WEEKLY ECONOMIC BULLETIN

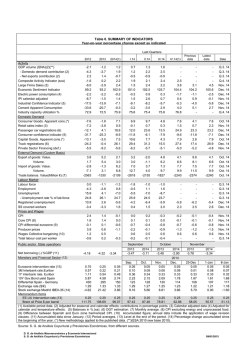

SPAIN WEEKLY ECONOMIC BULLETIN FEBRUARY 6th 2015 NIPO: 720-15-014-5 Elaboración y coordinación: Secretaría de Estado de Economía y Apoyo a la Empresa Dirección General de Análisis Macroeconómico y Economía Internacional Subdirección General de Análisis Coyuntural y Previsiones Económicas INDEX (1) Table 1. Quarterly National Accounts. Main Aggregates. Year-on-year change Table 1a. Quarterly National Accounts. Main Aggregates. Quarter-on-quarter change Table 1b. Quarterly National Accounts: Wages, Productivity and Labour Costs Table 2. General and Industry Activity Indicators Table 3. Construction and Services Activity Indicators Table 4. Domestic Demand (Private Consumption and Equipment Investment) Table 4a. Housing Indicators Table 5. External Demand, Balance of Payments and Net External Reserves Table 6. Labour Market Table 7. Prices and Wages Table 8. Public Sector: State Operations Table 9. Monetary and Financial Sector Table 10. International Indicators (I) Table 11. International Indicators (II) Table 12. Summary of Indicators Chart 12. Summary of Indicators (1) Supplementary data and list of abbreviations can be obtained from Síntesis de Indicadores Económicos. Table 1. QUARTERLY NATIONAL ACCOUNTS. BASE 2010 Chain-linked volume; adjusted data (1) February 6, 2015 Year-on-year growth rate in % 2013 2014(2) 2013 IV 2014 I 2014 II 2014 III 2014 IV Final consumption expenditure . Households . Non-profit Institutions (3) . General government Gross fixed capital formation . Tangible fixed assets . Equipment and cultivated assets . Construction . Intelectual Property Products Change in inventories (4) Domestic demand (4) . Good and service exports . Good and service imports Net exports (4) -2.4 -2.3 -0.1 -2.9 -3.8 -4.2 5.6 -9.2 -1.3 0.0 -2.7 4.3 -0.5 1.4 1.7 2.1 0.5 0.7 2.3 2.1 12.4 -3.9 2.9 0.2 1.9 4.1 7.3 -0.7 -0.3 -0.1 0.6 -1.1 -0.5 -0.5 14.7 -8.3 -0.3 -0.1 -0.5 5.1 3.8 0.5 1.1 1.3 0.6 0.5 0.5 0.0 15.4 -8.1 2.9 0.3 1.2 6.3 8.9 -0.5 1.8 2.3 0.5 0.7 3.2 3.5 12.7 -2.0 1.9 0.1 2.2 1.5 4.8 -0.9 2.2 2.7 0.5 0.9 3.1 2.9 9.5 -1.2 3.9 0.2 2.5 4.6 8.2 -0.9 - GROSS VALUE ADDED Agriculture, forestry and fishing Industry Construction Services GDP m.p.(*) 15.6 -1.8 -8.1 -1.0 -1.2 8.6 0.9 -2.8 1.2 1.4 18.4 -0.5 -6.0 0.0 0.1 13.9 0.3 -6.1 0.8 0.7 3.8 1.4 -1.8 1.3 1.3 8.4 0.9 -0.4 1.6 1.6 2.0 DEMAND (1) Seasonally and calendar adjusted data. (2) Available period data (3) Non-profit making institutions serving households. (4) Contribution to GDP growth (percentage points). (ESA 2010) (*) Q.4.14-Advanced Estimate Source: INE. DOMESTIC DEMAND: COMPONENTS (y-o-y % change) GROSS DOMESTIC PRODUCT & COMPONENTS 6 16 3 0 0 -3 -16 Private Consumption Expenditure GDP (y-o-y % change) -6 GFCF Construction Domestic demand (4) GFCF Equipm.and cultivat.assets Net exports (4) -9 -32 2009 2010 2011 2012 2013 2014 2009 NET EXPORTS: COMPONENTS (y-o-y % change) 2010 2011 2012 2013 2014 GVA NON AGRICULTURAL SECTORS (y-o-y % change) 26 10 13 0 0 -10 -13 GVA Industry Goods and services exports GVA Construction Goods and services imports GVA Services -20 -26 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 Table 1a. QUARTERLY NATIONAL ACCOUNTS. BASE 2010 Chain-linked volume; adjusted data (1) February 6, 2015 Quarter-on-quarter growth rate in % 2013 III 2013 IV 2014 I 2014 II 2014 III 2014 IV Final consumption expenditure 0.2 0.2 0.7 0.7 0.6 - . Households 0.4 0.4 0.6 0.9 0.8 - DEMAND . Non-profit Institutions (2) . General government Gross fixed capital formation . Tangible fixed assets 0.1 0.1 0.0 0.3 0.0 - -0.2 -0.1 1.1 -0.1 0.1 - 1.2 0.2 0.1 1.7 1.0 - 1.6 0.1 -0.3 2.0 1.1 - 4.7 1.7 2.0 3.8 1.7 - -0.3 -0.9 -1.7 0.8 0.6 - -1.0 0.5 2.1 0.2 0.9 - . Good and service exports 0.5 -0.2 0.0 1.3 3.5 - . Good and service imports 1.4 0.2 0.5 2.6 4.7 - -0.1 4.1 2.9 -3.0 4.4 - 0.6 -0.6 0.9 0.5 0.0 - . Equipment and cultivated assets . Construction . Intelectual Property Products GROSS VALUE ADDED Agriculture, forestry and fishing Industry Construction -1.3 -0.3 -0.8 0.5 0.1 - Services 0.3 0.3 0.2 0.5 0.6 - GDP M.P.(*) 0.1 0.3 0.3 0.5 0.5 0.7 (1) Seasonally and calendar adjusted data. (2) Non-profit making institutions serving households. (3) Contribution to GDP growth (percentage points). (ESA 2010).