Weekly Market Report for the Week Ended 30-01-2015

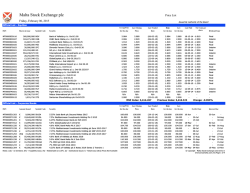

WEEKLY REPORT STOCK MARKET REPORT FOR JANUARY 30TH, 2015 EQUITIES A turnover of 2.210 billion shares worth N28.960 billion in 19,495 deals were traded this week by investors on the floor of The Exchange in contrast to a total of 2.119 billion shares valued at N25.941 billion that exchanged hands last week in 21,044 deals. The Financial Services Industry (measured by volume) led the activity chart with 1.361 billion shares valued at N10.215 billion traded in 11,030 deals; thus contributing 61.58% and 35.27% to the total equity turnover volume and value respectively. The Oil & Gas Industry followed with a turnover of 439.582 million shares worth N8.402 billion in 1,723 deals. The third place was occupied by the Consumer Goods Industry with 236.003 million shares worth N7.880 billion in 3,464 deals. Trading in the Top Three Equities namely- Oando Plc, Fidelity Bank Plc, and Access Bank Plc (measured by volume) accounted for 889.737 million shares worth N9.095 billion in 2,344 deals, contributing 40.27% and 31.40% to the total equity turnover volume and value respectively. Equity Turnover - Last 5 days Date Deals Turnover Volume Turnover Value (N) Traded Stocks Advanced Stocks Decline d Stocks Unchange d Stocks 26-Jan-15 3,568 263,858,146 3,874,135,692.02 92 22 17 53 27-Jan-15 4,346 468,181,883 4,675,457,725.98 112 25 28 59 28-Jan-15 3,892 242,766,630 3,670,624,465.83 100 23 18 59 29-Jan-15 3,889 917,084,798 11,988,298,700.10 95 19 26 50 30-Jan-15 3,800 317,667,583 4,751,718,276.68 105 15 33 57 Distribution of Quantity Traded FINANCIAL SERVICES OIL AND GAS CONSUMER GOODS OTHERS 8% 11% 20% For Further Inquiries Contact: Market Operations Department 61% Page 1 WEEKLY REPORT ETPs Also traded during the week were a total of 42,109 units of Exchange Traded Products (ETPs) valued at N1.197 million executed in 31 deals compared with a total of 256 units valued at N317,430.39 transacted last week in 21 deals. (See summary in the table below). S/N Security Deals Volume Value 1 LOTUSHAL15 12 38,318 356,884.09 2 VETGRIF30 10 3,455 53,261.75 3 NEWGOLD 9 336 786,527.00 TOTAL 31 42,109 1,196,672.84 RETAIL BONDS There was no activity recorded in the debt board this week. INDEX MOVEMENT The NSE All-Share Index and Market Capitalization depreciated by 0.84% to close on Friday at 29,562.07 and N9.847 trillion respectively. Similarly, all indices finished lower during the week with exception of the NSE Lotus Islamic Index and NSE Industrial Goods Index that rose by 0.88% and 1.14% respectively, while NSE ASeM Index closed flat. (See summary of Index movements in the table below). WEEK OPENING WEEK CLOSE WEEKLY CHANGE WtD MtD QtD YtD % Change The NSE All-Share Index (ASI) 29,812.05 29,562.07 -249.98 -0.84 -14.70 -14.70 -14.70 NSE 30 Index 1,347.79 1,334.09 -13.70 -1.02 -14.66 -14.66 -14.66 NSE Banking Index 307.02 297.93 -9.09 -2.96 -15.22 -15.22 -15.22 NSE Insurance Index 144.53 141.60 -2.93 -2.03 -5.38 -5.38 -5.38 NSE Consumer Goods Index 785.63 781.84 -3.79 -0.48 -13.47 -13.47 -13.47 NSE Oil/Gas Index 357.22 357.07 -0.15 -0.04 -6.06 -6.06 -6.06 NSE Lotus II 1,931.05 1,948.04 16.99 0.88 -13.18 -13.18 -13.18 NSE Industrial Goods Index 1,894.37 1,915.93 21.56 1.14 -10.45 -10.45 -10.45 NSE ASeM Index 1,213.36 1,213.36 0.00 0.00 0.00 0.00 0.00 For Further Inquiries Contact: Market Operations Department Page 2 WEEKLY REPORT The NSE All-share and NSE-30 Indices Week Ended January 30th, 2014 30,000.00 1,355.00 29,900.00 1,350.00 29,800.00 1,345.00 29,700.00 1,340.00 29,600.00 1,335.00 29,500.00 1,330.00 29,400.00 1,325.00 29,300.00 1,320.00 ASI NSE-30 NSE-30 SUMMARY OF PRICE CHANGES Twenty-eight (28) equities appreciated in price during the week lower than thirty-five (35) equities of the preceding week. Forty-one (41) equities depreciated in price higher than thirty-one (31) equities of the preceding week, while one hundred and twenty-seven (127) equities remained