BetaShares Portfolio Holdings Portfolio Holdings are the ASX

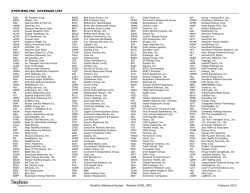

BetaShares Portfolio Holdings Portfolio Holdings are the ASX-listed shares and/or cash that the ETF invests in Fund Name: BETASHARES FTSE RAFI U.S. 1000 ETF Fund ASX Code: QUS Date: 6/02/2015 Security/Code Security Name Weighting # securities XOM EXXON MOBIL CORP 2.78% 1,255 T AT&T INC 2.06% 2,466 CVX CHEVRON CORP 1.89% 719 BAC BANK OF AMERICA CORP 1.80% 4,704 JPM JPMORGAN CHASE & CO 1.79% 1,312 GE GENERAL ELECTRIC CO 1.67% 2,845 WFC WELLS FARGO & CO 1.60% 1,246 BRK/B BERKSHIRE HATHAWAY INC-CL B 1.48% 413 PFE PFIZER INC 1.46% 1,881 AAPL APPLE INC 1.29% 445 C CITIGROUP INC 1.24% 1,061 JNJ JOHNSON & JOHNSON 1.24% 505 VZ VERIZON COMMUNICATIONS INC 1.22% 1,055 WMT WAL-MART STORES INC 1.20% 571 PG PROCTER & GAMBLE CO/THE 1.15% 552 MSFT MICROSOFT CORP 1.12% 1,103 INTC INTEL CORP 0.96% 1,185 COP CONOCOPHILLIPS 0.93% 581 MRK MERCK & CO. INC. 0.83% 579 IBM INTL BUSINESS MACHINES CORP 0.82% 215 HPQ HEWLETT-PACKARD CO 0.74% 811 CVS CVS HEALTH CORP 0.74% 302 KO COCA-COLA CO/THE 0.70% 695 PEP PEPSICO INC 0.69% 294 HD HOME DEPOT INC 0.68% 257 PM PHILIP MORRIS INTERNATIONAL 0.65% 327 UNH UNITEDHEALTH GROUP INC 0.64% 245 GS GOLDMAN SACHS GROUP INC 0.59% 136 UTX UNITED TECHNOLOGIES CORP 0.57% 201 ABT ABBOTT LABORATORIES 0.57% 522 DIS WALT DISNEY CO/THE 0.56% 227 CMCSA COMCAST CORP-CLASS A 0.55% 402 MO ALTRIA GROUP INC 0.54% 414 GM GENERAL MOTORS CO 0.54% 623 F FORD MOTOR CO 0.53% 1,386 TGT TARGET CORP 0.53% 287 AIG AMERICAN INTERNATIONAL GROUP 0.52% 419 MDLZ MONDELEZ INTERNATIONAL INC-A 0.51% 590 CSCO CISCO SYSTEMS INC 0.51% 796 KR KROGER CO 0.51% 293 ORCL ORACLE CORP 0.50% 487 MMM 3M CO 0.50% 124 PSX PHILLIPS 66 0.48% 267 MCD MCDONALD'S CORP 0.48% 209 LOW LOWE'S COS INC 0.47% 273 OXY OCCIDENTAL PETROLEUM CORP 0.46% 234 VLO VALERO ENERGY CORP 0.45% 344 USB US BANCORP 0.45% 427 GOOGL GOOGLE INC-CL A 0.45% 35 SLB SCHLUMBERGER LTD 0.44% 216 MET METLIFE INC 0.44% 371 BA BOEING CO/THE 0.42% 119 TRV TRAVELERS COS INC/THE 0.42% 161 BMY BRISTOL-MYERS SQUIBB CO 0.42% 290 MCK MCKESSON CORP 0.41% 80 COST COSTCO WHOLESALE CORP 0.41% 108 DUK DUKE ENERGY CORP 0.40% 194 LLY ELI LILLY & CO 0.40% 235 ESRX EXPRESS SCRIPTS HOLDING CO 0.39% 196 TWX TIME WARNER INC 0.39% 201 CAT CATERPILLAR INC 0.38% 193 PRU PRUDENTIAL FINANCIAL INC 0.37% 193 EXC EXELON CORP 0.37% 425 MS MORGAN STANLEY 0.37% 440 HON HONEYWELL INTERNATIONAL INC 0.37% 151 DOW DOW CHEMICAL CO/THE 0.37% 328 WBA WALGREENS BOOTS ALLIANCE INC 0.37% 202 PNC PNC FINANCIAL SERVICES GROUP 0.36% 170 DD DU PONT (E.I.) DE NEMOURS 0.36% 202 SO SOUTHERN CO/THE 0.36% 299 UNP UNION PACIFIC CORP 