RBC Caribbean Economic Report January 2015

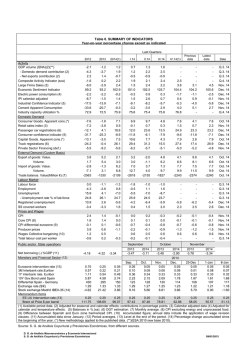

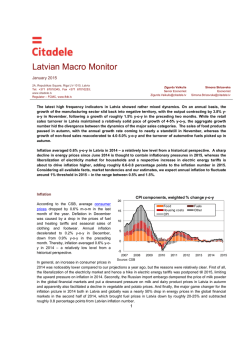

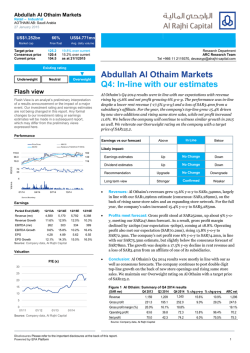

IMF Real GDP Growth Forecasts as at January 2015 GDP Growth % Emerging market and developing economies 5.0 January 2015 5 Advanced economies 4.7 CARIBBEAN ECONOMIC REPORT 5.5 5.2 World 5.1 4.4 4.5 4.0 3.8 3.4 4 3.5 3.3 3.3 3 2.4 2.3 1.8 1.4 1.2 2012 2013 2014e Source: IMF, RBC Financial (Caribbean) Limited 2015f 2016f RBC’s Commodity Index at Lowest Since 2009 2.5 2 RBC’s January 2015 Commodity Price Monitor showed the commodity price 1.5 index falling for a sixth consecutive month, with the pace of decline acceler- 1 ating to –11.2% in December 2014 from –4.1% in November. The commodity index saw its lowest level since September 2009, as the energy products subindex fell to a new post-recession low with a 20.1% m-o-m decline in December 2014, representing the sharpest monthly contraction in six years. The energy index was down by a substantial 36.7%, and the ex-energy index by 4.8%, y-o-y in December 2014. IMF trims 2015 and 2016 global growth forecasts again The IMF’s January 2015 update to the October 2014 World Economic Outlook revealed further reductions in global growth forecasts, based on slower growth anticipated for most major countries and regions, apart from the USA. Global growth in 2014 is now estimated at 3.3% - roughly the same rate as the previous two years. Both the 2015 and 2016 global growth forecasts were reduced by 0.3% each, to 3.5% and 3.7% respectively, as the boost from lower energy costs and stronger US growth is outweighed by weaker prospects for oil exporters, the Euro area, China, Russia and Japan. Growth for Latin American and the Caribbean (LAC) is estimated at 1.2% in 2014—down significantly from 2.8% in 2013. LAC growth forecasts have been reduced by 0.9% and 0.5% respectively for 2015 and 2016, to 1.3% and 2.3% respectively. The IMF is assuming an average oil price of USD56.73/bbl for 2015 and USD63.88/bbl in 2016. World Bank sees weaker growth and prospects than IMF The World Bank (WB) estimates global growth at 2.6% in 2014, only slightly stronger than the 2.5% expansion in 2013, and has forecasted 3.0% and 3.3% growth in 2015 and 2016 respectively. According to the WB’s annual Global Economic Prospects, the Euro Area and Japan accounted for more than half of the downward revisions to global growth in 2014, and one-third of the downward revisions to global growth in 2015. LAC growth decelerated significantly from 2.5% in 2013 to 0.8% in 2014—the slowest pace of growth in thirteen years, apart from 2009. The Caribbean* is estimated to have grown by Marla Dukharan 4.6% in 2014, and is projected to decelerate to 4.1% and 4.% in 2015 and Group Economist RBC Caribbean (868) 688-9845 [email protected] 2015 respectively. The Caribbean* is expected to “lead regional (LAC) growth, averaging 4.1% over 2015–17, benefiting from stronger external demand and rising tourism receipts”. * denotes Belize, Dominica, The Dominican Republic, Haiti, Jamaica, St. Lucia, St. Vincent and the Grenadines. Central Bank Net Foreign Assets : Aruba USD millions 800 750 Aruba—Strong tourist arrival growth and lower inflation According to the Central Bank’s (CBA) statistical digest, inflation dropped to 1.2% in