here - Thomson Reuters

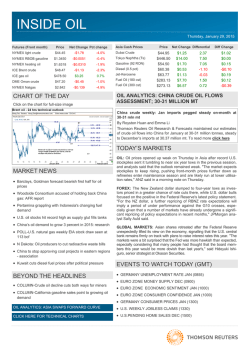

INSIDE U.S. OIL Thursday, January 29, 2015 Futures (Front Month) NYMEX light crude Close Net Change Pct Change U.S. Cash Crude $44.45 -$1.78 4.00 NYMEX RBOB gasoline $1.35 -$0.01 0.38 NYMEX heating oil $1.63 -$0.03 1.90 $48.47 -$1.13 2.33 $478.50 $3.25 0.68 Brent/WTI spread -$4.02 -$0.65 16.17 Reuters 321 Crack Spread $16.64 $1.15 6.91 ICE Brent crude ICE gas oil Price Net Change Differential Diff Change Light Louisiana Sweet $45.50 -$1.86 2.20 $0.68 Poseidon $40.15 -$2.06 2.75 $0.88 Thunder Horse $43.05 -$2.29 0.25 $0.75 U.S. Cash Crude Products (Values in Cents/Gal) NYH Prompt Heating oil NYH RBOB USG ULSD USG Prompt Gasoline Price 156.72 131.77 153.22 135.77 Net Change Differential Diff Change -1.65 -0.73 -2.65 -0.48 -6.00 -2.75 -9.50 -1.50 1.00 0.25 0.00 2.75 CHART OF THE DAY JOHN KEMP ON MARKETS Click on the chart for full-size image COLUMN– California gasoline sales point to growing oil demand Motorists in California purchased more gasoline in October 2014 than any corresponding month since 2007, according to state tax records, confirming the renewed growth in U.S. fuel demand. John Kemp is a Reuters market analyst. The views expressed are his own. Click here to read the rest of his column TODAY’S MARKETS MARKET NEWS Shell cuts spending by $15 bln as lower oil price takes toll China to raise commercial oil storage more than 10 pct in 2015 -sources U.S. oil stocks hit record high as supply glut fills tanks OIL: Brent crude oil futures held above $48 a barrel as investor inflows offset data showing that U.S. crude stocks had hit a record high. "It's a tug of war between the non-supportive fundamentals and investor flows - investors are more concerned about missing a potential bounce," said Ole Hansen, senior commodity strategist at Saxo Bank. "But there is nothing bullish to be found in those numbers. The break will be to the downside." FOREX: The U.S. dollar inched higher against the yen and was steady to the euro after a Federal Reserve statement which, with some caveats, was read as keeping the bank on track to raise interest rates later this year. "For us, its the growth and yield differentials that are most important," said Ian Stannard, head of European FX strategy with Morgan Stanley in London. Eni aims to shed Saipem debt by selling part of its stake - CEO Glencore considers closing S.Africa coal mines, laying off workers North Dakota: Oil producers aim to cut radioactive waste bills Oil booked for sea storage seen at least 50 million barrels Japan's JX plans Feb crude refining down 4 pct y/y REFINERY NEWS GLOBAL MARKETS: Stocks fell in Europe and Asia and the dollar strengthened after the Federal Reserve took an upbeat view of the world's largest economy and signalled it was on track to raise interest rates this year. "The bullish tone by the Fed on the economy caught investors off-guard," said John Plassard, senior equity sales trader at Mirabaud Securities in Geneva. U.S. EVENTS TO WATCH TODAY (EST) U.S. WEEKLY JOBLESS CLAIMS (0830) U.S.PENDING HOME SALES DEC (1000) Coker shut for repairs at Motiva Port Arthur refinery sources FCCU still shut at Marathon Galveston bay refinery in Texas -sources OIL ANALYTICS: ASIA SWAPS FORWARD CURVE INSIDE U.S. OIL January 29, 2015 OIL ANALYTICS: ASIA SWAPS FORWARD CURVE (0830 GMT) ICE BRENT FUTURES FORWARD ICE Brent Fut. Fwd Curve DUBAI SWAPS FORWARD CURVE 1M - 1Y 1M Yield 59.23 Dubai Swaps Fwd Curve 1M - 1Y 1M Yield 55.45 55.00 56.00 50.00 52.00 45.00 .12 .12 1M 2M 3M 4M 5M 6M 7M 8M 9M 10M 1Y 1M 1M 2M FO180 FOB CARGO SG FWD CURVE FO180 FOB Cargo SG Fwd Curve 3M 4M 5M 6M 7M 8M 9M 10M 1Y 1M FO3.5% BARGES ARA FORWARD CURVE 9M - 9M Yield FO3.5% Barges ARA Fwd Curve 1M - 1Y 1M Yield 305.00 300.00 276.50 270.00 260.00 290.00 250.00 240.00 280.00 .12 .12 9M 1M 2M FO380 FOB CARGO SG FORWARD CURVE FO380 FOB Cargo SG Fwd Curve 3M 4M 5M 6M 7M 8M 9M 10M NAPHTHA CFR JAPAN FORWARD CURVE Naphtha CFR Japan Fwd Curve 2M - 11M Yield 299.50 300.00 9M - 9M Yield 468.25 460.00 290.00 450.00 280.00 440.00 430.00 .12 270.00 .12 2M 3M 4M 8M 1Y 1M 9M 9M 10M 11M 2 INSIDE