(*) Q.4.14 Advanced Estimate Source: INE. DOMESTIC DEMAND: COMPONENTS (q-o-q % change) GROSS DOMESTIC PRODUCT AND COMPONENTS 8 4 GDP (q-o-q % change) Net Exports (3) 2 Domestic Demand (3) 0 0 -8 Private Consumption Expenditure -2 GFCF Construction GFCF Equipment and cultivated assets -16 -4 2009 2010 2011 2012 2013 2009 2014 NET EXPORTS: COMPONENTS (q-o-q % change) 2010 2011 2012 2013 2014 GVA NON AGRICULTURAL SECTORS (q-o-q % change) 5 14 7 0 0 -5 -7 GVA Industry Goods and services exports GVA Construction Goods and services imports GVA Services -10 -14 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 Table1b. QUARTERLY NATIONAL ACCOUNTS: WAGES. PRODUCTIVITY AND LABOUR COST (1) February 6, 2015 year on year percentage change 2013 2014(2) IV.Q.13 I.Q.14 Quarter on quarter percentage change II.Q.14 III.Q.14 IV.Q.13 I.Q.14 II.Q.14 III.Q.14 TOTAL ECONOMY Unit labour cost -0.4 -0.5 2.0 -1.2 -0.1 -0.4 -0.1 -0.3 0.6 -0.5 Compensation per employee 1.7 0.1 3.8 0.1 0.4 -0.1 0.2 -0.2 0.3 -0.5 Labour productivity 2.1 0.7 1.8 1.3 0.5 0.3 0.3 0.1 -0.2 0.0 GDP deflator 0.7 -0.4 0.5 -0.4 -0.5 -0.4 0.1 -0.3 -0.1 -0.1 -2.0 -0.9 -1.9 -3.2 -0.6 1.0 0.8 -1.6 1.9 -0.1 Compensation per employee 1.5 1.5 2.1 1.5 2.1 1.1 0.6 0.0 1.4 -0.9 Labour productivity 3.6 2.5 4.0 4.8 2.7 0.1 -0.2 1.6 -0.5 -0.8 GVA deflator 0.2 -1.3 -1.8 -2.0 -1.2 -0.8 0.1 -2.1 0.5 0.6 MANUFACTURING Unit labour cost (1) Adjusted seasonal and calendar effects. (2) Available period data. Source: INE (CN-2010). UNIT LABOUR COST AND THEIR COMPONENTS TOTAL ECONOMY y-o-y % change 9 MANUFACTURING y-o-y % change 15 Compensation per employee Labour productivity 6 Compensation per employee Labour productivity 10 Unit labour cost Unit labour cost 3 5 0 0 -3 -5 -6 -10 2009 2010 2011 2012 2013 2014 2009 2010 TOTAL ECONOMY q-o-q % change 6 2012 2013 2014 MANUFACTURING q-o-q % change 12 Compensation per employee Labour productivity 4 2011 Compensation per employee Labour productivity 8 Unit labour cost Unit labour cost 2 4 0 0 -2 -4 -4 -8 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 Table 2. GENERAL AND INDUSTRY ACTIVITY INDICATORS (Year-on-year percentage change except as indicated) February 6, 2015 Previous GENERAL Composite Activity Indicator (2) Social Security covered workers Electric power consumption (3) Non energy imports (vol.) Households & business financing (4) Economic Sentiment Indicator Large Firms Sales (5) Central Balance Sheet (Quarterly) - Gross operating income - ROI -Cost of debt (6) INDUSTRY Composite Industry Indicator (2) IPI calendar adjusted Social Security covered workers Business Surveys (balances in pp) Industry confidence indicator (sa) Industry unfilled orders Inventories Industry capacity utilization % 2014 2015(1) 2014 II 2014 III 2014 IV 2015 I(1) 2.2 1.6 -0.2 9.4 -5.2 102.8 2.4 2.5 3.6 106.6 - 2.1 1.5 0.9 5.9 -5.5 102.4 2.4 2.4 2.0 0.3 10.9 -4.4 103.6 2.2 2.4 2.3 -1.7 7.0 -4.4 104.3 3.8 2.5 3.6 106.6 - 0.0 0.7 - 3.3 0.6 -3.9 0.4 - 3.5 1.2 0.1 1.2 4.1 2.6 0.0 3.4 0.7 0.6 -7.1 -16 9 75.8 -4.5 -12 10 78.1 -8.2 -17 10 74.1 0.8 2.0 53.2 54.7 2.2 2.9 53.4 Industry Turnover Index (7) Industry new orders (7) PMI Industry Index Latest data data Date .. 2.6 -2.5 8.9 -4.5 105.6 3.1 .. 2.5 3.6 5.0 -4.1 106.6 4.5 Q.4. 14 - .. .. .. .. 2.8 -0.1 0.9 1.2 .. -0.5 1.1 .. -1.1 1.2 Dec. 14 Jan. 15 -5.7 -13 7 75.3 -5.3 -12 9 76.9 -4.5 -12 10 78.1 -5.8 -14 8 .. -4.5 -12 10 .. " " " Q.1. 15 1.1 0.2 53.1 0.7 3.9 53.7 54.7 1.5 3.4 53.8 -0.1 4.4 54.7 Nov. 14 " Jan. 15 Jan. 15 " Nov. 14 Dec. 14 Jan. 15 Nov. 14 Q.3. 14 " Q.4. 14 (1) Available period data. (2) Adjusted for seasonal, calendar and outliers effects. (3) Adjusted for calendar and temperature effects. (4) Deflated by CPI without energy and food. (5) Calendar adjusted deflacted and fixed sample. (6) Ordinary income on net assets (before taxes) minus interest on borrowed funds. (7) At current prices and adjusted for calendar. Sources: MESS, REE, BE, AEAT, INE, European Commission, SGACPE and NTC Research LTD-Reuters. INDUSTRY PROD. INDEX (CALENDAR ADJUSTED) ACTIVITY INDICATORS 8 110 10 0 0 85 -10 Y-o-y Annualized q-o-q -20 Economic Sentiment Indic. (right s.) Composite Activity Indicator (y-o-y) -8 60 2010 2011 2012 2013 2014 -30 2015 2009 ELEC. POWER CONSUM. AND LARGE FIRM SALES 10 2010 2011 2012 2013 2014 INDUSTRY CONF. IND. AND CAPACITY UTILIZATION 0 80 -20 72 0 -10 ICI Large firms sales (y-o-y) Cap.Utiliz.(right scale) Electric power consumption (y-o-y) -40 -20 2010 2011 2012 2013 2014 2015 64 2010 2011 2012 2013 2014 2015 Table 3. CONSTRUCTION AND SERVICES ACTIVITY INDICATORS (Year-on-year percentage change except as indicated) February 6, 2015 2015 I(1) Previous data Latest data 2014 2015(1) 2014 II 2014 III 2014 IV Date 0.3 0.4 - -0.3 -3.5 3.1 2.9 1.9 6.3 - .. 