November 2014 y-o-y, and net foreign assets declined to USD639 mil- 700 lion, which we estimate at 3.8 months of import cover. The Caribbean Tour650 ism Organization’s (CTO) data show that Aruba received 9.5% more stopover arrivals from January to November 2014, y-o-y. Though there was a 3.8% y-o- 550 y decline in arrivals from Canada, growth from all other source markets out- 500 weighed, including 24.7% y-o-y growth in arrivals from “other” markets. CBA Nov-14 Jul-14 Sep-14 May-14 Mar-14 Jan-14 Nov-13 Jul-13 Sep-13 May-13 Mar-13 Jan-13 Nov-12 Jul-12 Sep-12 May-12 Mar-12 Jan-12 600 Source: Central Bank of Aruba, RBC Financial (Caribbean) Limited data show that Venezuela is the fastest growing source market for stopover arrivals, up 34.8% y-o-y in Q3 2014. From January to September 2014, cruise Non-performing Loans / Total Loans : The Bahamas % Non-performing 17.5% passenger arrivals declined 2.7% y-o-y. The CBA’s Business Perception Survey 17.0% results reflect decreased optimism about current economic conditions. 16.5% 16.0% 15.5% 15.0% The Bahamas — Unemployment up from 14.3% to 15.7% The Department of Statistics reported that the overall unemployment rate 14.5% increased in November 2014 to 15.7%, up from 14.3% in May. Fiscal revenues 13.5% are set to improve as the VAT, which has been introduced as planned, is ex- 13.0% pected to earn BSD400 million in FY2015/16. In addition, the regularization of Nov-14 Sep-14 Oct-14 Jul-14 Aug-14 May-14 Jun-14 Apr-14 Mar-14 Jan-14 Feb-14 Dec-13 Nov-13 Sep-13 Oct-13 Aug-13 Jun-13 Jul-13 Apr-13 May-13 Feb-13 Mar-13 Jan-13 Dec-12 Oct-12 Nov-12 Sep-12 Aug-12 Jun-12 Jul-12 Apr-12 May-12 Jan-12 Feb-12 Mar-12 14.0% web shops has earned an estimated BSD20 million thus far. The Central Source: Central Bank of the Bahamas, RBC Financial (Caribbean) Limited Bank’s Financial Stability Report revealed a sharp deterioration in onshore International Reserves : Barbados USD '000 740,000 690,000 banks’ profitability, based partly on higher bad debt provisioning, as nonperforming loans crossed BSD1 billion—over 15% of total private sector loans. 590,000 Barbados — International reserves end 2014 down 9% 540,000 According to the Central Bank’s (CBB) December 2014 report, international 490,000 reserves stood at roughly USD526 million or 14.5 weeks of import cover. This 440,000 represents a 9% y-o-y decline, following four consecutive months of y-o-y Dec-14 Nov-14 Oct-14 Aug-14 Sep-14 Jul-14 Jun-14 Apr-14 May-14 Mar-14 Feb-14 Jan-14 Dec-13 Oct-13 Nov-13 Sep-13 Jul-13 Aug-13 Jun-13 Apr-13 May-13 Mar-13 Jan-13 Feb-13 640,000 growth in reserves. The CBB reported that long stay tourist arrivals are up Source: Central Bank of Barbados, RBC Financial (Caribbean) Limited 1.2% y-o-y, with growth coming from UK, Europe, Brazil and "other" coun- Gross Public Sector Debt / GDP : Barbados % of GDP 107% 108% 110% 2014 however. The CBB estimates that overall economic activity “improved 98% 100% by 0.3%" in 2014, based on expansion in investment in tourism related pro- 93% 88% 76% 90% jects, construction activity, mining and quarrying, solar generation and 80% chicken production. This follows a contraction of 0.3% in 2012 and zero 70% growth in 2013. The CBB is projecting growth of 2% this year, despite an ex- 60% tension of austerity measures by one year to April 2016 