Call Report Boot Camp - Financial Managers Society

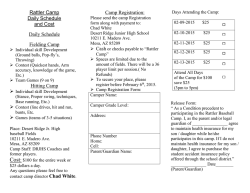

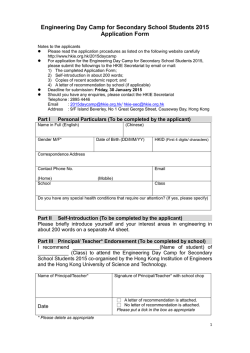

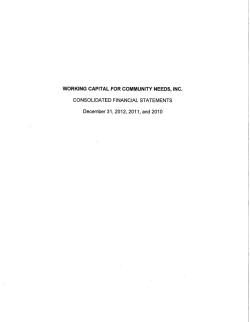

3 WAYS TO REGISTER QUESTIONS? Call 800-ASK-4FMS (800-275-4367) Mail: Financial Managers Society Fax: 312-578-1308 Internet: www.fmsinc.org/CALENDAR 1 North LaSalle Street, Suite 3100 Chicago, IL 60602-4003 Presorted Standard U.S. Postage PAID Wheeling, IL Permit No. 38 Registration NAME MARCH 10-11, 2015 TITLE Call Report Boot Camp ORGANIZATION MAILING ADDRESS CITY, STATE, ZIP MARCH 12, 2015 ASSET SIZE PHONE Half-Day Workshop: Consolidated Financial Statements for Bank Holding Companies FAX E-MAIL REGISTER Please select from one of the following options. Call for details about team discounts. Call Report Boot Camp | March 10-11, 2015 ○ FMS Member: $1,050 ○ Coworker of Member: $1,150 ○ Nonmember: $1,450 Orlando, FL | Hard Rock Hotel® at Universal Orlando® Resort $ $ $ Half-Day Workshop: Consolidated Financial Statements | March 12, 2015 ○ FMS Member: $400 $ ○ Coworker of Member: $425 $ ○ Nonmember: $550 $ Call Report Boot Camp + Half-Day Workshop | March 10-12, 2015 ○ FMS Member: $1,350 ○ Coworker of Member: $1,450 ○ Nonmember: $1,650 $ $ $ TOTAL $ Card # Exp. Date Signature Refunds and Cancellations A refund minus a $150 processing fee will be provided for cancellations received by FMS in writing by February 14, 2015. No refunds will be given for cancellations received after that date. A substitution from your institution is welcome at any time. FMS reserves the right to change instructors or reschedule/cancel sessions when necessary. FMS is not responsible for airfare penalties incurred due to the cancellation of the program. www.fmsinc.org 800-ASK-4FMS (800-275-4367) o Check enclosed payable to Financial Managers Society o Charge my MasterCard, Visa or American Express 1 North LaSalle Street, Suite 3100 Chicago, IL 60602-4003 METHOD OF PAYMENT Payment must accompany registration. FMS members and their co-workers save $100 each when two or more employees register for this seminar. Simply complete one form per person and deduct $100 from each registration fee. $ $ Save $100 Not an FMS member? Join now and save on registration! ○ FMS Regular Membership: $450 ○ FMS Affiliate Membership: $495 With a Members-only Team Discount! Please list any special accommodations (including dietary restrictions) you require. Essential Education for Your Staff Call Report Boot Camp Providing a unique approach that offers both a business and accounting focus, Call Report Boot Camp is an intensive and comprehensive analysis of all the information you need to accurately fulfill your reporting requirements. This unique program is specially designed for community institutions that are required to file the quarterly form FFIEC #041 and is ideal for both seasoned professionals, as well as newcomers facing the challenges of Call Report preparation. Led by industry expert Paul J. Sanchez, CPA, CBA, CFSA, this two-day seminar will provide participants with the essential “need-to-know,” basic call report information, as well as offer the insights and tools you need to ensure your institution can successfully prepare an accurate and complete Call Report. You Will Learn: • How to accurately and efficiently prepare your institution’s Call Report • How to properly comply with the extensive Call Report instructions • How to better understand the Call Report within the context of your bank’s business practices and accounting policies and procedures Agenda Tuesday, March 10, 2015 Wednesday, March 11, 2015 8:00 am 8:00 am 8:30 am to 4:30 pm 8:30 am to 4:00 pm General Call Report Filing Information Review of Somewhat Difficult Schedules – Cont. •Deposit Liabilities (RC-E) •Other Data for Deposit Insurance and FICO Assessments (RC-O) •Off-Balance Sheet Items (RC-L) •Regulatory Capital (Schedule RC-R) – including Basel III discussions Registration and Continental Breakfast Review of Call Report Financial Statements •Balance Sheet (Schedule RC) •Income Statement (Schedule RI) Review of Least Difficult Schedules •Cash and Balances Due From Depository Institutions (RC-A) •Other Assets (RC-F) •Other Liabilities (RC-G) •Trading Assets and Liabilities (RC-D) •Memoranda (RC-M) •Quarterly Averages (RC-K) Review of Somewhat Difficult Schedules •Securities (RC-B) •Loans and Leases (RC-C) •Past Due and Non-Accrual Assets (RC-N) •Charge-offs and Recoveries on Loans and Leases and Changes in Allowance for Credit Losses (RI-B) •Changes in Equity (Schedule RI-A) Continental Breakfast Review of Other Schedules Not Used by All Institutions •Mortgage Banking Activities (RC-P) •Bank Securitization and Asset Sales (RC-S) •Fiduciary and Related Services (RC-T) •Financial Assets and Liabilities Measured at Fair Value RC-Q) •Variable Interest Entities (RC-V) •Changes in Equity (RI-A) Questions About Your Institution’s Call Report (Bring your latest Call Report filing) Summary and Wrap-Up Post-Seminar Half-Day Workshop Consolidated Financial Statements for Bank Holding Companies Enhance your Call Report Boot Camp experience with the extra half-day workshop on Consolidated Financial Statements for Bank Holding Companies. This workshop provides valuable information about the Consolidated Bank Holding Company Reports that are filed quarterly by Bank Holding Companies (BHCs) and Savings and Loan Holding Companies (SLHCs) with their appropriate district Federal Reserve Bank. The half-day coverage is designed for preparers, reviewers, analysts, auditors and others who work with Consolidated Financial Statements. The primary focus is on the two most prominent forms (the FR Y-9C and the FR Y-LP) and the “creation” of the Consolidated Balance Sheet (Schedule HC) and Consolidated Income Statement (Schedule HI). Coverage will also include an overview of the following reports: • FR Y-6 – Annual Report of BHCs • FR Y-8 – Section 23 “Covered” Transactions •FR Y-10 – Changes in Organizational Structure •FR 2900 – Report of Transactions, Accounts, Other Deposits and Vault Cash •FR 2644 – Weekly Report of Selected Assets and Liabilities of Domestic Chartered Banks •UBNCPR – The Uniform Bank Holding Company Performance Report *You do not need to be registered for Call Report Boot Camp to attend this half-day program. Agenda Thursday, March 12, 2015 8:00 am Registration, Coffee and Refreshment Service 8:30 am to 12:00 pm Background Information Re: Business Combinations General Information About the Bank Holding Company Reports (Form FR Y-9C and Form FR Y-9LP) •Reporting Criteria •Exemptions from Reporting •Shifts in Reporting Status •Electronic Filing •GAAP Consolidation “Rules” •Exclusion from Coverage on Form FR Y-9C •Rounding •Negative Amounts •Verification/Sign-off •Amended Reports Consolidated Balance Sheet (Schedule HC) Consolidated Income Statement (Schedule HI) Review of Required Regulatory Reports – Other • Annual Report of BHCs (FR Y-6) • Section 23 “Covered” Transactions (FR Y-8) • Changes in Organizational Structure (FR Y-10) • Report of Transactions, Accounts, Other Deposits and Vault Cash (FR 2900) • Weekly Report of Selected Assets and Liabilities of Domestic Chartered Banks (FR 2644) Corporate Governors’ Analytical Overview: The Bank Holding Company Performance Report (BHCPR) Questions About Your Institution’s Holding Company Reports Summary and Wrap-Up Faculty Paul J. Sanchez, CPA, CBA, CFSA, conducts a small CPA practice and owns and operates Professional Service Associates, a consulting and professional training and development business that services corporate clients (auditors, controllers, etc.), CPA firms, professional associations and others. Prior to starting his consulting business, Paul was the Vice President for the Audit Division of a regional bank and a money-center bank. There he directed the professional practice development and training for internal auditors. Paul was also a technical staff member of the Auditing Standards and Examinations Divisions of the AICPA, and was an assistant professor at Long Island University — C.W. Post Campus, and an adjunct lecturer at City University of New York. He is the author of the publication Accounting Basics for Community Financial Institutions (Financial Managers Society, 2004 and 2009 editions) and the monthly publication