Latvian Macro Monitor

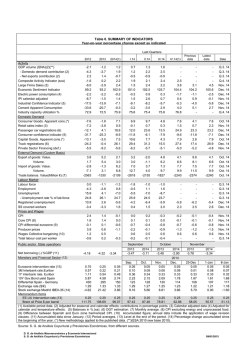

Latvian Macro Monitor January 2015 2A, Republikas Square, Riga LV-1010, Latvia Tel. +371 67010345, Fax +371 67010253; www.citadele.lv Regulator – FCMC, www.fktk.lv Zigurds Vaikulis Senior Economist [email protected] Simona Strizevska Economist [email protected] The latest high frequency indicators in Latvia showed rather mixed dynamics. On an annual basis, the growth of the manufacturing sector slid back into negative territory, with the output contracting by 3.8% yo-y in November, following a growth of roughly 1.5% y-o-y in the preceding two months. While the retail sales turnover in Latvia maintained a relatively solid pace of growth of 4-5% y-o-y, the aggregate growth number hid the divergence between the dynamics of the major sales categories. The sales of food products paused in autumn, with the annual growth rate coming to nearly a standstill in November, whereas the growth of non-food sales reaccelerated to 4.0-5.0% y-o-y and the turnover of automotive fuels picked up in autumn. Inflation averaged 0.6% y-o-y in Latvia in 2014 – a relatively low level from a historical perspective. A sharp decline in energy prices since June 2014 is thought to contain inflationary pressures in 2015, whereas the liberalization of electricity market for households and a respective increase in electric energy tariffs is about to drive inflation higher, adding roughly 0.6-0.8 percentage points to the inflation number in 2015. Considering all available facts, market tendencies and our estimates, we expect annual inflation to fluctuate around 1% threshold in 2015 – in the range between 0.5% and 1.5%. Inflation According to the CSB, average consumer prices dropped by 0.6% m-o-m in the last month of the year. Deflation in December was caused by a drop in the prices of fuel and heating tariffs and seasonal sales of clothing and footwear. Annual inflation decelerated to 0.2% y-o-y in December, down from 0.9% y-o-y in the preceding month. Thereby, inflation averaged 0.6% y-oy in 2014 – a relatively low level from a historical perspective. CPI components, weighted % change y-o-y 20 Food Housing costs CPI 15 Fuels Other 10 5 0 -5 2007 2008 Source: CSB 2009 2010 2011 2012 2013 2014 2015 In general, an increase in consumer prices in 2014 was noticeably lower compared to our projections a year ago, but the reasons were relatively clear. First of all, the liberalization of the electricity market and hence a hike in electric energy tariffs was postponed till 2015, limiting the upward pressure on inflation in 2014. Secondly, the Russian import embargo dampened the price of milk powder in the global financial markets and put a downward pressure on milk and dairy product prices in Latvia in autumn and apparently also facilitated a decline in vegetable and potato prices. And finally, the major game changer for the inflation picture in 2014 both in Latvia and globally was a nearly 50% drop in energy prices in the global financial markets in the second half of 2014, which brought fuel prices in Latvia down by roughly 20-25% and subtracted roughly 0.8 percentage points from Latvian inflation number. 1 Due to a sharp decline in oil prices, another significant event – the euro adoption has moved out of focus. Albeit the introduction of the euro and its impact on Latvian inflation has attracted much attention, in line with our expectations, the effect on consumer prices has been rather limited and has been pronounced only in certain services sectors. According to our estimates, the changeover to the euro and the rounding of prices on average has added 0.3-0.4 percentage points to the inflation number in 2014. A sharp decline in energy prices since June is thought to contain inflationary pressures in 2015. Whereas a decline in global energy prices translates into fuel prices in Latvia relatively fast, the price of natural gas and heating tariffs react to these changes with a certain lag. Assuming that oil prices are about to stabilize close to the levels seen by the end of 2014, natural gas tariffs for households may decline by 10% and heating tariffs, e.g. in Riga, may drop by roughly 20% in the coming months. Nevertheless, the liberalization of electricity market for households and the respective increase in electric energy tariffs is about to drive inflation number higher. According to our estimates, on average a household bill will increase by roughly 15-25%, depending on