Morning Flash

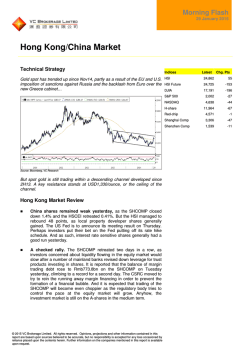

Morning Flash 30 January 2015 Hong Kong/China Market Technical Strategy Indices HSI The daily market breadth of the Hang Seng Index shows that percentage of constituents trading above the 250-day MAs (White line) has reached the HSI Future over-bought region earlier this month… DJIA S&P 500 Latest 24,596 Chg. Pts -266 24,563 -33 17,417 225 2,021 19 HSI Index, % Constituents trading above their SMAVG(250) and SMAVG(50) 26000 100.00% 90.00% 25000 80.00% 24000 70.00% 60.00% 23000 50.00% 22000 40.00% 30.00% 21000 20.00% 20000 10.00% 19000 0.00% %> SMAVG(250) Overbought Oversold %> SMAVG(50) %> SMAVG(10) HSI PX_LAST Source: Bloomberg, VC Research Trading outlook of the HSI may continue to be undermined by the consolidation of market breadth in the near-term. Hong Kong Market Review The SHCOMP retreated three consecutive days, as market rumors have it that the CSRC will step up measures to scrutinize illegitimate margin leadings by brokerages and banks. Market news said that the regulatory body plans to launch the new round of check next Tuesday. However, it is clear that Beijing does not want to kill the equity bull at its infancy and as such the CSRC announced that the margin check is a routine work and investors should not “excessively interpret” the motive of the move. Mainland brokerages under pressure, As investors concerned about a slower liquidity inflow to the equity market as brokerages and banks will be restricted to downsize their margin scale. Haitong Sec (6837.HK) was down 3.2% to HKD16.68/share, and Citic Sec (6030.HK) slid 2.75% to HKD24.75/share. Mainland banks also came under a new round of selling, with BOA (3988.HK) losing the most in the big-four state commercial banks by 2.2% to HKD4.35/share. Rebound in Macau gaming not sustainable, as a clear sign of stabilization in GGR has not emerged. A Macau SAR official indicated that monthly GGR in 2015 is expected to be within MOP23-28bn, more or less in line with the GGR levels in 2H14. Crude futures fell 2.4% on Wednesday. Locally listed crude-related shares fell generally. Petrochina (857.HK) was down 2.1% to HKD8.42/share. © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. NASDAQ 4,683 45 H-share 11,736 -228 Red-chip 4,505 -67 Shanghai Comp 3,262 -43 Shenzhen Comp 1,529 -9 Morning Flash 30 January 2015 Economic News U.S. initial jobless claims fall to near 15-year low: The number of Americans initially applying for unemployment aid fell sharply last week, echoing an improving job market. In the week ending Jan. 24, the advance figure of seasonally adjusted initial claims for jobless benefits decreased to 265,000, 43,000 less than the revised level of the previous week, the U.S. Labor Department said on Thursday. That was the lowest level since April 2000 and better than the market expectation of 300,000 new claims. There were no special factors impacting this week's initial claims, said the department. Meanwhile, the four-week moving average, which helps smooth out week-to-week volatility, edged down by 8,250 to 298,500 last week. The advance figure of seasonally adjusted insured unemployment during the week ending Jan. 17 decreased 71,000 from the previous week to 2,385,000. U.S. economy adds 252,000 new jobs in December, and the unemployment rate declined by 0.2 percentage point to 5.6 percent, the lowest level since June 2008, the Labor Department said earlier this month. (Xinhua) German Inflation Rate Is Negative for First Time Since 2009: Germany’s inflation rate turned negative in January for the first time in more than five years, aggravating a slump in consumer prices in the euro area. Prices in Europe’s largest economy fell 0.5 percent from a year earlier, the Federal Statistics Office in Wiesbaden said today. That’s the lowest rate since September 2009. Economists predicted a drop of 0.2 percent. The European Central Bank committed last week to spend at least 1.1 trillion euros ($1.2 trillion) on government bonds and other assets to avert deflation in the euro area. Prices in the 19nation bloc probably dropped this month at the second-fastest rate since the introduction of the single currency. (Bloomberg) German jobless rate hits record low in January: German jobless rate fell for the fourth consecutive month in January and hit its lowest level since German reunification two decades ago, official data showed on Thursday. In seasonally adjusted terms, the number of unemployed people fell by 9,000 to 2.84 million in January, German Federal Labour Agency said. The adjusted jobless rate thus dropped to 6.5 percent, following a rate of 6.6 percent in December last year. "The labour market is linked to the good performance of last year," said Frank-Juergen Weise, chief of the Nuremberg-based labour agency. In a separate report, German statistical office Destatis said roughly 42.8 million people were in employment in December 2014. The adjusted unemployment rate measured by concept of International Labour Organization (ILO) in December fell to 4.8 percent from the 5.0 percent in previous month. (Xinhua) Japan Inflation Slows More Than Forecast in Challenge to BOJ: Japan’s inflation rate slowed more than forecast in December, adding to central bank chief Haruhiko Kuroda’s challenges in reflating the world’s third-biggest economy. Consumer prices excluding fresh food rose 2.5 percent from a year earlier, the statistics bureau said Friday in Tokyo. That was less than the median projection of 2.6 percent in a Bloomberg