Morning Flash

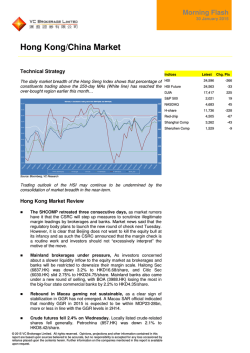

Morning Flash 29 January 2015 Hong Kong/China Market Technical Strategy Indices Gold spot has trended up since Nov14, partly as a result of the EU and U.S. HSI imposition of sanctions against Russia and the backlash from Euro over the HSI Future new Greece cabinet… DJIA Source: Bloomberg, VC Research But spot gold is still trading within a descending channel developed since 2H13. A key resistance stands at USD1,330/ounce, or the ceiling of the channel. Hong Kong Market Review China shares remained weak yesterday, as the SHCOMP closed down 1.4% and the HSCEI retreated 0.41%. But the HSI managed to rebound 48 points, as local property developer shares generally gained. The US Fed is to announce its meeting result on Thursday. Perhaps investors put their bet on the Fed putting off its rate hike schedule. And as such, interest rate sensitive shares generally had a good run yesterday. A checked rally. The SHCOMP retreated two days in a row, as investors concerned about liquidity flowing in the equity market would slow after a number of mainland banks revised down leverage for trust products investing in shares. It is reported that the balance of margin trading debt rose to Rmb773.8bn on the SHCOMP on Tuesday yesterday, climbing to a record for a second day. The CSRC moved to try to rein the running away margin financing in order to prevent the formation of a financial bubble. And it is expected that trading of the SHCOMP will become even choppier as the regulatory body tries to control the pace at the equity market will grow. Anyhow, the investment market is still on the A-shares in the medium term. © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. Latest 24,862 Chg. Pts 55 24,725 -153 17,191 -196 S&P 500 2,002 -27 NASDAQ 4,638 -44 H-share 11,964 -67 Red-chip 4,571 -1 Shanghai Comp 3,306 -47 Shenzhen Comp 1,539 -11 Morning Flash 29 January 2015 Economic News Fed Raises Assessment of Economy While Staying Patient on Rates: The Federal Reserve boosted its assessment of the economy and played down low inflation while repeating a pledge to stay “patient” on raising interest rates. The Federal Open Market Committee described the expansion as “solid,” an improvement over the “moderate” performance it saw in December. It substituted “strong” for “solid” in its evaluation of job gains after a meeting Wednesday in Washington. While inflation “is anticipated to decline further in the near term,” the FOMC said in a statement, it is likely to rise gradually toward its 2 percent goal “over the medium term” as the impact of low oil prices diminishes. Policy makers also said cheaper energy will help boost consumer buying power. The Fed’s confidence in the outlook for higher inflation and lower unemployment suggests it will stick to plans to raise interest rates this year for the first time since 2006. One caveat: officials will take “international developments” into account when considering an increase, language that contributed to a decline in stocks and Treasury yields. (Bloomberg) $11 Billion Wiped From Greek Banks on Nationalization Threat: The amount that investors gave Greek lenders last year was wiped off in three days of trading amid the threat of greater government control. In a bid to boost balance sheets, the nation’s banks raised more than $11.5 billion in additional share sales in 2014, the most in at least a decade, data compiled by Bloomberg show. That capital was almost wiped out as bank stocks lost about $11.4 billion in market value this week. Shares of Piraeus Bank SA and National Bank of Greece SA plunged the most, becoming fractions of their pre-crisis peaks. In his first week in office, Prime Minister Alexis Tsipras stood by pledges to renegotiate the terms of Greece’s bailout and has appointed ministers who said they will cease the sale of some state assets. That sparked a record 44 percent selloff in the FTSE/Athex Banks Index. The nation’s stocks and bonds slumped, even as Tsipras and his finance chief pledged to avoid a standoff with creditors. The benchmark ASE Index has fallen 15 percent in the past three days, and bond yields spiked to levels not seen since 2012. A person familiar with the matter said bank-deposit withdrawals accelerated to record levels in the runup to the Jan. 25 election. The losses took Greek stocks down 48 percent since a high in March, as anti-austerity party Syriza gained ground among voters. (Bloomberg) Japan’s Retail Sales Unexpectedly Slump in Challenge to Abe: Japanese retail sales unexpectedly fell in December, underscoring challenges to Prime Minister Shinzo Abe’s effort to stoke a recovery in the world’s third-biggest economy. Sales slid 0.3 percent from November for a third straight monthly decline, the trade ministry said Thursday in Tokyo. That compared with the median estimate for a 0.3 percent gain in a Bloomberg News survey. Sales increased 1.7 percent in 2014. A recovery in consumer spending that was hurt by last year’s sales-tax