0.35% 121 UPS UNITED PARCEL SERVICE-CL B 0.35% 144 ANTM ANTHEM INC 0.34% 102 CAH CARDINAL HEALTH INC 0.34% 165 HCA HCA HOLDINGS INC 0.33% 200 LYB LYONDELLBASELL INDU-CL A 0.33% 161 ALL ALLSTATE CORP 0.33% 188 QCOM QUALCOMM INC 0.33% 202 BK BANK OF NEW YORK MELLON CORP 0.33% 363 AXP AMERICAN EXPRESS CO 0.33% 161 GOOG GOOGLE INC-CL C 0.32% 25 MDT MEDTRONIC INC 0.31% 173 LMT LOCKHEED MARTIN CORP 0.31% 66 NOC NORTHROP GRUMMAN CORP 0.31% 78 TXN TEXAS INSTRUMENTS INC 0.31% 231 NEE NEXTERA ENERGY INC 0.30% 115 COF CAPITAL ONE FINANCIAL CORP 0.30% 167 EMC EMC CORP/MA 0.30% 468 ADM ARCHER-DANIELS-MIDLAND CO 0.30% 271 MPC MARATHON PETROLEUM CORP 0.30% 128 Market value $ 114,782.30 $ 84,855.06 $ 77,903.65 $ 74,276.16 $ 73,970.56 $ 68,735.20 $ 66,075.38 $ 60,929.89 $ 60,323.67 $ 53,204.20 $ 51,352.40 $ 51,186.80 $ 50,429.00 $ 49,477.15 $ 47,356.08 $ 46,149.52 $ 39,816.00 $ 38,270.47 $ 34,189.95 $ 33,746.40 $ 30,736.90 $ 30,338.92 $ 28,967.60 $ 28,400.40 $ 27,861.37 $ 26,840.16 $ 26,440.40 $ 24,314.08 $ 23,675.79 $ 23,578.74 $ 22,990.56 $ 22,873.80 $ 22,368.42 $ 22,322.09 $ 21,995.82 $ 21,700.07 $ 21,582.69 $ 21,248.85 $ 21,245.24 $ 20,905.55 $ 20,658.54 $ 20,436.44 $ 19,870.14 $ 19,656.45 $ 19,292.91 $ 18,918.90 $ 18,675.76 $ 18,608.66 $ 18,413.50 $ 18,262.80 $ 18,093.67 $ 17,519.18 $ 17,183.53 $ 17,179.60 $ 16,867.20 $ 16,839.36 $ 16,680.12 $ 16,501.70 $ 16,138.64 $ 16,108.14 $ 15,816.35 $ 15,418.77 $ 15,380.75 $ 15,298.80 $ 15,213.25 $ 15,160.16 $ 15,083.34 $ 14,917.50 $ 14,895.48 $ 14,788.54 $ 14,573.24 $ 14,476.32 $ 14,040.30 $ 13,838.55 $ 13,792.00 $ 13,741.35 $ 13,645.04 $ 13,525.92 $ 13,492.71 $ 13,461.21 $ 13,069.00 $ 12,824.49 $ 12,690.48 $ 12,623.52 $ 12,616.07 $ 12,585.60 $ 12,575.10 $ 12,561.12 $ 12,506.65 $ 12,312.32 GD BG MRO SYY ABBV ABC AEP PCG EMR WY FDX GLW ACE D CL BBT AMGN HIG FE APA AFL TWC CTL ITW DTV CB HES DVN EIX AET AMZN KRFT FLEX RTN STI DE DHR FOXA PEG KMB GIS PPG STT L JCI TMO FCX CBS MUR TJX M AMAT CSX BDX APC BBY XEL XRX AA V NSC CME BLK NLY ED NEM DAL DTE SPG ADP SE IP HAL ACN PCAR HUM UAL APD OMC AVT PLD MON BAX KSS LB SPLS PPL WM MAN ETR LLL EBAY EOG SYK WHR NUE GENERAL DYNAMICS CORP BUNGE LTD MARATHON OIL CORP SYSCO CORP ABBVIE INC AMERISOURCEBERGEN CORP AMERICAN ELECTRIC POWER P G & E CORP EMERSON ELECTRIC CO WEYERHAEUSER CO FEDEX CORP CORNING INC ACE LTD DOMINION RESOURCES INC/VA COLGATE-PALMOLIVE CO BB&T CORP AMGEN INC HARTFORD FINANCIAL SVCS GRP FIRSTENERGY CORP APACHE CORP AFLAC INC TIME WARNER CABLE CENTURYLINK INC ILLINOIS TOOL WORKS DIRECTV CHUBB CORP HESS CORP DEVON ENERGY CORP EDISON INTERNATIONAL AETNA INC AMAZON.COM INC KRAFT FOODS GROUP INC FLEXTRONICS INTL LTD RAYTHEON COMPANY