Download PDF - Turnkey Systems Sarl

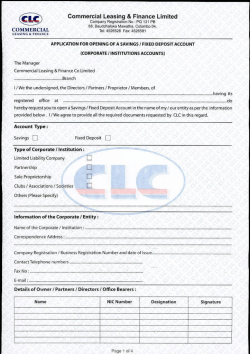

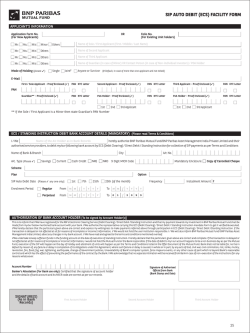

IBank® FATCA ENFORCE IBank® FATCA ENFORCE module is designed to assist Banks and MFIs (designated as FFI by the USA IRS) with their efforts in order to achieve compliance with United States of America – Foreign Account Tax Compliances ACT. Our deep knowledge of financial institutions KYC issues and AML requirements allows us to properly manage and implement FATCA solutions. Banking on our extensive expertise within the banking environment (since 1988) and our deep knowhow in data collection & validation, indicia analysis, transactional screening and anomalies classification we believe that IBank® FATCA ENFORCE covers foreign financial institutions (FFI) requirements by complementing their core banking applications by introducing modular enhancements. 1194984469218270249clessidra_architetto_fra_01.svg.med.png 177×297 pixels 04/10/2012 09:15 IBank® FATCA ENFORCE aims at covering all aspects of FACTCA implementation: - Pre-existing Accounts KYC indicia analysis. On-boarding new accounts verification & scoring. KYC Upgrade data path. KYC FATCA related document management. KYC Document scanning and archiving. “Shareholders” identification & Screening. “Proxy” accounts screening. “Minor” accounts screening. FATCA “de minimis” Reporting. Clients Due Diligence FATCA investigation. SWIFT Remittances monitoring. Foreign banks BIC code monitoring & reporting for NPFFIs. Generating FATCA/OECD v1.1 XML files. http://www.clker.com/cliparts/7/5/6/0/1194984469218270249clessidra_architetto_fra_01.svg.med.png - Turnkey Systems sarl – 2014 - Confidential Page 1 of 1 Module Overview MS Active Directory Integration:. User security profiles are integrated with MS Active Directory for unified account & groups authentication policies. Customizable Business Process Execution Workflow (BPEW): IBank® FATCA ENFORCE module embeds a proprietary built in multi-level workflow process for escalation, monitoring & follow up of accounts and transactions based on pre-defined rules defined within the “Business Logic Workflow Engine” thus generating detection process results. Suspicious transactions tagging and case follow up are simplified. A complete historical workflow of all test cases is stored for future reference. Continuous investigation and monitoring on daily basis covering new and existing accounts for any FATCA indicia changes. Remittances Monitoring & Withholding in Real Time. SWIFT outgoing remittances are validated and scanned (In both DOS PCC or RJE formats) against the clients and correspondent records within IBank® FATCA ENFORCE module. Recalcitrant clients and non participating FFIs destined remittances will be withheld before being rejected or released based on a user defined compliance workflow. Advanced dedicated reporting engine that covers the basic FATCA requirements in addition to that banks can create reporting templates covering various KYC classification and investigation requirements. Turnkey Systems sarl – 2014 - Confidential Design Architecture Staging Area Building: The staging area required by IBank® FATCA ENFORCE module is designated for extracting customers’ required data from Legacy Core Banking application in order follow up, query, report and investigate FATCA suspicious activities or follow on FATCA compliant Accounts. Client Based Reporting & Query: FATCA Regulatory reporting and queries are produced based on “customer” set criteria. Historical Scenario Builder: The staging data area is maintained continuously and historical data is sifted through to assist in recognizing behavioral patterns or initiate a cognitive scenario for FATCA investigation related Scenarios. Turnkey Systems sarl – 2014 - Confidential FATCA KYC CHECKLIST IBank® FATCA ENFORCE module is designed from ground up to upload and complement existing KYC data within core banking applications. IBank® FATCA ENFORCE incorporates into the bank’s KYC the following data for detailed indicia investigation: v USA Nationals (Primary / Acquired nationality / Additional Nationality). v Country of Birth v Spouse Nationality. v Green Card Holders (Permanent Resident). v Companies registered in the USA (USA Corporations). v Share Holders subject to FATCA. v Clients exceeding 180 days residency within. USA territorial borders. v SS/I-TIN/P-TIN/A-TIN Number for Individuals. v Employer Identification Number of Companies. v PFFI/FFI/Compliant/Non Participating classification for