02b 02b exchange summary volume and open interest

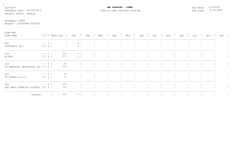

02B Side 01 02B EXCHANGE SUMMARY VOLUME AND OPEN INTEREST METAL FUTURES Side 01 2015 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin CME Group, Inc. 20 South Wacker Drive, Chicago, Illinois 60606-7499. Customer Service: (312) 930-1000 FINAL PG02B BULLETIN # 24@ Thu, Feb 05, 2015 PG02B EXCHANGE SUMMARY VOLUME AND OPEN INTEREST METAL FUTURES EXCHANGE OVERALL VOLUME AND OPEN INTEREST TOTALS GLOBEX® VOLUME * CME GROUP TOTALSEXCHANGE EXCHANGE FUTURES EXCHANGE OPTIONS OTC TOTALSOTC CLEARED ONLY FUTURES & OPTIONS METALS FUTURES ONLY METALS OPTIONS ONLY METALS 11243215 10004356 1238859 OPEN OUTCRY VOLUME 1217281 54616 1162665 PNT VOLUME -52 WEEKS (364 DAYS) AGOOVERALL COMBINED TOTAL VOLUME OPEN INTEREST ------ OVERALL COMBINED TOTAL -----VOLUME OPEN INTEREST & CHGE 522595 327834 194466 12983091 10386806 2595990 103050496 49150606 53876256 + + + 801339 134323 666952 13732474 10696189 3036075 93444897 47338125 46082803 295 295 23634 + 64 210 23969 257884 4890 17802 280576 2573984 + 3253 243671 2001837 243599 2292 9672 255563 902615 - 5973 212532 794567 14285 2598 8130 25013 1671369 + 9226 31139 1207270 414502 179373 165296 64136 34294 1237 1449 21048 1516 8 265 248 129 4888 + + + - 10 2178 3292 422 277 40 4 + + + + + - 5 2 58 27 4 10 90820 56608 51292 6413 5262 838 713 360 84 369472 154894 146327 62013 39412 1332 779 10084 599 28 114 40 20 - 400 20 30 40 178 292 3 7132 4318 METALS FUTURES & OPTIONS GC HG SI PL PA MGC SIL HRC QO GCK QC ALI QI AUP XSN UX TIO TIC SSF PIO HGS BUS COMEX GOLD FUTURES COMEX COPPER FUTURES COMEX SILVER FUTURES NYMEX PLATINUM FUTURES NYMEX PALLADIUM FUTURES 10 TROY OZ GOLD FUTURES 1000 OZ SILVER FUTURES NYMEX HOT ROLLED STEEL FUTURES COMEX MINY GOLD FUTURES KILO GOLD FUTURES COMEX E-MINI COPPER FUTURES COMEX PHYSICAL ALUMINUM FUTURES COMEX MINY SILVER FUTURES ALUMINUM MW TRANS PREM PLATTS SWAPS COMEX E-MINI SILVER FUTURES NYMEX URANIUM NYMEX IRON ORE FUTURES ASIAN IRON ORE FUTURES STEEL BILLET FOB BLK SEA IRON ORE(PLATTS) FUTURES COMEX COPPER SWAP FUTURES U.S. MIDWEST BUSHELING SCRAP 111187 70115 47285 9185 3752 1211 466 538 1260 494 7764 110 1422 250 126 123 111 90 45 17 12 119489 71485 49201 9435 3752 1211 466 126 123 111 90 45 17 12 4172 5427 260 4367 54 387 85 VOLUME AND OPEN INTEREST "RECORDS" SHOWN FOR CBOT PRODUCTS, ARE COMPRISED OF VOLUME AND OPEN INTEREST DATA AFTER THE CBOT/CME MERGER ON JULY 13, 2007. VOLUME AND OPEN INTEREST "RECORDS" SHOWN FOR NYMEX AND COMEX PRODUCTS, ARE COMPRISED OF VOLUME AND OPEN INTEREST DATA AFTER JUNE 1, 2008. VOLUME OR OPEN INTEREST (BOTH BEFORE AND AFTER THE LAST DAY OF TRADING) MAY BE AFFECTED BY: CASH FOR FUTURES,SPREADS,PRIOR DAYS' CLEARED TRADES (OUT-TRADES), POSITION ADJUSTMENTS,OPTIONS EXERCISES,POSITIONS IN DELIVERY,OR POSITIONS IN A CASH SETT CYCLE;GLOBEX VOLUME INCLUDES SIDE-BY-SIDE ACTIVITY. R=RECORD VOLUME OR OPEN INTEREST.THE INFORMATION CONTAINED IN THE REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT. IT IS ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM,DEMAND,OR CAUSE FOR ACTION. © Copyright CME Group Inc. All rights reserved. 