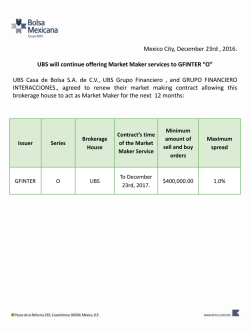

On icy roads

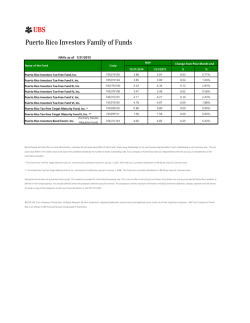

UBS HouseView Digest February 2015 On icy roads US Edition CIO Wealth Management Research On icy roads Mark Haefele Global Chief Investment Officer Wealth Management If you start to slide on icy roads, make sure you keep looking ahead to where you want to go. That was the advice my father gave me many years ago. I was reminded of it again in the first week of January as unusually snowy weather blanketed Zurich. But the slippery conditions have extended beyond the Swiss streets. Global markets have already served up an avalanche of events in 2015, from a plunging oil price and euro, to rallying government bonds, to a dramatic change in gears by the Swiss National Bank (SNB) that shifted the franc sharply higher. Those of you who read our CIO Year Ahead: The Diverging World will know that divergences in policy could drive a year of higher volatility and greater dispersion in asset prices. Still, January’s blizzard of news surpassed expectations. The diverging world brings into focus why maintaining a long-term and disciplined approach to investment is so important. To our minds this means following the principles of diversification, rebalancing and considered asset-class selection. I am pleased that by following these key tenets, CIO portfolios were only marginally impacted by the recent turmoil. From a shorter-term tactical perspective, the European Central Bank’s (ECB) recently enhanced quantitative easing (QE) program is the latest confirmation that the SNB’s decision does not reflect a wider shift among central banks to reverse their policies. We believe the underlying environment of low oil prices, low government bond yields, and improving economic growth (in developed markets in particular) should continue to provide a supportive backdrop for global equities. This diverging world is posing challenges, but it will also offer opportunities to generate returns. By focusing on the road ahead, we can find the best way to navigate forward. Mark Haefele Global Chief Investment Officer Wealth Management This Digest contains excerpted material. To read the full version, please see the UBS House View Investment Strategy Guide. This report has been prepared by UBS Financial Services Inc. (“UBS FS”) and UBS AG. Please see important disclaimers and disclosures beginning on page 5. FEBRUARY 2014 UBS HOUSE VIEW: DIGEST 1 Tactical preferences With US growth remaining solid and central banks still providing plenty of liquidity, we continue to recommend a preference for equities over bonds. We prefer US over foreign stocks and high yield to government bonds. d xe Fi me o c in Int’l Developed Emerg Markets i Mark ng ets Tot al Com mo dit ies US Mid cap EUR US Large cap Value GBP Asset Classes Tactical asset allocation al Tot CHF cap Large th w Gro JPY sh Ca tal To Oth er ities u q E US hange ign exc Fore USD US Small cap l ta To Int’ Dev l Ma elope rke d ts Em Ma ergi rke ng ts US HY Corp nal itio rad nt No tal To v’t Go US US IG Corp i un US M THIS MONTH 1) Equities We upgrade international developed markets to overweight and trim US equities. 2) Fixed income We prefer high yield corporate and investment grade credit to Treasuries and emerging debt. 3) Foreign exchange We close our preference for the Canadian dollar over the Swiss franc. LEGEND Overweight: Tactical recommendation to hold more of the asset class than specified in the moderate risk strategic asset allocation (see page 23) Underweight: Tactical recommendation to hold less of the asset class than specified in the moderate risk strategic asset allocation (see page 23) Neutral: Tactical recommendation to hold the asset class in line with its weight in the moderate risk strategic asset allocation (see page 23) There has been a change in the methodology for displaying the overweight and underweight recommendations since the 21 November 2015 edition of UBS House View. As of this publication, each bar represents a +/- 2% tactical tilt or part thereof (i.e., one bar = 0.5% to 2%, 2 bars = 2.5% to 4%, 3 bars = over 4%). NOTE: TACTICAL TIME HORIZON IS APPROXIMATELY SIX MONTHS 2 UBS HOUSE VIEW: DIGEST FEBRUARY 2015 Preferred investment views As of 22 January 2015 Asset Class Most preferred Least preferred Equities •US1 () • US small and mid caps1 () •Eurozone1 () • Transformational technologies2 () • The rising Millennials2 () • E-Commerce • Cancer therapeutics • US capex • Emerging markets Bonds • US investment grade3 () • US high yield3 () • Mortgage interest-only • US senior loans • Government