Daily Market Commentary

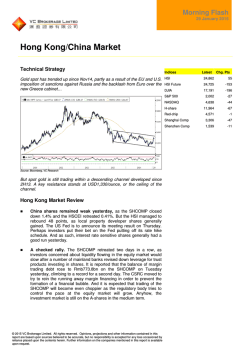

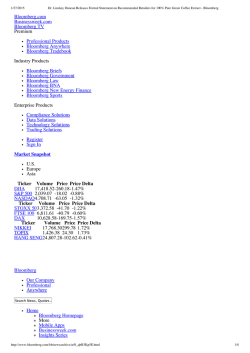

30 January 2015 Focus of the Day Morning Express Indices Alibaba (BABA.US) MIT‐‐Martina Internet Talk: SAIC event has greater social impact than real impact; Stock price may fluctuate in the short term Yuan MA Last Closing: US$89.81 [email protected] Not Rated Counterfeiting is a long‐standing social problem and it is also reflected on the Internet platform. The Internet companies have different styles when dealing with the disputes with the authorities, such as Baidu and Tencent’s low‐key style, Cheetah’s innovative style and Alibaba’s high‐profile style. Whether the Internet companies can respond quickly and expand their influence while solving the problem is the key. Taobao does not face any suspension risk for now, as such suspension would affect the employment of over 10m people. Its future is determined by customers’ habit and market operation rules. Taobao’s operation will be determined by whether or not the interaction between the company and the authorities and the media will have an impact on the activity of buyers and small and medium sellers. The social impact of the SAIC event is greater than any impact on Taobao’s operation and performance. The development of this event is determined by users’ habit and the market’s operation rules. Baidu’s stock price decreased by 20% between 5 Jan and 20 Jan 2009 due to its medical ad event. The stock price went up during the following half year since Baidu’s performance was not impacted by that event. Alibaba’s stock price may fluctuate in the short term but this event will not affect the long‐term stock price trend, in our view. Alibaba (BABA.US) Solid 4Q14 Non‐GAAP results; cautious on lower monetization rate Yuan MA Last Closing: US$89.81 [email protected] Not Rated Alibaba reported solid non‐GAAP results in 4Q14, with non‐GAAP diluted EPS up 13% YoY. Mobile GMV and monetization capability grew rapidly. However, lower monetization rate would impact near‐term online marketing revenue. When asked about the SAIC event, management disclosed that Alibaba has invested heavily to combat counterfeiting. Though we still like Alibaba’s long‐term value as it expands aggressively to new categories, such as pharmaceuticals and entertainment, and its cloud business expands rapidly, we are concerned about the near‐term pressure on the online marketing revenue growth on the PC side and its monetization rate. This, together with the SAIC event, may result in share price fluctuation in the near term. Close HSI 24,596 H Shares 11,736 SH A 3,418 SH B 291 SZ A 1,598 SZ B 1,067 DJIA 17,417 S&P 500 2,021 Nasdaq 4,683 FTSE 6,811 CAC 4,631 DAX 10,738 Source: Bloomberg 1d % -1.07 -1.90 -1.32 -0.39 -0.62 -0.32 1.31 0.95 0.98 -0.22 0.44 0.25 Ytd % 4.20 -2.07 0.86 0.15 8.10 3.67 -2.28 -1.83 -1.11 3.72 8.39 9.51 Close 49.13 1,259.85 16.99 5,484.00 118.33 1.51 1.13 3m % -43.61 5.09 2.93 -19.29 -7.71 -5.78 -10.15 Ytd % -14.30 6.33 8.17 -12.95 1.23 -3.21 -6.32 bps change HIBOR 0.39 US 10 yield 1.75 Source: Bloomberg 3m 0.01 -0.55 6m 0.01 -0.81 Indicators Brent Gold Silver Copper JPY GBP EURO HSI Technical HSI 50 d MA 200 d MA 14 d RSI Short Sell (HK$m) Source: Bloomberg BOCOM Int'l Corporate Access 4 Feb 5 Feb 5 Feb 9 Feb Download our reports from Bloomberg: BOCM〈enter〉 24,596 23,771 23,632 59 8,449 China National Household Paper Industry Association Jingdong (JD.US) Shengmu Organic Milk (1432.HK) Beijing distributor "One Belt, One Road" Seminar Morning Express 30 January 2015 Hang Seng Index (1 year) 26,000 Transportation Sector 25,000 Weekly transportation news wrap Geoffrey CHENG, CFA 24,000 [email protected] 23,000 Weekly 22,000 21,000 In terms of sector, we highlight some notable updates for the transportation industry this week as follows: Source: Company data, Bloomberg Global dry bulk market: The Baltic Dry Bulk Index slumped on a weekly basis, reaching the lowest point since September 2012. HS China Enterprise Index (1 year) 13,000 Railway: 1) China railway freight turnover and freight volume witnessed declines in December 2014; 2) CSR and CNR announced RMB45.4 billion worth of contracts from Chinese and foreign firms, and initiated global roadshow for merger at the end of January 2015. 