announced by the 64% 60% 62% 60% 50% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014e the deficit target for FY2015/16 is currently 5% of GDP. Net public sector Real GDP Growth : The Cayman Islands % change y-o-y 4.3% 5.0% 3.0% 1.9% 1.2% 2008 2009 2010 2011 2012 2013 2014f debt/GDP grew by about 6% of GDP during 2014, with increased financing secured mainly from the NIS and the CBB, while private sector holdings contracted. Non-performing loans as a percentage of total loans are up from 1.4% 1.0% 2007 Government. The Government is now aiming for a fiscal deficit of 7.2% of GDP, up from the initial target of around 6.5% of GDP, for FY2014/15, while Source: Central Bank of Barbados, RBC Financial (Caribbean) Limited 1.2% tries. CTO data still show a 0.6% y-o-y decline in stop-over arrivals to October 11.3% in Q3 2013 to 12.2% in Q3 2014. -1.0% -0.4% -2.7% -3.0% -5.0% -6.3% Source: Cayman Islands Economics and Statistics Office, RBC Financial (Caribbean) Limited 2 -7.0% Cayman Islands — Strong tourism growth continues According to CTO data, stopover arrivals grew 12.6% y-o-y from January to October 2014, while cruise passenger arrivals jumped by 20.2% y-o-y. Cuba — Strong tourism growth and better prospects Stopover Arrivals : Cuba # of stopover tourists 3,000,000 CTO data show that for January to November 2014, stopover tourist arrivals 2,900,000 grew 4.9% y-o-y to 2.67 million, mainly from Canada and “other” markets. 2,800,000 Moody’s recently reported that the shift in US policy toward Cuba (Caa2 sta2,700,000 ble) is a rating positive, and they “expect the resulting positive impact on the 2,600,000 economy from the looser restrictions to more than offset the negative impact 2,500,000 from a likely decrease in Venezuelan economic assistance.” Specifically, 2,400,000 Moody’s estimates that the inflow of remittances will double over the next 22,300,000 3 years, from over USD3.5 billion or about 4.4% of GDP in 2013, with the 2008 2009 2010 2011 2012 2013 2014e Source: Caribbean Tourism Organization, RBC Financial (Caribbean) Limited quadrupling of the remittance ceiling to USD2,000. Travel, tourism, trade, investment and financial intermediation are also set to increase over time. Provisional Net Official Reserves : Curacao and Sint Maarten NAf Millions 2,000 1,900 Curacao and St. Maarten — Higher growth and reserves 1,800 2014, while St. Maarten saw growth of 7.3% y-o-y from January to September 2014. Cruise passenger arrivals to Curacao increased by 9.7% y-o-y from Janu- Jan-15 Oct-14 Dec-14 Nov-14 Sep-14 Jul-14 Aug-14 Jun-14 Apr-14 May-14 Feb-14 Aug-13 Jun-13 May-13 Mar-13 Mar-14 1,300 Jan-14 that Curacao received 1.9% more stopovers y-o-y from January to November Dec-13 1,400 Oct-13 Q3 2014, while St. Maarten saw softer inflation at 1.9% y-o-y. CTO data show Nov-13 1,500 Sep-13 for the same period in 2013. Inflation in Curacao increased to 2.7% y-o-y in Jul-13 1,600 Apr-13 o-y in Curacao and 1.2% y-o-y growth in St. Maarten—both higher than growth Jan-13 1,700 Feb-13 The Central Bank’s quarterly bulletin for Q3 2014 revealed growth of 0.1% y- Source: Central Bank of Curacao and Sint Maarten, RBC Financial (Caribbean) Limited Inflation Rate : The Dominican Republic % change y-o-y 6.0 ary to November 2014, while St. Maarten saw a 16.5% y-o-y jump from Janu- 5.5 ary to October 2014. 