NEWTON REAL RETURN FUND - BNY Mellon Asset Management

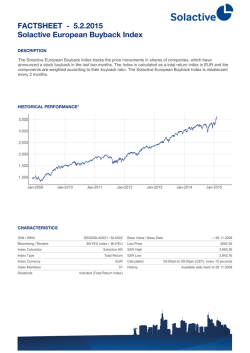

QUARTERLY INVESTMENT REPORT PREPARED FOR PROFESSIONAL CLIENTS AND, IN SWITZERLAND QUALIFIED INVESTORS // AS AT 31 DECEMBER 2014 NEWTON REAL RETURN FUND PERFORMANCE AIM The Fund aims to deliver a minimum return of cash (1 Month GBP LIBOR) +4% p.a. over 5 years before fees. In doing so, the Fund aims to achieve a positive return on a rolling 3 year basis. However, a positive return is not guaranteed and a capital loss may occur. PERFORMANCE DISCLOSURE Past performance is not a guide to future performance. The value of investments and the income from them is not guaranteed and can fall as well as rise due to stock market and currency movements. When you sell your investment you may get back less than you originally invested. For a full list of risks applicable to this fund please refer to the Prospectus or the Key Investor Information Document (KIID). QUARTERLY HIGHLIGHTS — — — Performance: The Fund produced a positive return over the quarter. Activity: Net equity exposure remained broadly flat. Sales included Deutsche Telekom and Paychex, while CA Technologies and Northeast Utilities were notable additions to the Fund. Outlook & Strategy: The Fund is currently positioned with the aim of protecting and preserving capital. 5 YEAR CUMULATIVE PERFORMANCE (%) INVESTMENT MANAGER Newton Investment Management: Newton follows a distinct global thematic investment approach and conducts extensive proprietary research. FUND RATINGS Source & Copyright: Morningstar and Morningstar OBSR ratings © 2015 Morningstar. All Rights Reserved. Ratings are collected on the first business day of the month. PERFORMANCE SUMMARY (%) Annualised GBP A Inc 1M 3M YTD 1YR 2YR 3YR 5YR -1.02 0.57 2.67 2.67 3.77 3.50 3.76 Source for all performance: Lipper as at 31 December 2014. Performance is shown for Sterling Income A Shares unless otherwise stated. Total return including income net of UK tax, ongoing charge and performance fee (where applicable). NEWTON REAL RETURN FUND // AS AT 31 DECEMBER 2014 PERFORMANCE COMMENTARY Volatility returned to global equity markets during the final quarter of 2014, with investors facing two pronounced sell-offs in relatively quick succession. THE LION’S SHARE OF THE RETURN CAME FROM EQUITY HOLDINGS AND GOVERNMENT BONDS Broadly speaking, both corrections were prompted by a resurgence of deflation-related concerns which did not chime with the widely held belief that global central-bank policy action can engender a self-sustaining economic recovery. A tangible illustration of an increasingly deflationary environment came in the form of a significant fall in the price of oil in December. Echoing these concerns, government-bond yields, including those of the UK, Germany and Australia, touched their lowest ever levels. The winner in global currencies continued to be the US dollar, which appreciated against most currencies internationally. Pushing against these factors, central banks once again intervened to prevent a sustained market decline. This time the Bank of Japan took market participants by surprise as it scaled up its quantitative easing programme. The Fund produced a positive return over the quarter. The lion’s share of the return came from equity holdings and government bonds, while derivative protection, corporate bonds and gold-mining equities detracted from performance. Among the most notable equity contributions were media-related holdings Wolters Kluwer, Vivendi and Reed Elsevier, which all continued to execute their respective operational strategies well. Accenture, the IT services company, stood out as another top contributor, helped by a strong set of financial results which prompted investors to start to factor in a rebound of corporate IT spending. Holdings related to the oil sector did not fare so well because of the sharp fall in the price of oil. With this in mind Total, Royal Dutch Shell, Suncor Energy and the Drill Rigs corporate-bond holding detracted from the Fund’s return. Commodity price weakness was not confined to the energy sphere: despite gold being one of the only commodities to post a positive return over the period, gold-mining shares suffered, apparently in sympathy with shares of the industrial miners. Government-bond exposure, held to reflect our view of a more challenging global economic backdrop, made a positive contribution as yields in many countries fell to historic lows. Although modified over the course of the quarter, derivative protection largely consisted of a short future on the S&P 500 