SUNTRUST BANKS INC DEERE & CO DANAHER CORP TWENTY-FIRST CENTURY FOX-A PUBLIC SERVICE ENTERPRISE GP KIMBERLY-CLARK CORP GENERAL MILLS INC PPG INDUSTRIES INC STATE STREET CORP LOEWS CORP JOHNSON CONTROLS INC THERMO FISHER SCIENTIFIC INC FREEPORT-MCMORAN INC CBS CORP-CLASS B NON VOTING MURPHY OIL CORP TJX COMPANIES INC MACY'S INC APPLIED MATERIALS INC CSX CORP BECTON DICKINSON AND CO ANADARKO PETROLEUM CORP BEST BUY CO INC XCEL ENERGY INC XEROX CORP ALCOA INC VISA INC-CLASS A SHARES NORFOLK SOUTHERN CORP CME GROUP INC BLACKROCK INC ANNALY CAPITAL MANAGEMENT IN CONSOLIDATED EDISON INC NEWMONT MINING CORP DELTA AIR LINES INC DTE ENERGY COMPANY SIMON PROPERTY GROUP INC AUTOMATIC DATA PROCESSING SPECTRA ENERGY CORP INTERNATIONAL PAPER CO HALLIBURTON CO ACCENTURE PLC-CL A PACCAR INC HUMANA INC UNITED CONTINENTAL HOLDINGS AIR PRODUCTS & CHEMICALS INC OMNICOM GROUP AVNET INC PROLOGIS INC MONSANTO CO BAXTER INTERNATIONAL INC KOHLS CORP L BRANDS INC STAPLES INC PPL CORP WASTE MANAGEMENT INC MANPOWERGROUP INC ENTERGY CORP L-3 COMMUNICATIONS HOLDINGS EBAY INC EOG RESOURCES INC STRYKER CORP WHIRLPOOL CORP NUCOR CORP 0.30% 0.29% 0.28% 0.27% 0.27% 0.27% 0.27% 0.27% 0.26% 0.26% 0.26% 0.26% 0.26% 0.26% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.24% 0.24% 0.24% 0.23% 0.23% 0.23% 0.23% 0.23% 0.23% 0.22% 0.22% 0.22% 0.22% 0.22% 0.22% 0.22% 0.21% 0.21% 0.21% 0.21% 0.21% 0.21% 0.21% 0.21% 0.21% 0.21% 0.21% 0.21% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.20% 0.19% 0.19% 0.19% 0.19% 0.19% 0.19% 0.19% 0.19% 0.19% 0.19% 0.19% 0.19% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.18% 0.17% 0.17% 0.17% 0.17% 0.17% 88 133 411 284 195 115 177 190 189 303 62 437 95 136 152 289 69 261 257 153 169 70 258 106 115 101 138 152 143 100 26 141 807 87 232 103 108 262 214 82 167 39 120 219 182 69 476 153 176 126 131 359 245 60 101 231 224 614 501 31 77 91 23 772 118 320 168 89 39 90 223 142 182 88 123 51 107 51 102 173 165 62 105 110 85 439 205 140 99 83 57 134 75 77 33 155 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 12,190.64 11,931.43 11,499.78 11,320.24 11,097.45 11,025.05 11,012.94 11,002.90 10,835.37 10,692.87 10,668.96 10,605.99 10,603.90 10,557.68 10,518.40 10,510.93 10,450.05 10,374.75 10,321.12 10,298.43 10,254.92 10,187.10 10,167.78 10,160.10 10,115.40 10,090.91 9,937.38 9,728.00 9,652.50 9,605.00 9,483.50 9,457.58 9,377.34 9,320.31 9,184.88 9,134.04 9,108.72 9,080.92 9,026.52 9,008.52 8,887.74 8,870.55 8,852.40 8,847.60 8,756.02 8,718.15 8,706.04 8,681.22 8,653.92 8,551.62 8,500.59 8,479.58 8,469.65 8,395.20 8,390.07 8,364.51 8,332.80 8,233.74 8,226.42 8,211.59 8,188.95 8,121.75 8,067.94 8,059.68 8,051.14 