5.0 4.5 4.0 The Dominican Republic — 7% growth estimated in 2014 3.5 3.0 CTO data show that from January to November 2014, stopover arrivals grew 2.5 by 9.7% y-o-y, while cruise passenger arrivals grew 11.1% y-o-y from January 2.0 1.5 to September 2014. The Central Bank (BCRD) estimates growth at roughly 7% inflation rate down to 1.58% y-o-y in December 2014. Although this inflation rate is increasingly below the target range of 4.5% +/- 1%, the BCRD main- Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 Jan-13 1.0 Feb-13 in 2014, while the third consecutive month of m-o-m deflation brought the Source: Central Bank of the Dominican Republic, RBC Financial (Caribbean) Limited Real GDP Growth : The Dominican Republic % change y-o-y Estimate 7.8% 8% tained its policy rate at 6.25% in its December 2014 monetary policy meeting. 8% 7.0% The DOP depreciated by 3.5% against the USD during 2014, and reserves stand 7% 7% at about 3.1 months of import cover according to the BCRD. The fiscal deficit 6% is expected to come in at 2.4% of GDP this year. A recent Moody’s report at- 6% 5.3% 5% tributed the rising growth to a 21% expansion in the mining sector, 11% 4.6% 4.5% 5% growth in construction, stronger tourism sector performance, and higher gold 3.9% 4% 3.5% output. Moody’s estimates that output growth will moderate and converge 4% 3% with its potential of approximately 5% in 2015. 2008 2009 2010 2011 2012 Source: IMF, Central Bank of the Cominican Republic, RBC Financial (Caribbean) Limited Jamaica — Stronger tourism performance, JMD weakens JMD / USD 2013 2014 Foreign Exchange Rate : Jamaica JMD 114 JMD 112 The Bank of Jamaica (BoJ) announced its inflation forecast in the range of 3- JMD 110 5% y-o-y for September 2015, and that FY2014/15 inflation would be below JMD 108 the 7-9% target. Deflation in November and December 2014 resulted in Q4 JMD 104 JMD 106 JMD 102 2014 deflation of 0.8% y-o-y, and 6.4% inflation for 2014 overall, down from JMD 100 JMD 98 9.5% in 2013. The BoJ expects the JMD to depreciate at a slower rate in 2015, JMD 96 JMD 94 having fallen from a peak of 15.46% y-o-y in October 2013, to 7.64% y-o-y in Dec-14 Oct-14 Nov-14 Sep-14 Jul-14 Aug-14 Jun-14 Apr-14 May-14 Mar-14 Jan-14 Feb-14 Dec-13 Nov-13 Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 Jan-13 JMD 92 Feb-13 December 2014. Import cover fell to about 18 weeks in December 2014. Source: Bank of Jamaica, RBC Financial (Caribbean) Limited 3 International reserves: Suriname USD Millions 1000 Suriname — International reserves end 2014 down 20% 950 The Central Bank’s online data show that inflation declined to 3.9% y-o-y in 900 December 2014, while reserves recovered slightly during that month to 850 USD621.8 million, which we estimate at roughly 3 months of import cover. 800 750 Trinidad and Tobago — Large USD injections underway 650 Central Bank (CBTT) data show that net official reserves grew by 13.3% y-o-y 600 in December 2014 to USD11.3 billion, estimated at roughly 12.5 months of Dec-14 Oct-14 Nov-14 Sep-14 Jul-14 Aug-14 Jun-14 Apr-14 May-14 Mar-14 Jan-14 Feb-14 Dec-13 Oct-13 Nov-13 Sep-13 Jul-13 Aug-13 Jun-13 Apr-13 May-13 Mar-13 Jan-13 Feb-13 700 import cover. The CBTT injected USD1.715 million into the financial system Source: Central Bank of Suriname, RBC Financial (Caribbean) Limited