Holdings - LKCM Funds

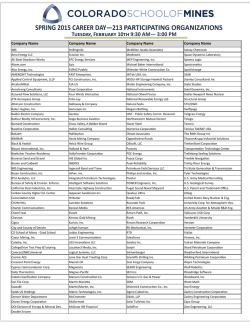

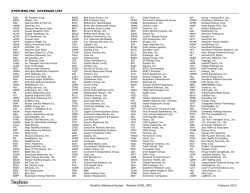

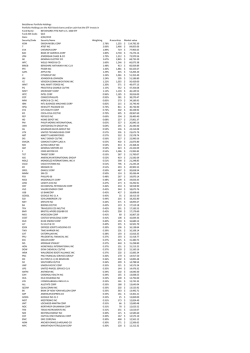

LKCM FUNDS LKCM Small Cap Equity Fund LKCM Equity Fund LKCM Balanced Fund LKCM Fixed Income Fund LKCM Small-Mid Cap Equity Fund Portfolio Holdings as of December 31, 2014 The attached portfolio holdings list provides information on the investments of the LKCM Small Cap Equity Fund, LKCM Equity Fund, LKCM Balanced Fund, LKCM Fixed Income Fund and the LKCM Small-Mid Cap Equity Fund as of the date indicated and has not been audited. This portfolio holdings list is not part of the Annual Report, Semi-Annual Report, or Form N-Q of the Funds. Fund holdings are subject to change and are not recommendations to buy or sell any security LKCM Small Cap Equity Fund Unaudited Portfolio Holdings as of December 31, 2014 Security Description Ticker MMF AND/OR T BILLS 63859B790 Shares / Par Value 444,984 Market Value 444,984 ACADIA HEALTHCARE ACETO ACI WORLDWIDE ACXIOM CORPORATION AKORN INC BANCORPSOUTH INC BARNES GROUP, INC BELDEN INC BELMOND LTD BRINKER INTL INC CARPENTER TECHNOLOGY INC CHARLES RIVER LABS INTL CIENA CORP CLARCOR INC COHERENT INC COLUMBIA BANKING COMMERCIAL METALS CO CYNOSURE DECKERS OUTDOOR CORP DEVRY EDUCATION GROUP, INC. DEXCOM DIAMONDBACK ENERGY INC E W SCRIPPS CO OHIO ENDOLOGIX INC EURONET WORLDWIDE INC EXACT SCIENCES CORP FLUIDIGM CORP FORTINET INC FRANKLIN ELEC INC GLOBE SPECIALTY HANMI FINANCIAL HEADWATERS INC HEALTHCARE SERVICES GROUP INC HEXCEL CORPORATION HFF INC HILLENBRAND INC ACHC ACET ACIW ACXM AKRX BXS B BDC BEL EAT CRS CRL CIEN CLC COHR COLB CMC CYNO DECK DV DXCM FANG SSP ELGX EEFT EXAS FLDM FTNT FELE GSM HAFC HW HCSG HXL HF HI 253,683 365,755 644,335 532,060 592,633 628,474 379,070 137,510 405,032 240,825 66,340 213,635 592,745 181,090 80,820 418,240 198,345 162,603 148,435 240,335 318,490 133,935 711,550 583,188 281,180 751,460 249,336 519,700 284,275 423,530 432,595 722,755 466,690 323,380 348,998 431,570 15,527,936 7,936,884 12,996,237 10,784,856 21,453,315 14,146,950 14,029,381 10,837,163 5,010,246 14,134,019 3,267,245 13,595,731 11,505,180 12,067,838 4,907,390 11,547,606 3,231,040 4,458,574 13,513,522 11,408,702 17,532,875 8,006,634 15,903,143 8,916,945 15,436,782 20,620,062 8,410,103 15,934,002 10,668,841 7,297,422 9,434,897 10,834,097 14,434,722 13,417,036 12,536,008 14,889,165 Security Description Ticker HOME BANCSHARES INC HSN, INC. INFINERA CORP INTERACTIVE INTELLIGENCE GROUP KATE SPADE & COMPANY KENNEDY-WILSON LA QUINTA HOLDINGS INC LANDSTAR SYSTEM INC LITHIA