12,000 11,000 10,000 9,000 8,000 Transportation: NDRC approved another six transportation projects with total investment of RMB55.7 billion. Source: Company data, Bloomberg Shanghai A-shares (1 year) 4,000 3,500 3,000 2,500 2,000 Source: Company data, Bloomberg Shenzhen A-shares (1 year) 1,800 1,700 1,600 1,500 1,400 1,300 1,200 1,100 1,000 900 800 Source: Company data, Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 30 January 2015 Last Closing: US$98.45 Internet Sector Alibaba Group (BABA.US) Not Rated MIT--Martina Internet Talk: SAIC event has greater social impact than real impact; stock price may fluctuate in the short term Counterfeiting is a long-standing social problem and it is also reflected on the Internet platform. The Internet companies have different styles when dealing with the disputes with the authorities, such as Baidu and Tencent’s low-key style, Cheetah’s innovative style and Alibaba’s high-profile style. Whether the Internet companies can respond quickly and expand their influence while solving the problem is the key. Taobao does not face any suspension risk for now, as such suspension would affect the employment of over 10m people. Its future is determined by customers’ habit and market operation rules. Taobao’s operation will be determined by whether or not the interaction between the company and the authorities and the media will have an impact on the activity of buyers and small and medium sellers. The social impact of the SAIC event is greater than any impact on Taobao’s operation and performance. The development of this event is determined by users’ habit and the market’s operation rules. Baidu’s stock price decreased by 20% between 5 Jan and 20 Jan 2009 due to its medical ad event. The stock price went up during the following half year since Baidu’s performance was not impacted by that event. Alibaba’s stock price may fluctuate in the short term but this event will not affect the long-term stock price trend, in our view. Long-standing social problems are reflected on and magnified by Internet platforms during specific periods of time Disputes between Internet companies and the authorities are often caused by a specific social problem. Such problem is magnified by Internet platforms, such as Baidu and Taobao, during specific periods, such as the CNY holiday. Low-key Baidu: On 5 Jan 2009, CCTV exposed that Baidu medical ads contained false information. Baidu did not respond to this directly, but made an investment on CCTV ads and Mr. Li Yanhong participated in the 2009 CCTV Spring Festival Gala. (See details in the report Seven ministries jointly regulated the Internet, published on 21 Jan 2009.) , , , , ,, , , The Internet companies have different styles when dealing with disputes with the authorities, such as Baidu and Tencent’s low-key style, Cheetah’s innovative style and Alibaba’s high-profile style. Whether the Internet companies can respond quickly and expand their influence while solving the problem is the key. Taobao does not face any suspension risk for now, as such suspension would affect the employment of over 10m people. Its future is determined by customers’ habit and market operation rules. Stock price may fluctuate in the short-term, but the long-term trend will not be affected. Stock data 52w High 52w Low Market cap (US$m) Issued shares (m) Avg daily vol (m) 1-mth change(%) YTD change(%) 50d MA 200d MA 14-day RSI Source: Bloomberg 1 Year Performance chart High-profile Alibaba: On 28 Jan 2015, the State Administration for Industry and Commerce (SAIC) of China published ”White paper related to the administrative guide to the Alibaba Group” and pointed out 5 problems of Alibaba’s e-commerce Download our reports from Bloomberg: BOCM〈enter〉 baba us Equity 80% AHXH Index MXCN Index 60% 40% 20% 0% J-14 Innovative Cheetah: The Ministry of Railways asked KIS (now named Cheetah) to terminate the train ticket purchasing service in Cheetah browser. Cheetah responded actively later on and launched Cheetah bus to send workers back to their hometowns during the CNY. (See details in the reports MOR incident provides a wonderful opportunity for promotion of Cheetah, published on 21 Jan 2013, and Train-ticket event attested to the company’s innovation capability; lift TP, published on 2 Feb 2013.) 120.00 82.81 259,097 2,465 14.54 -8.68 N/A 102.29 N/A 47.59 A-14 J-14 S-14 -20% Source: Company data, Bloomberg Ma Yuan (Martina), Ph.D [email protected] Tel: (8610) 8800 9788–8039 GuXinyu (Connie), CPA [email protected] Tel: (8610) 8800 9788-8045 D-14 30 January 2015 Last Closing: US$98.45 Internet Sector Alibaba Group (BABA.US) Not Rated Solid 4Q14 non-GAAP results; cautious on lower monetization rate Solid non-GAAP results in 4Q14; non-GAAP diluted EPS up 13% YoY: * * * * * , , , , ,, , , Solid non-GAAP results in 4Q14; non-GAAP diluted EPS up 13% YoY For the quarter ended Dec 2014, Alibaba’s revenue grew by 56% QoQ and 40% YoY to RMB26.2bn. About 24.5% of the revenue came from mobile devices. Mobile GMV and monetization capability grew rapidly. However, lower monetization rate would impact near-term online marketing revenue. Non-GAAP EBITDA margin was 58% in 4Q14 compared with 60% in 4Q13 and 51% in 3Q14. The YoY decrease was primarily due to the consolidation of newly acquired businesses, mainly UCWeb Inc. and AutoNavi, and investments