2.7 .. 12.5 Dec. 14 -1.7 -0.3 3.4 - -2.3 1.3 -0.5 27.6 1.6 -10.5 3.4 - 2.6 -4.0 3.4 -19.5 Jan. 15 Nov. 14 " CONSTRUCTION Composite Construction Indicator (2) Cement Apparent Consumption Social Security covered workers Floorage approvals: total Q.4. 14 5.0 - 11.2 21.2 3.7 - 13.8 -7.8 43.9 -41.4 -25.8 61.8 -55.8 9.6 -35.0 22.4 -22.6 -25.8 60.2 -25.1 -9.8 -25.8 " Jan. 15 -5.0 8.7 - -7.3 5.8 21.9 34.3 7.6 17.3 - 9.4 17.7 5.6 16.8 -3.1 1.1 - -2.9 6.4 -2.6 7.8 15.0 - .. 16.0 .. 14.0 Nov. 14 " Q.3. 14 - New -15.6 - -2.1 -14.7 -19.3 - -17.9 -20.6 " - Used 15.3 - 12.9 25.6 41.8 - 42.1 41.6 " 3.3 2.2 3.2 3.1 2.2 3.3 2.6 3.4 2.8 3.2 .. 3.0 .. 3.2 Q.4. 14 Social Security covered workers Air traffic passengers 4.6 - 5.9 5.2 4.3 - 3.2 4.5 Dec. 14 Railway traffic goods. (Tm per km) 2.8 7.1 - -5.6 7.3 8.5 7.6 12.0 5.9 - 8.5 2.9 13.2 5.6 " " 2.9 6.7 10.5 5.3 6.7 2.0 7.3 3.1 7.7 10.5 -0.1 10.0 2.9 10.5 " Jan. 15 9.9 2.6 16.4 - 9.1 3.1 8.8 2.7 14.0 3.5 16.4 - 20.7 4.3 16.4 2.8 " Nov. 14 Floorage approvals: housing Official bidding (at current prices) Construction confidence indicator (3) Mortgages. Number " . Amount borrowed Housing: Prices per sq meter Dwelling sales Nov. 14 SERVICES Composite Services Indicator (2) Foreign tourists Hotel overnight stays Retail trade confidence indicator (3) Services confidence indicator (3) Services Turnover Index (4) Jan. 15 (1) Available period data. (2) Adjusted for seasonal, calendar and outliers effects. (3) Balances in percentage points. (sa). (4) Adjusted for calendar. Sources: OFICEMEN, MESS, MFOM, AENA, RENFE, IET, INE, European Commission and SGACPE. SERVICES: SOCIAL SECURITY COVERED WORKERS AND TURNOVER INDEX (y-o-y % change) 8 HOUSING PRICES AND MORTGAGES: AMOUNT BORROWED (y-o-y % change) 9 60 Housing prices Turnover Index Mortgages: amount borrowed (right s.) Social Security covered workers 3 -3 -8 2 20 -5 -20 -12 2010 2011 2012 2013 2014 2015 -60 2009 2010 CONSTRUCTION INDICATORS 0 2011 2012 2013 2014 SERVICES INDICATORS 4 Confidence Indicator (balances) 5 40 Confidence Indicator (balances) Composite Indicator (y-o-y % change)(right s.) Comp. Ind. (y-o-y % change)(right s.) -35 -70 2010 2011 2012 2013 2014 2015 -10 0 -24 -40 0 -5 2010 2011 2012 2013 2014 2015 Table 4. DOMESTIC DEMAND (PRIVATE CONSUMPTION AND EQUIPMENT INVESTMENT) (Year-on-year percentage change except as indicated) February 6, 2015 Previous 2015 I(1) data Latest 2014 2015(1) 2014 II 2014 III 2014 IV data Date Composite Consumption Indicator (2) Retail sales index deflated Consumer goods. Apparent consum.(2)(*) IPI consumer goods (adjusted) Consumer goods imports (vol.) Passenger car registrations Real wages (3) Consumer confidence indicator (4) Large firms sales. Consumption (5) EQUIPMENT INVESTMENT 3.9 1.1 7.0 1.6 12.7 18.8 1.0 -8.9 1.9 32.8 -1.5 - 4.5 0.7 9.7 2.9 11.1 23.6 1.4 -6.1 2.0 3.7 0.3 4.8 1.9 12.4 13.5 1.8 -7.9 2.2 4.3 3.1 6.8 0.0 4.9 24.9 -9.6 2.6 32.8 -1.5 - .. 2.1 7.8 -0.8 5.0 23.2 .. -7.1 2.3 .. 6.0 5.8 -1.4 4.7 32.8 .. -1.5 3.0 Composite Equipment Indicator (2) Capital goods. Apparent consum.(2)(*) IPI capital goods (adjusted) Capital goods imports (vol.) Truck registrations Large firms sales. Capital (5) BUSINESS SURVEYS 14.8 7.2 0.6 18.9 26.1 1.1 25.5 - 16.0 7.6 2.2 17.5 31.3 0.9 11.5 4.3 -2.3 19.1 15.5 3.0 16.4 6.2 -1.8 6.5 27.4 -0.7 25.5 - .. 7.3 -2.8 10.6 28.9 -0.8 .. 5.0 -1.8 2.2 25.5 -0.6 Consumer goods. Capacity utilization (%) Capital goods. Capacity utilization (%) 73.1 77.4 71.8 80.8 72.6 77.6 72.8 77.5 74.2 78.4 71.8 80.8 .. .. .. .. PRIVATE CONSUMPTION Q.4. 14 Dec. 14 Nov. 14 Dec. 14 Nov. 14 Jan. 15 Q.3. 14 Jan. 15 Nov. 14 Q.4. 14 Nov. 14 Dec. 14 Nov. 14 Jan. 15 Nov. 14 Q.1. 15 " (1) Available period data. (2) Adjusted for seasonal and calendar effects. (3) Adjusted for seasonal outliers and calendar effects. And deflated by private consumption expenditure (4) Balances in percentage points (sa). (5) Calendar adjusted, deflacted and fixed sample. (*) New methodology applied to the published data. Sources: SGACPE, INE, AEAT, European Commission, DGT and MIET. 50 CONSUMER CONF. INDICATOR AND PASSENGER CAR REG. (balances and y-o-y % change) 0 IPI (CALENDAR ADJUSTED) y-o-y % change 16 0 0 -25 -16 Consumer goods Passenger car registrations Capital goods Consumer Confidence I.