Workshop CC

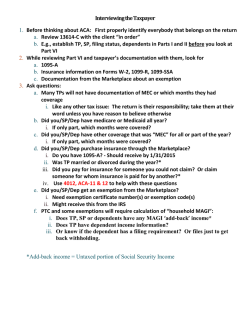

24th Annual Tuesday & Wednesday, January 27‐28, 2015 Ohio Tax Hya Regency Columbus, Columbus, Ohio Workshop CC Regional Update … Tax Advice for Companies Doing Business in Michigan & Pennsylvania Wednesday, January 28, 2015 11:00 a.m. to 12:30 p.m. Biographical Information June Summers Haas, Partner, Honigman Miller Schwartz and Cohn LLP 222 North Washington Square, Lansing,MI 488933 [email protected] 517.377.0734 Fax 517.365.9534 June Summers Haas is a partner with Honigman Miller Schwartz and Cohn LLP in Lansing, Michigan where she specializes in advising clients on a nationwide basis on multistate tax strategies, resolving tax disputes and litigating state tax cases. She is a nationally recognized expert on nexus issues and has been in the forefront of litigation defining the parameters of the resale exemption, establishing the applicability of the unitary business principle to Michigan taxes, establishing Michigan’s casual transaction exclusion, and distinguishing between sales of services and sales of tangible property. In addition, Ms. Haas spearheaded efforts to enact procedural reform for Michigan tax administration and has been a consultant to the Michigan Chamber of Commerce and the Legislature in drafting the Michigan Business Tax and the Corporate Income Tax. She was a consultant to the California Commission on the 21st Century Economy. Prior to joining Honigman Miller Schwartz and Cohn LLP, Ms. Haas was Michigan’s Commissioner of Revenue, administering 23 taxes, managing an 800 person tax revenue operation and advising the Governor and Treasurer on tax policy. Ms. Haas served for three years as Director of the Multistate Tax Commission’s National Nexus Program. Ms. Haas also has over twenty years of private law practice experience, including extensive state tax litigation and appellate work. She is a member of the BNA State Tax Advisory Board and the Hartman State and Local Tax Forum Advisory Board. Ms Haas has been selected for inclusion in Best Lawyers in America and Michigan Super Lawyers since 2007. She is a frequent speaker and author on state tax topics throughout the country. She was named to “The AllDecade State Tax Team” by State Tax Notes in January 2010. She is the author of the chapter on Jurisdiction to Tax in the new IPT book, State Business Income Taxation. June Summers Haas is a graduate of the University of Virginia Law School and received a bachelor’s degree with distinction in economics from George Mason University in Virginia. She is an adjunct professor in Thomas M. Cooley Law School LLM in Taxation Program. Randy L. Varner, Member, McNees Wallace & Nurick LLC 100 Pine Street, P.O. Box 1166, Harrisburg, PA 17108 717.237.5464 Fax: 717.260.1672 [email protected] Randy L. Varner is an attorney with the State and Local Tax Group at McNees Wallace and Nurick LLC, in Harrisburg, Pennsylvania. Has over 16 years of experience in the commercial litigation and state and local tax areas. He is an experienced litigator in administrative tribunals and courts at both the state and federal levels, and is admitted to practice in Pennsylvania, the United States District Court for the Middle District of Pennsylvania, the United States Court of Appeals for the Third Circuit and the Supreme Court of the United States. In Pennsylvania, Randy has successfully represented financial institutions, pharmaceutical companies, computer service providers, and light and heavy manufacturers in sales and use tax, corporate net income tax, and capital stock and franchise tax controversies before the Board of Appeals, the Board of Finance and Revenue, the Commonwealth Court, and the Supreme Court of Pennsylvania. In addition, Randy has secured significant tax savings for commercial developers, utilities, and industries in the property tax assessment area. He is a frequent author and speaker on state tax topics and is active in many tax organizations, including IPT and COST. A co-author of the Pennsylvania Bar Institute treatise "Assessment Law and Procedure in Pennsylvania," Randy has served as an evaluator in the advocacy program at The Dickinson School of Law of The Pennsylvania