The Ideas and Analysis Letter: The Sanchez “Take”. Details Location and Accommodations Hard Rock Hotel® at Universal Orlando® Resort 5800 Universal Boulevard Orlando, FL 32819 Special FMS Room Rate: $209 Single/Double Deadline for Rate: February 14, 2015 For Reservations Call: 1-866-360-7395 Identify yourself as an attendee of the Financial Managers Society program to receive the preferred rate. If you are making reservations through a travel agent, be sure to request that your reservation be placed in the FMS room block to guarantee the best rate. Tax-Deductible Programs An income-tax deduction may be allowed for educational expenses (including registration, travel, meals and lodging) undertaken to maintain or improve professional skills. (Treas. Reg. Sec. 1.162-5) Attire Business-casual attire is appropriate. Since hotel rooms are often cool, please bring a jacket or sweater. CPE Credit Earn up to 19 hours of CPE credit Level: Basic to Intermediate Prerequisites: None Advance preparation: None Field of Study: Accounting Instructional Method: Live-Group FMS is registered with the National Association of State Boards of Accountancy as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses. Complaints regarding sponsors may be addressed to: The National Registry of CPE Sponsors, 150 Fourth Avenue, North, Suite 700, Nashville, TN 37219-2417 Web: www.nasba.org. For more information regarding administrative policies such as complaints or refunds, call 800-ASK-4FMS (800-275-4367). Call Report Boot Camp Providing a unique approach that offers both a business and accounting focus, Call Report Boot Camp is an intensive and comprehensive analysis of all the information you need to accurately fulfill your reporting requirements. This unique program is specially designed for community institutions that are required to file the quarterly form FFIEC #041 and is ideal for both seasoned professionals, as well as newcomers facing the challenges of Call Report preparation. Led by industry expert Paul J. Sanchez, CPA, CBA, CFSA, this two-day seminar will provide participants with the essential “need-to-know,” basic call report information, as well as offer the insights and tools you need to ensure your institution can successfully prepare an accurate and complete Call Report. You Will Learn: • How to accurately and efficiently prepare your institution’s Call Report • How to properly comply with the extensive Call Report instructions • How to better understand the Call Report within the context of your bank’s business practices and accounting policies and procedures Agenda Tuesday, March 10, 2015 Wednesday, March 11, 2015 8:00 am 8:00 am 8:30 am to 4:30 pm 8:30 am to 4:00 pm General Call Report Filing Information Review of Somewhat Difficult Schedules – Cont. •Deposit Liabilities (RC-E) •Other Data for Deposit Insurance and FICO Assessments (RC-O) •Off-Balance Sheet Items (RC-L) •Regulatory Capital (Schedule RC-R) – including Basel III discussions Registration and Continental Breakfast Review of Call Report Financial Statements •Balance Sheet (Schedule RC) •Income Statement (Schedule RI) Review of Least Difficult Schedules •Cash and Balances Due From Depository Institutions (RC-A) •Other Assets (RC-F) •Other Liabilities (RC-G) •Trading Assets and Liabilities (RC-D) •Memoranda (RC-M) •Quarterly Averages (RC-K) Review of Somewhat Difficult Schedules •Securities (RC-B) •Loans and Leases (RC-C) •Past Due and Non-Accrual Assets (RC-N) •Charge-offs and Recoveries on Loans and Leases and Changes in Allowance for Credit Losses (RI-B) •Changes in Equity (Schedule RI-A) Continental Breakfast Review of Other Schedules Not Used by All Institutions •Mortgage Banking Activities (RC-P) •Bank Securitization and Asset Sales (RC-S) •Fiduciary and Related Services (RC-T) •Financial Assets and Liabilities Measured at Fair Value RC-Q) •Variable Interest Entities (RC-V) •Changes in Equity (RI-A) Questions About Your Institution’s Call Report (Bring your latest Call Report filing) Summary and Wrap-Up Post-Seminar Half-Day Workshop Consolidated Financial Statements for Bank Holding Companies Enhance your Call Report Boot Camp experience