(right s.) -50 -50 2010 14 2011 2012 2013 2014 -32 2015 CONSUMER GOODS: COMPOSITE AND APPARENT CONSUMPTION (y-o-y % change) 2009 7 20 2010 2011 2012 2013 2014 CAPITAL GOODS: COMPOSITE AND APPARENT CONSUMPTION (y-o-y % change) 0 -8 0 -20 Composite Indicator Composite Indicator (right s.) Apparent Consumption Apparent Consumption -30 -7 2009 2010 2011 2012 2013 2014 -40 2009 2010 2011 2012 2013 2014 Table 4a. HOUSING INDICATORS (Year-on-year percentage change except as indicated) February 6, 2015 2014 2015(1) 2014 II 2014 III 2014 IV 2015 I(1) Previous data 8.8 5.0 52.5 -53 -42 11.2 -28.2 -65 21.2 217.5 -41 3.7 49.7 -45 -42 4.1 13.8 111.8 -44 2.2 -7.8 34.9 -42 Mar. 14 Nov. 14 " Jan. 15 COINCIDENT INDICATORS Housing investment (QNA)(2010=100)(2) Construction GVA (QNA)(2010=100)(2) Composite Housing Indicator (2) CIPI(3). Building Cement apparent consumption (2) IPI Clay building materials Construction employment. LFS Construction unemployment. LFS -4.1 -2.8 -0.1 23.4 0.2 -2.1 -3.5 -24.8 - -3.4 -1.8 -0.1 36.9 -0.4 0.8 -5.3 -27.3 -1.5 -0.4 2.7 15.3 2.6 -5.1 -0.5 -30.1 1.8 11.8 6.5 -8.3 4.0 -23.3 - .. .. .. 7.8 6.8 -9.6 .. .. .. .. .. 15.3 7.9 -8.6 .. .. Q.3. 14 " Q.4. 14 Nov. 14 Dec. 14 " Q.4. 14 " HOUSING MARKET ACTIVITY Housing. Built for sale (thousands) Housing sales (thousands) - New - Used Non-resident foreigners transactions Housing investment deflator (QNA) (2) Housing Price Index - New - Used Rental CPI 25.9 293.4 112.2 181.2 4.8 -4.1 -0.2 0.5 -0.5 -0.7 - 6.7 79.2 31.4 47.8 12.1 -3.4 0.8 1.9 0.2 -0.7 5.4 79.1 27.6 51.6 -5.8 -3.6 0.3 0.8 0.1 -0.7 6.0 51.7 15.9 35.8 -0.7 - 3.4 26.5 8.1 18.3 .. .. .. .. .. -0.7 2.7 25.2 7.8 17.4 .. .. .. .. .. -0.7 Nov. 14 " " " Q.3. 14 " " " " Dec. 14 FINANCIAL CONDITIONS New housing mortgages - Number - Amount borrowed Interest rate on house purchase (4) Credit to households for housing Delinquency household loans ratio (%) Affordability based on wages (%) (5) -0.2 1.8 3.11 -3.9 6.15 35.7 - -0.5 2.8 3.23 -4.6 6.11 36.2 27.7 34.6 3.07 -3.8 6.01 35.0 16.2 13.6 2.84 -3.9 - - 18.0 14.9 2.88 -4.1 .. .. 14.2 12.2 2.64 -3.9 .. .. Nov. 14 " Dec. 14 " Q.3. 14 " LEADING INDICATORS Housing starts (thousands) Floorage approvals: housing Official bidding. Residential Housing order books (balances in pp) Latest data Date 1) Available period data. (2) Calendar and seasonal adjusted series. (3) Construction Industry Production Index. (4) To households. Annual equivalent rate. (5) Without deductions. Sources: MECC, INE, MFOM, OFICEMEN, MIET, EUROSTAT and BE. HOUSING. BUILT FOR SALE AND NEW SALES thousands 100 120 HOUSING STARTS AND ACCRUED thousands Housing starts Housing: built for sale Housing accrued New housing sales 80 50 40 0 0 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 HOUSING INVESTMENT AND COMPOSITE INDICATOR y-o-y % change 10 CEMENT CONSUMPTION AND CIPI BUILDING y-o-y % change 60 Cement consumption Housing investment (QNA) CIPI Building Composite Housing Indicator 30 -10 0 -30 -30 -60 2008 2009 2010 2011 2012 2013 2014 2008 ORDER BOOKS & CONSTRUCTION CONFIDENCE balances in pp 0 2009 2010 2011 2012 2013 2014 HOUS.FLOORAGE APPROVALS & IPI CLAY BUILDING y-o-y % change (smoothed) 30 Housing order books Construction confidence indicator 5 -40 -20 -45 Housing floorage approvals IPI Clay building materials -80 -70 2009 2010 2011 2012 2013 2014 2015 2008 CREDIT FOR HOUSE PURCHASE & MORTGAGES y-o-y % change 15 60 10 2009 2010 2011 2012 2013 2014 HOUSING PRICE & INTEREST RATE y-o-y % change & percentage 6,5 Credit to households Housing Prices per m2 Mortgages: amount borrowed (right s.) Interest rate on house purchase (right s.) 0 0 5,0 -10 3,5 0 -15 -60 2008 2009 2010 2011 2012 2013 -20 UNEMPLOYMENT RATE & AFFORDABILITY percentage 2,0 2008 2014 30 60 22 50 2009 2010 2011 2012 2013 2014 HOUSEHOLDS LOANS DELINQUENCY RATIO percentage 8 4 14 40 Unemployment rate Affordability based on wages (right s.) 6 30 2008 2009 2010 2011 2012 2013 2014 0 2008 2009 2010 2011 2012 2013 2014 Table 5. EXTERNAL DEMAND, BALANCE OF PAYMENTS AND NET EXTERNAL RESERVES Total 2012(2) 2013(2) Jan.