Weekly Holdings [PDF] - Goldman Sachs Asset Management

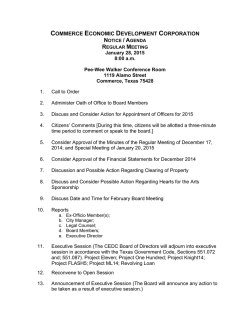

WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer NEW MEXICO FINANCE AUTHORITY ANNE ARUNDEL MARYLAND (COUNTY OF) ARIZONA TRANSPORTATION BOARD AUSTIN, TEXAS (CITY OF) AUSTIN, TEXAS (CITY OF) AUSTIN, TEXAS (CITY OF) AUSTIN, TEXAS (CITY OF) THE CITY OF NEW YORK KAISER FOUNDATION HOSPITALS STATE OF CALIFORNIA STATE OF CALIFORNIA CALIFORNIA DEPARTMENT OF WATER RESOURCES (ELECTRIC KAISER FOUNDATION HOSPITALS KAISER FOUNDATION HOSPITALS KAISER FOUNDATION HOSPITALS KAISER FOUNDATION HOSPITALS KAISER FOUNDATION HOSPITALS KAISER FOUNDATION HOSPITALS KAISER FOUNDATION HOSPITALS MONTGOMERY, MARYLAND (COUNTY OF) STATE OF CONNECTICUT STATE OF CONNECTICUT STATE OF CONNECTICUT STATE OF CONNECTICUT YALE UNIVERSITY HOUSTON, TEXAS (CITY OF) DALLAS TEXAS WATERWORKS & SEWER SYSTEM SOUTH CAROLINA PUBLIC SERVICE AUTHORITY DISTRICT OF COLUMBIA DISTRICT OF COLUMBIA ASCENSION HEALTH ENERGY NORTHWEST 37 38 Cusip 0135182W4 03588E4W0 040654UR4 0523962R8 052396KL1 05248MPY2 05248MQA3 090491ZE4 13032THF1 13063BRN4 13063CLC2 13066YQL6 13078GQW7 13078UPB3 13079JUA3 13079JUJ4 13079QCH2 13079SBJ5 13079TBL8 1448795B5 20772JEQ1 20772JHG0 20772JLR1 20772JZD7 20774SBK5 235219HX3 23530UAA2 25155WEX3 25476FNV6 25476FPW2 27884FTT7 29270CFD2 Effective Maturity Date 7/1/2015 4/1/2015 7/1/2015 9/1/2015 3/1/2015 2/9/2015 3/2/2015 1/29/2016 7/7/2015 2/1/2015 6/22/2015 5/1/2015 3/2/2015 3/3/2015 6/3/2015 4/1/2015 7/1/2015 7/1/2015 8/4/2015 11/1/2015 2/5/2015 2/5/2015 2/5/2015 2/5/2015 2/2/2015 2/15/2015 2/2/2015 3/18/2015 6/1/2015 9/30/2015 2/19/2015 7/1/2015 Final Maturity Date 7/1/2015 4/1/2015 7/1/2015 9/1/2015 3/1/2015 2/9/2015 3/2/2015 1/29/2016 7/7/2015 2/1/2015 6/22/2015 5/1/2015 3/2/2015 3/3/2015 6/3/2015 4/1/2015 7/1/2015 7/1/2015 8/4/2015 11/1/2015 4/15/2015 9/15/2015 3/1/2015 1/1/2016 2/2/2015 2/15/2015 2/2/2015 3/18/2015 6/1/2015 9/30/2015 2/19/2015 7/1/2015 Coupon/ Yield 4.00 5.00 1.65 5.00 5.00 0.08 0.08 1.25 0.14 5.00 1.50 5.00 0.14 0.14 0.14 0.01 0.14 0.14 0.14 2.00 0.42 0.31 0.16 0.06 0.03 4.00 0.06 0.22 1.00 1.50 0.11 5.50 Par 4,035,000.00 1,150,000.00 200,000.00 100,000.00 2,250,000.00 10,000,000.00 10,000,000.00 21,396,162.00 18,500,000.00 2,275,000.00 198,000,000.00 955,000.00 3,610,000.00 19,000,000.00 47,500,000.00 3,000,000.00 12,000,000.00 9,500,000.00 10,000,000.00 3,010,000.00 170,000.00 400,000.00 250,000.00 4,500,000.00 10,350,000.00 1,470,000.00 30,000,000.00 48,665,000.00 9,870,000.00 25,000,000.00 16,380,000.00 1,255,000.00 Amortized Cost 4,098,800.84 1,159,245.25 201,219.77 102,768.04 2,258,746.80 10,000,000.00 10,000,000.00 21,586,821.15 18,500,000.00 2,275,295.44 199,059,727.21 966,320.65 3,610,000.00 19,000,000.00 47,500,000.00 3,000,000.00 12,000,000.00 9,500,000.00 10,000,000.00 3,050,816.45 170,002.30 400,165.69 250,005.48 4,500,000.00 10,350,000.00 1,472,316.16 30,000,000.00 48,665,000.00 9,898,748.94 25,226,683.54 16,380,000.00 1,282,571.08 Percentage of Total 0.07% 0.02% 0.00% 0.00% 0.04% 0.17% 0.17% 0.37% 0.32% 0.04% 3.40% 0.02% 0.06% 0.32% 0.81% 0.05% 0.20% 0.16% 0.17% 0.05% 0.00% 0.01% 0.00% 0.08% 0.18% 0.03% 0.51% 0.83% 0.17% 0.43% 0.28% 0.02% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer ENERGY NORTHWEST ENERGY NORTHWEST NASSAU COUNTY INTERIM FINANCE AUTHORITY FLORIDA (STATE OF) FLORIDA (STATE OF) DALLAS TEXAS WATERWORKS & SEWER SYSTEM GARLAND TEXAS (CITY OF) STATE OF GEORGIA GUILFORD, NORTH CAROLINA (COUNTY OF) METHODIST HOSP-HARRIS CNTY, TX HEMPSTEAD NEW YORK (TOWN OF) HENNEPIN COUNTY, MINNESOTA HONOLULU HAWAII CITY & COUNTY WASTEWATER SYSTEM HOUSTON, TEXAS (CITY OF) HOUSTON, TEXAS (CITY OF) HOUSTON, TEXAS (CITY OF) HOUSTON, TEXAS (CITY OF) HOUSTON, TEXAS (CITY OF) HOUSTON, TEXAS (CITY OF) HEALTH CARE AUTHORITY OF THE CITY OF HUNTSVILLE (T HEALTH CARE AUTHORITY OF THE CITY OF HUNTSVILLE (T HEALTH CARE AUTHORITY OF THE CITY OF HUNTSVILLE (T JEA JEA KING, WASHINGTON (COUNTY OF) KING COUNTY WASHINGTON SEWER SYSTEM KING, WASHINGTON (COUNTY OF) KING COUNTY WASHINGTON SEWER SYSTEM JEA LAS VEGAS VALLEY WATER DISTRICT LAWRENCE, KANSAS (CITY OF) LAWRENCE, KANSAS (CITY OF) 37 38 Cusip 29270CKJ3 29270CZZ1 29508RGQ3 341150ZU7 343246DS0 349515RC2 366119SR7 373384E36 401784YY3 41400A2B2 424672VM2 425507CH1 438701NG5 442331GX6 442331GY4 442331GZ1 442331HA5 442331HN7 442331HP2 44706DFS0 44706DFY7 44706DGC4 46613SAB6 46616TBH7 49474FFU9 49476Q2A1 495260ZX2 495289ZS2 51166FBU2 51784U5X2 520121JR6 520121KN3 Effective Maturity Date 7/1/2015 7/1/2015 7/31/2015 7/1/2015 7/15/2015 2/15/2015 2/15/2015 2/1/2015 3/1/2015 8/13/2015 12/18/2015 12/1/2015 7/1/2015 3/1/2015 3/1/2015 3/1/2015 3/1/2015 3/1/2015 3/1/2015 2/2/2015 4/2/2015 3/2/2015 10/1/2015 2/11/2015 6/1/2015 3/2/2015 6/1/2015 1/1/2016 10/1/2015 4/6/2015 10/1/2015 10/1/2015 Final Maturity Date 7/1/2015 7/1/2015 7/31/2015 7/1/2015 7/15/2015 2/15/2015 2/15/2015 2/1/2015 3/1/2015 8/13/2015 12/18/2015 12/1/2015 7/1/2015 3/1/2015 3/1/2015 3/1/2015 3/1/2015 3/1/2015 3/1/2015 2/2/2015 4/2/2015 3/2/2015 10/1/2015 2/11/2015 6/1/2015 3/2/2015 6/1/2015 1/1/2016 10/1/2015 4/6/2015 10/1/2015 10/1/2015 Coupon/ Yield 5.00 2.00 1.25 5.00 5.00 2.00 5.00 5.00 4.00 0.14 1.50 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 0.10 0.09 0.06 3.00 0.05 4.00 0.12 4.00 5.00 5.00 0.08 2.00 2.00 Par 5,000,000.00 10,150,000.00 18,250,000.00 5,585,000.00 1,000,000.00 18,800,000.00 1,025,000.00 5,000,000.00 3,990,000.00 15,240,000.00 18,000,000.00 6,700,000.00 2,175,000.00 3,565,000.00 3,445,000.00 2,935,000.00 4,130,000.00 9,245,000.00 9,700,000.00 25,000,000.00 19,000,000.00 16,000,000.00 100,000.00 7,500,000.00 1,090,000.00 78,720,000.00 2,015,000.00 6,345,000.00 7,860,000.00 14,000,000.00 5,560,000.00 13,470,000.00 Amortized Cost 5,100,351.02 10,227,175.02 18,348,888.43 5,697,771.54 1,022,030.35 18,813,986.55 1,027,042.45 5,000,658.12 4,002,240.67 15,240,000.00 18,165,403.19 6,969,508.87 2,218,343.68 3,578,969.58 3,458,499.36 2,946,500.90 4,146,183.56 9,281,292.26 9,738,078.41 25,000,000.00 19,000,000.00 16,000,000.00 101,831.18 7,500,000.00 1,104,052.91 78,720,000.00 2,040,432.95 6,622,217.02 8,110,863.86 14,000,000.00 5,627,805.13 13,633,395.82 Percentage of Total 0.09% 0.17% 0.31% 0.10% 0.02% 0.32% 0.02% 0.09% 0.07% 0.26% 0.31% 0.12% 0.04% 0.06% 0.06% 0.05% 0.07% 0.16% 0.17% 0.43% 0.32% 0.27% 0.00% 0.13% 0.02% 1.34% 0.03% 0.11% 0.14% 0.24% 