with the extra half-day workshop on Consolidated Financial Statements for Bank Holding Companies. This workshop provides valuable information about the Consolidated Bank Holding Company Reports that are filed quarterly by Bank Holding Companies (BHCs) and Savings and Loan Holding Companies (SLHCs) with their appropriate district Federal Reserve Bank. The half-day coverage is designed for preparers, reviewers, analysts, auditors and others who work with Consolidated Financial Statements. The primary focus is on the two most prominent forms (the FR Y-9C and the FR Y-LP) and the “creation” of the Consolidated Balance Sheet (Schedule HC) and Consolidated Income Statement (Schedule HI). Coverage will also include an overview of the following reports: • FR Y-6 – Annual Report of BHCs • FR Y-8 – Section 23 “Covered” Transactions •FR Y-10 – Changes in Organizational Structure •FR 2900 – Report of Transactions, Accounts, Other Deposits and Vault Cash •FR 2644 – Weekly Report of Selected Assets and Liabilities of Domestic Chartered Banks •UBNCPR – The Uniform Bank Holding Company Performance Report *You do not need to be registered for Call Report Boot Camp to attend this half-day program. Agenda Thursday, March 12, 2015 8:00 am Registration, Coffee and Refreshment Service 8:30 am to 12:00 pm Background Information Re: Business Combinations General Information About the Bank Holding Company Reports (Form FR Y-9C and Form FR Y-9LP) •Reporting Criteria •Exemptions from Reporting •Shifts in Reporting Status •Electronic Filing •GAAP Consolidation “Rules” •Exclusion from Coverage on Form FR Y-9C •Rounding •Negative Amounts •Verification/Sign-off •Amended Reports Consolidated Balance Sheet (Schedule HC) Consolidated Income Statement (Schedule HI) Review of Required Regulatory Reports – Other • Annual Report of BHCs (FR Y-6) • Section 23 “Covered” Transactions (FR Y-8) • Changes in Organizational Structure (FR Y-10) • Report of Transactions, Accounts, Other Deposits and Vault Cash (FR 2900) • Weekly Report of Selected Assets and Liabilities of Domestic Chartered Banks (FR 2644) Corporate Governors’ Analytical Overview: The Bank Holding Company Performance Report (BHCPR) Questions About Your Institution’s Holding Company Reports Summary and Wrap-Up Faculty Paul J. Sanchez, CPA, CBA, CFSA, conducts a small CPA practice and owns and operates Professional Service Associates, a consulting and professional training and development business that services corporate clients (auditors, controllers, etc.), CPA firms, professional associations and others. Prior to starting his consulting business, Paul was the Vice President for the Audit Division of a regional bank and a money-center bank. There he directed the professional practice development and training for internal auditors. Paul was also a technical staff member of the Auditing Standards and Examinations Divisions of the AICPA, and was an assistant professor at Long Island University — C.W. Post Campus, and an adjunct lecturer at City University of New York. He is the author of the publication Accounting Basics for Community Financial Institutions (Financial Managers Society, 2004 and 2009 editions) and the monthly publication The Ideas and Analysis Letter: The Sanchez “Take”. Details Location and Accommodations Hard Rock Hotel® at Universal Orlando® Resort 5800 Universal Boulevard Orlando, FL 32819 Special FMS Room Rate: $209 Single/Double Deadline for Rate: February 14, 2015 For Reservations Call: 1-866-360-7395 Identify yourself as an attendee of the Financial Managers Society program to receive the preferred rate. If you are making reservations through a travel agent, be sure to request that your reservation be placed in the FMS room block to guarantee the best rate. Tax-Deductible Programs An income-tax deduction may be allowed for educational expenses (including registration, travel, meals and lodging) undertaken to maintain or improve professional skills. (Treas. Reg. Sec. 1.162-5) Attire Business-casual attire is appropriate. Since hotel rooms are often cool, please bring a jacket or sweater. CPE Credit Earn up to 19 hours of CPE credit Level: Basic to