the consumption volume, and is about to add roughly 0.6-0.8 percentage points to the inflation number in 2015. Considering all available facts, market tendencies and our estimates, we expect annual inflation to fluctuate around 1% threshold in 2015 – in the range between 0.5% and 1.5%. Retail trade Retail trade, SA, Dec 2009 = 100 350 200 According to the CSB, the seasonally Non-f ood (lhs) Total (excl. f uels) (lhs) 300 adjusted retail trade turnover at constant 180 Food (lhs) prices (excluding fuels) rose by 0.7% m-o-m Motor vehicles (rhs) 250 in November, reaching its highest level since 160 the end of 2008. On a monthly basis, an 200 increase was fueled by a pickup in trade 140 150 turnover of non-food products, whereas sales 120 of food products, in turn, declined over the 100 preceding month. While on an annual basis 100 50 the total retail sales turnover maintained a Source: CSB relatively solid pace of growth of roughly 40 80 5% y-o-y, the aggregate growth number hid 2007 2008 2009 2010 2011 2012 2013 2014 the divergence between the dynamics of the major sales categories. The sales of food products paused in autumn, with the annual growth rate coming to nearly a standstill in November, whereas the growth of non-food sales reaccelerated to 4.0-5.0% y-o-y respectively. Moreover, the turnover of automotive fuels (in real terms) picked up in autumn, rising by nearly 16% y-o-y in November, as lower fuel prices probably boosted the demand. The sales of motor vehicles and parts thereof grew by 5.3% y-o-y in November, whereas on a monthly basis, the dynamics still stayed relatively volatile. Manufacturing According to the CSB, the seasonally adjusted manufacturing output dropped by 2.0% m-o-m in November to its lowest level since June. On a monthly basis, a decline was relatively broad-based, with the output of food, wood, machinery and other sectors shrinking over the preceding month. The manufacturing output of basic metals and chemicals, in turn, rose in November over the previous months, partly offsetting declines elsewhere. On an annual basis, the growth of the manufacturing sector slid back into negative territory, with the output contracting by 3.8% yo-y in November, following a growth of roughly 1.5% y-o-y in the preceding two months. For the time being, the 2 adverse impact on the manufacturing sector from the imposed Russian sanctions has been relatively limited, affecting only certain food segments, most notably producers of milk and dairy products. The production of food shrank by 3.5% y-o-y in November. The impact of deteriorating Russian economic environment and weaker ruble has continued to take its toll on the manufacturing output of certain manufacturing sectors, including beverages, textiles and wearing apparel, etc. Moreover, the annual growth of the manufacturing output of wood slowed to 3.7% y-o-y in November, following an increase by roughly 8-10% y-o-y in the preceding months. The seasonally adjusted manufacturing turnover (at current prices) dropped by 0.9% m-o-m in November, as lower sales in export market dragged it down. On an annual basis, the manufacturing turnover contracted by 7.0% y-o-y, suppressed by a decline in the domestic market by 9% y-o-y in November. The manufacturing turnover in exports market dropped by 4.0% y-o-y, with the sales in the Eurozone countries shrinking by nearly 8% y-o-y and reporting a decline by 2.1% y-o-y in non-Eurozone market in November. Manufacturing output, working day adj., % y-o-y change (3m MA) 50% 30% 20% 100% 50% 10% 0% 0% -10% -50% -20% -30% -100% 2004 Source: CSB Banking sector According to the FCMC, the cumulative earnings of the Latvian commercial banks have reached 301 million EUR by the end of November, up from 262 million EUR in the respective period of the previous year. The provisions for bad and doubtful loans in commercial banks declined to 5.8% of the total loan portfolio in November, following an increase in the spring of 2014. 