NAFINTR Fondo Estratégico Nafinsa, S. A. de C. V., Sociedad de

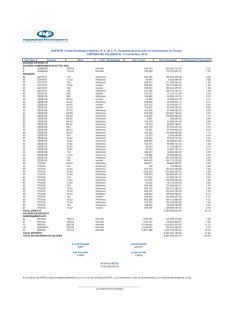

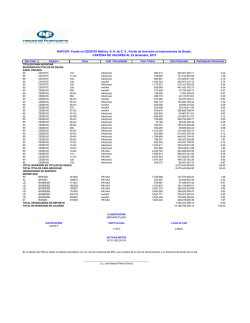

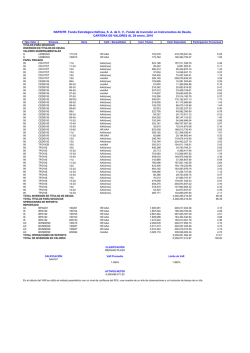

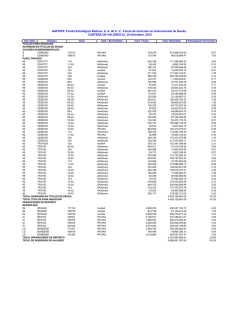

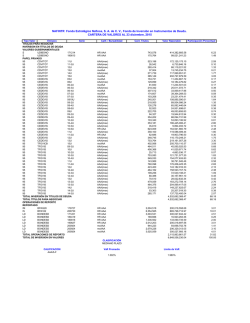

NAFINTR Fondo Estratégico Nafinsa, S. A. de C. V., Sociedad de Inversión en Instrumentos de Deuda. CARTERA DE VALORES AL 05 febrero, 2015 Tipo Valor Emisora VALORES EN DIRECTO VALORES GUBERNAMENTALES FED. NAC. S UDIBONO 160616 S UDIBONO 171214 S UDIBONO 190613 PRIVADOS 95 CDVITOT 11U 95 CDVITOT 11-3U 95 CDVITOT 12U 95 CDVITOT 12-2U 95 CDVITOT 13U 95 CDVITOT 14U 95 CEDEVIS 05U 95 CEDEVIS 06U 95 CEDEVIS 06-2U 95 CEDEVIS 06-3U 95 CEDEVIS 06-4U 95 CEDEVIS 07-2U 95 CEDEVIS 07-3U 95 CEDEVIS 0810U 95 CEDEVIS 08-2U 95 CEDEVIS 08-3U 95 CEDEVIS 08-4U 95 CEDEVIS 08-6U 95 CEDEVIS 09U 95 CEDEVIS 09-2U 95 CEDEVIS 09-4U 95 CEDEVIS 10U 95 CEDEVIS 10-2U 95 CEDEVIS 10-3U 95 CEDEVIS 10-4U 95 CEDEVIS 10-5U 95 CEDEVIS 10-6U 95 CEDEVIS 11U 95 CEDEVIS 11-2U 95 CEDEVIS 12U 95 CEDEVIS 13U 95 TFOVIS 09-3U 95 TFOVIS 10U 95 TFOVIS 10-2U 95 TFOVIS 10-3U 95 TFOVIS 10-4U 95 TFOVIS 11U 95 TFOVIS 11-2U 95 TFOVIS 11-3U 95 TFOVIS 12U 95 TFOVIS 12-2U 95 TFOVIS 12-3U 95 TFOVIS 12-4U 95 TFOVIS 13U 95 TFOVIS 13-2U 95 TFOVIS 13-3U 95 TFOVIS 14U 95 TFOVIS 14-2U 95 TFOVIS 14-3U TOTAL DIRECTO VALORES EN REPORTO GUBERNAMENTALES IS BPA182 180705 IS BPA182 190704 IS BPA182 200130 IS BPA182 201022 LD BONDESD 161027 LD BONDESD 180419 LD BONDESD 191226 M BONOS 161215 M BONOS 200611 TOTAL REPORTO TOTAL DE INVERSION EN VALORES Serie Calif. / Bursatilidad Cant. Títulos HR AAA HR AAA HR AAA AAA(mex) AAA(mex) AAA(mex) mxAAA mxAAA AAA(mex) mxAAA AAA(mex) mxAAA AAA(mex) mxAAA mxAAA AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) mxAAA AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) mxAAA AAA(mex) AAA(mex) AAA(mex) mxAAA mxAAA HR AAA HR AAA HR AAA HR AAA HR AAA HR AAA HR AAA HR AAA HR AAA Valor Razonable Participación Porcentual 442,743 638,865 428,305 248,454,116.76 361,013,201.02 248,607,320.55 2.63 3.82 2.63 523,198 16,991 280,414 292,808 390,303 271,739 153,721 129,899 81,650 218,342 307,512 174,607 103,206 515,844 218,000 5,991 126,278 52,923 222,705 94,327 354,202 81,973 103,340 303,470 353,181 35,810 113,393 186,019 62,686 1,213,195 845,405 464,011 708 575,274 848,083 549,033 127,604 760,098 189,080 423,400 464,162 284,357 444,640 305,403 404,059 393,303 339,595 387,266 342,926 170,291,313.79 4,978,268.89 112,821,198.96 107,199,398.70 185,766,168.29 133,080,668.19 14,416,852.96 23,123,062.49 14,580,009.10 34,356,209.55 45,430,425.85 42,553,926.30 27,362,610.16 290,877,805.07 107,762,204.94 129,208.47 73,629,740.71 29,008,449.38 61,084,006.66 25,110,835.85 106,992,970.37 3,783,843.27 60,427,064.46 17,654,708.35 204,799,957.90 11,880,304.83 36,321,394.43 73,164,713.49 23,276,027.24 471,760,190.66 336,768,231.50 79,327,882.01 113,913.34 139,785,152.74 189,662,926.15 181,245,752.76 41,374,914.96 222,735,414.72 64,416,662.32 167,021,067.27 183,398,050.48 118,794,385.33 190,626,560.58 136,424,868.76 177,028,532.01 184,307,244.45 174,614,881.58 197,696,574.39 178,735,879.89 6,335,777,072.88 1.80 0.05 1.20 1.14 1.97 1.41 0.15 0.24 0.15 0.36 0.48 0.45 0.29 3.08 1.14 0.00 0.78 0.31 0.65 0.27 1.13 0.04 0.64 0.19 2.17 0.13 0.38 0.77 0.25 5.00 3.57 0.84 0.00 1.48 2.01 1.92 0.44 2.36 0.68 1.77 1.94 1.26 2.02 1.45 1.88 1.95 1.85 2.09 1.89 67.11 2,748,568 1,256,210 10,175,000 870,495 7,416,460 1,000,000 5,516 4,645,799 2,267,578 274,628,457.68 125,405,207.75 1,017,535,538.94 87,856,360.29 740,346,407.09 99,461,794.35 546,521.36 500,041,732.41 259,737,429.50 3,105,559,449.37 9,441,336,522.25 2.91 1.33 10.78 0.93 7.84 1.05 0.01 5.30 2.75 32.89 100.00 CLASIFICACIÓN IDMP CALIFICACIÓN AAA/5-F VaR Promedio 0.635% Límite de VaR 1.980% ACTIVOS NETOS 9,469,065,694.00 En el cálculo del VAR se utilizó el método paramétrico con un nivel de confianza del 95%, una muestra de un año de observaciones y un horizonte de tiempo de un día. _________________________________________________ Luis Alberto Rico González

© Copyright 2026