Intermediate Prerequisites: None Advance preparation: None Field of Study: Accounting Instructional Method: Live-Group FMS is registered with the National Association of State Boards of Accountancy as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses. Complaints regarding sponsors may be addressed to: The National Registry of CPE Sponsors, 150 Fourth Avenue, North, Suite 700, Nashville, TN 37219-2417 Web: www.nasba.org. For more information regarding administrative policies such as complaints or refunds, call 800-ASK-4FMS (800-275-4367). Call Report Boot Camp Providing a unique approach that offers both a business and accounting focus, Call Report Boot Camp is an intensive and comprehensive analysis of all the information you need to accurately fulfill your reporting requirements. This unique program is specially designed for community institutions that are required to file the quarterly form FFIEC #041 and is ideal for both seasoned professionals, as well as newcomers facing the challenges of Call Report preparation. Led by industry expert Paul J. Sanchez, CPA, CBA, CFSA, this two-day seminar will provide participants with the essential “need-to-know,” basic call report information, as well as offer the insights and tools you need to ensure your institution can successfully prepare an accurate and complete Call Report. You Will Learn: • How to accurately and efficiently prepare your institution’s Call Report • How to properly comply with the extensive Call Report instructions • How to better understand the Call Report within the context of your bank’s business practices and accounting policies and procedures Agenda Tuesday, March 10, 2015 Wednesday, March 11, 2015 8:00 am 8:00 am 8:30 am to 4:30 pm 8:30 am to 4:00 pm General Call Report Filing Information Review of Somewhat Difficult Schedules – Cont. •Deposit Liabilities (RC-E) •Other Data for Deposit Insurance and FICO Assessments (RC-O) •Off-Balance Sheet Items (RC-L) •Regulatory Capital (Schedule RC-R) – including Basel III discussions Registration and Continental Breakfast Review of Call Report Financial Statements •Balance Sheet (Schedule RC) •Income Statement (Schedule RI) Review of Least Difficult Schedules •Cash and Balances Due From Depository Institutions (RC-A) •Other Assets (RC-F) •Other Liabilities (RC-G) •Trading Assets and Liabilities (RC-D) •Memoranda (RC-M) •Quarterly Averages (RC-K) Review of Somewhat Difficult Schedules •Securities (RC-B) •Loans and Leases (RC-C) •Past Due and Non-Accrual Assets (RC-N) •Charge-offs and Recoveries on Loans and Leases and Changes in Allowance for Credit Losses (RI-B) •Changes in Equity (Schedule RI-A) Continental Breakfast Review of Other Schedules Not Used by All Institutions •Mortgage Banking Activities (RC-P) •Bank Securitization and Asset Sales (RC-S) •Fiduciary and Related Services (RC-T) •Financial Assets and Liabilities Measured at Fair Value RC-Q) •Variable Interest Entities (RC-V) •Changes in Equity (RI-A) Questions About Your Institution’s Call Report (Bring your latest Call Report filing) Summary and Wrap-Up Post-Seminar Half-Day Workshop Consolidated Financial Statements for Bank Holding Companies Enhance your Call Report Boot Camp experience with the extra half-day workshop on Consolidated Financial Statements for Bank Holding Companies. This workshop provides valuable information about the Consolidated Bank Holding Company Reports that are filed quarterly by Bank Holding Companies (BHCs) and Savings and Loan Holding Companies (SLHCs) with their appropriate district Federal Reserve Bank. The half-day coverage is designed for preparers, reviewers, analysts, auditors and others who work with Consolidated Financial Statements. The primary focus is on the two most prominent forms (the FR Y-9C and the FR Y-LP) and the “creation” of the Consolidated Balance Sheet (Schedule HC) and Consolidated Income Statement (Schedule HI). Coverage will also include an overview of the following reports: • FR Y-6 – Annual Report of BHCs • FR Y-8 – Section 23 “Covered” Transactions •FR Y-10 – Changes in Organizational Structure •FR 2900 – Report of Transactions, Accounts, Other Deposits and Vault Cash •FR 2644 – Weekly Report of Selected Assets and Liabilities of Domestic Chartered Banks •UBNCPR – The Uniform Bank Holding Company Performance Report *You do not need to be registered for Call Report Boot Camp to attend this half-day program. Agenda Thursday, March 12, 2015 8:00 am Registration, Coffee and Refreshment Service 8:30 am to 12:00 pm Background Information Re: Business Combinations General Information About the Bank Holding Company Reports (Form FR Y-9C and Form FR Y-9LP) •Reporting Criteria •Exemptions from Reporting •Shifts in Reporting Status •Electronic Filing •GAAP Consolidation “Rules” •Exclusion from Coverage on Form FR Y-9C •Rounding •Negative Amounts •Verification/Sign-off •Amended Reports Consolidated Balance Sheet (Schedule HC) Consolidated Income Statement (Schedule HI) Review of Required Regulatory Reports – Other • Annual Report of BHCs (FR Y-6) • Section 23 “Covered” Transactions (FR Y-8) • Changes in Organizational Structure (FR Y-10) • Report of Transactions, Accounts, Other Deposits and Vault Cash (FR 2900) • Weekly Report of Selected Assets and Liabilities of Domestic Chartered Banks (FR 2644) Corporate Governors’ Analytical Overview: The Bank Holding Company Performance Report (BHCPR) Questions About Your Institution’s Holding Company Reports Summary and Wrap-Up Faculty Paul J. Sanchez, CPA, CBA, CFSA, conducts a small CPA practice and owns and operates Professional Service Associates, a consulting and professional training and development business that services corporate clients (auditors, controllers, etc.), CPA firms, professional associations and others. Prior to starting his consulting business, Paul was the Vice President for the Audit Division of a regional bank and a money-center bank. There he directed the professional practice development and training for internal auditors. Paul was also a technical staff member of the Auditing Standards and Examinations Divisions of the AICPA, and was an assistant professor at Long Island University — C.W. Post Campus, and an adjunct lecturer at City University of New York. He is the author of the publication Accounting Basics for Community Financial Institutions (Financial Managers Society, 2004 and 2009 editions) and the monthly publication The Ideas and Analysis Letter: The Sanchez “Take”. Details Location and Accommodations Hard Rock Hotel® at Universal Orlando® Resort 5800 Universal Boulevard Orlando, FL 32819 Special FMS Room Rate: $209 Single/Double Deadline for Rate: February 14, 2015 For Reservations Call: 1-866-360-7395 Identify yourself as an attendee of the Financial Managers Society program to receive the preferred rate. If you are making reservations through a travel agent, be sure to request that your reservation be placed in the FMS room block to guarantee the best rate. Tax-Deductible Programs An income-tax deduction may be allowed for educational expenses (including registration, travel, meals and lodging) undertaken to maintain or improve professional skills. (Treas. Reg. Sec. 1.162-5) Attire Business-casual attire is appropriate. Since hotel rooms are often cool, please bring a jacket or sweater. CPE Credit Earn up to 19 hours of CPE credit Level: Basic to Intermediate Prerequisites: None Advance preparation: None Field of Study: Accounting Instructional Method: Live-Group FMS is registered with the National Association of State Boards of Accountancy as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses. Complaints regarding sponsors may be addressed to: The National Registry of CPE Sponsors, 150 Fourth Avenue, North, Suite 700, Nashville, TN 37219-2417 Web: www.nasba.org. For more information regarding administrative policies such as complaints or refunds, call 800-ASK-4FMS (800-275-4367). 