Weekly Holdings [PDF] - Goldman Sachs Asset Management

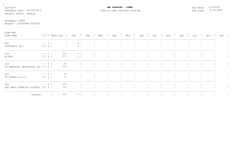

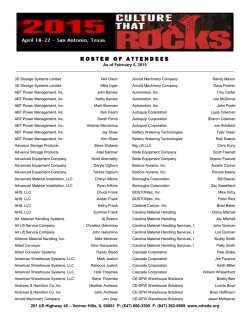

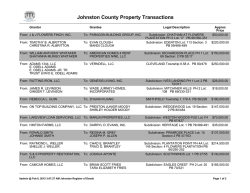

WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 45 77 Issuer ALPINE SECURITIZATION CORP. ALPINE SECURITIZATION CORP. BEDFORD ROW FUNDING CORP. CHARIOT FUNDING LLC CHARIOT FUNDING LLC CHARIOT FUNDING LLC CHARIOT FUNDING LLC CHARIOT FUNDING LLC CHARIOT FUNDING LLC GOTHAM FUNDING CORPORATION GOTHAM FUNDING CORPORATION GOTHAM FUNDING CORPORATION HANNOVER FUNDING COMPANY LLC JUPITER SECURITIZATION COMPANY LLC JUPITER SECURITIZATION COMPANY LLC JUPITER SECURITIZATION COMPANY LLC JUPITER SECURITIZATION COMPANY LLC JUPITER SECURITIZATION COMPANY LLC JUPITER SECURITIZATION COMPANY LLC JUPITER SECURITIZATION COMPANY LLC LMA-AMERICAS LLC LMA-AMERICAS LLC MATCHPOINT MASTER TRUST REGENCY MARKETS NO. 1, LLC VICTORY RECEIVABLES CORPORATION VICTORY RECEIVABLES CORPORATION TOTAL: ASSET BACKED COMMERCIAL PAPER Cusip 02086MP65 0208P4BP7 07644BVA7 15963URW8 15963US56 15963US72 15963USK3 15963UT97 15963UTA4 38346MP57 38346MPH1 38346MPP3 41068LQ90 4820P3QB2 4820P3QH9 4820P3RP0 4820P3RW5 4820P3T94 4820P3U68 4820P3VT7 53944RPB8 53944RPH5 5766P1P21 7588R1PR0 92646LPJ3 92646LQ60 Effective Maturity Date 2/6/2015 5/1/2015 8/10/2015 4/30/2015 5/5/2015 5/7/2015 5/19/2015 6/9/2015 6/10/2015 2/5/2015 2/17/2015 2/23/2015 3/9/2015 3/11/2015 3/17/2015 4/23/2015 4/30/2015 6/9/2015 7/6/2015 8/27/2015 2/11/2015 2/17/2015 2/2/2015 2/25/2015 2/18/2015 3/6/2015 BNP PARIBAS BANCO DEL ESTADO DE CHILE THE BANK OF NOVA SCOTIA MITSUBISHI UFJ TRUST 05574RPT6 05962P2X6 06417HZT6 112008578 2/4/2015 3/2/2015 10/21/2015 2/4/2015 Final Maturity Date 2/6/2015 5/1/2015 8/10/2015 4/30/2015 5/5/2015 5/7/2015 5/19/2015 6/9/2015 6/10/2015 2/5/2015 2/17/2015 2/23/2015 3/9/2015 3/11/2015 3/17/2015 4/23/2015 4/30/2015 6/9/2015 7/6/2015 8/27/2015 2/11/2015 2/17/2015 2/2/2015 2/25/2015 2/18/2015 3/6/2015 Coupon/ Yield 0.26 0.29 0.30 0.21 0.21 0.27 0.27 0.24 0.24 0.17 0.18 0.18 0.21 0.27 0.27 0.21 0.21 0.24 0.27 0.28 0.18 0.18 0.21 0.16 0.18 0.18 2/4/2015 3/2/2015 10/21/2015 2/4/2015 0.23 0.21 0.32 0.28 Par 100,000,000.00 300,000,000.00 75,000,000.00 50,000,000.00 50,000,000.00 25,000,000.00 25,000,000.00 50,000,000.00 100,000,000.00 80,000,000.00 184,667,000.00 75,000,000.00 50,000,000.00 25,000,000.00 25,000,000.00 25,000,000.00 100,000,000.00 100,000,000.00 25,000,000.00 50,000,000.00 295,000,000.00 37,900,000.00 145,000,000.00 188,076,000.00 141,594,000.00 110,000,000.00 2,432,237,000.00 Amortized Cost 99,995,666.67 300,000,000.00 74,880,625.00 49,974,041.67 49,972,583.34 24,982,000.00 24,979,750.00 49,957,000.00 99,913,333.34 79,998,111.11 184,651,303.31 74,991,375.00 49,989,208.33 24,992,687.50 24,991,562.50 24,988,041.67 99,948,083.33 99,914,000.00 24,970,750.00 49,919,111.11 294,983,775.00 37,896,778.50 144,998,308.33 188,055,102.68 141,581,256.54 109,981,300.00 2,431,505,754.93 250,000,000.00 45,000,000.00 