0.10% 0.23% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer LOS ANGELES COUNTY METROPOLITAN TRANSPORTATION AUT LOUISIANA (STATE OF) LOUISIANA (STATE OF) LOUISIANA (STATE OF) LOUISIANA (STATE OF) WISCONSIN (STATE OF) MANSFIELD INDEPENDENT SCHOOL DISTRICT MARYLAND TRANSPORTATION AUTHORITY JOHNS HOPKINS HEALTH SYSTEM CORPORATION (THE) MASSACHUSETTS BAY TRANSPORTATION AUTHORITY THE COMMONWEALTH OF MASSACHUSETTS THE COMMONWEALTH OF MASSACHUSETTS THE COMMONWEALTH OF MASSACHUSETTS THE COMMONWEALTH OF MASSACHUSETTS THE COMMONWEALTH OF MASSACHUSETTS PRESIDENT AND FELLOWS OF HARVARD COLLEGE PRESIDENT AND FELLOWS OF HARVARD COLLEGE MASSACHUSETTS WATER RESOURCES AUTHORITY MASSACHUSETTS WATER RESOURCES AUTHORITY MEMPHIS, TENNESSEE (CITY OF) BASIN ELECTRIC POWER COOPERATIVE ASCENSION HEALTH MILWAUKEE WISCONSIN (CITY OF) MINNEAPOLIS, MINNESOTA (CITY OF) STATE OF MINNESOTA ALABAMA POWER COMPANY MONTGOMERY, MARYLAND (COUNTY OF) MONTGOMERY, MARYLAND (COUNTY OF) MONTGOMERY, MARYLAND (COUNTY OF) NASSAU COUNTY INTERIM FINANCE AUTHORITY STATE OF NEVADA NEW MEXICO FINANCE AUTHORITY 37 38 Cusip 5447124P4 546415N30 546415TU4 5464166X1 5464167T9 55844RHY3 5643853M2 574192RF9 574217X83 57557XDY7 57582P7G9 57582P7H7 57582PE89 57582PK33 57582PWE6 57586U2U8 57586U2X2 57604XPJ0 57604XPL5 586145B52 58785PEB5 59465HPK6 602245ZX3 603790EU6 60412AAV5 607167DX8 6133402Y3 613340T65 61335WL21 63165TMQ5 641461XL7 64711RAY2 Effective Maturity Date 7/1/2015 7/15/2015 8/1/2015 12/1/2015 12/1/2015 10/1/2015 2/15/2015 3/1/2015 5/15/2015 3/2/2015 5/28/2015 6/25/2015 2/5/2015 2/5/2015 12/1/2015 2/4/2015 3/2/2015 2/4/2015 3/5/2015 4/1/2015 3/2/2015 3/16/2015 12/1/2015 2/1/2015 10/1/2015 10/1/2015 11/1/2015 7/1/2015 4/1/2015 9/15/2015 8/1/2015 6/15/2015 Final Maturity Date 7/1/2015 7/15/2015 8/1/2015 12/1/2015 12/1/2015 10/1/2015 2/15/2015 3/1/2015 5/15/2015 3/2/2015 5/28/2015 6/25/2015 9/1/2015 2/1/2016 12/1/2015 2/4/2015 3/2/2015 2/4/2015 3/5/2015 4/1/2015 3/2/2015 3/16/2015 12/1/2015 2/1/2015 10/1/2015 10/1/2015 11/1/2015 7/1/2015 4/1/2015 9/15/2015 8/1/2015 6/15/2015 Coupon/ Yield 5.00 5.00 5.00 5.00 5.00 2.00 5.00 5.50 5.00 0.08 1.50 1.50 0.47 0.31 5.00 0.03 0.03 0.32 0.28 5.00 0.09 0.90 2.00 5.00 5.00 0.32 5.00 5.00 0.04 2.00 2.00 5.25 Par 75,000.00 2,800,000.00 2,745,000.00 4,830,000.00 1,205,000.00 5,170,000.00 1,000,000.00 2,045,000.00 4,985,000.00 7,500,000.00 45,290,000.00 25,000,000.00 3,000,000.00 5,000,000.00 3,675,000.00 19,450,000.00 26,300,000.00 43,000,000.00 4,000,000.00 3,240,000.00 64,925,000.00 900,000.00 2,620,000.00 6,560,000.00 7,560,000.00 15,000,000.00 12,500,000.00 5,025,000.00 8,000,000.00 9,600,000.00 3,400,000.00 4,170,000.00 Amortized Cost 76,482.48 2,861,797.01 2,811,274.86 5,023,193.60 1,253,198.40 5,232,492.45 1,001,939.75 2,053,673.42 5,052,938.83 7,500,000.00 45,491,580.13 25,137,831.16 3,003,932.31 5,007,262.50 3,822,116.92 19,450,000.00 26,300,000.00 43,000,000.00 4,000,000.00 3,266,047.48 64,925,000.00 900,736.77 2,659,681.04 6,560,863.45 7,803,185.09 15,000,000.00 12,953,244.96 5,125,821.38 8,000,000.00 9,698,660.04 3,431,298.72 4,248,869.21 Percentage of Total 0.00% 0.05% 0.05% 0.09% 0.02% 0.09% 0.02% 0.04% 0.09% 0.13% 0.78% 0.43% 0.05% 0.09% 0.07% 0.33% 0.45% 0.73% 0.07% 0.06% 1.11% 0.02% 0.05% 0.11% 0.13% 0.26% 0.22% 0.09% 0.14% 0.17% 0.06% 0.07% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 37 38 Issuer Cusip NEW MEXICO FINANCE AUTHORITY 647310J69 UNIVERSITY OF NEW MEXICO 647429U23 THE CITY OF NEW YORK 64966H2X7 POWER AUTHORITY OF THE STATE OF NEW YORK 64985GR68 NEW YORK STATE LOCAL GOVERNMENT ASSISTANCE CORPORA 649876G37 NEW YORK STATE THRUWAY AUTHORITY 650013S30 NEW YORK STATE THRUWAY AUTHORITY 650028UX9 NEWPORT NEWS VIRGINIA (CITY OF) 652233EX1 COMMONWEALTH OF VIRGINIA 652233GV3 COMMONWEALTH OF VIRGINIA 655867BW8 DUKE UNIVERSITY 65818WDA9 STATE OF NORTH CAROLINA 658256J37 STATE OF NORTH CAROLINA 658256J45 ALASKA (STATE OF) 662523YW3 NORTHPORT-EAST NORTHPORT UNION FREE SCHOOL DISTRIC 666641HZ1 STATE OF OHIO 677521SG2 CASE WESTERN RESERVE UNIVERSITY 67756EUG7 KANSAS DEPARTMENT OF TRANSPORTATION 679384GF8 COMMONWEALTH OF PENNSYLVANIA 70869VAP9 PENNSYLVANIA TURNPIKE COMMISSION 7092236S5 PENNSYLVANIA TURNPIKE COMMISSION 709223E80 STATE OF TEXAS 727199CC3 PORTLAND OREGON (CITY OF) 736688HS4 PORTLAND OREGON SEWER SYSTEM 736742SW8 ILLINOIS REGIONAL TRANSPORTATION AUTHORITY 759911MZ0 SACRAMENTO MUNICIPAL UTILITY DISTRICT 78601Q2G5 STATE OF SOUTH CAROLINA 836895EA6 STATE OF SOUTH CAROLINA 83710D4L9 WASHINGTON (STATE OF) 848712PY5 CITY OF SPOKANE WA RVB 2015/12/01 5.00000 849103AA4 SENTARA HEALTHCARE 86481QAD1 STATE OF TEXAS 882723QE2 Effective Maturity Date 7/1/2015 4/1/2015 8/1/2015 2/13/2015 4/1/2015 4/1/2015 3/15/2015 7/15/2015 7/15/2015 3/1/2015 5/7/2015 3/1/2015 3/1/2015 6/30/2015 6/25/2015 2/1/2016 3/17/2015 7/1/2015 7/1/2015 2/5/2015 2/5/2015 2/15/2015 6/15/2015 3/1/2015 6/1/2015 2/2/2015 4/15/2015 3/1/2015 12/1/2015 12/1/2015 2/26/2015 8/31/2015 Final Maturity Date 7/1/2015 4/1/2015 8/1/2015 2/13/2015 4/1/2015 4/1/2015 3/15/2015 7/15/2015 7/15/2015 3/1/2015 5/7/2015 3/1/2015 3/1/2015 6/30/2015 6/25/2015 2/1/2016 3/17/2015 7/1/2015 7/1/2015 12/1/2015 6/1/2015 2/15/2015 6/15/2015 3/1/2015 6/1/2015 2/2/2015 4/15/2015 3/1/2015 12/1/2015 12/1/2015 2/26/2015 8/31/2015 Coupon/ Yield 5.00 4.00 5.00 0.04 5.00 5.00 3.00 3.00 5.00 5.00 0.10 5.00 5.00 2.00 1.00 4.00 0.09 2.00 5.00 0.42 0.79 5.00 5.00 5.00 5.75 0.05 1.00 5.00 5.50 5.00 0.13 1.50 Par 3,525,000.00 2,000,000.00 3,000,000.00 2,167,000.00 1,590,000.00 6,510,000.00 3,075,000.00 2,955,000.00 2,300,000.00 2,000,000.00 10,000,000.00 1,715,000.00 1,430,000.00 9,000,000.00 28,000,000.00 2,285,000.00 38,500,000.00 30,670,000.00 2,050,000.00 350,000.00 1,500,000.00 5,000,000.00 5,655,000.00 9,240,000.00 1,615,000.00 15,000,000.00 50,000,000.00 1,700,000.00 7,985,000.00 5,625,000.00 24,000,000.00 51,925,000.00 Amortized Cost 3,595,670.92 2,012,518.92 3,073,328.08 2,167,000.00 1,602,544.70 6,561,278.98 3,085,251.57 2,993,501.61 2,350,042.01 2,007,830.00 10,000,000.00 1,721,515.96 1,435,403.58 9,069,452.48 28,091,046.51 2,371,739.80 38,500,000.00 30,900,593.67 2,091,493.69 350,000.00 1,500,637.41 5,009,834.68 5,756,855.25 9,275,241.53 1,644,240.11 15,000,000.00 50,089,401.02 1,706,657.30 8,337,456.11 5,849,977.75 24,000,000.00 52,333,907.64 Percentage of Total 0.06% 0.03% 0.05% 0.04% 0.03% 0.11% 0.05% 0.05% 0.04% 0.03% 