-last month (1) 2013 2014 February 6, 2015 Previous Latest Date FOREIGN TRADE (Custom basis) Million euros: - Exports 226115 235814 215927 220682 22347 19944 Nov. 14 - Imports 257946 252347 230052 243332 24587 21500 - Trade balance -31831 -16533 -14125 -22650 -2240 -1555 “ “ 5.1 4.3 5.4 2.2 4.1 3.2 “ 3.0 4.5 5.4 3.2 6.6 4.5 “ -2.0 -2.2 -1.8 5.8 7.7 2.0 “ -6.3 2.2 2.6 8.4 9.9 4.3 “ -33.6 -48.1 -52.1 60.3 64.9 -11.6 “ Nov. 14 % change year on year:- Exports. Value Volume - Imports. Value Volume -Trade balance. Value BALANCE OF PAYMENTS (Million euros) Goods and services 16451 35731 34898 24690 2658 1771 -19436 -20649 -22615 -28337 -2347 -42 Current balance -2985 15082 12282 -3647 311 1729 “ “ Capital balance 5245 6884 5210 4045 189 240 “ Current and capital balance 2259 21965 17491 398 500 1969 “ 36367 -41644 -45573 111998 6679 26748 “ -137300 31953 13970 104426 8696 25337 “ 173665 -73598 -59542 7564 -2018 1411 “ Net change in BE position with Eurosystem -162366 123659 96088 21410 10184 9195 “ BE net position with the Eurosystem (3) -332561 -208902 -263742 -206530 -204347 -206530 Primary and secondary incomes Net change in assets, excluding BE Net change in liabilities, excluding BE NCA-NCL, excluding BE Q.3. 14 (1) Accumulated figures. (2) Customs data are final. (3) End of period data. Sources: DA, BE and SGACPE. EXPORTS. VOLUME y-o-y % change IMPORTS. VOLUME y-o-y % change 30 30 20 15 10 0 0 -15 -10 Smoothed Smoothed -30 Original -20 Original -30 -45 2009 2010 2011 2012 2013 2014 2009 BALANCE OF PAYMENTS quarterly averages. Billion euros 2010 2011 2012 2013 2014 NET CHANGE IN BE POSITION WITH EUROSYSTEM billion euros 4 40 2 20 0 0 -20 -2 -40 -4 Current & capital balance Trade balance -6 2010 2011 2012 2013 -60 -80 2014 2010 2011 2012 2013 2014 Table 6. LABOUR MARKET February 6, 2015 Latest data Date Change over previous year, thousands Thousands Percentage change over previous year Average Average Previous Latest Average Average Previous Latest 2013 2014(1) data data 2013 2014(1) data data LABOUR FORCE SURVEY Q.4. 14 " " " " " " Labour force Employment - Non agricultural - Wage earners - Temporary workers - Permanent workers Unemployment 23027 17569 16840 14483 3511 10972 5458 -254 -494 -487 -504 -156 -348 240 - 26.1 25.6 26.7 55.5 -236 205 206 217 173 44 -441 -242 274 307 289 155 135 -516 -44 434 482 390 177 213 -478 % of labour force " " " " Unemployment rate - Male - Female - Young (16-24 years) PUBLIC EMPLOYMENT SERVICES Registered unemployed Registered contracts - Permanent contracts - Temporary contracts Jan. 15 " " " 24.4 23.6 25.4 53.2 23.7 22.5 25.0 52.4 -1.1 -2.8 -2.9 -3.5 -4.6 -3.1 4.1 -1.0 1.2 1.3 1.5 5.3 0.4 -7.3 -1.0 1.6 1.9 2.0 4.6 1.3 -8.7 -0.2 2.5 2.9 2.8 5.3 2.0 -8.1 Points of change over previous year 23.7 22.8 24.7 51.8 Change over previous year,thousands 1.3 1.0 1.6 2.6 -1.6 -2.0 -1.2 -2.3 -2.0 -2.7 -1.2 -1.8 -2.0 -2.2 -1.8 -3.1 Percentage change over previous year 4526 1368 120 1248 125 1024 49 974 -269 1934 215 1719 -254 93 16 77 -289 109 22 87 2.6 7.4 4.5 7.7 -5.6 13.1 19.0 12.6 -5.4 7.2 19.2 6.4 -6.0 8.6 22.2 7.5 16575 13448 -548 -528 256 190 418 343 402 327 -3.3 -3.8 1.6 1.4 2.6 2.6 2.5 2.5 SOCIAL SECURITY SYSTEM Covered workers (2) - Payroll employment (2) Jan. 15 " (1) Available data period. (2) Monthly average Sources: INE, MESS and SPEE. EMPLOYMENT % change over previous year UNEMPLOYED % change over previous year 3 90 Unemployment LFS Employment LFS Registered unemployment Social security covered workers 0 60 -3 30 -6 0 -9 -30 2009 2010 2011 2012 2013 2014 2009 2010 EMPLOYEES % change over previous year 2011 2012 2013 2014 UNEMPLOYMENT RATE % of labour force 4 30 Total All Permanent workers Men 0 25 -4 20 -8 Women 15 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 Table 7. PRICES AND WAGES (Year-on-year percentage change) February 6, 2015 DEC. 2012 DEC 2013 Previous data Latest data 2012 2013 2014(1) CONSUMER PRICES (CPI). Headline Food Non food - Industry excluding energy - Services - Energy Core (2) 2.4 2.8 2.3 0.8 1.5 8.9 1.6 1.4 3.2 0.9 0.6 1.4 0.0 1.4 -0.2 -0.1 -0.2 -0.4 0.1 -0.8 0.0 2.9 3.3 2.7 1.5 2.2 7.6 2.1 0.3 1.8 -0.2 -0.5 0.0 0.2 0.2 -0.4 0.2 -0.5 -0.3 0.2 -3.2 -0.1 -1.0 -0.2 -1.3 -0.2 0.3 -8.5 0.0 Dec. 14 " " " " " " HARMONIZED INFLATION DIFF.(3): Total Core -0.1 -0.2 0.1 0.2 -0.6 -1.0 0.8 0.7 -0.5 -0.7 -0.8 -0.9 -0.9 -0.9 " " INDUSTRIAL PRODUCER PRICES: Total Consumer goods 3.8 2.5 0.6 2.2 -1.3 -0.5 3.3 3.5 0.6 0.0 -1.5 -0.1 -3.7 0.4 " " UNIT VALUE INDEX: Exports Imports 2.0 4.6 -0.2 -4.2 -0.9 -2.4 4.4 2.5 -2.4 -3.5 -2.3 -2.0 -1.3 -2.2 Nov. 14 " 1.2 -0.6 -0.6 -0.8 0.5 0.2 0.0 0.6 -0.3 -0.1 -0.8 1.0 -3.2 -3.6 -1.8 0.5 2.1 2.5 0.8 0.6 -0.1 0.0 -0.5 0.6 -0.4 -0.1 -1.5 Dec. 14 Q.III. 14 " " WAGES: Collective bargaining (4) Total labour cost per worker (5) - Wage costs - Non-wage costs Date (1) Available data period. (2) CPI excluding energy and non-processed food. (3) Difference between Spanish and Euro area harmonized inflation, in percentage points. (4) Data