unchanged lower than one hundred and thirty (130) equities recorded in the preceding week. Top 10 Price Gainers Company DANGOTE SUGAR REFINERY PLC P. Z. INDUSTRIES PLC IKEJA HOTEL PLC THE OKOMU OIL PALM COMPANY PLC COSTAIN (WEST AFRICA) PLC PRESCO PLC CAP PLC ECOBANK TRANSNATIONAL INCORPORATED NPF MICRO FINANCE BANK PLC UACN PROPERTY DEVELOPMENT CO. PLC For Further Inquiries Contact: Market Operations Department Open 5.53 25.00 2.70 24.46 0.65 29.63 36.00 15.05 0.81 8.60 Close Gain (N) 6.82 1.29 29.64 4.64 3.04 0.34 27.45 2.99 0.72 0.07 32.66 3.03 38.75 2.75 16.18 1.13 0.87 0.06 9.13 0.53 % Change 23.33 18.56 12.59 12.22 10.77 10.23 7.64 7.51 7.41 6.16 Page 3 WEEKLY REPORT Top 10 Price Decliners Company R. T. BRISCOE (NIG.) PLC DIAMOND BANK PLC MAY & BAKER NIGERIA PLC ZENITH INTERNATIONAL BANK PLC CHAMPION BREWERIES PLC UBA CAPITAL PLC N.E.M INSURANCE CO.(NIG) PLC FIDELITY BANK PLC SKYE BANK PLC STERLING BANK PLC Open 0.70 4.00 1.58 17.50 6.08 1.55 0.57 1.34 2.13 2.47 Close Loss (N) 0.61 -0.09 3.58 -0.42 1.44 -0.14 16.01 -1.49 5.62 -0.46 1.44 -0.11 0.53 -0.04 1.25 -0.09 1.99 -0.14 2.32 -0.15 % Change -12.86 -10.50 -8.86 -8.51 -7.57 -7.10 -7.02 -6.72 -6.57 -6.07 NEW LISTINGS • A total of 43,024 units at N34,541.45 per unit of Allan Gray Africa Fund were listed as Memorandum Listing at the Exchange on January 30th, 2014. FINANCIAL NEWS UNAUDITED ACCOUNT JOHN HOLT PLC: FIRST QUARTER (OCT-DEC,2014) FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31 DECEMBER, 2014- ‘000 Revenue 2014 N536,000 2013 N622,000 Loss After Tax 2014 (N246,000) 2013 (N96,000) SEVEN-UP BOTTLING COMPANY PLC: UNAUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31 DECEMBER, 2014 - ‘000 Revenue 2014 N59,829,956 2013 N54,954,328 Profit After Tax 2014 N4,541,820 2013 N3,917,647 PZ CUSSONS NIGERIA PLC: UNAUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 30 NOVEMBER, 2014 - ‘000 Revenue 2014 N 31,659,965 2013 N 32,460,952 Profit After Tax 2014 N1,441,187 2013 N 2,317,797 GUINNESS NIGERIA PLC: UNAUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31 DECEMBER, 2014 - ‘000 Revenue 2014 N 55,267,240 2013 N 52,757,566 Profit After Tax 2014 N 3,398,591 2013 N 4,996,890 AUDITED ACCOUNT VONO PRODUCTS PLC: AUDITED FINANCIAL STATEMENTS FOR THE PERIOD ENDED 31 DECEMBER, 2014 - ‘000 Revenue 2014 N215,149 2013 N192,161 Loss After Tax 2014 (N400) 2013 (N5,600) For Further Inquiries Contact: Market Operations Department Page 4 WEEKLY REPORT OTHER MARKET NEWS EVANS MEDICALS PLC: Appointment of new Directors: Mr Lawrence Fubara Anga and Mr Adegboyega Adeyinka Ademiluyi - Evans Medical Plc notified The Nigerian Stock Exchange that at its Board of Directors meeting held on Monday, 5 January 2015, Mr Lawrence Fubara Anga and Prince Adegboyega Adeyinka Ademiluyi were appointed Directors of Evans Medical Plc with effect from 24 November 2014. The company also notified The Exchange of the resignation of Mr Bolaji Odunsi from its Board with effect from 15 August 2014. Lawrence Fubara Anga obtained a law degree (LLB) from Churchill College, Cambridge University, England in 1983 before obtaining his MA also in Law from Cambridge University, England in 1988. A lawyer and political economist, Fubara is also a chartered tax practitioner (FCTI) and a chartered arbitrator (MCIArb). He is a founding partner in the law firm of AELEX, Legal Practitioners & Arbitrators; and Heads the firm’s Transportation, Banking and Financial Services Practice. Prior to this, he was a partner at the firms of Anga & Emuwa, L.F. Anga & Co. and George Etomi & Partners. He has a strong multi-disciplinary background in Law, Economics, Management and Fiscal Policy. He was between 2006 and 2010 the Chairman, Capital Market Solicitors Association and Chairman of its Strategy and Remuneration Committee and acts as counsel and advises several entities involved in aviation. He is the Chairman, Aviation Committee Section on Business Law, Nigerian Bar Association and the founder of the Aviation Law Society. He has an