0.17% 0.03% 0.02% 0.15% 0.48% 0.04% 0.66% 0.53% 0.04% 0.01% 0.03% 0.09% 0.10% 0.16% 0.03% 0.26% 0.85% 0.03% 0.14% 0.10% 0.41% 0.89% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 37 38 Issuer STATE OF TEXAS STATE OF TEXAS STATE OF TEXAS STATE OF TEXAS STATE OF TEXAS COMMONWEALTH OF VIRGINIA COMMONWEALTH OF VIRGINIA TOPEKA, KANSAS (CITY OF) TEXAS UNIVERSITY OF NORTH TEXAS BOARD OF REGENTS BOARD OF REGENTS OF THE UNIVERSITY OF TEXAS SYSTEM STATE OF UTAH COMMONWEALTH OF VIRGINIA WAKE, NORTH CAROLINA (COUNTY OF) WASHINGTON (STATE OF) WASHINGTON (STATE OF) WASHINGTON (STATE OF) WASHINGTON (STATE OF) STATE OF TEXAS WISCONSIN (STATE OF) WISCONSIN (STATE OF) WISCONSIN (STATE OF) TOTAL: OTHER MUNICIPAL DEBT Cusip 882756R50 882756R68 882756S26 882756S67 882854UW0 88880NAF6 88880NAG4 890568H27 91472PJM5 9151152U2 917542PZ9 928109A72 930863L78 93974CN30 93974CYL8 93974DJB5 93974DJU3 969887PR3 97705LEL7 97705LFW2 97705LP50 Effective Maturity Date 7/1/2015 1/1/2016 1/1/2016 7/1/2015 7/15/2015 6/1/2015 6/1/2015 10/1/2015 2/2/2015 7/1/2015 7/1/2015 6/1/2015 3/1/2015 2/1/2016 8/1/2015 7/1/2015 7/1/2015 2/15/2015 5/1/2015 5/1/2015 5/1/2015 ASCENSION AL PUTTER 2959 ALASKA HOUSING FINANCE CORPORATION ALASKA HOUSING FINANCE CORPORATION AUSTIN, TEXAS (CITY OF) MUSEUM OF MODERN ART UTAH TRANS AUTH BOA 3045X METRO ATLANTA RAP TRANS B STATE OF NEW YORK DENVER CO CNTY BOA 1050 010399CB7 01170PDV5 01170PEY8 052422DU3 05248P7S8 05248PG25 05248PG41 05248PJ22 05248PSA4 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Final Maturity Date 7/1/2015 1/1/2016 1/1/2016 7/1/2015 7/15/2015 6/1/2015 6/1/2015 10/1/2015 2/2/2015 7/1/2015 7/1/2015 6/1/2015 3/1/2015 2/1/2016 8/1/2015 7/1/2015 7/1/2015 2/15/2015 5/1/2015 5/1/2015 5/1/2015 Coupon/ Yield 5.00 5.00 5.00 5.00 5.00 5.50 5.63 1.00 0.21 5.00 4.00 4.00 5.00 5.00 5.00 4.00 1.00 5.00 5.00 5.00 5.00 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 0.03 0.02 0.01 0.02 0.07 0.07 0.07 0.17 0.07 Par 8,050,000.00 2,350,000.00 700,000.00 7,750,000.00 150,000.00 12,895,000.00 4,090,000.00 33,390,000.00 54,572,000.00 1,225,000.00 4,525,000.00 8,025,000.00 3,530,000.00 3,000,000.00 4,110,000.00 18,605,000.00 5,545,000.00 1,170,000.00 2,000,000.00 1,715,000.00 4,815,000.00 1,730,535,162.00 6,370,000.00 30,000,000.00 24,955,000.00 18,700,000.00 5,995,000.00 5,000,000.00 6,665,000.00 2,130,000.00 7,500,000.00 Amortized Cost Percentage of Total 8,213,568.70 2,452,921.06 729,884.64 7,906,136.70 153,241.68 13,121,442.94 4,163,135.04 33,571,958.40 54,572,000.00 1,249,327.03 4,596,936.06 8,128,459.41 3,543,702.87 3,143,860.99 4,210,168.43 18,905,375.76 5,565,384.78 1,172,303.80 2,023,741.71 1,735,340.84 4,873,567.91 1,740,078,779.61 0.14% 0.04% 0.01% 0.13% 0.00% 0.22% 0.07% 0.57% 0.93% 0.02% 0.08% 0.14% 0.06% 0.05% 0.07% 0.32% 0.09% 0.02% 0.03% 0.03% 0.08% 29.68% 6,370,000.00 30,000,000.00 24,955,000.00 18,700,000.00 5,995,000.00 5,000,000.00 6,665,000.00 2,130,000.00 7,500,000.00 0.11% 0.51% 0.43% 0.32% 0.10% 0.09% 0.11% 0.04% 0.13% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer STATE OF TEXAS MBTA BOA 1111 GWINNETT GA BOA 1112 MARYLAND TRANSPORTATION AUTHORITY NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY MUNICIPAL WATER FINANCE AUTHORITY ST OF MASS BOA 1203 KING COUNTY, WASHINGTON SALT RIVER PROJ BARC 09W CHILDREN'S HOSPITAL OF WISCONSIN, INC. SALT RIVER AGRIC IMPT & P ASCENSION HEALTH BARC 201 DUKE UNIV HEALTH SYS BARC TEXAS A&M BARC 39W COLUMBIA WTR & SWR BARC S KING COUNTY, WASH BARC 66 LOS ANGELES INTERNATIONAL AIRPORT NORTHWESTERN MEMORIAL HOS COMMONWEALTH OF PENNSYLVANIA LELAND STANFORD JUNIOR UNIVERSITY (THE) LELAND STANFORD JUNIOR UNIVERSITY (THE) UNIVERSITY OF SOUTHERN CALIFORNIA KAISER FOUNDATION HOSPITALS STANFORD HOSPITAL AND CLINICS SUTTER HEALTH ST. JOSEPH HEALTH SYSTEM CHEVRON CORPORATION KAISER FOUNDATION HOSPITALS JOHN MUIR MEDICAL CENTER KAISER FOUNDATION HOSPITALS KAISER FOUNDATION ROC 116 KAISER FOUNDATION HOSPITALS 37 38 Cusip 05248PSH9 05248PYN9 05248PYQ2 05248PZW8 05248RAN1 05248RAU5 05248RDM0 06740GAC0 06740GAS5 06740GBN5 06740GFQ4 06740GFY7 06740GGM2 06740GHD1 06740GHK5 06740GKP0 06740GLU8 06740GNJ1 123574BR5 1301783A2 1301784A1 130178NQ5 13033FK74 13033LJM0 13033LMM6 13033LPC5 13048PAA9 130795C70 130795UC9 130795WL7 130795YY7 130911RZ5 Effective Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/2/2015 2/6/2015 2/6/2015 2/6/2015 Final Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.04 0.07 0.07 0.07 0.07 0.07 0.07 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.03 0.04 0.02 0.03 0.02 0.03 0.01 0.06 0.03 0.01 0.01 0.01 0.01 0.03 0.03 0.01 Par 6,670,000.00 5,000,000.00 3,375,000.00 5,000,000.00 8,780,000.00 6,000,000.00 9,500,000.00 7,500,000.00 4,050,000.00 2,940,000.00 5,000,000.00 2,000,000.00 2,000,000.00 2,500,000.00 3,000,000.00 2,500,000.00 2,600,000.00 3,950,000.00 7,000,000.00 400,000.00 4,000,000.00 2,300,000.00 10,500,000.00 5,000,000.00 7,330,000.00 12,800,000.00 2,900,000.00 1,300,000.00 2,200,000.00 8,600,000.00 10,035,000.00 34,500,000.00 Amortized Cost 6,670,000.00 5,000,000.00 3,375,000.00 5,000,000.00 8,780,000.00 6,000,000.00 9,500,000.00 7,500,000.00 4,050,000.00 2,940,000.00 5,000,000.00 2,000,000.00 2,000,000.00 2,500,000.00 3,000,000.00 2,500,000.00 2,600,000.00 3,950,000.00 7,000,000.00 400,000.00 4,000,000.00 2,300,000.00 10,500,000.00 5,000,000.00 7,330,000.00 12,800,000.00 2,900,000.00 1,300,000.00 2,200,000.00 8,600,000.00 10,035,000.00 34,500,000.00 Percentage of Total 0.11% 0.09% 0.06% 0.09% 0.15% 0.10% 0.16% 0.13% 0.07% 0.05% 0.09% 0.03% 0.03% 0.04% 0.05% 0.04% 0.04% 0.07% 0.12% 0.01% 0.07% 0.04% 0.18% 0.09% 0.13% 0.22% 0.05% 0.02% 0.04% 0.15% 0.17% 0.59% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer CENTRAL PUGET SOUND REGIONAL TRANSIT AUTHORITY CENTRAL PUGET SOUND REGIONAL TRANSIT AUTHORITY CHARLOTTE-MECKLENBURG HOSPITAL AUTHORITY CATHOLIC HEALTH INITIATIVES COLORADO SPRINGS COLORADO (COMBINED UTILITIES SYTE COLORADO SPRINGS COLORADO (COMBINED UTILITIES SYTE ALABAMA POWER COMPANY COLUMBUS OH PUTTER 2365 YALE UNIVERSITY YALE UNIVERSITY YALE UNIVERSITY YALE UNIVERSITY YALE UNIVERSITY YALE UNIVERSITY YALE UNIVERSITY CONNECTICUT HOUSING FINANCE AUTHORITY CONNECTICUT HOUSING FINANCE AUTHORITY CONNECTICUT HOUSING FINANCE AUTHORITY CONNECTICUT HOUSING FINANCE AUTHORITY CYPRESS-FAIRBANKS ISD PUT DALLAS AREA RAPID TRANSIT... CHRISTIANA CARE HEALTH SE CHRISTIANA CARE HEALTH