increase is needed to help spur the economy. Talks between business and labor leaders this spring will determine the extent of pay gains that have been too small to offset rising living costs for consumers. (Bloomberg) © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. Morning Flash 29 January 2015 Market News Taobao responds to disputed inspection report: China's largest shopping website, Taobao.com, gave an official response to a controversial quality inspection report by the country's commerce regulator on Wednesday. The online store will file a complaint to the State Administration for Industry and Commerce (SAIC) based on accusations of a senior official's improper supervision, according to an announcement on Taobao's Sina Weibo account. "Director Liu Hongliang followed improper procedures and his legal assessment was emotional," Taobao said, "He reached a conclusion that was not objective, bringing a negative effect on Taobao and e-commerce businesses." "We welcome any supervision that is fair but oppose nonfeasance and random or malicious official actions," the post said. The move is the latest salvo between Taobao, the most profitable branch of e-commerce giant Alibaba Group, and the SAIC since the latter published a quality inspection report on Jan. 23 that gave Taobao the lowest rank in terms of certified product rate. The SAIC's sample test showed that only 37.25 percent of surveyed commodities sold on the website were authentic, lower than a 58.7-percent average of major online shopping platforms. Taobao's major rival, JD.com saw its rating at 90 percent. (Xinhua) China to push exports of railway, nuclear power products: China's State Council, the cabinet, on Wednesday announced plans to push exports of advanced railway, nuclear power and building material products. In a notice on gov.cn, the cabinet said government departments and enterprises should facilitate China "going global", by increasing international trade, investment cooperation and pushing for domestic economic restructuring. China's outbound investment reached 102.89 billion U.S. dollars last year, up 14.1 percent from a year earlier, ascending to the world's net capital exporters for the first time. China will support enterprises in steel, textile and building material sectors to develop the industrial chain to export not only China's products, but also its technology and standards. The government will aid enterprises with foreign exchange reserves to finance them "going global" through stocks or bonds issuance. (Xinhua) © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. Morning Flash 29 January 2015 Result Announcements China Billion Resources Limited (0274.HK) said it expects to record a net loss for each of the three financial years ended 31 December 2011, 2012 and 2013, mainly due to the debt restructuring in 2011 and significant impairment losses on property, plant, equipment, goodwill, mining rights and trade and other receivables. (Infocast) Willie International Holdings Limited (0273.HK) expects a consolidated net profit around HK$750 million for the year ended 31 December 2014, up 815% compared to the consolidated net profit of HK$82 million for the previous year. The rise in profitability was primarily attributable to the higher amount of realized and fair-value gains on financial assets held by the group for investment trading purpose plus fair-value gains on the group's long-term investments. (Infocast) Taking no account of the gain on disposal of other financial assets of approximately HK$32.2 million recorded for the year ended 31 December 2014, and one-off reversal of impairment loss on other financial assets of HK$25.6 million during the year ended 31 December 2013, it is expected that RoadShow Holdings Limited's (0888.HK) profit from operations for the year ended 31 December 2014 will decrease significantly by more than 45% as compared with that for the year ended 31 December 2013 of HK$83 million, the board of the company said. (Infocast) Beijing Jingcheng Machinery Electric Company Limited (0187.HK) said that it expects a gain in operating results for the year of 2014, as compared to a RMB108.239 million loss for 2013, and to realize net profit attributable to the shareholders of RMB20-30 million. (Infocast) Guotai Junan International Holdings Limited (1788.HK) announces that the consolidated net profit of the group for the year ended 31 December 2014 is expected to increase significantly by not less than 40% as compared with that for the year ended 31 December 2013. (Infocast) Shenzhen Expressway Company Limited (0548.HK) expects its net profit attributable to owners for the year of 2014 to have increased by 185-215% compared to the net profit of RMB719.692 billion for 2013. The basic earnings per share is expected to be RMB0.33. (Infocast) Announcing its preliminary annual results for 2014 according to China's accounting standards, China CITIC Bank Corporation Limited (0998.HK) said its net profit attributable to shareholders was