget but pointed out the counAnalyst Mark Irvine-Fortescue at in the oneworld alliance. brokerage Jefferies said Qatar’s invest- is trying to buy Irish airline Aer Lingus try remains in dire financial straits. Qatar’s national airline said it would ment was a strong endorsement of IAG for $1.5 billion, a deal that will increase “It is very good, but unfortunately look to strengthen commercial ties with and the tie-up would create opportuni- its take-off and landing slots at its full- (Baghdad) doesn’t have money,” he the European carrier and may consider ties in southeast Asia, India and the to-capacity London Heathrow hub. told Reuters. increasing its stake over time, although Middle East, where Qatar has an extenQatar Airways, owned by the counThe government is expected to it was not currently intending to exceed sive network. try’s sovereign wealth fund, has com- finance the deficit through Treasury 9.99 percent. peted with regional rivals Emirates and bills, government bonds and borrowCapacity “IAG represents an excellent opporEtihad Airways to become major globHe said huge capacity growth from al carriers. Its visibility in Europe has ing from local banks. tunity to further develop our In addition, Iraq plans on drawing Westwards strategy,” Qatar Airways Middle East carriers such as Qatar, been strengthened by a sponsorship Chief Executive Akbar Al Baker said Etihad Airways and Emirates was put- deal with Spanish soccer club funds from the International Monetary Fund through its Special on Friday, referring to its aim of ting pressure on the hubs of Europe’s Barcelona. carriers. expanding in western markets. It joined oneworld in 2013, becom- Drawing Right, and will introduce a “This strategy could be seen as a ing the first Gulf airline in enter into a tax on imported cars and cellular Non-European shareholders of IAG including Qatar Airways are subject to defensive ‘if you can’t beat them, join global alliance, which allows airlines to telephone SIM cards and the Internet. Kuwait has agreed to defer for one an overall cap on ownership as a result them’ move and should in time improve team up via code-sharing agreements of the requirement for EU airlines to be IAG’s structural and competitive posi- to boost the number of flights they year Iraq’s reparations for its 1990 invasion of its neighbour. majority owned by EU shareholders. tioning, possibly at the expense of Air offer. Turkish December trade deficit in line with expectations: data Qatar Airways takes $1.7b stake in BA ISTANBUL, Jan 30, (RTRS): Turkey’s trade deficit, the chief contributor to a large current account deficit seen as the economy’s main weakness, shrank 14.6 percent to $8.51 billion in December, in line with expectations. In 2014 as a whole, the deficit narrowed 15.4 percent to $84.51 billion, data from the Turkish Statistics Institute showed on Friday. Turkish markets largely shrugged off the data but the lira hovered close to a record low hit on Thursday on expectations the central bank will cut interest rates at an extraordinary policy meeting next week. The central bank cut interest rates earlier this month by 50 basis points, facing renewed criticism from key government figures for not cutting it more sharply ahead of a general election in June. On Tuesday, Governor Erdem Basci said that if the January inflation figures due to be released on Feb. 3 showed a sharp fall, then the bank could convene a monetary policy meeting (MPC) as early as the following day. Analysts say the lira was also under pressure from the U.S. Federal Reserve’s potential rate hikes for later this year and a politicisation of monetary policy could further add downward pressure on the Turkish currency. “The central bank governor’s warnings that they may cut interest rates in an unscheduled meeting within next week hit the Turkish Lira to a record low against USD,” Oyak Securities said in a research note. The lira traded at 2.4150 against the dollar at 0927 GMT, versus 2.4036 late on Thursday and a record low of 2.4240. The main equities index gained 0.28 percent to trade at 88,808.17 points by 0921 GMT, while the emerging markets index was down by 0.62 percent. The benchmark 10-year government bond yield was at 7.09 percent versus 7.06 percent on Thursday. Consumer Services sector, as its index closed at 1,069.65 points at a loss of 1.10%. Sectors’ Activity The Financial Services sector dominated total trade volume during last month with 2.36 billion shares changing hands, representing 43.28% of the total market trading volume. The Real Estate sector was second in terms of trading volume as the sector’s traded shares were 24.19% of last month’s total trading volume, with a total of 1.32 billion shares. On the other hand, the Financial Services sector’s stocks where the highest traded in terms of value; with a turnover of K.D. 112.94 million or 22.52% of last month’s total market trading value. The Banking sector took the second place as the sectors last month turnover of K.D. 110.62 million represented 22.06% of the total market trading value.

© Copyright 2026

![Current appeal [PDF]](http://s2.esdocs.com/store/data/000456387_1-84443a4282546a8fcd8c29f2bdd10a65-250x500.png)