SERVICES DESERT COMMUNITY COLLEGE DISTRICT WASHINGTON (STATE OF) SANTA ROSA CALIFORNIA (CITY OF) CHICAGO ILLINOIS BOARD OF EDUCATION NEW JERSEY TRANSPORTATION TRUST FUND AUTHORITY STATE OF CALIFORNIA KAISER PERMANENTE NEW YORK CITY MUNICIPAL WATER FINANCE AUTHORITY KENTUCKY MUNICIPAL POWER AGENCY 37 38 Cusip 15504REG0 15504REW5 160853MR5 19648AM93 1966305B9 196630U54 197210BA4 199491B91 20774HB29 20774LBN4 20774LRT4 20774LRU1 20774UCC7 20774UYD1 20774UYF6 20775B2G0 20775BL53 20775BLX2 20775BUH7 232760Q68 235241KP0 246388NX6 246388QP0 250375FG2 25154CL28 25154CR30 25154CRP1 25154LBJ2 25154LEM2 25155D2C4 25155D4P3 25155DFA4 Effective Maturity Date 2/2/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/5/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Final Maturity Date 1/31/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.03 0.06 0.02 0.16 0.04 0.10 0.03 0.05 0.01 0.01 0.01 0.01 0.02 0.03 0.03 0.02 0.02 0.03 0.02 0.03 0.03 0.02 0.02 0.08 0.15 0.12 0.13 0.11 0.12 0.09 0.07 0.11 Par 8,380,000.00 4,250,000.00 9,440,000.00 5,625,000.00 14,450,000.00 109,000,000.00 50,000,000.00 4,360,000.00 10,000,000.00 5,200,000.00 1,800,000.00 6,100,000.00 34,000,000.00 16,820,000.00 5,730,000.00 5,500,000.00 6,850,000.00 11,500,000.00 15,200,000.00 4,995,000.00 1,560,000.00 16,475,000.00 16,000,000.00 4,200,000.00 7,495,000.00 1,080,000.00 8,445,000.00 37,380,000.00 11,465,000.00 17,430,000.00 16,940,000.00 13,150,000.00 Amortized Cost 8,380,000.00 4,250,000.00 9,440,000.00 5,625,000.00 14,450,000.00 109,000,000.00 50,000,000.00 4,360,000.00 10,000,000.00 5,200,000.00 1,800,000.00 6,100,000.00 34,000,000.00 16,820,000.00 5,730,000.00 5,500,000.00 6,850,000.00 11,500,000.00 15,200,000.00 4,995,000.00 1,560,000.00 16,475,000.00 16,000,000.00 4,200,000.00 7,495,000.00 1,080,000.00 8,445,000.00 37,380,000.00 11,465,000.00 17,430,000.00 16,940,000.00 13,150,000.00 Percentage of Total 0.14% 0.07% 0.16% 0.10% 0.25% 1.86% 0.85% 0.07% 0.17% 0.09% 0.03% 0.10% 0.58% 0.29% 0.10% 0.09% 0.12% 0.20% 0.26% 0.09% 0.03% 0.28% 0.27% 0.07% 0.13% 0.02% 0.14% 0.64% 0.20% 0.30% 0.29% 0.22% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer NEW YORK UNIVERSITY NEW JERSEY STATE TURNPIKE AUTHORITY NEW YORK LIBERTY DEVELOPMENT CORPORATION NEW JERSEY STATE TURNPIKE AUTHORITY BAY AREA TOLL AUTHORITY COOK COUNTY ILLINOIS CATHOLIC HEALTH CARE WEST LOUISIANA (STATE OF) PENNSYLVANIA TURNPIKE COMMISSION SACRAMENTO MUNICIPAL UTILITY DISTRICT NEW JERSEY (STATE OF) CATHOLIC HEALTH INITIATIVES STATE OF CALIFORNIA DICKINSON INDEPENDENT SCHOOL DISTRICT, TEXAS DISTRICT OF COLUMBIA DISTRICT OF COLUMBIA WATER & SEWER AUTHORITY DISTRICT OF COLUMBIA WATER & SEWER AUTHORITY DISTRICT OF COLUMBIA WATER & SEWER AUTHORITY DISTRICT OF COLUMBIA WATER & SEWER AUTHORITY EAST ALABAMA HEALTH CARE AUTHORITY EXXON MOBIL CORPORATION EAST BAY CALIFORNIA MUNICIPAL UTILITY DISTRICT EAST BAY CALIFORNIA MUNICIPAL UTILITY DISTRICT EAST BAY CALIFORNIA MUNICIPAL UTILITY DISTRICT GRAND PRAIRIE TEXAS INDEPENDENT SCHOOL DISTRICT EL PASO COUNTY TEXAS HOSPITAL DISTRICT INOVA HEALTH SYSTEM INOVA HEALTH SYSTEM FEDERAL HOME LOAN MORTGAGE CORPORATION FEDERAL HOME LOAN MORTGAGE CORPORATION STATE OF FLORIDA FLORIDA STATE DEPARTMENT OF TRANSPORTATION 37 38 Cusip 25155DFC0 25155DG96 25155DGB1 25155DH53 25155DHC8 25155DLW9 25155DMN8 25155DSS1 25155DX22 25155DZ95 25155DZP9 25155WHA0 25155WXS3 253363LP8 25476FDY1 254845JT8 254845JV3 254845JX9 254845KA7 270416EY2 270777AE5 271014TW2 271014WL2 271014WN8 27884FVX5 283590DU8 303823FE3 303823KT4 31350ABB3 31350ABK3 3415358H8 343136G84 Effective Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/2/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/2/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Final Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.06 0.07 0.10 0.07 0.06 0.10 0.09 0.09 0.10 0.10 0.09 0.11 0.11 0.06 0.02 0.04 0.04 0.03 0.02 0.02 0.01 0.01 0.03 0.03 0.02 0.04 0.02 0.02 0.03 0.03 0.03 0.07 Par 5,600,000.00 12,130,000.00 43,085,000.00 22,235,000.00 3,145,000.00 6,660,000.00 18,500,000.00 9,000,000.00 8,750,000.00 3,750,000.00 16,250,000.00 10,155,000.00 40,375,000.00 13,350,000.00 16,665,000.00 5,750,000.00 4,050,000.00 6,200,000.00 5,000,000.00 15,000,000.00 5,525,000.00 7,670,000.00 8,600,000.00 5,600,000.00 10,065,000.00 13,395,000.00 5,900,000.00 4,580,000.00 15,950,000.00 11,495,000.00 7,425,000.00 27,105,000.00 Amortized Cost 5,600,000.00 12,130,000.00 43,085,000.00 22,235,000.00 3,145,000.00 6,660,000.00 18,500,000.00 9,000,000.00 8,750,000.00 3,750,000.00 16,250,000.00 10,155,000.00 40,375,000.00 13,350,000.00 16,665,000.00 5,750,000.00 4,050,000.00 6,200,000.00 5,000,000.00 15,000,000.00 5,525,000.00 7,670,000.00 8,600,000.00 5,600,000.00 10,065,000.00 13,395,000.00 5,900,000.00 4,580,000.00 15,950,000.00 11,495,000.00 7,425,000.00 27,105,000.00 Percentage of Total 0.10% 0.21% 0.73% 0.38% 0.05% 0.11% 0.32% 0.15% 0.15% 0.06% 0.28% 0.17% 0.69% 0.23% 0.28% 0.10% 0.07% 0.11% 0.09% 0.26% 0.09% 0.13% 0.15% 0.10% 0.17% 0.23% 0.10% 0.08% 0.27% 0.20% 0.13% 0.46% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer NATIONWIDE CHILDREN'S HOSPITAL, INC. NATIONWIDE CHILDREN'S HOSPITAL, INC. OHIOHEALTH CORPORATION GREENSBORO NORTH CAROLINA (CITY OF) GWINNETT CNTY PUTTER 2868 METHODIST HOSP-HARRIS CNTY, TX EXXON MOBIL CORPORATION NORTHSHORE UNIVERSITY HEALTHSYSTEM UNIVERSITY OF CHICAGO (THE) NORTHWESTERN MEMORIAL HOSPITAL-ILLINOIS UNIVERSITY OF CHICAGO (THE) TRINITY HEALTH CORPORATION NORTHWESTERN UNIVERSITY UNIVERSITY OF CHICAGO (THE) ASCENSION HEALTH ASCENSION HEALTH JEA PHOENIX AZ CIVIC IMPT WTR ME HLTH & ED, BOWDOIN COL ARIZONA STATE TRANSPORTATION BOARD CLARK CNTY WTR RECLAMATIO TEXAS CHILDRENS HOSPITAL CLARK CNTY WTR RECLMNT DI CLARK COUNTY NEVADA BOND BANK DISTRICT COLUMBIA PUTTER ARIZONA TRAN HWY PUTTER 3 NYS PERS INC TAX PUTTER 3 MEMORIAL SLOAN-KETTERING CANCER CENTER YALE UNIVERSITY PUTTER 31 DUKE UNIVERSITY RECTOR & VISITORS OF THE UNIVERSITY OF VIRGINIA MEMORIAL SLOAN-KETTERING CANCER CENTER 37 38 Cusip 3531865U9 3531865Z8 3531867L7 395468HS3 403755WK3 414009AU4 414190AB4 45189FFH2 4520017E4 45200FBZ1 45200FZV4 45203HTE2 45203HYZ9 45203HZA3 454798QC6 455057ZA0 46613PVY9 46632P3W1 46632P4C4 46632P4U4 46632P6P3 46632P6X6 46632P7D9 46632PC35 46632PC92 46632PDM2 46632PEM1 46632PFK4 46632PHJ5 46632PHN6 46632PHS5 46632PKN2 Effective Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 