Download - Inland Revenue Department

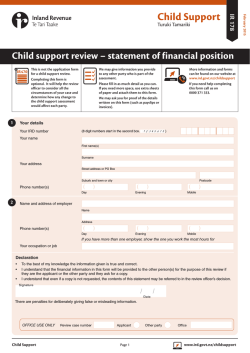

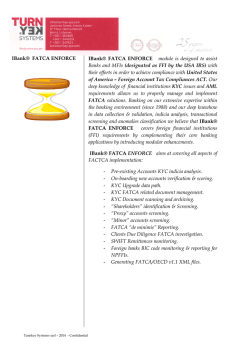

AGENTS ANSWERS Inland Revenue’s tax agents’ update Issue No 176 • February 2015 • IR 787 Planning for tax filing Welcome to 2015 and the first issue of Agents Answers. With school back and the summer holidays over, many of you will be focusing on the challenges of the year ahead. We know taxes will play a part in that so we continue to look for smart ideas to help you meet your tax requirements. Now is a great time to think about business planning for 2015. What better way to help you put a work plan in place than to give you some key dates so you can keep up to date with our tax events. See the table below. February 2015 15 Programme that issues L letters is turned off until August 2015 March 2015 23 24–25 31 The cut-off for requesting PTSs (personal tax summaries) for the year ending 31 March 2010 IR 526 forms issued to salary and wage (PTS) customers End of year for those with a standard balance date April 2015 1 E-File, PTS requests and IR 3 available 7 Payment of end-of-year tax is due (EOT clients) 14–15 IR 3 returns issued where no summary of earnings (SOE) is needed 13–14 IR 526 forms issued to IR 3 customers 18–21 Remaining IR 3 returns issued at around the same time as SOEs May 2015 June 2015 mid-June mid-June/early-August PTS confirmation available PTSs issued August 2015 early August Programme that issues L letters is turned on End-of-year preparations It’s also a good time to be thinking about your filing performance with March just around the corner. If you have clients who have an EOT but you won’t be able to file the returns by 31 March due to exceptional circumstances, then you should consider requesting deferred (D) status for them. (continued on next page) Welcome to Agents Answers In this issue: Planning for tax filing, provisional tax and interest in transitional years, clients trading online, speed up IRD number applications and GST registrations, from our technical tax area, changes to income adjustments for student loan and WfFTC, do you need to know about FATCA, certificate of exemption renewals and tax codes, understanding grace periods, Tool for Business revamped, child support is changing, latest Compliance Focus launched, upcoming changes to benefit and reimbursing allowances, updated tax agent application forms, new email scam targeting Kiwibank customers. If you have any suggestions for topics you’d like covered in this newsletter, email [email protected] REMINDERS 7 February: Income tax, student loan and Working for Families Tax Credits bills for the tax year ending 31 March 2014 are due for people who don’t have a tax agent with a valid extension of time (EOT). 13 February: This is the third interim filing date for tax agents with an EOT when 80% of returns should be filed for clients with standard balance dates. 28 February: Instalments of provisional tax and second student loan interim payments (for those with a May balance date) are due. Note: If a due date falls on a weekend, public holiday or provincial anniversary day, we can receive your return and payment on the next working day without a penalty being applied. 1 (continued from previous page) Remember all applications must be in writing. We need full details of the reasons and the expected date the return will be filed. Individual applications may be made, but bulk applications can be made for groups of companies or entities through your account manager. We need to receive your applications by Friday 13 March 2015 to be able to process them by the last working day of March (Tuesday 31 March 2015). Provisional tax and interest in transitional years The year a taxpayer changes their balance date is referred to as a “transitional year”. Tax law sets the pattern, number and amount due for provisional tax instalments in a transitional year, and the provisional tax for the following year. These rules affect what payments are due and when. This impacts tax pooling payments as well. There may be more or less than the usual three provisional tax instalments and the amounts at each instalment may not be equal, depending on factors such as when the change of balance date was approved, or when the preceding year’s tax return was filed. The rules for calculating interest are different to those for calculating provisional tax. In a transitional year there are special rules for the interest start date and the amount of residual income tax (RIT) due at each instalment date. When calculating interest, the RIT for the transitional year is divided between the provisional instalments for that year. The amount of RIT on which interest is calculated for each instalment (excluding the final instalment) is calculated using the following formula: (4 or 6)* × RIT months in transitional year *Use 4 if not registered for GST, or registered and using a monthly or two-monthly basis. Use 6 if registered for GST and using a six-monthly basis. Example A person who pays GST on a monthly basis with a standard March balance date has an August balance date approved, which results in a 17-month transitional year for 2015 (March 2014 to August 2015). The 2014 RIT is $52,000. The portion of RIT payable on the first 4 instalments for the purposes of calculating interest is: 4 × 52,000 17 = $12,235.30 Note: This amount on which interest is calculated will likely differ from the amount actually due under the provisional tax rules. The final instalment is calculated by subtracting the previous instalments from the total RIT. In this case: Previous instalments = 4 × $12,235.30 = $48,941.20 Final instalment = $52,000.00 – $48,941.20 = $3,058.80 The following resources provide more detail on transitional years: • Tax Information Bulletin Vol 5, No 11, April 1994 (pages 13–14) • Tax Information Bulletin Vol 7, No 13, May 1996 (pages 15–19) • Income Tax Act 2007, sections RC 9(11) Transitional years and RC 20(3) Formula • Tax Administration Act 1994, section 120KD. Clients trading online Do you have clients who conduct some or all of their business online? If so, we have a factsheet Online trading tax implications (IR 1022) designed to help this business group understand their tax obligations. Some online traders are unaware of their tax obligations. The IR 1022 gives pointers on taxes, paperwork and residency implications. It’s a quick read aimed at getting online traders on the right track. Keep a supply on hand for your online trader clients. You can download copies from www.ird.govt.nz (search keyword: IR1022) or order copies through your StationeryXpress account. Speed up IRD number applications and GST registrations When you apply for an IRD number or register for GST for a client we require confirmation that you have written authority to act on your client’s behalf. You can do this by attaching either a client linking form or a cover letter advising confirmation of written authority for all tax types. If you require an urgent IRD number or GST registration, you must include the reason why. Anything marked “urgent” without a valid reason will be treated as standard. AGENTS ANSWERS • Issue No 176 • February 2015 2 From our technical tax area The following summaries are from recent publications in the technical tax area of our website www.ird.govt.nz/technical-tax Full commentaries are also published in the Tax Information Bulletin. QB 14/11: Income tax – Scenarios on tax avoidance This question we’ve been asked (QWBA) is about applying section BG 1 of the Income Tax Act 2007 to three scenarios provided at a tax conference. The scenarios concern interest deductions, look-through companies and substituting debentures. A fourth scenario about debt capitalisation was included in a draft of this item consulted on earlier this year. The Commissioner is still considering the issues raised by that scenario. QB 14/12: Income tax – Foreign tax credits for amounts withheld from United Kingdom pensions This QWBA concludes that a person can’t claim a foreign tax credit in New Zealand for any amounts withheld by their United Kingdom pension provider from a United Kingdom pension. This confirms Inland Revenue’s longstanding view. HM Revenue & Customs agrees with Inland Revenue’s view and refunds amounts incorrectly paid to HMRC. The Commissioner has prepared the Commissioner’s operational position on foreign tax credits for amounts withheld from United Kingdom pensions, which can be found at www.ird.govt.nz (search keywords: foreign uk). QB 14/13: GST – Lotteries, raffles, sweepstakes and prize competitions of interest to non-profit groups who run these events as part of their fundraising activities. Where a registered person is running one of these events, GST needs to be accounted for on any ticket sales less any cash prizes paid or payable. The item covers similar content to BR Pub 07/11 “GST – Lottery operators and promoters”, which expired on 21 December 2012. It isn’t a change in view by the Commissioner and doesn’t apply to racing or sports betting. BR Pub 14/09: Income tax – Meaning of “anything occurring on liquidation” when a company requests removal from the register of companies This public ruling considers the meaning of “anything occurring on liquidation” in the context of a company which requests removal from the register of companies under s 318(1)(d) of the Companies Act 1993. The ruling concludes that liquidation of a company is a process, and the first step to start that process will usually be a resolution of shareholders to cease business, pay all creditors, distribute surplus assets, and to then request removal from the register. BR Pub 14/10: FBT – Provision of benefits by third parties – section CX 2(2) This public ruling considers when a benefit provided to an employee by a third party will be considered a fringe benefit under s CX 2(2) of the Income Tax Act 2007. The ruling provides a list of situations where the provision of a benefit by a third party will, and will not, be considered to be a fringe benefit. This item explains the GST rules for running a raffle, lottery, sweepstake or prize competition. It might be Changes to income adjustments for student loan and WfFTC If you have clients with a student loan or Working for Families Tax Credits (WfFTC), a number of new income types and adjustments will be used to calculate loan repayment obligations and WfFTC entitlements on income received on or after 1 April 2014. Student loans only Most of the income types and adjustments for student loans are the same as those for WfFTC. However, we need to know about any distributions from trusts that are not beneficiary income and/or foreign-sourced income of any non-resident student loan borrowers we treat as being physically present in New Zealand. Working for Families Tax Credits only The following are used for WfFTC adjustment purposes only: • passive income earned by a dependent child (or children) • other payments received New income types for both There are two new income types we need to know about for both WfFTC and student loans: • salary or wages exchanged for private use of an employer-provided motor vehicle • receiving a short-term charge facility (including vouchers) to purchase goods and services their