include the application of wage revision clauses in annual average data (except for the current year). (5) Data for December refer to 4th quarters. Sources: INE, Eurostat, DA, SGACPE and MESS. CONSUMER PRICES y-on-y % change 6 PRODUCER PRICES y-on-y % change 10 Headline inflation Core inflation 4 5 2 0 0 -5 -2 2009 2 2010 2011 2012 2013 2014 HARMONIZED INFLATION DIFFERENTIALS percentage points All items Consumer goods -10 2009 2010 2011 2012 2013 2014 WAGE INCREASE y-on-y % change 6 Headline 1 4 Core 2 0 0 Agreed wages index -1 -2 -2 Total wage cost per worker -4 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 Table 8. PUBLIC SECTOR: STATE OPERATIONS (Accumulated figures in million euro) February 6, 2015 IN CASH BASIS December December 2013 2012 1. REVENUE Taxes % IN CASH BASIS November November 2013 2014 117150 94436 % NATIONAL ACCOUNTING November November % 2013 2014 123344 75643 121118 97796 -1.8 29.3 107791 89885 8.7 5.1 150302 132370 Personal income tax Corporate income tax VAT Excise duties Other taxes Other revenue (1) 26532 21435 16384 4285 7006 47701 37924 19964 25502 7554 6851 23322 42.9 -6.9 55.6 76.3 -2.2 -51.1 36019 15261 25354 7095 6156 17906 39255 9.0 14102 -7.6 28149 11.0 6313 -11.0 6618 7.5 22713 26.8 2. EXPENDITURE Wages and salaries (2) Goods and services Interest payments Current transfers (2) Fixed investment Capital transfers 152357 160796 5.5 192373 15639 3200 28407 101155 5930 6464 0.5 -9.3 9.0 5.9 -12.3 31.5 143647 -1.3 13756 -0.3 2465 -1.3 31234 11.6 85997 -6.8 3148 -24.1 7048 46.7 189931 15556 3528 26055 95539 6762 4917 145499 13803 2496 27984 92261 4149 4805 3. NET OVERALL BALANCE (1-2) -29013 -39678 36.8 -37708 -26498 -29.7 -39629 -35561 -10.3 Pro-memoria Total taxes (3) Personal income tax VAT Excise duties 167745 70631 50463 18209 167773 69946 51939 19073 0.0 -1.0 2.9 4.7 153909 65264 49647 17582 160436 68027 53730 17959 17932 156812 133280 4.3 0.7 23532 31.2 1.3 4.2 4.2 8.2 2.1 (1) Includes fees, property income and current and capital transfers. (2) Homogenized data in relation to the change in the treatment of pensions paid by the State. (3) Includes the participation of regional and local governments. Source: MHAP. STATE OPERATIONS Accumulated figures in the last 12 months (€ billion) PERSONAL INCOME TAX Accumulated figures in the last 12 months (€ billion) 225 80 Revenue Expenditure 75 175 70 Net Overall Balance 125 65 75 60 2007 2008 2009 2010 2011 2012 2013 2014 2007 2008 2009 2010 2011 2012 2013 2014 CORPORATE INCOME TAX Accumulated figures in the last 12 months (€ billion) VALUE ADDED TAX Accumulated figures in the last 12 months (€ billion) 50 60 40 50 30 40 20 10 30 2007 2008 2009 2010 2011 2012 2013 2014 2007 2008 2009 2010 2011 2012 2013 2014 Table 9. MONETARY AND FINANCIAL SECTOR February 6, 2015 RESIDENTS´ FINANCING (1) Total financing (loans and securities) Non-financial corporations Households General government INTEREST RATES (2) ECB Intervention rate (3) Euribor rates: 3 month 12 month 10 year Gov. Bond yield: Spain Germany US 10 year spreads: Spain-Germany US-Germany Banks rates: Total Loans. Synthetic rate Mortgage loans (households) Deposits. Synthetic rate STOCK EXCHANGE MADRID. IBEX-35 (4) EXCHANGE RATES (2) US $/€ Jp ¥/€ Nominal effective (4) DEC NOV DEC JAN 2014 2015 2013 2014 2014 2015 JAN-29 FEB-5 -3.4 -3.9 - - -1.4 -6.6 -5.1 8.4 -0.5 -4.8 -3.9 6.8 -3.4 -3.9 - - - - 0.05 0.05 0.25 0.05 0.05 0.05 0.05 0.05 0.21 0.48 0.06 0.30 0.27 0.54 0.08 0.34 0.08 0.33 0.06 0.30 0.05 0.27 0.06 0.26 2.74 1.24 2.53 1.54 0.44 1.87 4.16 1.85 2.90 2.09 0.79 2.32 1.79 0.65 2.20 1.54 0.44 1.87 1.46 0.36 1.76 1.48 0.37 1.81 150 129 110 143 231 104 130 152 114 155 110 143 110 140 111 144 3.87 3.11 0.61 3.66 1.20 3.84 3.16 0.90 21.42 3.59 2.88 0.42 8.61 3.15 2.64 0.40 3.66 1.20 2.22 2.49 1.329 140.4 -4.10 1.162 137.5 -3.75 1.370 141.7 5.26 1.247 145.0 -4.15 1.233 147.1 -4.10 1.162 137.5 -3.75 1.132 133.4 -5.04 1.141 134.0 -4.67 (1) Year-on-year percentage change. (2) Period averages. (3) Data at the end of period. (4) Percentage change from the beginning of the year. Sources: BE, ECB, FT, Madrid stock exchange and MECC. RESIDENTS' FINANCING Y-o-Y % change 50 INTEREST RATES Percentages 8 Total 10 year government bond yield Non-financ.corporations 40 Households 6 12 month euribor General government 30 20 4 10 2 0 -10 0 01 02 03 04 05 06 07 08 09 10 11 12 13 14 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 DIFFERENTIALS WITH GERMANY 10 year, basis points EURO