7,942.40 7,889.28 7,887.18 7,871.37 7,792.20 7,731.41 7,719.12 7,714.98 7,685.92 7,682.58 7,677.54 7,671.90 7,569.42 7,556.16 7,485.71 7,453.05 7,381.72 7,357.35 7,355.70 7,353.35 7,344.47 7,341.05 7,310.80 7,288.38 7,260.01 7,243.56 7,197.14 7,139.25 7,120.19 7,091.04 7,052.50 BHI SBUX CMCSK PX NOV ARW QVCA IVZ BSX FITB CMI VIAB CI MMC KEY BEN AEE SRE YUM UNM K FLR CCL KMI PH GILD PSA AMP NU LNC RF MAT GPC PNR IM NKE NTRS LO TMK FTR TSO EQR PFG FIS PGR YHOO ADBE WMB BIIB HPT WDC ETN MCHP FMC ACGL MXIM WEC CHK VTR HCN RAI MTB AES DVA SVU VNO DG TRW DFS MOS SWK CELG XRAY SCHW GXP JCP SYMC XLNX HAS HCP OI ATVI SLG DGX CSC LUV CMS ECL NE GT MU CPB MUSA AVB WCC ALB BAKER HUGHES INC STARBUCKS CORP COMCAST CORP-SPECIAL CL A PRAXAIR INC NATIONAL OILWELL VARCO INC ARROW ELECTRONICS INC LIBERTY INTERACTIVE CORP-A INVESCO LTD BOSTON SCIENTIFIC CORP FIFTH THIRD BANCORP CUMMINS INC VIACOM INC-CLASS B CIGNA CORP MARSH & MCLENNAN COS KEYCORP FRANKLIN RESOURCES INC AMEREN CORPORATION SEMPRA ENERGY YUM! BRANDS INC UNUM GROUP KELLOGG CO FLUOR CORP CARNIVAL CORP KINDER MORGAN INC PARKER HANNIFIN CORP GILEAD SCIENCES INC PUBLIC STORAGE AMERIPRISE FINANCIAL INC NORTHEAST UTILITIES LINCOLN NATIONAL CORP REGIONS FINANCIAL CORP MATTEL INC GENUINE PARTS CO PENTAIR PLC INGRAM MICRO INC-CL A NIKE INC -CL B NORTHERN TRUST CORP LORILLARD INC TORCHMARK CORP FRONTIER COMMUNICATIONS CORP TESORO CORP EQUITY RESIDENTIAL PRINCIPAL FINANCIAL GROUP FIDELITY NATIONAL INFORMATIO PROGRESSIVE CORP YAHOO! INC ADOBE SYSTEMS INC WILLIAMS COS INC BIOGEN IDEC INC HOSPITALITY PROPERTIES TRUST WESTERN DIGITAL CORP EATON CORP PLC MICROCHIP TECHNOLOGY INC FMC CORP ARCH CAPITAL GROUP LTD MAXIM INTEGRATED PRODUCTS WISCONSIN ENERGY CORP CHESAPEAKE ENERGY CORP VENTAS INC HEALTH CARE REIT INC REYNOLDS AMERICAN INC M & T BANK CORP AES CORP DAVITA HEALTHCARE PARTNERS I SUPERVALU INC VORNADO REALTY TRUST DOLLAR GENERAL CORP TRW AUTOMOTIVE HOLDINGS CORP DISCOVER FINANCIAL SERVICES MOSAIC CO/THE STANLEY BLACK & DECKER INC CELGENE CORP DENTSPLY INTERNATIONAL INC SCHWAB (CHARLES) CORP GREAT PLAINS ENERGY INC J.C. PENNEY CO INC SYMANTEC CORP XILINX INC HASBRO INC HCP INC OWENS-ILLINOIS INC ACTIVISION BLIZZARD INC SL GREEN REALTY CORP QUEST DIAGNOSTICS INC COMPUTER SCIENCES CORP SOUTHWEST AIRLINES CO CMS ENERGY CORP ECOLAB INC NOBLE CORP PLC GOODYEAR TIRE & RUBBER CO MICRON TECHNOLOGY INC CAMPBELL SOUP CO MURPHY USA INC AVALONBAY COMMUNITIES INC WESCO INTERNATIONAL INC ALBEMARLE CORP 0.17% 0.17% 0.17% 0.17% 0.17% 0.17% 0.17% 0.16% 0.16% 0.16% 0.16% 0.16% 0.16% 0.16% 0.16% 0.16% 0.16% 0.16% 0.16% 0.15% 0.15% 0.15% 0.15% 0.15% 0.15% 0.15% 0.15% 0.15% 0.15% 