in new business initiatives, such as mobile operating system, local services and digital entertainment. The QoQ increase in non-GAAP EBITDA margin was due to seasonality. Though we like Alibaba’s long-term value as it expands to new categories, such as pharmaceuticals and digital entertainment, and its cloud business expands rapidly, we are concerned about the near-term pressure on the online marketing revenue growth on the PC side and its monetization rate. Net income in 4Q14 was RMB5.98bn, a decrease by 28% YoY. The decrease was due to 1) an increase in SBC expense; 2) a RMB830mn one-time charge for financing related fees; and 3) an increase in income tax expense. Non-GAAP net income increased by 25% YoY to RMB13.1bn in 4Q14. Non-GAAP diluted EPS in 4Q14 was RMB5.05, marking an increase by 13% YoY. The lower growth rate of non-GAAP diluted EPS compared to that of non-GAAP net income was due to an increase in diluted shares outstanding in the quarter following the completion of IPO. Annual active buyers reached 334mn in 4Q14, up by 45% YoY and 9% QoQ. In 4Q14, mobile MAU increased by 48 million sequentially and 95% YoY, reaching 265mn. Mobile GMV and monetization capability grew rapidly. Quarterly GMV transacted on China retail marketplaces reached RMB787bn, up by 49% YoY and 42% QoQ, attributable to an increase in active buyers and partially to category expansion like auction transactions. Taobao Marketplace contributed RMB494bn, or 63%, of the total China retail marketplaces GMV; Tmall contributed RMB293bn, or 37%, compared with 32% in 3Q14. Mobile GMV grew by 213% YoY to RMB327bn, accounting for 42% of the total GMV, compared with 36% in 3Q14 and 20% in 4Q13. The mobile monetization rate increased to 1.96% from 1.87% in 3Q14 and 1.12% in 4Q13. The increase was mainly due to increased mobile traffic as well as changes in buyers’ purchase behavior. This, together with the SAIC event, may result in share price fluctuation in the near term. Stock data 52w High 52w Low Market cap (US$m) Issued shares (m) Avg daily vol (m) 1-mth change(%) YTD change(%) 50d MA 200d MA 14-day RSI Source: Bloomberg 120.00 82.81 259,097 2,465 14.54 -8.68 N/A 102.29 N/A 47.59 1 Year Performance chart baba us Equity 80% AHXH Index MXCN Index 60% 40% However, lower monetization rate would impact near-term online marketing revenue. The blended monetization rate for the China Commerce Retail business was 2.7%, which was lower YoY compared with 3.05%. This was due to user experience enhancement efforts with lower CPC and a larger percentage of GMV coming from mobile, which had a lower monetization rate. In the short run, the growth rate of online marketing revenue may be adversely affected, while the improved user experience and strong user momentum in mobile will bring value in the long run. 20% 0% J-14 A-14 J-14 S-14 -20% Source: Company data, Bloomberg Ma Yuan (Martina), Ph.D Zero tolerance for counterfeiting. Management disclosed that over the past 2 years, Alibaba invested over RMB1bn, and hired over 1000 employees, to combat counterfeit products. Alibaba values integrity and the health of marketplace. It will continue to work with the government and brand owners, and apply data technology, to fight against counterfeiting. Comments: Although we like Alibaba’s long-term value as it expands to new categories, such as pharmaceuticals and digital entertainment, and its cloud business expands rapidly, we are concerned about the near-term pressure on the online marketing revenue growth on the PC side and its monetization rate. This, together with the SAIC event, may result in share price fluctuation in the near term. Download our reports from Bloomberg: BOCM〈enter〉 [email protected] Tel: (8610) 8800 9788–8039 GuXinyu (Connie), CPA [email protected] Tel: (8610) 8800 9788-8045 D-14 30 January 2015 Transportation Weekly Transportation Transportation Sector Weekly transportation news wrap The Baltic Dry Bulk Index slumped on a weekly basis, reaching the lowest point since September 2012. As of 28th January 2015, the weak rebound trend of global and domestic dry bulk markets of the previous two weeks reversed, with BDI dropping 13.5% WoW, or 43.4% YoY, to 666, and China Import Dry Bulk Freight Index (CDFI) down 6.6% WoW. The recent weak demand for both global and domestic dry bulk commodities continued to drag down the freight rates, in our view. The decline last week was largely a result of weak freight rate performance of Capesize and Panamax vessels. The Baltic Panamax Index (BPI) fell by 14.5% WoW with freight rates of Panamax vessels in the domestic market falling 14.3% WoW. The Baltic Capesize Index (BCI) tumbled to 785, slumping by 19.2% WoW, or 50.2% YoY, while the Baltic Supramax Index (BSI) edged down 8.2% WoW, or 42.7% YoY, to 618. China railway freight turnover and