397,000,000.00 250,000,000.00 250,000,000.00 45,000,000.00 397,000,000.00 250,000,138.76 Percentage of Total 0.31% 0.93% 0.23% 0.16% 0.16% 0.08% 0.08% 0.16% 0.31% 0.25% 0.57% 0.23% 0.16% 0.08% 0.08% 0.08% 0.31% 0.31% 0.08% 0.16% 0.92% 0.12% 0.45% 0.58% 0.44% 0.34% 7.56% 0.78% 0.14% 1.23% 0.78% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 45 77 Issuer COOPERATIEVE CENTRALE RAIFFEISEN-BOERENLEENBANK B. DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK MITSUBISHI UFJ TRUST AND BANKING CORPORATION MITSUBISHI UFJ TRUST AND BANKING CORPORATION MIZUHO BANK, LTD. MIZUHO BANK, LTD. NATIONAL BANK OF KUWAIT SAK NATIONAL BANK OF KUWAIT SAK NATIONAL BANK OF KUWAIT SAK NATIONAL BANK OF KUWAIT SAK OVERSEA-CHINESE BANKING CORPORATION LIMITED SUMITOMO MITSUI BANKING CORPORATION SUMITOMO MITSUI BANKING CORPORATION SUMITOMO MITSUI TRUST BANK, LIMITED SUMITOMO MITSUI TRUST BANK, LIMITED THE TORONTO-DOMINION BANK THE TORONTO-DOMINION BANK CREDIT INDUSTRIEL ET COMMERCIAL TOTAL: CERTIFICATE OF DEPOSIT Cusip 21684BWN0 23328AGS7 23328AHY3 60682AQX7 60682ARZ1 60688LQ90 60688LW51 63375PJE0 63375PKD0 63375PLQ0 63375PLR8 69033PD80 86562YE42 86562YE59 86563KTH6 86563KVF7 89112U2N0 89112UJ77 CRINDE Effective Maturity Date 9/11/2015 2/13/2015 5/5/2015 2/9/2015 3/4/2015 2/3/2015 3/5/2015 2/10/2015 2/19/2015 5/12/2015 4/29/2015 2/3/2015 3/12/2015 3/10/2015 2/23/2015 5/12/2015 6/10/2015 6/4/2015 4/1/2015 THE BANK OF NOVA SCOTIA DEXIA CREDIT LOCAL-NEW YORK BRANCH DEXIA CREDIT LOCAL-NEW YORK BRANCH DEXIA CREDIT LOCAL-NEW YORK BRANCH ELECTRICITE DE FRANCE STANDARD CHARTERED BANK STANDARD CHARTERED BANK STANDARD CHARTERED BANK STANDARD CHARTERED BANK UNITED OVERSEAS BANK LIMITED UNITED OVERSEAS BANK LIMITED 06417KVH9 25214T2Y0 25214V2X7 25214W2U1 28504JBE9 85324UP31 85324UPA5 85324USM6 85324USU8 91127QS75 91127QS83 8/17/2015 5/7/2015 5/20/2015 5/6/2015 1/15/2016 2/3/2015 2/10/2015 5/21/2015 5/28/2015 5/7/2015 5/8/2015 Final Maturity Date 9/11/2015 2/13/2015 5/5/2015 2/9/2015 3/4/2015 2/3/2015 3/5/2015 2/10/2015 2/19/2015 5/12/2015 4/29/2015 2/3/2015 3/12/2015 3/10/2015 2/23/2015 5/12/2015 6/10/2015 6/4/2015 4/1/2015 Coupon/ Yield 0.40 0.31 0.30 0.24 0.24 0.22 0.22 0.28 0.28 0.31 0.30 0.30 0.23 0.23 0.22 0.27 0.25 0.23 0.30 8/17/2015 5/7/2015 5/20/2015 5/6/2015 1/15/2016 2/3/2015 2/10/2015 5/21/2015 5/28/2015 5/7/2015 5/8/2015 0.28 0.31 0.31 0.32 0.76 0.25 0.25 0.29 0.30 0.25 0.25 Par 250,000,000.00 195,000,000.00 500,000,000.00 250,000,000.00 200,000,000.00 150,000,000.00 300,000,000.00 150,000,000.00 100,000,000.00 95,000,000.00 50,000,000.00 150,000,000.00 350,000,000.00 500,000,000.00 400,000,000.00 500,000,000.00 500,000,000.00 250,000,000.00 750,000,000.00 6,582,000,000.00 Amortized Cost 250,000,000.00 195,000,000.00 500,000,000.00 250,000,000.00 200,000,000.00 150,000,000.00 300,000,000.00 150,000,000.00 100,000,000.00 95,000,000.00 50,000,000.00 150,000,000.00 350,000,000.00 500,000,000.00 400,000,000.00 500,000,000.00 500,000,000.00 250,000,000.00 750,018,731.64 