RMB40.692 billion for the year, up 3.87% on year. Operating income rose 19% to RMB124.717 billion. Operating profit advanced a slight 4% to RMB54.405 billion. (Infocast) CITIC Securities Company Limited (6030.HK) has issued its preliminary financial data for 2014 using PRC accounting standards. Net profit attributable to owners of the parent was RMB11.295 billion for the year, up 115% on year. Operating revenue gained 83% to RMB29.511 billion. Operating profit climbed 97% to RMB13.51 billion. (Infocast) © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. Morning Flash 29 January 2015 Today’s Theme The European Union and U.S. are considering additional sanctions against Russia over its support for separatist rebels in eastern Ukraine, where renewed fighting in the region has caused heavy casualties. The economic turmoil in Russia has worsened after S&P revised its credit rating to junk level earlier this week. Gold price is expected to trade at the strong side as investors in search of safe haven. Zhaojin Mining (1818.HK) • Trailed down along a descending channel since 2H13. • But rising above all major MAs is a good sign. • A key resistance lies at HKD5.0/share, the upper band of the channel. Source: Bloomberg, VC Research Zijin Mining (2899.HK) Source: Bloomberg, VC Research © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. • Rising momentum has strengthened after Zijin shot through the ceiling of an ascending channel. • But a tough resistance lies at HKD2.75/share. Morning Flash 29 January 2015 Lingbao Gold (3330.HK) Source: Bloomberg, VC Research Hang Seng Composite Sectors Sector Hang Seng Index (HSI) Hang Seng Composite HSCI Utilities HSCI Industrial Goods HSCI Materials HSCI Conglomerates HSCI Telecommunication HSCI Property & Construction HSCI Info Technology HSCI Consumer Goods HSCI Financials HSCI Services HSCI Energy HS Mainland 100 HS China Enterprises HS China H-Financial HS China Affiliated Corps HS HK 35 HS HK Large Cap HS HK MidCap HS HK Small Cap Index 24,861.81 3,387.79 Day (%) Week (%) MTD (%) 0.22 2.09 5.32 0.11 1.59 3.69 YTD (%) 5.32 3.69 7,766.59 1,297.71 5,404.12 2,960.60 2,142.78 3,092.81 5,945.69 4,740.01 3,749.32 4,013.51 9,825.36 0.40 -0.42 0.22 0.41 0.49 0.42 0.52 0.41 -0.15 -0.38 -0.11 1.43 2.03 -0.92 2.32 1.36 1.10 4.94 0.29 1.09 6.15 0.22 3.35 2.82 -0.56 8.10 12.57 4.13 16.40 1.63 1.08 1.37 -0.64 3.35 2.82 -0.56 8.10 12.57 4.13 16.40 1.63 1.08 1.37 -0.64 7,549.33 11,963.64 18,327.76 4,571.44 -0.04 -0.55 -0.71 -0.03 0.44 -0.48 -0.99 0.01 4.03 -0.18 -0.54 5.09 4.03 -0.18 -0.54 5.09 2,830.08 2,030.95 4,501.58 2,256.08 0.40 0.16 -0.33 0.81 3.62 1.94 0.28 0.74 5.49 4.59 0.74 0.42 5.49 4.59 0.74 0.42 Source: Bloomberg © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. • Regained some momentum after Lingbao retaking the 50-day and 250-day MA. • Retreated after hitting the ceiling of a descending channel at HKD1.55/share, which remains a key resistance in near-term. Morning Flash - 29 January 2015 Analyst Certification Each research analyst primarily responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by that research analyst in the research report. Disclaimer T This document is prepared by VC Brokerage Limited (“VC”) to provide information about the securities mentioned herein. It is for distribution only under such circumstances as may be permitted by applicable law. It has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. It is published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this document. It should not be regarded by the recipients as a substitute for the exercise of their own judgment. Any prices or levels contained in these pages are indicative and may vary in accordance with changes in market conditions. Investors are warned that the price of any securities may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. No liability is accepted whatsoever for any direct, indirect or consequential loss arising from the use of this document, and no claims, actions or legal proceedings may be brought against VC in connection with this document in any manner whatsoever by any person dealing with the securities and/or the related financial instruments mentioned herein. Any opinions expressed in this document are subject to change without notice. VC is under no obligation to update or keep current the information contained herein. VC and its affiliates, their directors, officers and employees or clients may have or have had interests or long or short positions in the securities or other financial instruments referred to herein, and may at any time make purchases and/or sales in them as principal or agent. VC and its affiliates may have or have had a relationship with or may provide or has provided investment banking, capital markets and/or other financial services to the relevant companies. Employees of VC and its affiliates may serve or have served as officers or directors of the relevant companies. © 2014 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request.

© Copyright 2026