News survey of economists. Stripped of the effect of sales-tax increase last April, core inflation -- the Bank of Japan’s key measure -- was 0.5 percent. (Bloomberg) © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. Morning Flash 30 January 2015 ECB QE to have "spillover effect" on China-EU trade: A Chinese official said Thursday that the European version of quantitative easing (QE) is set to impose a "spillover effect," positive and negative, on China-Europe economic and trade relations. The remarks were made by Ministry of Commerce (MOC) spokesman Shen Danyang at a press conference days after the European Central Bank unveiled a program to buy 60 billion euros (about 68 billion U.S. dollars) of private and public bonds each month from March to ward off deflation in the eurozone last week. While a depreciating euro could help increase Chinese companies' import from Europe and reduce the cost of investing in Europe, it is not good for Chinese exports, with existing investment already made by Chinese firms facing risk of loss, Shen told reporters. For the European economy, Shen said, the QE's impact could be two-sided as well. (Xinhua) Yuan sees increased volatility as depreciation pressure mounts: The Chinese currency has seen sharp volatility against the U.S. dollar this week as a strengthening dollar stokes worries of the yuan's depreciation. The yuan continued to decline against the dollar on Wednesday with its spot exchange rate closing at 6.2480 per U.S. dollar, down 45 basis points from Tuesday, according to data released by the China Foreign Exchange Trade System. The rate also dropped almost 1.95 percent from the central parity rate, just short of the twopercent floatation band allowed by authorities. On Monday, the Chinese currency sank to its lowest level in seven months by closing at 6.2542 before rebounding to 6.2435 on Tuesday. (Xinhua) Sector News China's coal output suffers record fall last year: China's coal output may have dropped 2.5 percent in 2014, the first fall since 2000, according to an industrial report released on Thursday. Over 70 percent of the enterprises in the coal sector suffered losses last year, according to a report by the National Coal Association (CNCA). Weak demand, overcapacity and cheap imports have compounded the sector's woes, said Jiang Zhimin, vice president with CNCA. China's coal capacity is over four billion tonnes, with another one billion under construction and amounts to over 90 percent of the country's total energy resources. (Xinhua) China steel industry struggles: Although China's steelmakers saw a big rise in profits last year, the industry still has overcapacity problems that have dragged prices to record lows. China's major large and midsized steel firms reported 30.4 billion yuan (5 billion U.S. dollars) in profit in 2014, a sharp rise of 40.4 percent, the China Iron and Steel Association (CISA) revealed on Thursday. The association attributed the growth to lower fuel prices and cost cutting. Despite the rise, the CISA cautioned that China's economic slowdown and optimized structure is increasingly dampening appetite for steel products, adding more pressure to a sector already struggling with overcapacity. China's economy grew 7.4 percent in 2014, the weakest annual expansion in 24 years. (Xinhua) © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. Morning Flash 30 January 2015 China's machinery sector faces overcapacity: China's machinery industry faces overcapacity at the low end sectors and a lack of capacity at the high end, head of the China Machinery Industry Federation (CMIF) said Thursday. The biggest problem for the industry is "structural overcapacity" -- huge capacity in low addedvalue sectors, said Wang Ruixiang, president of CMIF, the leading association of China's machinery companies. Production capacity utilization rate in some sectors is as low as 30 percent, he told an industry meeting, warning that "industrial adjustment and upgrading is the top priority." However, integration of Beijing with neighboring Tianjin Municipality and Hebei Province, the "belt and road" initiative, and Yangtze River economic belt are historic opportunities for the machinery industry, Wang added. (Xinhua) Result Announcements Vinda International Holdings Limited (3331.HK) announced result for the year ended 31 December 2014: Net profit: HK$593.467M, up 9.31% YoY Basic EPS: HK$0.594 Final dividend per share proposed: HK$0.12 (Infocast) Kith Holdings Limited (1201.HK) announced result for the first 6 months ended 30 June 2014: Net profit: HK$15.656M (HK$211.598M net loss for the same period in 2013) Basic EPS: HK$0.0599 Interim dividend proposed: nil (Infocast) I.T Limited (0999.HK) announces that for the third fiscal quarter ended 30 November 2014, its comparable-store-sales decline in the Hong Kong market and the Mainland China market was 4.5% and 0.2%, respectively. Comparable-store-sales growth in the Japan market was 13.5% for the period. (Infocast) Luoyang Glass Company Limited (1108.HK) expects its annual results for 2014 to turn around to a profit of RMB10-20 million from a RMB98.981 million loss for 2013. The profit was mainly due to the reasons that: (1) during 2014, the company realized a gain from the disposal of equity interest in its subsidiary, Luoyang Luobo Industrial Co., Ltd; and (2) Luoyang Glass received subsidies from the government during 2014. (Infocast) Auto Italia Holdings Limited (0720.HK) said it expects to record a net profit for the year ended 31 