correspondent and financial institutions. v GIIN Management for FFIs v USA address for FATCA compliant accounts based on USA adopted format: - Street number - Street name - Building - Apartment number - City - State - Zip code (embedded cross validation between states and zip codes for additional accuracy). - Ultimate beneficiary full KYC. - Proxy Accounts full KYC. Turnkey Systems sarl – 2014 - Confidential FATCA INDICIA INVESTIGATION IBank® FATCA ENFORCE module analyses, investigates and scores KYC FATCA related indicia by sifting through KYC & historical transactions. IBank® FATCA ENFORCE clients will be screened and analyzed for possible FATCA avoidance. IBank® FATCA ENFORCE will deploy several user controlled scenarios for analyzing and validating existing customer while at the same time controlling the on-boarding process of new accounts. The investigative process covers the following indicia: - Original, Acquired & Additional Nationality. USA Country of birth. USA based residency or mailing address. Suspicious keyword phonetic investigation in all addresses. USA based phone number (Mobile or Landline). Green Card Holder. 181 day per year resident. Ultimate beneficiary nationality. Standing instructions covering USA outbound / inbound remittances. SWIFT USA outbound / inbound remittances. Additional drill down investigative scenarios covers the following methods are: - - Turnkey Systems sarl – 2014 - Confidential KYC Level v Joint account holders cross checking (if one of the holders is subject to FATCA compliance). v Proxy accounts (if one of the parties is subject to FATCA compliance). v Shareholders vs Multiple accounts cross checking. Transactional Level v SWIFT RJE file analysis for clients with Incoming/Outgoing Remittances from/to the USA without being FATCA compliant within the KYC. FATCA GIIN Management Turnkey Systems sarl – 2014 - Confidential IBank® FATCA ENFORCE is designed to load automatically the GIIN (Global Intermediary Identification Number) list distributed by the IRS related to compliant and participating FFIs. Based on the IRS GIIN the SWIFT BIC Correspondent table will be updated regarding their FATCA status. SWIFT remittances monitoring will be based jointly on the FATCA GIIN status and the client status. IRS GIIN list can be updated, queried and listed from within IBank® FATCA ENFORCE module. IBank® FATCA ENFORCE SWIFT Monitoring allows for SWIFT outgoing remittances to be validated in real time flow without disrupting the normal business flow. IBank® FATCA ENFORCE will scan all SWIFT messages and flagging recalcitrant clients, non US clients and Non participating FFIs. Based on a user defined compliance workflow, SWIFT messages can be released for transmission, cancelled or withheld amount computed and release for transmission. FACTA Enforce SWIFT GENERATOR FACTA Enforce SWIFT Validtor FACTA Enforce Outgoing Remittances Monitoring FATCA SWIFT Monitoring Turnkey Systems sarl – 2014 - Confidential IBANK® SWIFT Manager FATCA Reporting Document Management & Automatic FATCA documents management is fully maintained by the IBank® FATCA ENFORCE. Documents printout generation for endorsement as well as document acquisition and scanning are both fully integrated within IBank® FATCA ENFORCE module i.e.: • • • • • • Signed IRS W9 Signed IRS W8-GEN Signed Waiver Passport Picture SS Card Picture Driver License IRS declared reporting thresholds definition is parametric and can be easily maintained based on IRS requirements. The reporting levels within IBank® FATCA ENFORCE are: reporting levels within IBank® FATCA ENFORCE are: v Balance Reporting Thresholds. v Gross receipt / Gross withdrawal reporting. v FATCA declared, USA resident IRS reporting threshold. v FATCA declared, Non-USA resident IRS reporting threshold. v New FATCA compliant accounts reporting. v Withheld accounts reporting. v IRS reporting File generation. Turnkey Systems sarl – 2014 - Confidential Advanced Reporting IBank® embeds an advanced reports processor allowing for a highly flexible generation criteria, output criteria and output formats. All output reports are produces in any of the following formats: MS Excel format (.xls). PDF format. Screen View format. Physical Printout. • • • • • • Advanced reporting functionality. Multiple Output Formats (MS Excel, PDF, Screen Viewing, Physical Output) Multiple Output Media (A3, A4, US Fanfold) Automated Distribution List (via Email). Automatic Archiving Feature. Manual & Automated production capability (via Batch Processor). • Turnkey