U.S. OIL January 29, 2015 OIL ANALYTICS: ASIA SWAPS FORWARD CURVE (0830 GMT) NAPHTHA CIF NWE FORWARD CURVE Naphtha CIF NWE Fwd Curve NAPHTHA FOB SG FWD CURVE 1M - 1Y 1M Yield 444.50 440.00 Naphtha FOB SG Fwd Curve 49.00 49.65 48.00 430.00 420.00 47.00 410.00 46.00 .12 .12 1M 2M 3M 4M 5M 6M 7M 8M 9M 10M 1Y 1M 2M ICE GO FUT. FWD CURVE ICE GO Fut. Fwd Curve GO FOB CARGO SG FORWARD CURVE 9M - 9M Yield 533.00 520.00 GO FOB Cargo SG Fwd Curve 2M - 2M Yield 68.25 66.00 500.00 63.00 480.00 .12 .12 9M 2M JET FUEL FOB CARGO SG FWD Jet Fuel FOB Cargo SG Fwd Curve 2M - 2M Yield 1M - 1M Yield 69.44 68.00 66.00 64.00 .12 1M 3 INSIDE U.S. OIL January 29, 2015 MARKET NEWS Shell cuts spending by $15 bln as lower oil price takes toll China to raise commercial oil storage more than 10 pct in 2015 -sources Royal Dutch Shell shares fell on Thursday after the oil company missed profit expectations and announced a three-year, $15 billion cut in spending reflecting a steep fall in oil prices. Chief Executive Ben van Beurden however warned against an over reaction to the 60 percent drop in oil prices since June, while keeping dividends unchanged to soothe investors. "We are taking a prudent approach here and we must be careful not to over-react to the recent fall in oil prices," van Beurden said. Shell shares were down 3.7 percent at 0826 GMT after the company's fourth-quarter 2014 adjusted net income of $3.3 billion missed market expectations by more than 20 percent. "It was a big miss in upstream," said Raymond James analyst Bertran Hodee. The $15 billion spending cut, which will involve canceling and deferring projects through 2017, which would represent a 14 percent cut per year from 2014 capital investment of $35 billion. Storage companies in China are set to boost commercial oil tank capacity by more than a tenth this year, just in time to cash in on speculative demand to stock up on cheap crude, a survey of storage and trading executives shows. The volume of at least 42 million barrels of crude represents about one week of China's net crude oil imports, and purchases to fill the tanks could offer support global oil prices that have more than halved since last summer to drop below $50 a barrel as Saudi-led OPEC faces off with U.S. shale producers. Traders and producers are seeking to stash crude to sell months down the line on expectations that prices will possibly recover towards late 2015. Up to 30 tankers have been booked for such a purpose, Reuters has reported. Storage operators looking to meet this demand include Dutch tank and terminal specialist Vopak, Hong Kong-listed Brightoil Petroleum and little -known private companies CEFC China Energy and Zhejiang Tianlu Energy Group. U.S. oil stocks hit record high as supply glut fills tanks Eni aims to shed Saipem debt by selling part of its stakeCEO U.S. crude oil inventories surged to their highest on record last week, a third consecutive weekly jump as a global crude glut fills up storage tanks, government data showed on Wednesday, while gasoline and distillate inventories fell. Crude inventories rose by 8.9 million barrels during the week, according to the Energy Information Administration (EIA). Analysts had expected an increase of 4.1 million barrels. The bulk of the rise, 5.5 million barrels, occurred in the Gulf Coast PADD 3 region. The build was somewhat less than the nearly 13 millionbarrel increase reported late on Tuesday by the American Petroleum Institute (API). Still, it follows two weeks of strong increases and left U.S. stockpiles at 406.7 million barrels, the highest level since the EIA began keeping records in 1982. "While expectations for an incredibly large crude oil inventory build were set high, the report did not disappoint in its mostly bearish tilt," said John Kilduff, partner at Again Capital LLC in New York. Eni is not interested in selling its entire stake in oil contractor Saipem but wants to get the subsidiary's debt off its books, Eni's CEO said on Wednesday. Eni, which owns 43 percent of Saipem, has previously said the oil service group is not core to its business and will be sold. At current market