3 WAYS TO REGISTER QUESTIONS? Call 800-ASK-4FMS (800-275-4367) Mail: Financial Managers Society Fax: 312-578-1308 Internet: www.fmsinc.org/CALENDAR 1 North LaSalle Street, Suite 3100 Chicago, IL 60602-4003 Presorted Standard U.S. Postage PAID Wheeling, IL Permit No. 38 Registration NAME MARCH 10-11, 2015 TITLE Call Report Boot Camp ORGANIZATION MAILING ADDRESS CITY, STATE, ZIP MARCH 12, 2015 ASSET SIZE PHONE Half-Day Workshop: Consolidated Financial Statements for Bank Holding Companies FAX E-MAIL REGISTER Please select from one of the following options. Call for details about team discounts. Call Report Boot Camp | March 10-11, 2015 ○ FMS Member: $1,050 ○ Coworker of Member: $1,150 ○ Nonmember: $1,450 Orlando, FL | Hard Rock Hotel® at Universal Orlando® Resort $ $ $ Half-Day Workshop: Consolidated Financial Statements | March 12, 2015 ○ FMS Member: $400 $ ○ Coworker of Member: $425 $ ○ Nonmember: $550 $ Call Report Boot Camp + Half-Day Workshop | March 10-12, 2015 ○ FMS Member: $1,350 ○ Coworker of Member: $1,450 ○ Nonmember: $1,650 $ $ $ TOTAL $ Card # Exp. Date Signature Refunds and Cancellations A refund minus a $150 processing fee will be provided for cancellations received by FMS in writing by February 14, 2015. No refunds will be given for cancellations received after that date. A substitution from your institution is welcome at any time. FMS reserves the right to change instructors or reschedule/cancel sessions when necessary. FMS is not responsible for airfare penalties incurred due to the cancellation of the program. www.fmsinc.org 800-ASK-4FMS (800-275-4367) o Check enclosed payable to Financial Managers Society o Charge my MasterCard, Visa or American Express 1 North LaSalle Street, Suite 3100 Chicago, IL 60602-4003 METHOD OF PAYMENT Payment must accompany registration. FMS members and their co-workers save $100 each when two or more employees register for this seminar. Simply complete one form per person and deduct $100 from each registration fee. $ $ Save $100 Not an FMS member? Join now and save on registration! ○ FMS Regular Membership: $450 ○ FMS Affiliate Membership: $495 With a Members-only Team Discount! Please list any special accommodations (including dietary restrictions) you require. Essential Education for Your Staff 3 WAYS TO REGISTER QUESTIONS? Call 800-ASK-4FMS (800-275-4367) Mail: Financial Managers Society Fax: 312-578-1308 Internet: www.fmsinc.org/CALENDAR 1 North LaSalle Street, Suite 3100 Chicago, IL 60602-4003 Presorted Standard U.S. Postage PAID Wheeling, IL Permit No. 38 Registration NAME MARCH 10-11, 2015 TITLE Call Report Boot Camp ORGANIZATION MAILING ADDRESS CITY, STATE, ZIP MARCH 12, 2015 ASSET SIZE PHONE Half-Day Workshop: Consolidated Financial Statements for Bank Holding Companies FAX E-MAIL REGISTER Please select from one of the following options. Call for details about team discounts. Call Report Boot Camp | March 10-11, 2015 ○ FMS Member: $1,050 ○ Coworker of Member: $1,150 ○ Nonmember: $1,450 Orlando, FL | Hard Rock Hotel® at Universal Orlando® Resort $ $ $ Half-Day Workshop: Consolidated Financial Statements | March 12, 2015 ○ FMS Member: $400 $ ○ Coworker of Member: $425 $ ○ Nonmember: $550 $ Call Report Boot Camp + Half-Day Workshop | March 10-12, 2015 ○ FMS Member: $1,350 ○ Coworker of Member: $1,450 ○ Nonmember: $1,650 $ $ $ TOTAL $ Card # Exp. Date Signature Refunds and Cancellations A refund minus a $150 processing fee will be provided for cancellations received by FMS in writing by February 14, 2015. No refunds will be given for cancellations received after that date. A substitution from your institution is welcome at any time. FMS reserves the right to change instructors or reschedule/cancel sessions when necessary. FMS is not responsible for airfare penalties incurred due to the cancellation of the program. www.fmsinc.org 800-ASK-4FMS (800-275-4367) o Check enclosed payable to Financial Managers Society o Charge my MasterCard, Visa or American Express 1 North LaSalle Street, Suite 3100 Chicago, IL 60602-4003 METHOD OF PAYMENT Payment must accompany registration. FMS members and their co-workers save $100 each when two or more employees register for this seminar. Simply complete one form per person and deduct $100 from each registration fee. $ $ Save $100 Not an FMS member? Join now and save on registration! ○ FMS Regular Membership: $450 ○ FMS Affiliate Membership: $495 With a Members-only Team Discount! Please list any special accommodations (including dietary restrictions) you require. Essential Education for Your Staff

© Copyright 2026