PSG Wealth Global Creator Feeder Fund D

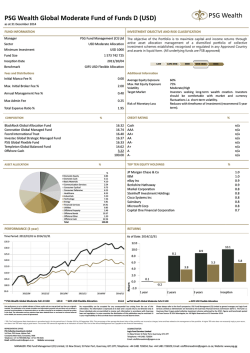

PSG Wealth Global Creator Feeder Fund D as at 31 December 2014 FUND INFORMATION INVESTMENT OBJECTIVE AND RISK CLASSIFICATION Manager Adriaan Pask ASISA Sector Global Equity General Minimum Investment R2000 lump sum Fund Size 1 603 254 407 Incep�on Date The PSG WEALTH GLOBAL CREATOR FEEDER FUND (the “portfolio”) is a ZAR denominated equity Feeder Fund, feeding solely into the PSG Wealth Global Creator Fund of Funds. The primary objective of the portfolio, via its holding in the underlying fund, is to maximize returns through active management of a diversified portfolio of equity based collective investment schemes established, recognized or regulated in any approved country, and assets in liquid form. ***PLEASE NOTE with effect from 1 March 2014 this fund's name has changed from PSG Konsult Global Creator Feeder Fund D to PSG Wealth Global Creator Feeder Fund D*** 2013/06/03 Benchmark GIFS Global Large Cap Blend Equity (ZAR) Fees and Distribu�ons Addi�onal Informa�on Distribu�on Frequency February Ini�al Manco Fee % 0.00 Max. Ini�al Broker Fee % (incl. VAT) 2.28 Annual Management Fee % (incl VAT) 0.46 Latest Distribu�on (cpu) 0.11 Total Expense Ra�o % (incl. VAT) * 1.48 Average Equity Exposure Max. Net Equity Exposure Vola�lity Target Market Risk of Monetary Loss 95% 100% High Investors seeking longterm wealth crea�on. Investors should be comfortable with market fluctua�ons i.e. shortterm vola�lity. Reduces with �meframe of investment (min. 5 year term). FEEDER FUND COMPOSITION % UNDERLYING FOF COMPOSITION PSG Wealth Global Creator FoF Domes�c Cash 99.51 0.49 100.00 Goldman Sachs Global Equity Investec Global Franchise Fund Nedgroup Global Equity Fund Sanlam World Equity Tracker Schroders Interna�onal QEP Threadneedle Global Select Offshore Cash ASSET ALLOCATION % TOP TEN EQUITY HOLDINGS % Microso� Corpora�on Roche Holding AG Nestle SA Novar�s AG Qualcomm Inc Safran SA Apple Inc Johnson & Johnson Comcast Corp Class A Recki� Benckiser Group PLC 2.2 1.7 1.7 1.5 1.4 1.1 1.1 1.1 1.1 1.1 Domes�c Cash Basic Materials Communica�on Services Consumer Cyclical Consumer Defensive Healthcare Industrials Technology Energy Financial Services U�li�es Offshore Property Offshore Other Offshore Cash Total % 0.50 3.42 3.43 9.30 14.55 10.83 9.49 18.63 10.52 13.80 1.27 1.27 0.07 2.92 100.00 PERFORMANCE (Since incep�on) RETURNS Time Period: 2013/06/03 to 2014/12/31 As of Date: 2014/12/31 135.0 130.0 125.0 120.0 115.0 110.0 Return 105.0 100.0 95.0 2013/09 PSG Wealth Global Creator FF D Management Company: Website: Email: 2013/12 2014/03 132.0 2014/06 2014/09 16.45 16.43 16.63 16.48 16.62 16.72 0.65 100.00 19.3 20.0 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 18.7 15.1 10.8 1 year Incep�on 2014/12 GIFS Global LargeCap Blend Equity PSG Collec�ve Investments Limited www.psgam.co.za [email protected] % 128.5 Tel: Fax: Toll Free Line: PSG Wealth Global Creator FF D GIFS Global LargeCap Blend Equity +27 21 799 8000 +27 21 799 8181 0800 600 168 1st Floor PSG House, Alphen Park Constan�a Main Road Constan�a, 7806 * TER: The Total Expense Ra�o (TER) for this por�olio/class of par�cipatory interest cannot be accurately determined. The TER of this class of par�cipatory interest/por�olio will be higher than the quoted service charge of the manager. DISCLAIMER Collec�ve Investment Schemes in Securi�es (Unit trusts) are generally medium to long term investments. The value of the share / units may go down as well as up and past performance is not a guide to future performance. Collec�ve Investment Schemes are traded at ruling prices and can engage in borrowing and scrip lending. A Feeder Fund is a por�olio that invests in a single por�olio of a collec�ve investment scheme, which levies its own charges and which could result in a higher fee structure for the feeder fund. A schedule of fees and charges and maximum commissions is available on request from PSG Collec�ve Investments Limited. Commission and incen�ves may be paid and if so, are included in the overall costs. The por�olios may be capped at any �me in order for them to be managed in accordance with their mandate. Different classes of Par�cipatory interests (units) can apply to these por�olios and are subject to different fees and charges. Forward pricing is used. Figures quoted are from Source: © 2014 Morningstar, Inc. All Rights Reserved for a lump sum using NAVNAV prices, with income distribu�ons reinvested. PSG Collec�ve Investments Schemes does not provide any guarantee either with respect to the capital or the return of a por�olio. PSG Collec�ve Investments Limited is a member of the Associa�on of Savings and Investments South Africa (ASISA) through its holdings company PSG Konsult Limited. All the performance data is net of fees includes income and assumes reinvestment of income on a NAV to NAV basis. Where foreign securi�es are included in a por�olio, the por�olio is exposed to risks, such as poten�al constraints on liquidity and the repatria�on of funds, macroeconomic risks, poli�cal risks, foreign exchange risks, tax risks, se�lement risks and poten�al limita�ons on the availability of marke�ng informa�on. Conflict of Interest Disclosure: The fund may from �me to �me invest in a fund managed by a related party. PSG Collec�ve Investments Limited or the Fund Manager may nego�ate a discount on the fees charged by the underlying Fund Manager. All discounts nego�ated are reinvested in the fund for the benefit of the unitholder. Neither PSG Collec�ve Investments Limited nor the Fund Manager retains any por�on of such discount for their own accounts. PSG Mul� Management (Pty) Ltd (FSP44306) and PSG Collec�ve Investments Limited are subsidiaries of PSG Group Limited.

© Copyright 2026