index. This holding has a linear return profile, moving one for one with the US market, and can be best thought of as representing synthetic cash within the portfolio. To this end, the Fund was effectively running with a high cash balance over the period. This dampened the Fund’s upside participation, but we maintained the position for fear that a significant market correction could occur. ACTIVITY REVIEW The broad shape of the portfolio remained consistent over the quarter, reflecting that little has changed to alter our outlook. ON A NOTIONAL BASIS, 30% OF THE FUND IS NOW PROTECTED Net equity exposure remained broadly flat as we increased the holdings of government bonds; we hedged most foreign-currency exposure back to the base currency of the Fund; and we switched half of the Fund’s gold mining exposure into direct gold-price exposure. 2 NEWTON REAL RETURN FUND // AS AT 31 DECEMBER 2014 The Fund continued to maintain a high level of derivative protection over the quarter. However, we slightly reduced the delta-adjusted equity-index protection by replacing an S&P 500 short future position with a put option on the same index. In addition to this change, we diversified the S&P 500 short future position, complementing it with protection on the FTSE 100 Index and the Eurostoxx 50 Index. On a notional basis, 30% of the Fund is now protected. The sale of a few equity holdings roughly offset the slight decrease in delta-adjusted equity protection. We sold German telecommunications operator Deutsche Telekom following a period of strong share-price performance which we believe has priced in many of the catalysts we have been waiting for. These catalysts included a mobile-market improvement in Germany driven by consolidation; continued outperformance or a sale of T-Mobile USA; and perhaps even a sale of EE in the UK. We sold the Fund’s holding in Paychex, the US payroll-outsourcing business, when the shares reached our price target. Paychex has defied market expectations by managing to produce impressive new client additions, as well as increasing its product pricing. Notable additions over the quarter included CA Technologies, the US mainframe and enterprise-IT-solutions company. We do not feel that the current valuation correctly reflects the significant amounts of cash the declining mainframe business will generate over the coming years. Furthermore, there is potential upside from a turnaround in the company’s enterprise-IT division. Another notable addition was Northeast Utilities, the transmission company, which has scope to materially grow its regulated asset base though the development of much-needed electricity and gas transmission infrastructure in the New England region of the US. We also introduced two UK-listed solar funds, Bluefield and Foresight Solar. Solar energy continues to attract a high level of subsidies from the UK government and, accordingly, solar generators produce very stable cash-flow streams. We increased the Fund’s exposure to government bonds, adding to existing US and Australian holdings. Australia stands out to us as one of the few countries which still has the capacity to cut interest rates meaningfully in the face of a slowing growth outlook. We chose to hedge the Australian dollar back to the Fund’s base currency. We put more conviction behind our view that growth prospects in the US are structurally challenged, implying that the interest-rate expectations built into the US Treasury curve are too optimistic. Holdings in gold-mining equities were reduced by half with the proceeds being switched into a physically backed exchange-traded note which tracks the price of gold. Although we see significant upside in gold-mining equities, due to the dramatic fall in the gold price these companies are now highly financially levered and increasingly vulnerable to further falls in the gold price. On the currency front there were profits, notably from reducing the Fund’s US dollar exposure from 20% to 5%, following the significant appreciation of the dollar over the period. 