freight volume witnessed declines in December 2014. National Railway Administration reported railway freight turnover and freight volume of December 2014. Railway freight turnover reached 232.3 billion ton-km in December, representing a decrease of 15.0% YoY, or 1.4% MoM. For the full year, China railway freight turnover amounted to 2,753 billion ton-km, falling by 5.2% YoY. Similarly, railway freight volume fell by 12.2% YoY, or 1.2% MoM, to 313.7 million tonnes in December 2014. Both railway freight turnover and freight volume saw accelerated MoM decline in December (in November, railway freight turnover and railway freight volume decreased by 6.3% YoY and 6.4% YoY, respectively), indicating weak domestic demand, in our view. China train makers CSR and CNR signed RMB45.4 billion worth of contracts with Chinese and foreign firms. Based on the announcements released by CSR and CNR, CSR signed 14 contracts worth RMB21.1 billion, equivalent to 21.6% of its FY13 revenue. CNR’s deals include sales and maintenance of high-speed trains and subways from Chinese and foreign companies. CNR is holding another 30 contracts worth RMB24.3 billion, equivalent to 25% of its FY13 revenue. CSR and CNR initiated roadshow for the merger in the last week of January 2015. NDRC approved another six transportation projects with total investment of RMB55.7 billion. According to news reports, during January 26- 28, 2015, NDRC approved six more infrastructure projects including the expansion of Hangzhou-Nanjing Highway Zhejiang section, Shangrila-Lijiang Highway, Tieling-Benxi Highway, the expansion of Zunyi-Guiyang Highway, Longnan airport, and Wugang airport with investments of RMB2.95 billion, RMB20.32 billion, RMB7.97 billion, RMB22.35 billion, RMB1.19 billion, and RMB971 million, respectively. As of 28th January 2015, NDRC has approved eight transportation projects this year, including Mile-Mengzi Railway Project and Jinan urban rail construction plan, with total investment of RMB108.89 billion. Since October 2014, the approval of transportation investments has been increased significantly to boost economic growth. We expect the growth of transportation investment to continue in 2015. Download our reports from Bloomberg: BOCM〈enter〉 1-Year Sector Performance 30% 25% 20% 15% 10% 5% 0% -5% -10% Jan-14 Sector performance HSI Index performance Apr-14 Jul-14 Oct-14 Source: Bloomberg Geoffrey Cheng, CFA [email protected] Tel: (852)2977 9380 Fay Zhou [email protected] Tel: (852) 2977 9381 Jan-15 Morning Express Market Review 30 January 2015 Hong Kong stocks fell on Thursday, dragged by the weakness in overseas markets. The Hang Seng Index slumped 265.96 points, or 1.07%, to close at 24,595.85. Ping An (2318.HK) was the biggest blue‐chip decliner, down 2.24%. Brokers fell on media reports that CSRC will start a new round of investigation on margin trading activities. CITIC Securities (6030.HK) dropped 2.8% while Haitong Securities (6837.HK) lost 3.2%. Mainland banks also retreated. MSB (1988.HK) slumped 4.5% and CMB (3968.HK) lost 2.2%. Sands China (1928.HK) shed 1% as 4Q adjusted property EBITDA was lower than estimated. Peer Galaxy Entertainment (27.HK) fell 2.3%. Shanghai Electric (2727.HK) rose 2.3% and CGN Power (1816.HK) increased 4.4%, as China will promote railway and nuclear power companies’ overseas investment. US stocks finished with solid gains on Thursday. The S&P 500 rose 19.1 points, or 1%, to 2,021.26. The DJIA added 225.48 points, or 1.3%, to 17,416.85. In Europe, the Stoxx Europe 600 fell 0.1% to 368.76. News Reaction It was reported that 26 provinces in Chinese Mainland reduced the targets of economic growth for 2015. As reported, among 28 provinces which had announced their targets of economic growth for 2015, except Shanghai which no longer set a target and Tibet maintained the same goal, the remaining 26 provinces reduced the targeted economic growth rate in 2015. It was rumored that subscription for a new batch of A shares is expected to launch next week. As reported, approval will be granted for subscription of new shares from approximately 20 companies next week and the subscription is set to commence next week. MOF: to gradually reduce quota for metal exports. As expressed by the spokesperson of MOF on Thursday, upon cancellation of bauxite exports quota, the export quota of metals will also decrease gradually. According to a spokesman of the department of treaty and law of MOF in response to the cancellation of the management of product export quotas such as domestic bauxite in January, the cancellation of export quotas for bauxite, tungsten, molybdenum and other products was to be in line with the reform of the management regime of resources products such as domestic bauxite, a policy adjustment by taking into account relevant decisions of WTO. MOF: to strengthen the rectification of electricity operators. As expressed by Shen Danyang, the spokesperson of MOF on Thursday, SAIC reported the monitoring report of online purchases in the second half of 2014, and relevant enterprises objected. MOF has been highly concerned and requested stronger rectification of electricity operators. The Chinese authorities will cease the grant of approval of coal mine projects in Eastern China. China is aspiring to cope with the drastic fall of prices due to overcapacity. Wang Xianzheng, the chairman of China Coal Industry Association said that the government will no longer approve coal mine projects in Eastern China on Thursday. Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 30 January 2015 Economic releases for this week ‐ USA Date Time Event 27-Jan Economic releases for this week ‐ China Survey Prior Durable goods order 0.5% -0.9% 27-Jan 27-Jan New Home sales (k) Consumer Confidence 450.0 95.0 438.0 92.6 28-Jan MBA mortgage applications - 14.2% - 307.0 Date Time Event Survey Prior 29-Jan Initial jobless claims (k) Source: Bloomberg Source: Bloomberg BOCOM Research Latest Reports Data Report Analyst 29 Jan 201 5 29 Jan 201 5 The Link REIT (823.HK) - A pricy ticket to a greenfield project New World Development (17.HK) - Securing urban landbank at a low cost Alfred Lau, CFA, FRM Alfred Lau, CFA, FRM 29 Jan 201 5 China Market Strategy - Margin of Danger Hao Hong, CFA 28 Jan 201 5 28 Jan 201 5 Energy Sector - Bocom Energy Weekly Kerry Logistics Network (636 HK) - Robust outlook expected for 2015 Fei Wu, Tony Liu Geoffrey Cheng, CFA 27 Jan 201 5 Kingsoft (3888.HK) - Raise Kingsoft Cloud valuation; lift TP and upgrade to Buy Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA 27 Jan 2015 27 Jan 2015 Container Shipping Sector - Weekly container shipping commentary Hang Lung Properties (101.HK) - Well-positioned against challenges Geoffrey Cheng, CFA Alfred Lau, CFA, FRM 26 Jan 2015 Property Sector - HK/China Property Weekly 20150123 Luella Guo, Alfred Lau, CFA, FRM 23 Jan 2015 23 Jan 2015 Transportation Sector - Weekly transportation news wrap Daphne (210.HK) - Another year of profit warning; de-rating imminent Geoffrey Cheng, CFA, Fay Zhou Phoebe Wong 23 Jan 2015 Austar Lifesciences Limited (6118.HK) - Revisiting our forecasts Milo Liu 23 Jan 2015 23 Jan 2015 Sinotrans Limited (598.HK) - Robust fundamentals unchanged in 2015 GOME (493.HK) - China's leading consumer appliances retailer with strong O2O growth; Initiate with Buy Geoffrey Cheng, CFA Anita Chu, Phoebe Wong 22 Jan 2015 Tencent (700.HK) - Moments feed ads indicate the commercialization of Weixin Ma Yuan (Martina), Ph.D, Gu Xinyu (Connie), CPA 22 Jan 2015 21 Jan 2015 Vipshop (VIPS.US) - High growth story but largely priced in; initiate with Neutral Orient Overseas International Limited (316 HK) – Company Update – Cautiously positive on lower bunker prices Phoebe Wong, Anita Chu Geoffrey Cheng, CFA 21 Jan 2015 20 Jan 2015 Energy Sector – Bocom Energy Weekly Container Shipping Sector - Weekly container shipping commentary Fei Wu, Tony Liu Geoffrey Cheng, CFA 20 Jan 2015 Energy Sector - Lower oil erodes benefit of higher Special Upstream Levy threshold; New crude oil price forecast spells caution and leads to downgrade Fei Wu, Tony Liu 19 Jan 2015 China South City Holdings Limited (1668.HK) - Slowdown in property sales, but new businesses still on track Alfred Lau, CFA, FRM Source: Company data, BOCOM International Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 30 January 2015 Hang Seng Index Constituents Company name Cheung Kong Hang Lung Proper Hengan Intl China Shenhua-H Hang Seng Bk China Res Land Cosco Pac Ltd Henderson Land D Aia Group Ltd Hutchison Whampo Kunlun Energy Co Ind & Comm Bk-H China Merchant Want Want China Sun Hung Kai Pro New World Dev Belle Internatio China Coal Ene-H Swire Pacific-A Sands China Ltd Clp Hldgs Ltd Bank East Asia Ping An Insura-H Boc Hong Kong Ho China Life Ins-H Citic Pacific China Res Enterp Cathay Pac Air Hong Kg China Gs Tingyi Hldg Co Esprit Hldgs Bank Of Commun-H China Petroleu-H Hong Kong Exchng Bank Of China-H Wharf Hldg Li & Fung Ltd Hsbc Hldgs Plc Power Assets Hol Mtr Corp China Overseas Tencent Holdings China Unicom Hon Sino Land Co China Res Power Petrochina Co-H Cnooc Ltd China Const Ba-H China Mobile Lenovo Group Ltd Hang Seng Index BBG code 1 HK 101 HK 1044 HK 1088 HK 11 HK 1109 HK 1199 HK 12 HK 1299 HK 13 HK 135 HK 1398 HK 144 HK 151 HK 16 HK 17 HK 1880 HK 1898 HK 19 HK 1928 HK 2 HK 23 HK 2318 HK 2388 HK 2628 HK 267 HK 291 HK 293 HK 3 HK 322 HK 330 HK 3328 HK 386 HK 388 HK 3988 HK 4 HK 494 HK 5 HK 6 HK 66 HK 688 HK 700 HK 762 HK 83 HK 836 HK 857 HK 883 HK 939 HK 941 HK 992 HK Share price (HK$) 145.40 22.75 88.80 21.15 135.90 20.20 11.26 55.50 45.10 101.90 8.14 5.60 28.55 9.21 128.20 