prices, Eni's stake in Saipem would fetch around $1.8 billion. Eni, the only big oil company with an oil service arm, is keen to get Saipem's 5 billion euros of debt off its balance sheet to help to underpin its finances in response to lower oil prices. The sale, part of a plan to shed 11 billion euros ($12.50 billion) of assets, was put on hold in December when Saipem shares fell sharply after the loss of a major contract with Russian energy giant Gazprom. North Dakota: Oil producers aim to cut radioactive waste bills North Dakota's oil industry is pushing to change the state's radioactive waste disposal laws as part of a broad effort to conserve cash as oil prices tumble. The waste, which becomes slightly radioactive as part of the hydraulic fracturing process that churns up isotopes locked underground, must be trucked out of state. That's because rules prohibit North Dakota landfills from accepting anything but miniscule amounts of radiation. The most common form of radioactive waste is a filter sock, a mesh tube resembling a sandbag through which fracking water is pumped before it's injected back into the earth. Tank and pipeline sludge are also radioactive. It's not clear how much of this waste is generated, as North Dakota officials only began requiring tracking last year; final 2014 reports aren't due until next month. Some put the number at 70 tons per day; others say 27 tons. Given that, estimates on potential savings aren't precise. But the oil industry says allowing North Dakota's landfills to accept more radioactive material could save at least $10,000 in transportation costs per truckload. worth of radioactive waste each year - a conservative estimate, state officials say - that translates to an annual savings of about $120 million statewide. Glencore considers closing S.Africa coal mines, laying off workers Global miner Glencore, the world's largest exporter of thermal coal, is considering closing some of its South African coal mines and laying off workers due to deteriorating market conditions and falling prices. Analysts believe the move would not be enough to combat a global coal supply glut but could herald the beginning of a production response to low prices. The potential closures at Optimum Coal Mines would cut production of thermal coal by at least 5 million tonnes per year and would put 1,070 jobs at risk, the company said in a statement. Optimum produces about 10 million tonnes of coal annually, half of which is sold to power utility Eskom while the rest is exported. European coal futures hit a nine-year low this week, extending a steady decline as demand has failed to keep pace with supply growth in the past few years and, more recently, imports into top consumer China's have slowed following the introduction of trade targets. 4 INSIDE U.S. OIL January 29, 2015 MARKET NEWS (Continued) Oil booked for sea storage seen at least 50 million barrels Japan's JX plans Feb crude refining down 4 pct y/y Oil booked by traders for storage at sea has reached at least 50 million barrels, industry sources said on Wednesday. In the past few weeks, trading firms including Trafigura, Vitol, Gunvor, Koch and energy company Shell have booked oil tankers for floating storage for up to 12 months. The more than 50 percent fall in spot prices since June enables traders to make money by storing the crude for delivery months down the line, when prices are expected to recover. Michael Jolliffe, co-founder and vice chairman of tanker group TEN Ltd, said the volume of floating storage was “about 50 million” barrels at the moment. Petter Haugen, shipping analyst with DNB Markets, said separately 30 VLCC supertankers – each capable of storing a maximum of 2 million barrels – had been chartered to store an estimated 60 million barrels of oil. Japan's top oil refiner JX Nippon Oil & Energy Corp said on Thursday it would refine 4 percent less crude oil for domestic consumption in February than the same month a year earlier, with milder winter weather curbing demand. The planned refining volume of 1.15 million barrels per day (5.10 million kilolitres) is the lowest for the month