Content - Angel Backoffice

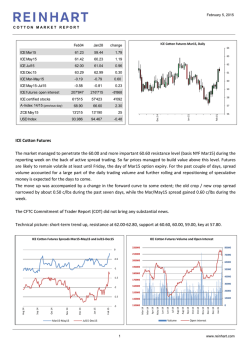

Commodities Daily Report nd Monday| 02 February, 2015 ` Agricultural Commodities Content Chana Sugar Oilseeds Edible Oils Spices Cotton Prepared by Anuj Gupta – A.V.P - Research [email protected] (011) 49165954 Ritesh Kumar Sahu – Analyst [email protected] (022) 2921 2000 (Ext 6165) Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from “Angel Commodities Broking (P) Ltd”. Your feedback is appreciated on [email protected] www.angelcommodities.com Commodities Daily Report nd Monday| 02 February, 2015 ` Agricultural Commodities Chana NCDEX Chana Feb. futures traded on positive note on Friday and closed 1.60% higher due to good support on the lower levels by the market participants. There is an expectation of new crop arrivals in less than a month’s time. Overall sentiments look mixed for Chana amid expected lower output and duty-free export allowed till Mar 2015. As per the Govt data, Chana has been sown over 83.93 lakh hectares which is less 15.5 % as on Jan 30, 2015 as compared to last year’s 99.27 lakh hac. The Weather so far has been conducive to the growth of Chana crop in the growing states. Outlook Market Highlights As on Jan 30, 2015 % change Unit `/qtl `/qtl Chana Spot - NCDEX Chana- NCDEX Feb Fut Last 3516 3562 Prev day 2.04 1.16 WoW 4.39 2.74 MoM -4.29 0.34 YoY 21.17 16.71 Source: Reuters Spread Matrix Spot 20-Feb-15 20-Apr-15 20-May-15 Closing 3516.05 3503 3562 3603 As on Jan 30, 2015 20-Apr-15 20-May-15 45.95 86.95 59 100 0 41 0 20-Feb-15 -13.05 0 - Technical Chart - Chana NCDEX Feb contract Market Highlights As on Jan 30, 2015 Chana futures are expected to trade mixed in the coming days due to low supplies in spot market and new crop to hit the local mandi in less than a month’s time. Technical Levels Contract Chana NCDEX Feb Futures Valid for Feb 02, 2015 Unit `/qtl Support Resistance 3430-3465 3530-3560 Sugar Sugar Mar. futures closed positive on Friday largely due to export subsidy announced by the Govt. But upward revision of production of sugar data by ISMA capped the further rise in prices. Food ministry had provided a subsidy of Rs 3,371 per tonne for exports of raw sugar until September 1.4 million tonnes of sugar. The Cabinet Committee on Economic Affairs (CCEA) approved a proposal to allow states to fix the retail price of sugar sold through the Public Distribution System (PDS). Sugar production has reached 10.3 million tonnes till Jan 15 for the 201415 season, as against 8.65 million tonnes in the year-ago, a rise of 19%. Till Jan 15, 494 sugar mills were operating in the country as against 486 sugar mills in a year ago. As per the revised forecast, Sugar mills are expected to produce around 26 million tonnes in 2014-15 season ending September. Maharashtra production is projected to rise to 9.5 million tonnes from 7.7 million tonnes in the previous year. ISMA projected the annual domestic demand of sugar at 24.8 million tonnes. Source: Telequote Unit Sugar SpotNCDEX Sugar M- NCDEX Mar Fut Sugar No 5- LiffeMar Fut Sugar No 11-ICE Mar Fut Last Prev. day WoW MoM % Change YoY `/qtl 2975 0.00 0.00 0.00 10.19 `/qtl 2723 0.29 1.00 -0.58 3.38 $/tonne 383.4 -0.31 -6.01 -1.99 -6.33 $/tonne 328.67 -0.40 -7.04 1.86 -1.33 Source: Reuters Sugar Spread Matrix Spot 20-Mar-15 20-May-15 20-Jul-15 Closing 2975 2723 2818 2889 Technical Chart – Sugar M 20-Mar-15 -252 0 - 20-May-15 -157 95 0 - As on Jan 30, 2015 20-Jul-15 -86 166 71 0 NCDEX March contract Global Sugar Updates In 2014-15, Rabobank has