The total number of mortgages constituted on dwellings recorded in

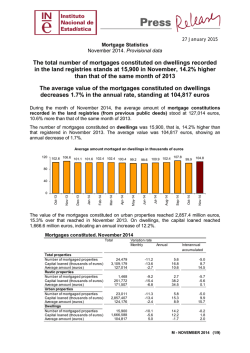

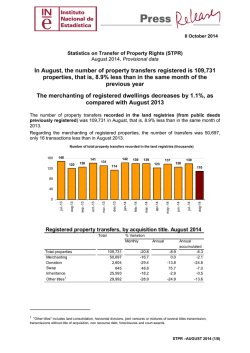

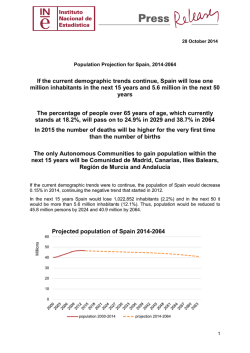

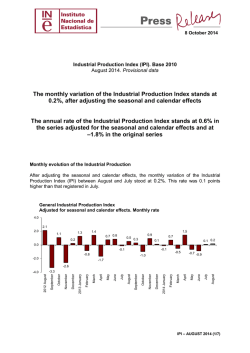

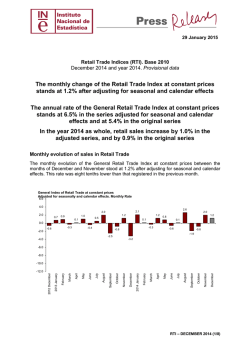

23 Decem ber 2014 Mortgage Statistics October 2014. Provisional data The total number of mortgages constituted on dwellings recorded in the land registries stands at 17,687 in October, 18.0% higher than that of the same month of 2013 The average value of the mortgages constituted on dwellings decreases 2.6% in the annual rate, standing at 99,866 euros During the month of October 2014, the average amount of mortgage constitutions recorded in the land registries (from previous public deeds) stood at 130,535 euros, 7.6% more than that of the same month of 2013. The number of mortgages constituted on dwellings was 17,687, that is, 18.0% higher than that registered in October 2013. The average value was 99,866 euros, showing an annual decrease of 2.6%. 97.5 102.6 106.6 101.1 101.6 102.4 102.4 100.4 99.2 98.6 Jun-14 120 May-14 Average amount mortaged on dwellings in thousands of euros 100.9 102.4 107.8 99.9 80 40 Oct-14 Sep-14 Aug-14 Jul-14 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 0 The value of the mortgages constituted on urban properties reached 3,299.1 million euros, 21.7% over that reached in October 2013. On dwellings, the capital loaned reached 1,766.3 million euros, indicating an annual increase of 14.9%. Mortgages constituted. October 2014 Total Total properties Number of mortgaged properties Capital loaned (thousands of euros) Average am ount (euros) Rustic properties Number of mortgaged properties Capital loaned (thousands of euros) Average am ount (euros) Urban properties Number of mortgaged properties Capital loaned (thousands of euros) Average am ount (euros) Dwellings Number of mortgaged properties Capital loaned (thousands of euros) Average am ount (euros) Variation rate Monthly Annual Interannual accumulated 27,554 3,596,767 130,535 -8.1 -7.4 0.8 9.4 17.7 7.6 -5.9 8.1 14.9 1,617 297,621 184,058 10.8 39.4 25.8 14.0 -13.5 -24.1 -6.5 -8.8 -2.5 25,937 3,299,146 127,198 -9.0 -10.1 -1.1 9.1 21.7 11.5 -5.9 9.5 16.3 17,687 1,766,322 99,866 -8.5 -15.2 -7.4 18.0 14.9 -2.6 -1.3 0.9 2.2 M - OCTOBER 2014 (1/9) Mortgages constituted according to the nature of the property According to the nature of the property, mortgages constituted on dwellings concentrated 49.1% of the total capital loaned in October. Distribution of the capital loaned for mortgages according to the nature of the property (%) 60 49.1 50 40 34.5 30 20 8.3 8.1 10 0 Dwellings Lands Other urban properties Rustic properties Monthly evolution of the mortgages constituted on dwellings In order to contribute to the analysis and interpretation of the data, the following chart shows the variation on the number of mortgages constituted on dwellings between the months of October and September for the last five years. In 2014, the monthly rate registered a decrease of 8.5%. Evolution of the monthly rate of de number of mortgages constituted for the dwellings (October variation as compared with September of the same year) 10 0.6 0 -10 -8.5 -10.9 -20 -30 -26.0 -28.7 2010 2011 2012 2013 2014 Regarding the capital loaned for mortgages constituted on dwellings, the monthly rate of 2014 was −15.2%. Evolution of the monthly rate of the capital lent of mortgages constituted for the dwellings (October variation as compared with September of the same year) 5.9 10 0 -10 -12.9 -20 -15.2 -30 -30.7 -40 2010 -31.5 2011 2012 2013 2014 M - OCTOBER 2014 2/9 Mortgage interest rates 92.8% of the mortgages constituted in October used a variable interest rate, as compared to 7.2% using a fixed rate. Euribor was the most used reference interest rate in constituting mortgages with a variable interest rate, specifically in 89.7% of new contracts. The average interest rate for the total properties was 3.78% and the average term was 21 years. The average interest rate for mortgages constituted on dwellings was 3.60%, that is, 14.1% less than that registered in October 2013. 