State University, where he earned his J.D. degree magna cum laude. Michigan Taxes: What’s New for 2015? June Summers Haas, Esq. Honigman Miller Schwartz and Cohn LLP Agenda • • • Sales and Use Tax • Online Registration • New Case Law • Refund Opportunities • New Legislation Business Taxes • Refund Opportunities • Credit Ordering • Apportionment Tax Administration • New Statute of Limitations • Offer in Compromise • Unclaimed Property Reform • Successor and Corporate Officer Liability Sales and Use Taxes Online Registration • Michigan Treasury Online Account allows: – – – – File and pay taxes electronically for 2015 and forward. Review and update registration information. Update, add or delete tax types. Add payroll service provider. • All SUW taxpayers required to sign up and pay online. • No new SUW booklets. Sales and Use Refund Opportunities • Manufactured property affixed to real property in another state. – RAB in process – Use Tax Base of Tangible Personal Property Affixed to Real Estate by Manufacturer/Contractor or Other Contractor. • Parts attached to rolling stock: – 2012 PA 467. – RAB in process – Sales and Use Tax Treatment of Interstate Motor Carriers. Manufacturing/Industrial Processing Exemption • • Detroit Edison Co v Dept of Treasury, 303 Mich App 612 (2014) pending before MI S Ct – Holding that equipment used to change form of electricity is exempt up to delivery to customer’s meter. – Concurrent exempt and nonexempt use is 100% exempt. MidAmerican Energy Co v Dep’t of Treasury, __ Mich App __ (12/4/2014) – Holding that electricity used to create and power the production of telecommunications signals is not exempt under sales tax because telecom signal is not tangible personal property. Electronic Transaction Cases • Thomson Reuters (Tax & Accounting) Inc v Dep’t of Treasury, Ct of Claims (2013), COA argument 4/8/2014 – Sale of access to database of case law information constitutes taxable sale of software. – Application for Leave to appeal to MI S Ct pending. • Auto-Owners Inc v Dep’t of Treasury, Court of Claims (2014) – Taxpayer purchased various transactions over internet. – Held software was not delivered in any manner; access to software on remote computer is not taxable use; under Catalina, the transactions were purchases of services, not software. – Appeal to COA pending. • Rehmann Robson v Dep’t of Treasury, Court of Claims (11/26/14) – “Unless and until the legislature expresses an intent to specifically tax transactions involving the remote access to a third party provider’s technology infrastructure, transactions such as those described in this case do not fit under the plain meaning of the UTA and are not properly subject to use tax.” Sales and Use Refund Opportunities • Refunds for payment of sales or use taxes on: – – – – Software maintenance contracts. Hardware maintenance contracts. Database services accessed electronically. Other electronic services. Sales and Use Tax Litigation NACG Leasing v Dep’t of Treasury, 495Mich 26 (2/6/2014) •COA held that purchase and lease of aircraft held not a “use.” The lessee’s possession was not interrupted. •COA found that the lessor did not “use” the aircraft in Michigan and therefore use tax not imposed on the lease: “a transfer of property unaccompanied by a transfer of possession is simply not ‘use’ that is subject to tax.” •MSC held that execution of lease in Michigan was an exercise of control incident to ownership constituting a taxable use, despite the purchaser/lessor does not obtaining actual possession of the property. WPGP1 held not applicable because addressed different facts. Sales and Use Tax Litigation MJR Group, Inc. v Dep’t of Treasury, unpublished decision per curium of COA (2/25/2014) •Theater company requested refund of sales tax on bottled water and prepackaged candy sold at its theaters' concession stands. •Sign above concession stand said tax is included in price. Company specifically alleged in its petition that it did not charge sales tax to its customers •The Michigan Tax Tribunal (MTT) denying MJR the refund based upon tax collection. •Court of Appeals held that MJR did not owe sales tax on bottled water or candy. There was a genuine