MOTORS INC CLASS A LOGMEIN INC MANHATTAN ASSOCIATES INC MANITOWOC INC MARKETAXESS HOLDINGS INC MATADOR RESOURCES MEMORIAL RESOURCE DEVELOPMENT MSA SAFETY INCORPORATED MWI VETERINARY SUPPLY INC OXFORD INDUSTRIES INC PEBBLEBROOK HOTEL TRUST PGT INDUSTRIES PIER 1 IMPORTS INC POLYONE CORP POOL CORPORATION POST HOLDINGS INC PRA GROUP INC PRIMORIS SVCS CORP PROSPERITY BANCSHARES INC RAMBUS INC RAVEN INDS INC RUCKUS WIRELESS SKECHERS USA INC CL A SONUS NETWORKS INC SOVRAN SELF STORAGE INC SPECTRANETICS CORP SPS COMMERCE INC STAG INDUSTRIAL INC STRATEGIC HOTELS & RESORTS INC SYNERGY RESOURCES CORP TAKE TWO INTERACTIVE TEAM HEALTH HOLDINGS TELEDYNE TECHNOLOGIES TEXAS CAPITAL BANCSHARES TREEHOUSE FOODS INC WINNEBAGO INDS INC WORTHINGTON INDUSTRIES HOMB HSNI INFN ININ KATE KW LQ LSTR LAD LOGM MANH MTW MKTX MTDR MRD MSA MWIV OXM PEB PGTI PIR POL POOL POST PRAA PRIM PB RMBS RAVN RKUS SKX SONS SSS SPNC SPSC STAG BEE SYRG TTWO TMH TDY TCBI THS WGO WOR Shares / Par Value 400,338 97,845 986,195 138,720 247,700 517,062 619,355 151,640 174,805 207,500 152,080 344,725 71,525 376,991 396,020 165,865 91,420 200,840 256,090 805,166 36,380 336,680 167,875 263,550 174,535 206,375 81,645 1,058,655 232,275 371,420 136,270 2,620,460 145,195 578,293 165,055 475,245 824,810 875,670 477,375 334,540 146,235 239,640 138,335 71,416 127,285 Market Value 12,874,870 7,436,220 14,516,790 6,644,688 7,928,877 13,081,669 13,662,971 10,998,449 15,153,845 10,238,050 6,192,698 7,618,423 5,129,058 7,626,528 7,140,241 8,805,773 15,533,172 11,088,376 11,685,387 7,753,749 560,252 12,763,539 10,649,990 11,040,110 10,110,813 4,796,155 4,519,867 11,740,484 5,806,875 4,464,468 7,528,918 10,403,226 12,663,908 19,997,372 9,347,065 11,643,503 10,912,236 10,980,902 13,380,821 19,246,086 15,024,184 13,019,641 11,831,793 1,554,012 3,830,006 LKCM Equity Fund Unaudited Portfolio Holdings as of December 31, 2014 Security Description Ticker MMF AND/OR T BILLS 63859B790 ABBOTT LABORATORIES ABBVIE INC ADOBE SYSTEMS INC AKAMAI TECHNOLOGIES AMAZON.COM INC AMGEN INC APPLE INC BALL CORPORATION BANK OF AMERICA CORP CABOT OIL & GAS CORP CARPENTER TECHNOLOGY INC CELGENE CORP COCA-COLA COMPANY COMERICA INC CONOCOPHILLIPS COPART INC CULLEN FROST BANKERS INC DANAHER CORPORATION DOVER CORPORATION E I DU PONT DE NEMOURS & CO EBAY INC EMC CORPORATION EOG RESOURCES INC EXXON MOBIL CORPORATION FMC CORPORATION FRANKLIN ELEC INC GENERAC HOLDINGS INC GENTEX CORPORATION GLACIER BANCORP INC GORMAN-RUPP CO HALYARD HEALTH INC HOME DEPOT INC HONEYWELL INTL INC INTERNATIONAL PAPER CO INTL BUSINESS MACHINES JARDEN CORP