HIGHER EDUCATION MARKET UPDATE 2/2/2015

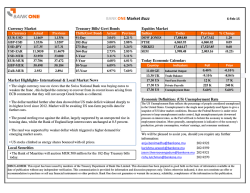

HIGHER EDUCATION MARKET UPDATE 2/2/2015 Market Commentary Recent Higher Education Pricings Final •Last week in the higher education sector, three issues priced with a total par amount of $129.6 million. Borrower (State) State Description Par (000s) •Last week the market’s focus was on the FOMC and the GDP release on Friday. Both of those events, coupled with more weakness out of Europe, produced volatility in the fixed income markets. Auraria Higher Education Center CO Parking Enterprise Revenue Refunding Bonds, Series 2015 6,030 •The market's attention turns to fundamentals this week in the form of more economic data, highlighted by Friday’s release of the January employment report. Board of Trustees of the University of Arkansas AR Athletic Facilities Revenue Refunding Bonds, Series 2015A (Fayetteville Campus) •The municipal market continues to lag treasuries; the larger calendar this week has put munis under pressure. Ratios have reached very attractive levels and should bring in some crossover buyers. Board of Trustees of the University of Illinois IL University of Illinois Auxiliary Facilities System Refunding Revenue Bonds, Series 2015A Maturity Spread Ratings 6/1/2029 55.3 A2 / AA / NR 14,180 9/15/2022 30.1 Aa2 / NR / NR 109,340 6/1/2038 102.6 Aa3 / AA- / NR Source: Thomson Reuters; Spread is the weighted average spread over the AAA G.O. MMD curve or the Treasury curve if Taxable •Municipal bond funds reported $892.5 million in inflows versus the previous week’s inflows of $771.2 million. The 4 week moving average is a positive $922.5 million. Key Interest Rates (%) Description Last Close 1mth ago 1yr ago 5yrs ago Prime Rate 3.25 3.25 3.25 3.25 1-month LIBOR 0.17 0.17 0.16 0.23 3-month LIBOR 0.25 0.26 0.24 0.25 SIFMA Index 0.02 0.03 0.04 0.20 12-month Treasury Note 0.14 0.21 0.08 0.29 2-year Treasury Bond 0.45 0.66 0.33 0.85 3-year Treasury Bond 0.74 1.07 0.66 1.39 5-year Treasury Bond 1.15 1.65 1.49 2.36 10-year Treasury Bond 1.64 2.17 2.64 3.64 30-year Treasury Bond 2.22 2.75 3.60 4.56 Source: Bloomberg Tax-Exempt AAA General Obligation Yields (%) Index Last Close 1mth ago 1yr ago 5yrs ago 1-year AAA G.O. Rate 0.14 0.16 0.17 0.28 2-year AAA G.O. Rate 0.41 0.48 0.30 0.61 3-year AAA G.O. Rate 0.59 0.78 0.49 0.86 5-year AAA G.O. Rate 0.94 1.32 1.10 1.60 10-year AAA G.O. Rate 1.72 2.04 2.53 2.96 30-year AAA G.O. Rate 2.50 2.86 3.85 4.20 Upcoming Higher Education Pricings Borrower (State) State Description Sale Date Par (000s) Ratings Nevada Sys of Hgr Ed NV Universities Revenue Bonds, Series 2015A 2/3/2015 64,320 Aa2/AA-/- Nevada Sys of Hgr Ed [D] NV Taxable Universities Revenue Bonds, Series 2015B Taxable 2/3/2015 7,535 Aa2/AA-/- Iowa BOR IA Athletic Facilities Revenue Bonds, Series I.S.U. 2015 (Iowa State University of Science and Technology) 2/5/2015 32,335 -/-/- week of 02/02/15 8,935 -/-/- University City SD MO General Obligation Bonds, Series A - Refunding and Series B Coastal Carolina Univ SC Higher Education Revenue Bonds, Series 2015 2/10/2015 94,990 A1/-/A+ Minnesota State Coll & Univ MN Revenue Fund and Refunding Bonds, Series 2015A 2/11/2015 36,060 -/-/- Minnesota State Coll & Univ MN Revenue Fund Bonds, Series 2015B (Taxable) 2/11/2015 41,790 -/-/- Source: Thomson Reuters Source: Thomson Reuters AAA MMD v. SIFMA Swap v. 70% of LIBOR Swap 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 AAA MMD Avg SIFMA Avg 70% of LIBOR Avg AAA MMD SIFMA 70% of LIBOR 0.00 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Averages reflect data since January 3, 2000 Source: MMD data from Thomson Reuters; SIFMA and LIBOR data from Bloomberg Raymond James Contacts Chuck Ellingsworth Hugh Tanner John Poche Lindsey Rea Jim Johnson 901-579-3575 615-665-6922 225-388-2644 901-578-4709 804-225-1104 [email protected] [email protected] [email protected] [email protected] [email protected] Amanda Del Bene Gavin Murrey Rob Nickell Megan DeGrass Chad Myers 212-906-3711 901-579-4283 214-365-5551 617-897-8968 901-579-4923 [email protected] [email protected] [email protected] [email protected] [email protected] Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. The information contained herein is based on sources which we believe reliable but is not guaranteed by us and is not to be considered all inclusive. It is not to be construed as an offer or the solicitation of an offer to sell or buy the securities herein mentioned. This firm and/or its affiliates and/or its individual shareholders and/or members of their families may have position in the securities mentioned and may make purchases and/or sales of these securities from time to time in the open market or otherwise. Opinions expressed are present opinions only and are subject to change without notice. Raymond James may also perform or seek to perform investment banking for entities referred herein. The securities and other investment products described herein are: 1) Not insured by the FDIC, 2) Subject to investment risks, including possible loss of the principal amount invested, 3) Not deposits or other obligations of, nor guaranteed by Raymond James or any of their affiliates. For institutional use only.

© Copyright 2026