1/31/2015 1/31/2015 2/2/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/5/2015 1/31/2015 1/31/2015 2/6/2015 Final Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 Coupon/ Yield 0.02 0.02 0.02 0.03 0.03 0.03 0.01 0.02 0.02 0.01 0.01 0.03 0.01 0.03 0.02 0.02 0.02 0.03 0.03 0.03 0.03 0.06 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.04 0.04 0.03 Par 18,120,000.00 25,270,000.00 16,600,000.00 15,000,000.00 8,870,000.00 10,000,000.00 5,000,000.00 11,875,000.00 7,754,000.00 19,600,000.00 2,000,000.00 1,650,000.00 8,900,000.00 4,500,000.00 17,500,000.00 24,600,000.00 1,515,000.00 7,140,000.00 6,955,000.00 4,065,000.00 6,305,000.00 4,795,000.00 7,000,000.00 6,000,000.00 4,500,000.00 6,605,000.00 6,660,000.00 2,680,000.00 11,995,000.00 3,500,000.00 15,010,000.00 5,655,000.00 Amortized Cost 18,120,000.00 25,270,000.00 16,600,000.00 15,000,000.00 8,870,000.00 10,000,000.00 5,000,000.00 11,875,000.00 7,754,000.00 19,600,000.00 2,000,000.00 1,650,000.00 8,900,000.00 4,500,000.00 17,500,000.00 24,600,000.00 1,515,000.00 7,140,000.00 6,955,000.00 4,065,000.00 6,305,000.00 4,795,000.00 7,000,000.00 6,000,000.00 4,500,000.00 6,605,000.00 6,660,000.00 2,680,000.00 11,995,000.00 3,500,000.00 15,010,000.00 5,655,000.00 Percentage of Total 0.31% 0.43% 0.28% 0.26% 0.15% 0.17% 0.09% 0.20% 0.13% 0.33% 0.03% 0.03% 0.15% 0.08% 0.30% 0.42% 0.03% 0.12% 0.12% 0.07% 0.11% 0.08% 0.12% 0.10% 0.08% 0.11% 0.11% 0.05% 0.20% 0.06% 0.26% 0.10% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer NEW YORK UNIVERSITY STATE OF TEXAS SAN DIEGO CA COMMUNITY COLLEGE DISTRICT ASCENSION HEALTH STATE OF NEVADA DWAP LOS ANGELES CA EMORY UNIVERSITY WASHINGOTN DC WTR & SWR P UNIVERSITY OF SOUTHERN CALIFORNIA HARRIS COUNTY TEXAS TOLL ROAD AUTHORITY DUKE UNIV PUTTER 3333 WASHINGTON D.C. SUFFOLK COUNTY NEW YORK WATER AUTHORITY WASHINGTON ST PUTTER 3538 THE WASHINGTON UNIVERSITY CLEVELAND CLINIC CLEVELAND CLINIC CLEVELAND CLINIC OHIO SAN ANTONIO, TX E & G PUT LOS ANGELES INTERNATIONAL AIRPORT HARVARD UNIV PUTTER 3840 CLAREMONT MCKENNA COLLEGE TRINITY HEALTH CORPORATION FRANCISCAN ALLIANCE, INC. ORANGE COUNTY CALIFORNIA WATER DISTRICT DALLAS AREA RAPID TRANSIT UNIVERSITY OF CHICAGO (THE) ORANGE COUNTY CALIFORNIA SANITATION DISTRICT STATE OF NEW YORK UPMC LAS VEGAS VALLEY WATER DISTRICT NEW YORK LIBERTY DEVELOPMENT CORPORATION 37 38 Cusip 46632PMU4 46632PNB5 46632PT60 46632PUK7 46632PV34 46632PV67 46632PV83 46632PVX8 46632PW25 46632PW41 46632PXH1 46632PYX5 46632PZK2 46633VCK3 46633VDJ5 46633VDT3 46633VEH8 46633VES4 46633VEX3 46633VF87 46633VG45 46633VGM5 46633VKC2 46633VMS5 46633VRJ0 46633VRL5 46633VX61 46633VXF1 46633VYM5 46636Y6Y1 46636YBW9 46636YNL0 Effective Maturity Date 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/5/2015 2/6/2015 2/2/2015 2/6/2015 2/6/2015 Final Maturity Date 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.03 0.03 0.04 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.05 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.06 0.06 0.03 0.04 0.05 0.05 0.03 0.13 0.06 0.20 Par 8,770,000.00 2,165,000.00 5,470,000.00 3,950,000.00 8,450,000.00 8,795,000.00 4,795,000.00 8,330,000.00 7,305,000.00 6,845,000.00 11,000,000.00 7,080,000.00 7,290,000.00 10,000,000.00 11,395,000.00 4,500,000.00 6,245,000.00 7,100,000.00 9,015,000.00 7,300,000.00 4,000,000.00 2,700,000.00 17,180,000.00 4,925,000.00 1,500,000.00 5,360,000.00 30,825,000.00 5,350,000.00 6,360,000.00 60,000,000.00 7,185,000.00 6,500,000.00 Amortized Cost 8,770,000.00 2,165,000.00 5,470,000.00 3,950,000.00 8,450,000.00 8,795,000.00 4,795,000.00 8,330,000.00 7,305,000.00 6,845,000.00 11,000,000.00 7,080,000.00 7,290,000.00 10,000,000.00 11,395,000.00 4,500,000.00 6,245,000.00 7,100,000.00 9,015,000.00 7,300,000.00 4,000,000.00 2,700,000.00 17,180,000.00 4,925,000.00 1,500,000.00 5,360,000.00 30,825,000.00 5,350,000.00 6,360,000.00 60,000,000.00 7,185,000.00 6,500,000.00 Percentage of Total 0.15% 0.04% 0.09% 0.07% 0.14% 0.15% 0.08% 0.14% 0.12% 0.12% 0.19% 0.12% 0.12% 0.17% 0.19% 0.08% 0.11% 0.12% 0.15% 0.12% 0.07% 0.05% 0.29% 0.08% 0.03% 0.09% 0.53% 0.09% 0.11% 1.02% 0.12% 0.11% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 37 38 Issuer Cusip NEW YORK STATE ENVIRONMENTAL FACILITIES CORPORATIO 46640KBE3 UNIVERSITY OF DELAWARE 46640KBP8 RIVERSIDE CALIFORNIA (CITY OF) 46640KCD4 METROPOLITAN TRANSPORTATION AUTHORITY 46640KLA0 THE CITY OF NEW YORK 46640KLW2 DISTRICT OF COLUMBIA WATER & SEWER AUTHORITY 46640KMP6 LAS VEGAS VALLEY WATER DISTRICT 46640KMX9 COMMONWEALTH OF PENNSYLVANIA 46640KRL0 NEW YORK STATE LOCAL GOVERNMENT ASSISTANCE CORPORA 46640KRX4 STATE OF CONNECTICUT 46640KRZ9 STATE OF CONNECTICUT 46640KSB1 NEW YORK (STATE OF) 46640KSD7 DEPARTMENT OF WATER AND POWER OF THE CITY OF LOS A 46640KSS4 NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY 46640KTG9 KING COUNTY WASHINGTON SEWER SYSTEM 49474E2G7 KING COUNTY WASHINGTON SEWER SYSTEM 495289U40 CALIFORNIA STATE UNIVERSITY 52522NMY2 OMAHA NEBRASKA PUBLIC POWER DISTRICT 534272ZF9 LOS ANGELES CALIFORNIA COMMUNITY REDEVELOPMENT AGE 544393BR1 DEPARTMENT OF WATER AND POWER OF THE CITY OF LOS A 544495DF8 DEPARTMENT OF WATER AND POWER OF THE CITY OF LOS A 544495DU5 DEPARTMENT OF WATER AND POWER OF THE CITY OF LOS A 544525DA3 DEPARTMENT OF WATER AND POWER OF THE CITY OF LOS A 544525DD7 DEPARTMENT OF WATER AND POWER OF THE CITY OF LOS A 544525PX0 HOWARD HUGHES MEDICAL INSTITUTE 545910AP6 LOUISIANA (STATE OF) 546475RC0 EXXON MOBIL CORPORATION 548351AC9 MARICOPA COUNTY ARIZONA INDUSTRIAL DEVELOPMENT AUT 56682PAL5 OCCIDENTAL PETROLEUM CORPORATION 574076AA3 HOWARD HUGHES MEDICAL INSTITUTE 574205FZ8 MASSACHUSETTS BAY TRANSPORTATION AUTHORITY 575567VG4 MASSACHUSETTS DEPARTMENT OF TRANSPORTATION 57563CAF9 Effective Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/2/2015 2/2/2015 2/2/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Final Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.02 0.03 0.17 0.04 0.02 0.01 0.02 0.01 0.01 0.02 0.01 0.03 0.01 0.02 0.02 0.01 0.01 0.01 Par 2,500,000.00 9,170,000.00 6,365,000.00 3,165,000.00 2,700,000.00 13,025,000.00 5,000,000.00 5,945,000.00 2,140,000.00 4,420,000.00 12,660,000.00 24,995,000.00 1,250,000.00 3,125,000.00 8,175,000.00 14,850,000.00 10,900,000.00 21,870,000.00 12,835,000.00 1,400,000.00 15,000,000.00 11,000,000.00 64,450,000.00 1,500,000.00 7,000,000.00 25,000,000.00 7,750,000.00 10,245,000.00 