EXCHANGE RATE Index 2001=100 180 5000 4000 3000 Spain Portugal Greece Italy Ireland France 160 US $/€ Jp ¥/€ 140 2000 120 1000 100 0 80 -1000 2009 2010 2011 2012 2013 2014 2015 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 Table 10. INTERNATIONAL INDICATORS (I) February 6, 2015 GDP % change IPI % change Latest 2013 q-o-q y-o-y 3 months (1) 1 year CPI % annual change Previous Budget balance (2) % GDP Unemployment rate % Labour force (4) Previous Latest Latest 2014 2015 Germany 0.2 0.1 III 1.2 0.6 0.2 Dec 0.2 -0.3 Jan 6.6 6.5 Jan 0.2 0.0 France 0.4 0.3 III 0.4 -0.5 -2.6 Nov 0.3 0.1 Dec 9.7 9.9 III -4.4 -4.3 U.Kingdom 1.7 0.5 IV 2.7 0.4 1.1 Nov 1.0 0.5 Dec 2.7 2.6 Dec -5.5 -4.4 Italy -1.9 -0.1 III -0.5 -1.0 -2.1 Nov 0.0 -0.6 Jan 13.3 12.9 Dec -3.0 -2.8 Spain (3) -1.2 0.7 IV 2.0 -0.4 -0.9 Dec -0.4 -1.0 Dec 23.7 23.7 IV -5.5 -4.4 0.1 0.3 III 1.3 0.3 0.0 Nov 0.3 -0.1 Dec 10.0 9.9 Dec -3.0 -2.7 -0.4 0.2 III 0.8 0.2 -0.3 Nov -0.2 -0.6 Jan 11.4 11.3 Dec -2.6 -2.3 US. 2.2 0.7 IV 2.5 1.4 4.9 Dec 1.3 0.8 Dec 5.8 5.6 Dec -5.1 -4.3 Japan 1.6 -0.5 III -1.2 1.7 -1.1 Dec 2.4 2.4 Dec 3.5 3.4 Dec -8.3 -7.3 OECD 1.4 0.6 III 1.7 0.2 2.2 Oct 1.8 1.5 Nov 7.2 7.2 Nov -3.9 -3.4 EU Euro area (1) Average of last 3 months relative to the previous 3 months average.(2) European Commission, IMF and OECD. (3) In Spain, IPI calendar adjusted and s.a. GDP Advanced Estimate. (4) In Germany and United Kingdom, registered unemployment. Sources: Eurostat, European Commission, IMF, OECD, The Economist and MECC. GDP y-o-y % change INDUSTRIAL PRODUCTION y-o-y % change. Smoothed series 8 20 10 4 0 0 -10 Spain Spain Germany -4 Germany -20 France France US US -8 -30 2009 2010 2011 2012 2013 2014 2009 2010 CPI y-o-y % change 2011 2012 2013 2014 BUDGET BALANCE % GDP 5 6 4 0 Spain France Germany US 2 -5 0 Spain -10 Germany -2 France US -4 2010 2011 2012 2013 -15 2014 2015 2010 2011 2012 2013 2014 2015 Table 11. INTERNATIONAL INDICATORS (II) Exports of goods (1) % change 1 1 month year Germany February 6, 2015 Imports of goods (1) % change 1 1 month year Stock markets (3) % change 1 30-12-14 week Current account % GDP (2) 2014 2015 € bn latest 12 m. -2.1 2.3 Nov 1.6 2.2 Nov 212.3 III 7.4 7.2 1.6 11.2 France 1.8 3.7 Dec 2.6 -1.4 Dec -21.8 Nov -1.7 -1.4 1.7 10.9 U.Kingdom 0.1 -2.8 Dec 2.7 3.1 Dec -120.2 III -4.8 -4.6 0.8 4.9 Italy -1.1 3.7 Nov -0.1 1.8 Nov 27.7 Nov 1.5 1.8 1.1 9.5 Spain -6.1 3.8 Nov -9.6 2.0 Nov -0.8 Nov 0.7 0.8 0.5 2.3 EU 1.0 3.2 Nov -1.1 1.0 Nov - 1.4 1.5 1.0 9.2 Euro area 0.2 4.2 Nov 0.0 1.2 Nov 241.6 Nov 3.0 3.1 1.3 9.3 -1.6 0.5 Dec 2.3 5.2 Dec -286.1 III -2.2 -1.7 2.7 -0.5 2.0 9.1 Dec 0.1 0.1 Dec 13.0 Nov 0.1 0.9 -0.6 0.3 US. Japan (1) All data seasonally adjusted. (2) Economic forecasts of European Commission, IMF and OECD. (3) Previous data. Sources: Eurostat, European Commission, IMF, OECD, The Economist and MECC. EXPORTS OF GOODS y-o-y % change. Smoothed series IMPORTS OF GOODS y-o-y % change. Smoothed series 30 40 20 20 10 0 0 Spain -10 Spain Gerrmany -20 Germany -20 France France US US -30 -40 2009 2010 2011 2012 2013 2014 2009 CURRENT ACCOUNT % GDP 2010 2011 2012 2013 2014 2014 2015 STOCK MARKETS December 2000=100 12 175 8 150 Spain Germany US 4 Spain France Germany US 125 0 100 -4 75 -8 50 2010 2011 2012 2013 2014 2015 2010 2011 2012 2013 February 6, 2015 Table 12. SUMMARY OF INDICATORS Year-on-year percentage change except as indicated Last Quarters Activity GDP volume (QNA)(2)(**) - Domestic demand contribution (2) - Net exports contribution (2) Composite Activity Indicator (sca) Large Firms Sales (3) Economic Sentiment Indicator Electric power consumption (4) IPI calendar adjusted Industrial Confidence Indicator (5) Cement Apparent Consumption Industry capacity utilization % Domestic Demand Consumer Goods. Apparent cons.(*) Retail sales index (3) Passenger car registrations (6) Consumer confidence indicator (5) Capital Goods. Apparent cons.(*) Truck registrations (6) Private Sector Financing (def.) External Demand (Custom Basis) Export of goods: Value. Volume. Import of goods: Value. Volume. Trade balance. Value (mill.€)(7) Labour Market Labour force Employment Unemployment - Unemployment rate % of lab.force Registered unemployment SS covered workers Prices and Wages CPI Core CPI (8) CPI differential eurozone (9) Producer prices Wages Collective bargaining (10) Total labour cost per worker Net borrowing (-) %GDP (11) Monetary and Financial Sector (12) Latest data 2014 2015(1) II.14 III.14 IV.14 -1.2 -2.7 1.4 0.2 -2.9 92.9 -2.2 -1.5 -13.9 -20.7 72.5 1.4 1.9 -0.7 2.2 2.4 102.8 -0.2 1.2 -7.1 0.4 75.9 106.6 3.6 -4.5 76.8 1.3 2.2 -0.9 2.1 2.4 102.4 0.9 2.6 -8.2 -3.5 75.4 1.6 2.5 -0.9 2.4 2.2 103.6 0.3 0.7 -5.7 2.9 75.8 2.0 2.4 3.8 104.3 -1.7 -0.1 -5.3 6.3 76.9 106.6 3.6 -4.5 76.8 3.1 105.6 -2.5 -0.5 -5.8 2.7 - 4.5 106.6 3.6 -1.1 -4.5 12.5 - Q.4. 