in 2014—30% more than 2013, but 4% less than 2012. In announcing its largest monthly injection ever at USD400 million in January 2015, the CBTT stated Central Bank USD Injections per annum : Trinidad and Tobago 1,715 1,550 1,475 1,315 1,400 823 1,000 800 671 487 2015 foreign exchange management...aimed at preventing foreign exchange shortfalls from arising as a result of escalating demand and reduced supply 1,200 600 386 310 296 “These larger and more frequent interventions reflect the nature of CBTT’s 1,800 1,600 1,020 1,393 2,000 1,785 1,899 USD '000 400 45 200 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 due to lower energy export earnings.” Sub-optimal USD supply may have contributed to headline inflation at 9% and food price inflation around 18% y-o-y in November 2014, as importers have reportedly resorted to paying USD bills in EUR, GBP or CAD, buying USD at higher prices on the parallel market, and stockpiling USD in anticipation of bills coming due—increasing import costs. Source: Central Bank of Trinidad and Tobago, RBC Financial (Caribbean) Limited Caribbean Economic Indicators Popl'n (000) Nominal GDP (USD Bn) Per capita Credit Rating & GDP (USD) (Outlook) Aruba 106 2.6 24,426 The Bahamas 347 8.2 Barbados 274 Gross Public Import Y-O-Y Inflation Unemp. debt/GDP cover (%) (%) (months) (%) 4.8% 7.6% 67.1% 3.8 1.2% 23,417 BBB (Negative) 0.7% 15.7% 61.8% 1.8 1.0% 4.5 16,307 B (Negative) -0.3% 13.2% 107.7% 3.3 1.7% 57 3.0 54,338 Aa3 (Stable) 2.2% 6.3% 21.0% n/a 1.5% 11,300 77.1 6,848 Caa2 (Stable) 2.8% 3.5% 22.3% n/a 0.7% 143 3.0 21,247 A- (Stable) 0.1% 13.0% 37.0% 4.2 2.7% 10,400 60.8 5,662 B+ (Stable) 7.0% 6.0% 48.0% 3.1 1.6% ECCU 605 5.7 8,922 n/a 0.7% 20.0% 98.5% 8.0 0.8% Guyana 756 2.7 3,596 Not rated 3.2% 11.0% 65.0% 3.5 -0.4% 2,751 15.3 5,526 B- (Positive) 1.8% 13.8% 146.2% 4.1 6.4% 43 0.8 19,333 Baa1 (Stable) 1.2% 15.0% 22.0% 4.2 1.9% 541 5.1 9,339 BB- (Stable) 4.1% 9.5% 31.0% 3.1 3.9% 1,328 23.8 17,935 A (Stable) 0.5% 3.2% 46.6% 12.5 9.0% Cayman Cuba Curacao Dom Rep Jamaica St. Maarten Suriname T&T BBB+ (Stable) Y-O-Y GDP change (%) Disclaimer: The material contained in this document is the property of RBC Financial (Caribbean) Limited ("RBC Caribbean") and may not be reproduced in any way, in whole or in part, without express authorization of the copyright holder in writing. This document is intended as a general source of information only, and should not be construed as offering specific tax, legal, financial, investment or other advice, and should not be acted or relied upon in that regard without seeking the advice of a professional. It also does not constitute an offer to sell or a solicitation to buy securities. The statements and statistics contained herein have been prepared by RBC Caribbean based on information and sources considered to be reliable. Every effort has been made to ensure that the material is correct at time of publication, but RBC Caribbean makes no representation or warranty, express or implied, as to its accuracy or completeness. Interest rates, market conditions, tax rulings and other investment factors are subject to rapid change. Individuals should consult with their personal tax advisor, accountant or legal or other professional before taking any action based upon the information contained in this document. 4

© Copyright 2026