4.11 4.04 3.97 3.82 3.88 3.90 3.76 3.59 3.60 Oct-14 4.14 Sep-14 4.21 Aug-14 4.29 Jul-14 4.19 Jun-14 4.15 May-14 5.00 Apr-14 Average interest rate on dwellings 4.00 3.00 2.00 1.00 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 0.00 Mortgages with registration changes In October, the total number of mortgages with changes in their conditions recorded in the land registries stood at 15,257, 34.2% lower than the figure recorded last year. On dwellings, the number of mortgages with modified conditions increased 29.3%. Considering the type of modification of conditions, in October 12,098 novations (or modifications produced within the same financial institution) were produced, with a decrease of 33.8%, as compared to October 2013. The number of transactions that changed institutions (creditor subrogations) decreased 30.7%, and the number of mortgages that changed the holder of the mortgaged property (debtor subrogations) did so by 48.4%. Mortgages with registration changes. October 2014 Total Total mortgages with changes Novations Subrogations Debtor Subrogations Creditor Variation rate Inter-monthly 15,257 12,098 659 2,500 -20.0 -23.8 -19.9 5.8 Interannual -34.2 -33.8 -48.4 -30.7 Interannual accumulated -14.8 -17.5 -12.4 1.2 Mortgages with changes in interest rate conditions Of the 15,257 mortgages with changes in their conditions recorded in the land registries, 34.1% were due to changes in the interest rates. After the change in conditions, the percentage of mortgages at a fixed interest rate decreased from 6.6% to 2.9%, and that of mortgages at a variable interest rate increased from 92.6% to 96.4%. M - OCTOBER 2014 3/9 Euribor was the rate to which the greatest percentage of mortgages at a variable rate was referenced, both before (75.1%) and after the change (86.5%). After the changing of conditions, the average interest rate of loans in mortgages at a fixed rate decreased by 0.56 points, and that of mortgages at a variable rate did so by 1.35 points. Mortgages with registration changes in interest rates conditions. October 2014 Interest rate modality Total interest rate changes Fixed Variable -Euribor Without interest Before the change in interest rate After the change in interes t rate No. of Original Original No. of Final interest Final average mortgages interest rate average mortgages rate structure interest of structure % interest of loan % loan 5,205 100.0 5,205 100.0 343 6.6 4.87 153 2.9 4.31 4,818 92.6 4.55 5,015 96.4 3.20 3,909 75.1 4.47 4,502 86.5 3.09 44 0.8 37 0.7 - Results by Autonomous Community The Autonomous Communities with the highest number of mortgages constituted on dwellings in October were Andalucía (3,329), Comunidad de Madrid (2,942) and Cataluña (2,694). The Autonomous Communities that registered the greatest annual variation rates were Comunitat Valenciana (46.3%), Aragón (37.1%) and Castilla-La Mancha (34.7%). The Autonomous Communities with the greatest capital loaned for mortgages constituted on dwellings were Comunidad de Madrid (403.2 million euros), Cataluña (295.4 million) and Andalucía (280.1 million). Mortgages constituted on dwellings by Autonomous City and Community. October 2014 Number Variation rate Monthly TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla - La Mancha Castilla y León Cataluña Comunitat Valenciana Extrem adura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Com unidad Foral de País Vasco Rioja, La Ceuta Melilla 17,687 3,329 514 350 499 675 192 667 625 2,694 2,106 315 803 2,942 486 380 926 119 25 40 -8.5 0.8 -24.9 8.4 8.7 -2.2 5.5 -18.4 -1.0 -3.0 -0.2 4.7 