14 Q.3. 14 Q.3. 14 Q.4. 14 Nov. 14 Jan. 15 Jan. 15 Dec. 14 Jan. 15 Dec. 14 Q.1. 15 -1.8 -3.8 4.1 -25.3 -3.5 -0.4 -9.2 7.0 1.1 18.8 -8.9 7.2 26.1 -5.2 32.8 -1.5 25.5 - 9.7 0.7 23.6 -6.1 7.6 31.3 -5.5 4.8 0.3 13.5 -7.9 4.3 15.5 -4.4 6.8 3.1 24.9 -9.6 6.2 27.4 -4.4 32.8 -1.5 25.5 - 7.8 2.1 23.2 -7.1 7.3 28.9 -4.5 5.8 6.0 32.8 -1.5 5.0 25.5 -4.1 Nov. 14 Dec. 14 Jan. 15 Jan. 15 Nov. 14 Jan. 15 Dec. 14 5.2 5.4 -1.3 3.1 -1330 2.2 3.2 5.8 8.4 -2059 - -2.0 -1.1 3.7 4.0 -1955 4.8 6.2 7.3 9.7 -2299 3.7 5.6 5.0 7.2 -1898 - 4.1 6.6 7.7 9.9 -2240 3.2 4.5 2.0 4.3 -1555 Nov. 14 Nov. 14 Nov. 14 Nov. 14 Nov. 14 -1.1 -2.8 4.1 26.1 2.6 -3.3 -1.0 1.2 -7.3 24.4 -5.6 1.6 -6.0 2.5 -1.0 1.1 -7.0 24.5 -6.4 1.5 -1.0 1.6 -8.7 23.7 -5.9 2.0 -0.2 2.5 -8.1 23.7 -5.8 2.3 -6.0 2.5 -5.4 2.6 -6.0 2.5 Q.4. 14 Q.4. 14 Q.4. 14 Q.4. 14 Jan. 15 Jan. 15 1.4 1.4 0.1 0.6 0.5 0.2 -0.2 0.0 -0.6 -1.3 -0.3 - 0.2 0.1 -0.4 -0.1 0.5 -0.1 -0.3 0.0 -0.8 -0.9 0.6 -0.4 -0.5 0.0 -0.8 -2.1 0.6 - - -0.4 -0.1 -0.8 -1.5 0.6 - -1.0 0.0 -0.9 -3.7 0.6 - Dec. 14 Dec. 14 Dec. 14 Dec. 14 Dec. 14 Q.3. 14 Public sector. State operations September -4.18 -4.32 -3.34 2013 -3.47 Oct. 0.05 0.08 0.34 2.15 128 1.27 5.66 2014 -3.11 2014 Nov. 0.05 0.08 0.34 2.09 130 1.25 8.61 I.15(1) Previous data 2013 October Date November 2013 -3.48 2014 -2.90 Dec. 0.05 0.08 0.33 1.79 114 1.23 3.66 Jan. 0.05 0.06 0.30 1.54 110 1.16 1.20 2013 -3.78 2014 -3.34 2015 22-Jan 29-Jan 0.05 0.05 0.06 0.05 0.28 0.27 1.40 1.46 95 110 1.16 1.13 2.25 2.22 5-Feb Eurozone intervention rate (13) 0.25 0.05 0.05 0.05 3M Interbank rate.Euribor 0.22 0.21 0.06 0.06 1Y Interbank rate. Euribor 0.54 0.48 0.30 0.26 10Y Gov.Bond yield Spain 4.58 2.74 1.54 1.48 Differential Spain - Germany 295 150 110 111 Exchange rate ($/€) 1.33 1.33 1.16 1.14 Stock exchange Madrid IBEX-35 (14) 21.42 3.66 1.20 2.49 Memorandum Items EE.UU Intervention rate.(13) 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 Brent oil Price $ per barrel 109.57 99.36 47.82 87.50 79.27 62.30 47.82 45.48 46.00 55.42 (1) Available period data. (2) Adjusted for seasonal and calendar effects; contributions in percentage points. (3) Calendar adjusted data (4) Adjusted for calendar and temperature effects. (5) Balances in %.(sa). (6) DGT estimation. (7) Monthly average. (8) CPI excluding energy and unprocessed food. (9) Difference between Spanish and Euro zone harmonized CPI. (10) Accumulated figures; annual data include the application of wage revision clauses. (11) Accumulated data since January. (12) Period averages. (13) Level at the end of the period. (14) Percentage change accumulated since the beginning of the year.(*) New methodology applied to the published data Indicator.(**) (ESA 2010 new base 2010). Source: S. G. de Análisis Coyuntural y Previsiones Económicas. from different sources. D. G. de Análisis Macroeconómico y Economía Internacional S. G. de Análisis Coyuntural y Previsiones Económicas Graph 12. SUMMARY INDICATORS 6 GDP AND COMPONENTS (Adjusted Data) y-o-y % change DOMESTIC DEMAND: COMPONENTS (Adjusted Data) y-o-y % change 17 0 0 -6 Domestic Demand (contrib.) -17 Households Cons.Exp. GDP 2009 5 GFCF Equip.and others Net exports (contrib.) -12 2010 2011 2012 2013 2014 INDUSTRY: PRODUCTION AND CONFIDENCE y-o-y % change and balances GFCF Construction -34 2009 2010 2011 2012 2013 2014 ACTIVITY INDICATORS y-o-y % change 10 110 Large Firms Sales (left) Econ.Sent.I.(right) Elect.Power Con (left) -2 5 -10 0 90 -5 80 -17 100 IPI calendar adjusted ICl -24 2010 30 2011 2012 2013 70 -10 2014 2015 2010 2011 2012 2013 2014 2015 CONSUMER GOODS. APPARENT CONSUMPTION y-o-y % change IMPORTS AND EXPORTS. CUSTOMS y-o-y % change (volume) 20 15 0 0 -20 Consumer goods (adjusted) -15 Imports Capital goods (adjusted) Exports -30 -40 2009 2010 2011 2012 2013 2014 2009 EMPLOYMENT (y-o-y % change) 4 4 2010 2011 2012 2013 2014 CONSUMER PRICES (y-o-y % change) Employment LFS Social Security covered workers 3 0 1 -4 -1 CPI Core inflation -2 -8 2010 2011 2012 2013 2014 D. G. de Análisis Macroeconómico y Economía Internacional S. G. de Análisis Coyuntural y Previsiones Económicas 2015 2009 2010 2011 2012 2013 2014

© Copyright 2026