9.12 8.84 4.24 104.40 39.20 69.50 32.25 82.95 26.70 30.75 13.36 17.40 18.00 17.88 18.54 8.75 6.45 6.17 178.30 4.35 62.70 7.61 72.30 82.25 34.60 22.90 134.60 11.74 13.08 21.85 8.42 10.20 6.25 104.30 10.04 Mkt cap (HK$m) 336,770 102,041 108,725 468,099 259,819 131,922 33,109 166,519 543,235 434,437 65,709 1,995,326 73,169 121,535 361,933 81,108 74,559 91,125 151,032 316,254 175,588 75,686 783,113 282,293 1,210,834 332,708 42,132 70,809 187,956 103,894 17,005 533,683 866,596 208,284 1,483,759 189,989 63,623 1,389,339 175,543 201,598 187,184 1,261,293 281,137 79,318 104,822 2,585,032 455,404 1,572,616 2,133,322 111,531 5d chg (%) 2.8 4.8 6.1 -2.1 3.0 -3.6 -0.7 4.1 0.1 3.7 0.9 -2.6 3.4 -1.9 5.1 0.3 -3.4 -4.7 2.7 3.6 1.7 3.5 -2.8 0.8 -3.1 -1.6 2.5 4.3 1.4 4.3 7.8 -4.2 -1.0 0.2 -2.5 3.6 3.8 0.6 5.6 4.4 -5.2 2.3 -3.0 5.1 3.8 -3.2 -4.0 -2.6 1.0 -2.5 Ytd chg (%) 11.6 4.6 9.6 -7.8 5.2 -1.2 2.2 2.2 4.5 14.2 11.1 -1.1 9.4 -9.9 8.4 2.2 1.4 -12.8 3.4 2.8 3.3 3.2 4.9 2.9 1.0 1.1 7.1 6.5 0.7 4.6 -5.7 -10.9 -1.3 3.8 -0.5 12.0 4.8 -2.3 9.3 8.8 -0.7 19.6 12.9 4.5 9.3 -2.1 -2.3 -1.9 15.2 -1.6 24,595.9 15,278,428 0.3 4.2 Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 –––– 52-week –––– Hi Lo (HK$) (HK$) 152.00 105.95 26.45 19.80 88.90 74.05 24.40 19.12 136.00 117.60 23.60 13.62 11.92 9.40 57.20 36.46 46.45 34.65 108.50 85.90 14.02 6.88 5.90 4.33 29.10 22.75 13.10 8.92 129.00 90.35 10.48 7.15 10.00 7.00 5.44 3.72 108.00 80.55 68.00 34.50 69.50 56.00 34.45 28.50 88.70 55.60 27.95 21.50 32.80 19.72 16.88 9.35 24.55 15.12 18.30 13.56 18.90 13.91 23.25 16.02 15.24 8.10 7.36 4.53 8.23 5.74 189.00 112.80 4.54 3.03 63.45 46.35 10.70 7.06 84.90 69.75 82.35 57.85 34.60 26.55 26.70 17.52 138.00 93.00 14.22 9.03 14.16 9.83 24.90 17.56 11.70 7.31 15.88 9.72 6.62 4.89 105.10 63.65 12.70 7.62 25,363.0 21,137.6 –––––––––– PE ––––––––––– 2014A 2015E 2016E (X) (X) (X) 7.8 9.4 10.0 8.7 15.7 16.4 30.1 29.0 23.9 7.9 8.7 8.5 15.6 15.6 14.0 7.7 10.5 8.9 14.5 12.9 11.3 9.3 17.8 17.4 28.5 21.9 19.5 9.2 12.1 12.7 10.4 10.6 10.9 5.7 5.7 5.4 16.5 16.9 15.4 22.5 22.8 19.5 10.3 16.4 15.3 6.9 11.0 10.1 N/A 13.3 12.7 32.9 53.4 30.5 11.9 15.3 13.9 15.4 15.9 16.6 19.5 16.6 16.3 10.9 11.7 11.6 16.7 13.8 12.9 12.2 11.5 10.5 26.1 19.0 16.6 9.5 7.6 6.9 22.9 92.6 54.2 24.1 20.4 12.0 27.0 25.6 23.8 32.1 29.9 24.2 80.1 74.2 33.3 6.0 5.9 5.7 8.5 9.6 13.8 44.4 40.5 30.2 5.8 5.9 5.5 8.0 16.2 14.3 9.8 16.1 14.0 11.7 10.7 10.1 2.8 20.0 19.6 13.6 19.0 18.7 7.5 8.2 7.1 45.7 42.3 32.2 17.9 17.4 15.4 8.8 14.9 14.5 9.0 8.7 8.0 9.4 10.6 15.8 6.6 7.1 12.5 5.5 5.4 5.2 14.6 15.6 15.4 14.9 17.7 15.2 10.4 11.4 10.3 Yield P/B (%) 2.4 3.3 2.1 5.3 4.0 2.2 2.7 1.8 1.0 2.3 2.8 N/A 2.7 2.9 2.6 4.5 N/A 2.4 3.4 4.4 3.7 3.4 1.0 3.8 1.2 2.0 1.4 1.4 1.8 1.5 0.8 N/A 4.8 2.0 5.6 2.8 6.2 5.3 3.1 2.7 2.1 0.2 1.7 3.8 3.4 4.7 5.6 6.0 3.0 2.4 (X) 0.9 0.8 6.6 1.2 2.4 1.4 0.9 0.7 2.5 1.0 1.3 1.1 1.1 8.3 0.8 0.5 2.3 0.5 0.7 7.8 1.9 1.1 2.6 1.7 2.9 0.6 0.8 1.2 3.7 4.4 1.0 0.8 1.0 10.1 1.0 0.7 1.7 0.9 1.4 1.3 1.6 13.6 1.0 0.7 1.6 1.1 1.0 1.1 2.1 4.4 3.5 1.4 Morning Express 30 January 2015 China Ent Index Constituents –––– 52-week –––– ––––––––––– PE ––––––––––– 2014A 2015E 2016E Company BBG Share Mkt 5d Ytd name code price (HK$) cap (HK$m) chg (%) chg (%) Hi (HK$) Lo (HK$) (X) (X) Shandong Weig-H 1066 HK 6.12 27,395.40 0.5 -2.2 10.2 5.7 72.1 22.2 China Shenhua-H 1088 HK 21.15 468,098.68 -2.1 -7.8 24.4 19.1 7.9 8.7 Sinopharm-H China Shipping-H 1099 HK 1138 HK 28.40 5.67 78,585.50 29,940.52 -1.0 -4.1 3.5 6.6 34.5 6.3 19.7 4.0 22.9 N/A Zoomlion Heavy-H 1157 HK 4.90 54,751.26 -5.8 -17.1 6.5 3.5 Yanzhou Coal-H Agricultural-H 1171 HK 1288 HK 6.31 3.79 61,838.78 1,393,758.14 -1.6 -3.1 -4.0 -3.3 7.3 4.1 4.9 3.0 New China Life-H 1336 HK 44.65 182,409.88 0.0 14.0 45.3 Ind & Comm Bk-H Tsingtao Brew-H 1398 HK 168 HK 5.60 52.60 1,995,326.31 69,987.13 -2.6 -2.4 -1.1 0.0 5.9 64.0 China Com Cons-H 1800 HK 8.51 223,555.79 -6.4 -8.8 10.2 4.9 8.6 China Coal Ene-H China Minsheng-H 1898 HK 1988 HK 4.24 9.50 91,124.95 391,172.25 -4.7 -5.6 -12.8 -6.9 5.4 10.7 3.7 5.9 32.9 5.8 Guangzhou Auto-H 2238 HK 7.13 59,371.58 0.7 1.0 9.9 6.6 11.7 Ping An Insura-H Picc Property & 2318 HK 2328 HK 82.95 15.06 783,112.65 223,317.38 -2.8 0.8 4.9 -0.1 88.7 16.2 55.6 9.4 16.7 15.6 Great Wall Mot-H 2333 HK 43.95 156,943.72 4.5 -0.3 45.7 26.1 Weichai Power-H Aluminum Corp-H 2338 HK 2600 HK 30.80 3.62 64,268.29 81,453.94 -3.4 -7.9 -5.8 0.8 34.9 4.3 25.8 2.5 China Pacific-H 2601 HK 37.80 379,301.66 -1.4 -4.1 42.0 China Life Ins-H China Oilfield-H 2628 HK 2883 HK 30.75 12.96 1,210,834.29 94,307.34 -3.1 -6.4 1.0 -3.7 32.8 23.4 Zijin Mining-H China Natl Bdg-H 2899 HK 3323 HK 2.43 7.51 85,783.50 40,546.69 -4.7 -2.2 10.5 -0.4 2.7 8.4 Bank Of Commun-H 3328 HK 6.45 533,682.69 -4.2 -10.9 358 HK 386 HK 12.56 6.17 62,599.99 866,596.49 -4.3 -1.0 -5.6 -1.3 Jiangxi Copper-H China Petroleu-H China