of February since JX Holdings was created in April 2010, a company spokeswoman said. Its January crude refining for domestic consumption was estimated at 1.13 million bpd (5.58 million kl), down 5 percent from the year-earlier period and unchanged from its original plan. The company said it imported about 1.26 million barrels of middle distillate this month, mostly from South Korea. JX permanently shut its 180,000-bpd Muroran refinery on March 31 to comply with a government requirement to boost efficiency, and its refining capacity has been reduced by 12 percent to 1.43 million bpd. REFINERY NEWS Coker shut for repairs at Motiva Port Arthur refinery sources FCCU still shut at Marathon Galveston bay refinery in Texas -sources Motiva Enterprises is repairing piping on a 95,000 barrel-per-day (bpd) coking unit at its 600,250 bpd Port Arthur, Texas, refinery while production is reduced due to planned work on other units, sources familiar with plant operations said on Wednesday. The coking unit, called Delayed Coking Unit 2, increases the amount of refinable material from a barrel of oil and converts residual crude into petroleum coke, a coal substitute. It was shut last week and is expected to be out of production for a total of four weeks, the sources said. Production at the Port Arthur refinery has been reduced while the 92,000 bpd gasoline-producing fluidic catalytic cracking unit, 49,000 bpd reformer, 18,000 bpd alkylation unit, and a sulfur recovery unit are shut for planned work, according to the sources. A 60,000 barrel-per-day (bpd) gasoline-producing fluidic catalytic cracking unit remains shut on Tuesday at Marathon Petroleum Corp's 451,00- bpd Galveston Bay Refinery in Texas City, Texas, said sources familiar with plant operations. The FCCU, which is the smaller of two at the refinery, was shut on Jan. 13 to repair a malfunction. A Marathon spokesman declined to discuss operation at the Galveston Bay refinery on Tuesday. 5 INSIDE U.S. OIL January 29, 2015 BEYOND THE HEADLINES and available only with long delays. Consumption statistics are particularly poor in terms of both accuracy and timeliness. As usual, the best data comes from the United States, where the Energy Information Administration (EIA) publishes weekly, monthly and annual estimates on the amount of “petroleum products supplied" to the domestic market. But product supplied is calculated as a residual from other data on domestic production, imports, exports and stock changes, so it is sensitive to errors in recording or estimating the other items. In particular, exports are estimated in the short term, so errors in estimating exports flow through directly into equal and opposite errors in calculating product supplied. The one point at which accurate and comprehensive data is available is when motor fuel is sold and excise taxes are paid. Federal and state governments impose excise taxes on every gallon of gasoline and diesel sold, and publish data on “taxable sales”. For example, California collects federal fuel tax of 18.4 cents on every gallon of gasoline sold as well as a state fuel tax of 36 cents per gallon. States report taxable sales to the Federal Highway Administration each month so the U.S. Department of Transportation can attribute revenues and distribute spending from the highway trust fund among the states. Unfortunately, the latest nationwide data relates to August 2014. Five months out of date, it is much too old to be useful in analysing short-term consumption trends. But some states release their own data on taxable sales much faster. California fuel sales data is available for October, only three months old. The state’s motor vehicle fuel tax is levied on gasoline upon distribution, importation or sale in the state, and there are fewer than 300 registered tax-paying entities, so the statistics are simple, comprehensive and clean. California motor vehicle fuel tax raised $5.2 billion for the State Transportation Fund in the 2012-13 fiscal year to construct and maintain public roads and mass transit systems. California is the largest motor fuel market in the country, ahead of