employer pays for. Where to find more information For the full list of income types and adjustments go to www.ird.govt.nz (search keywords: adjust income). Here you can see: • all the income and adjustment types • the years they apply to • how the calculations work • which social policy they apply to. There are also handy examples to help you complete the Adjust your income for Working for Families Tax Credits (WfFTC) (IR 215). • income earned by a non-resident spouse/partner. AGENTS ANSWERS • Issue No 176 • February 2015 3 Do you need to know about FATCA? If you’re a New Zealand financial institution (NZFI) or similar organisation, the United States (US) Foreign Accounts Tax Compliance Act (FATCA) may apply to you. Key dates The table below contains key dates for NZFIs. Date Past events 12 June 2014 Intergovernmental Agreement (IGA) signed between United States and New Zealand 30 June 2014 Royal Assent for New Zealand legislation to allow New Zealand financial institutions to collect and report data on their United States customers 1 July 2014 IGA takes effect in New Zealand and the United States 31 December 2014 Deadline for NZFIs to register with the IRS. How FATCA could affect your business FATCA requires all foreign financial institutions that are not exempt, including NZFIs, to register with and report to the US Internal Revenue Service (IRS) each year on US citizens and US tax residents, who have specified foreign financial assets that exceed certain thresholds. What you need to do If you’re unsure if this legislation applies to your client refer to our website www.ird.govt.nz (search keyword: FATCA). You’ll need to find out as soon as possible as the first disclosures for the 31 March 2015 year need to be sent to us by 30 June 2015. If you establish that you need to send annual FATCA disclosures to us you can send this through our new FATCA system—the International Data Exchange Portal (IDEP). The IDEP will be available on our website to all New Zealand reporting entities. We’ll act as an intermediary between NZFIs and the IRS and will provide services to collect and securely store FATCA-related information from NZFIs, sponsoring entities and third-party service providers (where permitted). We′ll then forward this information to the IRS as required by the New Zealand/United States Intergovernmental Agreement. Beginning in February 2015 you’ll be able to enrol for this service on our website and check that you can create a disclosure and upload your XML files using IDEP. We’ll be offering support for FATCA-related enquiries, from now until the “go-live” date of 1 April 2015. You’re welcome to email queries and feedback to [email protected] Event If you still need to register with the IRS you should do this immediately and find out what the consequences are for not having registered by 31 December 2014 Coming events 1 April 2015 NZFIs to start providing FATCA data to us 30 June 2015 Last day to provide FATCA data to us for 31 March 2015 year 30 September Last day for us to send 2015 New Zealand’s aggregate FATCA data to the IRS for the period up to 31 March 2015 Starting 1 April 2015 the system will be live and you’ll be able to submit your first FATCA disclosures to us. We′ll provide a dedicated 0800 number for FATCArelated enquiries. For information on how to enrol and send data using IDEP refer to our “Foreign Account Tax Compliance Act (FATCA) Inland Revenue user guide”, on our website www.ird.govt.nz (search keyword: FATCA). AGENTS ANSWERS • Issue No 176 • February 2015 4 Certificate of exemption renewals and tax codes With the tax year drawing to an end it’s time to talk about renewing certificates of exemption (COEs) and applying for special tax codes (STCs). Renewing a COE from tax on schedular payments If your client’s COE is about to expire, now’s the time to apply for a renewal using our online service “Apply for or renew a certificate of exemption from PAYE on schedular payments” at www.ird.govt.nz under “Get it done online”. To qualify, your client needs to: • be in business • receive schedular payments subject to a prescribed rate of tax under Schedule 4 of the Income Tax Act 2007 • have a good record in New Zealand for filing returns and paying tax when it’s due. Note: If your client is a non-resident contractor, write to us at: Inland Revenue PO Box 2198 Wellington 6140 Or call us on 04 890 3056. Companies operating in the agriculture, horticulture and viticulture industries can apply for a COE from tax on schedular payments. If you have any questions about this, call us on 0800 377 774. Applying for an STC or a COE from resident withholding tax Our online service “Apply for or renew a certificate of exemption from PAYE on schedular payments” can’t be used for applications for an STC or an exemption from resident withholding tax (IPE). This service can’t accept these applications and they will be declined. Instead, you need to download and fill in a Special tax code application (IR 23BS) form and post it to us. For an application to be exempt from resident withholding tax we need a completed Application for exemption from resident withholdinww tax (RWT) on interest and dividends (IR 451) form. Both these forms can be downloaded from www.ird.govt.nz “Forms and guides”. Understanding grace periods Grace periods apply to all tax types registered under any IRD number or entity, except child support, student loan repayments, donation tax credits and any late paid provisional tax instalments. They are calculated per customer not tax type and cover all eligible taxes due on the same day. Grace periods are considered when remission requests