bonds • Emerging market corporate bonds • Emerging market sovereign bonds3 () Foreign exchange •USD •GBP •EUR •CHF1 () Alternative investments Cash Recent upgrades Recent downgrades Changes made on 19 January 2015 Added on 12 January 2015 3 Changes made on 15 December 2014 1 2 FEBRUARY 2015 UBS HOUSE VIEW: DIGEST 3 Asset class overview Economy Global economic growth is set to accelerate in 2015 compared to 2014. The US is expected to contribute the most to this acceleration, as it should see its economy expand by more than 3% – the fastest pace since the financial crisis. We also foresee increasing economic growth in the Eurozone, albeit on a much lower level of around 1%. Fiscal headwinds are fading, credit conditions are gradually improving, and the ECB’s expansionary monetary policy will lend further support. The strong fall in oil prices since mid-2014 is an additional positive driver for both US and Eurozone growth. Emerging economies are expected to experience a further gradual deceleration of growth. Russia and Brazil look particularly weak given their lack of reform momentum. Equities US equities outperformed most other regions in 2014, with a total return of 13.5%, and we expect them to keep up their momentum in the months to come. Positive drivers – most important, solid earnings growth of around 7% and a robust economic backdrop – will likely remain in place. Swiss earnings face massive headwinds following the strong appreciation of the Swiss franc, and are therefore no longer attractive, in our view. We are neutral Swiss equities. We believe the underperformance of UK equities that we saw in 2014 has come to an end, and we upgrade the market to neutral. In the Eurozone, accelerating economic growth and a weaker euro should support earnings in 2015. We therefore introduced an overweight in Eurozone equities. Fixed income The strength of the US economy will allow the Fed to hike policy rates in the second half of 2015, leading to gradually rising US Treasury yields. In the Eurozone, monetary policy easing, low inflation and modest economic growth will keep rates very low. The low starting level of yields will likely lead to low returns on government bonds in the next six months. In particular, government bonds in euros or Swiss francs provide very limited upside. We therefore prefer positions in investment grade corporate bonds, offering a yield pickup. Fundamentals in emerging markets (EMs) have deteriorated further and we are holding underweights in EM corporate and government bonds against US high yield, which is pricing in a substantial pickup in default rates in the large energy sector. Foreign exchange The US dollar remains our favorite currency, and we hold an overweight relative to the euro as the divergence in growth rates, monetary policy, and bond yields favor the US currency. The surprising decision by the Swiss National Bank to suspend the exchange rate floor against the euro has led to an extreme appreciation of the Swiss franc, and we expect EURCHF to trade close to parity in the coming six months. We are overweight GBPCHF as we expect the Bank of England to raise policy rates in the second half of the year, which stands in stark contrast to the negative rates offered in Switzerland. With oil prices having fallen further over recent weeks, we remove our Canadian dollar overweight against the franc. 4 UBS HOUSE VIEW: DIGEST FEBRUARY 2015 Disclaimer Chief Investment Office (CIO) Wealth Management (WM) Research is published by UBS Wealth Management and UBS Wealth Management Americas, Business Divisions of UBS AG (UBS) or an affiliate thereof. CIO WM Research reports published outside the US are branded as Chief Investment Office WM. In certain countries UBS AG is referred to as UBS SA. This publication is for your information only and is not intended as an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. The analysis contained herein does not constitute a personal recommendation or take into account the particular investment objectives, investment strategies, financial situation and needs of any specific recipient. It is based on numerous assumptions. Different assumptions could result in materially different results. We recommend that you obtain financial and/or tax advice as to the implications (including tax) of investing in the manner described or in any of the products mentioned herein. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis and/or may not be eligible for sale to all investors. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness (other than disclosures relating to UBS and its affiliates). All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Opinions expressed herein may differ or be contrary to those expressed by other business areas or divisions of UBS as a result of using different assumptions and/or criteria. At any time, investment decisions (including whether to buy, sell or hold securities) made by UBS AG, its affiliates, subsidiaries and employees may differ from or be contrary to the opinions expressed in UBS research publications. Some investments may not be readily realizable since the market in the securities is illiquid and therefore valuing the investment and identifying the risk to which you are exposed may be difficult to quantify. UBS relies on information barriers to control the flow of information contained in one or more areas within UBS, into other areas, units, divisions or affiliates of UBS. Futures and options trading is considered risky. Past performance of an investment is no guarantee for its future performance. Some investments may be subject to sudden and large falls in value and on realization you may receive back less than you invested or may be required to pay more. Changes in FX rates may have an adverse effect on the price, value or income of an investment. This report is for distribution only under such circumstances as may be permitted by applicable law. Distributed to US persons by UBS Financial Services Inc., a subsidiary of UBS AG. UBS Securities LLC is a subsidiary of UBS AG and an affiliate of UBS Financial Services Inc. UBS Financial Services Inc. accepts responsibility for the content of a report prepared by a non-US affiliate when it distributes reports to US persons. All transactions by a US person in the securities mentioned in this report should be effected through a US-registered broker dealer affiliated with UBS, and not through a non-US affiliate. The contents of this report have not been and will not be approved by any securities or investment authority in the United States or elsewhere. UBS specifically prohibits the redistribution or reproduction of this material in whole or in part without the prior written permission of UBS and UBS accepts no liability whatsoever for the actions of third parties in this respect. Version as per May 2014. © UBS 2015. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved. Sources of strategic asset allocations and investor risk profiles Strategic asset allocations represent the longer-term allocation of assets that is deemed suitable for a particular investor. The strategic asset allocation models discussed in this publication, and the capital market assumptions used for the strategic asset allocations, were developed and approved by the WMA AAC. The strategic asset allocations are provided for illustrative purposes only and were designed by the WMA AAC for hypothetical US investors with a total return objective under five different Investor Risk Profiles ranging from conservative to aggressive. In general, strategic asset allocations will differ among investors according to their individual circumstances, risk tolerance, return objectives and time horizon. Therefore, the strategic asset allocations in this publication may not be suitable for all investors or investment goals and should not be used as the sole basis of any investment decision. Minimum net worth requirements may apply to allocations to non-traditional assets. As always, please consult your UBS Financial Advisor to see how these weightings should be applied or modified according to your individual profile and investment goals. The process by which the strategic asset allocations were derived is described in detail in the publication entitled “UBS WMA’s Capital Markets Model: Explained, Part II: Methodology,” published on 22 January 2013. Your Financial Advisor can provide you with a copy. Deviations from strategic asset allocation or benchmark allocation The recommended tactical deviations from the strategic asset allocation or benchmark allocation are provided by the Global Investment Committee and the Investment Strategy Group within Wealth Management Research Americas. They reflect the short- to medium-term assessment of market opportunities and risks in the respective asset classes and market segments. Positive / zero / negative tactical deviations correspond to an overweight / neutral / underweight stance for each respective asset class and market segment relative to their strategic allocation. The current allocation is the sum of the strategic asset allocation and the tactical deviation. FEBRUARY 2015 UBS HOUSE VIEW: DIGEST 5

© Copyright 2026