active Business Fraud and AntiCorruption practice advising clients on various aspects of FCPA compliance, anti-money laundering and anti-bribery laws in Nigeria. He is an active member of the Section of Energy and Resources Law of the International Bar Association, the Section on Natural Resources and Energy Law of the American Bar Association, the UK Energy Lawyers Group, and the advisory Board of the Institute for Energy Law of the Centre for American and International Law, USA. Lawrence has written several articles both in local and international journals and papers and has attended several conferences. He has served on several committees and boards both locally and internationally and is currently the Vice Chairman, Board of the Trustees of the Investors’ Protection Fund of The Nigerian Stock Exchange. Prince Adegboyega A. Ademiluyi is CEO and Managing Director of a shipping and trading group with offices in Nigeria and the United Kingdom. The group includes, Ship and Shore Services, International Cargo Surveys Limited and Ghazi Shipping. He is a core, founding Director of the National Truck Manufacturing Limited, a Kano-based plant that assembles commercial vehicles. He has served as an Advisor and Chairman to several international business enterprises. Prince Ademiluyi received his early education in the United Kingdom and Nigeria and holds a B.Sc. in Economics and an MBA in Finance from Howard University, Washington D.C. Prior to venturing into private enterprise, he was the Petroleum Industry Shipping Co-ordinator and Export Manager for Total Nigeria Plc. For Further Inquiries Contact: Market Operations Department Page 5 WEEKLY REPORT The following are the present Directors of Evans Medical Plc sequel to the appointment of the two directors and resignation of Mr. Bolaji Odunsi.: • • • • • • • • • • • • Chief S.A. Edu – Chairman Chief O. Olaopa –Group Managing Director Mr V. Eburajolo, mni Mr M.A. Ajufo Mr Wale Oyenuga Mr Adeoye Adekunle Oyewo Mr Ahmad Ibrahim Damcida Mr Sola Ibrahim Ogunwale Mrs Titilope Bamidele Adeyemi Mrs Teniola Aluko Mr Lawrence Fubara Anga Prince Adegboyega Adeyinka Ademiluyi. VITAFOAM NIGERIA PLC: Delay in the Release of 2014 Audited Accounts - Vitafoam Nigeria Plc (“the Company”) notified The Nigerian Stock Exchange that there will be a delay in the release of the Company’s Audited Financial Statements for the year ended 30 September 2014 and the Unaudited Accounts for the first quarter ended 31 December 2014. Vitafoam explained that the delay is as a result of challenges associated with its ongoing migration from Sage Line 500 accounting software to the newly acquired Sage ERP X3 Package. The Company explains that the implementation of the new software has impacted the timelines previously set for the preparation and audit of the year end accounts. The Company is hopeful that the issues will be satisfactorily resolved as soon as possible. INTERNATIONAL ENERGY INSURANCE PLC: Removal of Directors - International Energy Insurance Plc notified The Nigerian Stock Exchange that following a resolution of the Board of Directors of the Company passed at its meeting held on 15 September 2014, Messrs Callistus Udalor and Tosayee Ogbomo were removed as Directors of the Company. The Company added that the decision will be ratified at its next Annual General Meeting. OANDO PLC: Change of Terms of Rights Issue - Oando Plc notified The Nigerian Stock Exchange that the Securities and Exchange Commission (SEC) has approved the change in the terms of its Rights Issue. Accordingly, the Rights Issue size, price and ratio has been revised from 2,217,265,184 ordinary shares of 50 kobo each at N22.00 per share (on the basis of one new share for every four ordinary shares held; 1 for 4) to 2,956,353,579 ordinary shares of 50 kobo each at N16.50 per share (on the basis of one new ordinary share for every three ordinary shares held; 1 for 3). Oando Plc states that the Rights Circular and the initial terms of the Rights Issue