6,582,018,870.40 140,000,000.00 200,000,000.00 450,000,000.00 200,000,000.00 197,000,000.00 150,000,000.00 145,000,000.00 250,000,000.00 225,000,000.00 100,000,000.00 146,700,000.00 139,784,399.99 199,834,666.66 449,584,437.95 199,833,750.00 195,567,645.83 149,996,875.00 144,989,930.56 249,778,472.22 224,780,624.99 99,934,666.67 146,603,157.63 Percentage of Total 0.78% 0.61% 1.55% 0.78% 0.62% 0.47% 0.93% 0.47% 0.31% 0.30% 0.16% 0.47% 1.09% 1.55% 1.24% 1.55% 1.55% 0.78% 2.33% 20.47% 0.43% 0.62% 1.40% 0.62% 0.61% 0.47% 0.45% 0.78% 0.70% 0.31% 0.46% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 45 77 Final Maturity Date 8/7/2015 8/10/2015 Coupon/ Yield 0.31 0.31 Issuer UNITED OVERSEAS BANK LIMITED UNITED OVERSEAS BANK LIMITED TOTAL: FINANCIAL COMPANY COMMERCIAL PAPER Cusip 91127QV71 91127QVA4 Effective Maturity Date 8/7/2015 8/10/2015 FEDERAL HOME LOAN BANK SYSTEM FEDERAL HOME LOAN BANK SYSTEM FEDERAL HOME LOAN BANK SYSTEM FEDERAL HOME LOAN BANK SYSTEM OVERSEAS PRIVATE INVESTMENT CORP OVERSEAS PRIVATE INVESTMENT CORP TOTAL: GOVERNMENT AGENCY DEBT 3130A2NX0 3130A2YG5 3130A2ZV1 3130A3ZL1 690353A72 690353VV6 8/17/2015 10/5/2015 10/9/2015 2/26/2016 2/6/2015 2/6/2015 8/17/2015 10/5/2015 10/9/2015 2/26/2016 2/6/2015 2/6/2015 CITIBANK, NA 79406033 TOTAL: GOVERNMENT AGENCY REPURCHASE AGREEMENT 2/4/2015 ASB FINANCE LIMITED-LONDON BRANCH ASB FINANCE LIMITED-LONDON BRANCH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED BANK OF MONTREAL THE BANK OF NOVA SCOTIA BEDFORD ROW FUNDING CORP. DEXIA CREDIT LOCAL CHINA CONSTRUCTION BANK CORPORATION COMMONWEALTH BANK OF AUSTRALIA COOPERATIEVE CENTRALE RAIFFEISEN-BOERENLEENBANK B. CREDIT SUISSE AG CREDIT SUISSE AG DEXIA CREDIT LOCAL-NEW YORK BRANCH J.P. MORGAN SECURITIES LLC JPMORGAN CHASE BANK, NATIONAL ASSOCIATION KELLS FUNDING, LLC 2/2/2015 2/10/2015 4/17/2015 2/13/2015 2/23/2015 4/2/2015 3/20/2015 2/27/2015 2/4/2015 2/19/2015 3/23/2015 5/31/2015 4/1/2015 2/19/2015 3/9/2015 2/23/2015 0020P5EV7 0020P5EW5 05252TBB5 06366CFD5 06417FAR1 07644EAA4 104668003 16949EMV8 20272AGW0 21684BQD9 22546QAE7 22549T5W4 25215FAB0 46640CBA9 48125LJB9 48803AHA6 Par 50,000,000.00 50,000,000.00 2,303,700,000.00 Amortized Cost 49,919,055.56 49,917,763.89 2,300,525,446.95 Percentage of Total 0.21 0.25 0.26 0.34 0.11 0.11 255,650,000.00 270,000,000.00 290,000,000.00 264,000,000.00 6,100,000.00 86,000,000.00 1,171,750,000.00 255,650,000.00 270,000,000.00 290,000,000.00 264,000,000.00 6,100,000.00 86,000,000.00 1,171,750,000.00 0.79% 0.84% 0.90% 0.82% 0.02% 0.27% 3.64% 2/4/2015 0.07 250,000,000.00 250,000,000.00 250,000,000.00 250,000,000.00 0.78% 0.78% 9/1/2015 9/10/2015 10/16/2015 4/13/2015 2/23/2016 4/2/2015 6/20/2015 3/1/2015 3/30/2015 5/19/2015 3/23/2015 9/24/2015 7/1/2015 11/19/2015 2/5/2016 2/23/2015 0.28 0.28 0.42 0.23 0.36 0.28 0.45 0.42 0.25 0.28 3.50 0.26 0.31 0.35 0.36 0.25 50,000,000.00 100,000,000.00 260,000,000.00 500,000,000.00 350,000,000.00 50,000,000.00 100,000,000.00 250,000,000.00 200,000,000.00 250,000,000.00 