Cartera Semanal

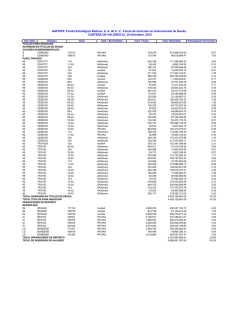

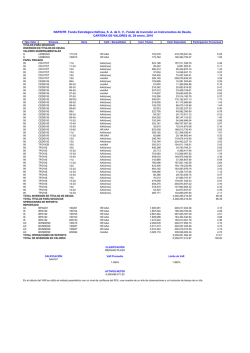

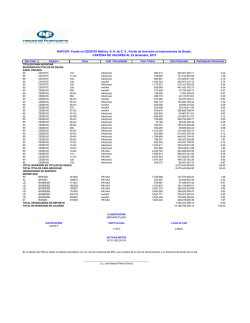

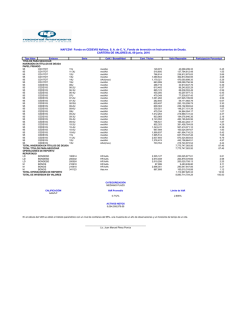

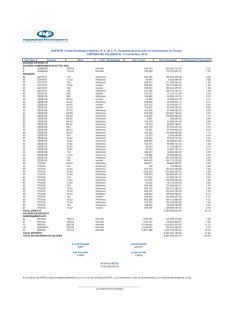

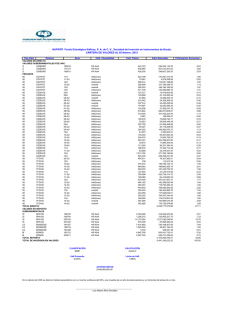

NAFINTR Fondo Estratégico Nafinsa, S. A. de C. V., Fondo de Inversión en Instrumentos de Deuda. CARTERA DE VALORES AL 23 diciembre, 2015 Tipo Valor Emisora TÍTULOS PARA NEGOCIAR INVERSIÓN EN TÍTULOS DE DEUDA VALORES GUBERNAMENTALES S UDIBONO 171214 S UDIBONO 190613 PAPEL PRIVADO 95 CDVITOT 11U 95 CDVITOT 11-3U 95 CDVITOT 12U 95 CDVITOT 13U 95 CDVITOT 14U 95 CDVITOT 15U 95 CEDEVIS 05U 95 CEDEVIS 06U 95 CEDEVIS 06-2U 95 CEDEVIS 06-3U 95 CEDEVIS 06-4U 95 CEDEVIS 07-2U 95 CEDEVIS 07-3U 95 CEDEVIS 0810U 95 CEDEVIS 08-2U 95 CEDEVIS 08-4U 95 CEDEVIS 08-6U 95 CEDEVIS 09U 95 CEDEVIS 09-2U 95 CEDEVIS 09-4U 95 CEDEVIS 10-2U 95 CEDEVIS 10-4U 95 CEDEVIS 10-5U 95 CEDEVIS 10-6U 95 CEDEVIS 11U 95 CEDEVIS 11-2U 95 CEDEVIS 12U 95 CEDEVIS 13U 95 TFOVICB 15U 95 TFOVIS 09-3U 95 TFOVIS 10U 95 TFOVIS 10-2U 95 TFOVIS 10-3U 95 TFOVIS 10-4U 95 TFOVIS 11U 95 TFOVIS 11-2U 95 TFOVIS 12U 95 TFOVIS 12-2U 95 TFOVIS 12-3U 95 TFOVIS 12-4U 95 TFOVIS 13U 95 TFOVIS 13-2U 95 TFOVIS 13-3U 95 TFOVIS 14U 95 TFOVIS 14-2U 95 TFOVIS 14-3U TOTAL INVERSIÓN EN TÍTULOS DE DEUDA TOTAL TÍTULOS PARA NEGOCIAR OPERACIONES DE REPORTO REPORTADO IM BPAG28 170727 IS BPA182 200730 LD BONDESD 171221 LD BONDESD 180419 LD BONDESD 180816 LD BONDESD 190627 LD BONDESD 200924 LD BONDESD 200924 LD BONDESD 200924 TOTAL OPERACIONES DE REPORTO TOTAL DE INVERSION EN VALORES Serie Calif. / Bursatilidad Cant. Títulos Valor Razonable HR AAA HR AAA 743,578 175,764 414,382,885.58 99,021,241.23 6.23 1.49 AAA(mex) AAA(mex) AAA(mex) mxAAA AAA(mex) mxAAA mxAAA AAA(mex) mxAAA AAA(mex) mxAAA mxAAA AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) HR AAA AAA(mex) HR AAA AAA(mex) AAA(mex) mxAAA AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) 523,198 26,542 280,414 37,004 271,739 385,149 153,721 129,899 81,650 218,342 307,512 174,607 103,206 240,001 218,000 126,278 52,923 222,705 94,327 354,202 103,340 353,181 35,810 623,009 358,100 62,686 348,745 703,764 402,568 464,011 456,368 25,713 753,083 549,033 143,969 760,098 423,400 464,162 199,256 80,388 70,510 479,059 484,375 318,419 53,303 285,171 172,125,175.10 6,730,846.16 88,119,221.52 13,745,234.75 117,999,851.51 202,727,879.59 11,454,867.72 18,184,479.82 11,244,501.03 25,611,072.71 33,069,417.96 39,364,269.53 23,231,474.41 108,895,590.61 89,934,086.24 65,082,440.64 24,931,698.61 49,053,655.83 19,944,612.94 88,094,731.99 53,893,106.92 186,445,006.41 9,894,493.72 164,941,660.79 119,588,489.44 19,903,796.50 116,170,249.21 219,161,057.26 205,700,110.57 45,095,025.50 41,020,971.74 4,683,536.17 121,721,577.20 154,077,633.83 38,791,945.46 176,206,425.35 143,182,016.33 158,523,157.74 72,540,108.21 30,157,961.10 28,022,632.34 183,272,709.14 204,569,417.05 149,237,625.67 25,207,019.30 137,735,400.04 4,532,692,368.47 4,532,692,368.47 2.59 0.10 1.33 0.21 1.77 3.05 0.17 0.27 0.17 0.39 0.50 0.59 0.35 1.64 1.35 0.98 0.38 0.74 0.30 1.33 0.81 2.80 0.15 2.48 1.80 0.30 1.75 3.30 3.09 0.68 0.62 0.07 1.83 2.32 0.58 2.65 2.15 2.38 1.09 0.45 0.42 2.76 3.08 2.24 0.38 2.07 68.18 68.18 2,004,518 6,554,565 3,003,531 169,666 1,336,562 2,012,203 944,223 2,079,226 3,025,059 200,018,558.68 665,728,712.97 300,027,834.42 16,923,263.36 133,090,735.59 200,018,697.56 93,698,752.78 206,329,313.05 300,027,993.16 2,115,863,861.57 6,648,556,230.04 3.01 10.01 4.51 0.25 2.00 3.01 1.41 3.10 4.51 31.82 100.00 HR AAA HR AAA HR AAA HR AAA HR AAA HR AAA mxAAA mxAAA mxAAA CLASIFICACIÓN MEDIANO PLAZO CALIFICACIÓN AAA/5-F Participación Porcentual VaR Promedio Límite de VaR 1.002% 1.980%

© Copyright 2026