remain valid during the acceptance/renunciation period and are only amended to the extent provided for in this notice. Shareholders who have already submitted their acceptance forms will not be required to submit new For Further Inquiries Contact: Market Operations Department Page 6 WEEKLY REPORT forms. However, shareholders who have not submitted their acceptance/renunciation forms are requested to complete the forms as is and in accordance with the instruction contained in the forms. Shareholders should note that the variation in the terms of the Rights Issue will not result in any change in the subscription amounts due from each shareholder, other than instances where there are rounding down approximations. Thus, any minimal surplus subscription funds that may accrue as a result of rounding down approximations will be refunded by the Registrars to the affected shareholders upon clearance of the basis of allotment by SEC. Similarly, shortfalls in subscription amounts as a result of rounding down approximations will be covered by the Company to ensure that no shareholder is worse off as a result of the change in the Rights Issue terms. ACCESS BANK PLC: Notice of Commencement of Rights Issue - Access Bank Plc (“the Bank”) notified The Nigerian Stock Exchange that the Securities and Exchange Commission (SEC) has approved the Bank’s Rights Issue of 7,627,639,636 ordinary shares of 50 kobo each at N6.90 per share. Acceptance List in respect of the Rights Issue will open from Monday 26 January 2015 and close on Wednesday 4 March 2015. Access Bank states that Rights Circulars will be mailed to all shareholders whose names appeared on the Bank’s Register of Members as at the close of business on Thursday 23 October 2014. UNITY BANK PLC: Appointment of Chairman and Vice Chairman - THOMAS A. ETUH, CHAIRMAN: Unity Bank Plc notified The Nigerian Stock Exchange of the appointment of Mr. Thomas A. Etuh and Alhaji Aminu Babangida as Chairman and Vice Chairman respectively effective 23 January 2015. Mr Thomas Etuh who was appointed Pioneer Vice Chairman of the Board of Directors, Unity Bank Plc on April 22, 2014 has varied experience, gained from over two decades of contribution to the public and private sectors of the economy, especially the Agric sector. An astute businessman and experienced entrepreneur, Mr Etuh has served as a Director in several companies in Nigeria and has chaired a number of board committees in Unity Bank including Finance and General Purpose Committee, Board Governance and Nominations Committee amongst others. Thomas studied Management, Banking and Public Administration at the Ahmadu Bello University, Zaria, Abubakar Tafawa Balewa University, Bauchi and University of Jos respectively. He holds a Post Graduate Diploma in Management from the Abubakar Tafawa Balewa University and is currently pursuing an MBA from the Business School, Netherlands. He has attended several local and international trainings and is an alumnus of the prestigious London Business School, University of Navarra, Barcelona, Spain, and the Lagos Business School. Thomas is a member of various professional bodies such as the Institute of Directors (IoD) and the Bank Directors Association of Nigeria (BDAN). ALHAJI AMINU BABANGIDA, VICE CHAIRMAN: Alhaji Aminu Babangida is an Entrepreneur and is a co-founder/Chief Executive Officer of Phoenix Energy, Abuja and Team Member of the El-Amin International School, Minna. He has also worked on the trading floor of Trafigura BV, London, UK. Babangida was appointed to the Board of Unity Bank Plc in 2011 where he has held Chairmanship and membership positions in a number of board committees including Credit Committee, Audit Committee, Information Technology & Strategy Committee, etc. For Further Inquiries Contact: Market Operations Department Page 7 WEEKLY REPORT He attended Regents Business School, London and Westminster Business School London where he obtained a BA in International Business and MA in International Business