forecasted a decline of 1.8 million tonnes of global sugar supplies in 2014/15. In Australia, drier weather is likely to result in lower sugar production in the year ahead due to the prospect of an El Nino weather event. China's sugar production predicted to decline 12% against the backdrop of a 4% rise in demand. According to ABARE, Dec quarterly forecast, Australian raw sugar exports would rise 6 % in 2014–15 to 3.3 mt, up 7%, with higher volumes more than offsetting the impact of lower prices. Source: Telequote According to International Sugar Organization, the world stock has reached 76.6 mn tonnes as of the end of 2015-16, equivalent to 42.8% of world annual consumption. www.angelcommodities.com Commodities Daily Report nd Monday| 02 February, 2015 ` Agricultural Commodities Outlook Sugar futures may trade on a mixed note on export subsidy announced by the government but the ample supplies may pressurize the prices. Technical Outlook Contract Sugar NCDEX Mar Futures Market Highlights As on Jan 30, 2015 Unit Soybean Spot- NCDEX `/qtl Last 3391 Soybean- NCDEX Feb Fut `/qtl 3434 2.08 1.81 -0.61 -9.18 Soybean-CBOT Feb Fut USc/Bsh 968 -0.72 -1.55 -5.45 -23.26 RM Seed Spot- NCDEX `/qtl 3661 -0.17 -9.33 -15.85 5.05 RM Seed- NCDEX Apr Fut `/qtl 3378 0.87 -2.48 -4.14 -0.12 Valid for Feb 02, 2015 Unit `/qtl Support 2708-2722 Resistance 2745-2755 Soybean NCDEX Soybean Feb futures closed on positive note on Friday and closed 2% higher on good buying support by the oil mills on lower prices and decline in supplies from producing belts. Soymeal exports fell by 59 per cent to 1.94 lakh tonnes (lt) in December 2014 against 4.70 lakh tonnes in the same month a year ago. The export of soybean meal during December 2013 was 4.71 lt. Global update Global Soybean production is projected at a record 314.4 million tonnes in 2014/15 up 1.6 million on gains for Brazil and the United States. The Brazil soybean crop projection is raised 1.5 million tons to a record 95.5 million. Global oilseed production for 2014/15 is projected at a record 532.4 million tons, up 1.6 million tons from last month. % Change Prev day WoW 0.89 0.95 MoM -0.85 YoY -15.01 Source: Reuters Soybean Spread Matrix Spot 20-Feb-15 20-Apr-15 20-May-15 Closing 3391 3405 3434 3458 20-Feb-15 14 0 - 20-Apr-15 43 29 0 - Mustard Seed Spread Matrix Spot Closing 3661 20-Apr-15 -316.45 20-May-15 -245.45 As on Jan 30, 2015 20-May-15 67 53 24 0 As on Jan 30, 2015 19-Jun-15 -231.45 20-Apr-15 3345 0 71 85 20-May-15 3416 - 0 14 Outlook 19-Jun-15 3430 - - 0 Soybean futures may trade on a mixed note on increased import duty on edible oil and poor buying support on higher prices. Technical Chart –Soybean NCDEX Feb contract Rape/mustard Seed Mustard seed futures traded on a positive note last week and closed 0.87% higher on low good demand and expectation of lesser than expected crop arrivals in coming months. The acreage in the country so far is down by about 3.2% at about 63.8 lakh hectares (lh). The acreage in Rajasthan has dropped by 12.6% at 26.4 lh. Traders expect rapeseed output to drop to 7.0 million tonnes in the 2014-15 crop year (July-June) from 7.4 million last year. There are reports of the decline in sowing in Rajasthan. Source: Telequote Global updates Global rapeseed production is projected at a record 71.94 million tons, up 1.2 million mainly on increased production for Canada (15.6 million tons). Technical Chart –Mustard Seed NCDEX Apr contract Reports of Bug infestation in Europe may lead to 15% drop in output of rapeseed, the region’s