December 2014, as compared with an audited loss of HK$55.7 million for the year ended 31 December 2013. (Infocast) China Automation Group Limited (0569.HK) announces that it expects the company's profit for the year ended 31 December 2014 to decrease significantly as compared with the profit recorded by the company for the year ended 31 December 2013. (Infocast) China COSCO Holdings Company Limited (1919.HK) announces that the group expects to record an increase of more than 50% in profit attributable to equity holders of the company for the year ended 31 December 2014 as compared to the profit attributable to the equity holders of the company of RMB235.47 million for the year ended 31 December 2013. (Infocast) © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. Morning Flash 30 January 2015 Today’s Theme The China’s State Council plans to facilitate the exports of railway, nuclear and construction materials products, echoing President Xi Jinping’s vow to develop a “New Silk Road”. Mainland nuclear names fared well across the board yesterday a result of the favorable policies to be implemented by Beijing. DongFang Elec (1072.HK) • Rising momentum has been strong. DongFang Elec looks set to break away from an ascending channel. • Staying above all major MAs is a good sign. • A psychological resistance stands at HKD17/share. Source: Bloomberg, VC Research Harbin Elec (1133.HK) Source: Bloomberg, VC Research © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. • Shot through the ceiling of a narrowing triangle earlier this month. • The 14-day RSI has retreated after hitting the over-bought region. • May test a psychological resistance at HKD6/share soon. Morning Flash 30 January 2015 Shanghai Elec (2727.HK) Source: Bloomberg, VC Research Hang Seng Composite Sectors Sector Hang Seng Index (HSI) Hang Seng Composite HSCI Utilities HSCI Industrial Goods HSCI Materials HSCI Conglomerates HSCI Telecommunication HSCI Property & Construction HSCI Info Technology HSCI Consumer Goods HSCI Financials HSCI Services HSCI Energy HS Mainland 100 HS China Enterprises HS China H-Financial HS China Affiliated Corps HS HK 35 HS HK Large Cap HS HK MidCap HS HK Small Cap Index 24,595.85 3,354.46 Day (%) Week (%) MTD (%) -1.07 0.30 4.20 -0.98 0.13 2.67 YTD (%) 4.20 2.67 7,757.80 1,293.26 5,329.11 2,956.53 2,146.08 3,066.72 5,870.23 4,736.44 3,688.92 3,998.91 9,650.52 -0.11 -0.34 -1.39 -0.14 0.15 -0.84 -1.27 -0.08 -1.61 -0.36 -1.78 1.25 2.33 -2.70 2.05 0.39 0.55 2.19 0.95 -1.18 4.03 -2.64 3.23 2.47 -1.94 7.95 12.75 3.25 14.92 1.55 -0.55 1.00 -2.41 3.23 2.47 -1.94 7.95 12.75 3.25 14.92 1.55 -0.55 1.00 -2.41 7,450.04 11,736.09 17,965.20 4,504.91 -1.32 -1.90 -1.98 -1.46 -1.23 -2.58 -2.74 -1.33 2.66 -2.07 -2.50 3.56 2.66 -2.07 -2.50 3.56 2,818.49 2,009.67 4,466.07 2,241.05 -0.41 -1.05 -0.79 -0.67 2.74 0.21 -0.24 0.17 5.06 3.50 -0.05 -0.25 5.06 3.50 -0.05 -0.25 Source: Bloomberg © 2015 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request. • Bumped upwards since 2Q14 on surging volatility. • Trading volume increased noticeably over the last few months is a good sign. • A key resistance lies at HKD5.14/share, the peak since 2010. Morning Flash - 30 January 2015 Analyst Certification Each research analyst primarily responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by that research analyst in the research report. Disclaimer T This document is prepared by VC Brokerage Limited (“VC”) to provide information about the securities mentioned herein. It is for distribution only under such circumstances as may be permitted by applicable law. It has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. It is published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this document. It should not be regarded by the recipients as a substitute for the exercise of their own judgment. Any prices or levels contained in these pages are indicative and may vary in accordance with changes in market conditions. Investors are warned that the price of any securities may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. No liability is accepted whatsoever for any direct, indirect or consequential loss arising from the use of this document, and no claims, actions or legal proceedings may be brought against VC in connection with this document in any manner whatsoever by any person dealing with the securities and/or the related financial instruments mentioned herein. Any opinions expressed in this document are subject to change without notice. VC is under no obligation to update or keep current the information contained herein. VC and its affiliates, their directors, officers and employees or clients may have or have had interests or long or short positions in the securities or other financial instruments referred to herein, and may at any time make purchases and/or sales in them as principal or agent. VC and its affiliates may have or have had a relationship with or may provide or has provided investment banking, capital markets and/or other financial services to the relevant companies. Employees of VC and its affiliates may serve or have served as officers or directors of the relevant companies. © 2014 VC Brokerage Limited. All rights reserved. Opinions, projections and other information contained in this report are based upon sources believed to be accurate, but no responsibility is accepted for any loss occasioned by reliance placed upon the contents herein. Further information on the companies mentioned in this report is available upon request.

© Copyright 2026