58,860,000.00 5,695,000.00 8,200,000.00 35,000,000.00 Amortized Cost 2,500,000.00 9,170,000.00 6,365,000.00 3,165,000.00 2,700,000.00 13,025,000.00 5,000,000.00 5,945,000.00 2,140,000.00 4,420,000.00 12,660,000.00 24,995,000.00 1,250,000.00 3,125,000.00 8,175,000.00 14,850,000.00 10,900,000.00 21,870,000.00 12,835,000.00 1,400,000.00 15,000,000.00 11,000,000.00 64,450,000.00 1,500,000.00 7,000,000.00 25,000,000.00 7,750,000.00 10,245,000.00 58,860,000.00 5,695,000.00 8,200,000.00 35,000,000.00 Percentage of Total 0.04% 0.16% 0.11% 0.05% 0.05% 0.22% 0.09% 0.10% 0.04% 0.08% 0.22% 0.43% 0.02% 0.05% 0.14% 0.25% 0.19% 0.37% 0.22% 0.02% 0.26% 0.19% 1.10% 0.03% 0.12% 0.43% 0.13% 0.17% 1.00% 0.10% 0.14% 0.60% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer THE COMMONWEALTH OF MASSACHUSETTS HARVARD UNIV ROC 11514 HARVARD UNIV PUTTER 3104 TRUSTEES OF TUFTS COLLEGE MUSEUM OF FINE ARTS MUSEUM OF FINE ARTS MESQUITE TEXAS INDEPENDENT SCHOOL DISTRICT METROPOLITAN TRANSPORTATION AUTHORITY METROPOLITAN TRANSPORTATION AUTHORITY THE METROPOLITAN WATER DISTRICT OF SOUTHERN CALIFO UNIVERSITY OF MINNESOTA FOUNDATION UNIVERSITY OF MINNESOTA FOUNDATION UNIVERSITY OF NEW HAMPSHIRE CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION CHEVRON CORPORATION EWING MARION KAUFFMAN FOUNDATION WASHINGTON UNIVERSITY (THE) BJC HEALTH SYSTEM WASHINGTON UNIVERSITY (THE) MONTGOMERY, MARYLAND (COUNTY OF) MUNICIPAL ELECTRIC AUTHORITY OF GEORGIA INTERMOUNTAIN HEALTH CARE INC. INTERMOUNTAIN HEALTH CARE INC. 37 38 Cusip 575827R44 57586C7X7 57586C8Q1 57586CV44 57586CV51 57586CV69 590759A22 59259NP49 59259Y2H1 592663XJ2 603786BF0 603786EH3 603786FP4 60528AAT1 60528AAU8 60528AAV6 60528ABH6 60528ABJ2 60528ABM5 60528ABR4 60528ABS2 60528ABV5 60528ABY9 60528ACC6 606037AW9 60635HXW4 60635R2F3 606901WS1 613340S90 626207CN2 626853CC7 626853CD5 Effective Maturity Date 1/31/2015 2/5/2015 2/5/2015 2/2/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/2/2015 1/31/2015 1/31/2015 2/2/2015 2/2/2015 2/6/2015 2/6/2015 2/6/2015 2/2/2015 1/31/2015 1/31/2015 2/2/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 Final Maturity Date 1/31/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 1/31/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 Coupon/ Yield 0.01 0.02 0.03 0.03 0.03 0.01 0.03 0.01 0.03 0.01 0.01 0.01 0.02 0.02 0.01 0.02 0.02 0.02 0.02 0.02 0.02 0.01 0.02 0.02 0.01 0.02 0.02 0.03 0.03 0.07 0.02 0.02 Par 1,635,000.00 5,390,000.00 3,040,000.00 11,200,000.00 27,350,000.00 3,500,000.00 18,820,000.00 2,300,000.00 7,425,000.00 2,200,000.00 6,135,000.00 2,500,000.00 3,000,000.00 3,000,000.00 8,900,000.00 10,700,000.00 10,000,000.00 12,545,000.00 8,450,000.00 1,000,000.00 26,400,000.00 7,250,000.00 39,140,000.00 41,670,000.00 1,750,000.00 2,000,000.00 20,000,000.00 1,300,000.00 7,980,000.00 38,360,000.00 1,600,000.00 3,725,000.00 Amortized Cost 1,635,000.00 5,390,000.00 3,040,000.00 11,200,000.00 27,350,000.00 3,500,000.00 18,820,000.00 2,300,000.00 7,425,000.00 2,200,000.00 6,135,000.00 2,500,000.00 3,000,000.00 3,000,000.00 8,900,000.00 10,700,000.00 10,000,000.00 12,545,000.00 8,450,000.00 1,000,000.00 26,400,000.00 7,250,000.00 39,140,000.00 41,670,000.00 1,750,000.00 2,000,000.00 20,000,000.00 1,300,000.00 7,980,000.00 38,360,000.00 1,600,000.00 3,725,000.00 Percentage of Total 0.03% 0.09% 0.05% 0.19% 0.47% 0.06% 0.32% 0.04% 0.13% 0.04% 0.10% 0.04% 0.05% 0.05% 0.15% 0.18% 0.17% 0.21% 0.14% 0.02% 0.45% 0.12% 0.67% 0.71% 0.03% 0.03% 0.34% 0.02% 0.14% 0.65% 0.03% 0.06% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer COLD SPRING HARBOR LABORATORY INC NASSAU COUNTY INTERIM FINANCE AUTHORITY NASSAU COUNTY INTERIM FINANCE AUTHORITY DARTMOUTH COLLEGE DARTMOUTH COLLEGE THE CITY OF NEW YORK THE CITY OF NEW YORK THE CITY OF NEW YORK THE CITY OF NEW YORK THE CITY OF NEW YORK THE CITY OF NEW YORK THE CITY OF NEW YORK NEW YORK CITY HOUSING DEVELOPMENT CORPORATION NEW YORK CITY HOUSING DEVELOPMENT CORPORATION NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK BOTANICAL GARDEN NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY NEW YORK CITY MUNICIPAL WATER FINANCE AUTHORITY NEW YORK CITY MUNICIPAL WATER FINANCE AUTHORITY NEW YORK CITY MUNICIPAL WATER FINANCE AUTHORITY UNIVERSITY OF ROCHESTER CORNELL UNIVERSITY STATE OF NEW YORK VASSAR COLLEGE NEW YORK (STATE OF) 37 38 Cusip 631657KW2 631663MM0 631663MN8 644614FP9 644614RZ4 649660NU7 649660SG3 64966BK51 64966FA79 64966FNJ9 64966FXC3 64966G2G6 64966TEX8 64970HBC7 6497167U5 649716GY7 649717QE8 64971KFG6 64971KGE0 64971Q6W8 64971QPP2 64971QYH0 64971WDD9 64971WGW4 64972F4M5 64972FSJ6 64972GBH6 64983M2Y3 64983MF37 64983PKJ9 64983PLR0 64983PQC8 Effective Maturity Date 1/31/2015 2/6/2015 2/4/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/2/2015 2/2/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 Final Maturity Date 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.03 0.02 0.02 0.02 0.01 0.04 0.02 0.03 0.02 0.01 0.03 0.02 0.02 0.01 0.04 0.02 0.02 0.04 0.04 0.03 0.02 0.01 0.01 0.01 0.02 0.01 0.01 0.03 0.01 0.03 0.02 0.03 Par 29,545,000.00 2,385,000.00 26,815,000.00 23,315,000.00 2,300,000.00 21,450,000.00 14,200,000.00 18,600,000.00 11,600,000.00 11,600,000.00 13,000,000.00 32,180,000.00 4,200,000.00 21,200,000.00 1,000,000.00 90,000.00 2,000,000.00 4,020,000.00 40,945,000.00 6,800,000.00 5,800,000.00 2,000,000.00 1,500,000.00 31,400,000.00 8,665,000.00 3,805,000.00 3,100,000.00 400,000.00 2,400,000.00 11,060,000.00 2,000,000.00 17,350,000.00 Amortized Cost 29,545,000.00 2,385,000.00 26,815,000.00 23,315,000.00 2,300,000.00 21,450,000.00 14,200,000.00 18,600,000.00 11,600,000.00 11,600,000.00 13,000,000.00 32,180,000.00 4,200,000.00 21,200,000.00 1,000,000.00 90,000.00 2,000,000.00 4,020,000.00 40,945,000.00 6,800,000.00 5,800,000.00 2,000,000.00 1,500,000.00 31,400,000.00 8,665,000.00 3,805,000.00 3,100,000.00 400,000.00 2,400,000.00 11,060,000.00 2,000,000.00 17,350,000.00 Percentage of Total 0.50% 0.04% 0.46% 0.40% 0.04% 0.37% 0.24% 0.32% 0.20% 0.20% 0.22% 0.55% 0.07% 0.36% 0.02% 0.00% 0.03% 0.07% 0.70% 0.12% 0.10% 0.03% 0.03% 0.54% 0.15% 0.06% 0.05% 0.01% 0.04% 0.19% 0.03% 0.30% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer NEW YORK (STATE OF) TRUSTEES OF COLUMBIA UNIVERSITY IN THE CITY OF NEW NEW YORK STATE ENVIRONMENTAL FACILITIES CORPORATIO NEW YORK STATE HOUSING FINANCE AGENCY NEW YORK STATE HOUSING FINANCE AGENCY NEW YORK STATE