Rail Gr-H Yield P/B (X) (%) (X) 18.6 1.3 2.4 8.5 5.3 1.2 20.7 52.5 17.4 15.4 1.1 0.0 2.7 0.7 16.5 19.6 14.9 3.8 0.7 6.8 5.5 15.3 5.4 18.6 5.0 0.4 N/A 0.6 1.0 21.1 18.7 15.0 13.8 0.4 2.6 4.3 50.4 5.7 28.8 5.7 28.0 5.4 24.8 N/A N/A 1.1 3.7 8.2 7.5 2.7 1.1 53.4 5.5 30.5 5.2 2.4 2.1 0.5 1.2 10.7 8.3 3.1 1.1 13.8 12.7 12.9 11.8 1.0 1.8 2.6 2.6 13.3 13.3 10.0 2.3 3.7 9.5 N/A 10.1 N/A 10.5 N/A 1.0 N/A 1.6 1.0 23.6 25.8 22.4 19.0 1.3 2.6 19.7 11.7 26.1 6.1 19.0 6.4 16.6 7.2 1.2 4.1 2.9 1.1 1.6 6.7 20.0 5.3 17.3 5.7 17.2 5.4 N/A 2.6 1.6 0.9 7.4 4.5 6.0 5.9 5.7 N/A 0.8 15.2 8.2 11.6 5.7 9.8 8.5 11.9 9.6 13.2 13.8 4.9 4.8 0.8 1.0 390 HK 5.78 208,441.34 -3.5 -9.4 6.7 3.0 10.0 9.4 8.5 1.4 1.1 3968 HK 3988 HK 17.28 4.35 447,218.55 1,483,758.67 -5.7 -2.5 -11.2 -0.5 20.0 4.5 12.1 3.0 6.1 5.8 6.0 5.9 5.5 5.5 4.5 5.6 1.2 1.0 Dongfeng Motor-H 489 HK 11.44 98,568.42 -1.7 4.2 15.2 9.6 5.9 6.2 5.9 2.0 1.1 Citic Securiti-H Haitong Securi-H 6030 HK 6837 HK 24.75 16.68 373,240.13 228,258.27 -3.1 -2.8 -15.2 -14.5 34.0 23.2 13.7 9.5 27.6 30.5 23.4 18.6 18.9 14.8 N/A 0.9 2.4 2.0 China Telecom-H 728 HK 4.54 367,432.97 -1.9 0.0 5.2 3.1 15.9 16.0 14.4 2.6 1.0 Air China Ltd-H Petrochina Co-H 753 HK 857 HK 7.09 8.42 116,112.33 2,585,031.76 -1.7 -3.2 13.1 -2.1 7.5 11.7 4.2 7.3 26.7 9.4 21.6 10.6 11.3 15.8 0.8 4.7 1.4 1.1 Huaneng Power-H 902 HK 10.64 148,956.32 -3.8 1.5 11.6 6.1 10.5 9.8 9.2 4.4 1.9 Anhui Conch-H China Longyuan-H 914 HK 916 HK 26.40 8.39 133,633.94 67,425.30 -3.8 -2.0 -9.1 4.0 35.7 10.0 24.0 7.1 9.3 27.9 9.7 21.7 9.1 15.2 1.6 0.7 1.9 1.7 China Const Ba-H 939 HK 6.25 1,572,615.52 -2.6 -1.9 6.6 4.9 5.5 5.4 5.2 6.0 1.1 China Citic Bk-H 998 HK 5.75 363,134.81 -0.5 -7.6 6.3 3.6 5.3 5.3 5.0 N/A 0.9 11,736 4,799,723 -2.6 -2.1 12,400.4 9,159.8 8.3 8.0 7.1 3.9 1.3 China Merch Bk-H Bank Of China-H Hang Seng China Ent Indx Source: Bloomberg Download our reports from Bloomberg: BOCM〈enter〉 Morning Express 30 January 2015 BOCOM International 11/F, Man Yee Building, 68 Des Voeux Road, Central, Hong Kong Main: + 852 3710 3328 Rating System Company Rating Fax: + 852 3798 0133 www.bocomgroup.com Sector Rating Buy: Expect more than 20% upside in 12 months LT Buy: Expect more than 20% upside but longer than 12 months Neutral: Expect low volatility Sell: Expect more than 20% downside in 12 months Outperform (“OP”): Expect more than 10% upside in 12 months Market perform (“MP”): Expect low volatility Underperform (“UP”): Expect more than 10% downside in 12 months Research Team Head of Research @bocomgroup.com (852) 2977 9393 raymond.cheng Strategy Raymond CHENG, CFA, CPA, CA Hao HONG, CFA (852) 2977 9384 Banks/Network Financials Qingli YANG @bocomgroup.com Economics hao.hong Miaoxian LI (86) 10 8800 9788 ‐ 8043 miaoxian.li Oil & Gas/ Gas Utilities (852) 2977 9212 yangqingli Fei WU (852) 2977 9392 fei.wu Shanshan LI, CFA (86) 10 8800 9788 ‐ 8058 lishanshan Tony LIU (852) 2977 9390 xutong.liu Li WAN, CFA (86) 10 8800 9788 ‐ 8051 Wanli Consumer Discretionary Property Phoebe WONG (852) 2977 9391 phoebe.wong Anita CHU (852) 2977 9205 anita.chu Consumer Staples Alfred LAU, CFA, FRM (852) 2977 9235 alfred.lau Luella GUO (852) 2977 9211 luella.guo Renewable Energy (852) 2977 9221 summer.wang Shawn WU (852) 2977 9386 shawn.wu Healthcare (852) 2977 9387 Insurance & Brokerage milo.liu Technology (852) 2977 9389 liwenbing Jennifer ZHANG (852) 2977 9250 yufan.zhang Zhiwu LI Jerry LI louis.sun (86) 10 8800 9788 ‐ 8039 yuan.ma Connie GU, CPA (86) 10 8800 9788 ‐ 8045 conniegu Metals & Mining (852) 2977 9243 Miles XIE (852) 2977 9209 lizhiwu (852) 2977 9216 miles.xie Transportation & Industrial Yuan MA, PhD Jovi LI (86) 21 6065 3606 Telecom & Small/ Mid‐Caps Milo LIU Internet Louis SUN Summer WANG jovi.li Download our reports from Bloomberg: BOCM〈enter〉 Geoffrey CHENG, CFA (852) 2977 9380 geoffrey.cheng Fay ZHOU (852) 2977 9381 fay.zhou Automobile Wei YAO (86) 21 6065 3675 wei.yao Morning Express 30 January 2015 Analyst Certification The authors of this report, hereby declare that: (i) all of the views expressed in this report accurately reflect their personal views about any and all of the subject securities or issuers; and (ii) no part of any of their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this report; (iii) no insider information/ non‐public price‐sensitive information in relation to the subject securities or issuers which may influence the recommendations were being received by the authors. The authors of this report further confirm that (i) neither they nor their respective associates (as defined in the Code of Conduct issued by the Hong Kong Securities and Futures Commission) have dealt in or traded in the stock(s) covered in this research report within 30 calendar days prior to the date of issue of the report; (ii)) neither they nor their respective associates serve as an officer