PYTHON FOR FINANCE BY YVES J. HILPISCH QUANTS HUB

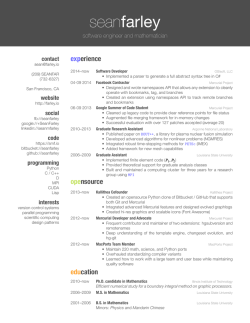

THE QUANTS HUB PROGRAMMING SCHOOL PRESENTS PYTHON FOR FINANCE BY YVES J. HILPISCH QUANTS HUB PROGRAMMING SCHOOL 10 WEEK ONLINE COURSE This conference offers an into and the latest practical Against the background ofintuitive financialinsight examples use cases, the aspects of The CVA desk: Reviewing theintroduces impact of regulatory changeslanguage & capital “Python for Finance” workshop to most important elements, tools and (performance) that Python as a platform charges, XVA management, pricing libraries adjustments & desk organization technology has to offer for Quant Finance.techniques as well as a more and the latest pricing, trading & modelling THE COURSE REQUIRES NO PRIOR KNOWLEDGE OF PYTHON BUT KNOWLEDGE OF A SIMILAR PROGRAMMING LANGUAGE AS WELL AS OF STANDARD FINANCIAL MODELS IS RECOMMENDED. YOU WILL LEARN • How to best start using Python, related tool and libraries for Quant Finance • How to model and store data efficiently with Python • How to implement compact and performant financial algorithms • How to visualize financial data with Python • How to manage and analyze financial time series data • How to implement performant I/O operations • How to increase the performance of financial Python code CERTIFIED BY EARLY BIRD DISCOUNT: 20% BEFORE 27TH FEBRUARY COURSE START DATE: 13TH APRIL 2015 COURSE OVERVIEW PYTHON FOR FINANCE WITH YVES J. HILPISCH ABOUT THE PRESENTER Each lecture will appear in your members area weekly, and all webinar invites will be sent directly. You can also contact Yves at any time with the Python forum. We can offer additional Webinars to candidates who live in different time zones. Python has established itself as a real contender in the Quant Finance world to implement efficient analytics workflows and performant applications. Although being an interpreted language, quantative analysts and developers can draw on the powerful (scientific) ecosystem that has grown around Python. This ecosystem comprises libraries such as NumPy that allows array management and operations both in a highly vectorized fashion and at the speed of C code. In addition, using the pandas library makes the management and analysis of financial time series both convenient and efficient. In such a context, data visualization is also easily accomplished with Python. The workshop also illustrates how to achieve “hardwarebound” input-output operations with Python/NumPy and libraries such as PyTables. In summary, against the background of financial examples and use cases, the “Python for Finance” workshop introduces to most important language elements, tools and (performance) libraries that Python as a platform technology has to offer for Quant Finance. Dr. Yves J. Hilpisch is the founder and managing director of The Python Quants GmbH, Germany. The company provides Python-based financial and derivatives analytics software (http://quant-platform. com) as well as consulting services and training related to Python and Finance. He is author of the books “Derivatives Analytics with Python” (see http://www. derivatives-analytics-with-python.com) as well as “Python for Finance - Analyze Big Financial Data” (see http://oreil.ly/1kAwNp5). Also visit Yves’ website at http://hilpisch.com and follow him on Twitter at http://twitter.com/dyjh. COURSE PREREQUISITES To take the course programming experience is expected in some languages; C, VB, Fortran, Matlab etc. Experience with C, C++ will also come in useful for some topics. Object oriented programming skills are not totally necessary but will also help. A knowledge of calculus, statistics, signal and image processing, optimization will all assist your learning but are not absolutely required. COURSE FEE With the 20% early bird discount, which runs until 27th February, the course fee is £798.40. Beyond this the regular course fee is £998.00. PRMIA CERTIFICATION The Professional Risk Managers’ International Association (PRMIA) is a non-profit professional association, governed by a Board of Directors directly elected by its global membership, of nearly 90,000 members worldwide. PRMIA is represented globally by over 65 chapters in major cities around the world, led by Regional Directors appointed