PSG Wealth Global Moderate Fund of Funds D (USD)

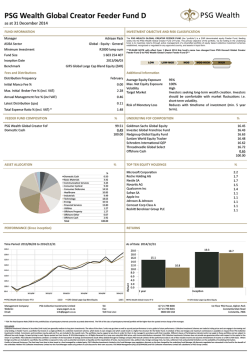

PSG Wealth Global Moderate Fund of Funds D (USD) as at 31 December 2014 FUND INFORMATION INVESTMENT OBJECTIVE AND RISK CLASSIFICATION PSG Fund Management (CI) Ltd The objective of the Portfolio is to maximize capital and income returns through USD Moderate Alloca�on active asset allocation management of a diversified portfolio of collective Manager Sector Minimum Investment USD 1000 Fund Size investment schemes established, recognised or regulated in any Approved Country and assets in liquid form. (All underlying funds are FSB approved) 1 573 742 725 Incep�on Date 2011/10/04 Benchmark GIFS USD Flexible Alloca�on Fees and Distribu�ons Addi�onal Informa�on Ini�al Manco Fee % 0.00 Max. Ini�al Broker Fee % 2.00 Annual Management Fee % 0.40 Max Admin Fee 0.25 Total Expense Ra�o % 1.95 COMPOSITION 16.32 16.74 16.40 16.37 16.33 14.62 3.22 100.00 ASSET ALLOCATION Risk of Monetary Loss % Cash AAA AA+ AA AA A+ A A n/a n/a n/a n/a n/a n/a n/a n/a TOP TEN EQUITY HOLDINGS % % JP Morgan Chase & Co IBM eBay Inc Berkshire Hathaway Markel Corpora�on Steinhoff Investment Holdings Cisco Systems Inc Sainsbury Microso� Corp Capital One Financial Corpora�on % 0.84 0.11 4.10 2.54 9.73 6.23 8.33 5.50 7.36 3.81 14.91 0.85 1.46 10.37 1.30 22.56 100.00 Domes�c Equity Domes�c Cash Basic Materials Communica�on Services Consumer Cyclical Consumer Defensive Healthcare Industrials Technology Energy Financial Services U�li�es Offshore Property Offshore Bonds Offshore Other Offshore Cash Total 60% 75% Moderate/High Investors seeking longterm wealth crea�on. Investors should be comfortable with market and currency fluctua�ons i.e. shortterm vola�lity. Reduces with �meframe of investment (recommend 5 year term). CREDIT RATING % BlackRock Global Alloca�on Fund Corona�on Global Managed Fund Foord Interna�onal Trust Investec Global Strategic Managed Fund PSG Global Flexible Fund Templeton Global Balanced Fund Offshore Cash Average Equity Exposure Max. Net Equity Exposure Vola�lity Target Market PERFORMANCE (3 year) RETURNS Time Period: 2012/01/01 to 2014/12/31 As of Date: 2014/12/31 135.0 1.0 1.0 0.9 0.9 0.8 0.8 0.8 0.8 0.8 0.7 12.0 130.0 10.1 10.0 125.0 8.0 120.0 8.9 8.1 6.0 115.0 5.8 5.3 3.8 4.0 110.0 2.0 Return 105.0 100.0 95.0 2012/06 2012/12 PSG Wealth Global Moderate FoFs D USD 2013/06 129.0 2013/12 2014/06 GIFS USD Flexible Alloca�on Past performance is not a reliable indicator of future results and you may get back less than you originally invested. This publica�on is for private circula�on and informa�on purposes only and does not con s�tute a personal recommenda�on or investment advice or an offer to buy/sell or an invita�on to buy/sell se curi�es in the fund. The informa�on and any opinions have been obtained from or are based on sources believ ed to be reliable, but accuracy cannot be guaranteed. 2014/12 116.8 0.0 0.1 0.2 2.0 1 year 2 years PSG Wealth Global Moderate FoFs D USD No responsibility can be accepted for any consequen�al loss arising from the use of this informa�on. The informa�on is expressed at its date and is issued only to and directed only at those individuals who are permi�ed to receive such informa�on in accordance with Guernsey laws and regula�ons. In some countries the distribu�on of this publica�on may be restricted: It is your responsibility to find out what those restric�ons are and observe them. 3 years Incep�on GIFS USD Flexible Alloca�on Please always refer to the fund’s prospectus. PSG Fund Management (CI) Limited as general manager and Legis Fund Services Limited as Administrator are licensed by the Guernsey Financial Services Commission (GFSC”). The fund is a Guernsey Class B openended collec�ve investment scheme authorised by the GFSC. Figures and benchmark quoted are from Source: © 2014 Morningstar, Inc. All Rights Reserved as at 31 December 2014. * TER: The Total Expense Ratio listed above is annualised and is for the period from 1 October 2013 to 30 September 2014. This percentage of the average Net Asset Value of the portfolio was incurred as charges, levies and fees related to the management of the portfolio. A higher TER ratio does not necessarily imply a poor return, nor does a low TER ratio imply a good return. The current TER cannot be regarded as an indication of future TERs. Part of the Annual Management Fee is payable to the financial intermediary. REPRESENTATIVE OFFICE PSG Collec�ve Investments Limited 1st Floor, PSG House, Alphen Park Constan�a Main Road, Constan�a, 7806 Telephone: +27 21 7998000; Fax: +27 21 7998181 Email: utoff[email protected] Website: www.psg.gg ADMNISTRATOR Legis Fund Services Limited 11 New Street, St Peter Port, Guernsey, GY1 2PF Telephone: +44 1481 726034 Email: utoff[email protected] MANAGER: PSG Fund Management (CI) Limited, 11 New Street, St Peter Port, Guernsey, GY1 2PF; Telephone: +44 1481 726034; Fax: +44 1481 726029; Email: utoff[email protected]; Website: www.psg.gg

© Copyright 2026