of any of the Hong Kong listed companies covered in this report; and (iii) neither they nor their respective associates have any financial interests in the stock(s) covered in this report. Disclosure of relevant business relationships BOCOM International Securities Limited, and/or its associated companies, has investment banking relationship with Bank of Communications, Harbin Bank Co., Ltd., Azure Orbit International Finance Limited, Hanhua Financial Holding Co., Ltd., Central China Securities Company Limited, China New City Commercial Development Limited, China Shengmu Organic Milk Limited, Broad Greenstate International Company Limited, China National Culture Group Limited, Sichuan Development Holding Co. Ltd., Austar Lifesciences Limited and BAIC Motor Corporation Limited within the preceding 12 months. BOCOM International Holdings Company Limited currently holds more than 1% of the equity securities of Shanghai Fosun Pharmaceuticals Group Co. Ltd. BOCOM International Securities Limited currently holds more than 1% of the equity securities of Sanmenxia Tianyuan Aluminum Company Limited. Disclaimer By accepting this report (which includes any attachment hereto), the recipient hereof represents and warrants that he is entitled to receive such report in accordance with the restrictions set forth below and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of law. This report is strictly confidential and is for private circulation only to clients of BOCOM International Securities Ltd. This report is being supplied to you strictly on the basis that it will remain confidential. No part of this report may be (i) copied, photocopied, duplicated, stored or reproduced in any form by any means or (ii) redistributed or passed on, directly or indirectly, to any other person in whole or in part, for any purpose without the prior written consent of BOCOM International Securities Ltd. BOCOM International Securities Ltd, its affiliates and related companies, their directors, associates, connected parties and/or employees may own or have positions in securities of the company(ies) covered in this report or any securities related thereto and may from time to time add to or dispose of, or may be interested in, any such securities. Further, BOCOM International Securities Ltd, its affiliates and its related companies may do and seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking, advisory, underwriting, financing or other services for or relating to such company(ies) as well as solicit such investment, advisory, financing or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. The information contained in this report is prepared from data and sources believed to be correct and reliable at the time of issue of this report. This report does not purport to contain all the information that a prospective investor may require and may be subject to late delivery, interruption and interception. BOCOM International Securities Ltd does not make any guarantee, representation or warranty, express or implied, as to the adequacy, accuracy, completeness, reliability or fairness of any such information and opinion contained in this report and accordingly, neither BOCOM International Securities Ltd nor any of its affiliates nor its related persons shall not be liable in any manner whatsoever for any consequences (including but not limited to any direct, indirect or consequential losses, loss of profits and damages) of any reliance thereon or usage thereof. This report is general in nature and has been prepared for information purposes only. It is intended for circulation amongst BOCOM International Securities Ltd’s clients generally and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. The information and opinions in this report are not and should not be construed or considered as an offer, recommendation or solicitation to buy or sell the subject securities, related investments or other financial instruments thereof. The views, recommendations, advice and opinions in this report may not necessarily reflect those of BOCOM International Securities Ltd or any of its affiliates, and are subject to change without notice. BOCOM International Securities Ltd has no obligation to update its opinion or the information in this report. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction in respect of the securities of company(ies) covered in this report. The securities of such company(ies) may not be eligible for sale in all jurisdictions or to all categories of investors. This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to any law, regulation, rule or other registration or licensing requirement. BOCOM International Securities Ltd is a wholly owned subsidiary of Bank of Communications Co Ltd. Download our reports from Bloomberg: BOCM〈enter〉

© Copyright 2026