HOUSING FINANCE AGENCY NEW YORK STATE HOUSING FINANCE AGENCY NEW YORK STATE HOUSING FINANCE AGENCY NEW YORK STATE HOUSING FINANCE AGENCY NEW YORK (STATE OF) UNIVERSITY OF ROCHESTER NEW YORK STATE THRUWAY AUTHORITY WAKE FOREST UNIVERSITY DUKE UNIVERSITY NUVEEN MUNICIPAL MARKET OPPORTUNITY FUND STATE OF OHIO CLEVELAND CLINIC OHIO STATE UNIVERSITY OHIO STATE UNIVERSITY OHIO STATE UNIVERSITY OKLAHOMA TURNPIKE AUTHORITY OMAHA NEBRASKA PUBLIC POWER DISTRICT STATE OF OREGON STATE OF OREGON CITY OF PHOENIX WATER SYSTEM BAYCARE HEALTH SYSTEM, INC. THE PORT AUTHORITY OF NEW YORK AND NEW JERSEY EMORY UNIVERSITY EMORY UNIVERSITY EMORY UNIVERSITY PURDUE UNIVERSITY PURDUE UNIVERSITY 37 38 Cusip 64983PTL5 64983QAU3 64986AZL8 64986M4E2 64986MJ55 64986MM28 64986MYY5 64986UMQ7 64986UPL5 649876U80 6499032H3 6500136J9 65818PEC9 65819GKN7 670657709 677519E97 67756DAZ9 677632E31 677632E49 677632NX5 679111TB0 681793V44 68608UAB2 68608UAG1 718814ZL3 72316MEZ8 73358WRM8 74265LSJ8 74265LTK4 74265LTL2 746173FX6 746189GJ2 Effective Maturity Date 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 1/31/2015 2/2/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Final Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.03 0.01 0.03 0.02 0.02 0.02 0.02 0.03 0.02 0.02 0.01 0.02 0.02 0.03 0.11 0.02 0.01 0.01 0.01 0.01 0.02 0.02 0.03 0.03 0.02 0.01 0.03 0.02 0.01 0.01 0.02 0.02 Par 5,900,000.00 3,600,000.00 7,245,000.00 10,325,000.00 33,700,000.00 9,000,000.00 5,400,000.00 83,775,000.00 11,200,000.00 11,645,000.00 6,200,000.00 13,865,000.00 21,475,000.00 8,000,000.00 35,800,000.00 15,100,000.00 29,170,000.00 12,500,000.00 12,500,000.00 10,200,000.00 1,300,000.00 3,570,000.00 3,730,000.00 5,540,000.00 17,435,000.00 13,750,000.00 2,585,000.00 9,000,000.00 950,000.00 800,000.00 5,750,000.00 10,175,000.00 Amortized Cost 5,900,000.00 3,600,000.00 7,245,000.00 10,325,000.00 33,700,000.00 9,000,000.00 5,400,000.00 83,775,000.00 11,200,000.00 11,645,000.00 6,200,000.00 13,865,000.00 21,475,000.00 8,000,000.00 35,800,000.00 15,100,000.00 29,170,000.00 12,500,000.00 12,500,000.00 10,200,000.00 1,300,000.00 3,570,000.00 3,730,000.00 5,540,000.00 17,435,000.00 13,750,000.00 2,585,000.00 9,000,000.00 950,000.00 800,000.00 5,750,000.00 10,175,000.00 Percentage of Total 0.10% 0.06% 0.12% 0.18% 0.57% 0.15% 0.09% 1.43% 0.19% 0.20% 0.11% 0.24% 0.37% 0.14% 0.61% 0.26% 0.50% 0.21% 0.21% 0.17% 0.02% 0.06% 0.06% 0.09% 0.30% 0.23% 0.04% 0.15% 0.02% 0.01% 0.10% 0.17% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 37 38 Issuer Cusip PURDUE UNIVERSITY 746189LE7 STATE OF HAWAII 74703UAE8 STATE OF HAWAII 74703UJL3 BAY AREA TOLL AUTHORITY 74703UKA5 PROVIDENCE HEALTH & SERVICES 74703ULG1 NEW YORK STATE LOCAL GOVERNMENT ASSISTANCE CORPORA 74703ULN6 ADVENTIST HEALTH SYSTEM/WEST 74703YCR9 BANNER HEALTH 74703YF96 PROVIDENCE HEALTH & SERVICES 74703YLT5 BAY AREA TOLL AUTHORITY 74703YN48 MIAMI-DADE, FLORIDA (COUNTY OF) 74926YA43 UPMC 74926YB83 FROEDTERT & COMMUNITY HEALTH, INC. 74926YC66 JOHNS HOPKINS HEALTH SYSTEM CORPORATION (THE) 74926YD57 VIRGINIA COMMONWEALTH TRANSPORTATION BOARD 74926YE23 CPS ENERGY 74926YH46 SUTTER HEALTH 74926YH61 BJC HEALTH SYSTEM 74926YJ28 NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY 74926YL74 KAISER FOUNDATION HOSPITALS 74926YSB8 INDIANA UNIVERSITY HOSPIT 74926YSG7 UNIVERSITY OF PITTSBURGH 74926YTU5 SISTERS OF CHARITY OF LEAVENWORTH HLTH 74926YVX6 UNIVERSITY OF NC AT CHARLOTTE 74926YVZ1 TRINITY HEALTH CORPORATION 74926YWX5 HOUSTON, TEXAS (CITY OF) 74926YYC9 OKLAHOMA TURNPIKE AUTHORITY 74926YYE5 LUCILE PACKARD CHILDREN'S HOSPITAL 74926YYV7 RALEIGH-DURHAM NORTH CAROLINA AIRPORT AUTHORITY 751073GK7 BROWN UNIVERSITY 762243CA9 NEW YORK CITY MUNICIPAL WATER FINANCE AUTHORITY 76252PBK4 ADVENTIST HEALTH SYSTEM SUNBELT HEALTHCARE CORPORA 76252PCF4 Effective Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/5/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Final Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.02 0.07 0.05 0.04 0.02 0.04 0.19 0.07 0.03 0.02 0.02 0.02 0.05 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.03 0.04 Par 12,335,000.00 3,000,000.00 6,000,000.00 760,000.00 8,665,000.00 5,250,000.00 18,605,000.00 10,500,000.00 2,900,000.00 13,370,000.00 41,400,000.00 20,000,000.00 5,275,000.00 5,650,000.00 6,775,000.00 5,000,000.00 835,000.00 6,665,000.00 6,300,000.00 12,600,000.00 11,000,000.00 7,000,000.00 7,000,000.00 11,380,000.00 6,870,000.00 8,330,000.00 9,600,000.00 2,000,000.00 19,700,000.00 11,000,000.00 7,400,000.00 4,530,000.00 Amortized Cost 12,335,000.00 3,000,000.00 6,000,000.00 760,000.00 8,665,000.00 5,250,000.00 18,605,000.00 10,500,000.00 2,900,000.00 13,370,000.00 41,400,000.00 20,000,000.00 5,275,000.00 5,650,000.00 6,775,000.00 5,000,000.00 835,000.00 6,665,000.00 6,300,000.00 12,600,000.00 11,000,000.00 7,000,000.00 7,000,000.00 11,380,000.00 6,870,000.00 8,330,000.00 9,600,000.00 2,000,000.00 19,700,000.00 11,000,000.00 7,400,000.00 4,530,000.00 Percentage of Total 0.21% 0.05% 0.10% 0.01% 0.15% 0.09% 0.32% 0.18% 0.05% 0.23% 0.71% 0.34% 0.09% 0.10% 0.12% 0.09% 0.01% 0.11% 0.11% 0.21% 0.19% 0.12% 0.12% 0.19% 0.12% 0.14% 0.16% 0.03% 0.34% 0.19% 0.13% 0.08% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer DISTRICT OF COLUMBIA NEW YORK CITY MUNICIPAL WATER FINANCE AUTHORITY REGENTS OF THE UNIVERSITY OF CALIFORNIA (THE) LOS ANGELES INTERNATIONAL AIRPORT INTERMOUNTAIN HEALTH CARE INC. RIVERSIDE CALIFORNIA (COUNTY OF) INTERMOUNTAIN HEALTH CARE INC. ROCHESTER, MINNESOTA (CITY OF) MAYO CLINIC SALT RIVER PROJ EAGLE 14 SA TX G & E PUTTER 2957 SAN FRAN PUBLIC UTILITIES SHELBY TENNESSEE (COUNTY OF) SOUTHERN CALIFORNIA PUBLIC POWER AUTHORITY MEMORIAL SLOAN-KETTERING CANCER CENTER VASSAR COLLEGE NEW YORK (STATE OF) CHILDRENS MEDICAL CENTER OF DALLAS MCLAREN HEALTH CARE CORPORATION STATE OF TEXAS STATE OF TEXAS TEXAS TRANSPORTATION COMMISSION TX TRANSP PUTTER 2902 STATE OF TEXAS TRIBOROUGH BRIDGE AND TUNNEL AUTHORITY TRIBOROUGH BRIDGE AND TUNNEL AUTHORITY CHEVRON CORPORATION UNION NORTH CAROLINA (COUNTY OF) REGENTS OF THE UNIVERSITY OF CALIFORNIA (THE) REGENTS OF THE UNIVERSITY OF CALIFORNIA (THE) REGENTS OF THE UNIVERSITY OF CALIFORNIA (THE) UNIVERSITY OF DELAWARE 37 38 Cusip 76252PCL1 76252PCN7 76252PDN6 76252PDX4 76252PEW5 769059WC6 769369AP4 771588PK0 771902FF5 79575DUU2 796253L91 79765RPG8 821686VT6 84247PGE5 88033LAK5 88033LAM1 88033LBF5 88033LET2 88033LFQ7 