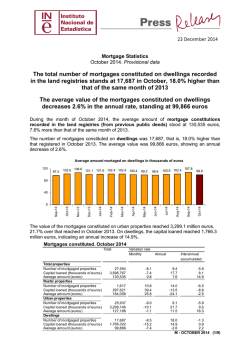

The total number of mortgages constituted on dwellings recorded in

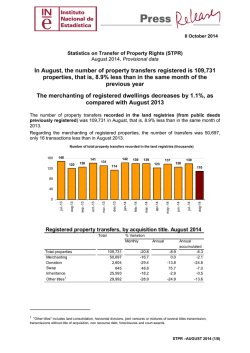

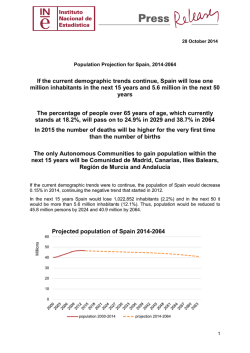

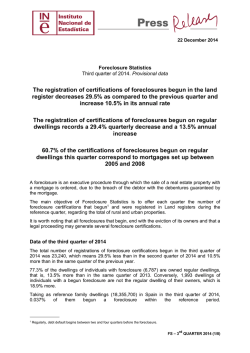

27 January 2015 Mortgage Statistics November 2014. Provisional data The total number of mortgages constituted on dwellings recorded in the land registries stands at 15,900 in November, 14.2% higher than that of the same month of 2013 The average value of the mortgages constituted on dwellings decreases 1.7% in the annual rate, standing at 104,817 euros During the month of November 2014, the average amount of mortgage constitutions recorded in the land registries (from previous public deeds) stood at 127,014 euros, 10.6% more than that of the same month of 2013. The number of mortgages constituted on dwellings was 15,900, that is, 14.2% higher than that registered in November 2013. The average value was 104,817 euros, showing an annual decrease of 1.7%. 102.6 106.6 101.1 101.6 102.4 102.4 100.4 99.2 98.6 Jun-14 120 May-14 Average amount mortaged on dwellings in thousands of euros 107.8 100.9 102.4 99.9 104.8 80 40 Nov-14 Oct-14 Sep-14 Aug-14 Jul-14 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 0 The value of the mortgages constituted on urban properties reached 2,857.4 million euros, 15.3% over that reached in November 2013. On dwellings, the capital loaned reached 1,666.6 million euros, indicating an annual increase of 12.2%. Mortgages constituted. November 2014 Total Total properties Number of mortgaged properties Capital loaned (thousands of euros) Average am ount (euros) Rustic properties Number of mortgaged properties Capital loaned (thousands of euros) Average am ount (euros) Urban properties Number of mortgaged properties Capital loaned (thousands of euros) Average am ount (euros) Dwellings Number of mortgaged properties Capital loaned (thousands of euros) Average am ount (euros) Variation rate Monthly Annual Interannual accumulated 24,479 3,109,179 127,014 -11.2 -13.6 -2.7 5.6 16.8 10.6 -5.0 8.7 14.5 1,468 251,772 171,507 -9.2 -15.4 -6.8 2.7 38.2 34.5 -5.7 -5.6 0.1 23,011 2,857,407 124,176 -11.3 -13.4 -2.4 5.8 15.3 8.9 -5.0 9.9 15.7 15,900 1,666,588 104,817 -10.1 -5.6 5.0 14.2 12.2 -1.7 -0.2 1.8 2.0 M - NOVEMBER 2014 (1/9) Mortgages constituted according to the nature of the property According to the nature of the property, mortgages constituted on dwellings concentrated 53.6% of the total capital loaned in November. Distribution of the capital loaned for mortgages according to the nature of the property (%) 60 53.6 50 40 30.3 30 20 8.1 8.0 10 0 Dwellings Lands Other urban properties Rustic properties Monthly evolution of the mortgages constituted on dwellings In order to contribute to the analysis and interpretation of the data, the following chart shows the variation on the number of mortgages constituted on dwellings between the months of November and October for the last five years. In 2014, the monthly rate registered a decrease of 10.1%, the lowest of the period considered. Evolution of the monthly rate of de number of mortgages constituted