ABT ABBV ADBE AKAM AMZN AMGN AAPL BLL BAC COG CRS CELG KO CMA COP CPRT CFR DHR DOV DD EBAY EMC EOG XOM FMC FELE GNRC GNTX GBCI GRC HYH HD HON IP IBM JAH Shares / Par Value Market Value 5,191,366 5,191,366 90,000 82,150 45,000 90,000 9,500 40,000 98,000 75,000 276,663 120,000 47,000 50,000 65,000 120,000 50,000 100,000 50,850 75,000 50,000 90,000 65,000 83,000 60,000 55,000 80,000 85,000 92,000 125,000 60,000 67,500 5,625 50,000 60,000 50,000 30,000 142,500 4,051,800 5,375,896 3,271,500 5,666,400 2,948,325 6,371,600 10,817,240 5,112,750 4,949,501 3,553,200 2,314,750 5,593,000 2,744,300 5,620,800 3,453,000 3,649,000 3,592,044 6,428,250 3,586,000 6,654,600 3,647,800 2,468,420 5,524,200 5,084,750 4,562,400 3,190,050 4,301,920 4,516,250 1,666,200 2,168,100 255,769 5,248,500 5,995,200 2,679,000 4,813,200 6,822,900 Security Description Ticker JOHNSON & JOHNSON JP MORGAN & COMPANY INC KANSAS CITY SOUTHERN KIMBERLY-CLARK CORPORATION KIRBY CORPORATION MARTIN MARIETTA MATERIALS MEMORIAL RESOURCE DEVELOPMENT MERCK & COMPANY INC MICROSOFT CORPORATION MONSANTO COMPANY NATIONAL INSTRUMENTS CORP NIKE INC NOBLE ENERGY INC PALL CORP PEPSICO INC PERKINELMER INC PFIZER INC PROCTER & GAMBLE COMPANY PROSPERITY BANCSHARES INC PRUDENTIAL FINANCIAL INC QUALCOMM INC RANGE RESOURCES CORP RAVEN INDS INC ROCKWELL COLLINS INC ROPER INDUSTRIES INC SABRE SCHLUMBERGER LIMITED SUNTRUST BANKS INC THERMO FISHER SCIENTIFIC TIFFANY & COMPANY TIME WARNER CABLE TIME WARNER INC TRACTOR SUPPLY COMPANY TRIMBLE NAVIGATION LTD UNION PACIFIC CORP V F CORPORATION VALMONT INDUSTRIES INC VERIZON COMMUNICATIONS WALGREEN BOOTS ALLIANCE INC WALT DISNEY COMPANY WASTE CONNECTIONS INC WELLS FARGO & COMPANY WHITEWAVE FOODS CO CL A ZIONS BANCORPORATION JNJ JPM KSU KMB KEX MLM MRD MRK MSFT MON NATI NKE NBL PLL PEP PKI PFE PG PB PRU QCOM RRC RAVN COL ROP SABR SLB STI TMO TIF TWC TWX TSCO TRMB UNP VFC VMI VZ WBA DIS WCN WFC WWAV ZION Shares / Par Value 38,000 40,000 28,000 45,000 45,000 50,000 86,130 80,000 100,000 50,000 55,000 33,500 35,000 55,000 55,000 100,000 115,000 50,000 40,000 65,000 33,000 48,000 52,500 40,000 23,000 160,000 24,500 109,604 50,000 35,000 23,000 34,000 40,000 155,000 70,000 60,000 35,000 70,000 50,000 43,385 65,000 120,000 90,000 110,000 Market Value 3,973,660 2,503,200 3,416,840 5,199,300 3,633,300 5,516,000 1,552,924 4,543,200 4,645,000 5,973,500 1,709,950 3,221,025 1,660,050 5,566,550 5,200,800 4,373,000 3,582,250 4,554,500 2,214,400 5,879,900 2,452,890 2,565,600 1,312,500 3,379,200 3,596,050 3,243,200 2,092,545 4,592,408 6,264,500 3,740,100 3,497,380 2,904,280 