by PRMIA’s Board. For more information visit: http://www.prmia.org CONTACT: Tel: +44 (0)1273 201 352 / Fax: +44 (0)1273 201 360 www.quantshub.com / [email protected] 10 WEEK COURSE SCHEDULE WEEK 1. LECTURE 1. PYTHON AND TOOLS The first lecture shows how to efficiently set-up a Python and develeopment environment for Quant Finance. It also introduces into IPython, and in particular into the Notebook version which allows interactive, browser-based financial analytics with Python WEEK 2. LECTURE 2. INTRODUCTORY FINANCIAL USE CASES This lecture immediately dives into three canonical use cases: calculating and plotting implied volatilities, implementing performant Monte Carlo simulations, backtesting a trend based trading strategy. These use cases illustrate the benefits of the major Python libraries (NumPy, pandas), explained in detail in later lectures. WEEK 3. LECTURE 3. DATA TYPES/STRUCTURES AND VISUALIZATION This lecture is all about data modeling and storage with Python and the visualization of data. It introduces the basic data types and structures in Python, shows how to make use of NumPy’s array capabilities and how to write vectorized numerical code with Python/NumPy. WEEK 4. PRACTICAL EXERCISE & WEBINAR WEEK This will cover the first 3 weeks of the course. The practical exercise will be marked and feedback given. WEEK 5. LECTURE 4. FINANCIAL TIME SERIES This lecture is about the use of the pandas library for the management and analysis of financial time series. It shows examples implementing simple and advanced analytics as well as time series visualization. It also shows how to work with High Frequency data. WEEK 6. LECTURE 5. INPUT-OUTPUT OPERATIONS Financial analytics and financial application development mainly rests on the efficient and performant management and movement of (large, big) data. This lecture illustrates how to make sure that data reading and writing (to HDDs, SSDs) takes place at the maximum speed that any given hardware component allows. Examples also illustrate how to make use of compression techniques in such a context. WEEK 7. LECTURE 6. PERFORMANCE LIBRARIES The Python ecosystem has to offer a number of powerful performance libraries. For example, using the Numba dynamic compling library allows to compile Python byte code at call-time to machine code by using the LLVM infrastructure. The resulting compiled functions are directly callable from Python. Similarly, using the Multiprocessing module of Python makes parallelization of Python function executions a simple and efficient task. WEEK 8. PRACTICAL EXERCISE & WEBINAR WEEK This will cover weeks 5-7 of the course. The practical exercise will be marked and feedback given. WEEK 9. REVISION WEEK. WEEK 10. FINAL PRACTICAL PROJECT WEEK. THE FINAL PROJECT WILL BE MARKED WITH FEEDBACK AND A PASS OR FAIL WILL GIVEN. ONE RETAKE IS ALLOWED IF YOU FAIL. THIS COURSE IS AVAILABLE GLOBALLY AND CAN ONLY BE ACCESSED ONLINE. BOOK YOUR PLACE NOW: http://www.wbstraining.com/php/events/showevent.php?id=244#booking PYTHON FOR FINANCE 10 WEEK ONLINE COURSE 13TH APRIL 2015 CONFERENCE FEE STRUCTURE Early Bird Discount: Regular Event Fee 20% Before 27th February Online Workshop: £798.40 inc. UK VAT £998.00 inc. UK VAT Special Discount Code: 50% Academic Discount / FULL-TIME Students Only DELEGATE DETAILS TO REGISTER, PLEASE FAX THE COMPLETED BOOKING FORM TO: COMPANY: +44 (0)1273 201 360 NAME: SPONSORSHIP: JOB TITLE/POSITION: Quants Hub offer sponsorship opportunities for all workshop, e-mail headers and the website. Contact sponsorship via telephone on: +44 (0)1273 201 352 NAME: JOB TITLE/POSITION: NAME: JOB TITLE/POSITION: DEPARTMENT: ADDRESS: DISCLAIMER: Quants Hub command the right to cancel or alter any part of this programme. CANCELLATION: By completing this form, the client hereby enters into a agreement stating that if a cancellation is made by fax or writing within two weeks of the event date no refund shall be given. However in certain circumstances a credit note may be issued for future events. Prior to the two week deadline, cancellations are subject to a fee of 25% of the overall course cost. COUNTRY: TELEPHONE: E-MAIL: DATE: SIGNATURE: REGISTRATION: Tel: +44 (0)1273 201 352 / Fax: +44 (0)1273 201 360 www.quantshub.com / [email protected]

© Copyright 2026