for the dwellings (November variation as compared with October of the same year) 40 25.2 20 11.4 0.2 0 -7.1 -10.1 -20 2010 2011 2012 2013 2014 Regarding the capital loaned for mortgages constituted on dwellings, the monthly rate of 2014 was −5.6%, also the lowest of the period. Evolution of the monthly rate of the capital lent of mortgages constituted for the dwellings (November variation as compared with October of the same year) 40 29.6 30 20 14.3 10 3.7 0 -3.4 -10 2010 2011 2012 2013 -5.6 2014 M - NOVEMBER 2014 2/9 Mortgage interest rates 92.6% of the mortgages constituted in November used a variable interest rate, as compared to 7.4% using a fixed rate. Euribor was the most used reference interest rate in constituting mortgages with a variable interest rate, specifically in 87.2% of new contracts. The average interest rate for the total properties was 3.48% and the average term was 21 years. The average interest rate for mortgages constituted on dwellings was 3.49%, that is, 18.6% less than that registered in November 2013. 4.04 3.97 3.82 3.88 3.90 3.76 3.59 3.60 3.49 Nov-14 4.11 Oct-14 4.14 Sep-14 4.21 Aug-14 4.29 Jul-14 4.19 4.00 Jun-14 5.00 May-14 Average interes rate on dwellings 3.00 2.00 1.00 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 0.00 Mortgages with registration changes In November, the total number of mortgages with changes in their conditions recorded in the land registries stood at 14,149, 40.9% lower than the figure recorded last year. On dwellings, the number of mortgages with modified conditions decreased 33.1%. Considering the type of modification of conditions, in November 11,115 novations (or modifications produced within the same financial institution) were produced, with a decrease of 42.0%, as compared to November 2013. The number of transactions that changed institutions (creditor subrogations) decreased 39.7%, and the number of mortgages that changed the holder of the mortgaged property (debtor subrogations) did so by 23.8%. Mortgages with registration changes. November 2014 Total Total mortgages with changes Novations Subrogations Debtor Subrogations Creditor Variation rate Inter-monthly 14,149 11,115 759 2,275 -7.3 -8.1 15.2 -9.0 Interannual -40.9 -42.0 -23.8 -39.7 Interannual accum ulated -17.3 -19.8 -13.5 -3.5 Mortgages with changes in interest rate conditions Of the 14,149 mortgages with changes in their conditions recorded in the land registries, 37.2% were due to changes in the interest rates. After the change in conditions, the percentage of mortgages at a fixed interest rate decreased from 5.7% to 3.4%, and that of mortgages at a variable interest rate increased from 93.3% to 95.9%. M - NOVEMBER 2014 3/9 Euribor was the rate to which the greatest percentage of mortgages at a variable rate was referenced, both before (78.7%) and after the change (86.7%). After the changing of conditions, the average interest rate of loans in mortgages at a fixed rate decreased by 1.17 points, and that of mortgages at a variable rate did so by 1.37 points. Mortgages with registration changes in interest rates conditions. November 2014 Interest rate modality