02B Side 02 02B EXCHANGE SUMMARY VOLUME AND OPEN INTEREST METAL OPTIONS ON FUTURES Side 02 2015 DAILY INFORMATION BULLETIN - http://www.cmegroup.com/dailybulletin CME Group, Inc. 20 South Wacker Drive, Chicago, Illinois 60606-7499. Customer Service: (312) 930-1000 FINAL PG02B BULLETIN # 24@ EXCHANGE SUMMARY VOLUME AND OPEN INTEREST METAL OPTIONS ON FUTURES GLOBEX® VOLUME HX COMEX COPPER OPTIONS C HX COMEX COPPER OPTIONS P TOTAL COMEX COPPER OPTIONS OG COMEX GOLD OPTIONS C OG COMEX GOLD OPTIONS P TOTAL COMEX GOLD OPTIONS SO COMEX SILVER OPTIONS C SO COMEX SILVER OPTIONS P TOTAL COMEX SILVER OPTIONS OG1 GOLD OPTIONS C OG1 GOLD OPTIONS P TOTAL GOLD OPTIONS OG2 GOLD OPTIONS C OG2 GOLD OPTIONS P TOTAL GOLD OPTIONS ICT IRON ORE 62% FE CFR CHINA APO C ICT IRON ORE 62% FE CFR CHINA APO P TOTAL IRON ORE 62% FE CFR CHINA APO PAO NYMEX PALLADIUM OPTIONS C PAO NYMEX PALLADIUM OPTIONS P TOTAL NYMEX PALLADIUM OPTIONS PO PLATINUM OPTIONS C PO PLATINUM OPTIONS P TOTAL PLATINUM OPTIONS SO1 SILVER OPTIONS C SO1 SILVER OPTIONS P TOTAL SILVER OPTIONS HRO U.S. STEEL APO C HRO U.S. STEEL APO P TOTAL U.S. STEEL APO 34 143 177 5450 5738 11188 1162 1471 2633 86 63 149 50 55 105 2 2 27 1 28 3 3 OPEN OUTCRY VOLUME 718 718 702 510 1212 141 527 668 PNT VOLUME 2280 1550 3830 1450 200 1650 ------ OVERALL COMBINED TOTAL -----VOLUME OPEN INTEREST & CHGE 34 861 895 8432 7798 16230 2753 2198 4951 86 63 149 50 55 105 900 900 1000 900 900 1002 1000 750 1002 777 1 778 3 750 3 1582 2950 4532 1102433 332350 1434783 117119 83961 201080 153 121 274 50 95 145 4811 4650 9461 3447 2654 6101 13573 1247 14820 81 92 173 + + + + + + + + + + + + + + 34 786 820 2636 2715 5351 268 18 286 46 15 61 50 20 30 + + + 900 900 1000 + + + + 1000 777 1 778 Thu, Feb 05, 2015 PG02B -52 WEEKS (364 DAYS) AGOOVERALL COMBINED TOTAL VOLUME OPEN INTEREST 10 67 77 14079 9835 23914 5317 3502 8819 1645 1111 2756 962743 437166 1399909 110753 89033 199786 100 100 3255 733 3988 12106 1674 13780 9693 4904 14597 10 10 200 260 460 VOLUME AND OPEN INTEREST "RECORDS" SHOWN FOR CBOT PRODUCTS, ARE COMPRISED OF VOLUME AND OPEN INTEREST DATA AFTER THE CBOT/CME MERGER ON JULY 13, 2007. VOLUME AND OPEN INTEREST "RECORDS" SHOWN FOR NYMEX AND COMEX PRODUCTS, ARE COMPRISED OF VOLUME AND OPEN INTEREST DATA AFTER JUNE 1, 2008. VOLUME OR OPEN INTEREST (BOTH BEFORE AND AFTER THE LAST DAY OF TRADING) MAY BE AFFECTED BY: CASH FOR FUTURES,SPREADS,PRIOR DAYS' CLEARED TRADES (OUT-TRADES), POSITION ADJUSTMENTS,OPTIONS EXERCISES,POSITIONS IN DELIVERY,OR POSITIONS IN A CASH SETT CYCLE;GLOBEX VOLUME INCLUDES SIDE-BY-SIDE ACTIVITY. R=RECORD VOLUME OR OPEN INTEREST.THE INFORMATION CONTAINED IN THE REPORT IS COMPILED FOR THE CONVENIENCE OF THE USER AND IS FURNISHED WITHOUT RESPONSIBILITY FOR ACCURACY OR CONTENT. IT IS ACCEPTED BY THE USER ON THE CONDITION THAT ERRORS OR OMISSIONS SHALL NOT BE MADE THE BASIS FOR ANY CLAIM,DEMAND,OR CAUSE FOR ACTION. © Copyright CME Group Inc. All rights reserved.

© Copyright 2026