Systems sarl – 2014 - Confidential Physical output format can be any of the following: A3 A4 US Fanfold. Produced reports can be automated and linked to a user defined distribution list. Reports will be generated in “PDF” format and distributed via email. Generated reports can be archived in PDF format and retrieved for viewing is based on any or a combination of criteria. BPEW Business Process Execution Workflow: “Business Process Execution Workflow” BPEW is implemented throughout our AML/CTF module allowing for thorough compliance tickets reporting, escalation, management and closure. Our proprietary “Business Process Workflow” engine is designed to span multi-locations. Advanced WYSIWYG functionality workflow definition and deployment. BPEW functionality can produce a documented printout that can be utilized for further business process documentation. • • • • • • • • Business Process Execution Workflow proprietary Engine. User selectable criteria. GUI Workflow Processor Modeling. Implemented throughout all modules. Unlimited Workflow Processes definition. Workflow Viewer functionality (locate process within Workflow streamline). Documents & Reports can be attached to workflow cycles. Multi-Location / Multi Sites functionality. Turnkey Systems sarl – 2014 - Confidential FATCA Case Management • • • • • Cover all cases opened by the compliance officer Process workflow Management. Follow up and reminders for open cases. Closure time limit. Customer Dashboard information for quick case resolution. Turnkey Systems sarl – 2014 - Confidential IBank® FATCA ENFORCE employs an effective case management procedure for easy investigation and reporting of FATCA suspicious activities. By defining a “Business Process Execution Workflow” based on case scenarios, findings will initiate “Alerts” that are logged for investigative follow up. In order to facilitate investigative task a widget dashboard is automatically presented to each case officer and throughout the workflow, comprising of current case anomaly, previous cases history for the same customer, transactional behavioral graph etc. All historical case data are kept in the database for future reference by auditors and regulatory bodies. All reports are archived in “PDF” format for retrieval. Moreover case workflow and reviewing process is stored in in-house investigation of employees. About us The Company TURNKEY SYSTEMS sarl is a leading software house in Lebanon that was established in 1988. TURNKEY SYSTEMS specializes in retail banking and large corporate business application integration. Currently our banking, financial & retail applications are running in various banks and around 40 corporates. Turnkey Systems sarl currently operates in Lebanon, Jordan and Cyprus. Our technical staff today numbers 25 highly trained Project manager/developers who combine higher education with experience. In addition to the technical staff, we have a team of six administration employees and an IT security officer. Turnkey Systems sarl have been ISO certified since 2004. Currently our establishment is ISO 9001:2008 Quality Management Certificated for IT Development. Currently we are registered to obtain the ISO 17799 Certification regarding IT Security, we expect to fulfill the certification requirements during the second half of 2015. Our main GUI development platform is Sybase PowerBuilder. Our Web Development is platform is Microsoft Silverlight. Within our staff we have two certified CITRIX administrator to insure the compatibility between our applications and the deployment of CITRIX environment for centralization or Web deployment. TURNKEY SYSTEMS services falls basically into four categories: - - Turnkey Systems sarl – 2014 - Confidential System Integrators: Offering consultation covering requirement studies, hardware specifications, tendering and selection, design of organizational procedures and workflow re-engineering. Application Development & Implementation of turnkey software applications. Wide Area Network design, implementation and commissioning. IT outsourcing for banks and large companies. Currently we are running 5 IT sites. Headquarters: Beirut - Lebanon 7th & 9th Floor – Aresco Center Justinian Street - Near Central Bank Tel : +961 (01) 352485 / 344009 +961 (03) 292905 Fax : +961 (01) 347423 Email : [email protected] Contingency Site: Beirut – Lebanon Dana Bldg –Emile Eddeh Street Office Hours: M-to-F 8:30 till 16:00 Beirut Local Time. Turnkey Systems sarl – 2014 - Confidential

© Copyright 2026