3,152,800 4,113,700 8,339,100 4,494,000 4,445,000 3,274,600 3,810,000 4,086,433 2,859,350 6,578,400 3,149,100 3,136,100 LKCM Balanced Fund Unaudited Portfolio Holdings as of December 31, 2014 Security Description Ticker MMF AND/OR T BILLS OA0933999 ABBOTT LABORATORIES ABBVIE INC ACCENTURE PLC ADOBE SYSTEMS INC AIR PRODS & CHEMS INC AIRGAS INC AKAMAI TECHNOLOGIES ALIBABA GROUP HOLDING LTD AMAZON.COM INC AMERICAN TOWER CORP REIT APPLE INC AT&T CORPORATION AUTO DATA PROCESSING BALL CORPORATION BANK OF AMERICA CORP CABOT OIL & GAS CORP CAPITOL FEDERAL FINANCIAL INC CBS CORPORATION CELGENE CORP CHEVRON CORPORATION CITRIX SYSTEMS INC COCA-COLA COMPANY COLGATE-PALMOLIVE CO COMERICA INC COMMERCIAL METALS CO COPART INC CULLEN FROST BANKERS INC CVS HEALTH CORPORATION DANAHER CORPORATION DIRECTV E I DU PONT DE NEMOURS & CO EBAY INC EMC CORPORATION EMERSON ELECTRIC COMPANY EOG RESOURCES INC EXXON MOBIL CORPORATION FMC CORPORATION GENERAL DYNAMICS CORP GENERAL ELECTRIC COMPANY GOOGLE INC GOOGLE INC CL C HOME DEPOT INC HONEYWELL INTL INC INTL BUSINESS MACHINES JP MORGAN & COMPANY INC KIMBERLY-CLARK CORPORATION MARTIN MARIETTA MATERIALS MERCK & COMPANY INC METLIFE INC MONSANTO COMPANY NATIONAL INSTRUMENTS CORP NUANCE COMMUNICATIONS INC O REILLY AUTOMOTIVE INC PALL CORP PEPSICO INC PERKINELMER INC PFIZER INC PIONEER NAT RES CO PROCTER & GAMBLE COMPANY PRUDENTIAL FINANCIAL INC QUALCOMM INC RANGE RESOURCES CORP ROCKWELL COLLINS INC SABRE SCHLUMBERGER LIMITED SM ENERGY COMPANY SUNTRUST BANKS INC THERMO FISHER SCIENTIFIC TIME WARNER INC TRIMBLE NAVIGATION LTD UNION PACIFIC CORP UNITED PARCEL SERVICE V F CORPORATION VERIZON COMMUNICATIONS WALGREEN BOOTS ALLIANCE INC WAL-MART STORES INC WALT DISNEY COMPANY WASTE MANAGEMENT INC WELLS FARGO & COMPANY WILLIAMS COMPANIES INC ZIONS BANCORPORATION ABT ABBV ACN ADBE APD ARG AKAM BABA AMZN AMT AAPL T ADP BLL BAC COG CFFN CBS CELG CVX CTXS KO CL CMA CMC CPRT CFR CVS DHR DTV DD EBAY EMC EMR EOG XOM FMC GD GE GOOGL GOOG HD HON IBM JPM KMB MLM MRK MET MON NATI NUAN ORLY PLL PEP PKI PFE PXD PG PRU QCOM RRC COL SABR SLB SM STI TMO TWX TRMB UNP UPS VFC VZ WBA WMT DIS WM WFC WMB ZION Shares / Par Value Market Value 507,131 507,131 10,200 8,200 3,200 4,100 2,500 3,000 6,600 4,500 1,300 2,600 5,950 7,400 3,700 5,700 11,000 10,200 19,500 5,600 5,800 2,695 4,000 8,600 4,700 9,500 9,500 11,000 3,900 4,700 4,900 3,900 4,200 6,000 9,400 3,000 3,800 3,227 4,300 1,400 9,400 350 350 4,000 3,400 1,500 6,400 2,100 2,700 5,200 6,300 1,900 7,500 8,000 2,100 3,200 3,600 12,000 10,000 1,400 3,500 3,400 2,000 4,000 4,400 12,000 3,395 3,400 