115,000,000.00 550,000,000.00 100,000,000.00 200,000,000.00 222,000,000.00 148,500,000.00 49,995,648.71 99,991,095.26 260,000,000.00 500,000,000.00 350,000,000.00 50,000,000.00 100,044,129.87 250,000,000.00 200,000,000.00 250,000,000.00 115,495,732.14 550,000,000.00 100,000,000.00 200,000,000.00 222,000,000.00 148,500,126.11 0.16% 0.31% 0.81% 1.55% 1.09% 0.16% 0.31% 0.78% 0.62% 0.78% 0.36% 1.71% 0.31% 0.62% 0.69% 0.46% 0.16% 0.16% 7.15% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 45 77 Issuer KELLS FUNDING, LLC KELLS FUNDING, LLC KELLS FUNDING, LLC KELLS FUNDING, LLC KELLS FUNDING, LLC KELLS FUNDING, LLC NATIONAL AUSTRALIA BANK LIMITED ROYAL BANK OF CANADA SKANDINAVISKA ENSKILDA BANKEN AB SWEDBANK AB DBS BANK LTD. ING BANK N.V. STANDARD CHARTERED BANK NATIONAL BANK OF KUWAIT SAK CHINA CONSTRUCTION BANK CORPORATION DBS BANK LTD. LLOYDS BANK PLC CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK NATIXIS SVENSKA HANDELSBANKEN AB WESTPAC BANKING CORPORATION WELLS FARGO BANK, NATIONAL ASSOCIATION WELLS FARGO BANK, NATIONAL ASSOCIATION TOTAL: OTHER NOTE Cusip 48803AHT5 48803AHW8 48803AJA4 48803AKA2 48803AKG9 48803AKH7 76417705 78009NLP9 79323295 79323310 79323312 79443330 79510398 79510400 79510412 79510428 79510466 79544842 79544973 86959JCN6 91621CCH2 94985HL77 94988ECV8 CREDIT SUISSE SECURITIES (USA) LLC BNP PARIBAS SECURITIES CORP. RBC CAPITAL MARKETS LLC WELLS FARGO SECURITIES LLC MITSUBISHI UFJ SECURITIES (USA), INC WELLS FARGO SECURITIES LLC SG AMERICAS SECURITIES LLC 71352477 73482831 76981429 78092836 79387229 79387367 79512989 Effective Maturity Date 4/23/2015 2/16/2015 2/16/2015 4/20/2015 2/17/2015 2/17/2015 2/11/2015 4/1/2015 2/2/2015 2/2/2015 2/2/2015 2/5/2015 2/2/2015 2/2/2015 2/2/2015 2/6/2015 2/2/2015 2/2/2015 2/2/2015 4/7/2015 3/2/2015 3/20/2015 2/12/2015 Final Maturity Date 4/23/2015 4/29/2015 5/15/2015 9/28/2015 10/8/2015 10/9/2015 5/11/2015 2/1/2016 2/2/2015 2/2/2015 2/2/2015 2/5/2015 2/2/2015 2/2/2015 2/2/2015 2/6/2015 2/2/2015 2/2/2015 2/2/2015 2/4/2016 2/1/2016 2/19/2016 9/14/2015 Coupon/ Yield 0.27 0.24 0.24 0.26 0.25 0.25 0.22 0.35 0.13 0.13 0.14 0.14 0.06 0.09 0.20 0.14 0.06 0.06 0.07 0.46 0.43 0.37 0.27 2/2/2015 2/5/2015 2/6/2015 3/17/2015 2/3/2015 2/3/2015 2/2/2015 5/8/2015 4/6/2015 2/6/2015 3/17/2015 2/3/2015 2/3/2015 2/2/2015 0.75 0.73 0.40 0.60 0.25 0.40 0.21 Par 33,000,000.00 50,000,000.00 80,000,000.00 75,000,000.00 120,000,000.00 150,000,000.00 500,000,000.00 300,000,000.00 1,050,000,000.00 1,000,000,000.00 500,000,000.00 750,000,000.00 450,000,000.00 1,000,000,000.00 250,000,000.00 500,000,000.00 500,000,000.00 1,300,000,000.00 958,500,000.00 195,000,000.00 246,000,000.00 150,000,000.00 425,000,000.00 14,028,000,000.00 Amortized Cost 33,000,000.00 50,000,000.00 80,000,000.00 74,994,827.59 119,991,200.00 149,988,423.17 500,000,000.00 300,000,000.00 1,050,000,000.00 1,000,000,000.00 500,000,000.00 750,000,000.00 450,000,000.00 1,000,000,000.00 250,000,000.00 500,000,000.00 500,000,000.00 