3 NEWTON REAL RETURN FUND // AS AT 31 DECEMBER 2014 INVESTMENT OUTLOOK Our strategy and outlook remain unchanged. We remain of the opinion that the underlying factors holding back economic activity are structural, and that the policy approach to the problem may well be making things worse. WE BELIEVE IT IS MORE LIKELY THAT WE WILL SEE FURTHER ROUNDS OF STIMULUS BEFORE ANY KIND OF ‘NORMALISATION’ OF INTEREST RATES Where policymakers are aiming to engender some level of inflation, they may well exacerbate deflationary trends by encouraging debt-fuelled consumption and overcapacity. Moreover, by repeatedly stepping in to underpin and place a backstop to the financial system, policymakers are likely to be introducing ‘moral hazard’ into the financial system and, potentially, a greater level of fragility within it. In this post-crisis expansion, it may well be that deleverage within the banking sector has taken place. However, in a universal ‘hunt for yield’ environment, the financial system as a whole is arguably more levered and more ‘pro-cyclical’ (positively correlated with economic growth) than ever. On balance, we believe it is more likely that we will see further rounds of stimulus before any kind of ‘normalisation’ of interest rates. Both routes will require investors to alter their expectations. Whether the recent bout of volatility continues is unclear, but it seems almost certain that further episodes of volatility will arise. Given our concerns about the investment backdrop, we think it is desirable to keep the Fund’s holdings focused. We are willing to participate in more risky assets where our themes give us confidence in asset’s long-term growth potential or where there is strong valuation support. We believe that these characteristics will prove to be particularly important in meeting our core long-term objective of increasing the real value of the Fund. The Fund is currently positioned to try to protect and preserve capital; this is because we believe that losing less in periods of asset-price falls may well be more profitable than chasing returns in a world distorted by artificially low interest rates. 4 ASSET ALLOCATION AND ATTRIBUTION NEWTON REAL RETURN FUND // AS AT 31 DECEMBER 2014 TOTAL PORTFOLIO BREAKDOWN (%) TOP 10 HOLDINGS (%) Equities 58.8 Europe ex UK Risk offsetting positions - equities (Delta netted exposure) 24.9 North America 17.2 UK 10.7 USA TREASURY NOTES 1.5% 31/08/ 2018 USD100 6.1 USA TREASURY NOTES 2.375% 15/08/ 2024 USD100 3.1 NOVARTIS AG CHF0.50 (REGD) 2.7 Japan 2.9 Pacific Ex Japan 2.7 ETFS PHYSICAL GOLD 0% SECURED NOTE (USD) 2.6 Others 0.5 BAYER AG NPV (REGD) 2.6 ROCHE HOLDINGS AG GENUSSCHEINE NPV 2.5 ACCENTURE PLC CLS 'A' USD0.0000225 2.5 WOLTERS KLUWER NV EUR0.12 2.3 AUSTRALIA (COMMONWEALTH) 4.5% BDS 21/04/2033 AUD1000 2.3 MICROSOFT CORP COM STK USD0.0000125 2.2 20.2 Index futures & options 20.2 Bonds 22.1 Govt Bonds 18.4 Corp Bonds 2.6 Index Linked Govt 1.2 Convertibles 2.2 Cash and Cash Equivalents 9.6 Others 7.2 Commodities 4.4 Infrastructure 2.0 Floating Rate Notes 0.8 Derivatives 0.0 EQUITY SECTOR BREAKDOWN (%) Pharmaceuticals & Biotechnology 11.7 Media 7.1 Mobile Telecommunications 6.1 Tobacco 4.4 Software & Computer Services 3.9 Risk offsetting positions: Chemicals 3.7 Equity index futures and options- Providing downside protection if equity markets sell-off. Oil & Gas Producers 3.4 Gas, Water & Multiutilities 3.2 Mining 2.8 Support Services 2.5 Fixed Line Telecommunications 2.1 Food & Drug Retailers 1.7 Construction and materials 1.5 Currency positioning- Long USD (We expect the USD to remain negatively correlated with risk assets.) CORPORATE BOND PORTFOLIO BREAKDOWNS RATING BREAKDOWN (%) AA A BBB B SECTOR ALLOCATION (%) 3.0 33.3 15.2 Telecoms / Utilities 81.8 Industrial 15.2 Government / Agency 3.0 48.5 AVERAGE DURATION (IN YEARS) Aerospace & Defense 1.1 Nonlife Insurance 1.0 Real Estate Investment Trusts 1.0 Electricity 0.6 Inv Grade 9.7 Technology Hardware & Equipment 0.5 High Yield 6.5 Electronic & Electrical Equipment 0.3 Banks 0.3 Source: BNY Mellon Investment Management EMEA Limited Portfolio holdings are subject to change at any time without notice, are for information purposes only and should not be construed as investment recommendations. 5 NEWTON REAL RETURN FUND // AS AT 31 DECEMBER 2014 INVESTMENT OBJECTIVE A total return comprised of long-term capital growth and income by investing in a broad multi-asset portfolio. DEALING 09:00 to 17:00 each business day Valuation point: 12:00 London time GENERAL INFORMATION Total net assets (million) Historic yield (%) IMA Sector Lipper sector Fund type Fund domicile Fund manager Alternate Base currency Currencies available Fund launch Distribution dates STERLING INCOME A SHARES SHARE CLASS DETAILS Inception date Min. initial investment Ongoing charge Annual mgmt charge ISIN Bloomberg Sedol Registered for sale in: £ 9,533.20 2.92 Targeted Absolute Return Lipper Global - Absolute Return GBP High ICVC UK Iain Stewart James Harries GBP GBP 01 Sep 1993 28 Feb, 30 Sep 30 Oct 2000 £ 1,000 1.61% 1.50% GB0001642635 NEWINTA LN 164263 AT, ES, GB TO LEARN MORE ABOUT THIS