Management respectively. He is knowledgeable in the field of oil exploration. He is a member of the Institute of Directors (IoD) and the Bank Directors Association of Nigeria (BDAN) and has attended various local and international courses.. LAFARGE AFRICA PLC: Mandatory Tender Offer (MTO) by Lafarge Africa Plc to other Shareholders of Ashakacem Plc - Further to the official closure of the MTO of Ashakacem Plc on 23 January 2015, Capital Assets Limited has directed that Dealing Members should forward all duly executed MTO Acceptance Forms received from their clients to the Registrar’s office (address below) before 1.00 p.m. on Friday 30 January 2015. Cardinal Stone Registrars Limited 385, Herbert Macaulay Street Yaba Lagos SEPLAT PETROLEUM DEVELOPMENT COMPANY PLC: Statement Regarding Possible Combination with Afren Plc. - In accordance with the provisions of Section 10 of the Amended Listing Rules of the Nigerian Stock Exchange, Seplat Petroleum Development Company Plc. (“Seplat” or the “Company”) notified The Exchange of the announcement by Afren plc (“Afren”) dated 30 January 2015 relating to a Rule 2.6 extension. Seplat acknowledges that in accordance with Rule 2.6(a) of the UK City Code on Takeovers and Mergers (the “Code”), by no later than 5.00 pm on 30 January 2015, the Company was required to either announce a firm intention to make an offer under Rule 2.7 of the Code or announce that it does not intend to make an offer. The board of Afren has received the consent of the UK Takeover Panel (the “Panel”) for an extension to the deadline until 5.00 p.m. on 13 February 2015 to enable the parties to continue their ongoing discussions. By this time Seplat must either announce a firm intention to make an offer for Afren or announce that it does not intend to make an offer for Afren, in which case the announcement will be treated as a statement to which Rule 2.8 of the Code applies. Seplat notes that this new deadline can be extended with the consent of the Panel in accordance with Rule 2.6(c) of the Code. PHARMA DEKO PLC: RIGHTS TRADING - EXTENSION OF CLOSING DATE - The Securities and Exchange Commission (SEC) approved an extension of the Acceptance period of the above Rights issue exercise by two (2) weeks . Accordingly, the Offer which was earlier scheduled to close on Friday, January 30, 2015 would now close on Friday, February 13, 2015. For Further Inquiries Contact: Market Operations Department Page 8 WEEKLY REPORT STERLING BANK PLC: Appointment of Non-Executive Directors - Sterling Bank Plc. (‘’the Bank’’) notified The Nigerian Stock Exchange of the appointment of Mr Olaitan Kajero and Mrs Tairat Tijani as Non-Executive Directors on the Board of the Bank. Olaitan Kajero (Non-Executive Director): Holds a Bachelor of Science Degree in Chemistry from the University of Lagos and an MBA finance from Olabisi Onabanjo University, Ago Iwoye in Ogun State. He started his career as Finance and Admin Manager at Communication Associates of Nigeria Limited in 1997. He went on to serve as General Manager and Group Chief Operating Officer in Aircom Nigeria Limited between 2001 and 2006, where he was responsible for general business development and managing the day to day activities of the Company. He is presently the Managing Director of STB Building Society Limited, a position he held since 2006. Tairat Tijani (Non-Executive Director): Graduated from the Lancaster University with Honours in Accounting, Finance & Economics. She also graduated with a Distinction in MBA, International Business from the University of Birmingham. She is a member of the Association of Chartered Certified Accountants (ACCA) and the Institute of Chartered Secretaries & Administrators of Nigeria. Mrs Tijani has garnered significant experience as an operator in the Capital Market. She was formerly the Head, Capital Markets Division of FBN Capital (a subsidiary of FBN Holdings Plc.) For Further Inquiries Contact: Market Operations Department Page 9

© Copyright 2026