Texas, Florida, New York and Illinois. The state accounted for 11 percent of nationwide gasoline sales in 2013, according to the EIA, or almost 39 million gallons per day. State gasoline sales can serve as a useful indicator for national trends, and they show gasoline demand is now growing rapidly. COLUMN-California gasoline sales point to growing oil demand By John Kemp Motorists in California purchased more gasoline in October 2014 than any corresponding month since 2007, according to state tax records, confirming the renewed growth in U.S. fuel demand. State gasoline consumption was 2.3 percent higher than in the same month in 2013 and 4.1 percent higher than in 2012, according to the California Board of Equalization, which collects motor vehicle fuel tax in the state. Sales have been growing since June 2013 and the trend is expected to accelerate as motorists respond to the halving of fuel prices by purchasing larger vehicles and driving more. Lower crude oil prices will gradually rebalance the market by slowing crude production growth and encouraging more use of refined fuels. GASOLINE SALES UP California’s gasoline sales have been rising for more than a year but the rate of increase accelerated in September and October 2014, coinciding with the sharp drop in pump prices. In October, California gasoline sales hit 1.272 billion gallons, up from 1.242 billion gallons in October 2013 (http:// link.reuters.com/vav83w). To switch units to something more familiar in the oil market, the extra 30 million gallons of gasoline sold in October 2014 was equivalent to an increase of 23,000 barrels per day (bpd). Multiplying up to national level, gasoline sales were more than 200,000 bpd higher across the United States in October 2014 compared with the same month a year earlier. If oil prices remain at their current level, and gasoline consumption continues to grow at recent rates, demand could easily rise by another 200,000 to 500,000 bpd in 2015. Assuming national crude oil production is flat in 2015, increased gasoline consumption from the United States alone could tighten the global oil market by between a quarter and a half a million barrels per day by the end of 2015. By itself that would not be enough to rebalance the oil market. But if U.S. diesel consumption also continues to rise, and increased fuel use is mirrored in Europe and China, thanks to lower prices, global oil consumption could easily rise by 1 million barrels per day by the end of the year. The International Energy Agency, using a more sophisticated model, predicts global oil demand will hit 94.4 million bpd in the fourth quarter of 2015, up almost exactly 1 million bpd from 93.4 million in the fourth quarter of 2014. FUEL CONSUMPTION DATA The problem with monitoring the oil market is the paucity of realtime data on either supply or demand. Data is mostly incomplete (John Kemp is a Reuters market analyst. The views expressed are his own) 6 INSIDE U.S. OIL January 29, 2015 ANALYTIC CHARTS Daily NYMEX Crude - 30 Min Daily ICE Brent Crude - 30 Min Daily ICE Gas Oil - 30 Min Daily NYMEX RBOB Gasoline - 30 Min Daily ICE Heating Oil - 30 Min Daily NYMEX Heating Oil - 30 Min (Inside U.S. Oil is compiled by Renuka Vijay Kumar in Bangalore) For more information: Learn more about our products and services for commodities professionals, click here For questions and comments on Inside U.S. Oil newsletter, click here Contact your local Thomson Reuters office, click here Your subscription: To find out more and register for our free commodities newsletters, click here © 2015 Thomson Reuters. All rights reserved. This content is the intellectual property of Thomson Reuters and its affiliates. Any copying, distribution or redistribution of this content is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in content, or for any actions taken in reliance thereon. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world. Privacy statement: To find out more about how we may collect, use and share your personal information please read our privacy statement here To unsubscribe to this newsletter, click here 7

© Copyright 2026