11,300 3,100 5,800 6,000 3,000 2,600 5,700 3,841 5,200 4,100 4,000 6,100 9,071 5,700 13,300 459,204 536,608 285,792 298,070 360,575 345,540 415,536 467,730 403,455 257,010 656,761 248,566 308,469 388,569 196,790 302,022 249,210 309,904 648,788 302,325 255,200 363,092 325,193 444,980 154,755 401,390 275,496 452,657 419,979 338,130 310,548 336,720 279,556 185,190 349,866 298,336 245,229 192,668 237,538 185,731 184,240 419,880 339,728 240,660 400,512 242,634 297,864 295,308 340,767 226,993 233,175 114,160 404,502 323,872 340,416 524,760 311,500 208,390 318,815 307,564 148,660 213,800 371,712 243,240 289,967 131,172 473,470 388,399 495,436 159,240 357,390 289,042 426,930 179,682 396,240 352,108 376,760 313,052 497,272 256,158 379,183 Security Description Ticker ABBVIE INC AIR PRODUCTS & CHEMICALS AIR PRODUCTS & CHEMICALS AMAZON.COM INC AMERICAN EXPRESS CREDIT AMGEN INC ANHEUSER-BUSCH INBEV APACHE CORP APPLIED MATERIALS INC AT&T INC BANK OF AMERICA CORP BB&T CORPORATION BB&T CORPORATION BROADCOM CORP COCA-COLA CO COMERICA INC CVS CAREMARK CORP CVS CAREMARK CORP DENTSPLY INTERNATIONAL DIRECTV HOLDINGS/FING EASTMAN CHEMICAL CO EASTMAN CHEMICAL CO EBAY INC ECOLAB INC EXPRESS SCRIPTS HOLDING EXPRESS SCRIPTS INC GILEAD SCIENCES INC HEWLETT-PACKARD CO HEWLETT-PACKARD CO INTEL CORP JPMORGAN CHASE & CO KRAFT FOODS GROUP INC MCKESSON CORP MERCK & CO INC NATIONAL OILWELL VARCO I NETAPP INC NOBLE HOLDING INTL LTD NOBLE HOLDING INTL LTD OCCIDENTAL PETROLEUM CORP ORACLE CORP PRUDENTIAL FINANCIAL INC ROPER INDUSTRIES INC SHERWIN-WILLIAMS CO SUNTRUST BANKS INC TEVA PHARMACEUT FIN BV THERMO FISHER SCIENTIFIC VERIZON COMMUNICATIONS WALGREEN CO WASTE MANAGEMENT INC WELLS FARGO & COMPANY WESTERN UNION CO 00206RAY8 00287YAK5 009158AQ9 009158AS5 023135AH9 0258M0DD8 031162BQ2 03523TBN7 037411AS4 038222AE5 05531FAK9 05531FAQ6 06051GEZ8 111320AE7 126650BH2 126650CB4 191216AK6 200340AP2 249030AB3 25459HBE4 277432AJ9 277432AM2 278642AG8 278865AP5 302182AF7 30219GAD0 375558AV5 428236BL6 428236BP7 458140AL4 48126EAA5 50076QAY2 58155QAC7 58933YAC9 637071AL5 64110DAC8 65504LAE7 65504LAH0 674599CB9 68389XAN5 74432QBR5 776696AD8 824348AP1 867914BE2 88165FAC6 883556BB7 92343VBD5 931422AJ8 94106LAX7 94974BEZ9 959802AR0 Shares / Par Value 45,000 75,000 75,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 100,000 115,000 125,000 134,000 150,000 150,000 150,000 150,000 160,000 160,000 175,000 175,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 200,000 225,000 225,000 250,000 250,000 250,000 275,000 295,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 310,000 