Total interest rate changes Fixed Variable -Euribor Without interest Before the change in No. of Original mortgages interest rate structure % 5,259 100.0 301 5.7 4,907 93.3 4,140 78.7 51 1.0 interest rate Original average interest of loan 4.71 4.54 4.46 - After the change in interest rate No. of Final interest Final average mortgages rate structure interest of % loan 5,259 100.0 177 3.4 3.54 5,043 95.9 3.17 4,561 86.7 3.08 39 0.7 - Results by Autonomous Community The Autonomous Communities with the highest number of mortgages constituted on dwellings in November were Andalucía (3,183), Comunidad de Madrid (2,565) and Cataluña (2,264). The Autonomous Communities that registered the greatest annual variation rates were La Rioja (106.3%), Extremadura (35.6%) and País Vasco (27.6%). The Autonomous Communities with the greatest capital loaned for mortgages constituted on dwellings were Comunidad de Madrid (382.9 million euros), Andalucía (288.7 million) and Cataluña (261.1 million). Mortgages constituted on dwellings by Autonomous City and Community. November 2014 Number TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla - La Mancha Castilla y León Cataluña Comunitat Valenciana Extrem adura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Com unidad Foral de País Vasco Rioja, La Ceuta Melilla 15,900 3,183 455 299 419 771 144 624 597 2,264 1,743 301 707 2,565 425 236 967 163 13 24 Variation rate Monthly Annual -10.1 14.2 -4.4 24.9 -11.5 19.4 -14.6 4.5 -16.0 -12.7 14.2 26.0 -25.0 -24.2 -6.4 10.2 -4.5 13.9 -16.0 16.6 -17.2 16.4 -4.4 35.6 -12.0 -17.1 -12.8 7.6 -12.6 21.8 -37.9 9.3 4.4 27.6 37.0 106.3 -48.0 -31.6 -40.0 26.3 Capital loaned Variation rate (thousands of euros) Monthly Annual 1,666,588 -5.6 12.2 288,700 3.1 26.0 41,934 -12.5 35.3 26,507 -13.0 -5.0 47,518 -19.7 -51.1 60,079 10.1 17.4 13,143 -26.1 -28.1 52,562 -4.3 2.6 51,313 4.6 34.1 261,111 -11.6 21.5 156,448 -13.0 22.4 22,074 -5.0 28.2 62,810 -8.0 -12.2 382,935 -5.0 7.2 31,875 -9.3 25.3 23,219 -45.5 -14.8 121,394 14.3 37.6 18,803 83.3 160.4 1,924 -45.4 15.4 2,239 -50.4 -2.7 M - NOVEMBER 2014 4/9 The Autonomous Communities with the greatest monthly rates in the number of mortgages constituted on dwellings were La Rioja (37.0%), Canarias (14.2%) and País Vasco (4.4%). In turn, the Autonomous Communities registering the greatest decreases in the monthly variation rates were Comunidad Foral de Navarra (−37.9%), Cantabria (−25.0%) and Comunitat Valenciana (−17.2%). Monthly variation of the number of mortgages constituted on dwellings. November 2014 Rioja, La 37.0 Canarias 14.2 País Vasco 4.4 Andalucía -4.4 Extremadura -4.4 Castilla - La Mancha -4.5 Castilla y León -6.4 TOTAL -10.1 Aragón -11.5 Galicia -12.0 Murcia, Región de -12.6 Madrid, Comunidad de -12.8 Asturias, Principado de -14.6 Cataluña -16.0 Balears, Illes -16.0 Comunitat Valenciana -17.2 Cantabria Navarra, Comunidad Foral de -25.0 -37.9 M - NOVEMBER 2014 5/9 Mortgages Statistics November 2014. Provisional data M.1 Total mortgaged rustic and urban buildings Capital in thousands of euros Total buildings Number Capital TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 