primary source of vegetable oil used to make food ingredients and biodiesel. Output of rapeseed may fall to a threeyear low of 20.5 million metric tons in 2015, down from a record 24 million last year. Outlook Mustard seed may trade on a mixed note. Lower levels buying interest and expectation of lower production may support the price. Technical Levels Valid for Feb 02, 2015 Contract Unit Support Resistance Soybean NCDEX Feb Futures RM Seed NCDEX Apr Futures `/qtl `/qtl 3340-3375 3280-3310 3430-3460 3365-3395 www.angelcommodities.com Commodities Daily Report nd Monday| 02 February, 2015 ` Agricultural Commodities Refined Soy Oil Ref soy oil Feb futures traded on positive note on Friday and closed 1.70 % higher on good domestic demand at lower prices and news on higher weekly soybean export data for China. In the month of Dec 14, there is an increase of 81 per cent import of Crude soybean oil to 97,027 tonnes as compared to last year’s 53,500 tonnes. It is mainly due to high prices of soybean and lesser realization for oil and soybean meal in export market, resulted in lower crushing and availability of domestic oil coupled with anticipated increase in import duty by the GOI. According to latest report of US Department of Agriculture (USDA), the domestic consumption of soybean oil in India is likely to be at around 3.45 million tons against 3.30 million tons last year. Recently, the customs duty on crude oil has been increased to 7.5 per cent from 2.5 per cent earlier, while the duty on refined edible oil has been raised to 15 per cent from 10 per cent, as per the notification issued by the Central Board of Excise and Customs. Market Highlights As on Jan 30, 2015 % Change Ref Soy oil SpotNCDEX Ref Soy oil- NCDEX Feb Soybean Oil- CBOTMar Fut CPO-Bursa Malaysia – Feb CPO- MCX – Feb Unit `/10 kg Last 637.10 Prev day -0.06 WoW -2.96 MoM -3.47 YoY -8.01 `/10 kg 583.40 1.70 -2.77 -8.67 -13.01 USc/lb 30.00 1.56 -6.16 -6.16 -19.07 MYR/Tn 2154 0.33 -5.19 -5.98 -15.56 `/10 kg 434.90 2.86 -2.16 -5.54 -18.27 Source: Reuters Refined Soy Oil SpreadMatrix Closing 20-Feb-15 20-Apr-15 As on Jan 30, 2015 19-Jun-15 Spot 637.1 -17 -53.7 -82 20-Feb-15 620.1 0 -36.7 -65 20-Apr-15 583.4 - 0 -28.3 19-Jun-15 555.1 - - 0 Crude Palm Oil MCX CPO Jan. futures traded on positive note on Friday and closed 2.86 % higher taking clue from international markets. There is good demand of CPO at lower prices. In the month of Dec 2014, alone India imported 778,815 tonnes of Crude palm oil which is about 9% and 12% increase m-o-m and y-o-y respectively. CPO Spread Matrix As on Jan 30, 2015 30-Mar-15 Closing 30-Jan-15 27-Feb-15 30-Jan-15 424.1 0 -1.3 2 27-Feb-15 422.8 - 0 3.3 30-Mar-15 426.1 - - 0 Technical Chart –Ref Soy Oil NCDEX Feb contract Palm oils make up 75% of the country's total vegetable oil imports in Dec 14 as per the SEA data released. India meets 60% of its annual vegetable oil demand of 17-18 million tonnes via imports. Crude palm oil output in Indonesia and Malaysia supply about 85 per cent of the world's palm oil. According to Trade Ministry, Indonesia the crude palm oil export tax for February is kept at zero, unchanged from January. The overseas shipment of Indonesia's crude palm oil (CPO) and its derivative products last year grew 2.5 percent to 21.76 million tons. The government's policy of cutting the export tax for the commodity to zero in the final quarter of last year helped increase exports. Thailand plans to import around 50,000 tonnes of crude palm oil from February due to a domestic