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 0.14% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.13% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.12% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.11% 0.10% 0.10% 0.10% 114 78 122 56 131 120 247 177 454 370 47 102 61 121 481 123 146 58 88 196 95 115 142 151 51 62 30 46 109 112 658 213 62 91 226 62 84 86 109 776 66 71 115 86 211 125 76 121 14 165 52 79 116 91 89 157 96 253 66 64 74 43 407 67 488 44 71 47 85 97 50 41 94 172 162 602 183 117 82 102 191 214 36 64 73 102 122 43 260 178 151 92 61 25 62 87 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 6,951.72 6,918.60 6,879.58 6,871.76 6,855.23 6,842.40 6,841.90 6,807.42 6,791.84 6,789.50 6,775.52 6,740.16 6,716.10 6,694.93 6,517.55 6,511.62 6,508.68 6,497.74 6,481.20 6,350.40 6,330.80 6,250.25 6,171.32 6,160.80 6,105.72 6,102.66 6,079.80 6,066.48 6,061.49 5,958.40 5,948.32 5,948.03 5,921.00 5,781.23 5,758.48 5,737.48 5,691.00 5,688.90 5,660.37 5,649.28 5,623.86 5,604.74 5,571.75 5,546.14 5,507.10 5,505.63 5,493.28 5,488.56 5,475.68 5,421.90 5,410.08 5,409.92 5,374.28 5,358.08 5,326.65 5,320.73 5,309.76 5,191.56 5,185.62 5,166.08 5,148.18 5,099.37 5,095.64 5,089.32 4,919.04 4,909.52 4,885.51 4,834.89 4,824.60 4,785.98 4,784.00 4,779.37 4,762.98 4,748.92 4,714.20 4,713.66 4,684.80 4,661.28 4,639.56 4,626.72 4,626.02 4,605.28 4,586.04 4,582.40 4,571.99 4,553.28 4,506.68 4,490.92 4,453.80 4,441.10 4,383.53 4,363.56 4,335.27 4,333.50 4,261.26 4,249.95 TSN LDOS RSG MHFI BBBY WRB HTZ IR IPG KLAC MA VFC BRCM WR NRG PKG PCP HNT SAIC CF NBR AME CAR CNP BF/B GNW BLL MHK TDS ATO RYN MGM AON NFG RAD CBG SNDK STX MAS CBL COH O FL ESS WIN ACM NCR NI WYN CAG VMC AGNC UDR FLS XL SNH HRB HSY EME WFT DLPH ZION TEX PCLN RL ADT RNR RKT OC SEE X TEN CCI AGN SHLD VSH GME TEL LYV LXK TYC GPI SANM ANF AMT HII DLR LVS ENR KND WYNN HTS DNR TKR UE TYSON FOODS INC-CL A LEIDOS HOLDINGS INC REPUBLIC SERVICES INC MCGRAW HILL FINANCIAL INC BED BATH & BEYOND INC WR BERKLEY CORP HERTZ GLOBAL HOLDINGS INC INGERSOLL-RAND PLC INTERPUBLIC GROUP OF COS INC KLA-TENCOR CORP MASTERCARD INC-CLASS A VF CORP BROADCOM CORP-CL A WESTAR ENERGY INC NRG ENERGY INC PACKAGING CORP OF AMERICA PRECISION CASTPARTS CORP HEALTH NET INC SCIENCE APPLICATIONS INTE CF INDUSTRIES HOLDINGS INC NABORS INDUSTRIES LTD AMETEK INC AVIS BUDGET GROUP INC CENTERPOINT ENERGY INC BROWN-FORMAN CORP-CLASS B GENWORTH FINANCIAL INC-CL A BALL CORP MOHAWK INDUSTRIES INC TELEPHONE AND DATA SYSTEMS ATMOS ENERGY CORP RAYONIER INC MGM RESORTS INTERNATIONAL AON PLC NATIONAL FUEL GAS CO RITE AID CORP CBRE GROUP INC - A SANDISK CORP SEAGATE TECHNOLOGY MASCO CORP CBL & ASSOCIATES