FUND PLEASE CONTACT US: 0500 66 00 00 +44 (0)20 7163 2367 [email protected] [email protected] www.bnymellon.co.uk www.bnymellonim.com Source: BNY Mellon Investment Management EMEA Limited Any views and opinions contained in this document are as at the date of issue; are subject to change and should not be taken as investment advice. Portfolio holdings are subject to change at any time without notice, are for information purposes only and should not be construed as investment recommendations. IMPORTANT INFORMATION The Fund may not be registered in all markets, please contact your local representative for further information. This is a financial promotion for Professional Clients. In Switzerland, this is for Regulated Qualified Investors and Qualified Investors only. This is not intended as investment advice. You should read the Prospectus and the Key Investor Information Document (KIID) for each fund in which you want to invest. The Prospectus and KIID can be found at www.bnymellonim.com. All information prepared within has been prepared by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA, formerly named BNY Mellon Asset Management International Limited). BNYMIM EMEA and its affiliates are not responsible for any subsequent investment advice given based on the information supplied. BNY Mellon Investment Management EMEA Limited is the distributor of the capabilities of its investment managers in Europe (excluding funds in Germany), Middle East, Africa and Latin America. Investment managers are appointed by BNY Mellon Investment Management EMEA Limited or affiliated fund operating companies to undertake portfolio management services in respect of the products and services provided by BNY Mellon Investment Management EMEA Limited or the fund operating companies. These products and services are governed by bilateral contracts entered into by BNY Mellon Investment Management EMEA Limited and its clients or by the Prospectus and associated documents related to the funds. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries. This document should not be published in hard copy, electronic form, via the web or in any other medium accessible to the public, unless authorised by BNYMIM EMEA to do so. No warranty is given as to the accuracy or completeness of this information and no liability is accepted for errors or omissions in such information. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised. To help us continually improve our service and in the interest of security, we may monitor and/or record your telephone calls with us. Registration for new Funds may still be pending in certain markets. Fund may not be registered for sale in all markets. The Newton Real Return Fund (the Fund) is a subfund of BNY Mellon Investment Funds, an investment company with variable capital (ICVC) incorporated in England and Wales under registered number IC27 and authorised by the Financial Conduct Authority. BNY Mellon Fund Managers Limited (BNY MFM) is the Authorised Corporate Director. BNY MFM, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1998251. Authorised and regulated by the Financial Conduct Authority. ICVC investments should not be regarded as short-term and should normally be held for at least five years. Where the sub-fund is registered, please note: In Austria, the current Prospectus is available free of charge from Raiffeisen Zentralbank Österreich Aktiengesellschaft, Am Stadtpark 9, A-1030 Vienna. In Spain, BNY Mellon Investment Funds is a collective investment vehicle ("Institución de Inversión Colectiva") that is duly registered by the Comisión Nacional del Mercado de Valores on the Register of foreign Collective Investment Institutions commercialised in Spain (“Registro de Instituciones de Inversión Colectiva extranjeras comercializadas en España”) under the number 186. In Switzerland, the Prospectus, Key Investor Information Document, Articles of Association, Annual Report and Semi-Annual Report may be obtained free of charge from Selnaustrasse 16, 8002 Zurich, Switzerland. BNP Paribas Securities Services, Paris, succursale de Zurich acts as representative agent and paying agent for BNY MIF. This document is issued in the UK and in mainland Europe (excluding Germany) by BNY Mellon Investment Management EMEA Limited. BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. BNYMIM EMEA, BNY MFM and any other BNY Mellon entity mentioned are all ultimately owned by The Bank of New York Mellon Corporation. BNY MFM is a member of the IMA. CP14355-23-04-2015(3M). MIC008-23-04-2015(3M). Issued on 28/01/2015

© Copyright 2026