0.0 -28.1 -8.1 1.3 -14.9 30.8 108.3 -31.0 Annual 18.0 21.9 37.1 -6.4 -4.2 7.1 20.0 1.1 34.7 18.9 46.3 28.6 -9.0 14.3 27.2 3.8 25.5 32.2 -63.2 100.0 Capital loaned Variation rate (thousands of euros) Monthly Annual 1,766,322 -15.2 14.9 280,123 -5.7 18.1 47,935 -25.4 42.5 30,475 0.9 -1.7 59,194 -2.7 -5.6 54,568 0.8 -0.6 17,791 6.0 8.2 54,916 -22.2 -0.6 49,065 -0.3 34.5 295,423 -10.6 11.0 179,916 9.2 58.3 23,225 10.4 39.6 68,294 -20.6 -14.1 403,176 -34.1 15.1 35,125 -12.7 25.3 42,625 1.5 -11.0 106,169 -19.7 21.7 10,260 48.3 55.0 3,524 183.3 -68.5 4,518 13.2 92.4 M - OCTOBER 2014 4/9 The Autonomous Communities with the greatest positive monthly rates in the number of mortgages constituted on dwellings were La Rioja (30.8%), Illes Balears (8.7%) and Principado de Asturias (8.4%). In turn, the Autonomous Communities registering the greatest decreases in the monthly variation rates were Comunidad de Madrid (−28.1%), Aragón (−24.9%) and Castilla y León (−18.4%). Monthly variation of the number of mortgages constituted on dwellings. October 2014 Rioja, La 30.8 Balears, Illes 8.7 Asturias, Principado de 8.4 Cantabria 5.5 Extremadura 4.7 Navarra, Comunidad Foral de 1.3 Andalucía 0.8 Galicia 0.0 Comunitat Valenciana -0.2 Castilla - La Mancha -1.0 Canarias -2.2 Cataluña -3.0 Murcia, Región de -8.1 TOTAL -8.5 País Vasco -14.9 Castilla y León Aragón Madrid, Comunidad de -18.4 -24.9 -28.1 M - OCTOBER 2014 5/9 Mortgages Statistics October 2014. Provisional data M.1 Total mortgaged rustic and urban buildings Capital in thousands of euros Total buildings Number Capital TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 27,554 5,905 854 521 979 1,113 277 1,172 1,148 3,743 3,146 561 1,360 3,934 750 586 1,234 181 35 55 3,596,767 695,407 78,568 43,043 134,025 98,635 55,082 155,872 141,423 532,018 308,677 49,673 137,757 796,817 59,993 113,541 159,750 25,362 4,856 6,268 Rustic buildings Number Capital 1,617 480 48 26 67 41 5 172 224 74 143 67 74 27 57 78 27 4 0 3 297,621 101,796 6,285 2,817 12,013 8,859 988 46,990 17,090 12,646 25,858 12,433 13,738 17,891 7,921 4,090 4,434 583 0 1,189 Urban buildings Number Capital 25,937 5,425 806 495 912 1,072 272 1,000 924 3,669 3,003 494 1,286 3,907 693 508 1,207 177 35 52 3,299,146 593,611 72,283 40,226 122,012 89,776 54,094 108,882 124,333 519,372 282,819 37,240 124,019 778,926 52,072 109,451 155,316 24,779 4,856 5,079 M.2 Urban buildings, according to type of building Capital in thousands of euros Urban buildings Number Capital TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 25,937 5,425 806 495 912 1,072 272 1,000 924 3,669 3,003 494 1,286 3,907 693 508 1,207 177 35 52 3,299,146 593,611 72,283 40,226 122,012 89,776 54,094 108,882 124,333 519,372 282,819 37,240 124,019 778,926 52,072 109,451 155,316 24,779 4,856 5,079 Dwellings Number 17,687 3,329 514 350 499 675 192 667 625 2,694 2,106 315 803 2,942 486 380 926 119 25 40 Capital 1,766,322 280,123 47,935 30,475 59,194 54,568 17,791 54,916 49,065 295,423 179,916 23,225 68,294 403,176 35,125 42,625 106,169 10,260 3,524 4,518 Lots Number 679 176 11 1 29 66 7 51 31 99 61 12 34 42 18 16 20 5 0 0 Other urban land Number Capital Capital 291,376 69,150 1,087 147 13,928 5,646 2,882 31,145 3,733 35,212 9,254 2,084 19,295 81,347 2,591 3,948 5,728 4,199 0 0 7,571 1,920 281 144 384 331 73 282 268 876 836 167 449 923 189 112 261 53 10 12 1,241,448 244,338 23,261 9,604 48,890 29,562 33,421 22,821 71,535 188,737 93,649 11,931 36,430 294,403 14,356 62,878 43,419 10,320 1,332 561 M - OCTOBER 2014 (6/9) October 2014. Provisional data M.3 Rustic buildings, according to loaning bank Capital in thousands of euros Rustic buildings Number Capital TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 1,617 480 48 26 67 41 5 172 224 74 143 67 74 27 57 78 27 4 0 3 297,621 101,796 6,285 2,817 12,013 8,859 988 46,990 17,090 12,646 25,858 12,433 13,738 17,891 