150% Food Wood Manuf acturing Basic metals (rhs) 40% 2006 2008 2010 2012 2014 Total loan portfolio, 3m change, mln EUR (adjusted for MFI licence cancellation) 2000 Government Fin. institutions Non-residents Nonf in. corporations Households Loan portf olio 1500 1000 500 0 -500 Source: Bank of Latvia -1000 According to the Bank of Latvia, the 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 banking sector loan portfolio stayed broadly unchanged in November over the preceding month, whereas the outstanding volume of loans shrank by nearly 2% y-t-d in the first eleven months of the year (adjusted for cancellation of licenses of two banks). The household loan portfolio contracted by 4.8% y-t-d by the end of November and nonfinancial resident corporate loan portfolio declined by nearly 4% y-t-d respectively. As opposed to shrinking resident portfolio, non-resident loan portfolio has increased by 3.6% y-t-d in November. The commercial banks have issued 2.3 billion EUR in new loans in the first eleven months of 2014, down from more than 2.9 billion EUR in the respective period of 2013. The volume of newly granted loans to corporate sector and non-residents has been somewhat weaker compared to the previous year, while the newly granted loans to households, in turn, rose by nearly 12 million EUR from January to November over the respective period of 2013. The total share of overdue loans in the banking sector loan portfolio rose to 14.3% in November. Albeit the credit quality has slightly deteriorated in November, the share of loans more than 90 days overdue has continued to shrink, reaching 7.4% of the total loan portfolio. The amount of deposits (excluding the deposits by central and local governments) rose by 2.0% m-o-m in November, mostly driven by an increase in non-resident and corporate savings. Household deposits have also risen by 0.6% m-o-m in November, already advancing by 5.5% y-t-d from January to November. The volume of deposits 3 of non-financial resident companies rose by 1.6% m-o-m in November, reaching its highest level since March. The volume of non-resident deposits stayed above 10 billion EUR mark for the third consecutive month, advancing by 16.5% y-t-d by the end of November. Treasury Latvia posted monthly general government budget deficit of 467 million EUR in December, the largest negative reading since the end of 2010. Hence, based on the cash flow method, cumulative general government budget deficit reached 399 million EUR in 2014, compared to a 128 million EUR deficit in the preceding year. Deterioration in the country’s fiscal position was mostly attributable to a pickup in government outlays, with the latter rising by 5% y-o-y in 2014, whereas budget revenue increased by 1.9% y-o-y respectively. Gen. government consolidated budget, 12 month rolling, bln EUR 10 5 8 4 6 3 4 2 2 1 0 0 -2 -1 Source: Treasury -4 -2 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Financial def icit (rhs) Expenditure (net, lhs) Revenue (net, lhs) Tax collections in both general and local government budgets rose by 5.7% y-o-y in 2014, broadly in line with the annual plan, while in 2013 tax collections were by more than 2% ahead of the annual plan. Among the major tax revenue sources, VAT collections registered the fastest growth in 2014, rising by more than 8% over the preceding year, followed by an increase in personal income tax collections by nearly 4% y-o-y and a pickup in excise tax collections by 2.4% y-o-y respectively. Corporate income tax was the only major source of tax revenue that fell short to meet the annual plan, with tax collections contracting by 2.1% y-o-y in 2014 and reaching only 88% of the annual plan. External trade and current account 100% Exports of goods, % y-o-y change, rolling 3m/3m 80% According to the Bank of Latvia, the current account fell back into negative territory in 60% November, registering a deficit of 37 million 40% EUR. Deterioration in the current account 20% balance was mostly attributable to higher 0% trade deficit with goods and a decline in current transfers to Latvia in November. -20% Agriculture and f ood Metals The cumulative current account deficit -40% Machinery widened to 613 million EUR by the end of Wood -60% November, up from 533 million EUR in the Exports Source: CSB respective period of the previous month. -80% 2007 2008 2009 2010 2011 2012 2013 2014 The worsening in the current account balance in the first eleven months of 2014 was mainly driven by lower net current transfers, whereas trade balance with goods, in turn, improved over the previous year. According to the CSB, exports of goods declined by 13.4% m-o-m in November, following an upsurge in the preceding month, as exports of cereals partly reversed gains reported in the preceding month, and lower exports of beverages and machinery contributed negatively to the exports dynamics. Imports dropped by 5.7% m-o-m in November, driven by a decline in imports of base metals and vehicles. On