1,300,000,000.00 958,500,000.00 195,000,000.00 246,000,000.00 150,000,000.00 425,000,000.00 14,028,501,182.85 400,000,000.00 500,000,000.00 300,000,000.00 250,000,000.00 175,000,000.00 200,000,000.00 100,000,000.00 400,000,000.00 500,000,000.00 300,000,000.00 250,000,000.00 175,000,000.00 200,000,000.00 100,000,000.00 Percentage of Total 0.10% 0.16% 0.25% 0.23% 0.37% 0.47% 1.55% 0.93% 3.26% 3.11% 1.55% 2.33% 1.40% 3.11% 0.78% 1.55% 1.55% 4.04% 2.98% 0.61% 0.76% 0.47% 1.32% 43.62% 1.24% 1.55% 0.93% 0.78% 0.54% 0.62% 0.31% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: 45 77 Issuer BNP PARIBAS PRIME BROKERAGE, INC. BARCLAYS CAPITAL INC BNP PARIBAS SECURITIES CORP. ING FINANCIAL MARKETS LLC HSBC BANK PLC HSBC SECURITIES (USA) INC BNP PARIBAS SECURITIES CORP. SG AMERICAS SECURITIES LLC MERRILL LYNCH, PIERCE, FENNER AND SMITH INC MERRILL LYNCH, PIERCE, FENNER AND SMITH INC SG AMERICAS SECURITIES LLC SG AMERICAS SECURITIES LLC SG AMERICAS SECURITIES LLC SG AMERICAS SECURITIES LLC MERRILL LYNCH, PIERCE, FENNER AND SMITH INC TOTAL: OTHER REPURCHASE AGREEMENT Cusip 79513123 79513125 79513159 79513167 79513169 79513175 79513177 79514496 79514531 79514549 79514668 79514706 79514710 79514715 79543309 THE PORT AUTHORITY OF NEW YORK AND NEW JERSEY BLACKROCK MUNIYIELD INVESTMENT FUND BLACKROCK INSURED MUNICIPAL INCOME INVESTMENT TRUS BLACKROCK MUNICIPAL BOND INVESTMENT TRUST NUVEEN MUNICIPAL MARKET OPPORTUNITY FUND NUVEEN MUNICIPAL MARKET OPPORTUNITY FUND NUVEEN MUNICIPAL MARKET OPPORTUNITY FUND PORTLAND MAINE (CITY OF)... EMORY UNIVERSITY PROVIDENCE HEALTH & SERVICES TOTAL: VARIABLE RATE DEMAND NOTE 05248PXG5 46636YHW3 46636YJA9 46636YLF5 67062E707 67062W608 670988500 7365594Y8 74265LHW1 743755AG5 Effective Maturity Date 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/6/2015 2/2/2015 2/2/2015 Final Maturity Date 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/6/2015 2/2/2015 2/2/2015 Coupon/ Yield 0.21 0.38 0.46 0.16 0.21 0.26 0.31 0.21 0.20 0.46 0.36 0.36 0.30 0.30 0.20 2/6/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 1/31/2015 1/31/2015 1/31/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 2/6/2015 0.09 0.14 0.14 0.14 0.11 0.14 0.11 0.18 0.11 0.11 Par 400,000,000.00 105,000,000.00 115,000,000.00 70,000,000.00 1,500,000,000.00 25,000,000.00 35,000,000.00 260,000,000.00 600,000,000.00 103,000,000.00 150,000,000.00 100,000,000.00 150,000,000.00 50,000,000.00 250,000,000.00 5,838,000,000.00 Amortized Cost 400,000,000.00 105,000,000.00 115,000,000.00 70,000,000.00 1,500,000,000.00 25,000,000.00 35,000,000.00 260,000,000.00 600,000,000.00 103,000,000.00 150,000,000.00 100,000,000.00 150,000,000.00 50,000,000.00 250,000,000.00 5,838,000,000.00 32,345,000.00 33,000,000.00 29,110,000.00 19,375,000.00 22,500,000.00 34,000,000.00 13,000,000.00 81,410,000.00 9,200,000.00 46,195,000.00 320,135,000.00 32,345,000.00 33,000,000.00 29,110,000.00 19,375,000.00 22,500,000.00 34,000,000.00 13,000,000.00 81,410,000.00 9,200,000.00 46,195,000.00 