24.479 4.747 788 451 681 1.299 203 1.037 1.084 3.239 2.577 490 1.310 3.607 665 341 1.650 260 19 31 3.109.179 555.053 79.799 54.779 91.951 204.252 18.845 88.639 153.117 411.848 241.326 62.296 115.213 623.882 67.763 36.252 275.315 23.487 2.806 2.556 Rustic buildings Number Capital 1.468 390 59 25 56 34 6 121 163 69 112 87 72 3 69 26 172 4 0 0 251.772 72.115 6.739 2.276 17.368 5.268 538 9.790 35.126 10.879 10.482 31.290 7.230 135 9.620 1.767 30.414 735 0 0 Urban buildings Number Capital 23.011 4.357 729 426 625 1.265 197 916 921 3.170 2.465 403 1.238 3.604 596 315 1.478 256 19 31 2.857.407 482.938 73.060 52.503 74.583 198.984 18.307 78.849 117.991 400.969 230.844 31.006 107.983 623.747 58.143 34.485 244.901 22.752 2.806 2.556 M.2 Urban buildings, according to type of building Capital in thousands of euros Urban buildings Number Capital TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 23.011 4.357 729 426 625 1.265 197 916 921 3.170 2.465 403 1.238 3.604 596 315 1.478 256 19 31 2.857.407 482.938 73.060 52.503 74.583 198.984 18.307 78.849 117.991 400.969 230.844 31.006 107.983 623.747 58.143 34.485 244.901 22.752 2.806 2.556 Dwellings Number 15.900 3.183 455 299 419 771 144 624 597 2.264 1.743 301 707 2.565 425 236 967 163 13 24 Capital 1.666.588 288.700 41.934 26.507 47.518 60.079 13.143 52.562 51.313 261.111 156.448 22.074 62.810 382.935 31.875 23.219 121.394 18.803 1.924 2.239 Lots Number 843 189 123 5 12 128 6 22 122 66 18 15 38 33 9 5 48 4 0 0 Other urban land Number Capital Capital 247.363 73.067 18.461 2.982 2.702 19.277 1.442 4.959 7.541 18.468 3.923 2.482 3.698 38.925 2.499 870 45.280 787 0 0 6.268 985 151 122 194 366 47 270 202 840 704 87 493 1.006 162 74 463 89 6 7 943.456 121.171 12.665 23.014 24.363 119.628 3.722 21.328 59.137 121.390 70.473 6.450 41.475 201.887 23.769 10.396 78.227 3.162 882 317 M - NOVEMBER 2014 (6/9) November 2014. Provisional data M.3 Rustic buildings, according to loaning bank Capital in thousands of euros Rustic buildings Number Capital TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 1.468 390 59 25 56 34 6 121 163 69 112 87 72 3 69 26 172 4 0 0 251.772 72.115 6.739 2.276 17.368 5.268 538 9.790 35.126 10.879 10.482 31.290 7.230 135 9.620 1.767 30.414 735 0 0 Banks Number 766 215 31 19 38 20 6 60 116 40 47 57 48 2 35 7 24 1 0 0 Capital 146.034 39.912 2.767 1.754 12.235 2.251 538 5.407 24.188 9.206 4.072 29.841 5.336 28 4.200 755 3.364 180 0 0 Other banks Number Capital 702 175 28 6 18 14 0 61 47 29 65 30 24 1 34 19 148 3 0 0 105.738 32.203 3.972 522 5.133 3.017 0 4.383 10.938 1.673 6.410 1.449 1.894 107 5.420 1.012 27.050 555 0 0 M.4 Urban buildings, according to loaning bank Capital in thousands of euros Urban buildings Number Capital TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 23.011 4.357 729 426 625 1.265 197 916 921 3.170 2.465 403 1.238 3.604 596 315 1.478 256 19 31 2.857.407 482.938 73.060 52.503 74.583 198.984 18.307 78.849 117.991 400.969 230.844 31.006 107.983 623.747 58.143 34.485 244.901 22.752 2.806 2.556 Banks Number 19.150 3.761 606 301 557 1.083 177 728 720 2.740 2.082 385 972 3.151 470 203 1.038 132 18 26 Capital 2.387.640 