7,921 4,090 4,434 583 0 1,189 Banks Number 833 233 21 18 49 18 5 53 71 43 94 57 55 24 30 37 20 3 0 2 Capital 172,908 59,164 2,421 2,025 8,962 1,938 988 17,527 6,694 10,248 15,120 10,757 8,368 17,166 5,194 2,591 2,365 280 0 1,100 Other banks Number Capital 784 247 27 8 18 23 0 119 153 31 49 10 19 3 27 41 7 1 0 1 124,713 42,632 3,864 792 3,051 6,921 0 29,463 10,396 2,398 10,738 1,676 5,370 725 2,727 1,499 2,069 303 0 89 M.4 Urban buildings, according to loaning bank Capital in thousands of euros Urban buildings Number Capital TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 25,937 5,425 806 495 912 1,072 272 1,000 924 3,669 3,003 494 1,286 3,907 693 508 1,207 177 35 52 3,299,146 593,611 72,283 40,226 122,012 89,776 54,094 108,882 124,333 519,372 282,819 37,240 124,019 778,926 52,072 109,451 155,316 24,779 4,856 5,079 Banks Number 21,647 4,389 637 378 838 878 243 836 722 3,247 2,628 454 1,127 3,402 511 231 898 148 32 48 Capital 2,818,382 521,828 54,905 32,842 101,708 76,262 24,845 93,695 106,663 441,874 245,938 34,277 99,866 721,365 34,507 80,036 118,963 19,544 4,713 4,551 Other banks Number Capital 4,290 1,036 169 117 74 194 29 164 202 422 375 40 159 505 182 277 309 29 3 4 480,764 71,783 17,378 7,384 20,304 13,514 29,249 15,187 17,670 77,498 36,881 2,963 24,153 57,561 17,565 29,415 36,353 5,235 143 528 M - OCTOBER 2014 (7/9) October 2014. Provisional data M.5 Total mortgages cancelled, according to type of building Total buildings TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla Rustic buildings 38,659 7,834 1,162 629 1,179 1,887 434 1,975 1,959 4,758 5,620 685 1,858 5,072 1,441 568 1,102 392 45 59 1,731 533 52 10 50 63 26 164 127 84 194 76 147 52 104 15 18 16 0 0 Dwellings Lots 24,956 5,185 592 400 587 1,221 273 1,177 1,164 3,171 3,794 438 1,081 3,597 953 339 678 233 25 48 Other urban land 1,421 221 18 30 33 46 5 85 279 116 141 23 140 81 39 136 18 10 0 0 10,551 1,895 500 189 509 557 130 549 389 1,387 1,491 148 490 1,342 345 78 388 133 20 11 M.6 Total cancelled mortgages, according to type of building and loaning bank Total buildings Banks TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 33,427 6,721 1,004 481 995 1,674 410 1,669 1,766 4,204 4,992 619 1,731 4,332 1,263 383 796 296 38 53 Rustic buildings Banks Other banks 5,232 1,113 158 148 184 213 24 306 193 554 628 66 127 740 178 185 306 96 7 6 1,280 365 14 9 37 46 26 146 81 53 140 58 143 45 84 8 13 12 0 0 Urban buildings Banks Other banks 451 168 38 1 13 17 0 18 46 31 54 18 4 7 20 7 5 4 0 0 32,147 6,356 990 472 958 1,628 384 1,523 1,685 4,151 4,852 561 1,588 4,287 1,179 375 783 284 38 53 Other banks 4,781 945 120 147 171 196 24 288 147 523 574 48 123 733 158 178 301 92 7 6 M - OCTOBER 2014 (8/9) October 2014. Provisional data M.7 Total mortgages with changes, according to type of change and type of building Total buildings TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 15,257 3,486 370 228 355 604 91 542 499 2,168 3,038 141 586 2,129 600 84 155 162 12 7 Type of change Type of building Novation Subrogations Subrogations Rustic Urban Debtor Creditor buildings buildings 12,098 2,846 327 204 351 333 72 389 361 1,797 1,932 108 488 2,002 540 74 108 154 12 0 For further information see INEbase – www.ine.es/en/ 659 89 28 3 1 42 0 26 48 43 284 0 7 17 26 5 31 8 0 1 2,500 551 15 21 3 229 19 127 90 328 822 33 91 110 34 5 16 0 0 6 615 204 9 21 40 15 3 21 37 20 88 8 63 28 52 3 2 1 0 0 14,642 3,282 361 207 315 589 88 521 462 2,148 2,950 133 523 2,101 548 81 153 161 12 7 Dwellings 9,315 1,933 201 122 202 455 65 279 319 1,567 1,993 84 212 1,212 426 55 93 80 11 6 All press releases at: www.ine.es/en/prensa/prensa_en.htm Press Office: Telephone numbers: 91 583 93 63 / 94 08 – Fax: 91 583 90 87 – [email protected] Information Area: Telephone number: 91 583 91 00 – Fax: 91 583 91 58 – www.ine.es/infoine/?L=1 M - OCTOBER 2014 (9/9)

© Copyright 2026