issue of material fact on collection of tax from its customers if testimony is deemed not to be credible. Lessor Election to Pay on Lease CDM Leasing LLC v Dept of Treasury, unpublished opinion per curiam COA Docket No. 317987 (12/18/2014) •Holding that election to pay tax on lease income is not available to lessor who uses airplane for personal use. See also FMG Leasing LLC v Dept of Treasury, unpublished opinion per curiam COA Docket No. 312448 (6/26/2014) No Use Tax Refunds for Assessment on MI Sales • Andrie, Inc v Dep’t of Treasury, 496 Mich 161; 853 NW2d 310 (6/23/2014) – Court of Claims: Use tax does not apply to purchases from Michigan vendors, as the Michigan Sales Tax Act imposed sales tax on the vendor. – Court of Appeals: Purchaser does not have the burden of proving that the sales tax was paid in defending against an assessment of use tax on the purchaser; the Department is obligated to pursue the seller for sales tax. – Michigan Supreme Court reversed: Purchaser liable for use tax unless she can prove that she paid sales tax or seller remitted sales tax. Recent Legislation Main Street Fairness Bills pass. SB 658 & 659 [MCL 205.52b & 205.92b] •Nexus rebuttably presumed if company or an affiliated person: – Sells similar line of products with same business name; – Promotes or facilitates sales through employees, representatives or independent contractors; – Maintains office, distribution facility or other place of business; – Uses trademarks, service marks or trade names in MI; – Shares management systems or practices; – Conducts activities significantly associated with establishing and maintaining the market in MI; or – Click through nexus agreement Recent Legislation • • No maximum discount for accelerated filers. 2014 PA 425 & 426. Transportation funding package: House Joint Resolution UU; HB 4539; 5492; 5493 and SB 847. All are tie-barred. – House Joint Resolution UU places following issues before the voters: • Exempts sales of gas and diesel motor fuel from sales tax after 10/1/2015. • Increase maximum sales and use tax by 1% (from 6 to 7%). • Dedicate certain portions of sales tax to school aid fund, eliminate universities from use of school aid fund; and dedicate portion to revenue sharing with localities. – Exempt gas and diesel from sales tax beginning 10/15/2015; – Motor Fuel Act to change fixed taxes to taxes based on average wholesale prices effective 10/15/2015; – Amend Motor Fuel Carrier Tax to change per-gallon tax rates; and – Amend Income Tax Act to increase earned income tax credit from 6% to 20%. BUSINESS TAXES Business Tax Refund Opportunities • MTC 3-Factor Election for Apportionment during 2008 through 2011. • IBM v Dep’t of Treasury, MI S Ct opinion final. • Lorillard v Dep’t of Treasury, on application for leave for review. • Anheuser-Busch v Dep’t of Treasury, pending at COA. • Effectiveness of PA 282. Business Tax Refund Opportunities • COD add back refunds for 2010 to 2014. • PA 282 – COD add back eliminated after 2011. • Pre-2011 refund claims required in 2015 for one payment in 2010 to 2014. • ITC recapture may now be refunded when no ITC taken. Unitary Group Refund/Planning • CIT - Elimination of intercompany transactions for calculation of deductions and credits under 2014 PA 14. • No similar legislation for MBT so intercompany transactions can be utilized for calculation of deductions and credits. • Sales Factor Elimination – Unitary FTEs. Unitary Group Refund/Planning • Taxpayers can make a binding election for inclusion of certain entities in the affiliated group – PA 266 of 2013 (SB 367). • Department’s use of IRC 318 attribution rules for determination of indirect ownership has been upheld. • Labelle Management Inc v Dep’t of Treasury, Court of Claims. • Do you need certainty in your group configuration? Refunds for Credit Ordering Denials • SBT credit carry forwards versus compensation/ITC/R&D MBT credits. • Hudsonville Creamery, Michigan Tax Tribunal, Docket No. 450134. • Ashley Capital, LLC, Court of Appeals, Docket No. 322386. • Vitec Inc v Dep’t Treasury, Court of Appeals Docket No. 324330. Credit Denials Packaging Corp of American v Dept of Treasury, unpublished COA Docket No. 317708 (12/16/2014) • SBT property tax credit denied because taxpayer failed to timely file property tax statements with assessor. Alternative Apportionment Sidney Frank Importing Inc v Dept of Treasury, unpublished opinion per curiam COA Docket No. 315610 (2014) • A failure to respond to a request for alternative apportionment is not a denial. • Remanded to trial court to require Department to respond. Get Your Factors In Order • Document sales factor methods for sourcing services and intangibles to location where client receives benefit. • Department is working on an RAB for determining where the benefit of services are received. • Ensure that you are sourcing sales of tangible personal property to the ultimate destination. PBM Nutritionals v Dep’t of Treasury, Court of Claims. Sale of Partnership Interest Robert Aikens v Dept of Treasury, unpublished opinion per curiam COA Docket No. 310528 (2014) • Individual’s sale of partnership interest generated business income that must be apportioned to MI based on factors of the partnership. ADMINISTRATIVE REFORM Notice to Taxpayer Representative Fradco, Inc v Dep’t of Treasury, 495 Mich 104 (2014). •MCL 205.8, “the department shall send the official representative … a copy of each letter or notice sent to that taxpayer” (statutory notice provision enacted as a part of 1993 Taxpayer Rights Legislation). •In Fradco, the Department did not provide the taxpayer’s representative with a copy of the final assessment until over 9 months after the final assessment was initially sent to the taxpayer. •MI Supreme Court held that notice to the representative is required once a power of attorney is filed. •Note: Department changed its power of attorney forms so watch what you file! Resolutions for Next Year: Appeal Properly • Coventry Healthcare Inc v Dep’t of Treasury, unpublished Court of Appeals (10/16/14) – Pay-to-play and Court of Claims jurisdiction. – Potential trap of unwary. • Martin Sprocket & Gear, Inc. v Dep’t of Treasury, unpublished Court of Appeals (10/21/14) – Pay-to-play and perceived overpayment status. Resolutions for Next Year: Know Your Rights • Statute of Limitations; Ends Unlimited Tolling of SOL, Transparency: 2014 PA 3. • No Quotas and Fair Treatment: 2014 PA 277. • Unclaimed Property Audit Reform: 2013 PA 148. • Unclaimed Property Procedural Reform: 2014 PA 423. • Offer in compromise. • Additional Interest on Tardy Refunds: 2014 PA 424. • Standards, Limits on Indirect Audits and Transparency 2014 PA 35. • Sales and Use Tax Indirect Audit Reform; Standards 2014 PAs 108, 109. • Successor Liability: Requires 60 day response and limits exposure. • Corporate Officer Liability; Limited to Trust Taxes, Clarifies Existing Law, Transparency: 2014 PA 3. Look for Refund Opportunities • 2014 PA 3 changed SOL rules. • For tax years currently under audit and beyond four year statute of limitations. – File quickly – Department position that SOL is open – Taxpayers are challenging • For tax years within 4 years, file within normal 4 year period. Rules for Statute of Limitations Have Changed PA 3 of 2014 • Effective February 6, 2014. • New statute of limitations restrictions to audits commence after September 30, 2014. • Sets deadlines when Department must complete the audit, provide preliminary audit determination and issue final assessment. • Specifies circumstances to extend SOL. • Allows taxpayer to treat claim for refund as deemed denied. • Dispute on SOL for pre September 30, 2014. Rules for Statute of Limitations Have Changed PA 3 of 2014 • From September 30, 2014 forward: • SOL is four years after the due date for filing the return or the date the return was filed. • Audit may be started within 4 year SOL. • Audit fieldwork and issuance of the preliminary audit determination must occur with in 1 Year after the 4 year SOL runs UNLESS taxpayer agrees in writing to an extension. • Limits issuance of final assessment to 9 months after the issuance of the preliminary audit determination. Rules for Statute of Limitations Have Changed PA 3 of 2014 • Extension of 9 months for issuance of Final Assessment IF the taxpayer: 1) “requests reconsideration” or, 2) “requests informal conference” – Discretionary