325,000 335,000 Market Value 46,036 76,282 81,079 99,973 101,671 101,931 102,114 102,225 102,790 110,427 110,966 115,345 124,119 133,673 143,571 148,584 151,481 152,267 161,451 162,593 179,060 179,761 197,572 199,370 201,257 202,992 203,838 204,126 204,476 204,678 205,008 205,657 228,083 229,854 247,936 249,405 256,039 272,189 292,078 298,144 299,777 300,344 300,573 301,895 303,046 305,824 307,450 308,247 312,891 322,679 335,386 LKCM Fixed Income Fund Unaudited Portfolio Holdings as of December 31, 2014 Security Description Ticker MMF AND/OR T BILLS OA0933999 Shares / Par Value 3,187,336 Market Value 3,187,336 AIRGAS INC ALCOA INC ALLERGAN INC AMERICAN EXPRESS CO FRN AMERICAN EXPRESS CREDIT AMERICAN TOWER CORP AMERICAN TOWER CORP AMERICAN TOWER CORP ANADARKO PETROLEUM CORP ANADARKO PETROLEUM CORP ANALOG DEVICES AT&T INC FRN AT&T INC FRN BALL CORP BALL CORP BALL CORP BANK OF AMERICA CORP BANK OF AMERICA FRN BRANCH BANKING & TR FRN BRANCH BANKING & TR FRN BRANCH BANKING & TRUST BURLINGTN NORTH SANTA FE CELGENE CORP CELGENE CORP CENTURYLINK INC CENTURYLINK INC CENTURYLINK INC CISCO SYSTEMS INC CISCO SYSTEMS INC COCA-COLA CO COMERICA INC COMERICA INC CVS CAREMARK CORP CVS CAREMARK CORP CVS CAREMARK CORP DENTSPLY INTERNATIONAL EASTMAN CHEMICAL CO ECOLAB INC ENTERPRISE PRODUCTS OPER ENTERPRISE PRODUCTS OPER EXPRESS SCRIPTS INC FAMILY DOLLAR STORES INC FANNIE MAE FANNIE MAE STEP UP FED HE LN BK STEP UP FED HM LN BK BD 009363AL6 013817AL5 018490AP7 025816BH1 0258M0DC0 029912BC5 03027XAA8 03027XAD2 032511AX5 032511BH9 032654AG0 00206RCB6 00206RCD2 058498AP1 058498AQ9 058498AR7 06051GFH7 06051GEW5 10513KAB0 10513KAC8 07330NAK1 12189TAY0 151020AD6 151020AJ3 156700AN6 156700AQ9 156700AS5 17275RAC6 17275RAE2 191216AK6 200340AN7 200340AP2 126650BH2 126650BW9 126650CB4 249030AB3 277432AJ9 278865AK6 29379VAS2 29379VBE2 302182AF7 307000AA7 31359MH89 3136G0PN5 3130A2HT6 3133XKQX6 950,000 500,000 1,017,000 3,533,000 1,900,000 1,250,000 4,870,000 2,500,000 2,000,000 2,000,000 1,050,000 3,000,000 1,500,000 2,000,000 5,000,000 2,000,000 4,000,000 4,548,000 2,325,000 2,534,000 500,000 185,000 5,279,000 4,000,000 1,402,000 2,000,000 4,500,000 1,000,000 700,000 1,500,000 892,000 1,000,000 2,750,000 2,000,000 1,725,000 1,446,000 2,625,000 1,760,000 2,229,000 4,000,000 2,760,000 4,500,000 1,000,000 1,000,000 3,500,000 1,000,000 971,612 533,792 990,890 3,535,833 1,956,696 1,357,854 5,113,943 2,656,033 2,139,630 2,225,002 1,074,437 3,051,114 1,511,379 2,090,000 5,262,500 2,070,000 4,079,728 4,584,830 2,318,025 2,519,822 497,646 203,031 5,331,801 4,217,792 1,521,170 