are made but use-of-money interest (UOMI) remains payable. If you deal with entities that have several divisions or branches, ie, multiple IRD numbers, the entity is eligible for only one grace period across the whole entity. Example Jolly Jacks Jelly Bunnies is a large company with branches across New Zealand. Each branch has its own IRD number. The branch in Nightcaps was late filing their November 2014 GST and the branch in Eketahuna was late filing their December 2014 GST. Only one will be given a grace period. In this case Nightcaps gets the grace period and Eketahuna will need to pay full penalties and interest. During the grace period (about 28 days) you’ll get a letter on your client’s behalf explaining the grace period and what action needs to be taken before penalties are added to their account. Your client will then get a letter two weeks later. This leaves less than two weeks for them to organise payment or make an arrangement. Reminding your client to take some action before the extended due date can help minimise any penalties. Tool for Business revamped The “Tool for Business” is an online interactive tool providing small business customers with an easy-to-use resource to get their tax obligations sorted quickly. We’ve recently updated this tool to a mobile-friendly format so it can be used from a mobile device wherever you or your clients have access to online services and a charged portable device. Check it out at www.ird.govt.nz/tool-for-business/ Please recommend it to your small business clients. It could save both you and them time. AGENTS ANSWERS • Issue No 176 • February 2015 5 Child support is changing Updated tax agent application forms The new way to work out child support assessments starts on 1 April 2015. Last June we changed the way you apply to be listed as a tax agent. As a result of your feedback we’ve made some changes to the application forms to make them easier to understand and complete. We’ll send notices to customers from mid-February letting them know the new amount of child support they’ll pay or receive. In mid-March, we’ll let employers know how much to deduct from each payday from April onwards. Starting on 1 April 2016, we’ll be making further changes to improve child support. These changes include a new administrative review ground and a lower maximum age of eligibility. There will also be new debt and penalty rules if customers fall behind with payments. We’ll continue to keep customers and employers informed of changes throughout the year. For more information on the changes and notices, please direct your clients to www.ird.govt.nz/cskey Latest Compliance Focus launched Late last year we launched Our Compliance Focus 2014–15. Have you taken a look yet? It includes a section for businesses with updated information on our areas of focus and some tax basics for everyone. Once you’ve downloaded the booklet you can email it to your clients or share with them in person to show you’re up to date with the latest issues in the world of tax. It will help you provide the best possible advice to ensure they get their taxes right. What you need to do If you’re applying to be listed as a tax agent you need to complete an Application to be listed as a tax agent or update a tax agent’s details (IR 791) form. If a tax agent is an entity (not a natural person), each key office holder needs to complete a separate Statutory declaration of a key office holder in support of an application to be a listed tax agent (IR 768) form. You must attach these to your IR 791 application form. You also need to attach an example of your authority to act letter and a list of at least 10 clients who are required to file income tax returns (not personal tax summaries) and for whom you hold signed authorities. If you stop being a tax agent you don’t need to complete these forms, instead you need to contact your account manager. For more information and support please go to www.ird.govt.nz/taxagents New email scam targeting Kiwibank customers Kiwibank customers are being targeted via email by scammers notifying them they have a tax refund and asking them to click on a link and enter their account information. Take a look and share today. You can download the new booklet from www.ird.govt.nz/taxagents/compliance/ Upcoming changes to benefit and reimbursing allowances Changes to the tax treatment of allowances that your clients might pay to their employees take effect on 1 April 2015. Allowances are payments made to an employee in addition to their salary or wage and can include payments for accommodation, food or clothing. A number of emails reporting this scam have been forwarded by customers to us at [email protected] We’ve notified Kiwibank and the Department of Internal Affairs′ scam unit. If you have clients who are customers of Kiwibank please warn them that this is a scam. Tell them to ignore and delete the email. The changes clarify the tax treatment of employerprovided accommodation, accommodation payments and other allowances or payments made by employers to cover employee expenditure. For detailed information about these changes, including if you can retrospectively apply the new rules, go to www.ird.govt.nz (search keywords: benefit allowances). Agents Answers comments generally on topical tax issues relevant to tax agents. Every attempt is made to ensure the law is correctly interpreted, but articles are intended as a brief overview only. The examples provided are not intended to cover every possible factual situation. Email: [email protected] www.ird.govt.nz AGENTS ANSWERS • Issue No 176 • February 2015 6

© Copyright 2026