shortage caused by drought according to the trade sources. Technical Chart –Crude Palm Oil MCX Feb contract Outlook Soy Oil futures and CPO prices may trade on a mixed note. Prices may follow the international trend; however appreciation in USDINR may pressurize the prices. Technical Outlook Valid for Feb 02, 2015 Contract Unit Support Resistance Soy Oil NCDEX Feb Futures CPO MCX Feb Futures `/qtl `/qtl 610-614 429-432 622-626 438-442 Source: Telequote www.angelcommodities.com Commodities Daily Report nd Monday| 02 February, 2015 ` Agricultural Commodities Spices Market Highlights Jeera Jeera Feb. futures traded on negative note last week and closed 1.08% down yesterday on subdued demand and expectation of new season crop arrivals next month. The fundamentals on Jeera is still positive due to less production estimate amid less sowing area in the Gujarat, the main Jeera producing state. Jeera Spot- NCDEX Jeera- NCDEX Feb Fut Turmeric Spot- NCDEX Turmeric- NCDEX Apr Fut As on Jan 30, 2015 Unit `/qtl `/qtl `/qtl `/qtl Last 15370 14720 7550 8028 % Change WoW MoM -5.66 1.21 -9.42 -8.00 -5.16 -1.81 -5.60 -10.70 Prev day -0.42 -1.08 -1.38 -2.97 Production and Exports YoY 22.35 20.46 18.94 9.37 Source: Reuters According to Gujarat government data released on 19th Jan 15, Jeera recorded 2.64 lakh hac, 42% less sowing compared to last year’s 4.54 lakh hac. The supplies of Jeera expected to rise in the next month due to arrival of new season crop. Export orders are diverted to India due to Geo-political tensions in Syria and Turkey. .Jeera (cumin) exports have been 87,500 tonnes in the first six months (Apr-Sep) of 2014-15, a rise of 25% from the corresponding period of the previous (Source: Spices Board) Outlook Jeera futures are expected to trade on mixed note as there is reduced demand from retailers and stockists amid adequate stock positions as the harvesting has started in Gujarat and Rajasthan. Jeera Spread Matrix Spot 20-Feb-15 20-Mar-15 20-Apr-15 20-Feb-15 -905 0 - 20-Mar-15 -650 255 0 - As on Jan 30, 2015 20-Apr-15 -420 485 230 0 Closing 20-Apr-15 20-May-15 As on Jan 30, 2015 20-Jun-15 7550 8028 8102 8310 478 0 - 552 74 0 - Closing 15370 14465 14720 14950 Turmeric Spread Matrix Spot 20-Apr-15 20-May-15 20-Jun-15 Technical Chart – Jeera 760 282 208 0 NCDEX Feb contract Turmeric Turmeric Apr. futures traded on negative note on Friday and closed 2.97% down due to subdued demand from retailers and traders at high prices. The new crop has now hit the markets in Maharashtra, Andhra Pradesh and Karnataka. There are concerns over crop loss due to cyclone ‘Hudhud’ that hit Andhra Pradesh in Oct 2014. Demand for the commodity has been increasing rapidly from North India and from the medicinal and cosmetic industry. Production, Arrivals and Exports Sowing of Turmeric in AP for the 2014-15 season is reported at 0.13 lakh ha, as against 0.1 lakh ha last year. The area in Telangana stood at 0.446 lakh ha against 0.431 lakh ha last year. Technical Chart – Turmeric NCDEX Apr contract Exports in turmeric have increased by 10% to 43,000 tonnes during Apr-Sep 2014 as compared to last year. The export target for the 2014-15 is 80,000 tonnes according to Spice Board. Outlook Turmeric futures may trade on a mixed to negative note on increased supply, less spot demand and profit booking on higher levels may restrict the gains. Technical Outlook Valid for Feb 02, 2015 Jeera NCDEX Feb Futures Unit `/qtl Support 14190-14320 Resistance 14570-14710 Turmeric NCDEX Apr Futures `/qtl 7760-7870 8100-8210 Source: Telequote www.angelcommodities.com Commodities Daily Report nd Monday| 02 February, 2015 ` Agricultural Commodities Kapas Cotton complex traded on negative note on Friday. MCX Cotton Dec Futures closed 1.91% down and NCDEX Kapas April’15 closed 1.95% down. Domestic spot markets were stable as millers were buying as per the requirements. The arrival pace in India has picked up as procurement by the government agencies has increased in Maharashtra, Andhra Pradesh and Gujarat. The state-run Cotton Corp of India (CCI) started to sell cotton through electronic auctions into a weak market as it struggles to store purchases of around 50 lakh bales procured in the current crop season. Cotton prices in China India and Pakistan have fallen by 25 to 30 per cent and on the international market the commodity has lost nearly 75 per cent from last year. According to Chinese Government survey, the cotton production in China is down 2.2% and fell by 6.16 mt as cotton area shrank nearly 3%. Market Highlights NCDEX Kapas Apr ‘15 MCX Cotton Feb 15 ICE Cotton Mar ‘15 Cot look A Index As on Jan 30, 2015 Unit `20 kgs `/Bale USc/Lbs Last 731 14360 59.36 % Change Prev. day WoW -1.95 -0.27 -1.91 1.41 -0.35 2.77 67.3 0.00 1.97 MoM YoY -8.34 -26.50 -8.13 -29.81 -1.51 -31.00 -3.93 -27.05 Source: Reuters Cotton Spread Matrix 30-Jan-15 27-Feb-15 30-Mar-15 Closing 30-Jan-15 14360 14630 14850 0 - Technical Chart - Kapas As on Jan 30, 2015 27-Feb-15 30-Mar-15 270 0 - 490 220 0 NCDEX April 2015 contract Domestic Production and Consumption According to Cotton Association of India (CAI), cotton output in the country would stand around 402 lakh bales in season 2014-15, slightly lower than the production of the previous season when it was 407.25 lakh bales. The arrival of cotton till Jan 11 is at 168.31 lakh bales according to CCI data which is almost 3 per cent higher compared to last year. The Indian Cotton Federation has estimated cotton crop for 2014-15 season (October-September) at 406 lakh bales with Gujarat top the list with 120 lakh bales, followed by Maharashtra at 90 lakh, Telangana (45 lakh), Karnataka (33 lakh) and Seemandhra (30 lakh). Technical Chart - Cotton MCX Feb contract Two successive years of the bumper harvest have contributed to the fall in the domestic prices below MSP. Cotton procurement by the CCI has touched 4.82 million bales highest in last six years. India’s cotton exports have also dropped by 40 per cent year on year with prices declining up to 30 per cent for the same time period as demand from China has slowed down in 2014-15. Global Cotton Updates (WASDE Report) Latest report has pegged global output up from its previous month's estimates to 119.17 Million 480-pound Bales. World ending stocks are now projected at 108.6 million bales. Global consumption is reduced nearly 4 lakh bales compared to last month. China’s consumption is lowered as mills’ response to falling domestic cotton prices continues to be sluggish and yarn imports to date remain high. Source: Telequote US production rose to 161,000 bales whereas domestic mill use and exports are unchanged. Ending stocks are now at 4.7 million. Outlook Cotton futures may trade on a mixed note as CCI has started to sell procured cotton in the domestic market. Selling on higher levels may be negative for the prices. Technical Outlook Contract Valid for Feb 02, 2015 Unit Support Resistance Kapas NCDEX April ’15 Fut `/20 kgs 717-724 742-753 Cotton MCX Feb Futures `/bale 14360-14510 14780-15920 www.angelcommodities.com

© Copyright 2026