2,105,000 4,691,250 1,055,193 782,773 1,664,486 905,476 994,344 3,036,754 2,171,664 1,742,036 1,478,169 2,675,374 1,818,089 2,282,389 4,023,456 2,838,069 4,752,950 1,054,694 1,001,264 3,507,123 1,092,718 Security Description Ticker FED HM LN BK STEP UP FED HM LN BK STEP UP FED HM LN BK STEP UP FED HM LN BK STEPUP FREDDIE MAC GILEAD SCIENCES INC HARRIS CORPORATION HEWLETT-PACKARD CO HEWLETT-PACKARD CO HEWLETT-PACKARD FRN IBM CORP JARDEN CORP JPMORGAN CHASE & CO JPMORGAN CHASE & CO JPMORGAN CHASE FRN KOHLS CORPORATION KRAFT FOODS GROUP INC LOCKHEED MARTIN CORP LOWE`S COMPANIES INC MASCO CORP MCDONALD`S CORP MCKESSON CORP MERRILL LYNCH PFD CAP TR III CUM PERP MORGAN STANLEY FRN MORGAN STANLEY FRN MORGAN STANLEY FRN NOBLE HOLDING INTL LTD NOBLE HOLDING INTL LTD O`REILLY AUTOMOTIVE INC PEPSICO INC PERKINELMER INC PROCTER & GAMBLE CO PRUDENTIAL FINANCIAL INC RANGE RESOURCES CORP REPUBLIC SERVICES INC ROPER INDUSTRIES INC SUNTRUST BANKS INC TEXAS INSTRUMENTS INC THERMO FISHER SCIENTIFIC US TREASURY N/B US TREASURY N/B VERIZON COMM FRN VERIZON COMM FRN VERIZON COMMUNICATIONS WALGREEN CO WALT DISNEY COMPANY WEATHERFORD WEATHERFORD INTL INC WELLS FARGO & CO FRN WELLS FARGO & COMPANY WESTERN UNION CO WESTERN UNION CO WESTERN UNION CO 3130A2M86 3130A2NW2 3130A3HP2 313382RJ4 3137EABA6 375558AV5 413875AL9 428236BV4 428236BX0 428236BZ5 459200GJ4 471109AB4 46625HHX1 46625HJY7 46625HJF8 500255AP9 50076QAY2 539830AE9 548661CH8 574599BG0 58013MEE0 58155QAC7 59021F206 61746BDN3 6174467V5 61745EF30 65504LAB3 65504LAJ6 67103HAA5 713448BJ6 714046AE9 742718BG3 74432QBR5 75281AAN9 760761AB2 776696AD8 867914BE2 882508AR5 883556BF8 912828EE6 912828EW6 92343VBL7 92343VBM5 92343VBY9 931422AH2 25468PCE4 94707VAC4 947074AJ9 94974BFK1 94974BFN5 959802AB5 959802AP4 959802AR0 Shares / Par Value 2,500,000 2,750,000 2,500,000 2,000,000 500,000 1,550,000 900,000 2,000,000 2,000,000 2,000,000 1,500,000 2,790,000 4,125,000 2,000,000 3,000,000 282,000 555,000 1,250,000 525,000 1,350,000 1,000,000 2,275,000 75,000 3,500,000 2,500,000 1,000,000 4,855,000 2,500,000 1,000,000 214,000 1,094,000 775,000 3,023,000 4,350,000 1,000,000 2,000,000 875,000 1,000,000 4,500,000 500,000 500,000 4,000,000 4,000,000 1,500,000 3,000,000 1,500,000 2,000,000 1,550,000 2,500,000 5,000,000 1,000,000 2,500,000 2,250,000 Market Value 2,502,798 2,752,426 2,496,675 1,999,710 556,808 1,551,787 1,027,825 2,143,440 2,035,148 1,967,706 1,672,715 3,069,000 4,235,117 2,004,108 3,025,830 313,879 564,486 1,361,695 542,806 1,566,000 1,112,108 2,329,955 1,914,750 3,510,378 2,541,830 1,012,798 4,919,557 2,193,468 