an annual basis, exports dropped by a 4 minor 0.8% y-o-y in November, as an increase in exports of wood and re-exports of mineral fuels was leveled down by a drop in exports of food, agriculture products, machinery, etc. Imports stayed essentially unchanged in November over the previous year, as an increase in imports of machinery and mineral fuels was offset by a drop in other major imports categories. Country-wise, exports to Russia dragged exports dynamics in November, reporting a drop for the first time in four months and shrinking by more than 18% y-o-y in November. Whereas the dynamics of exports to Eurozone countries has stayed rather mixed, on an annual basis, exports to Poland and Estonia have been shrinking since the mid-year, and exports to Lithuania and UK have been steadily rising over the preceding year. Real estate Riga's real estate market According to Arco Real Estate, a price of a 2500 2000 square meter in an average standard type apartment in Riga declined for the third 2000 1600 consecutive month, following a steady increase since the early 2013. The average 1500 1200 standard type apartment price in Riga slid to 637 EUR/m2 in December and the annual 1000 800 growth decelerated to 3.9% y-o-y in December. On the whole, the standard type 500 400 apartment prices rose by 5.2% y-o-y in Property purchase contracts, Riga (LHS) 2014, posting its fastest annual increase Avg. standard type apartment price, Riga, Euro/m2 (RHS) 0 0 since 2007. Lately, the number of property 2002 2004 2006 2008 2010 2012 2014 purchase contracts in Riga has stayed Source: ArcoReal Estate, Latio, Land Register relatively stable, whereas on an annual basis, the activity in the real estate market has weakened since September, when the amendments to the Immigration Law took effect. Similar to the preceding years, the number of apartments for sale in Riga declined in the end of the year. On an annual basis, the number of offers grew by 9.1% y-o-y in December, mostly reflecting an increase in the number of offers in the central part of the city. The Baltics Retail trade, % annual change, 3m MA The high frequency indicators showed rather 30 mixed dynamics across the Baltics in 20 November. On an annual basis, exports in both Latvia and Estonia contracted by 10 roughly 1% y-o-y in November, after growing by 6-7% y-o-y in the preceding month, and 0 advanced for the third consecutive month in -10 Lithuania (+2.8% y-o-y in November). The Lithuania manufacturing sector’s growth has stayed Estonia -20 Latvia positive in Estonia and Lithuania and slid to negative territory in Latvia. The output grew -30 by roughly 3% y-o-y in Lithuania and 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: Eurostat expanded by 6.1% y-o-y in Estonia, fueled by an increase in the manufactures of computers and electronics. The growth of the private consumption has stayed relatively solid across the Baltics. According to Eurostat, the growth in retail sales accelerated to 9% y-o-y in Estonia in November and stayed within a range of 5-6% y-o-y in Lithuania since the middle of 2014. 5 This material is solely of an informational nature and should not be construed as advice to buy, hold or sell any of the mentioned financial instruments. The authors of this material, as well as JSC Citadele banka or any of its affiliates, subsidiaries or representatives assume no responsibility for any inaccuracies or errors, for the possible use of the information contained in this material, such as explicit and implicit losses (including unearned profits), as well as for any penalties, even in case when they are informed about such possibility. The information contained in this report was obtained from sources believed to be reliable (www.bloomberg.com, www.reuters.com, other mass media, stock exchanges, central banks, national statistics authorities, company websites etc.), however JSC Citadele banka does not guarantee the accuracy and completeness of the information. The information and opinions expressed in this report reflect information and opinions as of the time of writing, and can be changed without any prior notice. In case of quotation, reference to the JSC Citadele banka or the relevant sources is mandatory. Any investment you make shall be based solely on your own evaluation of your financial circumstances and investment objectives. For the full text of disclaimer, please visit http://www.citadele.lv/lv/research/disclaimer/ 6

© Copyright 2026