with the Dept. as to whether “request for reconsideration” extends issuance of final assessment. • Extension for federal adjustments, audit and litigation for the duration of the review and 1 year thereafter. No change. • Taxpayer may deem a denial of the refund claim if no answer received within 1 year of the date the claim was “received.” PA 3: Statute of Limitations • Pre-February 6, 2014. • Department claims prior law applies so for pending audits, statute is open for period of audit and one year thereafter without any written waiver. • Post-February 6, 2014 and pre-Sept 30, 2014. • SOL suspended during the audit, without written waiver. • Taxpayers disagree. Claim 4 year statute of limitations applies. Failure to issue assessment within 4 years bars assessment but also bars refund claims What is A Refund Claim? • Tax Return showing an amount due. MCL 205.30. • Notice to Department that taxpayer believes the amounts should be refunded. • Ford Motor Co v Dep’t of Treasury, Ct of Claims. • No sum certain to be refunded needed. • Information to determine validity of claim not needed. Legislated Courtesy 2014 PA 277 Amended the Revenue Act: •Requires the Department to propose rules for courteous treatment of public, fair and consistent application of statutes and rules, and no collection goals or quotas. •If Department intentionally used a collection goal or quota, a taxpayer may be awarded actual damages up to $45,000. Offer In Compromise Program • Effective 1/1/2015: • Tax debt settlement based upon: 1. Doubt as to Liability; 2. Inability to pay; 3. Federal offer in compromise given for same year. • Intended for taxpayers with severe financial hardship. • Mich.gov/oic for forms – under construction. Rules for Unclaimed Property Audits • 2013 PA 148. • Places limits on the use of statistical or indirect auditing by requiring auditing ethical/professional– standards. • Mandates departmental disclosure of audit documents: nothing withheld. • Caps assessable audit costs. • Requires submission of administrative rules. Unclaimed Property Procedural Reforms 2014 PA 423 •Establishes right to administrative review of audit determination. •Informal review process. •Establishes right to appeal to court within 90 days. •Establishes penalty and interest appeal. Resolutions for Next Year: Don’t Buy a Tax Liability • SOL: If owner waives confidentiality, Dept. MUST supply the known or estimated tax of to a purchaser with 60 days. • Successor Liability Limited, if Purchaser escrowed the expected tax liability. – If 60 day response is not met, successor-purchaser is not liable. – If 60-day response was met, liability limited to amount of estimate. • Otherwise limitation is the fair market value of the owner-predecessor. Corporate Officer Liability 2014 PA 3 • PA 3 Limitation – Limit to Trust Taxes and require “willfulness.” – Prioritize successor liability before COL. – Allow challenges to the legal basis of the assessment. – Permit assessed Responsible Persons to sue other unassessed Responsible Persons. QUESTIONS? June Summers Haas, Esq. [email protected] (517) 377-0734 About This Presentation • This presentation contains general information only and the respective speakers and their firms are not, by means of this presentation, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This presentation is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. The respective speakers and their firms shall not be responsible for any loss sustained by any person who relies on this presentation. • 16240868.2 Pennsylvania Update Randy Varner Jim Fritz © 2014 McNees Wallace & Nurick LLC www.mwn.com ↑ Trends ↓ Twists Trepidations © 2014 McNees Wallace & Nurick LLC www.mwn.com trep∙i∙da∙tion noun \ˌtre‐pə‐ˈdā‐shən\ : a feeling of fear that causes you to hesitate because you think something bad or unpleasant is going to happen o © 2014 McNees Wallace & Nurick LLC www.merriam-webster.com/dictionary/trepidation www.mwn.com Political Outlook ELECTION RESULTS WHAT DO THEY MEAN? © 2014 McNees Wallace & Nurick LLC www.mwn.com ↑Trends↓ © 2014 McNees Wallace & Nurick LLC www.mwn.com Capital Stock & Franchise Tax Phase-out Year Millage Rate Year Millage Rate 1991 