1,099,351 260,572 1,191,867 1,089,871 3,098,696 4,371,750 1,127,757 2,003,820 912,599 1,023,304 4,754,628 512,578 523,203 4,074,228 4,164,736 1,554,036 2,966,715 1,622,106 1,782,732 1,657,888 2,506,130 5,253,620 1,074,133 2,595,883 2,298,544 LKCM Small-Mid Cap Equity Fund Unaudited Portfolio Holdings as of December 31, 2014 Security Description Ticker MMF AND/OR T BILLS 63859B790 ACADIA HEALTHCARE ACI WORLDWIDE ACUITY BRANDS INC AFFILIATED MANAGERS GROUP AKORN INC ALIGN TECHNOLOGY ALLEGHENY TECHNOLOGIES B/E AEROSPACE INC BANCORPSOUTH INC BELDEN INC CIENA CORP COMERICA INC DECKERS OUTDOOR CORP DEXCOM DIAMONDBACK ENERGY INC E TRADE FINANCIAL CORP EURONET WORLDWIDE INC EXACT SCIENCES CORP F5 NETWORKS INC FORTINET INC GANNETT COMPANY INC HEALTHCARE SERVICES GROUP INC HEXCEL CORPORATION HILLENBRAND INC JONES LANG LASALLE INC KATE SPADE & COMPANY KIRBY CORPORATION KLX INC LA QUINTA HOLDINGS INC LITHIA MOTORS INC CLASS A MARTIN MARIETTA MATERIALS MEMORIAL RESOURCE DEVELOPMENT MIDDLEBY CORP MWI VETERINARY SUPPLY INC PERKINELMER INC POLARIS INDS INC POLYONE CORP POOL CORPORATION PRA GROUP INC RAMBUS INC RAYMOND JAMES FINANCIAL SOVRAN SELF STORAGE INC TAKE TWO INTERACTIVE TEAM HEALTH HOLDINGS TELEDYNE TECHNOLOGIES TEXAS CAPITAL BANCSHARES TRACTOR SUPPLY COMPANY TRIMBLE NAVIGATION LTD ULTA SALON COSMETICS & FRAGRANCE WHITEWAVE FOODS CO CL A ZIONS BANCORPORATION ACHC ACIW AYI AMG AKRX ALGN ATI BEAV BXS BDC CIEN CMA DECK DXCM FANG ETFC EEFT EXAS FFIV FTNT GCI HCSG HXL HI JLL KATE KEX KLXI LQ LAD MLM MRD MIDD MWIV PKI PII POL POOL PRAA RMBS RJF SSS TTWO TMH TDY TCBI TSCO TRMB ULTA WWAV ZION Shares / Par Value Market Value 27,541,968 27,541,968 155,620 433,435 66,015 40,020 408,625 144,175 122,145 87,860 187,155 107,740 292,580 85,440 98,785 154,015 61,910 383,440 157,975 276,440 67,155 292,135 280,600 201,410 150,795 260,060 65,670 99,780 82,185 43,930 389,965 49,770 18,315 106,770 96,820 55,830 172,630 58,755 166,115 99,850 124,085 677,135 143,050 92,060 251,740 179,080 99,200 112,955 69,800 180,450 39,495 234,475 135,565 9,525,500 8,742,384 9,246,721 8,493,845 14,792,225 8,060,824 4,246,982 5,097,637 4,212,859 8,490,989 5,678,978 4,002,010 8,993,386 8,478,526 3,700,980 9,300,337 8,672,828 7,585,514 8,761,377 8,956,859 8,959,558 6,229,611 6,256,485 8,972,070 9,845,903 3,193,958 6,635,617 1,812,113 8,602,628 4,314,561 2,020,511 1,925,063 9,594,862 9,486,075 7,549,110 8,886,106 6,297,420 6,334,484 7,188,244 7,509,427 8,195,335 8,029,473 7,056,272 10,302,472 10,191,808 6,136,845 5,501,636 4,789,143 5,049,041 8,204,280 3,864,958

© Copyright 2026