380.714 62.654 30.966 66.174 181.336 15.220 57.723 101.299 352.113 198.742 29.806 83.597 557.107 44.862 23.185 189.114 8.127 2.543 2.358 Other banks Number Capital 3.861 596 123 125 68 182 20 188 201 430 383 18 266 453 126 112 440 124 1 5 469.767 102.224 10.406 21.537 8.409 17.648 3.087 21.126 16.692 48.856 32.102 1.200 24.386 66.640 13.281 11.300 55.787 14.625 263 198 M - NOVEMBER 2014 (7/9) November 2014. Provisional data M.5 Total mortgages cancelled, according to type of building Total buildings TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla Rustic buildings 37.945 8.402 863 622 1.095 2.054 450 1.862 1.799 4.903 5.823 634 1.802 4.508 1.504 323 935 309 20 37 1.910 453 175 27 54 38 16 100 168 57 455 46 96 68 108 14 25 9 0 1 Dwellings Lots 23.792 5.137 467 386 640 1.402 274 1.132 1.079 3.158 3.430 430 1.096 3.022 1.043 230 641 181 15 29 Other urban land 1.457 478 38 8 31 41 10 113 171 81 155 37 103 126 32 13 17 3 0 0 10.786 2.334 183 201 370 573 150 517 381 1.607 1.783 121 507 1.292 321 66 252 116 5 7 M.6 Total cancelled mortgages, according to type of building and loaning bank Total buildings Banks TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 32.933 7.210 691 490 960 1.896 397 1.582 1.590 4.353 5.126 580 1.668 4.006 1.271 204 637 218 18 36 Rustic buildings Banks Other banks 5.012 1.192 172 132 135 158 53 280 209 550 697 54 134 502 233 119 298 91 2 1 1.435 341 134 21 35 33 15 94 81 42 368 38 89 37 68 10 19 9 0 1 Urban buildings Banks Other banks 475 112 41 6 19 5 1 6 87 15 87 8 7 31 40 4 6 0 0 0 31.498 6.869 557 469 925 1.863 382 1.488 1.509 4.311 4.758 542 1.579 3.969 1.203 194 618 209 18 35 Other banks 4.537 1.080 131 126 116 153 52 274 122 535 610 46 127 471 193 115 292 91 2 1 M - NOVEMBER 2014 (8/9) November 2014. Provisional data M.7 Total mortgages with changes, according to type of change and type of building Total buildings TOTAL Andalucía Aragón Asturias, Principado de Balears, Illes Canarias Cantabria Castilla y León Castilla - La Mancha Cataluña Comunitat Valenciana Extremadura Galicia Madrid, Comunidad de Murcia, Región de Navarra, Comunidad Foral de País Vasco Rioja, La Ceuta Melilla 14.149 3.129 517 216 290 748 116 1.236 635 2.079 2.067 139 308 1.776 520 78 198 87 9 1 Type of change Type of building Novation Subrogations Subrogations Rustic Urban Debtor Creditor buildings buildings 11.115 2.626 493 192 287 422 116 1.035 521 1.415 1.334 101 272 1.573 468 51 125 75 9 0 For further information see INEbase – www.ine.es/en/ 759 93 7 9 0 183 0 14 10 73 257 10 3 13 10 26 39 12 0 0 2.275 410 17 15 3 143 0 187 104 591 476 28 33 190 42 1 34 0 0 1 923 284 12 14 37 18 3 34 108 26 79 15 9 239 41 0 3 1 0 0 13.226 2.845 505 202 253 730 113 1.202 527 2.053 1.988 124 299 1.537 479 78 195 86 9 1 Dwellings 8.348 1.956 249 115 156 378 36 501 351 1.435 1.351 82 180 1.000 334 60 104 54 6 0 All press releases at: www.ine.es/en/prensa/prensa_en.htm Press Office: Telephone numbers: 91 583 93 63 / 94 08 – Fax: 91 583 90 87 – [email protected] Information Area: Telephone number: 91 583 91 00 – Fax: 91 583 91 58 – www.ine.es/infoine/?L=1 M - NOVEMBER 2014 (9/9)

© Copyright 2026