320,135,000.00 Percentage of Total 1.24% 0.33% 0.36% 0.22% 4.66% 0.08% 0.11% 0.81% 1.87% 0.32% 0.47% 0.31% 0.47% 0.16% 0.78% 18.15% 0.10% 0.10% 0.09% 0.06% 0.07% 0.11% 0.04% 0.25% 0.03% 0.14% 1.00% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer TOTAL INVESTMENT PORTFOLIO 45 77 Cusip Effective Maturity Date Final Maturity Date Coupon/ Yield Par 32,925,822,000.00 Amortized Cost 32,922,436,255.13 NET OTHER ASSETS/LIABILITIES TOTAL NET ASSETS (762,584,426.71) Total: 32,159,851,828.42 WAM: The money market fund's weighted average maturity (WAM) is an average of the effective maturities of all securities held in the portfolio, weighted by each security's percentage of net assets. WAL: The money market fund's weighted average life (WAL) is an average of the final maturities (or where applicable the date of demand) of all securities held in the portfolio, weighted by each security's percentage of net assets. Effective Maturity Date: Represents the next interest rate reset date, demand date or prerefunded date. Final Maturity Date: Represents the maturity date utilized to calculate the WAL. Cash: Non interest bearing FDIC account. Fund holdings and allocations shown are unaudited, and may not be representative of current or future investments. Fund holdings and allocations may not include the Fund's entire investment portfolio, which may change at any time. Fund holdings should not be relied on in making investment decisions and should not be construed as research or investment advice regarding particular securities. Current and future holdings are subject to risk. Percentage of Total 102.37% -2.37% 100.00% WEEKLY HOLDINGS REPORT As of 01-30-2015 FINANCIAL SQUARE MONEY MARKET FUND Weighted Average Maturity: Weighted Average Life: Issuer 45 77 Cusip Effective Maturity Date Final Maturity Date Coupon/ Yield Par Amortized Cost An investment in a money market portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market portfolio seeks to preserve the value of an investment of $1.00 per share, it is possible to lose money by investing in a money market portfolio. A summary prospectus, if available, or a Prospectus for the Fund containing more information may be obtained from your authorized dealer or from Goldman, Sachs & Co. by calling 1-800-526-7384 (for Retail Shareholders) or 1-800-621-2550 (for Institutional Shareholders). Please consider a fund's objectives,risks, charges and expenses, and read the summary prospectus, if available, and the Prospectus carefully before investing. The summary prospectus, if available, and the Prospectus contains this and other information about the Fund. Goldman, Sachs & Co. is the distributor of the Goldman Sachs Funds. © 2013 Goldman Sachs. All rights reserved. 116791.MF.MED.TMPL/12/2013 Date of first use: December 16, 2013 Percentage of Total

© Copyright 2026

![Weekly Holdings [PDF] - Goldman Sachs Asset Management](http://s2.esdocs.com/store/data/000497211_1-772e9020c013e95f780f4833b0c5f7e8-250x500.png)