882723BC2 882723HZ5 88283LFN1 88283LGA8 882854MZ2 89602N2B9 89602NCG7 903592AP8 906400BS4 913366GN4 91412GGY5 91412GSG1 91425MAY3 Effective Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/5/2015 2/5/2015 2/2/2015 2/2/2015 1/31/2015 2/2/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 2/2/2015 Final Maturity Date 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 1/31/2015 Coupon/ Yield 0.04 0.03 0.03 0.03 0.04 0.17 0.05 0.02 0.01 0.02 0.03 0.05 0.04 0.06 0.03 0.03 0.03 0.03 0.10 0.02 0.02 0.03 0.03 0.03 0.01 0.04 0.01 0.02 0.01 0.02 0.02 0.03 Par 4,110,000.00 2,000,000.00 4,000,000.00 1,000,000.00 1,850,000.00 2,100,000.00 12,770,000.00 8,700,000.00 1,900,000.00 13,275,000.00 9,995,000.00 5,000,000.00 935,000.00 4,860,000.00 10,020,000.00 6,430,000.00 5,000,000.00 20,000,000.00 6,660,000.00 1,000,000.00 12,805,000.00 6,665,000.00 14,395,000.00 600,000.00 36,620,000.00 31,200,000.00 1,600,000.00 17,545,000.00 2,500,000.00 200,000.00 7,400,000.00 3,570,000.00 Amortized Cost 4,110,000.00 2,000,000.00 4,000,000.00 1,000,000.00 1,850,000.00 2,100,000.00 12,770,000.00 8,700,000.00 1,900,000.00 13,275,000.00 9,995,000.00 5,000,000.00 935,000.00 4,860,000.00 10,020,000.00 6,430,000.00 5,000,000.00 20,000,000.00 6,660,000.00 1,000,000.00 12,805,000.00 6,665,000.00 14,395,000.00 600,000.00 36,620,000.00 31,200,000.00 1,600,000.00 17,545,000.00 2,500,000.00 200,000.00 7,400,000.00 3,570,000.00 Percentage of Total 0.07% 0.03% 0.07% 0.02% 0.03% 0.04% 0.22% 0.15% 0.03% 0.23% 0.17% 0.09% 0.02% 0.08% 0.17% 0.11% 0.09% 0.34% 0.11% 0.02% 0.22% 0.11% 0.25% 0.01% 0.62% 0.53% 0.03% 0.30% 0.04% 0.00% 0.13% 0.06% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer UNIVERSITY OF DELAWARE UNIVERSITY OF ILLINOIS UNIVERSITY OF MASSACHUSETTS UNIVERSITY OF NEW MEXICO UNIVERSITY OF NEW MEXICO UNIVERSITY OF NORTH CAROLINA AT CHAPEL HILL UTAH STATE BOARD OF REGENTS RECTOR & VISITORS OF THE UNIVERSITY OF VIRGINIA UNIVERSITY OF WASHINGTON INTERMOUNTAIN HEALTH CARE INC. EXXON MOBIL CORPORATION UNIVERSITY OF RICHMOND WASHINGTON (STATE OF) WASHINGTON STATE ROC 1188 WASHINGTON (STATE OF) PROVIDENCE HEALTH & SERVICES PROVIDENCE HEALTH & SERVICES SEATTLE CHILDRENS HOSP WE ALABAMA POWER COMPANY WISCONSIN (STATE OF) FROEDTERT & COMMUNITY HEALTH, INC. TOTAL: VARIABLE RATE DEMAND NOTE TOTAL INVESTMENT PORTFOLIO NET OTHER ASSETS/LIABILITIES 37 38 Cusip 91425MAZ0 914325BJ3 914440HE5 914692WL8 914692XM5 914713ZE5 915183UB1 915217WC3 91523NFL5 917393AC4 919061DU2 9277803U8 93974B6H0 93974CVU1 93974DKL1 93978E3R1 93978HGF6 94985NNZ0 953450AD5 97705LUP0 97712DDK9 Effective Maturity Date 1/31/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/2/2015 2/6/2015 2/2/2015 2/6/2015 2/5/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Final Maturity Date 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 2/6/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 Coupon/ Yield 0.02 0.14 0.03 0.02 0.02 0.03 0.03 0.03 0.01 0.02 0.02 0.02 0.03 0.02 0.03 0.02 0.03 0.03 0.03 0.02 0.03 Par 2,155,000.00 7,495,000.00 22,600,000.00 33,190,000.00 2,075,000.00 5,345,000.00 9,490,000.00 12,195,000.00 3,350,000.00 21,600,000.00 7,000,000.00 15,000,000.00 9,995,000.00 2,250,000.00 4,700,000.00 9,000,000.00 16,060,000.00 10,990,000.00 37,290,000.00 7,200,000.00 5,000,000.00 4,116,374,000.00 5,846,909,162.00 Amortized Cost Percentage of Total 2,155,000.00 7,495,000.00 22,600,000.00 33,190,000.00 2,075,000.00 5,345,000.00 9,490,000.00 12,195,000.00 3,350,000.00 21,600,000.00 7,000,000.00 15,000,000.00 9,995,000.00 2,250,000.00 4,700,000.00 9,000,000.00 16,060,000.00 10,990,000.00 37,290,000.00 7,200,000.00 5,000,000.00 4,116,374,000.00 0.04% 0.13% 0.39% 0.57% 0.04% 0.09% 0.16% 0.21% 0.06% 0.37% 0.12% 0.26% 0.17% 0.04% 0.08% 0.15% 0.27% 0.19% 0.64% 0.12% 0.09% 70.21% 5,856,452,779.61 99.89% 6,469,518.53 0.11% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer 37 38 Cusip Effective Maturity Date Final Maturity Date TOTAL NET ASSETS Coupon/ Yield Total: Par Amortized Cost 5,862,922,298.14 WAM: The money market fund's weighted average maturity (WAM) is an average of the effective maturities of all securities held in the portfolio, weighted by each security's percentage of net assets. WAL: The money market fund's weighted average life (WAL) is an average of the final maturities (or where applicable the date of demand) of all securities held in the portfolio, weighted by each security's percentage of net assets. Effective Maturity Date: Represents the next interest rate reset date, demand date or prerefunded date. Final Maturity Date: Represents the maturity date utilized to calculate the WAL. Cash: Non interest bearing FDIC account. Fund holdings and allocations shown are unaudited, and may not be representative of current or future investments. Fund holdings and allocations may not include the Fund's entire investment portfolio, which may change at any time. Fund holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. Current and future holdings are subject to risk. An investment in a money market portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market portfolio seeks to preserve the value of an investment of $1.00 per share, it is possible to lose money by investing in a money market portfolio. A summary prospectus, if available, or a Prospectus for the Fund containing more information may be obtained from your authorized dealer or from Goldman, Sachs & Co. by calling 1-800-526-7384 (for Retail Shareholders) or 1-800-621-2550 (for Institutional Shareholders). Please consider Percentage of Total 100.00% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE TAX-FREE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer 37 38 Cusip Effective Maturity Date Final Maturity Date Coupon/ Yield Par a fund's objectives,risks, charges and expenses, and read the summary prospectus, if available, and the Prospectus carefully before investing. The summary prospectus, if available, and the Prospectus contains this and other information about the Fund. Goldman, Sachs & Co. is the distributor of the Goldman Sachs Funds. © 2013 Goldman Sachs. All rights reserved. 116791.MF.MED.TMPL/12/2013 Date of first use: December 16, 2013 Amortized Cost Percentage of Total

© Copyright 2026

![Weekly Holdings [PDF] - Goldman Sachs Asset Management](http://s2.esdocs.com/store/data/000494329_1-269a2f2c6a416fe67dab5539f673fef9-250x500.png)