PROPERTIES COACH INC REALTY INCOME CORP FOOT LOCKER INC ESSEX PROPERTY TRUST INC WINDSTREAM HOLDINGS INC AECOM TECHNOLOGY CORP NCR CORPORATION NISOURCE INC WYNDHAM WORLDWIDE CORP CONAGRA FOODS INC VULCAN MATERIALS CO AMERICAN CAPITAL AGENCY CORP REIT 0.0 UDR INC FLOWSERVE CORP XL GROUP PLC SENIOR HOUSING PROP TRUST H&R BLOCK INC HERSHEY CO/THE EMCOR GROUP INC WEATHERFORD INTERNATIONAL PL DELPHI AUTOMOTIVE PLC ZIONS BANCORPORATION TEREX CORP PRICELINE GROUP INC/THE RALPH LAUREN CORP ADT CORP/THE RENAISSANCERE HOLDINGS LTD ROCK-TENN COMPANY -CL A OWENS CORNING SEALED AIR CORP UNITED STATES STEEL CORP TENNECO INC CROWN CASTLE INTL CORP ALLERGAN INC SEARS HOLDINGS CORP VISHAY INTERTECHNOLOGY INC GAMESTOP CORP-CLASS A TE CONNECTIVITY LTD LIVE NATION ENTERTAINMENT IN LEXMARK INTERNATIONAL INC-A TYCO INTERNATIONAL PLC GROUP 1 AUTOMOTIVE INC SANMINA CORP ABERCROMBIE & FITCH CO-CL A AMERICAN TOWER CORP HUNTINGTON INGALLS INDUSTRIE DIGITAL REALTY TRUST INC LAS VEGAS SANDS CORP ENERGIZER HOLDINGS INC KINDRED HEALTHCARE INC WYNN RESORTS LTD HATTERAS FINANCIAL CORP DENBURY RESOURCES INC TIMKEN CO URBAN EDGE PROPERTIES-W/I 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.09% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.07% 0.07% 0.07% 0.07% 0.07% 0.07% 0.07% 0.07% 0.07% 0.07% 0.06% 0.06% 0.06% 0.06% 0.06% 0.05% 0.05% 0.05% 0.05% 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.04% 0.03% 0.02% 0.02% 0.01% 108 100 103 44 53 85 190 61 197 64 48 58 91 93 151 51 19 70 76 13 315 77 63 165 42 497 56 22 150 65 124 183 39 56 489 104 45 58 133 164 88 65 63 15 400 125 127 75 40 91 46 153 98 57 91 141 91 30 75 280 43 125 131 3 22 85 29 45 75 69 118 50 32 12 75 183 68 34 91 53 52 24 87 71 18 14 22 29 12 79 10 74 111 22 22 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 4,239.00 4,207.00 4,176.65 4,172.96 4,161.03 4,114.00 4,104.00 4,075.41 4,054.26 4,041.92 4,040.64 3,995.04 3,982.62 3,959.01 3,932.04 3,897.93 3,890.06 3,876.60 3,872.20 3,861.78 3,827.25 3,812.27 3,806.46 3,762.00 3,759.42 3,707.62 3,704.40 3,703.48 3,693.00 3,689.40 3,659.24 3,636.21 3,631.68 3,622.64 3,559.92 3,508.96 3,505.50 3,475.94 3,473.96 3,447.28 3,441.68 3,433.30 3,422.79 3,422.40 3,396.00 3,387.50 3,380.74 3,341.25 3,310.80 3,299.66 3,287.62 3,278.79 3,250.66 3,246.15 3,240.51 3,182.37 3,172.26 3,171.00 3,150.75 3,136.00 3,128.25 3,102.50 3,102.08 3,084.84 3,073.62 3,070.20 2,959.45 2,957.85 2,952.00 2,873.85 2,859.14 2,766.50 2,760.64 2,633.04 2,530.50 2,497.95 2,490.84 2,310.98 2,219.49 2,196.85 2,153.32 1,979.76 1,837.44 1,810.50 1,761.30 1,692.04 1,617.22 1,606.89 1,594.08 1,553.14 1,461.10 1,336.44 909.09 875.38 527.12

© Copyright 2026