13.00 2006 4.89 1992-97 12.75 2007 3.89 1998 11.99 2008-11 2.89 1999 10.99 2012 1.89 2000 8.99 2013 0.89 2001 7.49 2014 0.67 2002-3 7.24 2015 0.45 2004 2005 6.99 5.99 2016 0.00 © 2014 McNees Wallace & Nurick LLC Last Adjustment: Act 52 of 2013 www.mwn.com CNI - Net Loss Carryforward Cap 1995‐1998 $1 million ($500k from 88‐94) 1999‐2006 $2 million 2007‐2008 $3 million or 12.5% (greater) 2009 $3 million or 15% (greater of) 2010 & after $3 million or 20% (greater of) © 2014 McNees Wallace & Nurick LLC www.mwn.com CNI - Net Loss Carryforward, cont’d Carryforward Period 1981 1982 1983‐1987 1988 1989 1990‐93 1994 1995‐97 1998 & after © 2014 McNees Wallace & Nurick LLC 1 tax year 2 tax years 3 tax years 2 tax years + 1995 tax year 1 tax year + 1995 & 1996 3 years (starting in 1995) 1 tax year 10 tax years 20 tax years www.mwn.com Single Sales Factor & Market Sourcing Tax Years Pre-1999 1999-2006 2007-2008 2009 2010-2012 2013 © 2014 McNees Wallace & Nurick LLC Property Weight 33.33% 20% 15% 8.5% 5% 0% Payroll Weight 33.33% 20% 15% 8.5% 5% 0% www.mwn.com Sales Weight 33.33% 20% 70% 83% 90% 100% Single Sales Factor & Market Sourcing, cont’d Pre‐2014 Sourcing of Sales Tangible Personal Property Destination Services COP Intangibles COP 2014 & after (Act 52 of 2013) Tangible Personal Property Destination Services Delivery Intangibles COP © 2014 McNees Wallace & Nurick LLC www.mwn.com “Cost of Performance” “Sales, other than sales of tangible personal property, are in this State if: (A) The income‐producing activity is performed in this State; or (B) The income‐producing activity is performed both in and outside this State and a greater proportion of the income‐producing activity is performed in this State than in any other state, based on costs of performance.” Tax Reform Code §401(3)2(a)(17) After 2013, COP applicable only to Intangibles © 2014 McNees Wallace & Nurick LLC www.mwn.com “Cost of Performance” PA Revenue Dept. never issued COP regs Two Letter Rulings Published But often ignored by Audit Bureau and Taxing Division Other States Trending to Market Sourcing Inconsistent definition © 2014 McNees Wallace & Nurick LLC www.mwn.com Real Estate – post‐2013 “Sales from the sale, lease, rental or other use of real property [are sourced to Pennsylvania] if the real property is located in this State. If a single parcel of real property is located both in and outside this State, the sale is in this State based upon the percentage of original cost of the real property located in this State.” © 2014 McNees Wallace & Nurick LLC Tax Reform Code §401(3)2(a)(16.1)(A www.mwn.com ) Rental/Lease of TPP after 2013 (I) Sales from the rental, lease or licensing of tangible personal property [are sourced to PA] if the customer first obtained possession of the tangible personal property in this State. (II) If the tangible personal property is subsequently taken out of this State, the taxpayer may use a reasonably determined estimate of usage in this State to determine the extent of sale in this State. © 2014 McNees Wallace & Nurick LLC Tax Reform Code §401(3)2(a)(16.1)(B) www.mwn.com Services after 2013 – “Delivered” (I) Sales from the sale of service [are sourced to PA] if the service is delivered to a location in this State. If the service is delivered both to a location in and outside this State, the sale is in this State based upon the percentage of total value of the service delivered to a location in this State. (II) If the state or states of assignment under subparagraph (I) cannot be determined for a customer who is an individual that is not a sole proprietor, a service is deemed to be delivered at the customer's billing address. (III) If the state or states of assignment under subparagraph (I) cannot be determined for a customer, except for a customer under subparagraph (II), a service is deemed to be delivered at the location from which the services were ordered in the customer's regular course of operations. If the location from which the services were ordered in the customer's regular course of operations cannot be determined, a service is deemed to be delivered at the customer's billing address © 2014 McNees Wallace & Nurick LLC Tax Reform Code §401(3)2(a)(16.1)(C) www.mwn.com Business Privilege Tax on Services - Scope Local Transactions Only Distinguish Tax on Transaction from Tax on Privilege where Activity Outside Managed from Within ‐ Gilberti Apportion Interstate Base of Operations Required for Privilege‐based Tax Anything Goes ‐ Rendina Credit @ Base of Ops for Tax Paid at Location of Activity – Act 42 of 2014 © 2014 McNees Wallace & Nurick LLC www.mwn.com Tax Appeals Modernization Settlement Process dating to 1812 & “Insider” Board of Finance and Revenue dating to late‐1920’s Assessment Process – Act 119 of 2006 (eff. 1/1/2008) Formal Tax Court Avoided Compromises @BOA – Misc. Tax Bulletin 2011‐02 Penalty Abatement @Audit – eff. 12/1/2011 Independent BF&R Appointed Members, No More Ex Parte, Compromises, Published Decisions ‐ Act 52 of 2013 (eff. 4/1/14) © 2014 McNees Wallace & Nurick LLC www.mwn.com Twists © 2014 McNees Wallace & Nurick LLC www.mwn.com School Property Tax Reform Various Legislative Proposals Block of votes in PA House House Rejected Proposal SB 76 Increase PIT & SUT Rates Expand SUT to Additional Services Eliminate Many SUT Exemptions Action attempted before election. © 2014 McNees Wallace & Nurick LLC www.mwn.com Trepidations © 2014 McNees Wallace & Nurick LLC www.mwn.com Marcellus Shale Extraction Tax Other States Candidate Tom Wolf: 5% Tax o “Texas, Wyoming, Louisiana, New Mexico, West Virginia and most other states in the country currently benefit as oil and gas companies and other corporate interests cash in on those states' environmental resources.” o $500 million ‐ $1 billion © 2014 McNees Wallace & Nurick LLC www.mwn.com School Funding Elimination of School Property Taxes Replace Revenue by: Increasing Sales & Use Tax Rate Expanding Services Subject to Sales & Use Tax Eliminating Sales & Use Tax Exemptions Increasing Personal Income Tax Raft Increasing Local Business Privilege Taxes © 2014 McNees Wallace & Nurick LLC www.mwn.com Combined Reporting Addback (Act 52 of 2013) not enough? Democrat House & Senate Numerous bills over last several years Gubernatorial Candidate Tom Wolf “Close the Delaware loophole and end unfair tax credit programs.” Possible Reduction in CNI Rate? © 2014 McNees Wallace & Nurick LLC www.mwn.com Extension of CSFT 2014‐15 FY Revenue Yield: $328,200,000 2015‐16 FY Revenue Yield: $198,000,000 This tax has been extended before! The Commonwealth will need $$$$ © 2014 McNees Wallace & Nurick LLC www.mwn.com State & Local Pensions $50 billion Unfunded PSERS & SERS Liability “can repeatedly kicked down the road” “Pension Reform Act” (Act 120 of 2010) Multiplier Reduced from 2.5% to 2% Max Pension Capped @ Final Avg Vesting increased from 5 years to 10 years $33 billion savings over 30 years Current employees locked‐in © 2014 McNees Wallace & Nurick LLC www.mwn.com Administrative Activity Board of Finance and Revenue "New" Board began in April 2014 Adversarial Process Compromises Possible © 2014 McNees Wallace & Nurick LLC www.mwn.com Administrative Activity Computer System Implementation Delayed No traditional "ledgers" New "notice" correspondence from Department © 2014 McNees Wallace & Nurick LLC www.mwn.com Regulatory Activity Natural Gas Drilling Sales and Use Tax Bulletin (2014‐02) Intangible Drilling Costs Personal Income Tax Bulletin (2013‐04) Market Sourcing for Services Guidance in Development © 2014 McNees Wallace & Nurick LLC www.mwn.com Cases of Note Wirth v. Commonwealth, 82‐85 MAP 2014 (June 17, 2014) Nonresident Nonrecourse Debt Forgiveness Investors lost entire investment Interest accumulated Court held taxable on entire amount of loan forgiveness, including interest © 2014 McNees Wallace & Nurick LLC www.mwn.com Cases of Note Fish, Hrabrick and Briskin v. Township of Lower Merion, No. 1940 C.D. 2013 (September 19, 2014) Court held that lease receipts not taxable Local Tax Enabling Act forbids taxation of leases or lease transactions Township argued that it was taxing privilege of doing business Broad refund implications © 2014 McNees Wallace & Nurick LLC www.mwn.com QUESTIONS? Randy L. Varner McNees Wallace & Nurick LLC [email protected] 717‐237‐5464 © 2014 McNees Wallace & Nurick LLC www.mwn.com

© Copyright 2026