Weekly market report

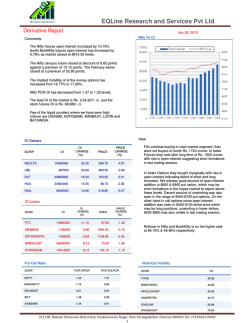

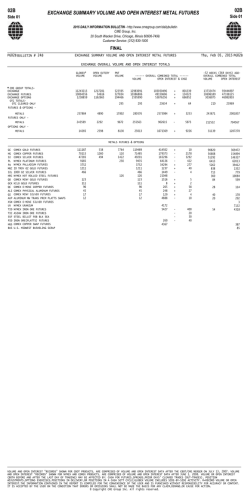

February 5, 2015 COTTON MARKET REPORT ICE Cotton Futures Mar15, Daily Feb04 Jan28 change ICE Mar15 61.23 59.44 1.79 ICE May15 61.42 60.23 1.19 ICE Jul15 62.00 61.04 0.96 ICE Dec15 63.29 62.99 0.30 ICE Mar-May15 -0.19 -0.79 0.60 ICE May15-Jul15 -0.58 -0.81 0.23 ICE futures open interest 207'847 216'715 -8'868 ICE certified stocks 61'515 57'423 4'092 68.90 66.60 2.30 57 ZCE May15 13'215 13'190 25 56 USD Index 93.986 94.467 -0.48 63 62 61 60 59 Jan 15 Feb 15 58 Dec 14 A-Index 14/15 (previous day) 64 ICE Cotton Futures The market managed to penetrate the 60.00 and more important 60.60 resistance level (basis NYF Mar15) during the reporting week on the back of active spread trading. So far prices managed to build value above this level. Futures are likely to remain volatile at least until Friday, the day of Mar15 option expiry. For the past couple of days, spread volume accounted for a large part of the daily trading volume and further rolling and repositioning of speculative money is expected for the days to come. The move up was accompanied by a change in the forward curve to some extent; the old crop / new crop spread narrowed by about 0.50 c/lbs during the past seven days, while the Mar/May15 spread gained 0.60 c/lbs during the week. The CFTC Commitment of Trader Report (COT) did not bring any substantial news. Technical picture: short-term trend up, resistance at 62.00-62.80, support at 60.60, 60.00, 59.00, key at 57.80. ICE Cotton Futures Spreads Mar15-May15 and Jul15-Dec15 ICE Cotton Futures Volume and Open Interest 0 -0.5 220000 80000 210000 70000 200000 60000 190000 -1 50000 180000 -1.5 40000 170000 30000 160000 -2 20000 150000 Mar15-May15 Volume Jul15-Dec15 1 Jan-15 Dec-14 Dec-14 Oct-14 Nov-14 Oct-14 Sep-14 Aug-14 Jul-14 Aug-14 Jun-14 Jun-14 0 Apr-14 130000 May-14 10000 Mar-14 Feb 15 Jan 15 Dec 14 Nov 14 Oct 14 Sep 14 Aug 14 -3 140000 Mar-14 -2.5 Open interest www.reinhart.com February 5, 2015 COTTON MARKET REPORT USA - This week should go on the books as largest of the year in terms of the movement of U.S. cotton from producers held stocks in to the hands of the merchants. In fact, the popular on-line trading platform for spot cotton recorded one of its largest days of record on Tuesday. The market has gone from new contract lows not too many days ago to an upside breakout and the highest price of the year thus far. The drop to new lows made selling cotton difficult for producers but this week’s rally coupled with the increase in the Marketing Loan Gain payment is just what producers were banking on. The reversal in the futures market started on Monday and set the stage for Tuesday’s gain of more than 150 pts. Another robust U.S. export sales report should have the USDA taking another look at their projections for ending stocks. The amount of cotton that has changed hands in the U.S. within the past few months is phenomenal in spite of a season where the futures market has been under pressure. Now it appears that I.C.E. cotton futures have done their job fundamentally speaking as the lower market has been a significant factor in creating demand. By now we believe that the large merchants have ownership of most of the crop, and with most of their possessions already committed. This is the basis for raising some questions about ending stock figures. We also consider certificated stocks which are less than 65’000 bales compared a number double that one year ago. With cotton trading in the country at strong basis levels it difficult to imagine how stocks can increase anytime soon. Commercially speaking, it does not make sense to tender new stocks at this moment. India – Cotton prices traded firm taking cues from higher prices in International market. Lint prices for new crop Shankar-6 good quality reported around INR 30’700 per candy ex-gin equivalent to US Cents 64.50 per lb FOB based on prevailing exchange rate. All India Daily arrivals have remained steady around 180’000 lint equivalent bales (170 kg). As per local sources, total arrivals for current crop have reached around 21 million bales (170 kg) of which total procurement by Cotton Corporation of India (CCI) is approximately 6.3 million bales. CCI have sold about 10’200 bales through E-Auction, domestic mills were active buyers. Some export business for 1.1/8 G5 was concluded around US Cents 65-66.00 lb CFR into Vietnam & Pakistan market, however, overall export demand remained slow. China – The ZCE cotton market was largely unimpressed by the recent rally on the ICE. Prices tried to challenge the upper end of the two month old trading range at around 13’400 (basis May15), but failed to generate enough upside momentum and pulled back to close virtually unchanged. Thus, the technical picture remained unchanged. A confirmed break below 12’740 would change the short term outlook from neutral to negative and set the life of contract low (12’320) as the new downside target. On the other hand, a close above 13’400 would likely trigger a rally to (at least) the 13’700 level. The market remains quiet as China is getting closer to the long Lunar New Year holidays. The import quota is still not released resulting in a slowdown in the demand for foreign cotton. Textile mills will close earlier this year due to poor business. Physical prices firmed up somewhat but actual sales remain slow. The PMI for January fell to 49.8 – this is the first time the PMI is below 50 since 2012. The China Central Bank announced a reduction of the bank deposit reserve by 0.5%. This will bring some 600 billion Yuan liquidity. The RMB against USD is under pressure. The information in this report is provided solely for informational purposes and should not be regarded as a recommendation to buy, sell or otherwise deal in any particular investment. Private customers should not invest in these products unless they are satisfied that the products are suitable for them and have sought professional advice. All information in this report is obtained from sources believed to be reliable and we make no representation as to its completeness or accuracy. The information may have been acted upon by us for our own purposes and has not been procured for the exclusive benefit of customers. 2 www.reinhart.com

© Copyright 2026